I. The VisionWave Investment Thesis

VisionWave Holdings (VWAV) is strategically moving from an emerging defense technology provider to a critical AI infrastructure and platform integrator.[1] This transition positions VWAV to capitalize on urgent global demand for autonomous platforms.[2] Global geopolitical instability drives this accelerated market necessity.[2] The company’s growth thesis rests upon superior edge sensing, AI integration, and a secure digital backbone.[1] Recent institutional validation, including S&P index inclusion and strategic capital raising, confirms this transition is effectively underway.[6] VWAV is emerging as a technically validated defense-AI equity.[7]

A. Key Drivers Summary

Geopolitical risk in Eastern Europe and the Indo-Pacific compels rapid defense modernization.[2] This creates immense demand for Unmanned Ground Vehicles (UGVs). The company’s technology moat centers on the Varan UGV.[4] This platform integrates proprietary 4D imaging radar and independently actuated suspension, offering mission resilience superior to legacy systems.[4] Strategically, the PVML partnership establishes a secure, governable AI infrastructure.[1] This integrated solution solves the critical Security-Speed Paradox endemic to autonomous warfare.[1]

II. Macro Drivers: Geopolitical Urgency and Economic Tailwinds

A. Geopolitical Instability Accelerates Procurement Cycles

Geopolitical tensions are substantially driving rapid development in the military robotics sector.[9] Heightened geopolitical risks in Eastern Europe and the Indo-Pacific necessitate urgent military procurement cycles for advanced robotics.[2] The ongoing conflict in Ukraine fundamentally shifts battlefield doctrine.[10] This conflict demonstrates that traditional heavy armor is vulnerable to inexpensive, autonomous drones.[3] Military requirements increasingly favor platforms prioritizing autonomy and speed over sheer mass.

Military acquisition along NATO’s eastern flank is soaring.[11] European allies are advancing purchases of new fighting vehicles as military budgets rapidly increase.[11] This acquisition boom stems from the need to replace equipment supplied to Ukraine.[11] For instance, Poland’s Defence Ministry is developing the largest tracked vehicle acquisition program in Eastern Europe.[11] This massive initiative seeks to replace the outdated BWP-1 fleet with approximately 1,400 tracked vehicles under the Borsuk program.[11] This structural demand creates a significant market opening for agile defense technology SMEs.

VWAV’s Varan UGV directly addresses this strategic market requirement.[12] The modular platform incorporates lessons learned from modern conflict, favoring adaptability.[3] VWAV’s December 2025 field testing in Europe is perfectly timed.[4] This testing positions the Varan as a readily available, conflict-validated solution for accelerated European procurement demand.[12]

B. The Economic Imperative for Unmanned Systems

The military UGV market shows robust economic expansion. Projections indicate the market will reach $2.87 billion by 2030, reflecting a 7.92% Compound Annual Growth Rate (CAGR) from its 2025 size of $1.96 billion.[13] This growth is fundamentally supported by rising global defense budgets.[14] Demand also increases for safer, more cost-effective military operations in high-threat zones.[14] UGVs reduce human exposure to danger, particularly in missions like Explosive Ordnance Disposal (EOD).[13] EOD applications held 44.5% of the UGV market share in 2024.[2]

The adoption of Manned–Unmanned Teaming (MUM-T) doctrine is a critical structural driver.[2] This doctrinal shift, emphasizing multi-domain operations, adds approximately +1.10% to the long-term UGV market CAGR.[2] MUM-T is a permanent strategic change, ensuring sustained, long-term UGV demand across allied nations [2] VisionWave designed the Varan platform explicitly for coordinated group operation and swarm coordination capabilities.[4] This design positions VWAV to capture the highest-impact growth vector identified in UGV market forecasts.[2] The company is capturing momentum from major macro market forces.

