A New Era for Network Security

NetScout Systems, Inc. (NASDAQ: NTCT) operates at a crucial intersection of network performance and cybersecurity. The company’s unique position has garnered attention from financial analysts. For example, B. Riley analysts recently reiterated a “Buy” rating for NetScout, setting a $33 price target. This positive sentiment directly stems from the company’s readiness to capitalize on the increasing integration of artificial intelligence (AI) within both network monitoring and network security sectors. The analysis presented here explores the underlying factors driving this optimistic outlook, moving beyond surface-level financial metrics to reveal the company’s intrinsic value and strategic foundations.

The market environment is at a critical inflection point. As of the first half of 2025, NetScout’s research found that Distributed Denial-of-Service (DDoS) attacks have surged, with over 8 million attacks monitored globally, including more than 3.2 million in the EMEA region. This escalation confirms a perfect storm of unprecedented cyber risk for organizations worldwide. The confluence of rapidly advancing technologies and evolving regulations is contributing to significant complexity in cyberspace, with the stakes for businesses having never been higher.1 This article provides a comprehensive assessment of NetScout’s strategic position, technological advantages, and financial health, contextualized against this escalating threat landscape.

The Macro-Cyber and Economic Battlefield

Geopolitics and the Cyber Arms Race

Geopolitical conflicts are not isolated events; they are a primary catalyst for innovation in cyberattacks.2 State-sponsored attacks often unveil sophisticated new tactics, which are then quickly adopted and commoditized by hacktivist groups and cybercriminals.2 NetScout’s own data illustrates this phenomenon, highlighting how conflicts like the India-Pakistan and Iran-Israel tensions triggered thousands of attacks against government and financial sectors. This proliferation of tools, including “DDoS-for-hire” services, has democratized the ability to launch devastating attacks, making even novice actors a formidable threat to critical infrastructure.

Independent research corroborates this escalation. Cloudflare’s Q2 2025 DDoS threat report revealed a record-breaking attack volume. Cloudflare’s automated systems blocked a staggering 27.8 million DDoS attacks in the first half of 2025 alone, a number equivalent to 130% of all attacks blocked during the entire year of 2024.3 This includes monumental attacks that peaked at 7.3 terabits per second (Tbps) and 4.8 billion packets per second (Bpps).3 The data from these separate reports clearly indicates that the threat is no longer theoretical; it is a global, escalating crisis that drives non-discretionary demand for robust cybersecurity solutions.

The Economics of Defense

The growing threat landscape has a direct impact on corporate and government spending. Analysts and market reports cite the increasing frequency and sophistication of cyberattacks as a primary driver of market growth.4 The global DDoS protection and mitigation market, for instance, is projected to grow from USD 4.34 billion in 2025 to over USD 13.90 billion by 2034, representing a robust compound annual growth rate (CAGR) of 13.81%.6

However, market growth is not without its challenges. Key industry restraints include a lack of cybersecurity professionals and budget constraints, particularly for small- and medium-sized enterprises.4 This dynamic strengthens the position of companies like NetScout. Its AI-enhanced and automated solutions act as force multipliers, handling the “heavy lifting” of data analysis and threat response.7 This approach allows understaffed security teams to focus on complex, high-stakes issues. NetScout’s business model and target customer base, which are centered on large enterprises and service providers with the requisite budget and scale, directly address these market limitations, positioning the company to capture the most profitable segment of the market.

