The recent 30% surge of Ondas Holdings Inc. (NASDAQ: ONDS) marks a pivotal transformation for the defense technology provider. Shares finished last week near a 52-week high of $11.70, reflecting a dramatic recovery from early lows of $0.57. This momentum signals investor confidence in the company’s evolution into a fully integrated global operating platform.

Ondas Inc.: A New Identity for a Scaled Platform

Management recently announced a corporate rebranding to “Ondas Inc.” starting Q1 2026. This change distances the firm from its origins as a collection of separate assets. CEO Eric Brock emphasizes that the new name aligns with their unified defense and security mission.

The company also relocated its headquarters to West Palm Beach, Florida. This strategic move taps into a business-friendly regulatory environment. Florida’s emerging hub for finance and defense technology supports disciplined capital formation. It also provides proximity to strategic partners in the high-growth aerospace sector.

Geostrategy: Securing Borders and Infrastructure

Ondas recently secured a landmark government tender to field a massive autonomous border-protection system. This program involves deploying thousands of drones as a prime contractor. Global instability drives this demand for persistent, 24/7 intelligence and surveillance.

Geostrategy now favors autonomous, scalable solutions that reduce human risk. Ondas also recorded $16.4 million in orders for counter-UAS systems at major European airports. This trend highlights the critical need for protecting transportation hubs from unauthorized drone incursions.

Economics: Revenue Targets and Market Capitalization

Financial indicators suggest a robust trajectory for 2026. The company targets at least $110 million in revenue this year, up from $36 million in 2025. This 200% growth forecast stems from a record $23.3 million backlog.

Investors must weigh this growth against past financing strains. Ondas recently recorded a $56.6 million non-cash charge related to securities exchanges. However, a strengthened balance sheet and $68.6 million in cash provide a solid foundation. For a deeper dive into valuation, read this analysis of Ondas Holdings’ defense tech investing.

Cyber & Tech: The “System of Systems” Advantage

The acquisition of Sentrycs bolsters Ondas’ cyber capabilities. Sentrycs uses “Cyber-over-RF” technology to take control of rogue drones without jamming. This protocol manipulation allows for safe mitigation in dense urban areas or sensitive airports.

Technology integration creates a “System of Systems” framework. Ondas fuses autonomous aerial drones with robotic ground platforms and intelligent sensors. This ecosystem delivers unified command and control for complex missions. It positions Ondas as one of the few providers offering end-to-end multi-domain autonomy.

Science & Innovation: AI-Powered Demining Efforts

Ondas recently completed a successful pilot program using AI for humanitarian demining in the Middle East. Partnering with Safe Pro Group, the company identified nearly 150 hazardous items across 22 acres. Advanced AI algorithms analyzed aerial imagery to locate landmines and unexploded ordnance.

This scientific application proves that Ondas’ tech transcends combat operations. The 4M Defense unit maps combat zones into actionable operational pictures. These innovations accelerate land reclamation and reconstruction efforts globally. They demonstrate the versatility of AI-driven sensing in high-stakes environments.

Patent Analysis and High-Tech IP

Ondas Networks maintains a strong competitive moat through its FullMAX platform. This software-defined wireless technology follows the IEEE 802.16t standard for mission-critical IoT. This standards-based approach ensures interoperability for railroads, utilities, and oil and gas sectors.

The company also holds critical IP in precision optics via its acquisition of SPO. These optical systems support missile defense and high-power laser applications. By owning the underlying technology, Ondas reduces supply chain risk. This intellectual property portfolio secures its dominance in the burgeoning counter-drone market.

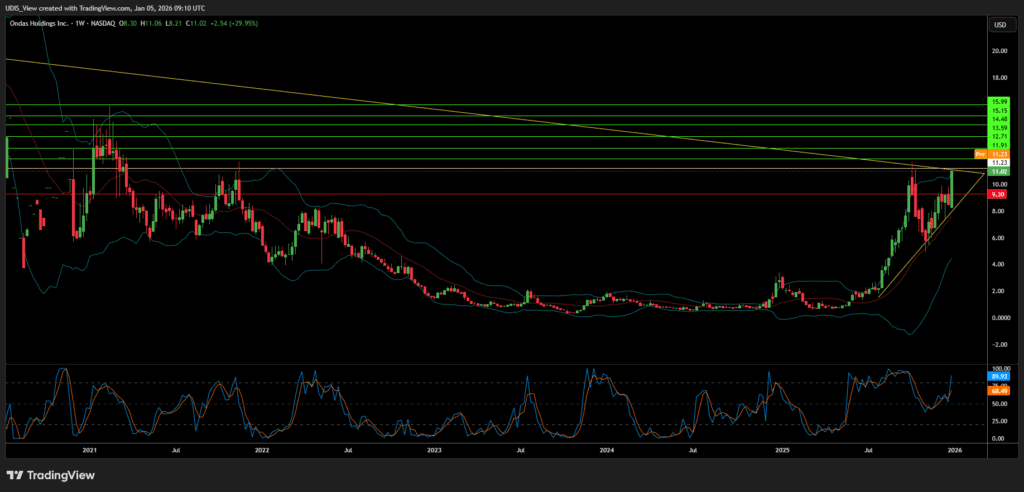

Ondas Holdings Inc Long (Buy)

Enter At: 11.23

T.P_1: 11.91

T.P_2: 12.71

T.P_3: 13.59

T.P_4: 14.48

T.P_5: 15.15

T.P_6: 15.99

S.L: 9.30