I. The Anatomy of a Regulatory Black Swan

The stock of UniQure N.V. (QURE) plunged dramatically in November 2025 following a profound regulatory reversal by the US Food and Drug Administration (FDA).1 Intraday trading saw the stock fall as much as 75%, collapsing from a previous closing price near $67.49 to approximately $26.1 This steep decline immediately exposed the systemic regulatory risks facing the entire gene therapy sector.3

The Catalyst and Immediate Damage

The core catalyst was the FDA’s unexpected feedback during a pre-Biologics License Application (BLA) meeting for AMT-130.4 AMT-130 is UniQure’s investigational gene therapy candidate for Huntington’s disease (HD).5 The agency now argues that data from the Phase I/II studies, which relied on an external control group, are inadequate to serve as primary evidence for a BLA submission.3

This stance fundamentally contradicted prior guidance received by UniQure over the preceding year.4 The company had previously planned on filing the BLA in the first quarter of 2026, anchoring its near-term valuation.5 This critical regulatory shift immediately injected severe uncertainty into the commercialization timeline.8

The Nature of the Shock

UniQure had secured both Breakthrough Therapy Designation (BTD) and Regenerative Medicine Advanced Therapy (RMAT) designation for AMT-130.4 These designations are specifically designed to expedite development and review for serious conditions with unmet needs.10 The FDA’s reversal invalidates the specific accelerated approval pathway UniQure had pursued.1

The market’s aggressive sell-off reflects institutional recognition of significant regulatory risk.3 Analysts called the FDA’s “about face” very surprising and challenging for the company.3 The uncertainty surrounding the BLA timing represents the single biggest threat to UniQure’s business model and its financial forecasts.8

Systemic Implication: Regulatory Arbitrage Failure

UniQure had executed a clear strategy based on previous regulatory assurances, including multiple Type B meeting agreements.4 The abrupt invalidation of these agreements demonstrates that prior designations and communications are increasingly unreliable.3 This proves that the regulatory philosophy currently in place trumps established regulatory mechanisms.10

Regulatory predictability is a necessary condition for successful capital deployment in high-risk areas like gene therapy.11 The FDA’s action now compels biotechs to treat Type B meeting outcomes not as binding commitments but as fluid, transient regulatory positions.4 This significantly raises the evidential standard and the financial bar for the entire gene therapy sector.3

II. The Scientific and High-Tech Challenge: External Controls and Data Rigor

The scientific and technological foundation of the AMT-130 program directly contributes to the current regulatory roadblock. The trial design, while innovative for a rare disease, proved statistically vulnerable under heightened FDA scrutiny 12

AMT-130 Gene Therapy Science

AMT-130 is an investigational gene therapy leveraging UniQure’s proprietary miQURE gene-silencing platform.13 The therapeutic payload consists of an AAV5 vector carrying an artificial microRNA.5 This construct is designed specifically to silence the huntingtin gene, inhibiting the production of the toxic mutant protein (mHTT) that causes Huntington’s disease.13

Huntington’s disease is a rare, inherited neurodegenerative disorder currently lacking any disease-modifying treatment.5 AMT-130 offers the potential of a one-time treatment, making its development a critical scientific milestone.7

The Single-Arm Trial Design

Due to the ethical constraints and logistical difficulty of conducting large, multi-year placebo-controlled trials in rare neurological disorders, UniQure employed a single-arm Phase I/II design.15 The company pre-specified its pivotal comparison against an external control group derived from the Enroll-HD natural history dataset.9

The Enroll-HD dataset is a comprehensive, digitally curated observational registry of HD patients 16 UniQure compared outcomes using propensity score-matched patient data from this large natural history registry.9 This use of sophisticated high-tech statistical matching represented an advanced approach to trial design in rare disease.9

FDA Critique: Statistical Vulnerability

In September 2025, positive topline data demonstrated statistically significant slowing of disease progression (cUHDRS and TFC) for high-dose AMT-130 compared to the external control.9 This readout initially sparked massive investor optimism, sending QURE shares soaring by 247%.12

