I. Decoding Palantir’s Premium Valuation

The AI Juggernaut’s Financial Momentum

Palantir Technologies (PLTR) demonstrates explosive financial growth driven by accelerating artificial intelligence (AI) adoption. The company secured an impressive trifecta, landing spots on the Investor’s Business Daily (IBD) 50, IBD Big Cap 20, and IBD Sector Leaders lists. These stringent screens confirm Palantir’s status as an AI market leader.

Palantir joined fellow AI leaders Nvidia, Broadcom, and Alphabet on recent lists of new buys by top mutual funds. This institutional recognition confirms Palantir has transitioned from a niche government contractor to a dominant, high-conviction AI investment. The market views Palantir as a crucial, defensible layer in the overall AI supply chain.

The company reported its first billion-dollar quarter in Q2, achieving 48% year-over-year sales growth.1 Palantir delivered eight consecutive quarters of accelerating revenue and earnings. Analysts forecast this acceleration will continue, anticipating a 68% earnings surge in the upcoming quarter.

The Multi-Domain Thesis: Justifying the Premium

Palantir’s valuation is extreme, trading at 100 times revenue and 224 times forward expected earnings.2 This high multiple requires structural justification beyond typical software growth metrics. Market skepticism remains high, with 84% of analysts recommending Hold or Sell ratings.

This analysis posits that the valuation premium reflects Palantir’s deep entrenchment across nine strategic domains. This strategy creates an impenetrable competitive moat.2 Palantir’s growth drivers depend on global defense alignment, macro-level productivity gains, and proprietary technology architecture.

Analysts often focus on the immediate 12-to-18-month outlook. The elevated market price, however, represents a qualitative bet on Palantir capturing vast enterprise AI return on investment. This perspective treats PLTR as a “transformational tech stock,” making traditional short-term metrics insufficient.

| Domain of Analysis | Strategic Driver | Key Metric/Platform | Significance |

| Geostrategy | U.S. Military Modernization (CJADC2) | Army Vantage ($618.9M ceiling) 3 | Core software backbone for the Army Data Platform.4 |

| Economics | Commercial Scalability | U.S. Commercial Rev. Growth: 93% 1 | Confirms successful enterprise adoption of AIP. |

| Technology | Data Integration Moat | Palantir Ontology 6 | Integrates complex data as objects; operational bus.6 |

| High-Tech | Rapid Client Conversion | AIP Bootcamps 6 | Significantly shortens time-to-value for enterprises. |

| Patent Analysis | IP Defensibility | Patent 12197514 8 | Protects core methods for data integration workspace management. |

II. Technological Foundation: The AI Competitive Moat

The Ontology: Palantir’s Core Differentiator (Technology)

The Palantir Ontology forms the foundation of the platform’s sophisticated architecture.6 This proprietary data model solves the hardest problem in enterprise AI: unifying disparate, siloed data sources.9 The Ontology integrates complex, real-world data as linked objects, clarifying operations for both human analysts and AI models.6

This integration methodology ensures higher fidelity, real-time AI outputs for customers across sectors. The Ontology powers mission-critical applications across structured, unstructured, and geospatial data modalities.6 It functions as an essential “operational bus” for connectivity throughout the customer’s entire enterprise.6

Palantir offers zero-copy access to clients’ existing data lakes and platforms.6 This technical approach secures rapid deployment without requiring disruptive, costly data migration. This proprietary methodology is non-trivial and difficult for competitors to replicate quickly, cementing Palantir’s technological moat.2

AIP Acceleration and Rapid Time-to-Value (High-Tech)

Palantir developed its Artificial Intelligence Platform (AIP) to leverage the Ontology, delivering tailored, company-specific AI solutions.10 AIP is explicitly designed to handle large-scale data operations, ensuring robust scalability and high performance.10 The platform offers a comprehensive suite of tools for building, training, and deploying large language models securely.10

Palantir dramatically accelerates client adoption through its signature AIP Bootcamps.6 These intensive sessions pair clients directly with Palantir engineers. Clients solve complex, real-world business problems using the platform within a matter of hours.6

This hands-on model bypasses the high complexity often associated with implementing advanced data analytics platforms.11 It delivers rapid outcomes and lowers the client’s perceived implementation risk.7 This high operational efficiency directly contributed to Palantir’s impressive 94% Rule of 40 score.2

Protecting the IP Edge (Patent Analysis)

Palantir actively fortifies its technological advantage through stringent intellectual property (IP) protection.8 The company secures granted patents that are fundamental to its core operational architecture. These legal protections reinforce Palantir’s “Narrow Economic Moat”.2

Patent 12197514 specifically details systems for creating and managing a data integration workspace.8 This IP directly safeguards the technical methods underlying the Ontology’s ability to model and manipulate data.6 These patents create significant legal barriers for competitors attempting to build rival operational buses.

