Rigetti’s Strategic Position in the Quantum Era

Rigetti Computing (Nasdaq: RGTI) stands as a crucial innovator in the emerging quantum computing sector. Its recent advancements in qubit fidelity and modular system design mark a significant technological step forward. This progress, combined with strategic partnerships and vital government contracts, positions Rigetti at the intersection of high-tech innovation, economic opportunity, and evolving geopolitical landscapes. The company’s trajectory reflects a convergence of scientific breakthroughs, market maturation, and national security imperatives.

Technological Prowess: Advancing Quantum Hardware

Rigetti’s fundamental strength lies in its persistent pursuit of quantum hardware innovation. The company focuses particularly on superconducting qubits. These advancements are essential for quantum computing’s practical application and eventual commercialization. Rigetti’s unique full-stack approach, from chip design to cloud services, provides a distinct competitive advantage.

Milestone Achievements in Qubit Fidelity

Rigetti achieved a mid-year performance milestone of 99.5% median two-qubit gate fidelity.1 This was accomplished on its modular 36-qubit system. This represents a twofold reduction in the median two-qubit gate error rate from previous results.3 This 99.5% fidelity milestone positions Rigetti as a leader in the quantum computing space. It significantly enhances the company’s competitive edge.4

The company plans to launch its 36-qubit system on August 15, 2025.1 Rigetti remains on track to release a 100+ qubit chiplet-based system. This larger system will also target 99.5% median two-qubit gate fidelity before the end of 2025.1

Rigetti’s 99.5% fidelity and rapid gate speeds for superconducting qubits are crucial for achieving “quantum advantage.” This directly addresses the core challenge of error rates in quantum computing. Lower error rates make their systems more practical for complex computations. Faster gates allow more operations within a qubit’s coherence time, enabling more intricate calculations before decoherence occurs. This positions Rigetti’s superconducting approach as a strong contender in the race for practical quantum computing. It attracts researchers and potential commercial clients who prioritize performance. This contrasts with competitors like Quantinuum, which utilize ion trap technology.5 This highlights a fundamental architectural choice with differing performance implications.

Scalable Architecture and Roadmap

The 36-qubit system consists of four 9-qubit “chiplets” tiled together.1 This design uses Rigetti’s proprietary modular chip technology. This modular approach paves the way for Rigetti to build larger, more powerful systems. This includes the planned 100+ qubit chiplet-based system.1

Superconducting qubits offer significant advantages. These include gate speeds over 1,000 times faster than other modalities like ion trap and pure atoms.1 They also offer inherent scalability.3 The transition from smaller, experimental Quantum Processing Units (QPUs) to larger, modular systems (36-qubit, 100+ qubit) reflects a clear trend in quantum computing. Scalability involves not just raw qubit count but also maintaining fidelity as the system expands. The modular chiplet design addresses this by integrating smaller, high-performing units.

Proprietary Innovation and Manufacturing

Rigetti leverages established techniques from the semiconductor industry. This allows the company to develop proprietary technology for scaling to higher qubit count systems.1 Rigetti has operated quantum computers over the cloud since 2017. This is done through its Rigetti Quantum Cloud Services platform.1

In 2021, Rigetti began selling on-premises quantum computing systems. These systems, with qubit counts between 24 and 84, support national laboratories and quantum computing centers.1 Its 9-qubit Novera™ QPU, introduced in 2023, supports a broader research and development community. It offers a high-performance, on-premises QPU designed to integrate with existing cryogenic and control systems.1 Rigetti designs and manufactures its chips in-house at Fab-1. This facility is the industry’s first dedicated and integrated quantum device manufacturing facility.3 Owning Fab-1 provides a strategic advantage. It ensures supply chain control, protects intellectual property, and enables rapid iteration on chip designs. These factors are critical for swift hardware development in a competitive field.

A “full-stack” approach, encompassing hardware, software, and cloud services, is a common strategy among leading quantum companies.4 This allows Rigetti to control the entire user experience and optimize performance across all layers. Offering both cloud and on-premises solutions caters to diverse customer needs. These range from initial research and development to sensitive government or enterprise applications requiring higher security and control. This dual approach expands their addressable market.

| QPU Name/Type | Qubit Count | Key Performance Metric | Error Rate Reduction | Launch/Release Timeline | Key Features |

| Modular 36-qubit system | 36 | 99.5% Median Two-Qubit Gate Fidelity | 2x reduction | August 15, 2025 | Multi-chip, Superconducting Qubits, Modular |

| 100+ qubit system | 100+ | 99.5% Median Two-Qubit Gate Fidelity | – | End of 2025 | Chiplet-based, Superconducting Qubits |

| Novera™ QPU | 9 | High-performance | – | 2023 (Introduced) | On-premises, Plugs into existing cryogenic systems |

| On-premises systems | 24-84 | – | – | 2021 (Began selling) | Supports national labs, quantum computing centers |

Table: Rigetti’s Core Quantum Technology Milestones

Strategic Alliances and Government Catalysts

Rigetti’s strategic partnerships and successful acquisition of government contracts are critical. These collaborations provide essential funding, validate its technological approach, and accelerate its path to commercialization. This reduces reliance on equity markets.

