Unpacking Tariff Threat and Its Broad Implications highlights a critical juncture for Japan’s benchmark stock index, heavily influenced by impending US tariff threats. This report provides a robust, evidence-based analysis, drawing upon recent market data, trade negotiation updates, corporate responses, macroeconomic indicators, and geopolitical developments to substantiate and deepen the original claims. The multifaceted nature of the tariff threat extends beyond immediate market reactions, influencing corporate strategy, national economic policy, and critical geopolitical alliances.

Market Response: The Nikkei 225’s Volatility Amidst Tariff Concerns

Nikkei 225 and Topix Index Movements

The Japanese equity market has demonstrated significant sensitivity to US trade policy rhetoric. On June 25, 2025, the Nikkei 225 briefly plunged nearly 9% as investors reacted to US President Donald Trump’s tariff concerns.1 This initial shock was followed by a second consecutive day of losses on July 2, with the Nikkei 225 falling 1.1% to approximately 39,500 and the broader Topix Index declining 0.6% to 2,814, after President Trump threatened a 35% tariff on Japanese imports.2 The Nikkei had previously snapped a five-day winning streak on July 1, underscoring the immediate impact of renewed tariff concerns.2

This rapid and substantial market reaction, even before tariffs were formally imposed, illustrates the forward-looking nature of financial markets. Investors quickly price in perceived future economic disruption, indicating a high level of apprehension and uncertainty regarding trade policy. The magnitude of the initial drop suggests that trade policy is a dominant factor influencing market sentiment in Japan.

The selloff was broad-based, affecting all sectors. Major decliners included technology firms such as Lasertec (-3.5%), Advantest (-4.6%), and SoftBank Group (-2.3%), as well as consumer discretionary giant Nintendo (-2.4%) and industrial heavyweight Mitsubishi Heavy Industries (-3.8%).2 This widespread impact across diverse segments of the Japanese economy indicates that the tariff threat is not isolated to a single sector. Instead, it carries pervasive implications across global supply chains and the entire economic system. The comments from Federal Reserve Chair Jerome Powell, noting that the inflationary impact of President Trump’s tariffs had prevented interest rate cuts, further underscore the broad macroeconomic implications of trade policy.2

While tariffs caused broad declines, market movements are often influenced by multiple factors. For instance, at other times, some technology and consumer stocks, including Advantest (+4.4%), Disco (+2.6%), Lasertec (+2.7%), SoftBank Group (+1.3%), and Nintendo (+6.6%), led gains.3 This suggests that while tariffs represent a significant headwind, other domestic and global factors, such as Japanese manufacturing activity returning to growth in June 2025 and the services sector expanding for a third consecutive month, can also drive market performance.3 Geopolitical concerns, such as reports of potential US strikes on Iran, also contribute to broader market sentiment.3 This indicates that the market’s position at a “precipice” is a result of a confluence of global and domestic dynamics, not solely tariffs.

Performance of iShares MSCI Japan ETF (EWJ) vs. S&P 500

The iShares MSCI Japan ETF (EWJ), a key indicator for Japanese equities, has shown underperformance relative to the S&P 500. As of June 30, 2025, EWJ’s year-to-date (YTD) total return was reported as 13.09% in one section of its overview, but its detailed returns table showed 2.44%.4 In contrast, the S&P 500’s YTD price return as of June 27, 2025, was 12.59%.5 Another source indicated the S&P 500 had an average YTD return of -7.40% in 2025 but noted it had “since normalized” after a “worst start”.6

These numerical variations in reported YTD performance highlight the complexities of real-time market data reporting, where figures can differ based on calculation methodology, reporting time, or specific data points used (e.g., price return vs. total return). However, despite these discrepancies, a consistent observation is that EWJ has underperformed the S&P 500 by 15% YTD, with auto stocks like Toyota and Honda leading the decline.8 This consistent qualitative assessment of relative performance suggests that, irrespective of precise figures, the trend of Japanese market weakness compared to the US market is a robust and persistent theme. The S&P 500’s recovery from a challenging start further emphasizes this relative underperformance of Japanese equities.

