The Bitter Taste of Rising Orange Juice Prices

Consumers increasingly notice the sharp rise in orange juice prices.1 This transforms a breakfast staple into a luxury item. This surge is not merely a seasonal fluctuation. It results from a complex interplay of global forces. The current situation reflects a perfect storm where trade policy shifts, climate-induced agricultural crises, and evolving market dynamics converge. No single factor solely drives this increase; instead, the confluence and interdependency of these diverse elements amplify the price impact, creating a more robust and less easily resolved pressure.

Understanding these drivers is crucial for both consumers and investors. This article unravels the intricate web of factors contributing to the escalating cost of orange juice. It examines geopolitical tensions, macroeconomic implications, and environmental challenges. These elements collectively squeeze the global supply. Mitigation strategies must therefore be multi-pronged, addressing the multifaceted nature of the problem.

Florida’s Fading Groves: A Supply Chain Under Stress

U.S. domestic orange production, primarily in Florida, has seen severe curtailment. This decline has significantly weakened the domestic supply base for orange juice. Citrus greening disease, an incurable bacterial infection, has devastated orange groves across Florida, dramatically reducing yields.1 This persistent, structural challenge to U.S. orange supply continues to plague the industry.

Compounding this, extreme weather events have further exacerbated the production crisis. Devastating hurricanes and prolonged droughts have severely impacted Florida’s orange yields.1 These environmental factors create a persistent, structural challenge to U.S. orange supply.

As domestic production dwindles, the United States has become increasingly dependent on foreign sources. Brazil has stepped in to fill this void, becoming the primary supplier.1 Between October 2023 and January 2024, Brazil supplied a staggering 81% of U.S. orange juice imports.1 This marks a notable increase from 76% in the previous season.1 This growing reliance on a single foreign supplier due to domestic agricultural collapse creates a significant geopolitical risk multiplier. Any disruption to that primary source would have disproportionate effects on supply and pricing. This makes the upcoming tariff particularly impactful, as it targets an already critical, concentrated supply line.

To illustrate this increasing reliance, consider the following data:

| Season | Brazil’s Share of U.S. OJ Imports (%) | Contextual Note |

| Previous Season | 76% | 1 |

| Oct 2023 – Jan 2024 | 81% | Up from previous season 1 |

| Source: Research Material | Reflects declining Florida production 1 |

Brazil’s Dominance and the Geopolitical Storm

Brazil holds a pivotal role as the primary orange juice supplier to the U.S..1 It controls an estimated 80% of the global orange juice trade share.4 Brazil also supplies over half of the orange juice sold in the U.S..4 This dominance makes Brazil an indispensable partner for the U.S. orange juice industry.

President Trump announced a significant 50% tariff on all imports from Brazil.1 This measure is scheduled to take effect on August 1, 2025.4 This represents a dramatic escalation from previous trade measures.4 It targets a wide range of Brazilian goods, including orange juice.5 This action directly increases the cost of orange juice imports, fueling price increases for consumers.5

The tariff is explicitly linked to political disputes. These include Brazil’s prosecution of former President Jair Bolsonaro and its alignment with BRICS nations.4 President Trump’s letter cited “partially due to the Brazilian cunning attack on the Free General Election and the fundamental Freedom of Speech of Americans”.4 This indicates a move driven by ideological and political grievances rather than conventional trade imbalances. This highly unusual, politically charged justification for the tariff suggests a departure from traditional trade policy. It introduces a geopolitical risk premium being applied to Brazilian commodities, making resolution less predictable through conventional economic negotiations. When tariffs are rooted in deep political or ideological disagreements, they become less about economic leverage and more about political signaling or punishment. This makes them harder to negotiate away, as the underlying grievance is non-economic. It introduces a higher degree of uncertainty and volatility, as political considerations, rather than market fundamentals, drive policy. This political risk becomes a permanent fixture in the commodity’s pricing.

The imposition of a 50% tariff will directly increase the landed cost of Brazilian orange juice in the U.S..5 This cost will inevitably pass on to consumers, further driving up retail prices.5 The Brazilian Real’s immediate depreciation by over 2% against the dollar following the announcement reflects market apprehension about the economic fallout for Brazil.4 The “all imports” nature of the tariff, effective August 2025, creates a pre-emptive market reaction. This incentivizes immediate strategic adjustments by businesses and investors, even before the tariff takes effect. Markets are forward-looking. The announcement creates immediate uncertainty and forces companies to begin planning for higher costs or alternative sourcing. This pre-emptive pricing of risk means that inflationary pressures and supply chain adjustments begin before the official implementation date. It also provides a window for potential renegotiation, but the market is already pricing in the likelihood of the tariff’s implementation.

