Strategic Assessment

Nippon Steel Corporation (NSC) stands at a critical historical inflection point. The company is currently executing a radical strategic pivot. It aims to transform from a domestic Japanese giant into a dominant global steelmaker.

This shift occurs under the “Carbon Neutral Vision 2050”. The “2030 Medium- to Long-term Management Plan” drives this aggressive evolution. Management targets 100 million tons of global crude steel capacity. Yet, this expansion faces severe headwinds.

The operating environment is volatile. Geopolitical friction defines the current era. Decarbonization mandates enforce massive capital expenditures. Cyber warfare targets industrial infrastructure. NSC’s strategy seeks to balance these opposing forces.

It aims to secure an underlying business profit of 1 trillion yen annually. This requires a fundamental decoupling from low-margin markets. It demands expansion into protected, high-growth regions like India and the United States.

The analysis reveals a stark dichotomy. Financially, NSC has strengthened its domestic earnings base. Strategically, it is aggressively pivoting away from China. This “de-risking” strategy is essential. It aligns with Western security frameworks.

However, the path forward is fraught with risk. The acquisition of U.S. Steel faces fierce political resistance. Green steel transition costs threaten long-term solvency. Cyber vulnerabilities jeopardize intellectual property. This report dissects these intersecting domains.

I. Macroeconomic Architecture and Financial Dynamics

1.1 Revenue Trajectories and Market Realities

Nippon Steel faces a contracting domestic market. Japan’s population is shrinking. Construction demand is plateauing. Consequently, revenue growth must come from overseas. Recent financial results confirm this pressure.

Revenue for the fiscal year ending March 2025 showed a decline. The company projected revenue of 8.70 trillion yen13. This represents a contraction of nearly 2% year-over-year.

Management has responded with structural reforms. They are closing inefficient blast furnaces in Japan. They are consolidating production lines. This improves asset efficiency. The focus has shifted from volume to margin.

The company prioritizes “spread improvement” in direct sales. This means passing raw material costs directly to customers. It protects margins against inflation.

1.2 Profitability and the “1 Trillion Yen” Target

The core financial metric is “Underlying Business Profit.” NSC aims for 1 trillion yen annually by fiscal year 2025. This is an ambitious target.

Forecasts for FY2025 currently sit lower, at approximately 680 billion yen. The gap highlights external headwinds. Global steel demand is sluggish. China continues to export deflation.

Despite this, profitability has improved historically. Breakeven points have lowered significantly. Facility structural measures have cut fixed costs. The company remains profitable even at lower output levels. This resilience is crucial. It provides the cash flow needed for strategic investments. Without this domestic stability, global expansion is impossible.

1.3 Shareholder Returns and Stock Split

Management signals confidence through shareholder returns. The company implemented a 5-for-1 stock split effective October 1, 2025. This move aims to increase liquidity.

It makes the stock more accessible to retail investors. The dividend policy targets a payout ratio of around 30%. This payout policy is maintained despite high capital needs. It suggests strong projected cash flows.

The dividend forecast for FY2025 is 160 yen per share (pre-split). This consistency appeals to institutional investors. It positions NSC as a stable yield generator. This is vital for maintaining a high share price during acquisition battles.

1.4 Currency Sensitivity and Risk Management

The yen’s valuation plays a complex role. A weak yen boosts reported overseas earnings. It increases the yen value of profits from AM/NS India. However, it inflates raw material costs. Japan imports all its iron ore and coking coal. A weak yen increases these import bills.

NSC mitigates this through formula-based pricing. Surcharges pass currency costs to domestic customers. The strategic focus is “local production, local consumption.” Expanding in the US and India creates a natural hedge. It matches revenues and costs in the same currency. This reduces exposure to yen volatility over the long term.

