Teledyne Technologies Incorporated recently announced record quarterly sales in its Q2 2025 report, achieving its greatest total and organic sales growth in three years.1 The company’s financial results, which included double-digit increases in both sales and earnings per share, are not a market anomaly. They represent the culmination of a deliberate and disciplined long-term strategy.1 This report asserts that Teledyne’s success is the direct outcome of its strategic positioning at the intersection of critical, high-barrier-to-entry markets. The company fortifies its position through geopolitical acumen, technological leadership, a formidable intellectual property portfolio, and a proactive stance on enterprise risk management. This multifaceted approach creates a robust competitive advantage, cementing Teledyne’s role as a silent leader in the global technology landscape.

A New Global Paradigm: Geopolitics and Geostrategy

Teledyne’s success is deeply intertwined with the shifting geopolitical landscape. The company’s products are not merely innovative; they are mission-critical components in modern defense and security. This is particularly evident in its development of micro unmanned aerial vehicles (UAVs), which are redefining tactical intelligence and situational awareness.

The Black Hornet Nano: A Micro-UAV Masterstroke

Teledyne FLIR’s Black Hornet Nano represents a masterclass in applying advanced technology to meet a precise military need. Originally developed by Prox Dynamics AS, a Norwegian company acquired by Teledyne in 2016 for $134 million, this military micro-UAV is a force multiplier for ground troops. The Black Hornet weighs just 18 g, small enough to fit in one hand, yet it provides invaluable local situational awareness. It delivers real-time video and still images, enabling soldiers to look around corners or over walls to identify hidden dangers and enemy positions.

The Black Hornet’s strategic value has been proven in modern conflict. The British Army used the drone during Operation Herrick in Afghanistan, and more recently, soldiers in Ukraine have deployed the high-tech drone.4 Its quiet electric motors and 20-minute flight time provide a discrete capability for reconnaissance and surveillance. The drone’s design, which does not store data on-board, prevents intelligence from being compromised if the unit is captured. This blend of technological sophistication and practical tactical utility makes the Black Hornet a critical asset in asymmetrical warfare, where information is as vital as firepower.4

Evolution of Reconnaissance: Black Recon and Beyond

Teledyne FLIR continues to innovate on this foundation with its new Black Recon system, revealed in 2023 after five years of development. Designed for armored vehicles, the system consists of a self-contained box with three UAVs that can be launched and recovered autonomously from the vehicle’s interior. This innovation directly addresses a significant tactical vulnerability: the need for crews to leave the safety of their vehicle to gain situational awareness. Each Black Recon drone weighs 350 g and can travel up to 6 km from its launch vehicle, with an endurance of 45 minutes. This system represents a significant step forward in integrating unmanned aerial systems into traditional ground combat platforms, providing a new layer of protection and intelligence. Deliveries are expected to begin in 2025.

Geopolitical Alignment and Supply Chain Fortification

Teledyne’s strategic moves extend beyond product development to international partnerships. The company’s collaboration with Japan’s ACSL, a leading drone manufacturer, is a prime example of this.5 This partnership is critically important because ACSL’s flagship SOTEN drone and its SAMO payload are both National Defense Authorization Act (NDAA) compliant and International Traffic in Arms Regulations (ITAR) free.5 The NDAA prohibits U.S. government agencies from using Chinese-made drones, a regulation that has created a massive market opportunity.7 By partnering with an NDAA-compliant manufacturer, Teledyne enables its thermal camera modules to be integrated into secure drone solutions for U.S. public safety and industrial markets.5

Teledyne’s products are specifically designed to meet stringent government and military requirements. This is not a coincidence. This intentional strategic alignment with U.S. and allied defense policy turns regulatory compliance into a powerful barrier to entry for competitors from non-allied countries. 5 Teledyne leverages its core technological expertise—specifically, its thermal imaging—to enable allied partners to meet critical security standards. This creates a formidable, politically reinforced advantage that many international competitors cannot replicate.

