MP Materials’ Ascent: A Strategic Market Revaluation

MP Materials (MP) shares recently experienced a remarkable surge, closing up approximately 51% at $45.23 apiece MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo, Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. This dramatic increase propelled the stock to its highest level in three years, dating back to early 2022 Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar, building on a substantial 90% year-to-date gain MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The primary catalyst for this significant market movement was the announcement of a multi-billion dollar public-private partnership with the U.S. Department of Defense (DoD) MP Materials Announces Transformational Public-Private Partnership – MP Materials. This collaboration aims to rapidly accelerate the development of an end-to-end U.S. rare earth magnet supply chain and reduce foreign dependency MP Materials Announces Transformational Public-Private Partnership – MP Materials. This surge occurred amidst an ongoing U.S.-China trade war, where rare earth metals have emerged as a central point of contention Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. China had previously threatened to restrict rare earth exports amid rising trade tensions MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo.

Rare earth magnets represent strategically vital components across advanced technology systems MP Materials Announces Transformational Public-Private Partnership – MP Materials. Their applications span both defense and commercial sectors MP Materials Announces Transformational Public-Private Partnership – MP Materials. These materials are indispensable for electric motors and in navigation equipment MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. For the Pentagon, the availability of rare earth supplies directly impacts national security MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. An F-35 fighter jet, for instance, incorporates over 900 pounds of rare earths, underscoring their critical role in modern defense capabilities MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo.

The dramatic stock surge, extending beyond typical market fluctuations, indicates a fundamental re-evaluation of MP Materials. The DoD pact directly caused the immediate price jump. Underlying drivers for this partnership include pressing national security concerns and the urgent need to reduce foreign reliance on these critical materials. China’s prior export restrictions further highlighted U.S. vulnerabilities. This agreement significantly de-risks MP Materials’ future revenue streams and provides substantial capital. The company transforms from a commodity miner, vulnerable to price volatility and foreign market manipulation, into a strategic national asset with guaranteed demand and price stability. Investors now value MP not merely for its current mining output, but for its pivotal role in a national strategic imperative. This shifts its valuation from a traditional mining company to an enterprise critical for defense and national infrastructure. The market is pricing in long-term, government-backed stability and growth, rather than just short-term commodity price movements.

Furthermore, geopolitical tensions directly fueled this market value creation for a domestic player. MP stock had already begun rising due to China’s threats of export restrictions MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. China’s limitations had previously disrupted development and production for major companies like Ford and Tesla MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. These actions underscored U.S. vulnerability, spurring decisive government action. The DoD deal represents a direct policy response to these geopolitical pressures. This demonstrates how geopolitical friction, particularly concerning critical resources, can directly trigger government intervention. Such intervention, in turn, creates substantial value for companies positioned to address strategic gaps. This highlights the increasing intertwining of national security, economic policy, and market performance in strategic sectors.

The Pentagon’s Game-Changing Investment in Domestic Supply

The agreement between MP Materials and the U.S. Department of Defense constitutes a multi-billion dollar public-private partnership MP Materials Announces Transformational Public-Private Partnership – MP Materials. This comprehensive pact includes an initial $400 million equity investment MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo, with the DoD purchasing new preferred MP stock alongside warrants MP Materials Announces Transformational Public-Private Partnership – MP Materials. This transaction positions the DoD as MP Materials’ largest shareholder, holding an effective stake of approximately 15% U.S. Becomes Largest Shareholder In MP Materials – Rare Earth Miner – To Counter China – Economic Times, surpassing China’s Shenghe Resources’ previous 8% stake MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. The agreement also commits up to $350 million in additional funding MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. A $150 million loan from the Pentagon will specifically support the development of heavy rare earth separation capabilities at MP Materials’ Mountain Pass facility MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo, MP Materials’ Deal With Defense Department – Defence Industry Europe. MP Materials itself will invest $600 million of its funds into these expansion projects MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. The DoD is funding this investment in part through the Cold War-era Defense Production Act MP Materials seals mega rare-earths deal with US to break China’s grip – CNA, signaling the profound urgency and national security priority attached to this initiative.