Table 1: Financial Performance Indicators (FY2025 Forecast)

| Metric | Value | Strategic Implication |

| Revenue | ¥8.70 Trillion | Contraction drives overseas pivot. |

| Business Profit | ¥680.0 Billion | Resilience amid market headwinds. |

| Dividend | ¥160 (Pre-split) | Management confidence in cash flow. |

| Global Rank | 4th (43.64 Mt) | Scale remains a key competitive advantage. |

| P/E Ratio | ~15.78 | Market prices in cyclical risks. |

II. Geopolitical Strategy and Trade Dynamics

2.1 The U.S. Steel Acquisition: A Geopolitical Litmus Test

The proposed acquisition of U.S. Steel is NSC’s boldest gamble. The deal is valued at $14.1 billion. It represents the cornerstone of NSC’s Western expansion strategy.

However, it has ignited a political firestorm. Bipartisan opposition emerged immediately. Both President Biden and Donald Trump opposed the deal. The opposition centers on national security. The Committee on Foreign Investment in the United States (CFIUS) reviewed the transaction.

Critics argue that foreign ownership threatens supply chain resilience. This argument ignores Japan’s status as a key ally. It highlights a new era of protectionism. Corporate nationality now trumps economic efficiency.

2.2 The “Golden Share” and Mitigation Measures

NSC has offered unprecedented concessions. They proposed a “Golden Share” arrangement. This would give the U.S. government veto power over certain decisions. They committed to maintaining U.S. production capacity. They promised no plant closures33. Capital investment commitments extend to 2028.

These measures aim to appease the United Steelworkers (USW). The union holds significant political sway. NSC’s strategy is to decouple ownership from control. They aim to prove their stewardship benefits American security. The outcome of this deal will set a precedent. It determines the limits of allied foreign investment in critical U.S. infrastructure.

2.3 De-risking: The China Exit Strategy

NSC is actively decoupling from China. The company dissolved its joint venture with Baoshan Iron & Steel (Baosteel). This venture stood for twenty years. Its termination marks a strategic withdrawal. NSC reduced its production capacity in China by 70%.

This “de-risking” serves multiple purposes. First, it reduces exposure to geopolitical coercion. Second, it protects intellectual property. Chinese competitors have moved up in the value chain. Continued partnership risks technology leakage. Third, it aligns with U.S. interests. A smaller China footprint aids the CFIUS review process. It signals NSC is a “trusted partner” in the Western alliance.

2.4 Economic Security and Raw Materials

Supply chain resilience is paramount. Japan lacks domestic resources. It relies entirely on imports. Economic coercion is a tangible threat. NSC remembers the 2010 rare earth embargo. The company is diversifying its supply base.

Investments in upstream mines secure iron ore. Stockpiling strategies are being refined. Recycling technologies reduce dependency on virgin materials. NSC aims to close the loop. This circular economy approach is a geopolitical hedge. It reduces reliance on hostile or unstable regimes for critical inputs.

III. The Indian Pivot: Strategic Growth Engine

3.1 AM/NS India: The Jewel in the Crown

India represents the future of volume growth. The ArcelorMittal Nippon Steel India (AM/NS India) joint venture is central. NSC aims to capture India’s infrastructure boom. The JV plans to triple capacity to 25-26 million tons by 2030. This is aggressive expansion.

India offers favorable demographics. Its population is young and growing. Urbanization is accelerating. Steel consumption per capita is rising. This contrasts sharply with China and Japan. NSC technology gives AM/NS India a quality edge. They can produce high-grade automotive steel locally. This substitutes imports and captures high margins.

3.2 Infrastructure Expansion: Hazira and Andhra Pradesh

Capital expenditure in India is massive. The Hazira plant is expanding from 9MT to 15MT. Further expansion targets 20MT. This involves new blast furnaces and rolling mills. The investment creates economies of scale. It lowers unit costs significantly.

A new greenfield project is underway in Andhra Pradesh. Land acquisition has begun in the Anakapalli district. This creates a second production hub. It provides access to eastern ports. This dual-hub strategy reduces logistics risks. It allows AM/NS India to serve the entire subcontinent efficiently.

3.3 Upstream Integration and Logistics

NSC is not just building mills. It is securing the supply chain. Investments in pellet plants ensure raw material quality. Slurry pipelines reduce transport costs. Acquisition of port facilities secures export channels.

