1. The Geopolitical and Macroeconomic Catalyst

1.1 The Great Decoupling and Spectral Sovereignty

The global semiconductor landscape operates under the immense gravitational pull of the United States-China technological decoupling. Peraso Inc. (NASDAQ: PRSO) exists not merely as a micro-cap component supplier but as a strategic asset within this bifurcated world order. The company’s focus on the 60GHz millimeter-wave (mmWave) spectrum aligns directly with the Western doctrine of “Spectral Sovereignty.”

Western governments actively dismantle telecommunications infrastructure reliant on Chinese vendors like Huawei and ZTE. This “Rip and Replace” initiative creates a forced capital expenditure cycle. The United States government mandates the removal of insecure hardware from rural and critical networks. This regulatory purge opens a vacuum in the Radio Access Network (RAN) and backhaul markets.

Peraso fills this void. The company designs its silicon in North America and utilizes Taiwan Semiconductor Manufacturing Company (TSMC) for fabrication. This supply chain architecture adheres to the “Clean Network” standards demanded by Western defense and infrastructure planners. The exclusion of Chinese vendors is not a temporary market fluctuation; it is a permanent geopolitical restructuring that benefits trusted vendors.

1.2 The “Build America” Imperative and CHIPS Act Nuances

The CHIPS and Science Act of 2022 fundamentally altered the economics of semiconductor production. While direct manufacturing subsidies target foundries like Intel and GlobalFoundries, the ecosystem benefits ripple downstream to fabless design firms like Peraso.

The Broadband Equity, Access, and Deployment (BEAD) program allocates over $42 billion to expand high-speed internet access. A critical friction point in this deployment is the definition of “American Made.” Fiber optic deployment is labor-intensive and slow. Wireless alternatives offer speed. Peraso’s technology, by virtue of its North American intellectual property (IP) origin, positions itself as a BEAD-compliant solution for the “Last Mile”.

Investors must recognize the macroeconomic efficiency here. Digging trenches for fiber costs between $50 and $100 per foot in urban areas. Peraso’s fixed wireless access (FWA) solutions eliminate this capital expenditure entirely. In a high-inflation, high-interest-rate environment, capital efficiency drives procurement decisions. Operators cannot afford the debt service required for massive fiber civil works. They turn to mmWave wireless as a deflationary technology.

1.3 The Decline of Legacy Connectivity

Macroeconomic trends favor the “Gigabit Society.” Remote work, telemedicine, and the metaverse (spatial computing) demand symmetric gigabit bandwidth. Legacy spectrum (sub-6GHz) is exhausted. The “Beachfront Property” of wireless spectrum is fully occupied by cellular carriers (AT&T, Verizon) and traditional Wi-Fi.

This congestion forces innovation into higher frequencies. Peraso operates in the 60GHz band (57-71 GHz). This is a “greenfield” spectrum. It is unlicensed, meaning operators do not pay billions for spectrum auctions. This economic advantage allows smaller Wireless Internet Service Providers (WISPs) to compete with cable monopolies without the barrier to entry of spectrum licensing costs.

The macro-thesis for Peraso is clear: It provides the picks and shovels for the “Wireless Fiber” revolution, enabling high-speed connectivity in an era where capital is expensive and spectrum is scarce.

2. Scientific Analysis: The Physics of 60GHz

2.1 The Oxygen Absorption Phenomenon

To understand Peraso’s moat, one must understand molecular physics. The 60GHz band is unique in the electromagnetic spectrum due to the resonance of the oxygen molecule ($O_2$). At exactly 60GHz, radio frequency (RF) energy excites the electrons in oxygen molecules.

