1. The Photonics Path: A Bet Against the Future

Quantum Computing Inc. (QCi) positions itself as a leader in integrated photonics, offering “accessible and affordable quantum machines”.1 The company’s business model hinges on a primary value proposition: its products operate at “room temperature and low power at an affordable cost. “.1 This approach stands in stark contrast to the cryogenic requirements of superconducting qubits, which demand complex and expensive cooling infrastructure close to absolute zero.3 QCi also benefits from leveraging existing semiconductor manufacturing facilities.2

However, this convenience masks a significant and persistent technological vulnerability. The company’s focus on a pure-photonic modality is a bet against the direction of fundamental physics. A core weakness of photonic qubits is the absence of natural interaction between photons, which are individual light particles.2 This presents a major obstacle to creating the two-qubit logic gates required for computation.2 Overcoming this limitation demands “specialized architectures” and the use of ancillary photons to mediate interactions, adding complexity and resource overhead.2 This foundational physical challenge raises serious questions about the long-term viability and scalability of QCi’s approach.

The broader quantum computing landscape is evolving away from single-modality solutions toward more robust hybrid systems. While QCi relies exclusively on photons, major industry players are pursuing alternatives that mitigate this core weakness. Superconducting qubits offer faster gate times but require immense cooling.2 Trapped-ion systems provide high-fidelity gates and long coherence times, though operations can be slower.4 A powerful contender is the neutral-atom approach, which uses laser-cooled atoms as qubits.3 This technology is a direct challenge to QCi’s value proposition, as neutral-atom systems can also operate at room temperature.3 Most tellingly, a significant trend is the development of hybrid models. Photonic Inc., in partnership with Microsoft, uses a combined approach that leverages the computational power of electron-based “spin qubits” with the communication capabilities of photons.8 This model directly addresses the photon interaction problem, suggesting that a pure-photonic approach, such as QCi’s, is a less viable long-term solution.

| Modality | Proponents | Coherence | Gate Speed | Scaling Approach | Cooling Required | Primary Technical Challenge |

| Photonic | QCi, others | Long | Slower | CMOS fabrication | Room temp | Lack of native photon interaction |

| Superconducting | IBM, Google | Short | Fast (nanosecond) | Linear wiring | Millikelvin | Extreme cooling, fabrication consistency |

| Trapped Ion | IonQ, Quantinuum | Very Long | Slower | All-to-all connectivity | Cryogenic to Room temp | Engineering complexity, bulkiness |

| Neutral Atom | QuEra, Pasqal | Long | Slower | Fewer control signals | Room temp | Laser complexity, qubit movement |

2. Altermagnets: A New Quantum Threat to Photonics

A recent scientific breakthrough presents a fundamental threat to QCi’s photonics-focused business model. In July 2025, a team from Japan’s Tohoku University, led by Associate Professor Satoshi Iguchi, confirmed the existence of a new class of magnetic materials known as “altermagnets.”.9 This discovery, published in

Physical Review Research, validates theoretical predictions from 2019.9 Unlike conventional magnets, altermagnets do not have net magnetization.9 They nonetheless influence the polarization of light reflected from their surface.9 The breakthrough came from a new optical measurement method derived from Maxwell’s equations.9

This is not merely a finding in materials science. The research connects altermagnetism to core quantum principles, including spin band splitting and rotational flows.9 This discovery lays the groundwork for the burgeoning field of spintronics.12 Spintronics uses the spin of an electron to store and process information, a direction the user queries explicitly, which favors over photon-based systems. The research suggests alternating magnetic materials are a “promising platform for realizing topological insulators,” which could serve as a foundation for building quantum bits.13 The work has also outlined how to create a “spin faucet” that electrically controls the spin polarization of a current, a vital component for next-generation, high-efficiency devices.12

The discovery validates a powerful, competing technological pathway. While QCi is a pure play on photons, this new science directly benefits electron-based systems, offering new methods for their manipulation and control.12 The discovery demonstrates that the frontiers of quantum research are advancing in areas that support QCi’s competitors, not its core business. The Tohoku University research effectively strengthens the investment case for electron-based approaches and, by extension, undermines the long-term viability of a company focused on a less robust, pure-photonic modality.

