The global defense architecture is fracturing. As of December 2025, the era of permissive technology transfer is over. The United States government has drawn a definitive line in the silicon. In a market-shifting move, the Federal Communications Commission (FCC) has banned DJI and Autel. This regulatory action is a kinetic event for the market, effectively decapitating the incumbent leadership of the small drone sector. It creates an immediate, strategic vacuum in the Western defense industrial base.

Red Cat Holdings (RCAT) stands alone at this inflection point. They are not merely a drone manufacturer; they are a primary beneficiary of a sovereign supply chain reset. Their “Arachnid” family of systems creates a closed-loop kill chain. Their financials reflect this reality, with Q3 revenue surging 646% and a balance sheet holding over $200 million in liquidity. They are acquiring capabilities while competitors face existential regulatory headwinds.

This report analyzes Red Cat’s ascent. We dissect the geopolitical friction driving their order book. We examine the physics of their anti-jamming radios and the computational science behind their visual navigation. We evaluate the economic moat created by their patent portfolio. This is not a speculative tech play; it is the industrialization of robotic warfare.

1. Geopolitical Analysis: The Great Decoupling

The End of the Grey Zone

For a decade, the West tolerated a vulnerability: Chinese-manufactured drones dominated commercial and government sectors. These devices functioned as efficient data collection nodes, mapping critical infrastructure and tracking law enforcement movements. The geopolitical risk became kinetic as the conflict in Ukraine demonstrated the dual-use reality of these platforms. A consumer drone is now recognized as a munition in waiting.

Washington has acted with decisive force. The “Covered List” designation for DJI and Autel is a market-clearing event. It prohibits the authorization of new equipment, effectively freezing the technological evolution of Chinese drones in the US. This is not a tariff; it is a blockade. It forces every federal agency, police department, and infrastructure operator to pivot immediately toward “Blue UAS” alternatives. Red Cat has positioned itself for this moment with domestic manufacturing, audited supply chains, and certified software.

Supply Chain Sovereignty

National security now dictates industrial policy. The concept of “friend-shoring” is central to Pentagon procurement. Reliance on adversarial supply chains for critical ISR (Intelligence, Surveillance, Reconnaissance) assets is strategic suicide. The 2025 National Defense Authorization Act (NDAA) codified this reality, mandating the removal of foreign-controlled technology from defense networks.

Red Cat operates a fully sovereign supply chain strengthened by the acquisition of FlightWave and Teal Drones. They utilize American manufacturing operating systems to insulate production from geopolitical shocks in Asia. In a fragmented world, a secure supply chain is a premium asset for which customers will pay for certainty of delivery.

The NATO Imperative

The NATO alliance is rearming, with European nations rapidly increasing expenditures for interoperable systems. The NATO Support and Procurement Agency (NSPA) catalogue is the gateway to this market, and Red Cat’s Black Widow system has secured this critical approval. This listing streamlines acquisition for 32 member nations and validates the system’s utility in high-intensity environments. Red Cat has already secured initial contracts with NATO allies, as stocks must be replenished following consumption in Ukraine.

Table 1: Geopolitical Tailwinds for Red Cat 35

| Drives demand for attractive mass | Consequence | Red Cat Advantage |

| FCC Covered List Ban | DJI/Autel barred from new US authorizations | Immediate market share capture |

| NDAA Section 1709 | Mandates removal of non-compliant UAS | Validates Blue UAS portfolio |

| NATO NSPA Listing | Streamlines allied procurement | Opens European defense market |

| Ukraine Conflict | Consumes small UAS at high rates | Drives demand for attritable mass |

2. Geostrategy: The Doctrine of Attrition

The Replicator Initiative

The Pentagon’s “Replicator” initiative seeks to field thousands of autonomous systems to provide “attritable mass” systems cheap enough to lose but capable enough to kill. Red Cat’s product roadmap aligns perfectly with these objectives. The company was selected as a finalist for the Army’s Short Range Reconnaissance (SRR) Tranche 2 program, validating the rucksack-portable Black Widow as a vital squad-level sensor.

Multi-Domain Operations

Red Cat has evolved into a multi-domain provider. The acquisition of FlightWave adds maritime capabilities, such as the Edge 130 Blue, which can operate from ships and land on water, a critical feature for the Indo-Pacific theater. Their new “Blue Ops” division is developing Uncrewed Surface Vessels (USVs). Furthermore, a partnership with Ocean Power Technologies integrates drones with autonomous buoys to create persistent sensor grids.