The atmosphere literally absorbs the signal. This phenomenon causes “specific attenuation,” typically weakening the signal by 15-16 dB per kilometer.

| Frequency | Atmospheric Interaction | Resulting Propagation | Strategic Utility |

| 2.4 GHz | Negligible absorption | Miles (Omnidirectional) | “Consumer Wi-Fi, Interference prone” |

| 5 GHz | Low absorption | Miles (Omnidirectional) | “Enterprise Wi-Fi, Congested” |

| 28 GHz | Low/Moderate (Water Vapor) | Line of Sight (Long) | 5G Cellular (Verizon/AT&T) |

| 60 GHz | High ($O_2$ Resonance) | Short (< 2km) | “Secure, High Reuse, Stealth” |

2.2 Turning Physics into Strategy

In traditional cellular engineering, signal loss is a defect. Engineers fight to maximize range. Peraso flips this paradigm. They weaponize the oxygen absorption defect to create two distinct advantages:

- Spatial Isolation (Frequency Reuse): Because the signal dies quickly, it does not pollute the spectrum. A WISP can deploy a Peraso link on a street corner and deploy another link on the very next block using the same frequency. The two links will not interfere. This allows for massive densification in urban environments, solving the capacity crunch that plagues lower frequencies.

- Physical Layer Security: The signal does not travel beyond its intended target. An adversary cannot intercept the data stream from a safe standoff distance. To intercept a 60GHz beam, one must physically stand directly in the narrow path of the transmission, which is easily detectable.

2.3 Beamforming and Phased Arrays

Peraso overcomes the signal loss inherent in 60GHz using “Beamforming.” This technique utilizes a Phased Array Antenna.

A phased array consists of multiple small antenna elements (Peraso uses 16 to 64 elements). By adjusting the timing (phase) of the signal sent to each element, the chipset can steer the radio beam electronically, without moving parts.

- Constructive Interference: The waves from each element combine to form a powerful, coherent beam in one direction.

- Gain: This focuses the energy, effectively shouting in a whisper-quiet room. Peraso’s modules achieve Effective Isotropic Radiated Power (EIRP) of up to 44 dBm, punching through the oxygen absorption for distances up to 1-2 kilometers.

- Agility: The beam can redirect in microseconds. If a truck blocks the path, the system can instantly bounce the signal off a building to reach the receiver. This is “Beam Steering,” and it creates resilience in dynamic urban environments.

2.4 Rain Fade vs. Oxygen Fade

Critics often cite “Rain Fade” as a killer for mmWave. Rain droplets scatter high-frequency waves. However, at 60GHz, the oxygen absorption is so dominant (16 dB/km) that it establishes the baseline link budget.

Peraso engineers the link with enough “Fade Margin” to handle the oxygen loss. Because the baseline loss is already high, the additional loss from rain is often within the calculated margin. The system is designed for the “worst-case” oxygen scenario, making it paradoxically robust against weather compared to bands like 70/80GHz, where rain is the primary attenuator.

3. Corporate Genealogy and Leadership DNA

3.1 The Intellon-Atheros Lineage

Peraso is not a startup in the traditional sense; it is a reincarnation of a proven semiconductor success story. The executive team shares a common ancestry at Intellon Corporation.

- Ron Glibbery (CEO): Formerly President of Intellon. He led the company’s dominance in Powerline Communications (PLC), specifically the HomePlug standard.

- Brad Lynch (COO): Formerly Director of Software Engineering at Intellon.

The Playbook: Intellon did not invent connectivity; they standardized it. They took a chaotic technology (data over power lines), drove the IEEE 1901 standard, and then sold the company to Atheros Communications for $244 million. Atheros was subsequently acquired by Qualcomm for $3.1 billion.

This history suggests Peraso’s roadmap is not to become a century-old conglomerate but to:

- Standardize 60GHz (via IEEE 802.11ay).

- Prove the mass market use case (FWA/VR).

- Exit via acquisition to a major aggregator (Broadcom, MediaTek, or a Defense Prime).

3.2 The MoSys Reverse Merger

In December 2021, Peraso Technologies (private) merged with MoSys, Inc. (public). This transaction was complex.

- MoSys: Was a struggling memory IP company. Peraso needed capital and a NASDAQ listing.

- The Transaction: It was effectively a reverse merger. The combined entity kept the MoSys listing but adopted the Peraso name and management.

- The Legacy Burden: The company inherited MoSys’s “Accelerator Memory” business. While technically interesting, it was not the core growth engine.