The NetScout Value Proposition

Who Are the Customers? A High-Value Base

NetScout’s customer base is a key indicator of its stability and future potential. The company services a high-value clientele across critical infrastructure sectors, including government, healthcare, financial services, energy and utilities, and telecommunications.9 These organizations rely on digital services and seamless connectivity for their operations, making network security and performance non-negotiable.10 While a historical revenue breakdown from fiscal year 2018 showed a balanced split between enterprise and service provider customers at 50% each, 11, a more recent analysis from Q1 FY26 reveals a significant divergence. During this period, the enterprise vertical saw revenue grows by a remarkable 17.7% year-over-year, accounting for 59% of total revenue. Conversely, the service provider vertical experienced a 5.6% decline, comprising 41% of total revenue.12

This performance divergence presents an important consideration for investors. While market reports show telecommunications and service providers are frequent targets of DDoS attacks, NetScout’s recent growth is disproportionately driven by its enterprise clients.3 This may indicate that the service provider segment is either facing intense competition, experiencing temporary fluctuations in large contract renewals, or lagging in its adoption of new solutions. NetScout’s strong and diversified customer base, with no single client accounting for more than 10% of revenue in Q1 FY26, provides a degree of resilience despite this vertical-specific trend 12

The Working Method: The Power of Smart Data

NetScout’s core technological advantage lies in its unique working method. The company’s foundation rests on patented technologies, particularly Adaptive Service Intelligence (ASI) and Deep Packet Inspection (DPI).13 Its solutions are designed to be “agent-less” and “non-intrusive,” meaning they do not disrupt network operations.13 Instead, they passively analyze raw network traffic, transforming it into highly scalable, actionable “smart data.”.13 This process provides a comprehensive, real-time, and historical view of the entire service-delivery network infrastructure, enabling IT teams to assure application performance and secure against threats.13

The power of this method is its ability to provide “pervasive visibility” across complex hybrid environments, from data centers to private and public clouds.13 By converting raw traffic into rich metadata, NetScout allows its customers to understand the performance and usage of their digital assets, a critical requirement for a successful digital transformation.15 This approach facilitates faster troubleshooting, reduces Mean Time To Know (MTTK) and Mean Time To Respond (MTTR) from days to minutes, and provides a singular view of network performance, security, and application delivery.9

Innovations in AI and Automation

NetScout strategically leverages AI to enhance its core products and address the escalating sophistication of modern threats. The company has integrated AI and machine learning (ML) into its Arbor DDoS protection suite, allowing the system to proactively detect, analyze, and mitigate threats.18 This intelligent approach allows the platform to learn from and adapt to new threats, neutralizing even the most sophisticated attacks.18 The system is also continuously informed by the ATLAS Intelligence Feed (AIF), a global threat intelligence source that provides unmatched visibility into internet traffic and attack activity 18

Another key innovation is the Omnis AI Insights solution, which is built on the company’s DPI technology.17 This platform generates a curated, high-fidelity dataset that is primed for AI/ML models.17 By providing this “high-octane fuel” for AI-powered analytics, the solution streamlines and automates data analysis, uncovers historical operational patterns, and refines risk mitigation.17 These curated data streams can be ingested into data lakes or seamlessly streamed to technology partners like Splunk and ServiceNow, reducing operational challenges and freeing up valuable time for security professionals.17 The company’s focus on automation directly responds to the industry’s cybersecurity skills gap, allowing a smaller workforce to achieve a higher degree of security.1

| Metric | Q1 FY26 Financial Highlights |

| Total Revenue | $186.75 million 20 |

| YoY Revenue Growth | 7% 12 |

| Non-GAAP Diluted EPS | $0.34 12 |

| YoY EPS Growth | 21.4% 12 |

| Gross Profit Margin | 78.7% 20 |

| Operating Profit Margin | 14.2% 20 |

Revenue Breakdown

| Q1 FY26 Revenue Breakdown | Revenue Contribution | YoY Growth |

| Enterprise Vertical | 59% 12 | 17.7% 12 |

| Service Provider Vertical | 41% 12 | -5.6% 12 |

| Geographic – United States | 54% 12 | N/A |

| Geographic – International | 46% 12 | N/A |

The Intellectual Property Fortress

Patents as a Strategic Asset

A strong patent portfolio is not a mere collection of documents; it is a critical source of a company’s defensible value. Patents are designed to prevent other companies from using an invention without permission, effectively acting as an international legal framework that protects a company’s core technological innovations. While a comprehensive, current list of NetScout’s patents is not readily available, a detailed legal case provides a powerful proxy for the value and defensibility of its intellectual property.

