Red Cat’s Ascent Amidst Market Volatility

Red Cat Holdings (NASDAQ: RCAT) operates as a small-cap entity within the drone technology sector.1 Its primary focus lies in developing rugged, military-grade drones through its key subsidiary, Teal Drones.1 The company specializes in integrating advanced robotic hardware and software solutions.2 These solutions cater to military, government, and commercial applications, with a stated mission to enhance operational effectiveness and safety.1 Red Cat aims to “Dominate the Night™” through its specialized offerings, such as the Teal 2 drone.1

The company’s stock, RCAT, has experienced a significant surge, rising over 100% in the last three months.3 This upward movement followed a $30 million equity offering completed in April.5 However, a substantial short interest, exceeding 20% of the stock’s float, suggests that some of this recent appreciation may stem from short covering activities.7

This report provides a comprehensive analysis of the intricate factors influencing Red Cat’s trajectory. It meticulously examines the prevailing market dynamics, the company’s strategic positioning, its financial health, and the ongoing legal challenges it faces. The aim is to offer a clear understanding of Red Cat’s current standing and future prospects.

Geopolitical Currents Fueling Drone Demand

The global landscape profoundly impacts the defense industry, particularly the military drone market. Geopolitical tensions and conflicts are reshaping defense spending and acquisition strategies worldwide. Red Cat Holdings operates directly within this evolving environment.

The Expanding Military Drone Market

The global military drone market demonstrates robust expansion. Its size stood at USD 11.7 billion in 2024.9 Projections indicate significant growth, reaching USD 21.28 billion by 2033.9 This represents an estimated Compound Annual Growth Rate (CAGR) of 6.6% from 2025 to 2033.9 This market expansion is primarily driven by military forces globally seeking enhanced surveillance capabilities and improved personnel protection.9 Drones offer distinct advantages in terms of cost-effectiveness and operational efficiency, making them central to modern defense strategies.9

Drones provide immediate intelligence and high-definition imagery. They can operate in hazardous environments without risking human lives.9 This capability is invaluable for counter-terrorism operations, border protection services, and extensive area surveillance functions.9 Furthermore, the integration of advanced Artificial Intelligence (AI) is significantly boosting drone autonomy, expanding their operational scope and effectiveness.9

Lessons from Ukraine and US Policy Shift

The ongoing conflict in Ukraine has dramatically underscored the critical role of commercially developed technologies in high-intensity warfare.10 Ukraine has effectively institutionalized a “commercial-first” defense market. This approach involves allocating a distinct budget and radically simplifying acquisition rules for innovative unmanned systems.11 Commercial technology, largely comprising unmanned systems, now accounts for nearly half of Ukraine’s defense procurement spending.11 This demonstrates the substantial benefits commercially developed solutions can offer in modern conflicts.11

The U.S. Department of Defense (DoD) is actively drawing lessons from Ukraine’s experiences.11 Recommendations for the U.S. include consolidating budget line items into larger categories. This would enable more flexible and rapid resource allocation, especially for unmanned systems.11 Establishing a dedicated budget for unmanned systems acquisition is also a key proposal.11 A notable policy shift reclassifies small drones, such as Red Cat’s Black Widow, as “consumable commodities”.12 This contrasts with their previous designation as durable property.12 This reclassification empowers soldiers to deploy these drones without concern for their potential destruction by adversaries.12 This policy change could significantly boost sales for companies like Red Cat.12

The ongoing geopolitical tensions and conflicts, particularly the war in Ukraine, have fundamentally reshaped global defense procurement. This goes beyond mere budget increases. It represents a strategic re-evaluation of how military technology is acquired. The shift towards “commercial-first” solutions and the reclassification of small drones directly benefits agile, innovative companies. This policy change reduces bureaucratic hurdles and psychological barriers to widespread drone deployment. It creates a powerful, long-term demand for Red Cat’s specific product offerings. Red Cat’s market position aligns strongly with these macro-level shifts in defense strategy. Its future success depends on its ability to capitalize on the DoD’s accelerated adoption of commercially-derived, rapidly deployable drone solutions.