The primary purpose of this substantial funding is to accelerate the build-out of a robust U.S. rare earth magnet supply chain MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The capital will facilitate the construction of new domestic magnet-manufacturing facilities and expand MP Materials’ existing mining and processing capabilities MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. MP Materials is already developing a magnet production facility in Fort Worth, Texas, with finished neodymium-iron-boron magnets expected by year-end Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. The deal further includes plans for a second “10X Facility” for magnet manufacturing at a yet-to-be-chosen location Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar, anticipated to be commissioned in 2028 MP Materials’ Deal With Defense Department – Defence Industry Europe. This new facility aims to achieve an annual magnet capacity of 10,000 metric tons MP Materials’ Deal With Defense Department – Defence Industry Europe. The overarching objective remains the establishment of a complete, end-to-end U.S. rare earth magnet supply chain MP Materials Announces Transformational Public-Private Partnership – MP Materials.

A critical component of this agreement is the 10-year price floor of $110 per kilogram for neodymium and praseodymium oxide MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo, How The U.s. Is Guaranteeing Mp Materials Future Sales – Nasdaq. This floor price is nearly double the average price of $60 per kilogram observed since 2008 MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo and significantly higher than the $52 per kilogram MP Materials received in the second quarter MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. This guarantee ensures MP Materials can operate successfully, even if China attempts to flood the market to depress prices MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. Additionally, the DoD will guarantee 100% purchase of magnets from the new facility for 10 years by defense and commercial customers MP Materials’ Deal With Defense Department – Defence Industry Europe. This price floor mechanism has long been sought by U.S. critical minerals companies MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. It directly counters China’s historical market manipulations, which previously contributed to bankruptcies for past owners of MP Materials’ mine MP Materials seals mega rare-earths deal with US to break China’s grip – CNA.

The DoD’s explicit financial guarantees and equity stake significantly de-risk MP Materials, making it highly attractive for further private sector investment. The DoD provides substantial capital, critically, it guarantees a price floor and 100% offtake for a decade MP Materials Announces Transformational Public-Private Partnership – MP Materials. These guarantees provide “stable and predictable cash flow with shared upside” and “reduce vulnerability to non-market forces.” MP Materials Announces Transformational Public-Private Partnership – MP Materials. This directly addresses the historical problem of Chinese market manipulation driving down prices and deterring investment. The deal has already attracted backing from JP Morgan and Goldman Sachs for a $1 billion loan for the 10X facility MP Materials Announces Transformational Public-Private Partnership – MP Materials. This signifies strong private capital confidence. Government strategic investments, particularly with explicit price and demand guarantees, act as powerful catalysts. They attract private capital by mitigating significant market risks, such as commodity price volatility and state-backed competition. This enables long-term, capital-intensive projects that would otherwise be too risky for purely commercial ventures. This creates a template for future public-private partnerships in other critical sectors.

The DoD becoming MP Materials’ largest shareholder is more than a financial transaction; it is a profound geopolitical statement. The DoD’s 15% stake surpasses China’s Shenghe Resources MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. This move directly counters China’s influence within MP Materials, which previously sent most of its ore to China for processing MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. MP Materials has now halted shipments to China MP Materials cuts off US rare earth to China amid ongoing tariff battle – Fox Business. This ensures strategic control over a vital domestic asset. It aligns MP Materials’ corporate objectives directly with U.S. national security interests. This is a clear assertion of economic sovereignty and a direct challenge to China’s “iron grip” on the rare earth supply chain. It signals to global markets and adversaries that the U.S. is prepared to use its full economic and strategic power to secure critical supply chains, even if it means direct government ownership stakes. This could set a precedent for similar interventions in other strategically vital industries.

The following table summarizes the key financial commitments and guarantees from the DoD deal, illustrating the scale and multi-faceted nature of the U.S. government’s commitment.

| Commitment/Guarantee | Details | Source |

| Initial Equity Investment | $400 million | MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo |

| Additional Funding Commitment | Up to $350 million | MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo |

| Pentagon Loan (Heavy RE Separation) | $150 million | MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo |

| MP Materials’ Own Investment | $600 million | MP Materials seals mega rare-earths deal with US to break China’s grip – CNA |

| DoD Shareholding | ~15% (Largest Shareholder) | U.S. Becomes Largest Shareholder In MP Materials – Rare Earth Miner – To Counter China – Economic Times |

| Price Floor (NdPr Oxide) | $110/kg (10 years) | How The U.s. Is Guaranteeing Mp Materials Future Sales – Nasdaq |

| Offtake Guarantee (New Facility) | 100% for 10 years | MP Materials’ Deal With Defense Department – Defence Industry Europe |

| Expected New Magnet Capacity | 10,000 metric tons/year | MP Materials’ Deal With Defense Department – Defence Industry Europe |