The Litigation as a Case Study

The legal case, Packet Intelligence LLC v. NetScout Systems, Inc., offers a unique window into the strategic importance of NetScout’s IP.21 The dispute centered on foundational technology for monitoring network packets.21 The patents in question – U.S. Patents: 6,665,725, U.S. Patents: 6,665,725, Patent 6,839,751, and 6,954,789 – described a method for identifying and classifying “conversational flows,” a technology that provides application-specific views of network traffic.21 The jury found that NetScout had willfully infringed all claims, rejected its invalidity defenses and awarded damages.21

Although a federal appeals court later reversed the pre-suit damages award on a legal technicality related to a marking requirement, the core finding of infringement was affirmed.21 This litigation confirms that NetScout’s underlying “working method” is valuable enough to be contested in court. The willingness of a competitor to challenge NetScout over its use of this packet monitoring technology validates the significance of the company’s intellectual property. The patents are not abstract; they protect a core element of its network monitoring capabilities, making them a critical, tangible asset for the company.

Navigating the Competitive Arena

The Complex Competitive Landscape

The cybersecurity market is fragmented and intensely competitive. NetScout’s position varies depending on the specific market segment. In the DDoS mitigation space, NetScout competes with major players like Cloudflare, Akamai, Radware, and Imperva.23 While these companies offer strong DDoS protection, NetScout is specifically recognized for providing “hybrid, adaptable DDoS solutions.”.23. This highlights its specialization in a crucial niche.

In the broader Application Performance Monitoring (APM) category, NetScout’s market share is a relatively small 2.82%, particularly when compared to companies like New Relic, which holds a dominant 76.47% share.24 This suggests that NetScout’s strength lies in a specialized, high-value niche rather than broad market dominance. The company also engages in strategic partnerships, or “co-opetition,” with other major players. For instance, NetScout has certified integrations with Palo Alto Networks, allowing security teams to leverage their combined platforms for a unified view of security events.19 This approach allows NetScout to extend its reach by integrating its specialized capabilities into other companies’ broader security stacks.

| Source | Market Size in 2025 | Market Size by 2034 | CAGR (2025-2034) |

| Precedence Research 6 | $4.34 billion | $13.90 billion | 13.81% |

| Market Research Future 25 | $18.36 billion | $58.11 billion | 13.65% |

Can NetScout Be a Major Player? A Nuanced Answer

The question of whether NetScout can become a major player in cybersecurity requires a nuanced answer. The company does not operate as a broad-market leader like Palo Alto Networks, which is recognized for its next-generation firewalls.26 Similarly, it does not hold a top position in the overall observability platforms market, a category in which Dynatrace has been named a leader.27

Instead, NetScout’s value is concentrated in a specialized, high-performance niche. The company has been named a “Technology Leader” and “Ace Performer” in DDoS mitigation, an area where it has a clear and validated competitive advantage.18 This focused leadership, supported by its proprietary DPI technology and deep expertise, makes it a critical and formidable player in a high-stakes segment of the market. Its strength lies in depth and specialization, not in market breadth, which is precisely why it can successfully serve high-value customers who demand the most advanced and resilient solutions.

The Asia-Pacific Growth Strategy

NetScout has a significant global presence, with international markets contributing a substantial 46% of its revenue in Q1 FY26.12. This is particularly relevant given the rapid growth of the Asia-Pacific (APAC) cybersecurity market. The APAC market is projected to reach over $146 billion by 2030, with a robust 15.9% CAGR from 2025 to 2030.28 The region is a high-growth environment for cybersecurity due to its rapid digitalization, large user base, and increasing adoption of cognitive technologies like AI and the Internet of Things (IoT).28

NetScout’s strategic focus on AI-driven analytics, 5G network visibility, and adaptable hybrid solutions is perfectly aligned with the emerging trends in the APAC region.29 For example, the company’s expertise in securing complex 5G network slices and its ability to provide comprehensive visibility for cloud-based applications directly address key challenges faced by organizations in this market.29 This strategic alignment positions NetScout to capture a larger share of the region’s burgeoning market, potentially offsetting any temporary weakness in other customer segments.

