Taiwan Semiconductor Manufacturing Company (TSMC) operates at the zenith of the global technology ecosystem, a position underscored by its commanding 67.6% market share in the pure-play foundry industry as of Q1 2025.1 The company’s financial performance remains exceptionally strong, with Q2 2025 revenue beating guidance and net income surging by over 60% year-over-year.2 This dominance is not a guarantee of security. A complex, multi-layered threat environment now poses an existential risk to the company’s long-term stability and, by extension, to the global economy.

This report analyzes the core risks to TSMC across multiple domains: geopolitics, macroeconomics, technology, and cybersecurity. A potential Chinese invasion of Taiwan represents a direct, catastrophic threat, but a more insidious “anaconda strategy” of non-kinetic coercion could achieve the same outcome by slowly strangling the island’s economic stability.3 Concurrently, U.S. policy, while ostensibly supportive through the CHIPS Act, creates financial headwinds by revoking key export privileges for TSMC’s China-based fabs and forcing a costly global expansion.4

The company also faces a relentless, unseen battle against cyber espionage and intellectual property theft, a high-stakes front in the geopolitical competition for advanced technology.6 Despite these challenges, TSMC is not a passive victim. The company is actively building a fortress of resilience through a costly global expansion, a robust IP protection system, and an unwavering commitment to its technological lead.7 While a present-day decline is not evident, the analysis concludes that TSMC’s future hinges on its ability to navigate this hyper-complex risk environment.

1. TSMC: At the Epicenter of Global Technology

TSMC’s position as a linchpin of the global technology ecosystem is undisputed. The company commands the pure-play wafer foundry market, with its market share expanding from 51% in 2019 to a remarkable 67.6% in the first quarter of 2025.1 This dominant position is built on a compounding cycle of financial strength and technological superiority, creating a “winner-takes-most” market structure.1 TSMC’s financial health is a testament to this strategy. In the second quarter of 2025, the company’s revenue reached $30.07 billion, surpassing expectations.2 This performance reflects a robust 44.40% year-over-year revenue growth.2 The company’s gross margin, while facing pressures from overseas fab expansion and foreign exchange rates, remains strong at 58.6%.2

The company’s success is a direct result of its technological leadership. The demand for advanced chips, particularly for artificial intelligence (AI) and high-performance computing (HPC), has become TSMC’s primary growth engine.1 This solid demand helped offset typical seasonal weakness in the smartphone sector during Q1 2025.1 The 3nm process alone accounted for 24% of TSMC’s wafer revenue in Q2 2025, demonstrating the critical role of advanced nodes.2 TSMC is the sole manufacturer for many of the world’s most powerful chips, including those designed by Nvidia, a partner that could account for over 20% of TSMC’s 2025 revenue.7 This partnership extends to producing six new products for Nvidia, including its new Rubin AI chip architecture.10

TSMC’s expanding market share and deep integration with the world’s leading technology firms create a precarious situation. The global technology ecosystem has become reliant on a single, geographically concentrated entity for its most critical components.11 The United States, for instance, sources 92% of its leading-edge chips from TSMC in Taiwan.13 This extreme concentration is not just a market dynamic; it represents a single point of failure that elevates what might have been a localized business interruption into a global systemic risk.11 Furthermore, the company’s immense profitability and market capitalization, standing at $903.75 billion, make it a high-value target for competitors and nation-states alike.1 This is not simply a matter of business competition; it is a geostrategic imperative. As competitors like Samsung and Intel struggle to replicate TSMC’s success in advanced node production, the incentive for industrial espionage and state-sponsored cyberattacks increases significantly.6 The recent alleged 2nm IP leak, a direct manifestation of this threat, underscores that TSMC’s financial and market strength is inextricably linked to the constant, unseen battle to protect its intellectual property.15

2. The Geopolitical Fault Line: A Question of Survival

The prospect of a Chinese invasion of Taiwan dominates geopolitical discourse. However, a full-scale amphibious assault would be an “operational nightmare” for Beijing, carrying immense human, political, and economic costs.16 The more immediate and probable threat is not a kinetic invasion, but a strategy of gradual coercion. Chinese leader Xi Jinping has made it clear that the use of force remains an option for reunification, but Beijing has a range of less kinetic, “grey zone” options at its disposal.17 This approach is often referred to as an “anaconda strategy,” where China slowly surrounds and constricts Taiwan to force political concessions.3