Macroeconomic Ripples: Inflation, Currencies, and Rate Cuts

A 50% tariff on a significant portion of U.S. imports from Brazil, including essential commodities like orange juice and coffee, directly increases import costs.1 These higher costs are then passed on to consumers, contributing to broader inflationary pressures across the economy.1 This inflationary impulse could complicate the Federal Reserve’s efforts to manage inflation. It might force them to maintain higher interest rates for longer, potentially delaying or preventing anticipated rate cuts.1 This creates a direct inflationary feedback loop that could undermine the Federal Reserve’s current monetary policy trajectory, creating a conflict between political trade actions and economic stability goals. If the political goal directly counteracts the economic goal of stimulating growth, it suggests a lack of policy coherence or a prioritization of political objectives over economic stability. This makes the Fed’s job harder and increases the likelihood of prolonged inflation or a more aggressive tightening cycle than otherwise necessary, impacting broader equity markets.

The announcement of the tariff immediately impacted Brazil’s economy. The Brazilian Real currency depreciated by over 2% against the dollar.4 This reflects investor concerns about reduced U.S. demand for Brazilian goods.5 Major Brazilian companies, such as aircraft manufacturer Embraer and oil giant Petrobras, also experienced setbacks in the U.S. stock market.4 This indicates expected revenue and margin pressures due to the levies.5 The immediate negative reaction of the Brazilian Real and major Brazilian companies highlights the asymmetric power dynamics in U.S.-Brazil trade relations. U.S. policy decisions can inflict significant, immediate economic pain on its trading partners. Even the threat of a tariff from a major trading partner can cause significant capital flight and devalue a currency, impacting national wealth and corporate valuations. This power imbalance could influence future negotiations or compel Brazil to seek stronger economic ties with other blocs.

As prices for everyday staples like orange juice and coffee rise, American consumers face reduced purchasing power.1 This widespread impact on household budgets can dampen overall economic activity and consumer confidence.

Climate Change and Disease: The Unseen Hand in Commodity Markets

Beyond the geopolitical tensions, fundamental agricultural challenges significantly contribute to the global orange shortage.2 Citrus greening disease has ravaged orange groves in both Florida and Brazil, the two largest producers.2 This incurable bacterial infection severely limits yields.2

Concurrently, extreme weather events have further reduced orange yields. Devastating hurricanes in Florida and prolonged drought conditions in Brazil have played a significant role.2 These environmental factors are long-term, systemic threats to orange production. The persistent and escalating impact of climate change and agricultural diseases introduces a structural, non-negotiable component to commodity price increases. This makes them less susceptible to short-term policy fixes. Unlike a temporary trade dispute or a one-off bad harvest, disease and long-term climate shifts represent a permanent or very difficult-to-reverse reduction in global productive capacity.

The combined impact of disease and adverse weather has created a significant global deficit in orange supply.2 This fundamental imbalance means that even without tariffs, prices would likely be trending higher due to scarcity. The environmental pressures create a baseline of elevated prices upon which geopolitical factors then add further premiums. This signals a need for long-term agricultural innovation, diversification of supply, or a fundamental shift in consumer habits, rather than just trade policy adjustments.

Beyond Orange Juice: Broader Commodity and Supply Chain Vulnerabilities

The 50% tariff is not limited to orange juice.5 Brazil is a top global exporter of various commodities, including coffee, iron ore, and oil.5 The tariff directly raises the cost of these imports into the U.S., potentially squeezing margins for importers and creating supply shortages across multiple sectors.5 Brazil supplies approximately 35% of U.S. unroasted coffee imports, making it the largest single supplier.1

Brazil is also a key exporter of automotive components, including steel parts and semiconductors.5 The tariffs could disrupt U.S. auto production.5 Automakers like Ford (F) and General Motors (GM) rely on Brazilian steel and components.5 Higher import costs may squeeze profit margins for these manufacturers and risk production delays.5

This creates both risks and opportunities across various sectors.5 While U.S. importers and manufacturers face headwinds, the tariffs also incentivize domestic production and sourcing.5 This shift creates opportunities for U.S. steel producers and auto parts manufacturers.5 The “all imports” tariff strategy from the U.S. signals a broader de-risking or reshoring imperative in critical supply chains. This is driven by geopolitical rather than purely economic efficiency considerations. This broad application suggests a strategic move to reduce overall U.S. reliance on Brazil across critical sectors, potentially as part of a wider geopolitical alignment strategy. It forces U.S. companies to actively seek domestic or alternative international suppliers, accelerating trends like reshoring or “friend-shoring.” This long-term strategic shift prioritizes supply chain resilience and geopolitical alignment over immediate cost efficiency, fundamentally altering global trade patterns for key commodities and manufactured goods.

