The global financial markets experienced a seismic shift on December 5, 2025. Shares of DigitalBridge Group (NYSE: DBRG) appreciated by nearly 50% in a single trading session.

This surge was catalyzed by credible reports that SoftBank Group is in advanced negotiations to acquire the digital infrastructure firm. While headlines focus on the takeover premium, the underlying narrative reveals a profound recalibration of value in the digital economy. The market is waking up to a new reality: power is the scarcest commodity.

This report analyzes the rumored transaction not as a real estate deal, but as a strategic “time arbitrage.” AI scaling is no longer constrained by silicon availability. It is constrained by gigawatt-scale energy access. DigitalBridge’s portfolio of 20.9 gigawatts (GW) represents an asset class that competitors cannot replicate within a commercially viable timeframe.

We dissect the convergence of “Project Izanagi,” Masayoshi Son’s $100 billion AI chip initiative, with DigitalBridge’s operational dominance. The analysis suggests this merger would create the world’s first vertically integrated Sovereign AI utility. We examine the transaction through geostrategy, where data centers function as embassies; patent law, where thermal management IP dictates viability; and macroeconomics, where the PJM interconnection queue governs technological progress.

Whether as a SoftBank subsidiary or a standalone entity, DigitalBridge is now the fulcrum of the AI revolution.

I. Strategic Imperative: The AI Supply Chain

SoftBank’s “Project Izanagi” Blueprint

SoftBank CEO Masayoshi Son has articulated a vision transcending venture capital. “Project Izanagi,” named after the Japanese deity of creation, aims to deploy $100 billion to construct an AI semiconductor powerhouse. This entity is designed to rival NVIDIA.

This ambition requires more than chip design. It demands a physical ecosystem capable of housing processors running at unimaginable thermal densities. SoftBank’s divestment of its NVIDIA stake was a strategic reallocation, moving capital to fund this vertical integration. SoftBank controls Arm Holdings (chip architecture) and may acquire Graphcore or build proprietary silicon. However, the “Project Stargate” initiative revealed a vulnerability: this proposed $500 billion collaboration with OpenAI lacked “shovel-ready” sites with secured power.

DigitalBridge: The Infrastructure Solution

DigitalBridge resolves SoftBank’s infrastructure bottleneck immediately. The acquisition offers distinct strategic advantages required by “Project Izanagi.”

Immediate Capacity Injection

DigitalBridge leased 2.6 GW of capacity in Q3 2025 alone. This represented one-third of the entire U.S. hyperscale market.This demonstrates an execution capability SoftBank lacks internally. The ability to deploy capacity at this speed is a decisive competitive advantage.

The “Time Premium” of Power

Developing greenfield data centers takes 3-5 years. Delays are primarily due to utility interconnection queues. DigitalBridge’s portfolio includes “power banked” assets sites with utility contracts already in place. This allows SoftBank to deploy capital and GPUs immediately, bypassing the need to wait until 2028 or 2029.

Global Footprint for Sovereign AI

Nations are demanding “Sovereign AI,” where data must stay within borders. DigitalBridge’s decentralized platform provides the necessary geopolitical distribution. Vantage covers North America and EMEA; Scala covers Latin America; Yondr operates globally. This aligns with SoftBank’s need to serve government and enterprise clients worldwide.

The Stargate Connection

Reports indicate “Project Stargate” faced delays due to site selection debates. SoftBank and OpenAI struggled to find locations with sufficient power. DigitalBridge’s portfolio contains the exact assets Stargate requires. The acquisition effectively buys the foundation for the $500 billion supercomputer project.

SoftBank views DigitalBridge as a battery. The 20.9 GW power bank is a strategic reserve of electrons that can be converted into compute tokens. Acquiring DigitalBridge is cheaper than negotiating with fifty utility commissions and faster than building transmission lines. It is the only path to immediate scale.

II. The Asset Portfolio: A 20.9 GW Engine

Undervalued Utility Infrastructure

The market consistently undervalued DigitalBridge, viewing it as a traditional real estate investment trust (REIT). It is actually a utility-grade infrastructure platform. The intrinsic value lies in the “Power Bank” a secured pipeline of energy entitlements serving as the lifeblood for hyperscalers.

Vantage Data Centers: The Hyperscale Chassis

Vantage Data Centers exemplifies the scale required for the generative AI era. Specifications of active developments confirm they are building “AI Factories.”

