1. The SHIELD Catalyst: A Market Dislocation

1.1 The $151 Billion Signal

The financial markets witnessed a seismic event on December 22, 2025. Sidus Space (NASDAQ: SIDU) announced its selection for the SHIELD program. This contract fundamentally alters the company’s trajectory. The Missile Defense Agency (MDA) awarded this Indefinite-Delivery/Indefinite-Quantity (IDIQ) vehicle.

It carries a staggering ceiling of $151 billion. This figure dwarfs the company’s pre-announcement market capitalization. The market reaction was immediate and violent. Sidus stock surged 97.41% in a single trading session. Investors must understand the magnitude of this dislocation. A micro-cap company secured access to one of the largest defense vehicles in history.

The trading volume exploded to 74.2 times the daily average. This indicates a massive repricing of risk. Institutional algorithms and retail traders alike flooded into the equity. The valuation impact was approximately $44 million in hours. This event is not merely a press release. It is a validation of technology.

The MDA does not award SHIELD contracts lightly. The selection process is rigorous. It involves deep technical vetting of capabilities. Sidus demonstrated proficiency in AI/ML, digital engineering, and open architectures. These are the pillars of modern missile defense. The award signifies that Sidus has transitioned from a speculative startup to a defense prime partner.

1.2 The Structure of Opportunity

The SHIELD contract is an IDIQ vehicle. This structure is critical to understand. It is not a guaranteed check for $151 billion. It is a license to compete. Sidus holds a “hunting license” alongside other awardees. The government will issue task orders for specific missions. Sidus must bid on these orders. However, the sheer size of the ceiling implies massive deal flow.

The government intends to issue “staggered awards”. This ensures a continuous pipeline of opportunities over ten years. Even a fractional market share represents exponential growth. Sidus currently generates less than $5 million in annual revenue. A single substantial task order could double the company’s size overnight.

The contract scope is broad. It covers the “Golden Dome” missile defense strategy. This includes detecting and tracking ballistic, hypersonic, and cruise missiles. These are high-priority, high-budget mission sets. The funding is secure. The contract ceiling validates the government’s commitment to this architecture. Sidus is now positioned at the center of this spending torrent.

1.3 Competitive Landscape and Validation

Sidus is not alone in this arena. Major defense contractors also received awards. Parsons Corporation (NYSE: PSN) was named a SHIELD awardee. Amivero was also selected. Competing against giants like Parsons presents challenges. These firms have deep lobbying arms and vast resources.

Yet, Sidus’s inclusion is strategic. The MDA explicitly seeks “innovative” capabilities. They need agility that legacy primes often lack. Sidus offers a distinct value proposition. Its satellites are 3D-printed and AI-enabled. They are cheaper and faster to build than traditional assets. The presence of Sidus alongside Parsons validates its technology stack. It proves that “New Space” agility is required for “Old War” defense. The government needs both scale and speed. Parsons brings scale. Sidus brings speed. This symbiotic ecosystem allows for varied task order wins. Sidus may be suited for smaller, agile missions. It may also subcontract for massive system integration efforts. Both paths lead to revenue growth.

| Metric | Value | Implication |

| Contract Ceiling | $151 Billion | Massive Total Addressable Market |

| Sidus Market Cap | ~$89 Million | Extreme Valuation Asymmetry |

| Stock Gain | +97.41% | Immediate Market Repricing |

| Volume Spike | 74.2x Avg | High Institutional Interest |

| Duration | 10 Years | Long-term Revenue Visibility |

2. Geopolitics: The Rise of the Golden Dome

2.1 The Strategic Imperative

The United States is pivoting its defense strategy. The new doctrine is the “Golden Dome”. This initiative aims to create a comprehensive missile defense shield. It covers the entire American homeland. President Trump announced this vision in May 2025. It is the modern successor to the Strategic Defense Initiative.