The following table summarizes the comparative year-to-date performance:

Comparative Year-to-Date Performance: iShares MSCI Japan ETF (EWJ) vs. S&P 500 (as of June 2025)

| Index/ETF | YTD Performance (as reported) | Relative Performance vs. S&P 500 |

| iShares MSCI Japan ETF (EWJ) | 13.09% / 2.44% 4 | Underperformed by 15% 8 |

| S&P 500 | 12.59% 5 / -7.40% (normalized) 6 | N/A |

US Tariff Threats and Trade Negotiations: Escalating Tensions

Specific Tariff Threats and Deadlines

US President Donald Trump has repeatedly threatened to impose significant tariffs on Japanese goods. He indicated that Japan could face tariffs as high as 35% or more if a trade agreement is not reached by a self-imposed July 9 deadline.9 This statement came as a 90-day suspension period for reciprocal tariffs was set to expire, with no indication of an extension.9 President Trump expressed skepticism about finalizing a deal with Japan before this date and stated his intention not to extend the current pause on tariffs.10 He plans to send letters to multiple countries, including Japan, informing them of the tariff rates they will face without new agreements.10 These proposed tariffs, ranging from 30% to 35%, would significantly surpass the current 10% baseline tariffs in place during negotiations and the 24% tariffs initially imposed in April but subsequently paused.10 This increasing severity of proposed tariffs and the US’s unilateral approach underscores the escalating stakes in trade negotiations.

Key Negotiation Points: Automotive and Agriculture

The core of the trade dispute revolves around two critical sectors: automotive and agriculture.

- Automotive Industry:

Japan’s chief trade negotiator, Ryosei Akazawa, has repeatedly stated that Japan cannot accept the US’s 25% tariffs on cars.11 He emphasized that Japanese automakers produce roughly 3.3 million cars annually in the US, a figure significantly larger than the 1.37 million vehicles they ship there.11 These companies have invested over $60 billion in the US and created 2.3 million local jobs, demonstrating their substantial contribution to the US economy.11 Despite these facts, the Trump administration’s focus on auto tariffs is driven by the trade deficit with Japan.12

The imposition of tariffs has already had tangible effects on Japanese automakers. Toyota Motor Corp. anticipates a ¥180 billion ($1.3 billion) reduction in its operating income due to US tariffs in just two months.13 To manage these costs, Japanese automakers are gradually passing them on to consumers, leading to price hikes on certain US models.14 Toyota, for instance, plans to raise prices on some US models by an average of $270 starting in July, although it attributes this to a routine adjustment, the timing aligns with the tariff impact.15

In response to these tariff challenges, Japanese automakers are implementing strategic shifts towards localization. Honda is considering moving part of its car production from Mexico and Canada to the United States, aiming for 90% of US-sold cars to be manufactured locally.16 This includes shifting CR-V SUV production from Canada and HR-V SUV production from Mexico to the US.16 Toyota is also pursuing aggressive localization of production and research and development expansion in the US to reduce trade risk.13 Its strategy includes a $13.5 billion US battery plant and a target of 75% North American content by 2026 to comply with the US-Mexico-Canada Agreement (USMCA), potentially eliminating up to $15,000 per vehicle in tariffs.17 Toyota has also pivoted to low-inventory, high-margin sales strategies and prioritized hybrids, which now account for 46% of its global sales, to preserve profit margins and avoid the complexities of battery-electric vehicles.17 These strategic adjustments highlight how tariffs compel companies to reconfigure their global operations, profoundly impacting a key industry that employs approximately 5.29 million people in Japan, nearly 10% of its total workforce.18 The automotive sector also represents a significant portion of Japan’s exports, with motor vehicle exports totaling ¥17.3 trillion in 2022.20. The tension between US tariff goals and Japan’s significant economic contribution through local production and job creation remains a central point of contention. - Agricultural Sector:

