Perpetua Resources Corp. (NASDAQ: PPTA) surges as a leader in U.S. critical minerals. The company develops the Stibnite Gold Project in Idaho. This initiative produces gold and antimony, restores legacy mine sites, and creates jobs. Recent financing totals $474 million, including a $100 million private placement from Paulson & Co. BlackRock also invests heavily. Government backing includes over $80 million from the Department of Defense. Analysts rate PPTA as a Buy with a $18.25 target. Stock rose 10.11% on August 3, 2025, amid antimony demand spikes. China’s export curbs fuel this momentum. Perpetua positions itself to supply 35% of U.S. antimony needs.

Geopolitics Fueling Perpetua’s Rise

Geopolitical tensions propel Perpetua Resources forward. China dominates 48% of global antimony production and 63% of U.S. antimony imports. Beijing imposed export restrictions on antimony in September 2024, banning sales to the U.S. by December. This escalates U.S.-China trade wars over critical minerals. Perpetua counters this vulnerability. The Stibnite Project offers America’s only domestic antimony mine. It reduces reliance on China, Russia, and Tajikistan, which control 90% of supply. Investors like John Paulson recognize this edge. Stock jumped 19% after China’s curbs. Perpetua secures national interests amid rising conflicts.

Geostrategic Imperatives Boost Value

Geostrategy drives Perpetua’s valuation upward. Antimony powers defense tech like missiles, night vision, and ammunition. The U.S. stockpiles just 1,100 tons against 23,000 tons consumed yearly. Perpetua revives Stibnite, a WWII antimony source. DoD awards $59.2 million for antimony trisulfide advancement. EXIM eyes $2 billion financing. This fortifies U.S. supply chains against adversaries. Conflicts in Ukraine and the Middle East amplify demand. Perpetua emerges as a strategic asset, enhancing national security.

Macroeconomic Trends Propel Growth

Macroeconomic forces accelerate Perpetua’s ascent. Critical minerals boom amid clean energy transitions. Global antimony prices surged 228% in 2024 due to shortages. U.S. policies prioritize domestic production via the Defense Production Act. Perpetua benefits from $6.9 million in additional DoD funding. Inflation Reduction Act incentives spur mining investments. Gold prices hit record highs, bolstering project economics. Analysts forecast PPTA at $21.51 average target. Perpetua capitalizes on these trends, delivering strong returns.

Economic Benefits Drive Investor Interest

Economics underpin Perpetua’s surge. The project creates over 550 direct jobs in rural Idaho. It partners with College of Western Idaho for scholarships worth $250,000. This closes tuition gaps via Idaho LAUNCH grants. Construction costs $2.2 billion, funded by recent equity raises. Operations yield family-wage careers and economic vitality. Governor Brad Little praises local benefits. Stock rose 219% on volume spikes, reflecting market confidence. Perpetua stimulates growth while restoring sites.

Technological Innovations Enhance Operations

Technology advances Perpetua’s efficiency. The company employs detailed engineering for low-carbon grid power from Idaho Power. Partnerships with Ambri develop liquid metal batteries using antimony. This enables 13 Gigawatt hours of clean storage. Sunshine Silver collaboration explores antimony processing flowsheets. Perpetua advances trisulfide for munitions. These innovations cut emissions and boost output.

Cybersecurity Risks in Focus

Cyber threats challenge the mining sector. Perpetua identifies cyber incidents as key risks in filings. Hackers target operations, disrupting supply chains. The industry faces rising attacks on critical infrastructure. Perpetua mitigates through robust protocols. This safeguards growth amid digital vulnerabilities.

Scientific and Environmental Progress

Science guides Perpetua’s environmental restoration. The project removes legacy waste, restores rivers, and enables salmon migration. It aligns mining with conservation. Feasibility studies confirm sustainable practices. Antimony’s role in solar and batteries advances green tech. Perpetua commits to ESG, earning FAST-41 transparency status.

High-Tech Applications Spur Demand

High-tech sectors demand antimony, lifting Perpetua. It features in semiconductors, solar panels, and batteries. Ambri’s batteries store renewables efficiently. Perpetua supplies for photovoltaic glass and circuit boards. This meets clean energy goals by 2035.

Patent Analysis Reveals Opportunities

Patent landscape shows limited Perpetua-specific innovations. No unique patents emerge for antimony mining. The company focuses on process advancements via partnerships. Broader industry patents cover separation tech, restricted by China. Perpetua pursues trisulfide development, potentially yielding future IP.

Perpetua Resources thrives across domains. It counters geopolitical risks, secures strategic supplies, and drives economic growth. Investors seize this momentum for America’s mineral future.

References

- Tickeron on X: “$PPTA Stock Perpetua Resources (PPTA, $17.26) Moving Average Convergence Divergence (MACD) Histogram turned positive on August 6, 2025 $NEM $WPM $GFI $KGC $PAAS $HL $AG $SSRM #TradingBot https://t.co/W9mJAJJ73f” / X

- An Antimony Goldmine with ESG-Integrated Upside

- Eye on PPTA! Jumped 219% in booming resource sector.

- Perpetua Resources Announces Full Exercise of Option and Additional Proceeds of US$49 Million

- Perpetua Resources Advances Stibnite Gold Project with Strategic Partnerships and Job Creation

- Perpetua Resources closes $425m financing to fund Stibnite Gold Project

- Perpetua Resources secures $400M equity financing for Stibnite project in Idaho

- Perpetua Resources gets final federal permit for Stibnite Gold project in Idaho

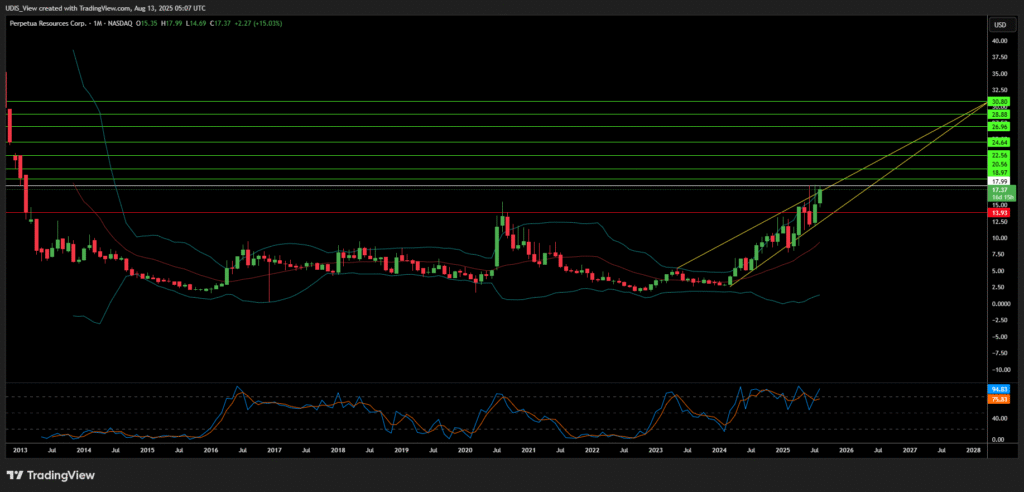

Perpetua Resources Long (Buy)

Enter At: 17.99

T.P_1: 18.97

T.P_2: 20.56

T.P_3: 22.56

T.P_4: 24.64

T.P_5: 26.96

T.P_6: 28.88

T.P_7: 30.80

S.L: 13.93