This is not theoretical. It is a funded mandate. The Fiscal Year 2026 budget allocates billions to space-focused projects. The “One Big Beautiful Bill Act” includes $13.8 billion specifically for Space Force. The “Golden Dome” is the central driver of this spending. The goal is layered defense. It must stop threats in all phases of flight. This requires sensors in space. Ground-based radar is limited by the horizon. It cannot see over the curve of the Earth. Space-based sensors have no such limit. They provide the “eyes” for the Golden Dome. Sidus Space builds these eyes.

2.2 The Threat: National Total War

The urgency stems from near-peer adversaries. Intelligence reports are alarming. China is mobilizing for “national total war”. Beijing aims for a “strategic decisive victory” by 2027. This timeline is rapidly approaching. The US defense establishment is racing to close capability gaps.

China creates a “large and growing arsenal”. This includes nuclear, maritime, and space capabilities. They threaten the US homeland directly. The “Golden Dome” is the answer to this threat. It is a defensive posture against existential risk. Sidus aligns with this national need. Its satellites support “multi-domain operations”. They detect and track incoming threats. This capability is essential for sovereignty. The government cannot rely on commercial data alone. It needs dedicated, secure assets. Sidus provides this sovereign capability.

2.3 The Hypersonic Gap

The most acute threat is hypersonic weaponry. China and Russia have fielded Hypersonic Glide Vehicles (HGVs). These weapons travel faster than Mach 5. They maneuver in the upper atmosphere. This makes their trajectory unpredictable.

Traditional ballistic missiles follow a predictable arc. Calculating their impact point is simple physics. HGVs break this model. They glide and turn. Legacy defenses cannot track them effectively. The “kill chain” is broken. Space sensors are the only solution. A constellation in Low Earth Orbit (LEO) can track HGVs from above. It provides continuous custody of the target. Sidus’s LizzieSat platform is designed for this. It hosts sensors that feed data into the Golden Dome architecture. This solves the blind spot in American defense.

2.4 Space as a Warfighting Domain

Space is no longer a sanctuary. It is a contested domain. Adversaries will attack US satellites in a conflict. Russia has researched nuclear anti-satellite weapons. A single detonation could wipe out existing constellations. This creates a need for “resiliency.” The US must be able to replace satellites quickly.

This concept is called “Tactically Responsive Space” (TacRS). The goal is to launch new assets within hours of an attack. Sidus excels here. Its 3D-printing process allows for rapid manufacturing. It can produce a satellite bus in 45 days. This speed is a strategic asset. It ensures the Golden Dome can heal itself. If a node is destroyed, Sidus prints a replacement. This resilience is a key selling point to the Space Force.

2.5 Alliance Dynamics

The threat is global. NATO allies are increasing defense spending. New targets are set at 3.5% of GDP. The “Golden Dome” will likely extend protection to allies. This expands the market for Sidus. Sidus is ITAR registered. It complies with export controls. This allows it to sell data and hardware to approved partners. As Europe re-arms against Russia, demand for space-based intelligence grows. Sidus can serve this market. It can export the “Golden Dome” capability to NATO partners.

3. Macroeconomics: The Capital Super-Cycle

3.1 The Federal Reserve Pivot

The macroeconomic environment is shifting in Sidus’s favor. High interest rates have punished micro-cap stocks. They increase the cost of capital. They compress valuations for unprofitable companies. But the tide is turning.

The Federal Reserve projects rate cuts. The median federal funds rate is projected to fall to 3.6% by the end of 2025. Further cuts to 3.4% are expected in 2026. This is the “Fed Pivot.” Lower rates are rocket fuel for Sidus. They reduce the interest expense on future debt. More importantly, they increase risk appetite. Investors rotate capital back into high-growth sectors. Defense technology is a primary beneficiary. As yields on safe bonds fall, capital seeks returns in space equities.

3.2 The Defense Spending Super-Cycle

Defense spending is decoupling from the broader economy. It acts as a counter-cyclical buffer. The US DoD requested $961.6 billion for FY 2026. This is a 13.4% increase over the prior year.