- The Pivot: Throughout 2023 and 2024, Peraso systematically wound down the memory business. This created “noise” in the financial statements revenue declines from the memory EOL masked the explosive growth in the mmWave core business.

Current State: As of 2025, the company is a pure-play mmWave wireless entity. The painful restructuring is complete, and the financial optics are beginning to align with the growth narrative.

3.3 Board Composition and Governance

The recent appointment of Cees Links to the Board of Directors (December 2025) acts as a strategic signal.

- The “Father of Wi-Fi”: Links was instrumental in establishing the original 802.11 standard at NCR/Lucent.

- Exit Experience: He founded GreenPeak Technologies (IoT) and sold it to Qorvo.

- Significance: His presence validates Peraso’s technology. Industry veterans of his caliber do not join sinking ships. He likely sees the parallel between the early days of Wi-Fi (802.11b) and the current state of WiGig (802.11ay). His network will be crucial for facilitating a future exit or strategic partnership with a Tier-1 player like Qorvo or Apple.

4. The Technological Moat & Patent Fortress

4.1 The 802.11ay Standard Essentiality

Peraso’s intellectual property valuation relies on “Standard Essential Patents” (SEPs). The company holds nine essential claims for the IEEE 802.11ay standard.

What is 802.11ay?

It is the successor to 802.11ad. While 802.11ad capped out at ~7 Gbps, 802.11ay enables:

- Channel Bonding: Combining multiple 2.16 GHz channels to create a massive data pipe.

- MIMO: Sending multiple data streams simultaneously.

- Speed: Theoretical throughputs exceeding 20-40 Gbps.

The Strategic Implications:

Any company that wants to build a compliant 802.11ay device, be it a Meta Quest VR headset, an Apple AR device, or a high-end ASUS router, must navigate Peraso’s patent thicket. This creates an asymmetric leverage point. Peraso does not need to manufacture the chip for the iPhone; they simply need to license the IP that allows the iPhone to talk to the AR glasses.

4.2 VRIO Analysis of the Patent Portfolio

| VRIO Dimension | Assessment | Analysis |

| Value | High | The company is small, limiting its ability to litigate against aggressive infringers. However, the Board’s experience suggests they know how to package IP for sale. |

| Rarity | High | Qualcomm has largely abandoned new R&D in this specific niche to focus on cellular 5G. Peraso stands alone as the 802.11ay specialist. |

| Imitability | Low | “The mixed-signal RF engineering required to work at 60GHz is ‘Black Magic.’ It requires specific talent that takes decades to cultivate.” |

| Organization | Medium | The company is small, limiting its ability to litigate aggressive infringers. However, the Board’s experience suggests they know how to package IP for sale. |

4.3 Specific Patent Assets

- US Patent 11,462,833: Millimeter-wave phased-arrays with integrated artificially pillowed inverted-L antennas. This innovation allows the antenna to be printed directly onto the module PCB, reducing manufacturing costs and size. This is critical for fitting the tech into small consumer electronics.

- US Patent 12,375,949: System for seamless recovery of distributed access points. This patent covers the “self-healing” capability of mesh networks. If a node fails (e.g., a truck blocks the view), the network instantly reroutes. This is the “Secret Sauce” behind the WeLink partnership.

5. Strategic Market Domains

5.1 Fixed Wireless Access (FWA): The Urban Mesh

The urban connectivity market faces a “Last 100 Meter” problem. Fiber is at the curb, but getting it into the apartment building is expensive.

The Solution: Peraso partners with WeLink and Ubiquiti (implied via “Major Global Equipment Supplier” references) to create wireless bridges.

- Economics: A Peraso-enabled node costs ~$200-$500. A fiber drop costs $2,000+. The ROI is immediate.

- The “DUNE” Strategy: “Dense Urban Network Environment.” Peraso optimizes its MAC layer (software) to handle the chaotic interference of a city. Their chips can discriminate between their own signal and a competitor’s, maintaining high throughput where other radios fail.

