I. The $251 Billion Defense and Aviation Powerhouse

The Investment Thesis: Dual-Market Acceleration

RTX Corporation operates at a confluence of global necessity and market recovery. Geopolitical instability mandates increased defense spending globally.1 This defense demand provides a critical foundation for revenue certainty. At the same time, commercial aviation recovery fuels high-margin aftermarket segments.3 RTX maximizes proprietary technological assets across military and civil sectors. This powerful dual-market exposure drives superior financial predictability.

The company reported substantial operational strength in Q3 2025.4 Total sales reached $22.5 billion, representing a 12% year-over-year increase.4 Adjusted EPS grew 17% over the prior year, reaching $1.70.4 Strong results allowed RTX to raise its full-year outlook for both adjusted sales and adjusted EPS.4

Strategic Certainty: The $251 Billion Backlog

RTX maintains an industry-leading backlog of $251 billion.4 This immense figure ensures unparalleled long-term revenue visibility. It reflects robust global demand for proprietary defense and commercial products.4 This backlog confirms the enduring nature of RTX’s core contracts and advanced technology solutions.

The size of this backlog must be interpreted through a strategic lens. Global defense spending currently surges.2 Governments increasingly rely on Multi-Year Procurement (MYP) contracts.5 These stable, long-cycle commitments underpin the $251 billion figure.4 The backlog functions as a predictable, high-quality, long-term revenue stream, rather than a simple order list. This inherent stability substantially de-risks future financial projections. It also supports the stable credit outlook affirmation of “BBB+” from S&P Global Ratings.7

Table 1: RTX Corporation: Q3 2025 Financial Summary and Outlook

| Metric | Q3 2025 Result | Full-Year 2025 Outlook | Source |

| Sales (Reported) | $22.5 Billion (+12% YoY) | $86.5 – $87.0 Billion (Raised) | 4 |

| Adjusted EPS | $1.70 (+17% YoY) | $6.10 – $6.20 (Raised) | 4 |

| Free Cash Flow (FCF) | $4.0 Billion | $7.0 – $7.5 Billion (Confirmed) | 4 |

| Company Backlog | $251 Billion | N/A | 4 |

II. Geopolitical Imperatives and Geostrategic Demand

The New Global Defense Floor (Geopolitics, Macroeconomics)

World military expenditure demonstrates unprecedented upward mobility.2 Global spending reached $2.718 trillion in 2024.2 This marked a 9.4% real-terms increase from 2023 levels.2 This current surge represents the steepest year-on-year rise since the Cold War ended.2

European budgets represent a vital driver of this expansion.1 European defense spending grew by 11.7% in 2024 in real terms.1 Regional spending now exceeds 2014 nominal levels by more than 50%.1 Rising threat perceptions globally force nations to accelerate inventory modernization rapidly.1

NATO allies established a crucial new financial benchmark in 2025.9 Member states committed to investing 5% of GDP annually by 2035.9 This ambitious target covers core defense and security-related expenditures.9 The new defense floor signals decades of sustained budget stability for defense contractors. This commitment implies many NATO nations will double or triple their current core defense expenditures.9

Table 2: Global Defense Spending and Strategic Drivers (2024-2025)

| Region/Measure | Growth Rate/Target | Geopolitical Implication | Source |

| World Military Expenditure | +9.4% (2024 Real Terms) | Highest surge since the Cold War | 2 |

| European Defense Spending | +11.7% (2024 Real Terms) | Accelerated modernization and replenishment demand | 1 |

| NATO Core Defense Target | 5% of GDP by 2035 | Mandates predictable, high-volume, long-term procurement | 9 |

| US DIB Policy | Multiyear Procurement (MYP) | Stabilizes industrial base and guarantees future demand volume | 5 |

Industrial Base Expansion and Procurement Certainty (Geostrategy, Economics)

Ongoing global conflicts stress the capacity of Western defense industrial bases (DIBs).10 Governments now recognize the necessity of sustained capacity and industrial modernization.10 The U.S. government prioritizes sufficient funding for DIB reform and expansion.10

This strategic requirement mandates the use of multi-year procurement (MYP) contracts.5 MYP contracts offer long-term stability essential for the supply chain.6 They reimburse contractors for capacity investments through cancellation penalties.5 This model stabilizes demand, mitigating risk and encouraging critical expansion.6 The policy signals a transition from reactive tactical spending toward long-term structural defense growth.