Quanta Computer Partnership

Rigetti finalized a $35 million equity investment from Quanta Computer in April 2025.8 This was part of a broader strategic collaboration. This investment boosted Rigetti’s cash and investments to $237.7 million by the end of April 2025.9 The partnership includes a $100+ million deal spanning five years. This funding supports the development of non-QPU hardware, including control systems and manufacturing components.7

This collaboration allows Rigetti to focus its resources on core QPU technology. It leverages Quanta’s expertise in high-volume manufacturing.7 The deal aims to scale to 10,000+ qubits by 2030. This is a necessary threshold for fault-tolerant computing.8 This partnership provides substantial capital and manufacturing expertise for non-QPU hardware. It enables Rigetti to allocate its own capital and research and development efforts more efficiently towards its core QPU technology. This external validation and shared development burden significantly de-risk Rigetti’s long-term hardware scaling ambitions. This makes it a more attractive investment.

Quantum computing is capital-intensive and requires specialized manufacturing. By offloading non-QPU hardware development and leveraging Quanta’s high-volume manufacturing capabilities, Rigetti can focus its limited resources on its most critical and proprietary component: the quantum processor unit. This strategic division of labor accelerates development, reduces internal costs, and provides a clear pathway to mass production when the market matures. This represents a key de-risking factor for investors in a speculative industry.

High-Impact Government Contracts

Rigetti was selected for Stage A of DARPA’s Quantum Benchmarking Initiative.9 This six-month performance period focuses on its utility-scale quantum computer concept. This DARPA award is worth up to $1 million upon completion of program milestones.9 DARPA selected only 15 companies from over 100 applicants to develop “utility-scale quantum computing” within seven years.7 This validates Rigetti’s technology. Rigetti’s proposal combines its proprietary multi-chip architecture with quantum error correction codes. It targets systems with over 10,000 qubits and 99.9% gate fidelity.7

Rigetti secured a $5.48 million Air Force consortium award. This award advances its breakthrough Alternating-Bias Assisted Annealing (ABAA) chip fabrication technology. ABAA improves qubit frequency targeting by a factor of 10.7 The company also received three Innovate UK awards. It leads a £3.5 million consortium to advance quantum error correction (QEC) capabilities on superconducting quantum computers.7 This UK collaboration with Riverlane and the National Quantum Computing Centre (NQCC) will conduct ambitious QEC tests. These tests demonstrate real-time QEC capabilities, a requirement for universal, fault-tolerant quantum computing.7 Rigetti also holds a $20 million contract with the UK’s National Quantum Technologies Programme, expanding its international reach.8

Government agencies like DARPA fund cutting-edge, high-risk, high-reward technologies with national security implications. Their selection process is rigorous. Therefore, securing such contracts signals a strong vote of confidence in Rigetti’s technical capabilities and its potential to contribute to critical national interests, such as post-quantum cryptography and advanced materials. This public sector funding provides a stable, non-dilutive revenue stream. It supports long-term research and development, which is vital for a company operating in an early-stage, capital-intensive industry. It also positions Rigetti as a key player in the national quantum strategy.

Competitive Validation

The DARPA selection specifically validates Rigetti’s technology approach against major competitors like IBM.7 These government and global partnerships provide non-dilutive funding. This reduces reliance on equity markets and allows Rigetti to scale without further shareholder dilution.8 Rigetti’s focus on niche markets, such as government-funded research and high-performance computing, creates a defensible position against broader cloud players like IBM and AWS.8

The emphasis on Quantum Error Correction (QEC) in multiple government contracts (DARPA, Innovate UK) and partnerships (Riverlane) highlights its importance.7 Achieving real-time QEC is a fundamental requirement for universal, fault-tolerant quantum computing.10 Rigetti’s involvement here indicates its commitment to overcoming one of the biggest hurdles in quantum computing. Current quantum computers are “noisy” and prone to errors. QEC is the theoretical and practical solution to this problem, enabling reliable quantum computation. Without effective QEC, large-scale, complex quantum algorithms cannot run reliably. Rigetti’s active participation and leadership in QEC research and development, especially with partners like Riverlane, a QEC specialist, suggest they are tackling this challenge directly. This focus is essential for transitioning from noisy intermediate-scale quantum (NISQ) devices to truly fault-tolerant quantum computers. These are necessary for widespread commercial and strategic applications.