The US has demanded that Japan import more American rice, soybeans, and maize.11 President Trump specifically claimed that Japan faces a major rice shortage but refuses to accept US rice, using this as leverage in tariff discussions.10 However, Japan’s Chief Cabinet Secretary Yoshimasa Hayashi has firmly stated that Japan has no intention of sacrificing its agricultural sector in response to these demands.21 Hayashi emphasized that Japan will continue “sincere and constructive negotiations” to achieve a mutually beneficial agreement.21

The US rice production forecast for 2025/26 was lowered by 4.9 million hundredweight to 214.4 million, a 3.5% decrease from the previous year, primarily due to excessive spring rainfall in the Delta region.23 Despite this production decrease, total US rice supply is forecast at a record 310.6 million hundredweight, supported by higher beginning stocks and increased imports, which are projected to reach a record 50.7 million hundredweight.23 Globally, rice production is projected at a record 541.6 million tons.23 The US is utilizing agricultural imports as a point of leverage, while Japan faces domestic political sensitivity around protecting its agricultural sector, particularly given the importance of rice in its culture and economy. The broader market dynamics for agricultural commodities, including supply disruptions and geopolitical tensions, could lead to price volatility, as reflected in the Invesco DB Agriculture Fund (DBA).24

Diplomatic Engagements and Setbacks

The escalating trade tensions have also impacted diplomatic relations and security cooperation between the US and Japan. A scheduled annual “2+2” security talk between the allies’ top diplomats and defense chiefs, involving US Secretary of State Marco Rubio and Defense Secretary Pete Hegseth with Japanese Foreign Minister Takeshi Iwaya and Defense Minister Gen Nakatani, was canceled or postponed.25 This occurred after the US reportedly demanded that Tokyo increase its defense budget to 3.5% or even 5% of its GDP, a significant hike from an earlier request of 3%.25 Japanese officials, including Chief Cabinet Secretary Yoshimasa Hayashi, have stated that Japan will not be dictated on defense spending, emphasizing the substance of capabilities over arbitrary figures.25

Further illustrating the intertwined nature of trade and security agendas, Japanese Prime Minister Shigeru Ishiba abruptly canceled his trip to a NATO leaders’ summit in The Hague in June 2025, citing “various circumstances” following US military strikes on Iranian nuclear sites.27 This absence meant a potential meeting between Ishiba and President Trump, where discussions on unilateral tariffs were anticipated, did not occur.27 Other IP4 countries like Australia and South Korea also skipped the summit.27 The US’s demands for increased defense spending among its allies were a prominent theme at the NATO summit, where leaders endorsed a commitment to invest 5% of GDP annually on core defense and security-related spending by 2035.29

Japan has committed to increasing its defense spending to 2% of GDP by fiscal 2027, a significant shift from its historical 1% cap following Russia’s 2022 invasion of Ukraine.30 The budget for fiscal 2025 is ¥8.7 trillion, which is 1.8% of fiscal 2022 GDP and 1.6% of projected fiscal 2025 GDP.31 However, the US continues to press for higher contributions, with some officials suggesting targets of 3% or even 5% of GDP.25 This push for increased defense spending comes amid domestic political considerations in Japan, where previous security legislation changes in 2015 sparked mass protests due to concerns about reinterpreting the pacifist constitution.32 While public opinion has shown some support for strengthening military capabilities in response to perceived threats from China, pushing defense spending too high could incur significant political costs, especially with an Upper House election in July.25 The US’s push for allies to shoulder more defense burdens, while simultaneously imposing trade tariffs, creates a complex dynamic that strains long-standing alliances and highlights a potential strategic divergence in priorities.