Corporate Health and Strategic Vision

Current Financial Performance and Growth Drivers

NetScout’s recent financial results reflect its strategic momentum. In Q1 FY26, the company reported revenue of $186.75 million, a 7% year-over-year increase.20 Product revenue was particularly strong, surging by 19.3% and indicating robust demand for the company’s core technology.12 The company also reported a non-GAAP diluted earnings per share (EPS) of $0.34, exceeding analyst forecasts and reflecting a 21.4% year-over-year increase, partially due to cost management and restructuring initiatives from the previous fiscal year.12 The company’s financial position is solid, with a healthy balance sheet that has more cash than debt, and strong gross profit margins of nearly 79%.20 Analysts have suggested the stock appears undervalued, with a 3-year stock return forecast of 6.0%.30

The Strategic Plan and Timeline

NetScout’s strategic plan is anchored in its commitment to innovation and technological leadership.10 The company’s inferred vision is to be a leader in providing pervasive visibility and analytics for the connected world, empowering organizations to innovate and compete effectively.10 To achieve this, NetScout has identified several key strategic priorities: accelerating its cybersecurity revenue growth, continuing to innovate its Arbor DDoS protection using AI/ML, and expanding its market presence.10 The company’s long-term commitment to this vision is evidenced by its significant investment in research and development, which totaled $229.7 million in fiscal year 2024.10

Organizational Capacity and Potential

As of recent data, NetScout’s employee count ranges from approximately 2,273 to 3,000 employees located across more than 50 regional offices.11 While a specific developer count is not available, the company’s output potential is not solely defined by a raw number. Its approach to development is rooted in a structured Secure Software Development Lifecycle (SDLC) model.33 This process incorporates security by design throughout all phases of product development, ensuring that products are resilient and well-defended against vulnerabilities.33 NetScout’s developers and testers receive regular security training, and all products undergo rigorous automated and manual security scans before release.33 This emphasis on quality, security, and consistent process ensures that the company’s output is of a high standard, a critical value driver for its high-stakes customer base in government and critical infrastructure.

Conclusion: A Resilient Player in a High-Stakes Game

The analysis of NetScout’s business reveals a company strategically positioned to capitalize on a market defined by geopolitical instability and technological evolution. NetScout’s recent growth is not accidental; it is a direct consequence of the company’s ability to provide essential solutions in a world where cyber threats have become a constant, non-discretionary risk. The company’s financial performance, particularly the strong growth in its enterprise segment and product revenue, validates its strategic focus.

NetScout’s core strengths are clear. It possesses a high-value customer base in critical sectors, a patented technological advantage rooted in its unique DPI and smart data methodologies, and a recognized leadership position in the high-growth DDoS mitigation niche. Furthermore, its proactive investment in AI and automation directly addresses the industry’s cyber skills gap, effectively positioning its technology as a force multiplier for its clients. NetScout is not a major broad-market player, but its depth and specialization make it a dominant and essential force. Its focus on providing AI-enhanced, hybrid solutions for large, global enterprises places it in an excellent position to capitalize on the continued escalation of global cyber threats and the ongoing demand for network visibility.

Refferences

- Geopolitical tensions, AI, and more are complicating the …

- How Geopolitics Impacts Your Company’s Cybersecurity Risk – Paid Program

- Hyper-volumetric DDoS attacks skyrocket: Cloudflare’s 2025 Q2

- Cybersecurity Market Size, Share, Analysis | Global Report 2032 – Fortune Business Insights

- Cybersecurity Market Size, Share, Growth & Forecast [2030]

- DDoS Protection and Mitigation Market Size to Hit USD 13.90 Bn by 2034

- What Is AI in Cybersecurity? – Sophos,

- AI in Cybersecurity: How AI is Changing Threat Defense – Syracuse University’s iSchool