The spending is “front-loaded”. The administration wants capabilities now. The “One Big Beautiful Bill Act” (OBBBA) drives this surge. It injects massive liquidity into the industrial base. Sidus sits in the “sweet spot.” The budget prioritizes space and missile defense. These sectors are growing faster than the overall budget. Sidus captures this sector-specific inflation. The rising tide lifts its boat higher than others.

3.3 Inflation and Supply Chains

Inflation remains a challenge. Material costs have risen. Supply chains are fragile. However, Sidus has a hedge. It uses vertical integration. The company manufactures in-house in Florida. It uses 3D printing to reduce waste. It keeps a “digital inventory” of parts. It prints parts on demand. This avoids tying up cash in physical stock. It insulates Sidus from supply shocks. Labor inflation is the remaining risk. Specialized engineers are expensive. Sidus competes for talent with giants. The SHIELD contract provides the revenue to pay competitive salaries. It secures the human capital needed to execute.

3.4 Valuation Asymmetry

Current market valuation creates an asymmetric bet. The company’s market cap is roughly $89 million. The contract ceiling is $151 billion. This ratio is 1,696 to 1. The market prices Sidus as a distressed asset. The contract prices it as a strategic partner. This gap must close. If Sidus executes, the stock re-rates. Even capturing 0.05% of the contract yields $75 million in revenue. That nearly doubles the current market cap in sales alone. Deep value investors look for this skew. The downside is limited to the current price. The upside is a multiple of the current price. The risk-reward ratio is heavily skewed to the upside.

| Economic Factor | Trend | Impact on Sidus |

| Fed Rates | Falling (3.6% by 2025) | Lower cost of capital; higher equity valuation |

| Defense Budget | Rising ($961B FY26) | Increased customer liquidity; more contract wins |

| Inflation | Persistent | Mitigated by 3D printing and digital inventory |

| Risk Appetite | Increasing | Capital flows into micro-cap defense tech |

4. The LizzieSat Platform: Technological Sovereignty

4.1 Hybrid Architecture

The LizzieSat is the core of Sidus’s offering. It is not a standard satellite. It is a “hybrid” platform. It combines the best of different classes. It is small enough for a low-cost launch. It is large enough for powerful payloads.

The bus is 3D-printed. This is revolutionary. It allows for custom configurations without retooling. Sidus can change the shape of the satellite to fit the mission. This flexibility is patented. The platform supports “multi-mission” profiles. It can do remote sensing. It can do communications. It can do edge computing. All on the same bus. This maximizes revenue per orbit. One satellite serves multiple clients.

4.2 Flight Heritage

Paper satellites do not win wars. The DoD buys flight heritage. Sidus has it. The “LizzieSat-3” mission was a success. It completed bus-level commissioning. The company established two-way communications. It activated critical subsystems. It validated the autonomous navigation software. This “SpacePilot” software allows the satellite to fly itself. It maintains orientation without ground control. This heritage de-risks the platform. The MDA knows the bus works. It survives the launch environment. It operates in the vacuum of space. This lowers the barrier to winning SHIELD task orders.

4.3 Modularity and Patents

Sidus protects its design with patents. The “Modular Satellite Testing Platform” patent is key. It covers the structural elements of LizzieSat. The design enables a “plug-and-play” approach. Sidus can swap sensors easily. It uses a modular command and data handling system. This reduces Non-Recurring Engineering (NRE) costs. Competitors must redesign for new payloads. Sidus just plugs them in. This speed is a competitive moat. It allows Sidus to say “yes” to urgent missions. When the Space Force needs a new sensor tomorrow, Sidus can deliver.

4.4 Data-as-a-Service (DaaS)

Sidus sells more than hardware. It sells data. The business model is “Data-as-a-Service”. Sidus owns the satellites. It sells the data streams to multiple customers. This creates recurring revenue. A single image of a port can be sold to the Navy. Then, to a hedge fund tracking shipping. Then to an insurance company. The marginal cost of the second sale is zero. This model scales efficiently. As the constellation grows, the data library grows. The value of the network increases. The SHIELD contract funds the constellation build-out. Commercial sales provide the profit margin.