Broader Economic and Geopolitical Implications

Japan’s Domestic Economic Vulnerabilities

Japan’s economy faces inherent vulnerabilities that could be exacerbated by the tariff threat. The country’s economy contracted an annualized real 0.2% in the January-March period of 2025, marking the first decline in four quarters.35 Furthermore, Japan’s real wages fell by 1.8% in April from a year earlier, marking the fourth consecutive month of decline, reflecting persistent inflationary pressure outpacing wage growth.36

The International Monetary Fund (IMF) and Bank of Japan (BoJ) have provided their economic outlook for 2025, anticipating growth to pick up to 1.2%, driven by private demand and strengthening real wage growth.37 Inflation is expected to converge to the BoJ’s 2% target in late 2025.37 However, the IMF’s Executive Directors noted that risks are tilted to the downside, including from increased trade tensions.37 The possibility of tariffs from the US, with whom Japan maintains a significant trade surplus, could dampen these positive prospects.38 The current economic situation, characterized by sluggish growth, falling real wages, and rising bankruptcies, makes the economy particularly susceptible to external shocks.38 The tariff threat thus compounds existing economic weaknesses, potentially disrupting the “virtuous cycle of growth” that the government aims to achieve.38

Global Trade Uncertainty and US Policy

The looming tariff threat against Japan is part of a broader pattern of unpredictable US trade policy, contributing to global volatility. US Treasury Secretary Scott Bessent indicated that tariff talks with over a dozen trade partners could extend until September 1, the US Labor Day, shifting from the earlier July 9 deadline.39 President Trump also affirmed the flexibility of the original deadline, stating, “We can do whatever we want. We could extend it, we could make it shorter”.39 While the UK has already secured a trade deal, negotiations are ongoing with the European Union, India, Mexico, and Vietnam.41 However, the abrupt halt of trade discussions with Canada over its digital services tax serves as a reminder of the unpredictable nature of US trade politics.41 This unpredictability creates significant uncertainty for businesses and investors worldwide, making it challenging to formulate definitive responses and long-term strategies.13

Geopolitical Landscape and Alliance Dynamics

The trade disputes are occurring within a complex geopolitical landscape, further impacting alliance dynamics. The US strikes on Iranian nuclear sites, which preceded Prime Minister Ishiba’s cancellation of his NATO summit trip, highlight the broader global security concerns that can suddenly shift diplomatic priorities.27

At the NATO summit, leaders agreed to a significant hike in defense spending, committing allies to invest 5% of GDP annually on core defense and security-related spending by 2035.29 This target, pushed by President Trump, aims to ensure individual and collective obligations are met.29 The US has explicitly pressed its allies, including Japan, South Korea, and NATO members, to shoulder more costs for their defense and for hosting US forces.30 Pentagon spokesman Sean Parnell echoed this sentiment, stating that Europe needs to “step up more for the defense of its own continent”.43 This push for allies to increase defense spending, coupled with reductions in US military assistance to Ukraine due to domestic stock levels 43, signifies a shifting burden within alliances. The US’s approach to its allies, characterized by demands for increased financial contributions alongside trade pressures, suggests a re-evaluation of traditional alliance commitments and a potential strategic divergence in priorities, where economic and security agendas are increasingly intertwined.

Conclusion

The analysis indicates that the tariff threat poses a substantial and multifaceted challenge to Japan, impacting its financial markets, key industries, and diplomatic relations with the United States. The Nikkei 225’s immediate and sharp declines in response to tariff rhetoric underscore the market’s sensitivity and forward-looking nature, reflecting deep investor concern over potential economic disruption. The broad-based nature of the selloff, affecting diverse sectors, highlights the pervasive interconnectedness of global supply chains and the wide-ranging implications of trade policy. While other factors also influence market performance, the consistent underperformance of Japanese equities relative to the S&P 500 underscores the disproportionate impact of these trade tensions on Japan.

The US’s escalating tariff threats, particularly the proposed 30-35% duties and the firm July 9 deadline, represent a significant increase in stakes. This unilateral approach forces Japanese industries, especially the critical automotive sector, to undertake costly strategic shifts towards localization and product re-prioritization to mitigate tariff impacts. Concurrently, the US’s demand for increased agricultural imports, particularly rice, creates domestic political challenges for Japan, which is committed to protecting its agricultural sector.