Table 1: Geopolitical and Economic Drivers of UGV Demand

| Driver Domain | Causal Mechanism | VisionWave Catalyst |

|---|---|---|

| Geopolitics / Geostrategy | Heightened risk (Eastern Europe, Indo-Pacific) mandates urgent modernization.[2] | Varan UGV field testing timed for European procurement cycles.[4] |

| Economics / Macroeconomics | Global defense budget surge fuels 7.92% UGV market CAGR.[13] | Capital inflow secured without dilution strengthens expansion capacity.[6] |

| Geostrategy (MUM-T Doctrine) | Doctrinal shift adds +1.10% long-term CAGR impact.[2] | Varan designed specifically for coordinated group operation and swarm capability.[4] |

III. Foundational Technology: Superior Sensing and Mobility

A. The Varan UGV: An AI-Native Platform

The Varan UGV is an AI-native platform designed by VisionWave’s UK engineering team.[4] The vehicle features independently actuated suspension legs and proprietary 4D radar technology.[4] Varan is modular, supporting multiple payloads including remote weapon systems, counter-drone defense, troop transport, and casualty evacuation.[4] This inherent modularity allows for rapid reconfiguration and flexibility in the theater.[4]

Varan was designed from the ground up as an autonomous system using in-house developed systems.[12] This approach ensures optimized performance and accelerates deployment.[12] The platform is available in both electric and hybrid variants, enhancing operational versatility.[12] This modular and dual-use design supports improved platform reusability and supportability.[15] This focus addresses modern defense concerns regarding system sustainability.

The independently actuated suspension system is critical for mission reliability and terrain capability.[4] This specialized feature ensures vehicle stability in extreme, unstructured environments.[16] The suspension system allows the UGV to adjust its posture dynamically.[16] This is essential for clearing high obstacles and navigating complex terrain like ditches, ensuring operational mobility when mission success depends on movement.[16]

B. Revolutionizing Perception with 4D Imaging Radar

Varan utilizes VisionWave’s proprietary 4D radar technology for advanced perception.[4] This technology is a significant scientific advancement in autonomous sensing.[8] 4D imaging radar adds the crucial dimension of elevation to the conventional radar measurements of range, speed, and azimuth.[8] This elevation data delivers a richer, more complete understanding of the environment [8]

The technology provides the precision necessary for advanced autonomy, achieving azimuth resolutions under one degree and detection ranges exceeding 300 meters.[8] Unlike LiDAR, 4D imaging radar is uniquely resilient in adverse conditions.[8] It operates reliably through fog, rain, and darkness.[8] This all-weather, all-lighting capability is essential for 24/7 military operational readiness.[8]

VWAV aligns with high-tech industry movements by prioritizing 4D imaging radar.[18] Major automotive sensing companies have shifted focus away from 4D LiDAR to this superior imaging radar.[18] VWAV utilizes this technology to address the full spectrum of sensing requirements necessary for higher levels of autonomy.[8] The resulting highly accurate point cloud and direct velocity measurement capabilities significantly enhance threat detection and situational awareness.

IV. The Digital Stack: Cyber Resilience and AI Infrastructure

A. The Strategic Shift to Infrastructure Integration

VisionWave’s partnership with PVML Ltd. signifies a strategic commitment to high-value AI infrastructure integration.[1] The company expands its role beyond hardware supply, capturing a higher value proposition in the defense digital stack.[1] This collaboration integrates VisionWave’s advanced radar and vision systems with PVML’s real-time data-AI infrastructure.[1]

This integration addresses a critical geostrategic priority: decision dominance.[1] The value of sensor hardware depends entirely on the infrastructure’s ability to securely process, distribute, and act on massive data loads.[1] The integrated architecture creates a “secure digital backbone” where mission data, analytics, and decision logic converge rapidly.[1] By providing this infrastructure, VWAV establishes a “stickier” relationship with defense clients.[1] This infrastructure also creates an additional revenue stream from sophisticated software services.