Economic Landscape and Market Opportunity

The quantum computing market is experiencing rapid growth. Increasing investments and the potential for transformative applications across diverse industries drive this expansion. Rigetti is strategically positioned to capitalize on this expanding opportunity.

Quantum Computing Market Growth

The global quantum computing market was estimated at USD 1.42 billion in 2024.11 It is projected to reach USD 4.24 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 20.5% from 2025 to 2030.11 Another projection indicates the market could reach USD 5.2 billion by 2030, with a CAGR of around 38.98% from 2024-2030.12 The hardware market alone is expected to exceed $25 billion by 2030.13 Investments in quantum startups surpassed $5 billion in 2023. These investments are projected to grow fivefold by 2030.13 By 2030, over 50% of Fortune 500 companies are expected to integrate quantum computing into their operations.13 North America holds a significant market share, accounting for 31.01% in 2024.11 Robust public and private investments drive this dominance.12

The significant market size projections and high CAGR contrast sharply with Rigetti’s current low revenue ($1.5 million in Q1 2025).9 This highlights the “pre-commercialization” phase of the industry. However, it also signals immense future growth potential that investors are betting on. The discrepancy between current revenue and future market projections is typical for disruptive, early-stage technologies. Investors are not valuing Rigetti on its present earnings but on its anticipated share of a rapidly expanding future market. The high CAGR indicates that the market is expected to accelerate significantly in the coming years. Rigetti’s current focus on research and development and strategic partnerships aims to capture a substantial portion of this future market. This justifies its speculative valuation. This also implies that the increasing relevance of Rigetti is largely forward-looking.

| Source | 2024 Market Size (USD Billion) | 2030 Projected Market Size (USD Billion) | Compound Annual Growth Rate (CAGR) | Key Market Segments/Insights |

| Grand View Research | 1.42 | 4.24 | 20.5% (2025-2030) | Hardware (63.91% in 2024), BFSI (highest revenue share in 2024), North America (31.01% in 2024) |

| MarkNtel Advisors | 1.1 | 5.2 | 38.98% (2024-2030) | Cloud-based deployment anticipated to be significant, Machine learning to hold max market share |

| PatentPC | – | 65 (Global market) / 25 (Hardware market) | 30-40% (Global) / 5x investment growth | Investments in quantum startups surpassed $5B in 2023, 50%+ Fortune 500 integration by 2030 |

Table: Global Quantum Computing Market Forecasts (2024-2030)

Economic Value Beyond Quantum Advantage

Quantum computers can generate economic value even without exhibiting a “quantum advantage”.14 This refers to performing calculations classical computers cannot. This value arises from asymmetric cost structures. Quantum algorithms can offer variable cost advantages due to speedup, for example, 1,000 times faster gate speeds.1 Even if scaling a quantum computer is currently more expensive than a classical one, a quantum computing company can be more profitable. It can also invest more in market creation due to its efficient variable cost structure.14 Investments in higher quality qubits, entanglement, and error correction allow quantum computers to solve larger, more intractable problems. This expands their addressable market.14 Quantum computers excel at tasks requiring optimization, such as airline route optimization and supply chain logistics.11 They can revolutionize industries like finance, healthcare, artificial intelligence, and cybersecurity.11

The concept that quantum computers can generate economic value without full “quantum advantage” is a crucial shift in perspective. It implies that early commercialization is possible through cost efficiencies and problem-solving speedups. This holds true even if classical computers can eventually solve the same problem. This suggests a more immediate revenue pathway for Rigetti than previously assumed, potentially reducing the “wait-and-see” period for investors. The traditional view of quantum computing investment often hinges on achieving “quantum supremacy” or “quantum advantage,” which implies a long, uncertain path to profitability. This new understanding suggests that even incremental improvements in speed or efficiency over classical methods can create economic value by reducing variable costs for specific computations. This means Rigetti does not need to outperform all classical computers on all problems to become commercially viable. It only needs to be better or cheaper for some valuable problems. This broadens the addressable market and accelerates the potential for revenue generation, making the investment case more tangible.