Furthermore, the trade disputes have demonstrably strained diplomatic engagements, as evidenced by the cancellation of key security talks and the Japanese Prime Minister’s absence from the NATO summit. The US’s persistent demands for higher defense spending from its allies, including Japan, at times reaching 5% of GDP, signal a re-evaluation of alliance burdens. This occurs against a backdrop of Japan’s own commitment to increase defense spending to 2% of GDP by 2027, a target already pushing against domestic political and economic constraints.

In synthesis, Japan stands at a precarious economic and geopolitical juncture. The tariff threat exacerbates existing domestic economic vulnerabilities, including a recent GDP contraction and declining real wages, threatening to derail a fragile recovery. The unpredictable nature of US trade policy contributes to global volatility, making it difficult for businesses and governments to plan effectively. The interplay of economic pressure and security demands from the US is reshaping the dynamics of the US-Japan alliance, compelling Japan to navigate a complex environment where its economic stability and strategic autonomy are simultaneously challenged. The broad implications suggest a period of continued uncertainty and strategic adjustments for Japan in its international economic and security relationships.

References

- Nikkei 225 plunges on Trump tariff concernsーNHK WORLD-JAPAN NEWS – YouTube, accessed July 2, 2025, https://www.youtube.com/watch?v=isX4-ycLir4

- Japanese Shares Drop as Trump Threatens 35% Tariff – Equityworld Futures Portal News, accessed July 2, 2025, https://www.ewfpro.com/index.php/en/market/128-market-update-nikkei/94522-japanese-shares-drop-as-trump-threatens-35-tariff

- Asian Stocks Fall on Earnings Concern – Trading Economics, accessed July 2, 2025, https://tradingeconomics.com/articles/02042008200643.htm

- iShares MSCI Japan ETF | EWJ, accessed July 2, 2025, https://www.ishares.com/us/products/239665/ishares-msci-japan-etf

- S&P 500® | S&P Dow Jones Indices – S&P Global, accessed July 2, 2025, https://www.spglobal.com/spdji/en/indices/equity/sp-500/

- S&P 500: historical performance from 1992 to 2025 – Curvo, accessed July 2, 2025, https://curvo.eu/backtest/en/market-index/sp-500

- S&P500 YTD Performance by Year – Current Market Valuation, accessed July 2, 2025, https://www.currentmarketvaluation.com/quick-charts/s&p-ytd-performance.php

- The Rice Tariff Rumble: How Japan’s Stance Could Shake Agri-Commodities and Auto Stocks – AInvest, accessed July 2, 2025, https://www.ainvest.com/news/rice-tariff-rumble-japan-stance-shake-agri-commodities-auto-stocks-2507/

- President Warns Japan of 35% Tariffs as Trade Deadline Looms – AInvest, accessed July 2, 2025, https://www.ainvest.com/news/president-warns-japan-35-tariffs-trade-deadline-looms-2507/

- Donald Trump threatens to raise tariffs again on Japan – Eurasia Business News, accessed July 2, 2025, https://eurasiabusinessnews.com/2025/07/01/donald-trump-threatens-to-raise-tariffs-again-on-japan/

- Japan can’t accept 25% car tariffs, Akazawa reiterates – The Japan Times, accessed July 2, 2025, https://www.japantimes.co.jp/business/2025/06/26/economy/japan-trade-negotiator-car-tariffs/

- How the U.S. Auto Industry Can Increase Its Market Access in Japan, accessed July 2, 2025, https://www.middlebury.edu/institute/sites/default/files/2023-08/G%20Struck%20WP-Auto%20Parts%20to%20Japan%202023.pdf

- Toyota profit hit by $1.3 billion after tariffs – Nasdaq, accessed July 2, 2025, https://www.nasdaq.com/articles/toyota-profit-hit-13-billion-after-tariffs

- Tariff pressures force Japanese carmakers to hike prices | The DONG-A ILBO, accessed July 2, 2025, https://www.donga.com/en/article/all/20250702/5698078/1

- Tariff Talk: Toyota To Raise Prices On Certain U.S. Models – CarPro, accessed July 2, 2025, https://www.carpro.com/blog/tariff-talk-toyota-to-raise-prices-on-certain-u.s.-models