3. Geostrategic and Cybersecurity Misalignment

Quantum computing exists within a geopolitical landscape where nations view it as a military asset and a national security threat.14 The primary concern is the ability of a “sufficiently powerful quantum computer” to execute Shor’s algorithm and break current asymmetric encryption.16 This capability could compromise sensitive information, including military and intelligence secrets, financial records, and critical infrastructure data.16 The threat is not abstract; it drives a “harvest now, decrypt later” paradigm where adversaries are already collecting encrypted data for future decryption once quantum capabilities become available.14

The US government has a clear, national-level strategy for this threat. National Security Memorandum 10 ordered a transition to “post-quantum cryptography (PQC)” across federal systems.16 PQC consists of a new set of

classical cryptographic algorithms designed to withstand attacks from future quantum computers.15 This approach is favored for its ease of integration into existing IT infrastructure and for its interoperability.16 The National Security Agency (NSA) has explicitly “prohibited” the use of Quantum Key Distribution (QKD) to secure national security information.16

QCi’s business model is fundamentally misaligned with this global PQC mandate. QCi’s patent portfolio includes systems for “quantum-secured, private-preserving computations”.1 However, these proprietary, quantum-based solutions face a strategic headwind from the government’s push toward standardized, classical PQC protocols.16 This strategic decision by a major potential customer signals a preference for a different solution, fundamentally devaluing QCi’s technology in a key market segment. The company’s focus on quantum-based security solutions puts it at odds with the national security priorities of its most significant potential clients.

4. A House of Cards: Financial and Patent Red Flags

A critical review of QCi’s financials and legal standing reveals a company with a valuation disconnected from its fundamental health. As of August 2025, QCi’s market capitalization was approximately $2.52 billion, a remarkable 4,435.90% increase in one year.21 This valuation is a clear sign of extreme speculation, given the company’s financial performance. For its most recent quarter, QCi reported a net income of $-36.48M and missed earnings estimates by a staggering

−372.73.22 The company’s Price/Sales (TTM) ratio is an astronomical 7,169.47, a figure that dwarfs competitors in the technology hardware sector, which often trade at single-digit multiples. 23

This speculative valuation is now being tested by significant legal challenges. QCi is the subject of an ongoing “Securities Fraud Class Action” lawsuit.24 The complaint alleges that the company made “materially false and/or misleading statements” about its business.24 Allegations from a short-seller report, cited in the lawsuit, claim that QCi overstated its “multi-million dollar contracts” with NASA, which were actually a single contract worth only “$26,000”.25 The report also alleges that a “massive facility” for manufacturing chips was merely a “tiny lab” incapable of mass production.25 These revelations caused a 15% drop in the company’s stock price.25

The company also lacks a meaningful intellectual property moat. QCi describes its patent portfolio as “ever growing” and lists several disclosures related to lidar and quantum-secured computations.1 A 2022 analysis, however, reported QCi held between 7 and 17 active patents, highlighting a lack of clarity in their reporting. This is a stark contrast to a leading competitor, IonQ, which has an IP portfolio exceeding “1,000 licensed, owned, or controlled patents and patent applications” as of August 2025.9 This patent disparity of two orders of magnitude leaves QCi exposed in a capital-intensive industry. The company’s reported research and development expenses of $12.4M in 2022 are also far below the industry average of $87.5M annually, further highlighting its weak competitive position.

| Metric | QCi (QUBT) | Competitor Average (e.g., CMPO, CRSR) |

| Market Capitalization | $2.52 billion | $946.91 million to $2.24 billion 23 |

| 1-Year % Change | 4,435.90% 21 | 25.25% to 68.23% 23 |

| Net Income (Last Quarter) | $-36.48M 22 | Varies, but often positive 23 |

| Earnings Surprise (Last Quarter) | -372.73% 22 | Varies 22 |

| Price/Sales (TTM) | 7,169.47 23 | 0.67 to 5.97 23 |

| Company | Total Patents/Applications | Reported R&D Spending |

| Quantum Computing Inc. | 7-17 active patents (2022) | $12.4M (2022) |

| IonQ | >1,000 licensed, owned, or controlled patents and applications (2025) 9 | Not specified |

5. Conclusion: An Unstable Foundation for the Future

Quantum Computing Inc.’s business model faces insurmountable headwinds from multiple vectors. Its core commitment to a pure-photonic modality is technologically vulnerable due to fundamental limitations in photon interaction. This weakness is compounded by recent scientific breakthroughs, such as the discovery of altermagnets, which accelerate the development of more robust, electron-based qubit systems favored by major industry players. The company’s strategic vision is also fundamentally misaligned with the cybersecurity landscape, where governments are standardizing on classical PQC solutions rather than embracing QCi’s proprietary quantum-secured technology.