5. Edge AI: The Kill Chain Accelerator

5.1 The Latency Problem

Missile defense is a race against time. Hypersonic missiles move at miles per second. Every millisecond counts. Traditional satellites are too slow. They use a “bent pipe” architecture. The satellite sees a threat. It sends the data to a ground station. Humans process it. They send a command back. This takes minutes. In a hypersonic war, minutes are fatal. The data bottleneck is the downlink. Satellites generate terabytes of data. The radio link is a straw. It cannot send everything down instantly. The “kill chain” breaks at the speed of the downlink.

5.2 The FeatherEdge Solution

Sidus solves this with “FeatherEdge”. This is an edge AI computer. It lives on the satellite. It processes data in orbit. It does not send raw images down. It sends answers. “Missile detected at coordinates X, Y, Z.” This message is tiny. It travels instantly. The latency drops from minutes to milliseconds. This capability is the holy grail. It enables “sensor-to-shooter” loops. The satellite talks directly to the interceptor. The ground station is bypassed. The kill chain becomes instantaneous.

5.3 Technical Specifications

FeatherEdge is a beast. It integrates NVIDIA Jetson Orin modules. It delivers up to 100 Trillion Operations Per Second (TOPS). Some configurations reach 248 TOPS. This is supercomputer power in a shoebox. It is ruggedized for space. It handles radiation and thermal extremes. It runs Linux. This makes it easy for developers. The system is “software-defined”. Sidus can update the AI in orbit. If the enemy changes tactics, Sidus uploads a patch. The satellite learns new threats overnight. This adaptability is vital for the Golden Dome.

5.4 Third-Party Ecosystem

Sidus opens its platform to others. It runs third-party apps. Other defense contractors can upload their algorithms to LizzieSat. This creates an “App Store” for orbit. Sidus charges for hosting. It charges for computing time. It monetizes the infrastructure. This attracts partners. A small AI startup cannot launch a satellite. But they can write code. They deploy on Sidus. Sidus gets revenue. The customer gets space access. It is a win-win ecosystem.

| Spec | Value | Benefit |

| Processor | NVIDIA Jetson Orin | Industry standard AI compute |

| Performance | 100 – 248 TOPS | Real-time threat detection |

| OS | Linux | Easy software porting |

| Function | Edge Computing | Reduces latency to near-zero |

| Upgrade | Over-the-Air | Adaptable to new threats |

6. Manufacturing Revolution: The 3D Advantage

6.1 The Markforged Partnership

Sidus redefines manufacturing. It partners with Markforged. They use additive manufacturing for flight hardware. This is not prototyping. This is production. They use the Markforged X7 printer. It prints continuous carbon fiber. The material is Onyx FR-A. It is flame-retardant. It is flight-qualified. This material is stronger than aluminum. Yet it is lighter. Weight is money in space. Lighter satellites cost less to launch. They carry more payload. Sidus gains a margin advantage on every launch.

6.2 Speed and Digital Inventory

The killer app is speed. Sidus targets a 45-day production cycle. Traditional aerospace takes years. Sidus uses a “digital warehouse”. It does not store piles of aluminum. It stores digital files. When a part is needed, it is printed. This frees up cash. Working capital is not trapped in inventory. It reduces storage costs. It allows for rapid iteration. If a design improves, the next print is the new design. No tooling costs to scrap.

6.3 Sovereign Supply Chain

Sidus manufactures in the USA. The facility is in Cape Canaveral. This is strategic. The US government fears Chinese supply chains. A chip from China could have a backdoor. Sidus controls its process. It prints its own structures. It integrates secure electronics. This “sovereign” status is a requirement for SHIELD. The Golden Dome cannot be built with foreign parts. Sidus offers a clean supply chain. This makes it the safe choice for classified work.

7. Financial Analysis: The Valley of Death

7.1 The Revenue Challenge

Sidus faces financial headwinds. Revenue has contracted. Q3 2025 revenue was $1.3 million. This is down from $1.87 million in the prior year. The company is in transition. It is moving from legacy engineering to DaaS. Transitions are painful. Revenue lumps are common. Full-year 2024 revenue was $4.7 million. The cost of revenue was $6.1 million. This creates a gross loss. Sidus loses money on every dollar of revenue. This must change. The SHIELD contract is the catalyst to flip margins positive.