- Honda will manufacture 90% of its sales in the U.S. – MEXICONOW, accessed July 2, 2025, https://mexico-now.com/honda-will-manufacture-90-of-its-sales-in-the-u-s/

- Toyota’s Tariff Tactics: A Strategic Shift to High Margins and Long-Term Dominance – AInvest, accessed July 2, 2025, https://www.ainvest.com/news/toyota-tariff-tactics-strategic-shift-high-margins-long-term-dominance-2506/

- www.progressiverecruitment.com, accessed July 2, 2025, https://www.progressiverecruitment.com/en-jp/knowledge-hub/industry-insights/automotive-industry-trend-future/#:~:text=The%20Japanese%20automotive%20market%20is,10%25%20of%20Japan’s%20total%20workforce.

- The Inside Story of Manufacturing and Operations in Japan (2019), accessed July 2, 2025, https://www.hays.co.jp/en/theinsidestory/hays_2054100

- Japan Automobile Manufacturers Association, Inc., accessed July 2, 2025, https://www.jama.or.jp/english/reports/docs/MIoJ2023_e.pdf

- Japan says not to sacrifice agriculture amid U.S. rice import pressure – China.org, accessed July 2, 2025, http://www.china.org.cn/world/Off_the_Wire/2025-07/01/content_117956354.shtml

- Japan says not to sacrifice agriculture amid U.S. rice import pressure – Macau Business, accessed July 2, 2025, https://www.macaubusiness.com/japan-says-not-to-sacrifice-agriculture-amid-u-s-rice-import-pressure/

- US rice production forecast lowered amid excessive Delta rainfall – Feed & Grain, accessed July 2, 2025, https://www.feedandgrain.com/business-markets/commodities/news/15748755/us-rice-production-forecast-lowered-amid-excessive-delta-rainfall

- Invesco DB Agriculture Fund Stock Price: Quote, Forecast, Splits & News (DBA) – Perplexity, accessed July 2, 2025, https://www.perplexity.ai/app/finance/DBA

- Japan scraps ‘two-plus-two’ meeting with U.S. over defense spending demand, report says, accessed July 2, 2025, https://www.japantimes.co.jp/news/2025/06/21/japan/politics/japan-us-two-plus-two-cancelled/

- Japan scraps US meeting after Washington demands more defence spending, accessed July 2, 2025, https://www.straitstimes.com/asia/east-asia/japan-scraps-us-meeting-after-washington-demands-more-defense-spending

- Ishiba to skip key NATO summit following Iran strikes – The Japan Times, accessed July 2, 2025, https://www.japantimes.co.jp/news/2025/06/23/japan/politics/ishiba-nato-trip/

- Why Did Japan Skip the NATO Summit? – The Diplomat, accessed July 2, 2025, https://thediplomat.com/2025/06/why-did-japan-skip-the-nato-summit/

- NATO leaders agree to hike military spending and restate ‘ironclad commitment’ to collective defense if attacked – PBS, accessed July 2, 2025, https://www.pbs.org/newshour/world/nato-leaders-agree-to-hike-military-spending-and-restate-ironclad-commitment-to-collective-defense-if-attacked

- Japan to boost defense spending to 1.8% of GDP, reaching $70 billion this fiscal year, accessed July 2, 2025, https://www.aa.com.tr/en/asia-pacific/japan-to-boost-defense-spending-to-18-of-gdp-reaching-70-billion-this-fiscal-year/3538701

- Japan Targets 2% Defense Spending | Nippon.com, accessed July 2, 2025, https://www.nippon.com/en/japan-data/h02457/japan-targets-2-defense-spending.html

- Massive Protest Against Japanese Military Legislation – VOA, accessed July 2, 2025, https://www.voanews.com/a/massive-protest-against-japanese-military-legislation/2938322.html

- Japanese anti-war protesters take to the streets, but they’re not likely to win this battle, accessed July 2, 2025, https://theworld.org/stories/2015/08/31/sundays-protest-japan-was-one-biggest-yet