The table below summarizes the key impacts across various sectors:

Key Commodity & Sector Impacts of Brazil Tariffs

| Commodity/Sector | Key Impact | Investment Implication |

| Orange Juice | Direct cost increase, supply disruption | Long futures (FCOJ), commodity ETFs 2 |

| Coffee | Supply chain disruption, higher prices | Long futures (C), ETFs like iPath Coffee ETN (JO) 5 |

| Iron/Steel | Higher costs for U.S. manufacturers | Buy U.S. producers (Nucor (NUE), Steel Dynamics (STLD)) 5 |

| Auto Components | Production delays, higher costs for U.S. auto | Buy U.S. suppliers (American Axle (AXL), BorgWarner (BWA)) 5 |

| U.S. Auto Manufacturers | Squeezed profit margins, production risks | Avoid until supply chain adjustments materialize 5 |

| Brazilian Exporters | Margin pressure from reduced U.S. sales | Short Brazilian commodity exporters (Vale (VALE)) 5 |

| Source: Research Material |

Investment Outlook: Navigating Volatility and Opportunity

The U.S.-Brazil tariff conflict creates a landscape of sector-specific vulnerabilities and opportunities.5 This requires investors to adopt flexible and agile strategies.5 The tariff conflict creates a clear divergence in market performance between U.S. domestic suppliers (beneficiaries of reshoring) and U.S. companies reliant on global supply chains (vulnerable to disruption). This necessitates a nuanced, sector-specific investment approach. This is not a broad market “buy” or “sell” signal. It requires investors to actively identify and capitalize on the winners and losers of geopolitical trade shifts. The investment strategy shifts from general market trends to granular, sector-specific plays driven by supply chain reconfigurations and protectionist policies. This highlights the increasing importance of geopolitical analysis in fundamental investment decisions.

Given the supply shortages and increased import costs, coffee futures (C) and orange juice futures (FCOJ) may surge.2 Investors could consider long positions in these contracts or related ETFs like iPath Coffee ETN (JO) or the Invesco DB Commodity Index Tracking Fund (DBC).5 The FCOJ market has shown signs of a near-term bottom with upside momentum.2

As demand shifts away from tariff-affected Brazilian imports, U.S. domestic producers stand to benefit.5 Companies like Nucor (NUE) and Steel Dynamics (STLD) in the steel sector could gain market share.5 Auto parts manufacturers like American Axle (AXL) or BorgWarner (BWA) may also see increased demand.5

Conversely, U.S. automakers (F, GM) with heavy reliance on Brazilian steel and components face higher costs and potential production delays.5 This will squeeze profit margins.5 Brazilian commodity exporters like Vale (VALE) could experience margin pressure due to reduced U.S. sales.5 Investors can use options to protect against downside risks in vulnerable auto stocks while capitalizing on commodity upside.5

The situation remains fluid.5 Potential negotiations before August 1, 2025, could reduce or reverse tariffs.5 However, global spillover, such as BRICS retaliation or expanded U.S. tariffs, could amplify market volatility.5 Higher commodity prices could also force the Federal Reserve to tighten policy further, dampening equity markets broadly.5 The mention of “negotiations” and “global spillover” as wildcards suggests that the market is pricing in not just the tariff itself, but also the uncertainty of its resolution and potential broader geopolitical ramifications. These factors introduce a significant “uncertainty premium” into asset prices. Investors are not just reacting to known facts but also to the probability of future events, both positive and negative. This necessitates hedging and agile strategies, as the market’s direction could pivot rapidly based on geopolitical developments. It underscores that the investment landscape is increasingly shaped by non-economic, political variables.