Another key patent grant, 12164404, covers approaches for real-time incident monitoring and resolution.8 This methodology applies broadly to high-stakes situations, including global financial markets and defense operations.12 In regulated industries, proven, legally defended methodology is essential, securing Palantir’s long-term dominance.

III. Geopolitical Primacy: Powering the Western Security Architecture

Command and Control Dominance (Geostrategy)

Palantir has spent over two decades developing AI solutions for U.S. intelligence and defense agencies. This long-standing relationship provides unparalleled domain expertise and institutional trust.13 Palantir’s systems are now central to U.S. military modernization efforts.

The U.S. Army extended its partnership, awarding a contract with a total ceiling of $618.9 million for the Army Vantage platform 3 Army Vantage unifies the Army’s historically fractured data landscape.4 This core software system accelerates decision-making across readiness, logistics, and force management.3

The Marine Corps finalized a contract for the Maven Smart System (MSS), a foundational, data-centric command and control (C2) platform.14 MSS enhances intelligence, targeting, and battlespace awareness capabilities.14 These platforms confirm Palantir as the essential software vendor for the DoD’s Combined Joint All-Domain Command and Control (CJADC2) strategy.14 This positions Palantir as a critical national security asset, ensuring persistent, high-value government revenue streams.13

Enabling the Kill Chain and Allied Support (Geopolitics)

Palantir Gotham supports warfighters with an AI-powered kill chain, seamlessly integrating target identification and effector pairing.15 The system dramatically enhances situational awareness and effectiveness in the modern battlespace.4 MSS further enables the autonomous tasking of sensors, including satellites and drones.15

MSS streamlines four out of six steps in the military’s time-sensitive kill chain process.16 This efficiency allows targeting officers to decide on 80 targets per hour, versus just 30 targets without the system.16 This direct contribution to lethality provides a clear, necessary tactical advantage for the DoD.

Palantir also extends its geopolitical influence by supporting key democratic allies.17 NATO adopted the Maven Smart System for AI-enabled battlefield operations.17 Palantir provides software to Ukraine and supports the UK Ministry of Defence in its goal to become a data-centric organization.17 This entrenchment secures continuous, high-margin, long-term contracts globally.

Cyber Resilience and Data Sovereignty (Cyber)

Palantir’s success in sensitive government sectors relies heavily on its robust security and governance frameworks.6 The platforms incorporate advanced security measures for the protection of highly sensitive data.10 Security functionality spans role-, classification-, and purpose-based access controls.6

Palantir maintains strict walls between customers, contractually and technologically.19 The company does not collect, hold, store, or sell customer data for its own commercial purposes.19 This commitment ensures data sovereignty, a crucial requirement for agencies like the UK Ministry of Defence.18

This high standard of data integrity and security mitigates major political and legal risks associated with cloud adoption. The compliance moat makes it exceptionally difficult for less established providers to penetrate critical sectors like defense and national public health systems.20

IV. Macroeconomic Tailwinds and Commercial Expansion

The Productivity Paradigm Shift (Macroeconomics)

The advent of generative AI in early 2023 sparked a global shift in productivity paradigms. Business leaders require expert software systems to efficiently harness this verifiable financial windfall. Palantir fills a critical gap by providing the systems and expertise necessary to generate real-time, data-driven solutions.

This positions Palantir as an indispensable enabler of macroeconomic efficiency gains across industrial sectors. The company successfully translates its core defense-honed capabilities, speed, security, and data integration, to enterprise needs.21 This cross-sector proficiency maximizes Palantir’s total addressable market.1 Palantir is a primary beneficiary of the accelerating corporate AI spending spree.

U.S. Commercial Segment Breakout (Economics)

Palantir’s most significant financial development is the spectacular breakout in its commercial segment. U.S. commercial revenue surged 93% year-over-year in Q2.1. This growth rate far outpaced nearly every other software peer.1 This exceptional performance confirms robust enterprise adoption of the Artificial Intelligence Platform (AIP).5

U.S. commercial revenue reached a $1 billion annual run rate.5 The segment’s total contract value (TCV) simultaneously surged 222%. This TCV growth confirms strong future revenue visibility and sustained commercial momentum.