Financial Fundamentals: A Foundation of Resilience

Teledyne’s financial performance provides a clear picture of its underlying strength. The company’s record-setting Q2 2025 results highlight its ability to generate both substantial top-line growth and impressive profitability.

Exceptional Q2 2025 Performance

Teledyne reported net sales of $1.51 billion for the second quarter of 2025, a robust 10.2% increase over the same period in 2024.1 This growth was not solely dependent on acquisitions; it included a strong organic component.1 The company also reported a 16.5% increase in GAAP diluted earnings per share, which rose to $4.43 from $3.77 in the prior year.3 Non-GAAP diluted earnings per share also saw a healthy increase, climbing to $5.20 from $4.58.1 Management noted that orders exceeded sales for the seventh consecutive quarter, a leading indicator of continued demand and future revenue growth.2

Organic Growth Across All Segments

A deeper analysis of the Q2 results reveals a fundamental strength that separates Teledyne from many of its peers. The company’s sales grew organically in every single business segment.1 The Aerospace and Defense Electronics segment showed exceptional performance, with a 36.2% increase in sales and a 16.6% increase in operating income.3 The Instrumentation and Digital Imaging segments also posted strong organic growth of 10.2% and 4.3% respectively.3

When a company’s revenue growth is driven by a single product line or a specific market trend, it can create a fragile business model. Teledyne’s broad-based organic growth demonstrates that its core technological foundation and strategic market positioning are broadly successful. This diversified health insulates the company from potential fluctuations or downturns in any one industry. This broad, multi-segment performance is a testament to the success of its vertically integrated business model and the effective cross-pollination of technologies across its portfolio.

Table 1: Key Financials, Q2 2025

| Metric | Q2 2025 Result | Year-over-Year Change |

| Net Sales | $1.51 billion 1 | +10.2% 3 |

| GAAP Diluted EPS | $4.43 3 | +17.5% 2 |

| Non-GAAP Diluted EPS | $5.20 1 | +13.5% 1 |

| Organic Sales Growth | Growth in every segment 1 | — |

| Operating Margin (Non-GAAP) | 22.2% 1 | +0.6% 1 |

| Orders | Exceeded sales 2 | — |

Valuation and Analyst Sentiment

Teledyne’s stock valuation reflects this strong performance. The company’s P/E ratio is 29.46, which is slightly above its 10-year historical average of 26.63.9 Analysts have taken notice, with several recent price target upgrades, including one to $630. The stock holds an average rating of “Moderate Buy” from analysts on MarketBeat.com. This positive sentiment is mirrored by institutional investors, who have been actively increasing their positions in the company. In the first quarter, Goldman Sachs Group, for example, acquired an additional 90,302 shares, and Ascent Group LLC raised its holdings by 570%.

Interpreting Insider Transactions in Context

Some observers may note recent insider stock sales, including a Director’s sale of 1,975 shares and the CEO’s sale of 6,735 shares. While insider sales can sometimes signal a lack of confidence, these transactions should be viewed within their full context. The Director’s sale represented a 3.71% decrease in their position, and the CEO’s was a 39.33% decrease. Simultaneously, institutional investors are actively buying large blocks of shares, and analysts are raising their price targets. This institutional confidence, combined with the company’s record-setting performance, outweighs any negative signal from the sales. The sales likely represent routine personal financial management, rather than a fundamental shift in confidence about the company’s future.

A Diverse Portfolio: From Seabed to Satellite

Teledyne’s technological advantage is not limited to a single domain. The company has methodically built a diverse portfolio of highly engineered products that are foundational to industries ranging from marine exploration to deep space missions.