Investment Dynamics in High-Tech

The quantum sector is gaining momentum as companies transition from research to commercial applications.7 Increased public awareness, education, and investment are key to fostering a robust quantum economy.15 Low interest rates generally encourage venture capital investments in riskier assets like high-tech startups. This is because they reduce borrowing costs and opportunity costs.16 Economic growth, measured by GDP, employment, and consumer confidence, positively influences investor sentiment and appetite for risk in venture capital.16 Industry trends and disruptive innovations, such as quantum computing, attract significant investor interest.16 While rising interest rates can hurt growth stocks, historical data on Nasdaq performance during rate hike cycles is ambiguous. Some periods have shown significant gains.18 Speculative investments, like Rigetti, focus on price fluctuations and potential substantial gains. They also provide market liquidity.19

The macroeconomic factors favoring venture capital and high-tech investment provide a supportive backdrop for Rigetti. Despite its current low revenue, the broader market conditions encourage speculative bets on disruptive technologies. High-tech, especially quantum computing, is a speculative investment. Such investments thrive in environments where capital is inexpensive and investors are willing to take on higher risk for potentially outsized returns. A growing overall economy and strong labor markets signal a healthy environment for innovation and adoption. These macro trends create a “risk-on” sentiment that benefits companies like Rigetti, allowing them to attract capital despite their early stage of commercialization. This explains why Rigetti’s valuation can be high despite low current revenues.

Geopolitical Imperatives and Cybersecurity Defense

Quantum computing’s emergence is not merely a technological revolution; it is a geostrategic imperative. The potential to break modern encryption systems has elevated quantum research to a national security priority. This influences global power dynamics and drives significant government investment, directly benefiting companies like Rigetti.

The Quantum Threat to Global Security

Quantum computers pose a significant threat to current encryption standards. They are capable of breaking modern cryptography, for example, using Shor’s algorithm.20 This threat could compromise sensitive information. This includes national security data, personal emails, financial records, and cryptocurrency transactions.21 The National Security Agency (NSA) states that adversarial use of a quantum computer could be “devastating to and our nation”.21 While current quantum computers are not yet capable of this, the threat is real. It is potentially 15 years away, but adversaries may already be storing encrypted data for future decryption.21

The “quantum race” is not just about technological supremacy. It concerns national security and economic dominance.20 The ability to break encryption or develop unbreakable communication fundamentally shifts the balance of power. Rigetti, as a leading U.S.-based quantum hardware developer, is inherently a strategic asset in this global competition. Governments are investing heavily because quantum capabilities will determine future intelligence, military, and economic security. Rigetti’s deep engagement with U.S. and allied government programs positions it as a key player in the Western effort to maintain quantum superiority or parity. This makes its success directly tied to national strategic interests.

National Quantum Strategies: PQC vs. QKD

Two primary countermeasures are being developed: Post-Quantum Cryptography (PQC) and Quantum Key Distribution (QKD).21 PQC is software-based and relies on mathematical problems resistant to quantum attacks. The U.S. government, through National Security Memorandum 10, has chosen PQC as its preferred defense. It mandates upgrades by 2035.21 The NSA prohibits QKD for U.S. national security information.21

QKD is hardware-based and uses quantum physics. It is generally more expensive. China is the clear world leader in QKD deployment. It has a national-scale network, including fiber optics and satellites. This network is used for encrypted communications with Russia and South Africa.21 Divergent strategies among U.S. allies, with some opting for PQC, some for QKD, and some for both, pose significant interoperability challenges. This is especially true for military communications.21

The differing national strategies regarding PQC and QKD highlight a potential future interoperability crisis. This is particularly relevant for allied military communications. If allied militaries cannot securely communicate due to incompatible cryptographic systems, it undermines defense alliances. Rigetti’s focus on PQC-compatible advancements, such as 99.9% gate fidelity for 10,000+ qubits combined with QEC, aligns with the U.S. preference. This could be crucial for future allied communication architectures. Rigetti’s technological advancements are not just about raw computing power. They also enable future secure and interoperable communication systems for the U.S. and its partners. This gives it a critical geostrategic role.

Rigetti’s Role in National Security

Rigetti’s participation in DARPA’s Quantum Benchmarking Initiative directly aligns with U.S. strategic goals for quantum-safe communications.7 Its focus on utility-scale quantum computing with quantum error correction is key. The Air Force award for chip fabrication technology, ABAA, and UK Innovate awards for quantum error correction demonstrate Rigetti’s involvement.7 These projects develop critical components for national security applications. Rigetti’s superconducting qubits and multi-chip architecture are key technologies advancing to meet these high-stakes requirements.7

The 15-year horizon for the quantum threat to cryptography provides a long-term justification for sustained government and private investment in quantum computing.21 This extended timeline allows companies like Rigetti to continue research and development without immediate pressure for widespread commercial deployment. The strategic imperative remains. The “15 years away” threat does not mean inaction. Instead, it signals a long-term, sustained commitment from governments to develop countermeasures. This provides a stable funding environment for quantum companies like Rigetti. It implies that the increasing importance of Rigetti is not a short-term market fluctuation. It is a response to a fundamental, long-term shift in the global security landscape. This ensures continued strategic relevance and investment.