The FDA’s rejection centers on the adequacy of the external control data as primary evidence for approval.3 External controls are statistically vulnerable to known and unknown confounding variables that propensity score matching may not fully address.18 The FDA is demanding a standard of evidence that minimizes bias, likely requiring a prospective, randomized, head-to-head trial.18 This confirms a hardening stance on data robustness for novel gene therapies 12

Causal Relationship: Breakthrough Misinterpretation

The market aggressively priced UniQure stock after the BTD designation and the positive data release.8 This reflected an overestimation of the BTD’s weight. Many physicians and investors misunderstand that BTD relies on preliminary clinical evidence and does not guarantee subsequent accelerated approval.10

The FDA’s decision clarifies that BTD is merely an expediting mechanism, not a mechanism for validation of statistically inferior trial designs.10 The underlying statistical fragility of the external control comparison, though initially accepted by the agency, ultimately became the fatal flaw under heightened scrutiny.18 This scenario underscores the critical need for investors to distinguish between expedited review status and true regulatory validation.

III. Geopolitics and Geostrategy: The Regulatory Quake in Washington

The reversal of AMT-130 is not an isolated scientific critique but a manifestation of significant geopolitical and geostrategic uncertainty within US regulatory institutions. Instability within the FDA’s Center for Biologics Evaluation and Research (CBER) directly translates into sector-wide market volatility.11

CBER Leadership Volatility

CBER, the office responsible for regulating gene therapies, has experienced rapid senior leadership turnover.11 This instability includes the departure of long-time CBER Director Peter Marks and the reported administrative leave of Office of Therapeutic Products (OTP) Director Nicole Verdun and her Deputy, Rachel Anatol 20

Verdun and Anatol previously received high praise from the biotech industry for efforts to modernize and streamline gene therapy regulatory pathways.20 Their sidelining, alongside other personnel changes across the Department of Health and Human Services (HHS), signals institutional turmoil.20

The Geostrategic Shift

The leadership shifts signal a geostrategic pivot away from rapid industry accommodation toward emphasizing the “gold standard of science”.20 This shift is explicitly tied to the new philosophical approach within CBER. Vinay Prasad, who succeeded Marks, has been publicly critical of using surrogate endpoints and the accelerated approval pathway for genetic medicines.22

Prasad favors traditional, rigorous evidence, which inherently conflicts with single-arm trials based on external natural history controls.24 This philosophical hardening explains the FDA’s new, rigid stance on UniQure’s data adequacy.12 The agency is now scrutinizing applications accepted under previous, more flexible administrations 11

Geopolitical Implication: Investment Climate Deterioration

High turnover and philosophical dissonance at CBER create immense regulatory uncertainty, impacting drug sponsors’ communication quality and frequency.11 This lack of predictable regulatory rapport constitutes a systemic geopolitical risk.11 For high-risk, high-reward rare disease programs, regulatory instability deters capital flow.

When regulatory leadership is in flux and prior agreements are easily overturned, the required discount rate applied to future revenue forecasts increases drastically.25 This uncertainty affects the capital viability of the entire gene therapy sector, compelling investors to demand much higher risk premiums for pre-approval assets.3

The US versus EU Regulatory Divide

The US-centric instability prompts biotechs to seek regulatory hedges in other jurisdictions.6 UniQure noted plans to collaborate with other regulatory agencies, including those in the European Union (EMA) and the United Kingdom (MHRA).1

The US is rapidly moving toward a stricter interpretation of accelerated approval requirements.26 This divergence creates a unique geostrategic opportunity for the EU. The proposed EU Biotech Act aims to promote biotech research and development by reducing bureaucratic processes and supporting faster access to innovative medicines.27 If the EU successfully implements more efficient clinical trial frameworks, it could attract R&D capital seeking a less volatile regulatory environment 27

IV. Macroeconomics and Economics: The Unbearable Cost of Delay

The FDA’s decision instantly destroyed billions in market capitalization, highlighting the severe economic vulnerability of single-catalyst biotech companies.3 The primary financial consequence of this regulatory shift is the destruction of Net Present Value (NPV) through an indefinite delay.