- Japan’s Remilitarization Struggle Since the Shinzo Abe’s Leadership – Ejournal FISIP Unjani, accessed July 2, 2025, https://ejournal.fisip.unjani.ac.id/index.php/JGSS/article/download/1642/417

- Japan’s Q1 GDP contraction revised up to annualized real 0.2 pct – NAMPA, accessed July 2, 2025, https://www.nampa.org/text/22653530

- Japan’s real wages fall for 4th month in April – NAMPA, accessed July 2, 2025, https://www.nampa.org/text/22650760

- IMF Executive Board Concludes 2025 Article IV Consultation with Japan, accessed July 2, 2025, https://www.imf.org/en/News/Articles/2025/04/01/pr25084-japan-imf-executive-board-concludes-2025-article-iv-consultation-with-japan

- Japan: Economic Update – 2024 in review and prospects for 2025, accessed July 2, 2025, https://www.mfat.govt.nz/en/trade/mfat-market-reports/japan-economic-update-2024-in-review-and-prospects-for-2025

- US trade talks may extend until Sept. 1: Treasury secretary – Anadolu Ajansı, accessed July 2, 2025, https://www.aa.com.tr/en/americas/us-trade-talks-may-extend-until-sept-1-treasury-secretary/3615881

- US Expects to Finalize Trade Deals by Labor Day in September – Bessent – NAMPA, accessed July 2, 2025, https://www.nampa.org/text/22671939

- Five Risks for Stocks That Will Cloud the Outlook for the Second Half – TradeAlgo, accessed July 2, 2025, https://www.tradealgo.com/news/five-risks-for-stocks-that-will-cloud-the-outlook-for-the-second-half

- Nato members confirm defence and security spend to hit 5% of GDP by 2035 | BBC News, accessed July 2, 2025, https://www.youtube.com/watch?v=KjXMvmDhy_g

- US won’t send some weapons pledged to Ukraine following a Pentagon review of military aid – Star Tribune, accessed July 2, 2025, https://www.startribune.com/us-wont-send-some-weapons-pledged-to-ukraine-following-a-pentagon-review-of-military-assistance/601384985

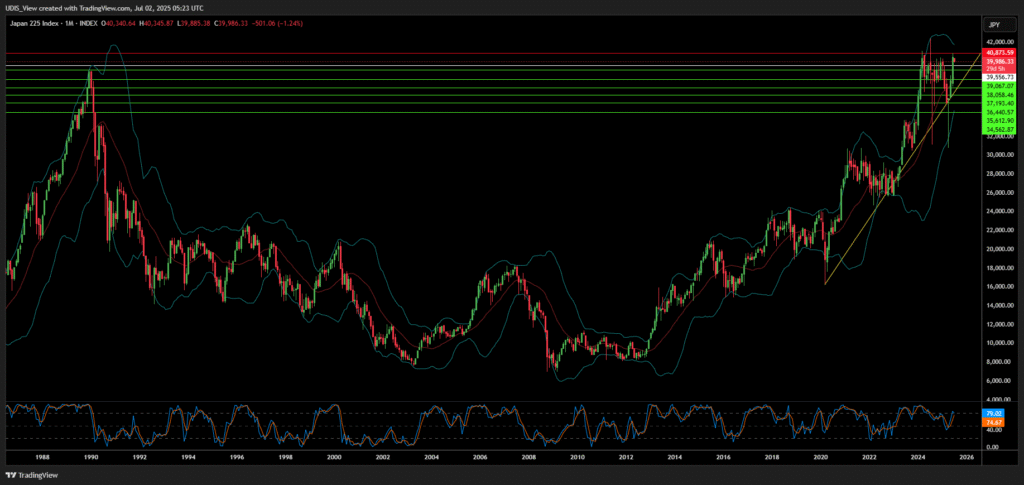

Nikkei 225 Short (Sell)

Enter At: 39556.73

T.P_1: 39067.07

T.P_2: 38058.46

T.P_3: 37193.40

T.P_4: 36440.57

T.P_5: 35612.90

T.P_6: 34562.87

S.L: 40873.59