Intellectual Property: A Foundation for Competitive Edge

Rigetti’s robust intellectual property portfolio forms a critical strategic moat. This is essential in the highly competitive and nascent quantum computing industry. These patents protect its groundbreaking innovations. They also signal its leadership in key technological areas.

Rigetti’s Patent Portfolio

As of 2023, Rigetti holds 37 quantum computing patents.22 The portfolio is valued at approximately $12.5 million.22 Patents are categorized into Quantum Computing Architecture (18 patents, $6.2 million value), Quantum Chip Design (12 patents, $4.1 million value), and Quantum Software Algorithms (7 patents, $2.2 million value).22 Rigetti’s patent portfolio represents 2.3% of the global quantum computing intellectual property landscape.22 This landscape totals 1,600 patents worldwide. The company maintains 37 unique patent positions. It has a filing rate of 8 to 10 new patents per year.22 Rigetti also holds 43 quantum algorithm patents. It ranks among the top three quantum algorithm research organizations.22

In a pre-commercialization industry like quantum computing, intellectual property becomes a key asset for valuation. It often outweighs current revenue. Rigetti’s substantial patent portfolio signals its pioneering status and future revenue potential. This can come through licensing or market dominance. This explains how a company with low current revenue can command a significant market capitalization. In early-stage, high-tech sectors, tangible assets like revenue and profit are often minimal. Investors therefore look to intangible assets, particularly intellectual property, as indicators of future market position and competitive advantage. Rigetti’s patents, especially in core areas like architecture and chip design, represent proprietary knowledge. It is difficult and expensive for competitors to replicate.22 This creates a “moat” that can protect future market share and generate licensing revenue. This justifies a higher valuation based on future potential rather than current performance.

IP as a Strategic Moat

Developing a quantum computing patent is complex and expensive. It requires approximately $3.4 million in research and development costs per patent.22 The average development time is 24 to 36 months. This makes imitation difficult. Fewer than seven companies worldwide had demonstrated comparable quantum error mitigation strategies as of 2023.22 Rigetti’s quantum error correction capabilities provide a potential sustained competitive advantage. This is achieved through reduced computational errors and enhanced system reliability.22 The IP portfolio provides competitive differentiation. Rigetti holds a 3.7% market share in quantum computing technology patents.22

The significant number of patents and dedicated teams in “quantum error mitigation” and “error correction” highlights Rigetti’s strategic understanding of the biggest hurdle to practical quantum computing.22 This focus, combined with their 99.5% fidelity milestone, suggests a concerted effort to move towards fault-tolerant systems. Error correction is widely recognized as the most critical technical challenge in scaling quantum computers. By dedicating significant R&D resources and patenting efforts to this area, Rigetti demonstrates a forward-thinking strategy. Success in error correction directly translates to more reliable and powerful quantum computers, which are essential for solving real-world problems. This strategic focus enhances Rigetti’s long-term viability and competitive position, as it addresses a fundamental limitation of current quantum technology.

R&D Investment and Future Innovation

Rigetti invested $62 million in research and development in 2022.22 It maintains 47 dedicated quantum research professionals. These are organized into specialized error mitigation teams. They include algorithm developers, error correction specialists, and hardware integration experts.22 The company’s annual IP protection budget is $2.1 million.22 Rigetti generated $850,000 in IP licensing revenue in 2022.22 Rigetti is listed among smaller companies to consider for partnerships or patent acquisition opportunities.23 This, combined with its unique patent positions and high R&D investment, suggests it could be an attractive target for larger tech giants seeking to solidify their quantum positions. In rapidly evolving tech sectors, consolidation is common. Companies with strong IP portfolios and specialized expertise, like Rigetti, become valuable acquisition targets for larger players who might prefer to acquire proven technology rather than develop it from scratch. This potential for an attractive exit strategy adds another layer of appeal for investors, even if the primary goal is organic growth.

Financial Performance and Investor Outlook

Rigetti’s financial performance reflects its position as an early-stage, R&D-intensive company in a nascent market. While revenues are currently low, strategic investments and a strong cash position provide a runway for future growth. This attracts significant investor interest.