This strategy involves a continuous escalation of non-military actions, including a record 3,075 military flights into Taiwan’s air defense identification zone (ADIZ) in 2024, an 81% increase from the previous year.3 China’s navy and coast guard practice blockades and quarantines around the island, while its vessels have severed undersea internet cables connecting to smaller Taiwanese islands.3 Cyberattacks are a key component of this strategy, with Taiwanese government systems enduring approximately 2.4 million cyberattacks daily, most attributed to Chinese hackers.3

The threat to TSMC’s factories is not limited to physical destruction from an invasion. A less-kinetic “maritime quarantine” could effectively cripple the company. TSMC chairman Mark Liu has publicly stated that an invasion would render its factories “inoperable” due to the constant, highly specialized inputs required for production.11 Taiwan, as an island, is highly vulnerable to such a measure, importing 97% of its energy and 70% of its food supply.3 The relentless pressure of an anaconda strategy, even without a full-scale invasion, creates a perpetual crisis that erodes investor confidence and operational stability.16 The slow erosion of the operational environment, rather than a single catastrophic event, is the more insidious threat to TSMC’s long-term position.

A conflict over Taiwan presents a paradox of mutually assured economic destruction. Given that TSMC produces 92% of the world’s most advanced chips, any disruption would have devastating global consequences, triggering a recession and costing the global economy over $1 trillion.11 However, China would also face severe economic repercussions. A staggering $1.3 trillion of Chinese imports and exports pass through the Taiwan Strait, including a majority of its energy, ores, and metals.17 A blockade would be a double-edged sword, causing significant self-inflicted economic pain.17 This economic interdependence is a key deterrent to a full-scale conflict. Beyond the economic fallout, the human capital risk is profound. The specialized workforce that keeps TSMC’s fabs running could be a key target. A conflict could trigger a brain drain, with key technical talent emigrating, or, conversely, a Chinese blockade could trap this talent on the island, potentially to be “weaponized” to restart the fabs under new management.13 The US is already facing domestic labor shortages for its new fabs, highlighting the global talent gap and the strategic value of TSMC’s human capital.12

3. Economic Pressures and Strategic Adjustments

TSMC’s financial performance, while robust, is not immune to macroeconomic pressures. The company operates in a highly cyclical industry, and a general economic downturn could lead to reduced demand for its services, affecting revenues and margins.21 The company also faces significant headwinds from foreign exchange fluctuations. An unfavorable appreciation of the New Taiwan dollar (NT dollar) is expected to reduce TSMC’s Q3 2025 gross margin by approximately 260 basis points, a factor outside of the company’s control.2

A more complex challenge stems from U.S. policy. The U.S. is a key partner, providing subsidies through the CHIPS Act to incentivize onshoring and de-risk the supply chain.5 However, the U.S. is also a source of direct financial pressure. The Trump administration has revoked the “validated end user” (VEU) status for TSMC’s Nanjing, China, facility, effective December 31, 2025.4 This decision forces TSMC to apply for individual licenses for each shipment of U.S.-made equipment, slowing operations and making future technology upgrades and capacity expansions difficult.22 This move, which also targets Samsung and SK Hynix, signals a broader U.S. effort to tighten export controls and limit foreign firms’ ability to operate in China.22

The revocation of VEU status is a clear example of the U.S. government’s contradictory approach to TSMC. The company is receiving billions in subsidies to build a U.S. presence, yet it is simultaneously being hit with policies that disrupt its existing operations.5 This forces TSMC to undertake a massive, costly global reorganization. The company’s $165 billion investment in six advanced fabs in Arizona is a strategic hedge against geopolitical risk, but it comes at a significant financial cost.2 The Arizona projects are already facing delays due to labor and visa issues, pushing back the timeline for the second fab.12 The higher labor costs in Arizona, where technician salaries are substantially higher than in Taiwan, will drive wafer costs up by 10-20% and put continuous pressure on TSMC’s gross margins.7 This trend is not confined to TSMC; it reflects a broader fragmentation of the high-tech industry as national security concerns drive protectionist policies and disrupt established supply chains.18 This process of de-globalization will likely create parallel, less efficient innovation ecosystems, slowing technological progress across the board.13

4. The Unseen Battle: Cyber and Intellectual Property Threats

While a military conflict remains a distant possibility, the “chip war” is already being fought in the digital realm. TSMC faces a persistent and sophisticated cybersecurity threat, with over 19,000 employee credentials linked to the company circulating on the dark web.25 These compromised credentials serve as direct entry points for state-sponsored adversaries and cybercriminals.25 Cyberattacks against Taiwan’s government systems, with most incidents attributed to Chinese hackers, further highlight the pervasive threat landscape.3 This is not simply about stealing data; it is a geostrategic tactic. With U.S.-led export controls limiting China’s access to advanced lithography equipment, talent and trade secret theft have become the primary alternative to close the technology gap.15