Geopolitical Imperative: De-risking the Rare Earth Supply Chain

China maintains a near-monopoly over the global rare earth supply chain, granting it significant geopolitical leverage. In 2024, China led global rare earth mining, producing approximately 270,000 metric tons out of a worldwide total of 390,000 metric tons MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The U.S., by contrast, mined only about 45,000 metric tons MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. China also dominates rare earth refining, controlling about 85% of worldwide capacity MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. Crucially, China produces 95% of rare earth magnets and processes 90% of all rare earth metals MP Materials: Navigating Geopolitical Turbulence to Secure Rare Earth Dominance – Ainvest. This extensive control allows China to significantly influence global pricing and production MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo.

China has demonstrably used its rare earth dominance as a geopolitical lever through export restrictions. Amidst rising trade tensions with the U.S., China threatened to restrict exports MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. It halted exports in March as part of a trade dispute MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. These restrictions caused a 75% drop in rare earth magnet exports from China and led to production suspensions for companies like Ford and Tesla MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. While some restrictions eased in June, China continued to limit certain shipments MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. In response to these limitations, MP Materials halted shipments of rare earth concentrates to China, its largest customer, and increased sales to new buyers in the U.S., Japan, and South Korea MP Materials cuts off US rare earth to China amid ongoing tariff battle – Fox Business.

The U.S. faces significant national security implications due to its reliance on foreign rare earth sources. The nation relies almost entirely on foreign sources for rare earth magnets MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. Rare earths are vital for defense applications, as exemplified by the F-35 fighter jet containing over 900 pounds of these materials MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The DoD’s 2024 National Defense Industrial Strategy includes a “mine to magnet” plan, aiming for DoD self-sufficiency by 2027 MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. President Trump invoked emergency powers in March to boost domestic critical mineral production, underscoring the high-level commitment to offset China’s control MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. MP Materials CEO Jim Litinsky noted an unprecedented “sense of urgency” after China began limiting exports MP Materials seals mega rare-earths deal with US to break China’s grip – CNA, highlighting the strategic imperative.

China’s actions clearly demonstrate a strategy of weaponizing its rare earth dominance to exert geopolitical pressure. China holds a near-monopoly on mining, processing, and magnet production. Its restricted exports amid trade tensions directly impacted U.S. companies and caused a significant drop in magnet exports. This forced the U.S. to confront its vulnerability and accelerate domestic supply chain efforts. This highlights a global trend where critical resources are increasingly used as tools of foreign policy and economic coercion. Nations reliant on single-source suppliers face significant strategic vulnerabilities. The MP Materials deal directly responds to this weaponization, aiming to build resilience and deter future coercive tactics. It underscores the shift from purely economic competition to strategic resource competition.

The U.S. commitment to an end-to-end domestic rare earth supply chain is not merely economic policy but a foundational element of national security. The DoD explicitly states rare earths are a “matter of national security” MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo and has a “mine to magnet” plan for self-sufficiency by 2027 MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The goal is to reduce “foreign dependency” MP Materials Announces Transformational Public-Private Partnership – MP Materials. Reliance on foreign sources, particularly a geopolitical rival, creates unacceptable risks for defense systems and critical commercial technologies. The DoD’s significant investment, including equity ownership and long-term guarantees, reflects the depth of this imperative. It is not just about having the raw material, but controlling the entire value chain up to the finished magnet. This signifies a profound shift in U.S. industrial policy, moving beyond free-market principles to direct intervention in strategically vital sectors. It acknowledges that certain supply chains are too critical to be left solely to market forces, especially when dominated by potential adversaries. This “mine to magnet” strategy could become a blueprint for securing other critical mineral and material supply chains, influencing future industrial investments and geopolitical alliances.

MP Materials: Forging U.S. Rare Earth Independence

MP Materials holds a unique and critical position in the Western Hemisphere’s rare earth landscape. It stands as the largest producer of rare earths in the region MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The company owns and operates the only significant rare earths mine and processing facility in the U.S., located at Mountain Pass, California Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. MP Materials primarily produces neodymium and praseodymium oxides, two of the most important rare earth elements MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo.