Marine Instrumentation: The Blue Economy’s Backbone

Teledyne Marine is a recognized leader in oceanographic technology. Its Teledyne RD Instruments division is the industry’s leading manufacturer of Acoustic Doppler Current Profilers (ADCPs).10 These instruments are vital for measuring flow velocity and direction in waterways. The stability of this business is highlighted by a new, decade-long contract with Rijkswaterstaat, the executive agency of the Dutch Ministry of Infrastructure and Water Management. This agreement for the supply and maintenance of more than 80 ADCPs reinforces the long-term, predictable revenue streams derived from mission-critical government contracts. Furthermore, the introduction of the eXtreamer, a new marine seismic streamer, engineered for high-resolution surveys, positions Teledyne to capitalize on the growing demands of the offshore energy and scientific research markets.

Space and High-Tech: The Final Frontier

In the space domain, Teledyne’s innovations are pushing the boundaries of what is possible. Teledyne e2v recently introduced its 16-GB radiation-tolerant DDR4 memory, which is the highest-density space-grade DDR4 memory on the market. This component is certified to meet NASA Level 1 and European Cooperation for Space Standardization (ECSS) Class 1 requirements, the most stringent certifications for space use. This level of certification is a significant technical and legal barrier to entry. The memory device is designed to withstand the rigors of space, including severe temperature variations and intense radiation exposure. Its pin-to-pin compatibility with previous 4-GB and 8-GB variants allows system designers to easily upgrade older designs without a full board redesign, giving it a strong market advantage.12

Cross-Domain Synergy: The FLIR Acquisition

The 2021 acquisition of FLIR Systems for $8.2 billion was a strategic masterstroke.13 It allowed Teledyne to acquire a global leader in infrared (IR) cameras and digital imaging technology, which Teledyne has since integrated horizontally across its diverse portfolio.13 The thermal imaging technology is not confined to a single product line but is a foundational component of both defense and industrial solutions. This is evident in the Black Hornet and Black Recon drones, which use FLIR’s proprietary IR cameras. The Hadron 640R and Boson thermal camera modules, which are part of the FLIR portfolio, are also being integrated into products from partners like ACSL.5 This strategy of acquiring and integrating core technologies across all four business segments creates significant operational efficiencies and product differentiation. A single research and development investment in a thermal sensor, for example, can generate revenue across multiple, distinct markets (military, public safety, industrial automation), maximizing return on investment and creating a more robust, integrated product portfolio.

The Intellectual Property Moat: Science as a Competitive Advantage

Teledyne’s competitive advantage is not just in its products but in the intellectual property that underpins them. The company has methodically built a formidable patent portfolio that acts as a powerful barrier to entry for competitors.

A Deep and Broad Patent Portfolio

Teledyne holds a total of 5,131 patents globally, with 2,950 of them granted.14 More than 40% of these patents remain active.14 This is not simply a matter of quantity. The company boasts an exceptional 85.6% patent grant rate at the United States Patent and Trademark Office (USPTO), a statistic that far surpasses the industry average and signals the high quality and defensibility of its innovations.14 The portfolio spans Teledyne’s key domains, with 38% in imaging and photonics, 33% in defense and aerospace electronics, and 29% in scientific instrumentation.

The value of this portfolio is evident in its citation record. Teledyne’s patents are highly cited by major industry players like Boeing, Samsung Electronics, and Raytheon.14 This is a crucial indicator of a patent’s foundational nature and commercial relevance. When industry giants consistently cite Teledyne’s intellectual property, it means Teledyne’s innovations are fundamental building blocks for future industry-wide development.16 This creates a powerful intellectual property moat. Teledyne’s competitive advantage comes not just from selling products but from owning the underlying technology that the entire industry relies on. This provides a long-term revenue stream and a powerful legal defense against competitors.