A high-profile case in August 2025 exemplified this threat. TSMC uncovered a potential leak of its cutting-edge 2nm process technology.15 The company’s comprehensive monitoring systems, including its AI-driven anomaly detection, flagged unauthorized access, prompting immediate legal action and the termination of implicated employees.8 The investigation extended to Japanese equipment supplier Tokyo Electron, underscoring the vulnerabilities in cross-border collaboration and the critical importance of supply chain security.8 The incident marks the first high-profile case under Taiwan’s strengthened national security legislation for protecting “core technologies”.15

TSMC has a “zero-tolerance policy” on intellectual property violations and a robust, dual-track IP management system that utilizes both patents and trade secrets.26 The company’s Trade Secret Sustainable Intelligent Management Center (TSMC-TSMC) uses AI, automation, and cross-system integration to monitor projects and flag anomalies in real-time.8 This system, which has cataloged over 610,000 cases of technologies and know-how, is a critical component of its competitive advantage.8 TSMC is also proactively building an ecosystem-wide security model by extending its confidentiality framework to suppliers and partners in the U.S. and Europe, offering pro bono training to standardize security practices.8 This approach strengthens the entire supply chain, reinforcing trust with key clients like Apple and Nvidia who prioritize IP security.27 TSMC’s robust IP management system is no longer just a business function; it is a core component of its national and global strategic importance.8

5. The Race for Technological Supremacy

TSMC’s technological lead is the foundation of its market dominance. This lead is not merely a matter of research and development but of operational excellence and execution at scale. Yield is the key metric that separates TSMC from its competitors. As of mid-2025, TSMC’s 2nm (N2) node yield is at 65%, with projections to increase to 75% as the technology matures.28 This is significantly higher than its competitors, with Intel’s 18A process at 55% and Samsung’s SF2 process lagging at 40%.28 This high yield allows TSMC to begin mass production earlier, securing major customers and further expanding its market share.28

Table: Advanced Node Yield and Roadmap Comparison (TSMC vs. Intel vs. Samsung)

| Company | Node Name | Current Yield | Projected Future Yield | Mass Production Timeline | Key Technology |

| TSMC | N2 | ~65% 28 | ~75% 28 | Late 2025 7 | GAAFET 28 |

| Intel | 18A | ~55% 28 | 65-70% by Q4 2025 28 | End of 2025 28 | RibbonFET 28 |

| Samsung | SF2 | ~40% 28 | ~50% by Q4 2025 28 | Delayed 7 | MBCFET 28 |

TSMC’s technology roadmap continues to underpin its leadership. The company is on track to scale 2nm production in late 2025 and plans to introduce its 1.4nm manufacturing by 2027, with mass production in 2028.7 By contrast, Samsung has struggled with its advanced nodes and has delayed its 1.4nm plans.7 Intel’s 18A and 14A projects face postponements and low yields, and the company has been a “technological laggard for more than a decade”.29 The competitive landscape is so stark that Samsung and Intel are exploring a foundry alliance, a rare move that underscores the difficulty of competing with TSMC’s overwhelming lead.31

TSMC’s competitive advantage extends beyond technical specifications to its intellectual property (IP) fortress. The company employs a dual-track strategy of patents and trade secrets.26 As of the end of 2024, TSMC had accumulated over 104,000 patent applications and 69,000 patents granted worldwide.26 The company’s patent quality is “significantly higher than the industry average” and its portfolio is strategically deployed in key markets like the U.S., Taiwan, and China, aligning with its customer base.32 This patent fortress creates a formidable barrier to entry that competitors cannot easily overcome. TSMC’s “unparalleled customer service approach” created the entire fabless chip industry and built a level of customer trust that is an intangible, but invaluable, form of intellectual property.30 This trust is now being leveraged as customers place “rush orders” to navigate geopolitical risks, demonstrating a feedback loop where instability strengthens TSMC’s position due to its reputation for reliability.1

6. Building a Fortress: Mitigating Risk and Ensuring Resilience

TSMC is not merely reacting to geopolitical forces; it is proactively building a fortress of resilience. Its global expansion is the most visible component of this strategy. The company’s massive investment in the U.S., Japan, and Germany is a direct response to national security policies and a hedge against the concentration of its advanced manufacturing in Taiwan.8 The Arizona Fab 21 project, a $65 billion investment, is set to host 30% of TSMC’s 2nm capacity once mature, providing U.S. customers with a domestic supply chain.7 In Japan, the Kumamoto Fab 1 is already operational, with a second fab under construction.7 These expansions are a key part of TSMC’s strategy to align with the “Chip 4” alliance, which includes the U.S., Japan, South Korea, and Taiwan.8