Red Cat’s Strategic Foundation: Innovation and Industry Standing

Red Cat Holdings has built its market position on a foundation of strategic acquisitions, technological innovation, and adherence to stringent defense standards. These elements collectively define its competitive posture in the rapidly evolving drone industry.

Core Subsidiaries and Product Portfolio

Red Cat operates primarily through two wholly-owned subsidiaries: Teal Drones and FlightWave Aerospace.2 Teal Drones is a recognized leader in small Unmanned Aerial System (sUAS) innovation.13 It provides advanced solutions to the U.S. military and its allies.13 Its flagship products, the Teal 2 and Black Widow drones, are central to Red Cat’s defense offerings.10 FlightWave Aerospace contributes the Edge 130 drone to the company’s diverse product portfolio.10

Blue UAS Certification and “Made in America”

A critical differentiator for Red Cat is its adherence to U.S. defense standards. The Teal 2 and Black Widow systems are American-made.13 They are developed under strict design guidelines.13 These systems have earned Blue UAS Certification from the U.S. Department of Defense.13 This certification is paramount for government procurement, especially as U.S. agencies increasingly restrict foreign-made drones, such as those from DJI.16 Red Cat’s commitment to using secure, National Defense Authorization Act (NDAA)-compliant components further solidifies its position as a trusted domestic supplier.16

Technological Advantages

The Teal 2 drone is specifically designed for short-range reconnaissance missions.15 It excels in low-light and night operations. This capability is enabled by its Teledyne FLIR Hadron 640R sensor, which provides high-resolution thermal imaging.4 The Teal 2 system also incorporates multi-vehicle control and advanced artificial intelligence capabilities.4 Teal’s systems are characterized by their open, modular, and interoperable architecture. This design ensures their effectiveness in modern operational environments.13

Intellectual Property Landscape

Teal Drones, Inc. holds several key patents that underpin its technological offerings. These include patents related to “Controlling a drone through user movement” (Patent No. 10836486), “Modular arms on a rotor-based remote vehicle” (Patent No. 10683089), “Drone-relative geofence” (Patent No. 10671072), and “Thrust vectoring on a rotor-based remote vehicle” (Patent No. 9938005).17 Additionally, Red Cat Holdings maintains a perpetual, worldwide, royalty-free, non-exclusive license for specific unmanned aerial vehicle (UAV) and printed circuit board patents from UAV Patent Corp..18

Red Cat’s strategic emphasis on achieving Blue UAS certification and its “Made in America” manufacturing approach directly addresses critical national security and supply chain concerns within the U.S. defense sector.13 This regulatory compliance creates a significant barrier to entry for non-compliant competitors. The company’s patent portfolio, while not explicitly tied to its current flagship products in all details, indicates a foundational commitment to innovation in drone design and control. This internal intellectual property, combined with strategic partnerships like the one with Palantir for AI integration 10, demonstrates a deliberate strategy to develop a comprehensive technological ecosystem. This approach aims to differentiate Red Cat beyond mere hardware sales, moving towards offering integrated, intelligent drone solutions. Such solutions typically command higher margins and foster stronger, more enduring client relationships. Red Cat is actively positioning itself as a leader in providing advanced, secure, and compliant drone solutions for defense and government applications. This strategy, if successfully executed, could establish a sustainable competitive advantage through technological superiority and adherence to stringent national security requirements.

Securing the Future: Contracts and Collaborative Ventures

Red Cat Holdings’ growth trajectory is significantly shaped by its success in securing key government contracts and forging strategic partnerships. These agreements validate its technology and provide a foundation for future revenue.