7.2 Cash Burn and Solvency

The company burns cash. The Q3 2025 net loss was $6.0 million. Cash reserves were $12.7 million. This implies a short runway. Sidus survives on equity raises. It raised $15.5 million in 2024. Dilution is the price of survival. Existing shareholders get watered down. However, the SHIELD award changes the calculus. The stock price surge allows for “accretive” dilution. Sidus can raise more cash for fewer shares. This extends the runway. It bridges the “Valley of Death” until SHIELD payments arrive.

7.3 Balance Sheet Mechanics

The balance sheet shows strain. But also resilience. Current assets were $21.1 million in Sep 2025. Current liabilities are managed. The company uses asset-based loans. It manages working capital tightly. The “digital inventory” helps here. Interest rate cuts in 2026 will help further. They lower the cost of debt service. They improve the terms of future loans. Sidus can refinance expensive debt. This improves cash flow.

7.4 The Path to Profitability

Profitability requires scale. Fixed costs are high. R&D is expensive. Sidus needs volume to cover these costs. The SHIELD contract provides volume. It absorbs the fixed costs. Once fixed costs are covered, DaaS margins flow to the bottom line. DaaS has high margins. Selling data costs little. Gross margins can exceed 80% at scale. Sidus is building the infrastructure for this now. The losses today are investments in that high-margin future.

8. Cyber and Regulatory Moats

8.1 CMMC Compliance

The cyber battlefield is active. The DoD demands security. The Cybersecurity Maturity Model Certification (CMMC) is the standard. It becomes mandatory in late 2025. Contractors must be certified. If not, they lose contracts. Sidus is preparing. It aligns with NIST SP 800-171 standards. It handles Controlled Unclassified Information (CUI) securely. This creates a barrier to entry. New startups cannot easily meet these standards. Sidus is inside the castle walls.

8.2 The Patent Fortress

Intellectual Property is a shield. Sidus has a robust portfolio. It holds 11 granted patents. The “EMI Filter” patent is valuable. It protects avionics from interference. This has dual-use potential. It applies to commercial aviation, too. The “Modular Satellite” patent is the crown jewel. It protects the LizzieSat architecture. It prevents copycats. Sidus owns an efficient way to build satellites. This IP adds value to the balance sheet.

8.3 Regulatory Certifications

Sidus is AS9100 Rev D certified. This is the aerospace quality standard. It is ISO 9001:2015 certified. These are not just badges. They are tickets to play. Major primes require them. The government requires them. Sidus is ITAR registered. It handles sensitive defense tech. This allows it to work on the Golden Dome. Commercial-only space companies cannot touch this work. Sidus’s regulatory moat is deep.

9. Future Outlook: 2026 and Beyond

9.1 The Task Order Pipeline

The immediate future is about execution. The MDA will issue task orders in mid-2025. Sidus must win them. The strategy is clear. Bid on AI/ML scopes. Leverage the FeatherEdge advantage. Win small prototypes. Then scale to production. Revenue recognition should begin in late 2025. It will ramp in 2026. The SHIELD ceiling allows for rapid scaling. Sidus could exit 2026 with $50M+ in revenue run rate.

9.2 Lunar Ambitions

Sidus looks to the Moon. The Trump administration wants a Moon base by 2028. This opens a new market. Sidus is developing “LunarLizzie”. It has contracts for lunar transport support. It positions for the cislunar economy. The Golden Dome extends to cislunar space. The Space Force monitors the space between Earth and the Moon. Sidus sensors will be there. The company is securing its place in the next frontier.

9.3 The Investment Thesis

Sidus Space is a high-risk, high-reward play. The risks are financial. Cash burn is real. Dilution is likely. But the reward is strategic. Sidus owns the technology for the new era of war. It builds the eyes of the Golden Dome. It processes data at the edge. It manufactures at the speed of conflict. The $151 billion contract is the validator. The macro tailwinds are the accelerator. For investors, Sidus is a call option on American space dominance. If the Golden Dome is built, Sidus will likely be one of its architects.