Table 2: Teledyne’s Strategic IP Domains

| Patent Category | Percentage of Portfolio | Key Products & Applications |

| Imaging & Photonics | 38% | Thermal by FLIR, Hadron 640R, Boson, X-Ray Detectors, High-Resolution Cameras 5 |

| Defense & Aerospace Electronics | 33% | Black Hornet Nano, Black Recon, Avionics Systems, Electronic Warfare Components, Radiation-Tolerant Memory 13 |

| Scientific Instrumentation | 29% | Acoustic Doppler Current Profilers (ADCPs), Marine Seismic Streamers, Environmental Monitors, Leak Detection Sensors 10 |

The Research and Development Engine

The source of this intellectual property is Teledyne’s relentless commitment to research and development. In 2022, the company invested $474 million in R&D, marking a 5.6% year-over-year growth. Teledyne employs a highly skilled workforce, with 4,700 engineers holding advanced degrees, a demographic that accounts for 37% of its total workforce. This specialized talent pool is the primary engine behind its technological innovation and patent generation. The company’s investment in its human capital is directly correlated with its ability to maintain its technological leadership and its powerful intellectual property portfolio.

Fortifying the Enterprise: Cybersecurity and Supply Chain

In today’s interconnected world, a company’s success is also measured by its ability to manage digital and physical risks. Teledyne has demonstrated a proactive approach to both cybersecurity and supply chain management, further reinforcing its competitive position.

A Proactive Cybersecurity Posture

Teledyne maintains a robust cybersecurity program, overseen by a dedicated Chief Information Security Officer (CISO) and a team who brief the CEO and Board of Directors regularly on this topic.18 The company and some of its business units have received external audits and certifications from top information security standards, including Cyber Essentials Plus, a UK government-backed scheme.19 This proactive stance on security is a critical element of its value proposition, particularly in its work with government and defense clients.18

The CMMC Mandate: A New Strategic Imperative

The Department of Defense’s (DoD) new Cybersecurity Maturity Model Certification (CMMC) program is rapidly becoming a mandatory requirement for defense contractors.20 The final rule for CMMC 2.0 went into effect in December 2024, and the DoD plans to require CMMC compliance in nearly all new contracts starting in October 2025.21 This new regulatory environment is not just a compliance exercise; it is becoming a significant competitive filter.

The time and resources required to achieve CMMC compliance are substantial, and many smaller or less-prepared companies will struggle to meet the strict standards.21 Teledyne’s existing cybersecurity infrastructure and its proactive pursuit of certifications give it a crucial head start in meeting these new standards faster and more efficiently than its competitors.18 This will likely enable the company to win or retain more defense contracts as the CMMC rules are phased in, effectively creating a “compliance moat” that reinforces its already strong market position.

Vertical Integration and Supply Chain Resilience

Teledyne’s vertically integrated business model allows it to maintain tight quality control and mitigate potential supply chain disruptions.13 For its defense and aerospace segments, it sources and uses components that meet or exceed military and aerospace specifications.22 This is a crucial element of its value proposition, especially in a world of complex, interdependent supply chains. This control over its production processes ensures the reliability of its products, a non-negotiable trait for its mission-critical applications.

Outlook and Conclusion: A Durable Competitive Advantage

Teledyne’s exceptional performance is not rooted in a single product or a passing market trend. It is a synthesis of strategic acquisitions, disciplined intellectual property development, and a focus on mission-critical, high-barrier-to-entry markets. The company leverages geopolitical realities to its advantage, using compliance as a strategic filter against competitors. Its technological innovations, from the seabed to satellites, are not isolated but are part of a horizontally and vertically integrated ecosystem that maximizes return on research and development investment.

The company faces the same risks as any diversified industrial conglomerate, including competition from rivals such as Northrop Grumman and Thermo Fisher Scientific and exposure to geopolitical and macroeconomic risks.13 However, Teledyne has quietly built a strategic, multi-layered moat, ensuring its dominance across its diverse and essential portfolio. Its ascent is not a surge but a calculated, deliberate climb, powered by a disciplined and long-term strategy that positions it for continued and predictable growth.