- Frontier Campus (Texas): This is a $25 billion investment delivering 1.4 GW of GPU compute capacity. The site is engineered for racks exceeding 250kW in density and utilizes liquid cooling loops essential for NVIDIA’s Blackwell and Rubin architectures. The scale of this single campus rivals the total capacity of many sovereign nations.

- Lighthouse Campus (Wisconsin): This $15 billion, 1.0 GW project underscores a geographic shift away from constrained markets like Northern Virginia toward regions with available power generation. Wisconsin offers favorable thermal climates for free cooling, which reduces the energy required for thermal management.

These campuses are backed by long-term contracts with investment-grade leaders like Oracle and Microsoft. This provides stable, inflation-linked cash flows that justify a premium valuation multiple.

Switch: The Fortress of Reliability

The 2022 take-private of Switch secured the industry’s highest-quality assets. Switch operates “The Citadel” in Tahoe Reno, the world’s largest data center campus, which is critical for national security and mission-critical workloads.

Switch invented the Tier 5® Platinum Standard, which surpasses the Uptime Institute’s Tier IV. It mandates 100% renewable energy usage, zero roof penetrations using a dual-roof “Switch SHIELD,” and demands “forever” run capabilities without water. With 20-foot concrete walls and a dedicated fire department, it is the preferred hosting environment for sensitive government data.

DataBank: The Edge Distribution Layer

While Vantage and Switch serve centralized hyperscale markets, DigitalBridge’s ownership of DataBank covers the edge. As inference workloads grow relative to training, the need for low-latency distribution points in Tier 2 cities is acute. DigitalBridge offers a converged ecosystem where a customer can train a model at a Vantage facility in Texas and deploy it for inference via DataBank facilities in Indianapolis. All sites are interconnected by fiber, reducing latency and data egress costs.

Valuation Disconnect and FRE

Before the rumors, DigitalBridge traded below $10. The market missed the explosive growth in Fee-Related Earnings (FRE), which grew 43% year-over-year in Q3 2025. Non-cash items hid the underlying cash flow machine. SoftBank’s due diligence focused on asset replacement cost; replicating 21 GW of power capacity would cost multiples of DigitalBridge’s enterprise value.

III. Macroeconomic Drivers: The Grid Crisis

The Physics of Inflation

The acquisition rationale is rooted in US energy reality. The power grid faces a massive supply-demand imbalance driven by the electrification of transport, the re-industrialization of manufacturing, and the exponential load growth of data centers.

The PJM Interconnection Bottleneck

PJM Interconnection, the grid operator for the mid-Atlantic (covering the data center hub of Northern Virginia), is the epicenter of the crisis. PJM’s capacity auction for the 2025/2026 delivery year cleared at record highs, with prices jumping from approximately $29 to over $329 per megawatt-day. This tenfold increase signals a severe shortage of firm generation capacity. Furthermore, interconnection queue wait times now exceed 4-5 years.

The Value of “Grid-Connected” Assets

In this environment, an existing data center with a signed Interconnection Service Agreement (ISA) is a golden ticket. Owning infrastructure also hedges against rising costs. Material inflation affects copper and transformers, but DigitalBridge locked in costs years ago. SoftBank acquires these assets at historical cost basis, not replacement cost.

GDP Impact

AI infrastructure is a macroeconomic driver, having contributed 1.1 percentage points to US GDP growth in the first half of 2025. DigitalBridge is not passively waiting for the grid; Vantage partnered with VoltaGrid to deploy over 1 GW of natural gas microgrids This “behind-the-meter” generation allows them to bypass utility delays and guarantees uptime.

IV. Technological Sovereignty: Patent Analysis

The Thermal Constraint

DigitalBridge’s advantage is fortified by intellectual property. Modern AI clusters demand 100kW to 250kW per rack, making traditional air cooling obsolete.

Switch’s Patent Fortress

Rob Roy, founder of Switch, holds over 950 issued and pending patent claims.

- Wattage Density Modular Design (WDMD): Allows legacy servers to coexist with high-density AI rigs, preventing the creation of hotspots.

- Switch SHIELD: A dual-roof system providing thermal insulation and preventing water ingress, crucial for uptime during extreme weather.

- Exterior Wall Penetrating HVAC (TSC): Moves cooling units outside, maximizing white space and ensuring technicians do not need to enter the secure facility.