Conclusion: An Agile Approach to a Shifting Global Landscape

The rising cost of orange juice is a microcosm of complex global dynamics. It is driven by the devastating impact of citrus greening and extreme weather on key growing regions.2 This is coupled with a politically charged U.S. tariff on Brazil, the world’s dominant supplier.1 These factors create a multi-layered challenge to supply, directly translating into higher consumer prices.

The geopolitical currents suggest a prolonged period of sector-specific disruption and opportunity.5 While tariffs could be renegotiated, the underlying drivers of supply chain re-evaluation and climate impact will persist.2 Investors must remain agile, adapting strategies to evolving trade policies and environmental realities.5

For consumers, orange juice prices will likely remain elevated. This reflects both fundamental scarcity and geopolitical risk. For investors, the situation underscores the growing importance of integrating geopolitical and environmental analysis into traditional financial models. It highlights the need to identify opportunities in supply chain resilience and domestic production, and to navigate volatility with strategic foresight.

References

- In the US? Time to go out and stock up on coffee, OJ. Prices about to rise. – Forexlive, accessed July 10, 2025, https://www.forexlive.com/centralbank/in-the-us-time-to-go-out-and-stock-up-on-coffee-oj-prices-about-to-rise-20250709/

- Market Bottom Alert: Are FCOJ Prices Set to Gain Here? – Palmetto Grain Brokerage -, accessed July 10, 2025, https://www.palmettograin.com/news/story/33273311/market-bottom-alert-are-fcoj-prices-set-to-gain-here

- Market Bottom Alert: Are FCOJ Prices Set To Gain Here? – Barchart.com, accessed July 10, 2025, https://www.barchart.com/story/news/33273310/market-bottom-alert-are-fcoj-prices-set-to-gain-here

- Trump announces sweeping 50% tariff on all Brazilian imports starting Aug. 1 – Fox Business, accessed July 10, 2025, https://www.foxbusiness.com/politics/trump-announces-sweeping-50-tariff-all-brazilian-imports-starting-august-1

- US-Brazil Tariff Talks: A Crossroads for Commodities and Emerging Markets – AInvest, accessed July 10, 2025, https://www.ainvest.com/news/brazil-tariff-talks-crossroads-commodities-emerging-markets-2507/

- BRICS Tariffs and Global Trade Dynamics: Navigating Opportunities and Risks in a Shifting Landscape – AInvest, accessed July 10, 2025, https://www.ainvest.com/news/brics-tariffs-global-trade-dynamics-navigating-opportunities-risks-shifting-landscape-2507/

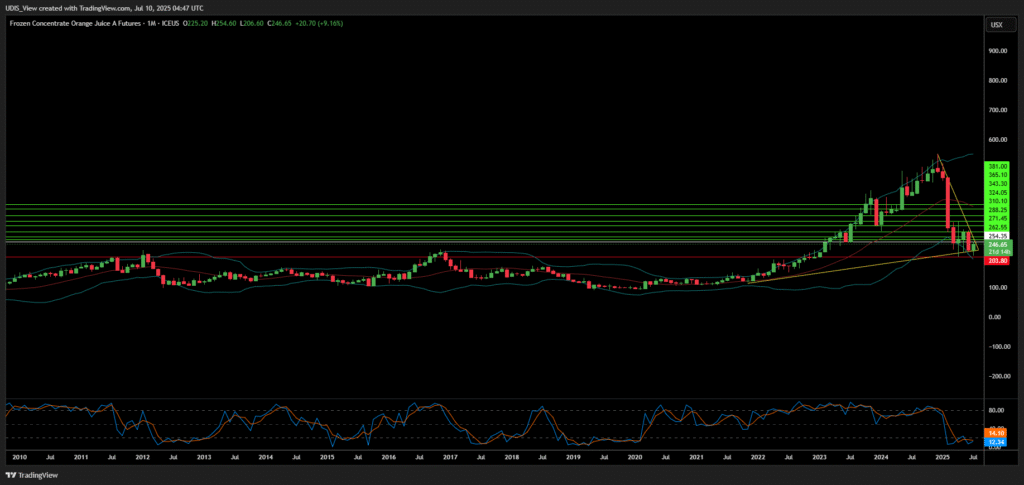

Orange Juice Long (Buy)

Enter At: 254.35

T.P_1: 262.55

T.P_2: 271.45

T.P_3: 288.25

T.P_4: 310.10

T.P_5: 324.05

T.P_6: 343.30

T.P_7: 365.10

T.P_8: 381.00

S.L: 203.80