5.2 Defense and Tactical: The Invisible Network

The war in Ukraine and conflicts in the Middle East demonstrate the danger of RF emissions. “If you emit, you die.”

Peraso’s Value Prop: The Perspectus series modules offer LPD (Low Probability of Detection). A soldier using a 60GHz radio to control a drone is invisible to Russian electronic warfare units located 2km away because the signal has already been absorbed by the atmosphere.

Traction: The company secured a design win with a Middle East defense contractor. Volume shipments began in June 2025. This is a high-margin, sticky revenue stream. Once a technology is designed into a military platform, it remains there for decades.

Drone Applications: Drones require massive bandwidth for 4K video. 2.4GHz is congested and easily jammed. 60GHz offers the bandwidth of a physical cable with the freedom of flight.

5.3 High-Speed Transport and Automotive

- The “Data Offload” Problem: Autonomous vehicles (AVs) generate terabytes of sensor data daily. Uploading this via 5G LTE is cost-prohibitive.

- The Solution: A “Gas Station” model. When the AV pulls into a charging station or depot, it connects to a Peraso 60GHz hotspot. It offloads gigabytes of data in seconds.

- Rail: Peraso provides connectivity for trains. The “Track-to-Train” link allows passengers to stream Netflix while moving at 100mph. This requires sophisticated Doppler correction, which Peraso’s baseband processor handles natively.

5.4 Consumer Electronics: The VR/AR Grail

- The Tether Problem: High-end VR (like the early HTC Vive) required a cable to the PC to handle the video bandwidth.

- Wireless VR: To go wireless, you need >2 Gbps throughput with <5ms latency. Wi-Fi 6 (5GHz) struggles with latency.

- Peraso’s Role: 60GHz is the only wireless standard capable of uncompressed video transmission. Peraso positions its silicon as the “Wireless HDMI” cable for the next generation of headsets.

6. Competitive Landscape

6.1 The “Last Man Standing” in Silicon

The 60GHz market has seen a massive consolidation.

- Qualcomm: The elephant in the room. They acquired Wilocity (early WiGig) and integrated it. However, Qualcomm’s strategic focus shifted entirely to 5G mmWave (28GHz/39GHz) for cellular carriers. They effectively exited the dedicated 802.11ad/ay networking chip market for smaller OEMs. This left a vacuum that Peraso filled.

- Intel: Also dabbled in WiGig but retreated to focus on standard Wi-Fi (client side) and computing.

- Sivers Semiconductors: A formidable technical competitor from Sweden. Sivers excels in photonics and high-end mmWave. However, Sivers focuses more on the RF front-end and licensed 5G bands. Peraso’s advantage is the Integrated Baseband. Peraso sells the whole solution (MAC + PHY + RF), whereas Sivers often requires a separate baseband processor.

- Blu Wireless: A UK-based company focusing on transport (rail). They compete in the niche “high-speed mobility” sector but lack Peraso’s volume manufacturing footprint for consumer/FWA applications.

6.2 Competitor SWOT Analysis

| Competitor | Strengths | Weaknesses | Peraso’s Advantage |

| Sivers | High-performance RF, Photonics integration | Lacks integrated baseband, Higher cost | Cost/Integration: Peraso offers a “complete” module. |

| Qualcomm | Massive scale, cellular dominance | Focus is split; 60GHz is a rounding error | Focus: Peraso is a pure-play 60GHz specialist. Customer support is superior for smaller OEMs. |

| Cambium | Strong brand in WISP market | Primarily an integrator, not a silicon designer | Partnership: Cambium is a potential customer, not a chip competitor. |

6.3 Market Share Strategy

Peraso intends to bite into the market by targeting the “Tier-2” and “Tier-3” OEMs first. While Qualcomm chases Apple and Samsung, Peraso secures the entire ecosystem of FWA providers (Ubiquiti, Mikrotik, WeLink). This “bottom-up” strategy builds volume and validates the technology, making Peraso the de facto standard for anyone outside the top 3 handset makers.

7. Financial Analysis & The Takeover Siege

7.1 The Mobix Labs Hostile Offer

In late 2025, Mobix Labs (NASDAQ: MOBX) launched an aggressive, unsolicited takeover bid for Peraso.