Recent Financial Highlights

Total revenues for Q1 2025 were $1.5 million.9 This marked a 36% decline from the previous quarter. It also represented a 52.5% year-over-year drop.10 Total operating expenses for Q1 2025 were $22.1 million.9 This was up 13.2% from Q4 2024 and 22.0% from Q1 2024. Higher research and development expenditures drove this increase.10 The operating loss widened to $21.6 million for Q1 2025.9 Net income for Q1 2025 was $42.6 million. This was largely due to $62.1 million of non-cash gains from changes in fair value of derivative warrant and earn-out liabilities.9

As of March 31, 2025, cash, cash equivalents, and available-for-sale investments totaled $209.1 million.9 Following the $35 million equity investment from Quanta Computer in April 2025, cash and investments rose to $237.7 million.9 An additional $350 million at-the-market (ATM) stock offering in early June boosted cash and investments to $575 million.8 This eliminated debt and provided a multiyear research and development runway.

| Metric | Value (USD Million) | Notes |

| Total Revenues (Q1 2025) | 1.5 | 36% decline QoQ, 52.5% decline YoY |

| Total Operating Expenses (Q1 2025) | 22.1 | Up 13.2% QoQ, 22.0% YoY (due to R&D) |

| Operating Loss (Q1 2025) | 21.6 | – |

| Net Income (Q1 2025) | 42.6 | Includes $62.1M non-cash gains from derivative warrant/earn-out liabilities |

| Cash & Investments (March 31, 2025) | 209.1 | – |

| Cash & Investments (April 30, 2025) | 237.7 | After $35M Quanta investment |

| Cash & Investments (June 2025) | 575.0 | After $350M ATM offering; eliminated debt, multiyear R&D runway |

Table: Rigetti Computing: Key Financial Metrics (Q1 2025)

Analyst Sentiment and Market Valuation

Rigetti’s market capitalization was $5.5 billion as of July 19, 2025.24 Multiple analysts have issued price targets for RGTI. A median target of $15.0 comes from four analysts in the last six months.4 Another source indicates an average target of $14.83 from six analysts.7 Out of six analysts covering RGTI, five recommend “Strong Buy” and one recommends “Moderate Buy”.7 Another source shows 90% Buy and 10% Hold recommendations.24 Analysts anticipate sales to increase from $10.8 million in 2024 to $150 million by 2029.7 Losses per share are forecast to narrow from $0.29 in 2024 to $0.16 in 2028.7 RGTI stock has risen significantly: 32.51% in the past week, 47.68% in the past month, and 1,390% over the last year.25 Major institutional holdings include BlackRock Inc. (4.69%) and Morgan Stanley (1.19%).24

The stark contrast between Rigetti’s low current revenue and its multi-billion dollar market capitalization clearly indicates that investors are pricing in future potential rather than present performance. This is common for highly speculative, disruptive tech stocks. The stock’s significant recent rise reflects growing optimism about this future. A company’s market capitalization reflects investor expectations for future earnings and growth. When current revenues are minimal, but valuation is high, it signals that the market perceives significant long-term value in the company’s technology and market position. The rapid increase in stock price suggests that recent technical milestones and strategic partnerships are being interpreted as strong indicators of future success, driving speculative investment. This highlights the forward-looking nature of the financial markets in valuing quantum computing companies.

Investment Thesis and Risk Considerations

RGTI is considered a high-risk, high-reward speculative opportunity for aggressive investors.8 Its $575 million cash cushion and partnerships provide a foundation to outpace competitors.8 The 15-25% upside potential hinges on hitting 2025 milestones and securing enterprise contracts.8 Revenue remains “lumpy” due to the industry’s research and development phase. This underlines the difficulty of commercializing quantum services at scale.7 The continued cost burden of maintaining in-house fabrication and multi-disciplinary hardware-software integration efforts presents a challenge.9 Factors that may cause actual results to differ materially include the company’s ability to achieve milestones, technological advancements, and successfully obtain government contracts.1

The substantial cash reserves are critical for Rigetti’s survival and growth. In a sector with high research and development costs and delayed commercialization, a long cash runway provides stability. It reduces immediate fundraising pressure, allowing sustained investment in core technology. Quantum computing development is expensive and has a long gestation period before widespread commercial profitability. Companies in this space often burn through significant capital. Rigetti’s recent capital infusions provide a crucial multi-year runway, mitigating the immediate risk of liquidity issues. This financial stability allows the company to focus on achieving its ambitious technical milestones, which are essential for its long-term viability and eventual commercial success. Investors view this healthy cash position as a key de-risking factor.