Valuation Collapse and Financial Headwinds

Before the announcement, UniQure’s market capitalization stood between $3.71 billion and $4.17 billion.17 The stock fell by up to 75% on the news, immediately repricing the company based on a dramatically heightened risk profile.1

The planned BLA submission in Q1 2026 was the company’s vital near-term catalyst.5 Analysts had predicted ambitious forecasts, including $306.4 million in revenue by 2028, on this timeline.8 The indefinite delay renders this growth projection obsolete.8 Furthermore, UniQure already operates with negative profit margins and declining revenues, exacerbating the financial headwinds created by the setback.17

NPV Destruction and Probability of Failure

Delaying a rare disease approval has a disproportionately severe impact on Net Present Value.29 Analysis of accelerated approval pathways shows that a regulatory setback resulting in a median delay of three years makes 33% to 66% of such therapies unprofitable (negative NPV).29 For AMT-130, this delay pushes potential profitability significantly further into the future.

The probability of a rare disease drug advancing from Phase 1 to approval is already low at 6.2%.30 Adding substantial multi-year development time and the cost of new trials exponentially increases the probability of outright project abandonment.31 The market collapse reflects the institutional acknowledgment that the required capital raise for a new, likely larger, randomized controlled trial (RCT) will be highly dilutive to existing shareholders.

Analyst Recalibration

Following the announcement, analysts swiftly recalibrated their valuations. For instance, H.C. Wainwright lowered its price target on QURE from $110 to $70.25 While some firms maintained a positive rating, the target reduction acknowledges the significant time value of money lost.25 The stock’s massive sell-off, which exceeded the decline in the broader biotech index, suggests institutional concern about data adequacy, not just procedural delay.25 The investment narrative shifts from a near-term growth story to a high-risk, protracted development challenge.8

Table 1: Financial Consequences of AMT-130 Regulatory Reversal

| Metric | Pre-Reversal Valuation Context | Post-Reversal Impact (Nov 2025) | Macroeconomic Implication |

| Stock Price (QURE) | $67.49 (Nov 2) 3 | Dropped to ~$26 (49%–75% loss) 1 | Massive market capitalization destruction |

| BLA Timeline | Q1 2026 Submission Planned 5 | Unclear; likely 3+ year delay 29 | Severe NPV erosion for orphan drug 29 |

| 2028 Revenue Target | $306.4 Million 8 | High Risk; Unachievable on previous schedule 8 | Requires a massive forward discount on future cash flow |

| Analyst Target (H.C. Wainwright) | $110 25 | Cut to $70 (Buy rating maintained) 25 | Re-anchoring valuation to a longer time horizon |

The tightening of regulatory standards imposes greater capital discipline on the biotech sector. Firms must now budget for contingencies, including funding multi-year RCTs, favoring large, diversified companies over smaller, single-asset operations.

V. Cyber, High-Tech, and Patent Analysis: IP Dilution via Delay

The FDA’s increased scrutiny extends beyond pure medical science into the robustness and reliability of the digital data utilized for BLA submissions. This high-tech assessment directly impacts the financial value of UniQure’s intellectual property (IP).

High-Tech Data Integrity Scrutiny

UniQure’s trial leveraged sophisticated High-Tech methodology.9 The company relied on propensity score matching a complex statistical tool to compare its small cohort of treated patients to the large, digitally archived data set of natural history HD patients (Enroll-HD).9

The FDA is universally heightening its scrutiny on data integrity, especially for submissions that rely heavily on complex, digitally generated Real-World Data (RWD) and third-party testing.32 The agency’s rejection of the external control arm signals that, even with pre-specified statistical protocols, the “digital control arm” is deemed an insufficient surrogate for a traditional controlled trial.6 The agency maintains that RWD methods are vulnerable to inherent biases, completeness issues, and confounding factors.18

Causal Relationship: Data Type Dictates Approval Path

The FDA’s increasingly rigid stance confirms that the type of data (RWD versus prospective RCT) now dictates the likelihood of approval via the Accelerated Pathway.12 RWD is confirmed as high-risk primary evidence for novel gene therapies, even those with BTD or RMAT designation 18

Companies must recognize that accelerated pathway designations do not automatically validate the RWD methodology employed.4 The FDA reserves the right to reject this methodology during the pre-BLA phase, forcing sponsors into time-consuming, gold-standard trials.7

Patent Erosion and Exclusivity Loss

Intellectual property valuation is directly linked to the commercialization window provided by patent exclusivity. AMT-130 relies on a patent family covering its miQURE gene-silencing platform and RNA constructs.14 These patents are set to expire in 2035.33

Every year of regulatory delay consumes one year of market exclusivity, directly devaluing the asset.29 A probable three-year delay required to initiate and complete a new randomized trial dramatically shortens the effective commercial lifetime of AMT-130.29 The market capitalization plunge reflects the discounting of revenues over this newly restricted patent runway.