RTX proactively invests to meet this guaranteed, sustained demand.12 The company invested over $600 million in manufacturing expansion this year alone.12 Raytheon specifically allocated $300 million toward capacity expansion for its backlog fulfillment.13 This commitment ensures manufacturing output aligns with the growing requirements of the defense sector.

Missile Integration and Counter-UAS Dominance

The Redstone Missile Integration Facility in Huntsville, Alabama, is central to this expansion.13 Raytheon is completing a major capacity increase at this site.14 The investment, previously detailed at $115 million, will significantly boost missile production.14 The facility integrates the critical Standard Missile family, including SM-3 and SM-6 variants.15 This capacity increase directly supports counter-hypersonic solutions development.15

The U.S. Army recently awarded Raytheon a massive $5.04 billion cost-plus-fixed-fee contract.16 This contract covers the essential Coyote Missile System components.16 Coyote is designed to effectively defeat single drones and drone swarms.17 Paired with Raytheon’s Ku-band Radio Frequency Sensor (KuRFS) radar, the system provides integrated detection capabilities.17 This contract, extending through 2033, establishes counter-UAS technology as a multi-billion-dollar cornerstone of modern defense strategy. RTX secures a dominant position in this essential, modern defense niche.

III. High-Tech Supremacy: The Science of Superior Sensing

Gallium Nitride and Next-Generation Radar (Technology, Science, High-Tech)

RTX establishes its technological leadership through Gallium Nitride (GaN) material science.18 GaN is fundamentally superior to older Gallium Arsenide (GaAs) semiconductors.18 It offers enhanced power density and efficiency critical for advanced systems. This scientific advantage translates into superior battlefield performance and compact form factors.

By integrating patented GaN technology into core defense franchises, RTX creates an enduring technological competitive advantage. GaN enables performance improvements that are fundamental, not merely incremental, securing RTX as a critical sensor provider globally. This ensures long replacement cycles and profitable maintenance revenues.

LTAMDS: Air and Missile Defense Innovation

The Lower Tier Air and Missile Defense Sensor (LTAMDS) utilizes this GaN capability.20 This revolutionary radar defeats advanced threats, including high-speed hypersonic weapons.20 The GaN-powered primary array generates more than twice the power of the legacy Patriot radar system.18 LTAMDS uses a three-array structure, eliminating battlefield blind spots.18 It simultaneously detects, tracks, classifies, and engages multiple threats from any direction.18 This design preserves existing military customers’ Patriot investment while providing exponential capability improvements.20

APG-82(V)X and Asymmetric Warfare Dominance

RTX further expanded its GaN portfolio with the APG-82(V)X radar variant in 2025.21 This advanced Active Electronically Scanned Array (AESA) radar incorporates GaN to increase range and effectiveness.19 APG-82(V)X delivers multi-function fire control, advanced signal processing, and integrated electronic warfare capabilities.19 The multi-functionality supports faster target detection and precise engagement against modern fighter aircraft and cruise missiles.21

The company also applies AESA technology to lightweight, flexible systems.22 The PhantomStrike radar weighs less than 150 pounds and is fully air-cooled.22 It delivers superior situational awareness at approximately half the cost of typical fire control radars.23 PhantomStrike is powered by a GaN array, enabling long-range detection for platform-agnostic integration.22 This flexibility allows its use on UAVs, helicopters, and light-attack aircraft, dominating the asymmetric warfare market.23

Cyber Resilience Mandates (Cyber)

Advanced radar systems like LTAMDS and APG-82(V)X operate as highly digital, interconnected ecosystems.21 This digital nature introduces critical cyber vulnerabilities that adversaries can exploit.24 Protecting sensitive radar information and ensuring uninterrupted operation is vital for national security.24

RTX must integrate robust cyber defense measures directly into these systems. The effectiveness and reliability of advanced military sensors depend entirely on their data integrity.24 The future of warfare relies on secure multi-domain operations.25 The company’s focus on 21st Century Security concepts confirm cyber resilience as a core offering. This requirement expands the revenue opportunity beyond hardware into recurring software and security services.