- Voice of the Customer – Visibility | NETSCOUT

- Mission Statement, Vision, & Core Values (2025) of NetScout

- NETSCOUT Overview, Vision and Strategy PowerPoint Presentation, free download – ID:8844237 – SlideServe

- NetScout Systems, Inc. (NTCT) Stock Price, Market Cap, Segmented Revenue & Earnings

- Understanding NETSCOUT Products

- Insights from the SPARK Matrix™: Network Observability – Q3 2025 Report | NETSCOUT

- THE DATA AVALANCHE CHALLENGE WITHIN DIGITAL TRANSFORMATION – Netscout

- Voice of the Customer | NETSCOUT

- AI Data Curation – Omnis AI Insights Solution | NETSCOUT

- In the Fight Against DDoS, NETSCOUT Emerges as a Top Contender in the Q3 2025 SPARK Matrix

- Technology Partners – NETSCOUT Integrations

- Earnings call transcript: NetScout beats EPS forecast in Q1 2025

- Packet Intelligence LLC v. NetScout Systems, Inc., No. 19-2041

- Patent Case Summaries | Week Ending July 17, 2020, | News & Insights | Alston & Bird

- 9 Best DDoS Protection Service Providers in 2025 – eSecurity Planet

- www.6sense.com

- Ddos Protection Mitigation Market Size, Share, Report 2034

- Compare NETSCOUT Omnis Security vs. Palo Alto Networks AutoFocus in 2025 – Slashdot

- 2025 Gartner® Magic Quadrant™ for Observability Platforms – Dynatrace

- Asia Pacific Cyber Security Market Size & Outlook, 2030 – Grand View Research

- Top 5 Cybersecurity Trends to Watch in 2025 | Managed Security Service Provider

- VIAV or NTCT – With 6.0% Return Forecast, NTCT Probably Deserves Your Money | Trefis

- NetScout Systems, Inc. (NTCT) SEC Filings 2025: Financial Reports …

- NetScout Systems (NTCT) Competitors and Alternatives 2025 – MarketBeat

- Security Development Lifecycle | NETSCOUT

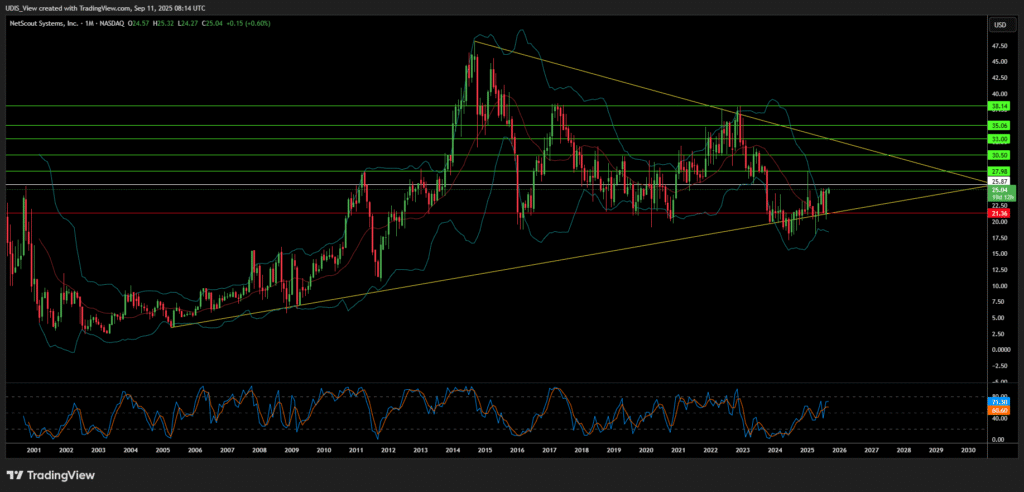

NetScout Long (Buy)

Enter At: 25.87

T.P_1: 27.98

T.P_2: 30.50

T.P_3: 33.00

T.P_4: 35.06

T.P_5: 38.14

S.L: 21.36