Trend: Patent Valuation Model Shift

The UniQure experience mandates a permanent shift in biotech valuation models. Analysts must now incorporate a substantial regulatory risk premium related to patent clock deterioration for single-asset gene therapy companies.33 Investors must assume potential delays of two to three years for any program relying exclusively on single-arm trials and external controls, necessitating a higher discount rate on future cash flows.

VI. Conclusion: Investment Outlook and Risk Mitigation

The regulatory setback for UniQure’s AMT-130 is not an isolated event but a clear symptom of sector-wide regulatory tightening driven by leadership changes and a philosophical shift toward stricter evidential standards at the FDA.20

The Path Forward

UniQure must now urgently interact with the FDA to define a viable path toward definitive approval.4 This requirement likely mandates initiating a new, prospective, randomized, and placebo-controlled trial, significantly extending the development timeline well beyond the previously anticipated 2026 BLA submission.5

The company must aggressively pursue regulatory alignment in Europe.1 Successful submission to the European Medicines Agency (EMA) or the UK’s MHRA would provide crucial external validation of the clinical data and a necessary commercial hedge against US volatility.6

Sector Mandate

UniQure’s experience serves as a clear warning to the entire gene therapy sector.3 Accelerated approval pathways are shrinking under the new CBER leadership.23 Development stage companies that rely on single-arm trials and external controls face immediate pressure on their valuations.12 The investment community must re-underwrite these assets based on a multi-year delay and a significantly heightened capital requirement to fund confirmatory trials.

Investment Recommendation

Investors must re-underwrite QURE stock based on a significant delay and a heightened probability of costly follow-on trials. The stock now represents a long-term, high-risk deep-value play. Its viability hinges entirely on the company successfully negotiating a viable new BLA path within the next six months and securing the necessary capital without excessive dilution.8 Failure to rapidly define this path will consume too much of the remaining patent runway, rendering the project’s economics unviable.29

Table 2: Key Risks and Mitigation Strategies for Gene Therapy Investments

| Risk Domain | UniQure Specific Risk | Broader Industry Risk | Mitigation Strategy (Investor/Company) |

| Regulatory (Geopolitics/Geostrategy) | FDA CBER reversal on prior BLA guidance 4 | Unpredictable, philosophy-driven regulatory tightening 23 | Diversify geographically (EU/UK hedge) 1; Increase capital reserves for contingency trials. |

| Science/Technology (High-Tech) | Reliance on external Enroll-HD data rejected 18 | Skepticism regarding RWD/external controls as primary evidence 12 | Fund randomized, controlled trials (RCTs) upfront, even for orphan diseases. |

| Economic (Macroeconomics) | Indefinite delay destroys NPV and revenue forecasts 29 | Low probability of success (6.2%) amplified by a delay 30 | Apply higher discount rates; Invest in firms with pipeline diversification 31 |

| Patent (Cyber) | Patent life eroded until 2035 expiry 33 | Loss of exclusivity window due to mandated delays 29 | Focus R&D on proprietary IP with a longer runway or broader indication coverage. |

References

- uniQure stock plummets after FDA shifts stance on Huntington’s therapy

- UniQure Shares Sink After Negative FDA Response to Huntington’s Disease Treatment

- FDA Does ‘About-Face’ on UniQure’s Huntington’s Gene Therapy – BioSpace

- uniQure Provides Regulatory Update on AMT-130 for Huntington’s Disease

- FDA changes stance on uniQure gene therapy data | Cellgenetherapyreview.com

- uniQure Receives FDA Feedback Impacting BLA Submission Timeline for AMT-130 Gene Therapy for Huntington’s Disease

- uniQure’s gene therapy for Huntington’s hits FDA roadblock

- How FDA’s Revised Stance on AMT-130 Data Has Changed uniQure’s (QURE) Investment Story