IV. Commercial Engines and Aftermarket Profitability

GTF Engine Durability and Efficiency (Technology, Economics)

Pratt & Whitney’s Geared Turbofan (GTF) engine family powers a significant portion of the global narrowbody fleet.26 Early models faced technical challenges, notably related to powder metal component durability.8 RTX addressed these operational issues through substantial technical and financial commitment.

The optimized GTF Advantage engine achieved EASA certification in Q4 2025.27 This crucial validation allows entry into service beginning in 2026.27 The GTF Advantage provides better fuel efficiency and 4% more takeoff thrust at sea level.27 Most importantly, it features a more durable hot section design. This design targets up to double the Time on Wing compared to prior models.27

Solving the core durability issue cements Pratt & Whitney’s control over its installed engine base. Retention of these A320neo and A220 fleets guarantees a continuous, highly lucrative stream of MRO and parts sales for decades. The initial operational setback ultimately strengthened the long-term commercial segment by enforcing a necessary durability upgrade.

Mitigating Cash Flow Impacts

RTX manages the financial implications of the GTF fleet issues effectively. The company confirmed a stable $7.0–$7.5 billion free cash flow outlook for 2025.4 This FCF projection already incorporates the estimated $1.5 billion cash impact related to fleet inspections and repairs.8

The launch of Hot Section Plus (HS+) offers immediate relief to operators.27 HS+ is an upgrade option derived from GTF Advantage technology.27 It provides 90% to 95% of the durability benefits to existing GTF engines.27 This upgrade stabilizes the current fleet and maintains strong customer relations.

The Aviation Aftermarket Moat (Economics)

Global air traffic recovery is accelerating and appears structurally sustained.3 Passenger traffic is forecast to exceed 12 billion by 2030, driven by international growth.3 This recovery drives overwhelming, inelastic demand for maintenance, repair, and overhaul (MRO).

Collins Aerospace, an RTX business, leverages its global scale and OEM expertise.28 Collins offers comprehensive, global support through a network of over 70 MRO sites.28 Their AssetFlex program provides flexible, high-margin aftermarket solutions.29 These offerings include predictable flat-rate exchanges and robust repair chain management.29 Supply chain issues currently delay new aircraft deliveries.30 This compels airlines to invest more heavily in maintaining and repairing their current fleets. The profitability of RTX’s commercial segment is therefore resilient against macro supply chain volatility, thriving on the persistent necessity of MRO.

V. Innovation Moat: Patent Analysis and Cyber Resilience

Intellectual Property Leadership (Patent Analysis, Science)

RTX establishes market superiority through aggressive innovation and R&D investment.31 The company consistently secures top rankings in global patent indices.31 These include lists from the European Patent Office and Clarivate.31 RTX’s intellectual property portfolio exceeds 60,000 patents globally.31

This vast IP portfolio results from massive, sustained R&D spending.31 RTX invested $7.5 billion in research and development during 2024.31 Patents span transformative areas, including advanced materials, artificial intelligence, autonomy, and next-generation propulsion systems.31 This investment ensures RTX maintains foundational technical advantages over competitors.

This extensive R&D spending translates directly into highly specialized IP. Proprietary technologies like GaN secure the technical advantages necessary to win long-term government contracts.20 This creates a powerful, self-reinforcing cycle where investment, patents, and contracts continuously build market share. This IP provides sustained pricing power and serves as a significant barrier to entry for potential competitors.