Vantage’s Cooling Innovations

Vantage focuses on “sustainable density.” Their air-cooled chillers with economizers use virtually zero water, a critical operational license in drought-prone regions that are restricting water usage. Furthermore, their designs include pre-tapped headers for Direct-to-Chip (DTC) cooling, ensuring they can support next-generation silicon without major retrofits. “Coolant starvation” in poorly designed systems would throttle GPU performance and destroy value.

V. Geopolitics and National Security: CFIUS

The Regulatory Hurdle

The Committee on Foreign Investment in the United States (CFIUS) is the greatest risk to the deal. Switch hosts sensitive government workloads and holds FedRAMP High authorizations. Its facilities meet Department of Defense (DoD) standards (IL4/IL5).

SoftBank’s China Exposure

SoftBank has reduced its stake in Alibaba, but historical ties to Chinese tech investment remain. CFIUS may fear technology transfer or influence from foreign adversaries. However, SoftBank has navigated CFIUS before, notably agreeing to remove Huawei equipment during the Sprint/T-Mobile merger.

Sovereign AI and Foreign Policy

SoftBank’s ownership could essentially be advantageous for US policy. Having an allied firm dominate markets in Latin America and Southeast Asia is preferable to Chinese state-owned enterprises, aligning with the “friend-shoring” of the digital supply chain.[35] SoftBank must demonstrate its capital is free of influence from non-allied nations.[39]

VI. Financial Analysis: Beyond GAAP

Fee-Related Earnings (FRE)

Investors must look through the “GAAP fog.” The true measure of health is Fee-Related Earnings (FRE), which grew 43% YoY in Q3 2025. Institutional investors are aggressively allocating capital, proven by the successful $11.7 billion close of its flagship fund.

Valuation Multiples

RBC Capital raised its price target to $23, based on a 32x multiple of the 2026 estimated FRE. Some analysts argue intrinsic value is closer to $30. SoftBank is paying for the future value of the 21 GW pipeline.

VII. Conclusion: The Infrastructure of Intelligence

The rumored acquisition validates the thesis that power is the bottleneck of the digital age. If the deal proceeds, SoftBank becomes a vertically integrated “AI Supermajor,” controlling the chip (Arm/Izanagi), the data center (DigitalBridge), and the funding (Vision Fund).

This signals a move from “AI hype” to “AI industrialization.” This phase requires concrete, copper, and cooling. Patent portfolios like Switch’s ventilation and air flow control will be the blueprints for this industrialization. In 2025, land is sold by the megawatt. DigitalBridge Group holds the keys to the grid the most valuable currency on earth.

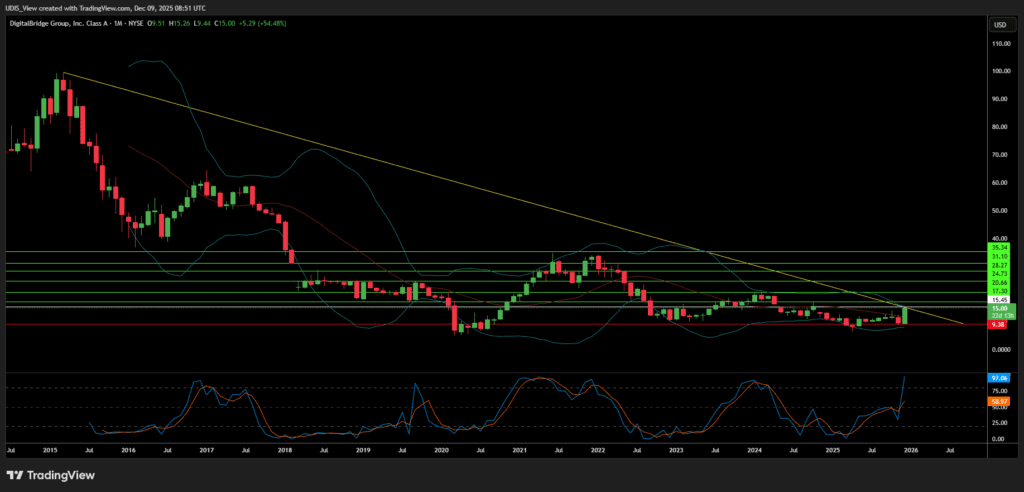

DigitalBridge Long (Buy)

Enter At: 15.45

T.P_1: 17.30

T.P_2: 20.66

T.P_3: 24.73

T.P_4: 28.27

T.P_5: 31.10

T.P_6: 35.34

S.L: 9.38