This vertical integration is crucial in India. Infrastructure bottlenecks often hamper manufacturing. Owning logistics assets guarantees uptime. It insulates the company from local systemic inefficiencies. It ensures reliable delivery to demanding automotive customers.

Table 2: India Expansion Roadmap

| Project | Target Capacity | Status | Strategic Goal |

| Hazira Expansion | 15 Million Tons (Phase 1) | Underway | Capture the western India demand. |

| Andhra Pradesh | 7 Million Tons (Initial) | Land Acquired | East coast export hub. |

| Total Target | ~26 Million Tons (2030) | Planned | Market dominance in India. |

IV. Technological Supremacy and Patent Warfare

4.1 Electrical Steel: The EV Battlefield

Nippon Steel controls a strategic chokepoint. Non-Oriented Electrical Steel is vital for Electric Vehicles (EVs). It forms the core of high-efficiency traction motors. NSC’s brands “HOMECORE” and “HILITECORE” lead the market. They offer superior magnetic properties. This improves motor efficiency and vehicle range.

Demand is exploding. The electrical steel market could reach $68 billion by 2031. NSC is investing heavily to expand capacity. Setouchi and Kyushu works are receiving major upgrades. This capacity is specifically for high-grade EV steel. It aims to lock in global automakers.

4.2 The Patent Litigation Strategy

NSC uses law as a weapon. In 2021, it sued Toyota and Baosteel for patent infringement. It is alleged that Baosteel stole electrical steel technology. It is alleged that Toyota used this stolen tech. Suing a major customer is unprecedented in Japan.

This signaled a paradigm shift. NSC values its IP monopoly over traditional relationships. It views high-grade steel as proprietary technology. It is not a commodity. NSC eventually settled with Toyota 56 to preserve national unity. However, the suit against Baosteel continues. This maintains pressure on Chinese competitors. It warns global buyers to respect NSC’s IP rights.

4.3 High-Tensile Steel Innovations

NSC dominates automotive lightweighting. “NSafe-AUTOLite” is a key solution. It uses ultra-high tensile strength steel (1.2 GPa). This reduces weight without sacrificing safety58. It is critical for EVs. Lighter bodies offset heavy battery packs.

The company’s metallurgy is advanced. They control microstructure at the sub-micron level. This achieves both strength and formability. Competitors struggle to replicate this. It allows automakers to mold complex parts. This locks them into NSC’s material ecosystem early in the design phase.

4.4 Titanium and Specialty Products

NSC diversifies beyond steel. Its titanium division serves aerospace and ocean energy. “TranTixxii” titanium is used in iconic architecture. These niche markets offer high margins. They are less cyclical than general construction steel. They showcase NSC’s material science capabilities.

V. Decarbonization: The Green Industrial Revolution

5.1 The “NSCarbolex” Strategy

Decarbonization is an existential challenge. NSC has launched the “NSCarbolex” brand. It has two pillars. “NSCarbolex Neutral” offers certified green steel. It uses a mass-balance approach to allocate emissions reductions. “NSCarbolex Solution” offers high-performance products. These help customers reduce their emissions.

This branding strategy is sophisticated. It allows NSC to monetize green premiums immediately. It does not wait for a full technological transition. It captures value from incremental improvements. It positions NSC as a partner in customers’ climate goals.

5.2 Transition Technologies: Blast Furnace Evolution

NSC cannot abandon blast furnaces overnight. They are too capital-intensive. The “COURSE50” project aims to reduce emissions by 30%. It injects hydrogen into blast furnaces. It separates CO2 from gas emissions.

“Super COURSE50” targets a 50% reduction. This is a bridge technology. It extends the life of existing assets. It maintains production volume during the transition. Critics argue this prolongs coal use. However, NSC views it as a pragmatic necessity.

5.3 The Shift to Electric Arc Furnaces (EAF)

NSC is pivoting to EAF production. They are investing 868 billion yen in large-scale EAFs. These use scrap metal and electricity. They emit far less carbon than blast furnaces.