B. Solving the Security-Speed Paradox

Autonomous systems require real-time processing speed, but mandated security protocols traditionally introduce latency.[1] This conflict is known as the “Security-Speed Paradox.” The partnership addresses this by integrating a governance layer.[1] The architecture employs real-time permissions enforcement governing every layer of access, transmission, and model interaction.[1]

This cyber-resilience mechanism allows autonomous systems to operate rapidly while maintaining strict security mandates.[1] Operational resilience is further guaranteed by VisionWave’s proprietary Evolved Intelligence™ (EI) framework.[5] EI is the adaptive AI layer designed for deterministic edge autonomy.[5] Deterministic autonomy ensures bounded-latency inference and control.[5] This is crucial for mission-critical timing in contested environments.

EW-resilient autonomy is a significant defense procurement driver.[2] The EI framework is engineered for operation in electronic warfare (EW) heavy environments where GPS or communications may be degraded.[2] By solving both data security and operational resilience challenges, VisionWave validates the viability of its autonomous platforms in the most challenging scenarios.[1]

V. Competitive Moat: Intellectual Property and Strategic Access

A. Protecting the AI and Sensing Core

Intellectual Property (IP) establishes a vital competitive moat in the specialized defense sector.[19] VisionWave holds a portfolio of globally approved patents.[21] The company aggressively manages its IP, demonstrated by filing a prompt response to the USPTO to expedite examination of a patent continuation.[5] This proactive strategy protects the underlying investment in R&D.

The IP core focuses on unique sensing capabilities. This includes the “multi-planar radio-wave detection and imaging system” referenced in a patent continuation filing.[5] Known as Vision-RF, this proprietary technology converts radio-frequency signals into real-time visual intelligence.[22] This capability allows operators to achieve sensing superiority, including the ability to “see through walls, underground, and underwater”.[22]

These proprietary sensing technologies, combined with continuous advancements in control systems identified through patent trend analysis [23], differentiate VWAV from competitors.[22] The IP provides competitive barriers against primes and maximizes leverage during defense procurement negotiations.[19]

B. Navigating the International Defense Procurement Landscape

Successfully securing defense contracts requires navigating complex international procurement and geopolitical landscapes.[19] VisionWave addresses this by appointing Admiral (Ret.) Eli Marum and Ambassador (Ret.) Ned L. Siegel to its Advisory Board.[22] These are deliberate strategic appointments, moving beyond mere corporate governance.[22]

These high-level military and diplomatic veterans establish an “operational bridge”.[22] This bridge connects the company’s cutting-edge technology with complex international defense procurement systems.[22] Admiral Marum offers expertise in naval modernization, complementing Ambassador Siegel’s diplomatic and business experience.[24] This strengthens VisionWave’s position as a technological bridge among allied nations [24]

This strategic access is crucial for accelerating the commercialization timeline.[22] While 2025 focuses on pilot validations, these appointments facilitate necessary global partnerships and strategic initiatives.[24] The expertise helps translate technical superiority into major government contracts, positioning the company for substantial scaled commercialization post-2025.[22]

Table 2: VisionWave Proprietary Technology Stack and Competitive Moat

| Domain | Technology Platform | Key Differentiator |

|---|---|---|

| Science / High-Tech | 4D Imaging Radar | Adds elevation data (4th dimension) for superior all-weather, high-resolution perception.[8] |

| Technology / Science | Independently Actuated Suspension (IAS) | Ensures operational capability and stability on extreme, unstructured terrain.[4] |

| Cyber / High-Tech | Evolved Intelligence™ (EI) & PVML Backbone | Deterministic edge autonomy secured by real-time permissions enforcement.[1] |

| Patent Analysis | Vision-RF Continuation | Multi-planar radio-wave detection, providing proprietary sensing beyond optical constraints.[5] |