The company’s financial and legal vulnerabilities further expose its fragile foundation. A highly speculative valuation built on negative earnings and an astronomical Price/Sales ratio signals a reliance on market hype over fundamentals. The ongoing securities fraud lawsuit, with its allegations of misrepresented contracts and facilities, strikes at the heart of the company’s credibility and public-facing claims. Finally, QCi’s minimal patent portfolio and low R&D spending compared to its competitors demonstrate an absence of the competitive moat required to thrive in a capital-intensive and rapidly evolving technology race. The confluence of these factors presents a compelling and multi-layered case for long-term decline.

References

- Company – Quantum Computing Inc

- Integrated Photonics for Quantum Computing: Scalable Platforms for Photonic Qubits and Logic Gates – AZoOptics

- Harnessing the Power of Neutrality: Comparing Neutral-Atom Quantum Computing With Other Modalities

- The Quantum Race: Exploring Alternative Qubit Modalities – Embedded

- What Is Quantum Computing? | IBM

- What is Trapped Ions – QuEra Computing

- Trapped-ion quantum computing – NQCC

- Photonic Inc.

- Research News – Shedding Light on a New Type of Magnet

- Scientists confirm ‘altermagnet’ that bends light – Perplexity

- Scientists confirm ‘altermagnet’ that bends light – Perplexity

- Altermagnets That Turn On and Off – Physical Review Link Manager

- Altermagnetism Enables Quantum Spin Hall Phase With Multiple Helical Edge States

- The Quantum Threat: Our Government Knows More Than You Do

- Quantum computing as a weapon? The looming cryptographic cyber-threat – TechHQ

- U.S.-Allied Militaries Must Prepare for the Quantum Threat to Cryptography | RAND

- Post-Quantum Cryptography – Homeland Security

- What Is Quantum Computing’s Threat to Cybersecurity? – Palo Alto Networks

- Quantum’s Impact on Cybersecurity: The Hero and Villain – Viva Technology

- Intellectual Property – Quantum Computing Inc

- Quantum Computing (QUBT) Market Cap & Net Worth – Stock Analysis

- QUBT Stock Price and Chart – Quantum Computing Inc. – TradingView

- QUBT Quantum Computing Inc. Peers & Competitors – Seeking Alpha

- Quantum Computing Inc. (NASDAQ: QUBT) Securities Fraud Class Action | New Cases,

- Bogus Contracts Enrage QUBT Investors; Lawsuit Follows | Levi & Korsinsky, LLP | Securities Class Action Attorneys

- IonQ Fortifies Quantum Leadership with Groundbreaking Patents, Surpassing 1,000 Total IP Assets

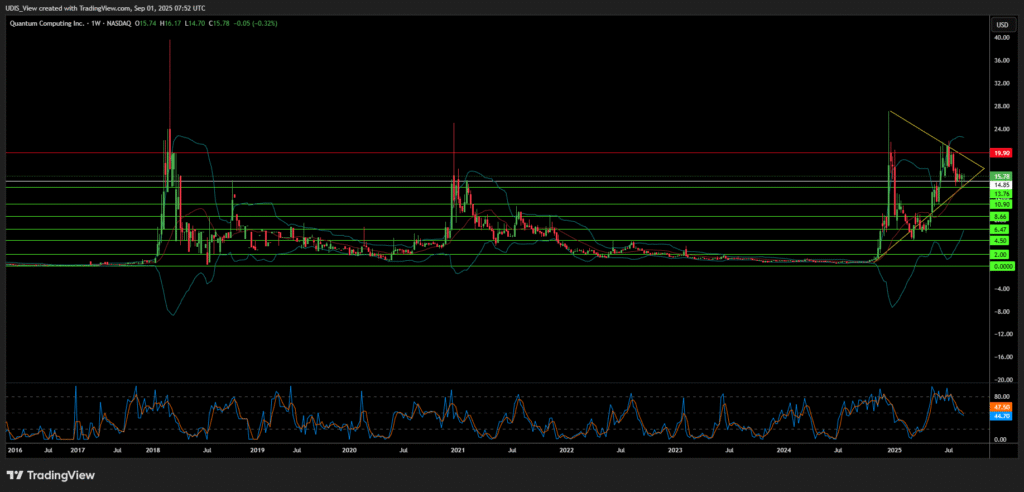

Quantum Computing Short (Sell)

Enter At: 14.85

T.P_1: 13.76

T.P_2: 10.90

T.P_3: 8.66

T.P_4: 6.47

T.P_5: 4.50

T.P_6: 2.00

T.P_7: 0

S.L: 19.90