The U.S. commercial performance significantly de-risks the overall investment thesis. Historically reliant on lucrative government contracts, 13 the 93% surge demonstrates Palantir’s ability to scale commercially. This structural shift toward a balanced, diversified revenue model warrants higher long-term valuation multiples 21

Vertical Integration and Science Applications (Science)

Palantir’s platforms demonstrate exceptional vertical scalability across critical regulated industries.22 These demanding sectors include health sciences, finance, and complex manufacturing.12 The complexity of data in these environments mirrors the complexity found in defense systems.

Key science contracts provide stable, non-cyclical revenue streams. Palantir secured a $44.4 million contract with the U.S. Food and Drug Administration (FDA).20 The software supports the development of new medicines and public health analytics.12

In the UK, Palantir holds a 7-year, £330 million contract with NHS England for a federated data platform.20 This platform integrates disparate health data systems, showcasing the Ontology’s flexibility in highly sensitive, regulated public data environments 22

V. Financial Performance and Valuation Friction

The Rule of 40 and Profitability Metrics (Economics)

Palantir exhibits exceptional financial health and operational efficiency. The company achieved a remarkable 94% score on the Rule of 40 metric.2 This score is the benchmark for efficient, high-growth software enterprises.

The company secured significant GAAP profitability, reporting operating margins of 26.8% and a GAAP profit margin of 22.1% in Q2.1. Palantir operates with immense financial stability, reporting approximately $6.0 billion in cash and U.S. Treasuries.23 The firm maintains virtually zero long-term debt.23 Robust free cash flow reached $1.27 billion, representing a 57% FCF margin.1 This $6 billion war chest provides resilience and resources for aggressive R&D and strategic acquisitions.

Forecasting Future Growth and Raised Guidance (Economics)

Wall Street forecasts continued, accelerating earnings momentum for Palantir. Analysts expect a 58% rise in full-year earnings, followed by a substantial 30% gain in 2026. Management previously raised its full-year revenue outlook, citing faster-than-expected AI adoption.1 The company anticipates maintaining GAAP operating profit and net income in every quarter 23

The stock exhibits strong technical indicators, confirming sustained institutional buying interest. PLTR currently trades above its 21-day exponential moving average and its 50-day line. The combination of strong TCV growth and continuous guidance implies robust visibility into future revenue streams.

Reconciling the Valuation Multiples (High-Tech/Economics)

Palantir’s valuation remains exceptionally high, trading at roughly 100 times revenue and 252 times forward P/E.2 This multiple represents a nearly 500% premium over many AI peers.2 Morningstar acknowledges the company’s excellent performance but rates the stock Highly Uncertain due to the valuation being a major headwind 2

Morningstar nonetheless projects 40% average annual growth, which sees revenue climbing from $4.2 billion to $21 billion.2 Bullish investors argue that focusing only on immediate valuation metrics misses the trajectory of every truly transformational tech stock. They believe Palantir is priced for eventual infrastructure dominance. Wedbush analyst Dan Ives suggests the stock could surge 122% to join the $1 trillion club by 2028.

Palantir is priced as a proprietary platform company with a narrow moat.2 Its critical role in mission-critical applications justifies sustained premium pricing. The major risk remains multiple compressions, which would be triggered immediately by any unexpected growth deceleration.2

VI. Conclusion: Risk Assessment and Investment Mandate

Bear Case Considerations and Structural Risks

Analysts remain cautious due to Palantir’s complex valuation and operational risks. The high complexity of Palantir’s platform requires heavy customization for each client.11 This complexity limits immediate scalability compared to simpler, “plug-and-play” AI software competitors.11

The extreme P/E ratio demands flawless operational execution.25 Any shortfall in the critical U.S. commercial growth segment could trigger significant multiple compression and widespread selling pressure.25

Palantir’s deep involvement in sensitive defense and immigration contracts generates ongoing ethical scrutiny.20 These controversies regarding military targeting systems pose reputational and regulatory risks that must be monitored closely.26

The Long-Term Investment Thesis and Mandate

Palantir has built an institutionally required platform, translating proprietary data architecture into both military superiority and commercial dominance. The foundational Ontology provides a structural advantage in unifying complex, siloed data.6 The 93% commercial growth rate validates AIP’s scalability across global enterprise customers.5

The investment thesis rests on structural shifts: geopolitical entrenchment (CJADC2, Maven) and massive macroeconomic capture (AIP productivity gains). These factors justify the aggressive valuation premium.