VI. Conclusion: Institutional Validation and Future Trajectory

A. Financial Strength and Institutional Momentum

VisionWave demonstrates financial strength and disciplined capital management. The company raised approximately $4.64 million through the exercise of 403,620 common-stock purchase warrants.[6] This capital raise, executed at an exercise price of $11.50 per share, strengthens the balance sheet and enhances liquidity.[6]

Raising capital through warrant exercises, without issuing new equity, reflects strong shareholder confidence.[6] It aligns with management’s goal of minimizing dilution.[7] This financial independence signals maturity to institutional investors. The company also achieved significant institutional milestones, including inclusion in the S&P Total Market Index.[6] It received a 5/5 Technical Attribute rating from Nasdaq Dorsey Wright.[6] These validations confirm the company’s growing institutional footprint and market strength.[6] These milestones reduce risk perception and support higher valuation multiples as the company enters its scaling phase.

Table 3: Institutional Validation and Strategic Access

| Corporate Action | Domain Addressed | Significance for Valuation |

|---|---|---|

| $4.64M Capital Raise (Warrant Exercises) [6] | Economics | Financial maturity; minimizes dilution and signals robust shareholder confidence.[7] |

| S&P Index Inclusion / 5/5 Nasdaq Rating [6] | Economics / Macroeconomics | Confirms institutional eligibility and validates technical market strength. |

| Appointment of Admiral/Ambassador [22] | Geostrategy / Strategy | Establishes critical access for navigating complex international defense procurement.[24] |

B. Synthesis of Integrated Strategy

VisionWave Holdings is exceptionally positioned at the intersection of urgent geopolitical demand and next-generation technology. The company’s integrated deployment timeline accelerates market capture. European field integration in late 2025 and accelerated rollout through 2026 directly target rapidly closing procurement windows.[1] The fundamental value resides in the comprehensive system integration. This system leverages proprietary 4D sensing and Vision-RF technology.[5] This feeds deterministic Evolved Intelligence™ autonomy, all secured by the PVML digital backbone.[1] This integrated, resilient offering provides the decision dominance essential for future multi-domain operations.

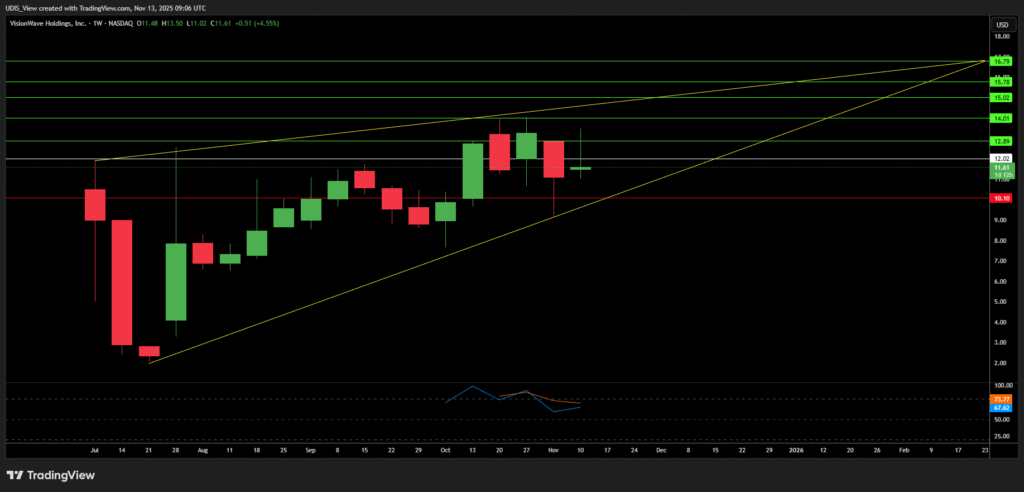

VisionWave Long (Buy)

Enter At: 12.02

T.P_1: 12.89

T.P-2: 14.01

T.P-3: 15.02

T.P_4: 15.78

T.P_5: 16.79

S.L: 10.10