However, EAFs have quality limitations. Impurities in scrap can weaken steel. NSC is developing technology to use EAFs for high-grade steel. This is difficult. Success here would be a game-changer. It would allow green production of automotive grades.

5.4 Hydrogen Direct Reduction (H2-DRI)

The ultimate goal is Hydrogen Direct Reduction. This process uses 100% hydrogen to reduce iron ore. It produces only water as a byproduct. NSC aims for commercialization by 2050.

This depends on external factors. It requires massive amounts of cheap green hydrogen. Japan’s energy infrastructure is a bottleneck. NSC is lobbying for government support. The Green Innovation Fund supports this R&D, but the timeline remains long and uncertain.

5.5 Regulatory Risk: The CBAM Threat

Europe’s Carbon Border Adjustment Mechanism (CBAM) is a threat. It taxes carbon-intensive imports. NSC exports could face heavy levies. This would destroy competitiveness in the EU market.

NSC must decarbonize to survive. The alternative is losing the European market. CBAM effectively exports EU climate policy. It forces NSC to align its capital expenditure with Brussels’ mandates. This accelerates the retirement of coal-based assets.

VI. Cybersecurity and Digital Resilience

6.1 The 2025 Zero-Day Breach

Digital vulnerability is a major risk. In March 2025, NSC subsidiary NSSOL suffered a breach74. Hackers exploited a zero-day vulnerability. They targeted network equipment. They accessed internal servers.

Data was exfiltrated. It included customer and employee information. The breach highlights the fragility of connected systems. As NSC digitizes, its attack surface grows. Operational Technology (OT) is increasingly exposed to IT threats.

6.2 Zero Trust Architecture

NSC is adopting “Zero Trust” security. This model assumes no user or device is safe. Verification is required for every access request. It replaces perimeter defense with granular control.

This is essential for a global company. Employees access systems from everywhere. Remote work expands risk. Zero Trust mitigates lateral movement by attackers. It limits the damage from any single compromised credential.

6.3 AI and Digital Transformation (DX)

NSC uses AI to optimize production. The “NS-DIG” platform analyzes vast datasets. It uses deep learning for image recognition. It inspects products for defects automatically.

AI also predicts equipment failures. This enables predictive maintenance. It prevents unplanned downtime. It optimizes energy usage in furnaces. This contributes directly to carbon reduction goals. DX is not just IT; it is core to manufacturing efficiency.

6.4 Data-Driven Decision Making

Data integration drives speed. NSC is integrating legacy systems. This breaks down silos between steelworks. It allows for centralized planning. It enables “smarter manufacturing”.

Real-time data visibility is crucial. It allows rapid response to market changes. It optimizes inventory levels. It matches production to demand more accurately. This agility is a competitive advantage in a volatile market.

VII. Product Innovation: The “ZEXEED” Case Study

7.1 Defining Market Superiority

“ZEXEED” exemplifies NSC’s product strategy. It is a high-corrosion-resistant coated steel. It resists rust ten times better than standard galvanized steel. It is used in harsh environments.

This product solves a specific customer pain point: infrastructure aging. It extends the lifespan of bridges and buildings. It reduces life-cycle costs. Customers pay a premium for this longevity.

7.2 Metallurgy and Mechanism

ZEXEED uses a unique alloy coating. It contains Zinc, Aluminum, and Magnesium. The magnesium creates a dense protective film. This film self-heals over cut edges.

This technology is proprietary. It is difficult to reverse-engineer. It creates a moat around NSC’s market share. It targets the civil engineering sector. This sector demands reliability over the decades.

7.3 Market Positioning

ZEXEED allows NSC to bypass commodity pricing. It is sold by value, not weight. It aligns with sustainability goals. Longer-lasting steel means less replacement. This reduces the total carbon footprint of infrastructure.

NSC markets this aggressively. They provide warranties for service life. This confidence builds trust. It differentiates NSC from low-cost Chinese competitors. It secures high margins in the domestic construction market.