Cybersecurity as a Strategic Enabler (Cyber)

Modern defense platforms represent complex, high value, interconnected digital systems.25 Advanced radar, communications, and command and control functions are particularly vulnerable to cyber exploitation.24 Protecting the integrity and availability of these systems is non-negotiable for operational success.24

RTX must integrate robust cyber safeguards into all connected military products.24 The viability of high-tech defense systems depends critically on securing data integrity in contested environments.25 The company’s strategic focus confirms that cyber resilience is mandatory for maintaining customer trust. This capability ensures platform viability in the evolving landscape of digital warfare.

VI. Financial and Valuation Trajectory

Cash Flow Certainty and Margin Expansion (Economics, Macroeconomics)

RTXs raised 2025 financial outlook confirms strong operational momentum.4 The company achieves double-digit organic sales growth across all three segments.4 This strength supports six consecutive quarters of adjusted segment margin expansion.4

Future profitability is strongly correlated with projected free cash flow (FCF) generation.33 Analysts project substantial FCF growth through 2027.33 FCF is expected to increase dramatically, rising from $5.5 billion in 2023 to an estimated $9.9 billion by 2027.33 This trajectory represents a robust annualized growth rate of 15.5%.33

Valuation Perspective

Rapid FCF growth profoundly improves valuation metrics.33 The Price-to-FCF multiple is projected to decline significantly by 2027.33 The multiple drops from 31.3 times in 2023 to an estimated 17.3 times in 2027.33 This substantial decline indicates a significant valuation de-rating. The market currently undervalues the future cash generating capacity of the high-tech, defense-backed enterprise.

S&P Global Ratings affirmed the company’s “BBB+” long-term credit rating.7 The outlook was revised to stable, reflecting operational performance improvements.7 This stable rating confirms the strong financial profile and improving cash flow trajectory.4 RTX remains dedicated to capital returns for its shareholders.4

Table 3: RTX Free Cash Flow (FCF) and Valuation Projection (2023 vs. 2027 Est.)

| Metric | 2023 Actual | 2027 Estimate | Source |

| Free Cash Flow (FCF) | $5.5 Billion | $9.9 Billion | 33 |

| FCF Growth Rate | 12.1% | 15.5% | 33 |

| Price-to-FCF Multiple | 31.3 times | 17.3 times | 33 |

Investment Community Confidence

Wall Street analysts maintain a highly positive consensus on RTX.34 Thirteen firms cover the stock, yielding a collective “Buy” consensus rating.35 Importantly, zero firms currently recommend selling the stock.34 Recent ratings include “Overweight,” “Outperform,” and “Buy” from major firms.34 Price targets range up to $181.0, signaling considerable expected upside from current stock levels.34

VII. Conclusion: Asserting the Long-Term Value Proposition

RTX Corporation successfully translates geopolitical instability into predictable financial performance. The firm leverages global defense mandates into stable, multi-decade procurement contracts.2 It converts proprietary technological superiority (GaN and AESA radar) into mission-critical platforms.20 Strategic capacity expansion investments guarantee manufacturing output alignment with demand.12

Simultaneously, the commercial aviation recovery provides robust, high-margin revenue diversification.3 The company secured its commercial future by addressing GTF durability, cementing its aftermarket monopoly. The $251 billion backlog confirms the powerful, structural long-term growth trajectory.4 RTX stands as a structurally sound investment, poised for significant FCF expansion and valuation appreciation.

References

- The Military Balance 2025: Defence Spending and Procurement Trends

- Unprecedented rise in global military expenditure as European and Middle East spending surges | SIPRI

- Joint ACI World-ICAO Passenger Traffic Report, Trends, and Outlook

- RTX Reports Q3 2025 Results

- Multiyear Procurement (MYP) and Block Buy Contracting in Defense Acquisition: Background and Issues for Congress

- Multiyear Procurement | www.dau.edu

- S&P Global Ratings revised outlook on RTX to stable and affirmed at “BBB+” (Local Currency LT) credit rating – Cbonds

- RTX provides update on Pratt & Whitney GTF fleet; Updates 2023 and 2025 outlook

- NATO’s new spending target: challenges and risks associated with a political signal | SIPRI