The Asymmetry of Swarms

The future of warfare is “one pilot, many drones.” Red Cat is advancing this through the “Futures Initiative”. Their partnership with Apium Swarm Robotics enables “one-to-many” control, allowing smaller units to control larger areas with reduced cognitive load. The swarm handles formations while the human makes lethal decisions.

3. Macroeconomic Drivers: The Defense Supercycle

Global instability is driving a secular bull market in defense spending. The global drone market is projected to reach nearly $58 billion by 2030. Red Cat is capturing this growth, taking market share from legacy providers and banned foreign entities.

Efficiency is used to mitigate inflationary pressures. Their “Warp Speed” integration optimizes production, and their investment in US facilities creates a defensible barrier to entry. Capital is following these trends; institutional investors like Vanguard and BlackRock have added shares, validating the regulatory moat and contract momentum. With Q3 revenue of $9.6 million, Red Cat has the cash to fund operations without dependence on capital markets.

4. Economic Analysis: A Financial Inflection

Red Cat is in hyper-growth mode. Revenue grew 646% year-over-year in Q3 FY2025, confirming adoption of the Teal 2 and Black Widow systems. Sequential growth of 200% indicates accelerating momentum. The company ended Q3 with over $212 million in cash and receivables. The strategic divestiture of its consumer segment has focused the company purely on defense, where contracts offer predictable margins and recurring revenue.

Table 2: Red Cat Holdings Financial KPIs (Q3 FY2026) 55

| Metric | Value | Implications |

| Revenue Growth (Y/Y) | +646% | Validates product-market fit |

| Sequential Growth (Q/Q) | +200% | Accelerating demand signal |

| Cash Position | ~$212.5M | Funding for M&A and R&D |

| FY2025 Guidance | $34.5M – $37.5M | Management confidence in execution |

| Backlog | Record Highs | Revenue visibility for FY2026 |

5. Technology Analysis: The Arachnid Architecture

The Black Widow Platform

The Black Widow is a tactical quadcopter designed for infantry. It is rucksack portable and deployable rucksack that can be deployed in under a minute. Its modular airframe allows for field repairability. A Picatinny rail supports secondary payloads, allowing the system to adapt to various mission requirements.

Edge 130 Blue: Hybrid VTOL

The Edge 130 Blue is a hybrid tricopter that combines vertical takeoff with fixed-wing endurance, flying for over two hours. It is ideal for long-range ISR and mapping. Its Blue UAS certification makes it available to all federal agencies.

FANG: The Kinetic Solution

FANG is an FPV strike drone designed for precision. Unlike hobbyist components, FANG is cyber-secure, using encrypted links compatible with military radios. It completes the “sensor-to-shooter” loop within the Red Cat ecosystem.

Modular Open Systems Approach (MOSA)

Red Cat utilizes an open architecture. The “Tomahawk Ecosystem” allows a single controller to operate multiple platforms, including ground robots. This interoperability is a strategic requirement for the military, and integration with ATAK (Android Team Awareness Kit) puts drone data directly onto the soldier’s map.

6. Cyber Domain: Hardening the Edge

The “Blue UAS” Moat

Security is a primary differentiator. Red Cat has multiple systems on the “Blue UAS” list, proving the hardware and code are vetted by the Defense Innovation Unit (DIU). This status acts as a barrier to entry while guaranteeing access to DoD procurement dollars.

Encryption and EW Defense

Red Cat uses military-standard AES-256 encryption to secure video feeds and command links. Unlike competitors who may upload data to the cloud, Red Cat drones store data locally or on secure government servers to ensure operational security (OPSEC). To survive electronic warfare, Red Cat partners with Doodle Labs for radios that use frequency hopping. The systems also support “radio silence,” allowing autonomous operation without transmitting electronic signatures.

7. Scientific Deep Dive: Physics of Communication

Hex-Band Radio Physics

The Doodle Labs “Helix” radio operates across six frequency bands (M1-M6) to ensure spectrum agility.