References

- Teledyne Technologies Reports Second Quarter Results

- Teledyne reports record Q2 sales, raises 2025 earnings outlook – Investing.com

- Teledyne Technologies Reports Second Quarter Results – Nasdaq

- Ukraine’s Black Hornet Micro Drone is the FUTURE of Infantry Ops – YouTube

- Teledyne FLIR OEM announces Japanese drone manufacturer ACSL as new Thermal by FLIR collaborator – Vertical Magazine

- Teledyne FLIR OEM Announces Japanese Drone Manufacturer ACSL as New Thermal by FLIR Collaborator | RoboticsTomorrow

- Teledyne EchoOne – NDAA Compliant LiDAR for Drones – RMUS – Unmanned Solutions

- Compared to Estimates, Teledyne (TDY) Q2 Earnings: A Look at Key Metrics – July 23, 2025

- TDY – Teledyne Technologies PE ratio, current and historical analysis – FullRatio

- Teledyne RD Instruments Acoustic Doppler Current Profilers and Doppler Velocity Logs

- Marine Instrumentation – Teledyne Technologies

- Teledyne e2v Releases Engineering Models of 16GB Space-Qualified DDR4 Memory

- Teledyne Technologies Incorporated (TDY) Business Profile – stockrow

- Teledyne Technologies Patents – Key Insights and Stats

- Teledyne Technologies Incorporated (TDY): VRIO Analysis – dcfmodeling.com

- Unlock Strategic Insights with Our Patent Portfolio Quality Report

- Highly reliable GaN Switch for hi-rel applications now available off the shelf – Teledyne Defense Electronics

- Ethics & Values – Teledyne Technologies

- Accreditations – Teledyne Labtech

- Cybersecurity Maturity Model Certification (CMMC) – Defense Counterintelligence and Security Agency

- CMMC Deadline 2025 Update: CMMC May Be Required in Most Contracts Starting This October – Secureframe,

- Defense – Teledyne AES

- May 2024 – Teledyne Investor Presentation.pdf

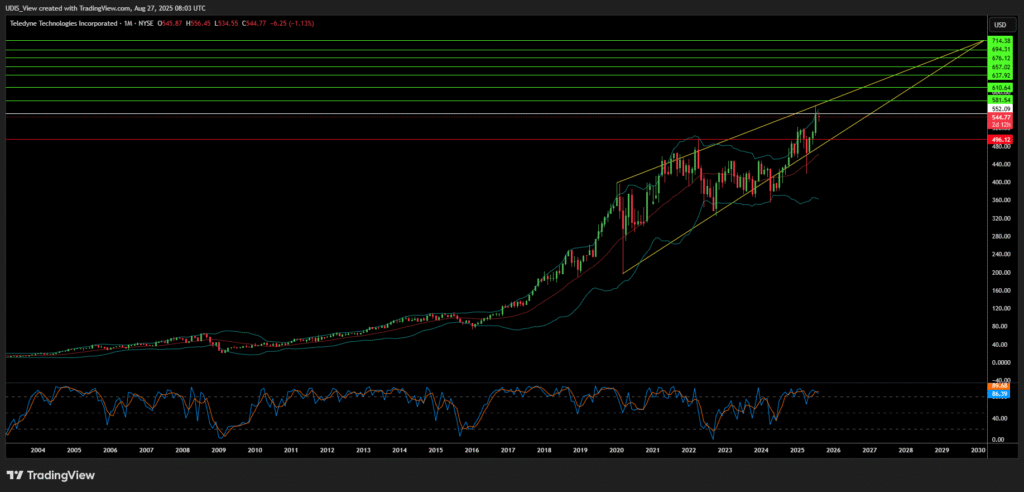

Teledyne Long (Buy)

Enter At: 552.09

T.P_1: 581.54

T.P_2: 610.64

T.P_3: 637.92

T.P_4: 657.02

T.P_5: 676.12

T.P_6: 694.31

T.P_7: 714.38

S.L: 496.12