10. Conclusion

Sidus Space stands at the threshold of transformation. The convergence of geopolitics, technology, and macroeconomics has created a perfect storm. The “Golden Dome” initiative demands exactly what Sidus provides: responsive, AI-enabled space/defense capability. The SHIELD contract is the mechanism for this transformation. It bridges the gap between potential and reality. It provides the funding vehicle to scale. Financially, the company must navigate a treacherous path. It must manage cash carefully. It must execute flawlessly. But the destination is worth the journey. A profitable, sovereign, defense-prime status awaits. Sidus Space is no longer just a space company. It is a national security asset.

11. Appendix: Data & Metrics

11.1 Key Financial Indicators

| Metric | Value | Note |

| Q3 2025 Revenue | $1.29 M | Decline year-over-year |

| Q3 2025 Net Loss | $6.03 M | Investment phase burn |

| Cash on Hand | $12.73 M | “As of Sep 30, 2025” |

| Market Cap | ~$89 M | Post-SHIELD announcement |

| SHIELD Ceiling | $151 B | Shared IDIQ pool |

11.2 Patent Portfolio Highlights

| Patent Title | Status | Application |

| Modular Satellite Testing Platform | Granted | LizzieSat structural flexibility |

| EMI Filter Unit | Granted | Avionics protection / Dual-use |

| High-Load Vacuum Feedthrough | Granted | Manufacturing process tech |

| Regolith-Polymer Print Head | Allowed | Lunar manufacturing future |

11.3 Threat vs. Solution Matrix

| Geopolitical Threat | Sidus Solution | Technical Enabler |

| Hypersonic Missiles | Real-time Tracking | FeatherEdge AI (100 TOPS) |

| Satellite Destruction | Rapid Reconstitution | 3D Printing (45 Days) |

| Grey Zone Activity | Maritime Awareness | Multi-Sensor Fusion |

| Supply Chain Risk | Sovereign Manufacturing | Vertical Integration (USA) |

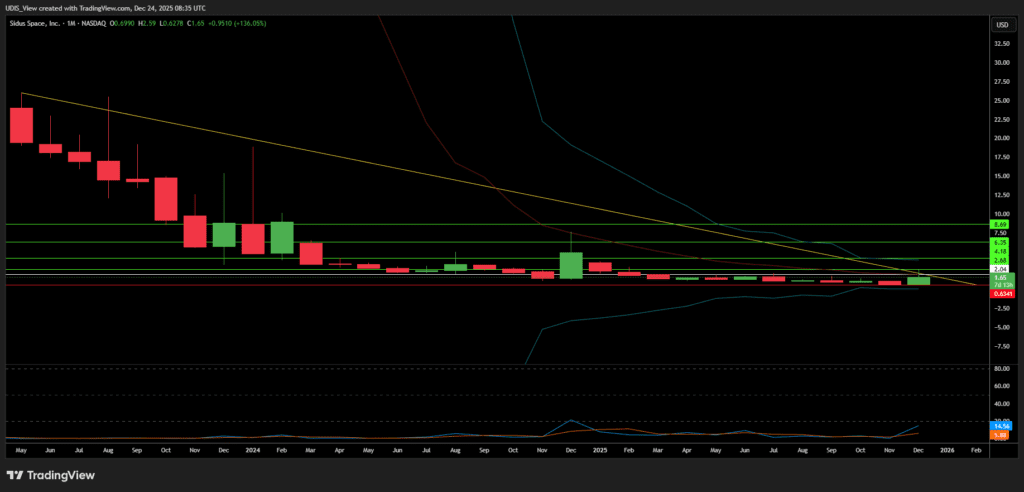

Sidus Space Long (Buy)

Enter At: 2.04

T.P_1: 2.68

T.P_2: 4.18

T.P_3: 6.35

T.P_4: 8.69

S.L: 0.63