- Implications of Russia’s War on Ukraine for the U.S. and Allied Defense Industrial Bases

- Defense Production for Ukraine: Background and Issues for Congress

- RTX Logs 12% Sales Growth in Q3 2025 With $251B Backlog – GovCon Wire

- Q3 2025 RTX Corp Earnings Call Transcript – GuruFocus

- Raytheon Expands Huntsville Missile Facility with $115M Investment – Speakin’ Out News

- Raytheon reaches 50% completion of $115M Missile Integration Facility expansion on Redstone Arsenal – 256 Today

- Raytheon Wins $5B Army Contract for Coyote Missile System – GovCon Wire

- US Army awards USD 5 billion contract to Raytheon for Coyote system

- RTX Raytheon continues early production of missile-defense radar to attack several threats simultaneously – Military Aerospace

- Raytheon Launches New APG-82 Radar Variant With GaN Tech – ExecutiveBiz

- LTAMDS: Lower Tier Air and Missile Defense Sensor | Raytheon – RTX

- RTX unveils new APG-82(V)X radar enhanced with gallium nitride

- Big radar power for small aircraft | Raytheon – RTX

- PhantomStrike | Raytheon – RTX

- What are the applications of radar in military and security?

- Radar | Lockheed Martin

- Pratt & Whitney PW1000G – Wikipedia

- News | Type certification for RTX’s Pratt & Whitney GTF Advantage …

- Aftermarket Services | Collins Aerospace

- Part Consignment, Exchange and Repair Chain Management | Collins Aerospace

- Global Outlook for Air Transport June 2025 – IATA

- RTX racks up top rankings for patents and innovation

- RTX, Including Collins Aerospace and Pratt & Whitney, is Top-Ranked for Patents and Innovation; Pratt Celebrates a Century – Connecticut by the Numbers

- Could RTX Be the Hidden Gem That Boosts Your Portfolio? – Nasdaq

- New Analyst Forecast: $RTX Given ‘Neutral’ Rating – Quiver Quantitative

- Raytheon Technologies (RTX) Stock Forecast: Analyst Ratings, Predictions & Price Target 2025 – Public Investing

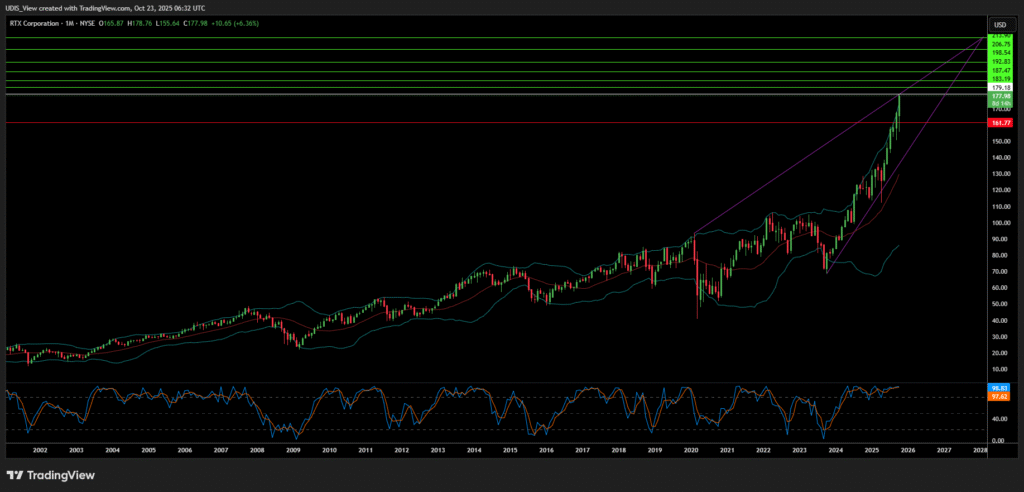

RTX Long (Buy)

Enter At: 179.18

T.P_1: 183.19

T.P_2: 187.47

T.P_3: 192.83

T.P_4: 198.54

T.P_5: 206.75

T.P_6: 213.90

S.L: 161.77