Investors must possess a long-term view and an “ironclad constitution” to withstand inherent volatility. Palantir represents a volatile but likely lucrative investment for those focused on decades of AI infrastructure expansion. Employing strategies like dollar-cost averaging is recommended to mitigate the risk posed by the high valuation entry point.

Refferences

- Palantir Q2 Revenue Tops $1B as AI Platform Adoption Accelerates …

- Palantir Earnings: Blockbuster Growth Amid High Expectations …

- Palantir Expands Army Vantage Partnership with $618.9 M Contract

- Palantir Defense Solutions | US Army

- Cathie Wood Can’t Stop Buying PLTR Stock. Should You Invest While It’s Still Below $200?

- Platform overview • Overview • Palantir

- Palantir AIP Bootcamp: r/PLTR – Reddit

- Patents Assigned to Palantir Technologies, Inc.

- How Palantir Is Revolutionizing Big Data Analytics – Bronson.AI

- AIP overview – Palantir

- Palantir Stock: Bull vs. Bear | The Motley Fool

- Palantir Information Security

- How Palantir’s Government Contracts Are Shaping Its Financial Future | User | ricentral.com

- Marine Corps partners with Chief Digital and Artificial Intelligence Office and Defense Innovation Unit for Enterprise CJADC2 Capability Acceleration of Palantir System > United States Marine Corps Flagship > Press Release Display

- Gotham | Palantir

- Project Maven – Wikipedia

- Palantir’s AI Revolution: How One Company is Transforming Military Defense from Silicon Valley to Global Battlefields – AI News Hub

- New strategic partnership to unlock billions and boost military AI and innovation – GOV.UK

- About Palantir

- Palantir Technologies – Wikipedia

- Palantir Technologies: Decoding the Data Giant’s AI Ambitions and Geopolitical Influence

- Palantir Ranked No. 1 in Worldwide Artificial Intelligence Software Study in Market Share and Revenue

- Palantir Technologies Inc. (PLTR) stock analysis and forecast for 2025 – RoboForex

- Palantir reports sales up 48%, cites ‘astonishing’ AI impact – InvestmentNews

- Palantir Q2 2025 earnings preview: can fundamentals justify the premium? – IG

- Ethical investing and Palantir – Reddit

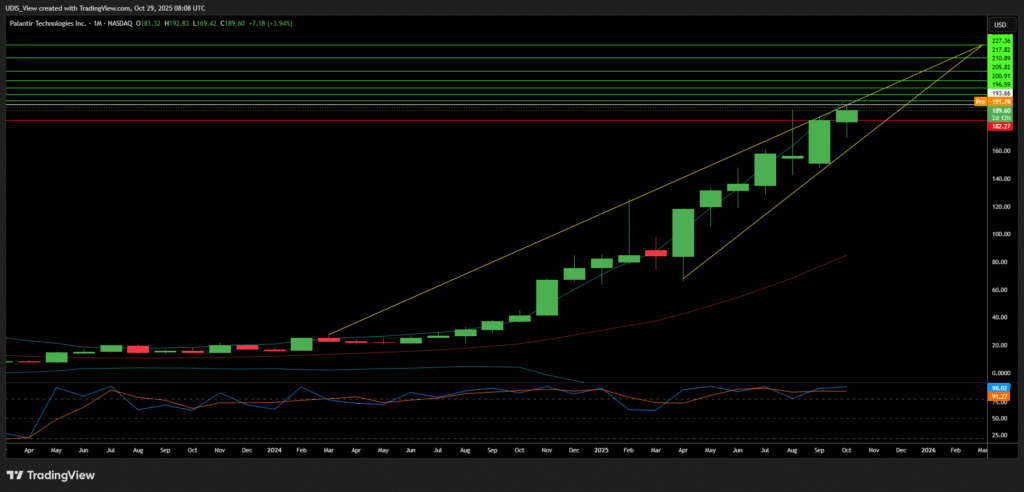

Palantir Long (Buy)

Enter At: 193.66

T.P_1: 196.59

T.P_2: 200.91

T.P_3: 205.82

T.P_4: 210.89

T.P_5: 217.82

T.P_6: 227.36

T.P_7: 236.75

S.L: 182.27