VIII. Conclusion: The Strategic Trilemma

Nippon Steel faces a “Strategic Trilemma.” It must balance Growth, Security, and Sustainability. Growth depends on the Global South. The India pivot is sound. It accesses volume and demographic growth. The U.S. expansion accesses high-value demand. Success requires navigating protectionism. The U.S. Steel deal is the test case.

Security demands decoupling. The exit from China is necessary. It protects IP and aligns with allies. However, it sacrifices the world’s largest market. The patent wars signal a combative future. NSC will fight to protect its technological edge.

Sustainability threatens solvency. The costs of green steel are immense. The technology is not yet mature. CBAM forces the pace. NSC uses “NSCarbolex” to bridge the gap. It monetizes transition technologies while R&D catches up.

Final Verdict: Nippon Steel is transforming successfully. It is shedding its identity as a Japanese volume producer. It is becoming a global, high-tech materials company. Its survival depends on executing the U.S. and India strategies perfectly. It must do this while holding the line on IP and funding the green transition. The risks are high, but the strategic logic is coherent.

Appendix: Data Tables

Table 3: Global Crude Steel Production Ranking (2024)

| Rank | Company | Tonnage (Mt) | HQ Location |

| 1 | China Baowu Group | 130.09 | China |

| 2 | ArcelorMittal | 65.00 | Luxembourg |

| 3 | Ansteel Group | 59.55 | China |

| 4 | Nippon Steel | 43.64 | Japan |

| 5 | HBIS Group | 42.28 | China |

Source: World Steel Association

Table 4: Key Patent Technologies & Brands

| Brand | Application | Key Benefit |

| NSafe-AUTOLite | Automotive | 1.2 GPa Strength, Weight reduction 92 |

| HILITECORE | EV Motors | High efficiency, Low magnetic loss 93 |

| ZEXEED | Infrastructure | 10x Corrosion Resistance vs GI 94 |

| NSCarbolex | Green Steel | Certified emissions reduction 95 |

| TranTixxii | Design/Architecture | Aesthetics, Durability 96 |

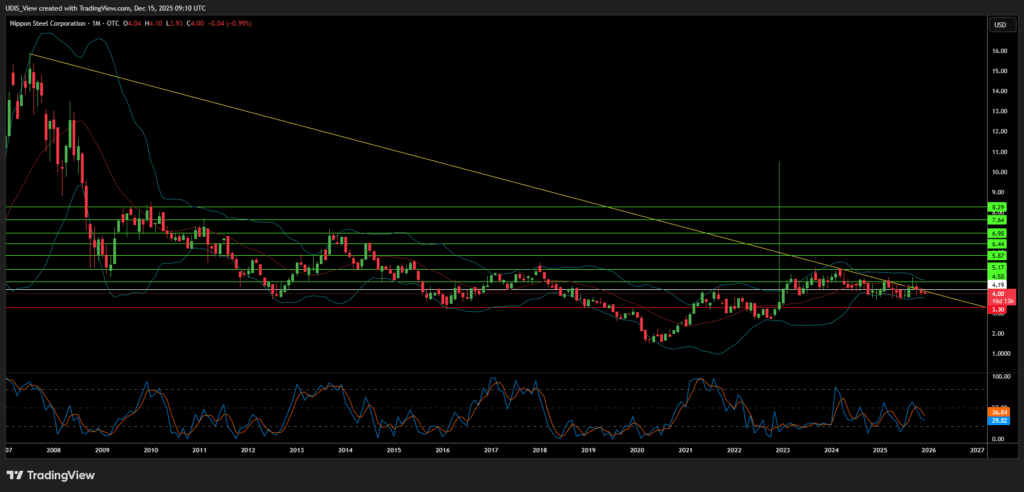

Nippon Steel Long (Buy)

Enter At: 4.19

T.P_1: 4.58

T.P_2: 5.17

T.P_3: 5.87

T.P_4: 6.44

T.P_5: 6.98

T.P_6: 7.64

T.P_7: 8.29

S.L: 3.30