The company has ambitious expansion plans focused on bolstering domestic processing and magnet production. MP Materials is actively developing a rare earth magnet production facility in Fort Worth, Texas, which expects to produce finished neodymium-iron-boron magnets by the end of this year Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. A second magnet manufacturing facility, dubbed the ’10X Facility’, is planned at a new location Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar, with commissioning expected in 2028 MP Materials’ Deal With Defense Department – Defence Industry Europe. This facility will significantly boost total U.S. rare earth magnet manufacturing capacity to an estimated 10,000 metric tons annually MP Materials’ Deal With Defense Department – Defence Industry Europe. MP Materials also intends to add additional heavy rare earth separation capabilities at its Mountain Pass facility, supported by a $150 million DoD loan MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. While MP Materials previously sent most of its ore to China for processing MP Materials seals mega rare-earths deal with US to break China’s grip – CNA, it now processes about 40% of its concentrate domestically MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo and has halted shipments to China MP Materials cuts off US rare earth to China amid ongoing tariff battle – Fox Business.

The DoD partnership profoundly transforms MP Materials’ operations. The 10-year price floor ensures stable and predictable cash flow, providing a robust financial foundation MP Materials Announces Transformational Public-Private Partnership – MP Materials. This agreement significantly reduces vulnerability to “non-market forces,” such as China attempting to manipulate the market MP Materials Announces Transformational Public-Private Partnership – MP Materials. The guaranteed offtake from the new facility provides long-term demand certainty, securing future revenue streams MP Materials’ Deal With Defense Department – Defence Industry Europe. This initiative is widely viewed as a “decisive action by the Trump administration to accelerate American supply chain independence” MP Materials Announces Transformational Public-Private Partnership – MP Materials. MP Materials CEO James Litinsky emphasizes that the company is meeting a vital national security need while maintaining a “free market public company approach” MP Materials seals mega rare-earths deal with US to break China’s grip – CNA.

The DoD deal fundamentally transforms MP Materials’ business model and strategic role. Initially, MP Materials was primarily a rare earth miner, sending much of its concentrate to China for processing. This exposed the company to commodity price volatility and Chinese market control. The DoD deal provides the capital for vertical integration into processing and magnet manufacturing. The price floor and offtake guarantees stabilize revenue and de-risk expansion. MP Materials moves from being a raw material supplier to a critical, integrated component of the U.S. defense and commercial supply chain. It becomes a strategic asset, not just a mining company. This illustrates how government intervention, driven by national security, can catalyze the vertical integration of key industries domestically. It fosters the creation of resilient, end-to-end supply chains within national borders, fundamentally altering the competitive landscape for companies like MP Materials and creating new investment opportunities in strategic manufacturing capabilities. This shifts the focus from lowest-cost production to secure, reliable supply.

Macroeconomic Impact and Future Outlook

The DoD partnership carries significant financial implications for MP Materials. The $110 per kilogram price floor, nearly double historical averages and current market prices, ensures robust profitability and stable cash flow MP Materials Announces Transformational Public-Private Partnership – MP Materials. The guaranteed purchase of 100% of the new facility’s output for 10 years provides unparalleled long-term revenue visibility MP Materials’ Deal With Defense Department – Defence Industry Europe. This financial stability empowers MP Materials to invest substantially, committing $600 million of its own funds, in expansion projects MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. The deal effectively reduces vulnerability to “non-market forces,” such as China potentially flooding the market to drive down prices MP Materials Announces Transformational Public-Private Partnership – MP Materials.

The broader market reacted positively, signaling implications for other domestic players in the critical minerals sector. Shares of Energy Fuels, a holder of uranium and rare earth mining rights in the U.S., gained 16.1% following the announcement MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. Energy Fuels lauded the contract, viewing it as a “strong precedent and indication that the Trump Administration is indeed serious about restoring domestic rare earth and critical minerals supply chains” MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The DoD possesses deep financial resources, and the concept of floor pricing proves highly attractive to commercial firms MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. However, not all analyses were uniformly optimistic. Jefferies analyst Laurence Alexander downgraded MP Materials to a “hold” rating, citing China’s shift to short-term export licenses as a factor reducing the risk of “near-term shortages” Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar. Alexander also noted a mixed demand outlook for MP Materials’ key commercial markets, including electronics, windmills, electric vehicles, and robots Why MP Materials Is Up More Than 50% After This Pentagon Rare Earths Deal – Morningstar.

The long-term vision for U.S. self-sufficiency in rare earths is clear. The DoD’s “mine to magnet” plan aims for self-sufficiency by 2027 MP Materials Stock Soars 51% on a Defense Pact for Rare Earths – Moomoo. The projected 10,000 metric tons per year magnet capacity from MP Materials’ new facility is considered a “game changer for the ex-China industry” MP Materials seals mega rare-earths deal with US to break China’s grip – CNA. The deal represents a critical step in breaking China’s pervasive grip on the rare earths sector MP Materials seals mega rare-earths deal with US to break China’s grip – CNA.