The high percentage of “Buy” recommendations from analysts, despite current operating losses and low revenue, reinforces the long-term, speculative investment thesis.7 Analysts likely factor in the market growth projections and Rigetti’s strategic positioning. Financial analysts typically provide recommendations based on a company’s fundamentals and future prospects. The strong “Buy” ratings for Rigetti, despite its current financial losses, indicate that analysts believe the company’s technological advancements, strategic partnerships, and position in a rapidly growing market outweigh the near-term financial challenges. This suggests a consensus view that Rigetti is a promising long-term investment, albeit with inherent risks associated with an emerging technology.

Conclusion: Charting Rigetti’s Future Trajectory

Rigetti Computing’s increasing prominence stems from a powerful synergy of technological breakthroughs, strategic foresight, and alignment with global imperatives. Its advancements in quantum hardware, particularly superconducting qubits and modular designs, are pushing the boundaries of what is computationally possible. These technical achievements are bolstered by crucial partnerships with industry leaders like Quanta and significant non-dilutive funding from government agencies. This validates its approach and extends its operational runway.

The company operates within a quantum computing market poised for exponential growth. This growth is driven by the pressing need for advanced computational capabilities in diverse sectors. It is also fueled by the urgent geopolitical demand for quantum-safe cybersecurity. Rigetti’s robust intellectual property portfolio further solidifies its competitive position. It provides a strategic moat in this nascent, high-stakes arena. While current financial performance reflects its early-stage, R&D-intensive nature, a strong cash position and optimistic analyst sentiment underscore its long-term investment appeal. Rigetti is not merely a technology company. It is a strategic asset in the unfolding quantum era, charting a course towards a future where quantum computing reshapes industries and secures nations.

References

- Rigetti Demonstrates Industry’s Largest Multi-Chip Quantum …, accessed July 22, 2025, https://investors.rigetti.com/news-releases/news-release-details/rigetti-demonstrates-industrys-largest-multi-chip-quantum/

- Rigetti Demonstrates Industry’s Largest Multi-Chip Quantum Computer; Halves Two-Qubit Gate Error Rate – GlobeNewswire, accessed July 22, 2025, https://www.globenewswire.com/de/news-release/2025/07/16/3116290/0/en/rigetti-demonstrates-industry-s-largest-multi-chip-quantum-computer-halves-two-qubit-gate-error-rate.html

- Rigetti Demonstrates Industry’s Largest Multi-Chip Quantum Computer and Halves Two-Qubit Gate Error Rate – HPCwire, accessed July 22, 2025, https://www.hpcwire.com/off-the-wire/rigetti-demonstrates-industrys-largest-multi-chip-quantum-computer-and-halves-two-qubit-gate-error-rate/

- Rigetti Computing Achieves 99.5% Two-Qubit Gate Fidelity Milestone with New 36-Qubit System – Quiver Quantitative, accessed July 22, 2025, https://www.quiverquant.com/news/Rigetti+Computing+Achieves+99.5%25+Two-Qubit+Gate+Fidelity+Milestone+with+New+36-Qubit+System

- Our Trapped Ion Quantum Computers – Quantinuum, accessed July 22, 2025, https://www.quantinuum.com/products-solutions/quantinuum-systems

- Quantum Chemistry Gets Error-Corrected Boost from Quantinuum’s Trapped-Ion Computer, accessed July 22, 2025, https://thequantuminsider.com/2025/05/22/quantum-chemistry-gets-error-corrected-boost-from-quantinuums-trapped-ion-computer/

- Rigetti Just Hit A New Quantum Computing Milestone. Should You Buy RGTI Stock Now?, accessed July 22, 2025, https://www.barchart.com/story/news/33537351/rigetti-just-hit-a-new-quantum-computing-milestone-should-you-buy-rgti-stock-now

- Rigetti Computing: Quantum Leap or Risky Bet? A Speculative Play …, accessed July 22, 2025, https://www.ainvest.com/news/rigetti-computing-quantum-leap-risky-bet-speculative-play-future-computing-2507/

- Rigetti Computing Reports Its Q1 2025 Financial Results, accessed July 22, 2025, https://quantumcomputingreport.com/rigetti-computing-reports-on-its-q1-2025-financial-results/

- Rigetti Computing Reports First Quarter 2025 … – Investor Relations, accessed July 22, 2025, https://investors.rigetti.com/node/10206/pdf

- Quantum Computing Market Size | Industry Report, 2030 – Grand View Research, accessed July 22, 2025, https://www.grandviewresearch.com/industry-analysis/quantum-computing-market

- Quantum Computing Market Size, Growth, Demand & Trend …, accessed July 22, 2025, https://www.marknteladvisors.com/research-library/global-quantum-computing-market.html