Pivotal U.S. Army SRR Program

Red Cat Holdings achieved a significant milestone in 2024. Its Black Widow drone was selected as the winner of the U.S. Army’s Short Range Reconnaissance (SRR) Program of Record.12 This designation makes the Black Widow the sole drone utilized by the Army for its SRR program.12 The Army’s current acquisition objective for this program is 5,880 systems over a five-year performance period.10 This long-term contract is expected to facilitate continuous product improvement and production scaling for Red Cat.19 It also creates substantial opportunities for additional sales to other U.S. Department of Defense (DoD) entities and allied nations.19

U.S. Customs and Border Protection (CBP) Contracts

Beyond military applications, Teal Drones has secured contracts with U.S. Customs and Border Protection (CBP). These agreements total $1.8 million for the provision of 106 Teal 2 drone systems.4 The contracts also include spare parts and training.4 These specific contracts are part of a broader five-year Blanket Purchase Agreement (BPA) between CBP and five drone companies, with an estimated total value of $90 million.4 The Teal 2 drones enhance situational awareness for Border Patrol agents, providing airborne reconnaissance, surveillance, and tracking capabilities.4 These contracts have contributed to Red Cat’s current backlog, which stands at over $7.5 million, indicating accelerating Teal 2 revenue.4

Strategic Partnerships

Red Cat has strategically engaged with key technology partners to enhance its product capabilities and operational efficiency. A notable collaboration is with Palantir Technologies Inc. (NASDAQ: PLTR).10 This partnership focuses on integrating Palantir’s Visual Navigation (VNav) software into Red Cat’s Black Widow drones.10 It also involves deploying Palantir’s Warp Speed manufacturing operating system.10 This collaboration aims to transform autonomous small Unmanned Aerial System (sUAS) operations through advanced AI software.13 Additionally, Red Cat has partnered with ESAero to assist with fast-tracked, customer-specific projects. This allows Red Cat to maintain its focus on core hardware and software development.20

The U.S. Army SRR program win for the Black Widow represents a foundational achievement. It provides a substantial, multi-year revenue stream and solidifies Red Cat’s position as a key defense contractor.10 This is not merely a one-off sale but a program of record, implying sustained demand and opportunities for upgrades. The CBP contracts, while smaller in scale, are equally significant. They demonstrate the versatility and broader applicability of Teal 2 drones across various government agencies beyond the military.4 This diversification of government clients reduces reliance on a single customer. The Palantir partnership is particularly strategic because it integrates advanced AI and manufacturing optimization directly into Red Cat’s core products. This technological enhancement is crucial for scaling production efficiently and delivering superior capabilities. It helps meet the demands of large government orders, transforming contract wins into consistent, high-volume revenue. Red Cat is actively building a robust foundation for long-term revenue growth. It secures marquee government contracts and leverages cutting-edge technology partnerships. The critical challenge lies in the effective execution of these contracts and the efficient scaling of its manufacturing capabilities. This conversion of opportunities into sustainable, profitable revenue is paramount.

Table 1: Key Government Contracts and Associated Values

| Contract Name | Contracting Agency | Red Cat Product(s) | Initial Value/Objective | Duration | Key Details |

| Short Range Reconnaissance (SRR) Program of Record | U.S. Army | Black Widow | 5,880 systems | 5 years | Sole drone for Army SRR; allows continuous improvement & scaling; opens DoD/allied sales 10 |

| Blanket Purchase Agreement (BPA) | U.S. Customs and Border Protection (CBP) | Teal 2 | $90 million (total BPA) | 5 years | Red Cat secured $1.8M for 106 Teal 2 systems; enhances situational awareness for Border Patrol 4 |

Financial Trajectory: Growth Projections Versus Profitability Challenges

Red Cat Holdings presents a complex financial picture, characterized by significant growth potential alongside current unprofitability and operational scaling challenges. Understanding these dynamics is crucial for assessing its investment profile.