The MP Materials deal establishes a robust precedent for government support in critical mineral supply chains, potentially catalyzing investment across the entire domestic sector. Energy Fuels’ stock rose, and its characterization of the deal as a “strong precedent” underscores this. The explicit financial and demand guarantees from the DoD demonstrate a viable model for de-risking investment in capital-intensive, strategically vital, yet historically volatile sectors. This blueprint can be replicated. This could unlock significant private capital for other domestic critical mineral projects – mining, processing, and refining – that were previously deemed too risky due to Chinese market manipulation. It signals a long-term commitment from the U.S. government. This marks a potential turning point for the U.S. critical minerals industry. It shifts the investment calculus from purely market-driven to one heavily influenced by national security and industrial policy. This could lead to a broader revitalization of domestic mining and processing capabilities, creating new jobs and reducing reliance on geopolitical rivals across a spectrum of critical materials beyond just rare earths. It fosters an ecosystem where strategic importance outweighs short-term cost advantages.

Conclusion: A New Era for Critical Minerals in the West

The MP Materials-DoD partnership represents a landmark public-private collaboration, directly addressing critical national security vulnerabilities in the rare earth supply chain. It signals a decisive shift in U.S. industrial policy, prioritizing resilience and independence over purely cost-driven globalized supply chains. The comprehensive nature of the deal – encompassing equity investment, loans, price floors, and purchase guarantees – provides a robust framework for de-risking and accelerating domestic production.

This initiative stands as a direct response to China’s near-monopoly and its use of rare earths as a geopolitical lever. The “mine to magnet” strategy is now backed by substantial financial commitment and direct government involvement, underscoring the urgency and strategic importance. The deal positions MP Materials as a cornerstone of U.S. rare earth self-sufficiency, capable of providing critical materials for both defense and advanced commercial technologies. MP Materials CEO James Litinsky’s remarks about the “sense of urgency” MP Materials seals mega rare-earths deal with US to break China’s grip – CNA and the “transformational public-private partnership” MP Materials Announces Transformational Public-Private Partnership – MP Materials powerfully reinforce this strategic imperative. The MP Materials case serves as a powerful illustration of how geopolitical tensions are reshaping global supply chains and driving strategic investments in critical minerals, ushering in a new era for resource security and industrial independence in the Western Hemisphere.

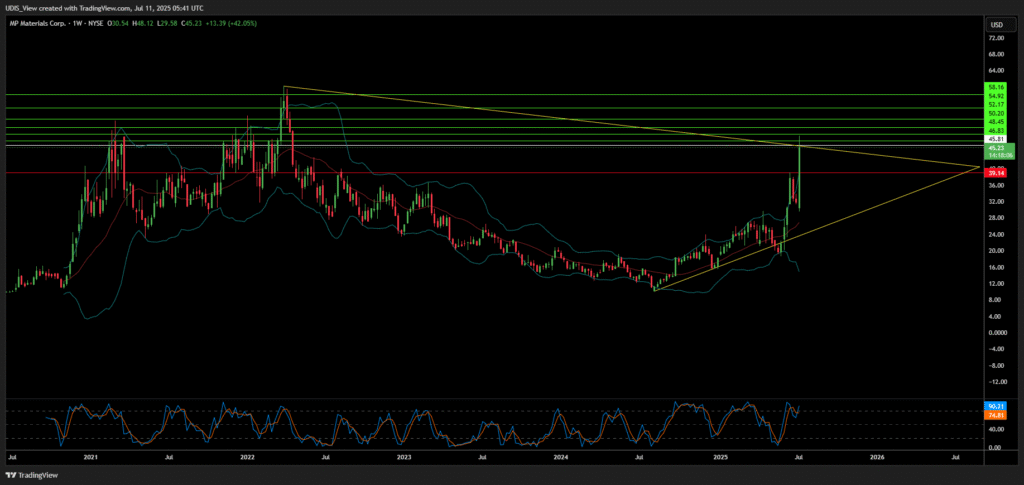

MP Materials Long (Buy)

Enter At: 45.81

T.P_1: 46.83

T.P_2: 48.45

T.P_3: 50.20

T.P_4: 52.17

T.P_5: 54.92

T.P_6: 58.16

S.L: 39.14