- uniQure Announces Positive Topline Results from Pivotal Phase I/II Study of AMT-130 in Patients with Huntington’s Disease

- Physician Perceptions of the FDA’s Breakthrough Therapy Designation: An Update – NIH

- HHS 2.0: FDA In Focus – Ahead of the Curve® | TD Securities

- FDA halts uniQure’s plans for Huntington’s disease gene therapy

- Huntington’s Disease | Programs & Pipeline – uniQure

- Issued Patents in the U.S. and EU – Forbion

- Taysha Gene Therapies Announces FDA Breakthrough Therapy Designation and Provides Positive Regulatory Update on TSHA-102 in Rett Syndrome

- Understand and Interpret the Data Contents – Enroll-HD

- UniQure stock crashes over 50% today after FDA says Huntington’s therapy data isn’t enough – here’s what investors need to know – The Economic Times

- UniQure and FDA No Longer in Alignment on Approval Pathway for AMT-130 – HDBuzz

- Physician Perceptions of the FDA’s Breakthrough Therapy Designation: An Update – PubMed

- FDA gene therapy leaders sidelined amid broader agency overhaul – FirstWord Pharma

- Gene therapy faces fresh uncertainty as two more top FDA officials depart – BioPharma Dive

- UniQure dives after FDA’s ‘very surprising’ reversal on Huntington’s gene therapy

- Prasad’s FDA exit may accelerate cell and gene therapy approvals

- Biotech is guessing how Vinay Prasad might change the FDA. His research, writing offer clues. | BioPharma Dive

- uniQure stock price target lowered to $70 at H.C. Wainwright on FDA setback

- The 2025 MedTech Regulatory Divide: A Strategic Analysis of the US and EU Innovation Landscapes | HTEC

- The EU Biotech Act Unlocking Europes Potential

- UniQure Market Cap 2013-2025 | QURE – Macrotrends

- Calculating the Value and Impact of Accelerated Approvals: Final Findings

- NBER WORKING PAPER SERIES ESTIMATING THE FINANCIAL IMPACT OF GENE THERAPY IN THE U.S. Chi Heem Wong Dexin Li Nina Wang Jonathan

- Financing repurposed drugs for rare diseases: a case study of Unravel Biosciences – PMC

- Notifications on Data Integrity – Medical Devices – FDA

- 10-K – SEC.gov

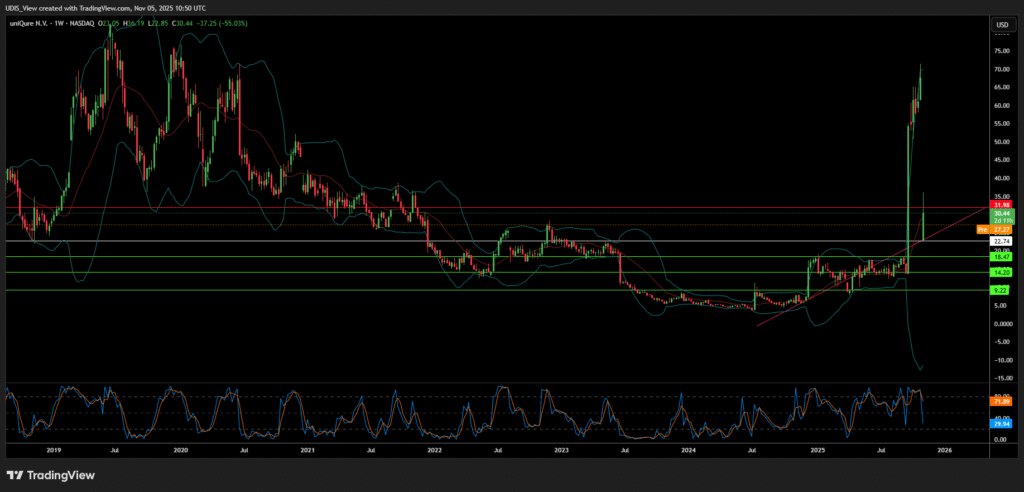

UniQure Short (Sell)

Enter at: 22.74

T.P_1: 18.47

T.P_2: 14.20

T.P_3: 9.22

S.L: 31.98