Current Financial State

Red Cat Holdings is currently operating at a loss and generates limited revenue [User Query]. The company’s revenues contracted by 2.8% to $12 million over the last 12 months.10 More concerning is the sharp quarterly revenue decline of 72.1%, falling to $1.6 million in the most recent quarter from $5.8 million year-over-year.10

The company exhibits severely negative profitability metrics. Its Operating Margin stands at -278.3%, reflecting operating losses of $34 million over the last four quarters.10 The Operating Cash Flow Margin is -251.1%, indicating negative operating cash flow of $31 million.10 Furthermore, the Net Income Margin is -456.7%, with net losses totaling $56 million.10 These figures are indicative of the company’s intensive investment phase, as it focuses on scaling production capabilities and fulfilling its newly secured military contracts.10

Future Revenue Projections

Despite current losses, Red Cat projects substantial revenue growth in the coming years. The company forecasts revenues of $80-$120 million for calendar year 2025.6 This guidance is segmented across its product lines: $25-65 million from SRR-related Black Widow sales, $25 million from non-SRR Black Widow sales, $25 million from Edge 130 sales, and $5 million from Fang FPV sales.14 For 2026, revenue is anticipated to exceed $150 million.10 Analyst forecasts align with this aggressive growth, projecting Red Cat’s revenue to grow by 108.2% per annum, significantly outpacing the U.S. market’s 8.8% growth rate.21 Earnings are projected to grow by 123.3% per annum, with EPS growth of 124.7% per annum.21 However, analysts generally forecast the company to remain unprofitable over the next three years.21

Recent Equity Offering

To fund its ambitious growth plans, Red Cat completed a $30 million registered direct equity offering in April 2025.5 This offering involved the sale of 4,724,412 shares of common stock to institutional investors.6 The net proceeds are designated for general corporate and working capital purposes. This includes the development of a new unmanned surface vessel division.5 The offering expanded the company’s float by approximately 5.6%.6

Stock Performance and Market Sentiment

RCAT stock has demonstrated significant momentum, rising over 100% in the last three months [User Query]. This surge may be partially attributable to short covering, given the stock’s substantial short interest. Currently, 18.65% of its float is sold short, which is considerably higher than the peer group average of 7.71%.7 Analysts generally maintain a positive outlook, with a “Buy” consensus rating (50% Strong Buy, 50% Buy).22 Price targets for RCAT range from $6.50 to $13.00, with an average target of $9.75.23

Valuation and Financial Flexibility

On traditional valuation metrics, Red Cat’s stock appears expensive, with a price-to-sales ratio of 80x compared to the S&P 500’s 3.1x.10 However, when considering 2025 revenue projections, the adjusted price-to-sales ratio drops to 6x forward revenues. Analysts consider this valuation reasonable for a high-growth defense contractor.10 The company maintains a solid financial foundation, characterized by a low debt burden ($28 million in debt against a $980 million market cap, resulting in a 2.8% debt-to-equity ratio) and a healthy cash position ($7.7 million in cash and equivalents).10 This financial flexibility is crucial for funding ongoing growth investments and fulfilling new contracts.10

Red Cat’s current deep unprofitability and recent revenue contraction starkly contrast with its aggressive future revenue forecasts and analyst projections for triple-digit growth.10 This financial profile is characteristic of a “growth-at-any-cost” strategy. In this model, significant upfront investment is made to capture market share in an emerging sector. The $30 million equity offering, while dilutive to existing shareholders, is a critical capital injection. It is necessary to fund this ambitious growth trajectory, particularly for scaling production and expanding into new areas like unmanned surface vessels.5 The high short interest indicates that a significant portion of the market remains skeptical about the company’s ability to achieve these targets and translate contract wins into sustainable, profitable revenue. The current high price-to-sales ratio, when adjusted for future revenue projections, suggests that the market is pricing in this anticipated growth. The core investment thesis, therefore, hinges entirely on Red Cat’s operational execution: its ability to rapidly ramp up manufacturing, fulfill large government contracts, and manage associated operational challenges to achieve profitability. Red Cat represents a highly speculative investment. Its valuation is largely based on future potential rather than current performance. Investors are betting on management’s ability to navigate complex operational challenges and convert significant contract opportunities into consistent, scalable, and eventually profitable revenue streams. Failure to meet these ambitious revenue guidances or to demonstrate a clear path to profitability could lead to significant downside risk, despite the current positive analyst sentiment.