The company’s public statements reveal a carefully managed, dual-priority strategy. While it is de-risking through overseas expansion, it is simultaneously reinforcing that Taiwan remains its primary operational and technological hub. TSMC Chairman C.C. Wei has stated that the company’s first, second, and third priorities are Taiwan.14 This is a strategic paradox: TSMC must expand overseas to mitigate risk, but the core of its competitive advantage remains anchored in Taiwan, where the most advanced R&D and production are located.5 A full-scale conflict would therefore not just impact its production but its entire R&D and technological leadership.

Beyond physical expansion, TSMC is fortifying its digital defenses. The company has established a Global Security Management (GSM) organization that leverages AI and IoT to strengthen information and physical security across its global fabs.33 The company has joined consortia like SEMI and the Taiwan Semiconductor Cybersecurity Committee to promote a collective, industry-wide approach to defense.34 A key part of this strategy is extending its IP governance framework to suppliers, offering pro bono training to standardize security practices.8 This approach recognizes that the supply chain is often the weakest link in the security chain.35

| Risk | Description of Risk | TSMC’s Mitigation Strategy |

| Geopolitical Conflict | A Chinese invasion or blockade of Taiwan could render TSMC’s main fabs inoperable and disrupt global supply chains. | Multi-billion dollar investments to build advanced fabs in the U.S., Japan, and Germany to diversify its manufacturing base.5 |

| U.S. Export Controls | Revocation of “validated end user” (VEU) status for the Nanjing fab could slow operations and complicate capacity expansion in China. | Evaluating the situation and communicating with U.S. authorities, while committing to uninterrupted operation of the Nanjing fab and expanding partnerships with Chinese equipment makers.4 |

| Intellectual Property (IP) Theft | State-sponsored cyber espionage and industrial espionage aim to steal TSMC’s cutting-edge chip designs and manufacturing recipes. | Implementation of an AI-driven, dual-track IP management system that protects both patents and trade secrets.8 It also extends its confidentiality network to overseas suppliers.8 |

| Supply Chain Vulnerabilities | The supply chain, including EDA tool providers and raw material suppliers, presents weak points that can be exploited by threat actors. | Establishment of a Global Security Management (GSM) organization to strengthen information and physical security, and engagement in industry-wide cybersecurity consortia like SEMI.33 |

| Labor & Cost Challenges | Higher labor costs and visa issues in the U.S. lead to margin dilution and project delays for its overseas fabs. | Actively working to address labor and visa challenges while maintaining its commitment to expand capacity. The company believes premium pricing for advanced nodes will offset these costs.7 |

7. Outlook: Navigating an Uncertain Future

The analysis concludes that TSMC’s dominant position is not a guarantee of security but a high-stakes vulnerability. The company faces a perfect storm of risks that are inextricably linked, forming a geopolitical equation with potentially catastrophic outcomes. The primary risk is not a single, decisive kinetic invasion, but the slow, persistent erosion of its operational environment through China’s “anaconda strategy” of non-military coercion.3 This strategic instability could cripple the company and trigger a global economic crisis.

The company’s proactive strategy of global expansion, technological leadership, and robust intellectual property protection positions it as a resilient force.7 The company is actively building a fortress to mitigate risks, but the effort is costly and complex, creating financial headwinds that could affect its margins.2 The so-called “decline” of TSMC is therefore not a present-day reality but a potential outcome of a failure to navigate this hyper-complex, multi-layered risk environment. TSMC remains the linchpin of the global technology ecosystem. The company’s future, and by extension the future of global innovation, hinges on its ability to execute its de-risking strategy while maintaining its technological lead.11 The story of TSMC is a microcosm of a new global order where economic, technological, and strategic competitions are inextricably linked.