- The Offer: $1.30 per share in all cash.

- The Premium: 53% over the 20-day VWAP.

- The Rationale: Mobix Labs lacks the deep 60GHz IP portfolio. They see Peraso as undervalued. They want to acquire the “Military Grade” mmWave tech to bolster their own defense offerings.

Peraso’s Defense: The Board rejected the initial advances, implementing a “poison pill” and dilutive financing to maintain independence. They argue the offer “undervalues” the company’s long-term potential.

Analysis: This hostile activity establishes a “Floor Valuation.” Sophisticated industry players are willing to pay a premium for Peraso’s assets. This validates the thesis that the public market (retail investors) does not understand the value of the patent portfolio.

7.2 Financial Health and Cash Burn

- Revenue: Q3 2025 revenue was $3.2 million, up 45% sequentially. The annualized run rate is approaching $13-15 million.

- Gross Margin: Expanding to ~56%. This is a healthy number for a hardware company, indicating pricing power and manufacturing efficiency.

- Burn Rate: The company loses ~$1.2 million per quarter.

- Cash Runway: With ~$1.9 million in cash (Q3 2025), the runway is perilously short. This necessitates constant capital raises (dilution) or a strategic event (sale/merger).

- Dilution Risk: Shareholders have faced significant dilution. The share count has ballooned as the company sells equity to keep the lights on. This is the primary reason for the stock’s historical decline, not the technology, but the financing mechanics.

7.3 Why the Stock Declined (2023-2024)

- Memory EOL: Revenue appeared to drop as they killed the MoSys memory business. Algorithms reading headline revenue numbers sold the stock, missing the underlying growth in mmWave.

- Small-Cap Liquidity: High interest rates crushed the micro-cap sector. Investors fled “unprofitable tech.”

- Dilution Cycles: Repeated secondary offerings created selling pressure.

8. Operational Capacity & Supply Chain

8.1 The Fabless Model

Peraso employs a “Fabless” semiconductor model.

- Engineers: The company employs ~42-48 staff, heavily skewed toward R&D. They are located primarily in San Jose, California (Headquarters) and Toronto, Canada (R&D Center).

- Manufacturing: They do not own factories. They utilize TSMC and potentially GlobalFoundries for wafer fabrication.

- Assembly: OSAT (Outsourced Semiconductor Assembly and Test) partners handle the packaging.

8.2 Capacity and Output

- Scalability: Because they use Tier-1 foundries, their capacity is theoretically infinite. They are not constrained by their own factory floor. If WeLink orders 1 million units, Peraso simply reserves more wafer starts at TSMC.

- Supply Chain Resilience: By moving toward US-centric supply chains (supported by the CHIPS Act ecosystem), Peraso mitigates the risk of Taiwan Strait tensions. The strategic shift of GlobalFoundries to license GaN from TSMC for US production provides a future roadmap for domestic mmWave manufacturing.

9. Products and Use Cases

9.1 The Perspectus Series (PRM2141X)

This is the flagship product for FWA.

- Integration: It is a complete module. It includes the chipset, the amplifiers, and the antenna.

- Specs: 16-element phased array. 38 dBm EIRP. USB 3.0 interface.

- Utility: A WISP allows a technician to climb a roof, plug this module into a router, and aim it. The software handles the beamforming. This “Plug and Play” nature is critical for rapid deployment.

9.2 The X720 Chipset

The silicon heart of the module.

- Capability: Supports the full 57-71 GHz band.

- Differentiation: It operates at industrial temperature ranges (-40 °C to +85 °C), making it suitable for outdoor deployment in Alaskan winters or Arizona summers.

.3 Versatus Series

Targeted at consumers and enterprises.

- Use Case: VR headsets, secure office networking.

- Focus: Low power consumption, high throughput.

10. Conclusion: The Asymmetric Investment Thesis

Peraso Inc. represents a classic “Deep Tech” paradox. The financial statements are bruised by the transition from a legacy memory business and the brutal capital costs of being a public micro-cap. Yet, the underlying asset, the dominance of the 60GHz spectrum, is increasing in value daily.