Table 3: Hex-Band Radio Spectrum Advantages

| Band | Physics Characteristic | Operational Benefit |

| M1 – M2 | Long Wavelength / Diffraction | Penetrates buildings; Non-Line-of-Sight ops |

| M3 – M4 | Balanced Propagation | General purpose comms; Urban navigation |

| M5 – M6 | High Bandwidth / Throughput | 4K Video streaming; Rapid data transfer |

The “Sense” technology monitors the noise floor and switches bands instantly if jammed, optimizing the link budget in real-time.

8. Science of Autonomy: Visual Navigation

Visual SLAM and VNav

In GPS-denied environments, Red Cat uses Visual SLAM (Simultaneous Localization and Mapping). Onboard AI triangulates movement from frame-to-frame “keypoints” to calculate motion and build a 3D map. Through a partnership with Palantir, VNav software handles these heavy computations at the edge, allowing flight through complex environments without satellites.

9. High-Tech Analysis: Swarming Intelligence

True swarming is decentralized. Technology from partner Apium allows drones to “think” collectively and share state data. This bio-mimicry ensures the swarm remains resilient even if nodes are lost. One operator can set intent for a fleet, multiplying combat power while the network functions as an integrated “Combat Cloud”.

10. Patent and Legal Moat

Red Cat protects its differentiators through a defensive IP strategy:

- Optics (Fat Shark): Patents on FPV optical architectures.

- Positioning (Skypersonic): Patent No. 10,877,162 covers terrestrial positioning for GPS-denied indoor flight.

- Modularity (Teal): Patent No. 9,926,077 covers modular arm designs.

Combined with the FCC legal blockade and Blue UAS certifications, these assets create a formidable barrier to entry.

11. Institutional and Market Analysis

Institutional accumulation by Vanguard and BlackRock signals confidence that Red Cat is graduating to a core defense holding. While high short interest remains, positive news could trigger a squeeze. Analysts rate the stock a “Strong Buy”, with sentiment shifting as Red Cat is recognized as a strategic asset defining robotic warfare.

Conclusion

Red Cat Holdings is the geopolitical alpha of 2026. In a world of decoupled supply chains and nationalized drone markets, they are the designated survivor and strategic leader. Armed, funded, and cleared for takeoff, the company is delivering the exact capabilities the Pentagon demands.

Would you like me to create a summary table comparing Red Cat’s product line specifications to traditional commercial drones?

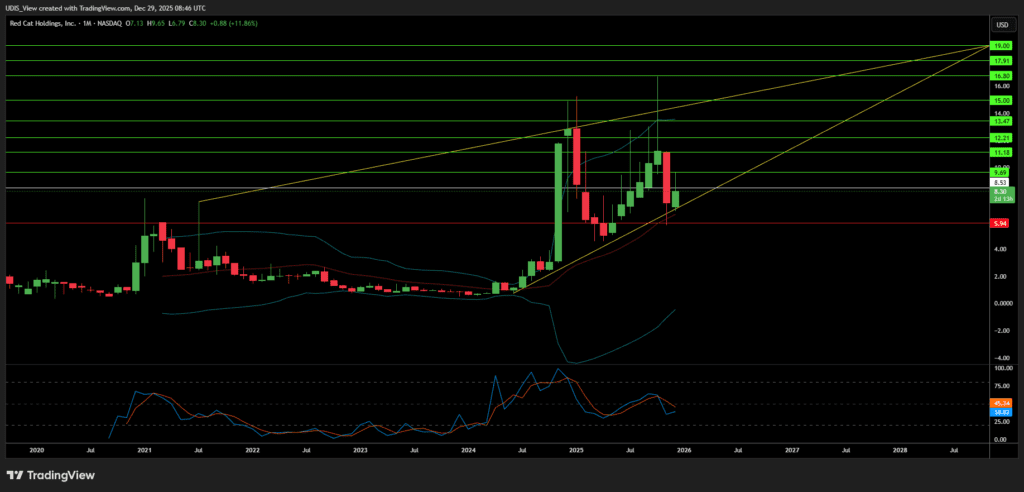

Red Cat Long (Buy)

Enter At: 8.53

T.P_1: 9.69

T.P_2: 11.18

T.P_3: 12.21

T.P_4: 13.47

T.P_5: 15.00

T.P_6: 16.80

T.P_7: 17.91

T.P_8: 19.00

S.L: 5.94