Tetra Tech’s broad capabilities in engineering and technology are fueling its market surge. The Pasadena-based company emphasizes “leading with science,” from patented analytic tools to an in-house AI innovation lab. For example, it holds over 500 global patents (302 granted) across infrastructure and environmental technologies. Its federal IT “Innovation Lab” focuses on AI, robotics and cloud migration to automate data workflows. These advances boost project efficiency and have drawn Wall Street optimism: analysts rate TTEK a “Moderate Buy” (average target ~$41.7), and its backlog topped $4.15 billion in Q3 2025. In short, Tetra Tech’s tech edge and project pipeline reinforce its growth narrative.

Geostrategic and Economic Drivers

Global infrastructure demand underpins Tetra Tech’s outlook. Researchers estimate $64 trillion needed in worldwide infrastructure over the next 25 years. Infrastructure like roads, bridges, rails, power plants and utilities is “the keystone” of growth. In this context, Middle East stability is critical: U.S.-led plans (the so-called “Gaza GREAT Trust” proposals) envision Gaza as a revived trade corridor linking Asia and Europe. Post‑war Gaza could sit at the crossroads of a new Israel–Middle East trade route (the IMEC initiative) serving Europe, GCC and Asia. Such geopolitical shifts raise the strategic value of engineering firms: Tetra Tech’s U.S. roots and Middle East experience align with American and Gulf-backed reconstruction agendas. As a result, international stakeholders eye companies like Tetra Tech to deliver cross-border projects (water pipelines, transit links, digital networks) that serve both commerce and stability.

Gaza Reconstruction Opportunity

Extensive destruction in Gaza will demand comprehensive rebuilding of infrastructure. Gaza’s immediate rebuild needs are staggering. UN and development officials estimate $18–50 billion required to restore essentials – including roads, tunnels and transit hubs plus power, water and sanitation systems. This scale is roughly 14 years of cleanup work. Infrastructure (roads, bridges, power plants, water treatment) will be first priorities, as pipelines, tunnels and even an airport must be reconstructed. A $10–20 billion contract in Gaza would dwarf Tetra Tech’s current market cap (~$9.4B) – multiplying its annual revenue manifold. In short, winning a major Gaza rebuild contract could transform TTEK’s business.

Local expertise is critical for tasks like debris removal, pipeline repair and demilitarization. Tetra Tech’s track record in conflict-zone recovery directly applies. The firm highlights 40+ years of work in war‑torn regions, and it already has USAID contracts in the West Bank and Gaza (e.g. a $47 M project to improve municipal water and energy in 2016). In Ukraine, Tetra Tech supplied generators and equipment to restore power grids and led explosive‐ordnance clearance teams to make rebuilding safe. These are exactly the skills Gaza will need: clearing rubble (including UXO), rebuilding electricity and water systems, and engineering roads, waste and emergency facilities. Given the shortage of local resources and the high stakes, international donors will likely rely on experienced contractors. If Gaza’s new administration signs off on a U.S.-linked reconstruction plan, Tetra Tech is well-placed to bid on early infrastructure work, from desalination plants to hospitals.

Technology and Innovation Edge

Tetra Tech’s growth also reflects its high‑tech offerings. Beyond civil engineering, it markets advanced analytics and cyber tools. Its innovation lab develops cognitive AI systems and robotics to automate complex tasks, and it holds patents like the Volans™ 3D simulation for sustainable aviation. With over 500 active patents worldwide, Tetra Tech distinguishes itself as a high-R&D firm in the industrial sector. It also emphasizes cybersecurity and cloud-based solutions – for example, designing secure data centers and deploying automation in federal agencies. This tech focus appeals to governments and private clients alike. In an era when smart infrastructure (IoT water sensors, digital twin mapping, AI-driven energy management) is prized, Tetra Tech’s blend of engineering plus software expertise sets it apart from traditional builders. Such innovation is a magnet for investment: venture and equity analysts note that TTEK’s EPS and revenue growth forecasts outpace industry averages.

Investor Confidence and Market Outlook

Financial markets have noticed. Institutional ownership of Tetra Tech is extremely high (93.9% of shares), with many funds recently adding stakes. For instance, Paradoxiom Capital built a new 140,955‑share position ($4.1 M) in Q1 2025, and others (Cambridge, SG Americas, FORA) increased positions for millions more. Insider selling has been minimal (only ~0.4% of stock held by executives). On Wall Street, analysts are bullish: KeyCorp upped its price target to $43 (overweight), and research firm WallStreetZen upgraded TTEK to a “buy.” Overall consensus remains “Moderate Buy” with targets in the low $40s.

This confidence is backed by results. In Q3 2025, Tetra Tech reported ~11% revenue growth year-over-year (excl. pass-through contracts) and record backlog ($4.15B). The firm has also raised full-year guidance, citing greater U.S. federal infrastructure and disaster funding. Meanwhile, global trends favor more contracts: U.S. support for development projects in Gaza and Ukraine could add to Tetra Tech’s pipeline. All told, strong technical fundamentals, institutional demand, and the prospect of a Gaza rebuild contract have combined to drive TTEK’s stock higher.

In summary, Tetra Tech’s rise is the product of converging factors: surging worldwide infrastructure needs, strategic opportunities in the Middle East, and the company’s own innovation. Its extensive patent base, IT and cyber capabilities, and field experience in conflict recovery make it a leading candidate for mega-projects. With analysts and investors increasingly optimistic, TTEK appears well-positioned to benefit from both global engineering trends and any large-scale reconstruction contracts in Gaza and beyondbrookings.edumarketbeat.com.

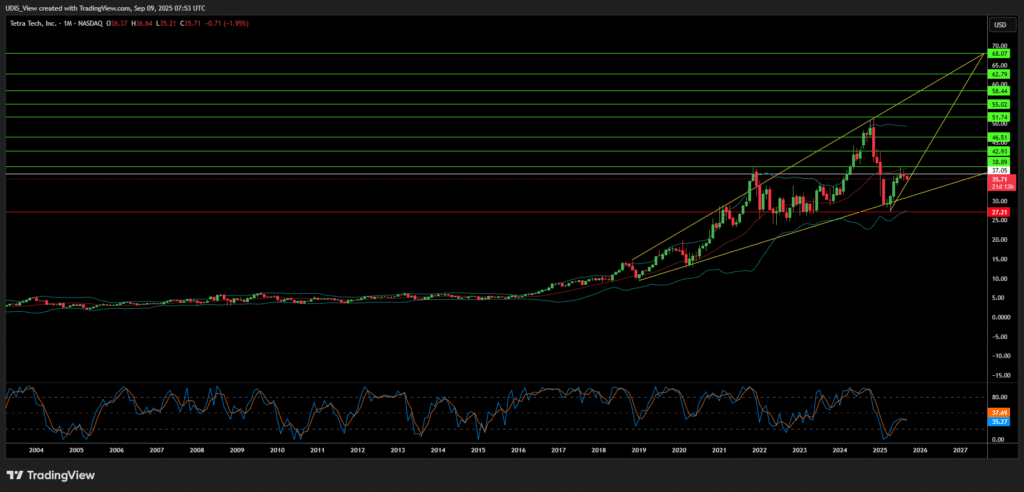

Tetra Tech Long (Buy)

Enter At: 37.05

T.P_1: 38.89

T.P_2: 42.93

T.P_3: 46.51

T.P_4: 51.74

T.P_5: 55.02

T.P_6: 58.44

T.P_7: 62.79

T.P_8: 68.07

S.L: 27.21