Table 2: Red Cat Holdings Financial Snapshot and Projections

| Metric | Current (LTM/Most Recent Q) 10 | 2025 Projection 6 | 2026 Projection 10 |

| Revenue | $12M (LTM), $1.6M (Most Recent Q) | $80M – $120M | >$150M |

| Net Income | -$56M (LTM) | -$35M (Forecast) 21 | $10M (Forecast) 21 |

| Operating Margin | -278.3% (LTM) | N/A | N/A |

| Operating Cash Flow | -$31M (LTM) | N/A | N/A |

| Cash & Equivalents | $7.7M | N/A | N/A |

| Total Debt | $28M | N/A | N/A |

| Market Capitalization | ~$980M (approx.) | N/A | N/A |

| Price-to-Sales Ratio | 80x (Current) | 6x (Forward 2025) | N/A |

| Short Interest % Float | 18.65% 8 | N/A | N/A |

| Analyst Consensus Rating | Buy (50% Strong Buy, 50% Buy) 22 | N/A | N/A |

| Average Price Target | $9.75 23 | $8.50 22 | N/A |

Note: LTM = Last Twelve Months; N/A = Not Available in provided data for projection.

The Legal Shadow: Class Action Allegations and Their Ramifications

Red Cat Holdings is currently facing a significant legal challenge in the form of a securities class action lawsuit. This litigation casts a shadow over the company’s operational transparency and financial representations.

The Olsen v. Red Cat Holdings, Inc. Lawsuit

Red Cat Holdings is a defendant in a securities class action lawsuit, Olsen v. Red Cat Holdings, Inc., filed in the U.S. District Court for the District of New Jersey (Case No. 25-cv-05427).24 The lawsuit alleges violations of the Securities Exchange Act of 1934.24 The Class Period, during which affected shareholders purchased securities, spans from March 18, 2022, to January 15, 2025.24

Allegations of Misleading Statements

The core of the complaint revolves around allegations that Red Cat made materially false and/or misleading statements. These statements concern two critical aspects of its business: its production capacity and the value of a key U.S. Army contract.24

Production Capacity Overstatement

The lawsuit alleges Red Cat overstated the production capacity of its Salt Lake City Facility.24 On July 27, 2023, Red Cat disclosed that the facility could only produce 100 drones per month.24 The company also revealed the facility was still under construction, being refined and expanded.24 This revelation reportedly caused Red Cat’s stock price to fall by nearly 9%.24 Further concerns arose on September 23, 2024, when Red Cat reported missed first-quarter fiscal year 2025 earnings and revenue estimates.24 The company admitted to a “pause in manufacturing” for retooling the Salt Lake City facility, which impacted Teal 2 sales.24 Following this news, the stock price reportedly declined by over 25%.24

Contract Value Overstatement

The lawsuit also claims Red Cat overstated the value of its U.S. Army Short Range Reconnaissance (SRR) Contract.24 On January 16, 2025, Kerrisdale Capital published a report challenging Red Cat’s assertions.24 The report alleged the SRR contract was “much smaller and less favorable” than management had intimated.24 Kerrisdale estimated the contract’s actual annual value at only $20-25 million, based on U.S. Army budget documents.24 This contradicted Red Cat’s implied “hundreds of millions” in potential revenue.24 This news resulted in a stock price decline of more than 21% over two trading sessions.24

Additional Concerns

The Kerrisdale report also raised additional concerns. It highlighted minimal capital investments in the Salt Lake City facility.25 It also questioned the timing of executive departures and insider transactions that occurred shortly after the SRR contract win.25

Lead Plaintiff Deadline and Current Status

The deadline for shareholders to seek appointment as lead plaintiff in the lawsuit was July 22, 2025.24 The lawsuit remains pending in the United States District Court for the District of New Jersey.27