The Bull Case:

- Geopolitics: The “Clean Network” initiative forces Western operators to buy non-Chinese backhaul. Peraso is the primary beneficiary.

- Physics: The oxygen absorption of 60GHz is the only way to achieve dense, interference-free urban networking. There is no alternative law of physics to exploit.

- Defense: The “Stealth” characteristics of mmWave make it indispensable for modern drone warfare.

- M&A Floor: The Mobix Labs offer confirms that the IP is worth significantly more than the current market cap.

The Bear Case:

- Liquidity: The company is constantly running out of cash. Dilution is a certainty unless they hit break-even soon.

- Execution: Marketing a complex technology to fragmented WISPs is hard work. It is slower than landing a single contract with Apple.

Final Verdict: Peraso is the “Silent Giant” of the Gigabit Era. While Qualcomm and others fight over the crowded 5G cellular market, Peraso has quietly fortified the unlicensed 60GHz frontier. For investors with a tolerance for volatility and an eye for geostrategic trends, Peraso offers a rare pure-play exposure to the physical layer of the next internet.

11. Appendix: Management Profiles & Institutional Ownership

11.1 Key Management

| Name | Role | Background | Strategic Value |

| Ron Glibbery | CEO | President of Intellon (Sold to Atheros) | Proven exit capability; Standards expert. |

| Brad Lynch | COO | “Intellon, Kleer Semiconductor” | Deep operational history with Glibbery. |

| Jim Sullivan | CFO | “MoSys, Apptera, 8×8” | Experience in public market turnarounds. |

11.2 Investor Profile

- Institutional Ownership: ~3-10% (Low). Major holders include Vanguard and Renaissance Technologies.

- Retail Dominance: The float is largely held by retail investors, contributing to volatility.

- Implication: The low institutional ownership means the stock is not “crowded.” If Peraso crosses the $100M market cap threshold, institutional algorithms will begin to buy, creating a “flywheel” effect on the share price.

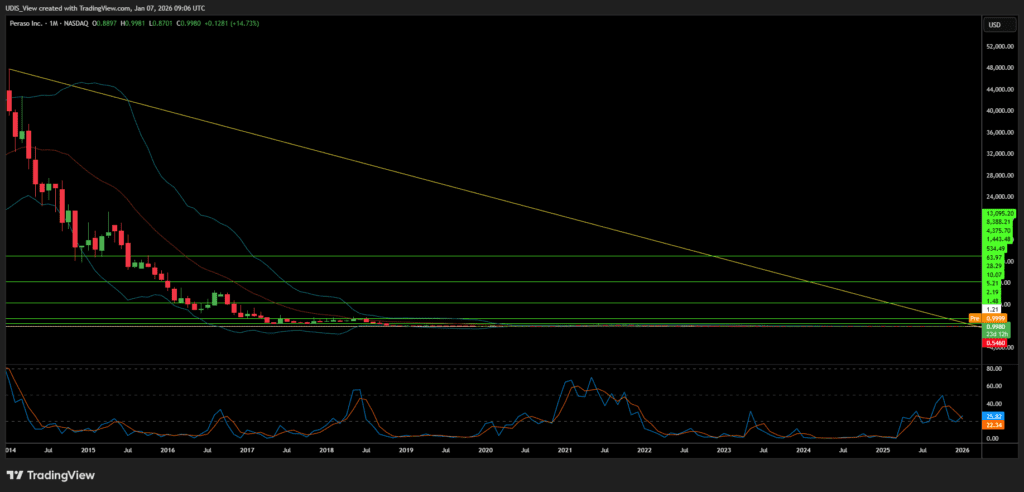

Peraso Inc Long (Buy)

Enter At: 0.9980

T.P_1: 1.21

T.P_2: 1.48

T.P_3: 2.19

T.P_4: 5.21

T.P_5: 10.07

T.P_6: 28.29

T.P_7: 63.9700

S.L: 0.5460