Platinum, long overshadowed by gold, is commanding significant attention from investors and analysts alike.1 This industrial precious metal has recently surged to multi-year highs, signaling a profound shift in market dynamics.2 Its rise stems from a confluence of factors, including robust industrial demand, critical supply constraints, evolving geopolitical landscapes, and strategic investment maneuvers.3 Understanding these drivers is paramount for any astute investor navigating the complexities of the commodities market.

The Industrial Engine: Fueling Platinum’s Ascent

Platinum’s industrial utility forms the bedrock of its demand, making it highly sensitive to global economic activity. The automotive sector, traditionally the largest consumer, relies heavily on platinum for catalytic converters, which reduce harmful emissions from internal combustion engines.4 While the rise of battery electric vehicles (BEVs) has introduced some headwinds, the robust growth in hybrid vehicle production — which often requires heavier platinum loadings — continues to provide substantial support.

Beyond automotive, platinum finds extensive application in various industrial processes, including chemical applications and laboratory equipment.5 Although some sectors, such as China’s paraxylene industry, have seen a decline in demand, the overall industrial landscape maintains a steady appetite for this versatile metal. The ongoing energy transition also spotlights platinum’s vital role in green hydrogen generation through PGM-catalyzed electrolysers and green electricity generation via PGM-catalyzed fuel cells, ensuring its long-term industrial relevance.

Supply Under Pressure: A Market in Deficit

The current platinum price rally substantially reflects a tightening supply picture. For the past two years, and projected to continue into 2025, the platinum market has experienced persistent physical deficits, meaning demand consistently outstrips supply.6

Several factors contribute to this constrained supply. Mine output has struggled, with global production remaining well below historical averages. Flooding in South Africa, smelter outages in Zimbabwe, and operational restructuring in North America have all impacted primary supply. While South African output recently rose, this largely reflects the release of built-up inventories rather than fresh production.

Secondary supply, primarily from recycled jewelry and autocatalysts, has also proven insufficient to bridge the gap. Although autocatalyst recycling improved in China due to higher scrappage rates, overall recycling volumes have not kept pace with demand, exacerbating the supply deficit.7

Geopolitical Currents and Geostrategic Plays

While platinum’s industrial fundamentals are strong, broader geopolitical and geostrategic factors also influence its price. Like gold, platinum can attract safe-haven buying during times of uncertainty, as investors seek to preserve capital.8 Gold’s significant rise over the past year, fueled by expanding trade tensions and sustained central bank buying, has created a halo effect, drawing attention to other precious metals like platinum.

Crucially, China’s increasing influence in the platinum market represents a significant geostrategic development. Chinese imports of platinum have surged, driven by a sharp rebound in demand.9 As gold prices reach historic highs, Chinese consumers are increasingly turning to platinum as an attractive alternative for both jewelry and investment.10 This pivot by a major consumer market carries substantial weight for global platinum price discovery. Furthermore, China’s proactive steps to establish a new platinum and palladium trading ecosystem, including the proposed Guangzhou Futures Exchange (GFEX) physically settled futures contracts, aim to enhance price risk management and boost domestic demand, with potential global ramifications.11

Investment Momentum and Shifting Sentiment

Beyond industrial and geopolitical factors, investor sentiment and strategic allocations are providing significant impetus to platinum’s price. A strong appetite for physical platinum, particularly in China, has reinforced the rally. Chinese first-quarter buying of platinum investment bars, especially smaller denominations, has rocketed by 140% year-on-year, indicating robust retail interest.12 Aggressive marketing of platinum bars, coins, and jewelry across social media platforms like TikTok further stimulates this demand.

Western-listed platinum Exchange-Traded Funds (ETFs) are also showing signs of a resurgence, with holdings expanding since mid-May.13 This renewed inflow suggests growing investor confidence and potential for a speculative rally, particularly given elevated lease rates that signal a tightening market.

Lower borrowing costs, anticipated from potential interest rate cuts by central banks, generally benefit precious metals as they do not pay interest.14 This macro-economic backdrop further enhances platinum’s appeal as an investment.

Conclusion: Platinum’s Enduring Appeal

Platinum’s recent price surge is not merely a fleeting phenomenon. It reflects a potent combination of tightening supply, resilient industrial demand, evolving geopolitical dynamics, and increasing investor conviction. While above-ground stocks remain elevated, continued mine cutbacks and the sustained physical deficit will gradually draw down these inventories, creating a fertile ground for further price appreciation.15 As China solidifies its role as a pivotal market and the global energy transition underscores platinum’s long-term utility, this unique metal is clearly stepping into the spotlight, offering compelling opportunities for discerning investors.

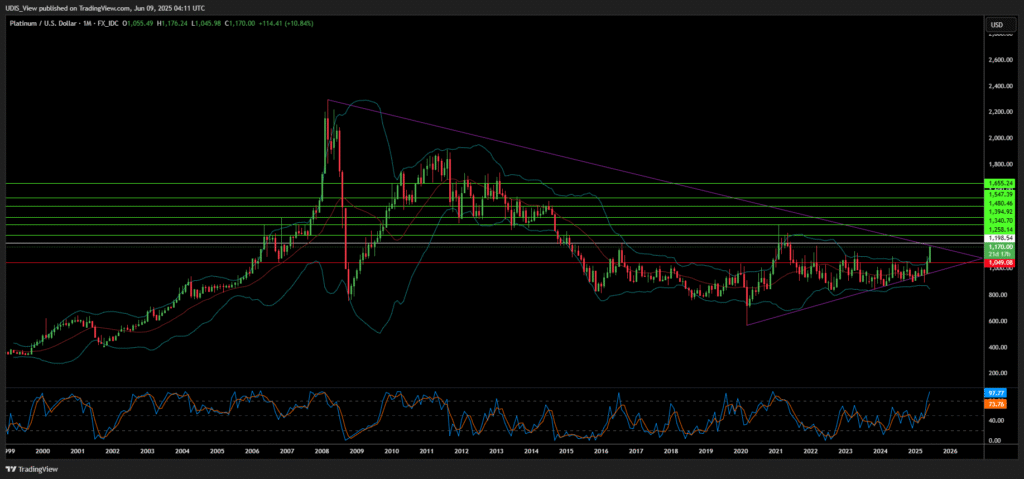

Platinum Long (Buy)

Enter At: 1198.54

T.P_1: 1258.14

T.P_2: 1340.70

T.P_3: 1394.92

T.P_4: 1480.46

T.P_5: 1547.39

T.P_6: 1655.24

S.L: 1049.08