References

- TSMC market share increases to 67.6% in Q1 2025

- TSM Q2 2025 Earnings Report on 7/17/2025 – MarketBeat

- How China Intensified Its Tactics Against Taiwan | Council on …

- US moves to tighten flow of advanced chip equipment to Chinese plants – POLITICO Pro

- Unpacking TSMC’s $100 Billion Investment in the United States

- Chinese Hackers Target Taiwan’s Semiconductor Sector with Cobalt Strike, Custom Backdoors

- TSMC Stock Price Forecast: NYSE:TSM Balances Export Risks With AI Growth

- TSMC’s Trade Secret Management System: A Strategic Move to …

- Samsung vs. TSMC vs. Intel: Who’s Winning the Foundry Market? (Latest Numbers)

- Nvidia CEO Jensen Huang’s advice: Buying stake in this Apple, Google chip partner will be ‘very smart’,,

- A Chinese invasion of Taiwan would cripple the global semiconductor supply chain – and the planet – bne IntelliNews

- The TSMC and a Chinese Invasion of Taiwan – Etonomics

- How Disruptive Would a Chinese Invasion of Taiwan Be? | American Enterprise Institute

- TSMC mulled moving chip fabs from Taiwan over China threat – The Register

- TSMC Terminates Employees in Wake of Alleged 2 nm Trade-Secret Breach – AnySilicon

- Rethinking the Threat: Why China is Unlikely to Invade Taiwan – Stimson Center

- Crossroads of Commerce: How the Taiwan Strait Propels the Global Economy – CSIS

- Risk Management | Taiwan Semiconductor Manufacturing Company Limited

- Taiwan’s semiconductor power and the threat of Chinese invasion | 7NEWS

- 2025 Global Semiconductor Industry Outlook | Deloitte US

- TSMC Annual Report 2012 :: Company Performance :: Financial Highlights

- US Ends Chip Waiver For TSMC To Supply Its Chinese Fabs – Asia Financial

- US limits TSMC’s ability to send chipmaking equipment to its fabs in China – SiliconANGLE

- TSMC’s Nanjing fab waiver loss no threat to competitiveness: MOEA – Focus Taiwan

- How Hackers Could Attack TSMC – SemiWiki

- TSMC 2024 Annual Report – TSMC Investor Relations

- TSMC Expands Confidentiality Network Across US and European Partners – CoinCentral

- 2nm Node Yield: Latest Developments from TSMC, Intel, and …

- We’re still waiting for the first 2nm chips but TSMC is accelerating its plans for 1.4nm silicon manufacturing, starting in 2027 | PC Gamer

- U.S. Intel – Stratechery by Ben Thompson

- Samsung Electronics and Intel explore a foundry alliance, joining forces on everything from packaging to glass substrates to catch up with TSMC. | SemiWiki,

- 99% Approval Rate For TSMC Patents In 2019: Let’s Take A Closer Look At Its Portfolio

- Information Security – TSMC

- How the semiconductor industry is grappling with cybersecurity threats | Manufacturing Dive

- Supply Chain Attacks Surge in 2025: Double the Usual Rate – Cyble

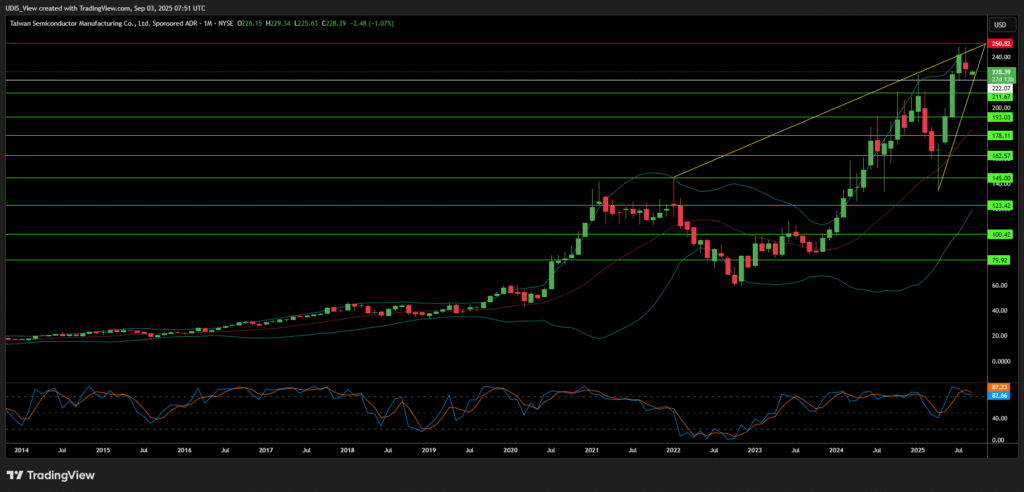

TSMC Short (Sell)

Enter At: 222.07

T.P_1: 211.67

T.P_2: 193.03

T.P_3: 178.11

T.P_4: 162.57

T.P_5: 145.00

T.P_6: 123.42

T.P_7: 100.42

T.P_8: 79.92

S.L: 250.82