The class action lawsuit directly challenges the veracity of Red Cat’s public statements regarding two critical aspects of its business: its manufacturing capacity and the financial value of its most significant contract. The substantial stock price declines following the disclosures about production limitations and the Kerrisdale report’s allegations demonstrate a direct and negative impact on investor confidence.24 These allegations, if substantiated, could expose the company to significant financial penalties and severe reputational damage. Furthermore, concerns about executive departures and insider trading add another layer of skepticism regarding management’s confidence in the company’s stated prospects.25 This lawsuit underscores the paramount importance of accurate, transparent, and timely disclosure. This is particularly true for companies operating in high-growth, government-dependent sectors, where investor sentiment is highly sensitive to perceived misrepresentations. Beyond potential financial liabilities, the lawsuit poses a significant threat to Red Cat’s credibility. This could negatively impact its ability to secure future government contracts, attract new investors, and maintain existing partnerships. Investors must carefully consider the ongoing legal uncertainties and the potential for prolonged litigation to overshadow the company’s growth narrative.

Investment Outlook: Balancing Opportunity and Risk

Red Cat Holdings presents a compelling, yet inherently high-risk, investment proposition within the defense technology sector.3 The company is strategically positioned to benefit from the burgeoning global military drone market.9 It also gains from a significant policy shift in U.S. defense procurement, which favors agile, commercial-first solutions.11

Its core offerings, particularly the Blue UAS certified, American-made Black Widow and Teal 2 drones, are well-aligned with critical government requirements.13 Key contract wins, most notably the U.S. Army Short Range Reconnaissance (SRR) Program, provide a robust foundation for substantial future revenue.10 Strategic partnerships, such as the collaboration with Palantir, further enhance Red Cat’s technological edge and manufacturing efficiency, crucial for scaling operations.10

However, Red Cat faces considerable operational and financial challenges. The company is currently unprofitable, exhibiting significant net losses and negative cash flow.10 It must successfully scale its manufacturing capabilities to meet the demands of large military contracts.10 The ongoing class action lawsuit alleges misleading statements regarding both production capacity and the actual value of its key SRR contract.24 These allegations pose substantial reputational and financial risks, potentially impacting future contract awards and investor confidence.24 Furthermore, a high short interest in the stock reflects a notable degree of market skepticism regarding its ability to execute its ambitious plans.7

For investors with a high tolerance for risk, RCAT stock remains a “long-term moonshot worth monitoring”.3 A cautious approach, such as scaling into positions slowly, may help mitigate near-term downside volatility.3 The potential for meaningful upside exists if Red Cat successfully converts its significant contract wins into scalable, consistently profitable revenue streams.3 The company’s ability to navigate its operational challenges, resolve legal uncertainties, and demonstrate a clear path to profitability will be paramount to realizing its projected growth.

References

- Red Cat Holdings, Inc. – AnnualReports.com, accessed July 21, 2025

- Red Cat Holdings, Inc. (RCAT), accessed July 21, 2025

- America Wants Drone Dominance: Are These Stocks Ready to Soar? – MarketBeat, accessed July 21, 2025

- Red Cat Signs Contract with U.S. Customs and Border Protection for …, accessed July 21, 2025

- Securities and Exchange Commission – SEC.gov, accessed July 21, 2025

- Red Cat Holdings Announces Closing of $30 Million Registered Direct Offering of Common Stock, accessed July 21, 2025

- How Do Investors Really Feel About Red Cat Holdings? – Moomoo, accessed July 21, 2025

- RCAT – Red Cat Holdings, Inc. Stock – Share Price, Short Interest …, accessed July 21, 2025

- Military Drone Market Size, Share, Trends, Industry Report, 2033

- What’s Behind The 500% Rise In Red Cat Stock? | Trefis

- Unleashing U.S. Military Drone Dominance: What the United States

- RCAT, KTOS, AVAV Rally As DoD Pushes Small-Drone Plan

- Teal Drones: Homepage

- Drone Tech Firm Red Cat Raises $46.75M to Scale Military Production | RCAT Stock News

- Teal Drones – Red Cat Holdings

- Teal Drone: Price, Specs, and Red Cat Ownership Explained – Flying Glass

- Patents Assigned to TEAL DRONES, INC.