- The Future of Quantum Computing: Growth Projections and Industry Forecasts for 2030, accessed July 22, 2025, https://patentpc.com/blog/the-future-of-quantum-computing-growth-projections-and-industry-forecasts-for-2030

- Quantum Economic Advantage Francesco Bova Avi Goldfarb Roger …, accessed July 22, 2025, https://www.nber.org/system/files/working_papers/w29724/w29724.pdf

- Building more investment and support for quantum computing – The World Economic Forum, accessed July 22, 2025, https://www.weforum.org/stories/2025/04/quantum-computing-benefit-businesses/

- Venture Capital Timing: 5 Macroeconomic Factors to Consider – Social Sector Network, accessed July 22, 2025, https://socialsectornetwork.com/venture-capital-timing-5-macroeconomic-factors-to-consider/

- The Ultimate VC Guide for Today’s Macro Economy – Number Analytics, accessed July 22, 2025, https://www.numberanalytics.com/blog/ultimate-vc-guide-macro-economy

- How Rising Rates Could Influence Tech Earnings – OpenMarkets – CME Group, accessed July 22, 2025, https://www.cmegroup.com/openmarkets/equity-index/2022/How-Rising-Rates-Could-Influence-Tech-Earnings.html

- Speculation: Trading With High Risks, High Potential Rewards – Investopedia, accessed July 22, 2025, https://www.investopedia.com/terms/s/speculation.asp

- www.justsecurity.org, accessed July 22, 2025, https://www.justsecurity.org/116473/security-stakes-global-quantum-race/#:~:text=In%20this%20respect%2C%20the%20quantum,need%20for%20stronger%20defense%20alliances.

- U.S.-Allied Militaries Must Prepare for the Quantum Threat to …, accessed July 22, 2025, https://www.rand.org/pubs/commentary/2025/06/us-allied-militaries-must-prepare-for-the-quantum-threat.html

- Rigetti Computing, Inc. (RGTI): VRIO Analysis – DCFmodeling.com, accessed July 22, 2025, https://dcfmodeling.com/products/rgti-vrio-analysis

- Quantum Computing Report – Patinformatics, accessed July 22, 2025, https://www.patinformatics.com/quantum-computing-report

- Rigetti Computing Share Price (NASDAQ: RGTI) – Stock Quote, Live Chart – INDmoney, accessed July 22, 2025, https://www.indmoney.com/us-stocks/rigetti-computing-inc-share-price-rgti

- RGTI Stock Price and Chart – Rigetti Computing, Inc. – TradingView, accessed July 22, 2025, https://www.tradingview.com/symbols/NASDAQ-RGTI/

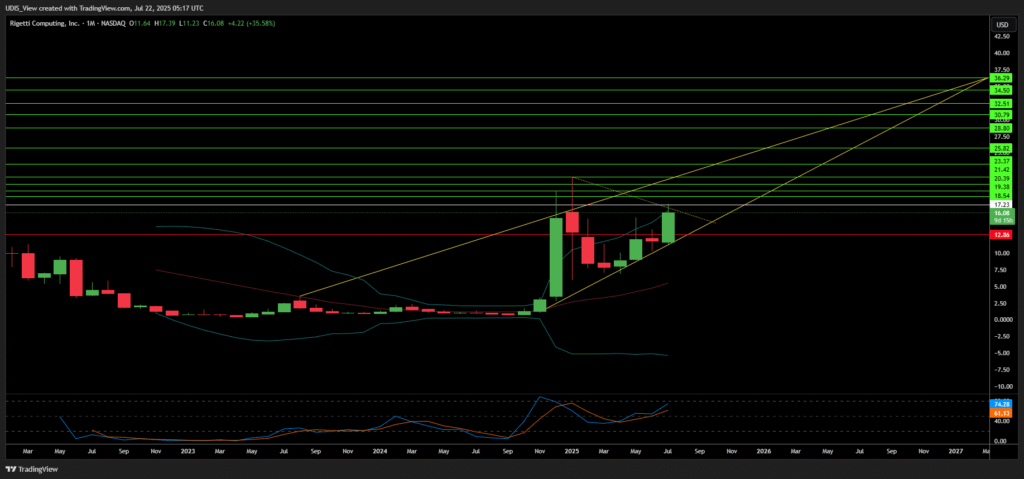

Rigetti Long (Buy)

Enter At: 17.23

T.P_1: 18.54

T.P_2: 19.38

T.P_3: 20.39

T.P_4: 21.42

T.P_5: 23.37

T.P_6: 25.82

T.P_7: 28.80

T.P_8: 30.79

T.P_9: 32.51

T.P_10: 34.50

T.P_11: 36.29

S.L: 12.86