- Patent Assignment and License Back Agreement between UAV Patent | Unusual Machines, Inc. | Business Contracts | Justia,

- Red Cat Announces Production Selection for U.S. Army Short Range Reconnaissance Program – Stock Titan

- Red Cat Signs Contract with U.S. Customs and Border Protection for 106 Teal 2 Drone Systems

- Red Cat Holdings (NasdaqCM:RCAT) Stock Forecast & Analyst

- RCAT Stock Forecast: Analyst Ratings, Predictions & Price Target

- Red Cat Holdings (RCAT) Stock Forecast & Analyst Ratings

- INVESTOR DEADLINE TUESDAY: Red Cat Holdings, Inc. Investors with Substantial Losses Have Opportunity to Lead Investor Class Action Lawsuit – RCAT – PR Newswire, accessed July 21, 2025, https://www.prnewswire.com/news-releases/investor-deadline-tuesday-red-cat-holdings-inc-investors-with-substantial-losses-have-opportunity-to-lead-investor-class-action-lawsuit—rcat-302506342.html

- Pomerantz Law Firm Announces the Filing of a Class Action Against Red Cat Holdings, Inc. and Certain Officers – RCAT – PR Newswire

- RED CAT 96 HOUR DEADLINE ALERT: Former Louisiana Attorney General and Kahn

- Red Cat Holdings, Inc. (RCAT) Securities Class Action Lawsuit Update [June 24, 2025]

- RCAT Press Release: Red Cat Holdings, Inc. Class Action: The Gros

- RED CAT SHAREHOLDER ALERT: CLAIMSFILER REMINDS INVESTORS WITH LOSSES

- Red Cat Faces Scrutiny Over Army Drone Contract

- The Gross Law Firm Reminds Red Cat Holdings, Inc. Investors of the Pending Class Action Lawsuit with a Lead Plaintiff Deadline of July 22, 2025 – RCAT

- SEC Filings :: Red Cat Holdings, Inc. (RCAT)

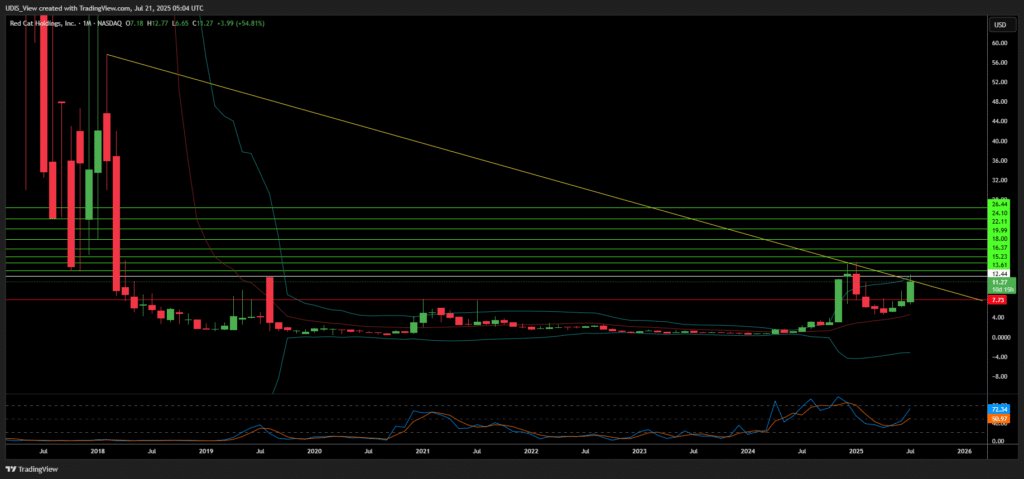

Red Cat Holdings Long (Buy)

Enter At: 12.44

T.P_1: 13.61

T.P_2: 15.23

T.P_3: 16.37

T.P_4: 18.00

T.P_5: 19.99

T.P_6: 22.11

T.P_7: 24.10

T.P_8: 26.44

S.L: 7.73