1. The Geopolitical Pivot to the Deep

The global security architecture is shifting. For decades, naval supremacy meant aircraft carriers and destroyers. The surface was the focus. That era is ending. The new frontier is the seabed. Critical infrastructure now lies thousands of meters underwater.

Energy pipelines traverse vast ocean floors. Data cables carry 97% of the world’s internet traffic. These assets are the arteries of the modern global economy. Yet, they remain largely undefended. This vulnerability is now a central concern for NATO. It is a priority for global defense ministries. It is the single greatest driver for the rise of Kraken Robotics 1.

Kraken Robotics (TSX-V: PNG, OTCQB: KRKNF) has seized this moment. The company has evolved rapidly. It is no longer just a sensor manufacturer. It is a vertically integrated provider of subsea intelligence. Its technology makes the ocean transparent. It allows navies to see threats in real-time. It allows energy companies to inspect assets with millimeter precision. The market has recognized this transformation. The stock price has surged over 1,000% since 2023.1 This is not a speculative bubble. It is a fundamental re-rating of a critical defense asset.

The company operates at the intersection of three megatrends. First is the weaponization of the seabed. Sabotage events like the Nord Stream blasts changed everything.2 Second is the global energy transition. Offshore wind farms are multiplying. They require constant subsea monitoring.3 Third is the technological obsolescence of legacy sonar. Old systems are too slow and too blurry. Kraken’s Synthetic Aperture Sonar (SAS) changes the physics of imaging.4

This report analyzes Kraken’s ascent by dissecting the financial metrics driving its valuation and exploring the physics behind its technological moat. In addition to evaluating the geopolitical forces filling its order book, the evidence suggests Kraken is building a monopoly on subsea clarity, effectively becoming the operating system for the blue economy.

2. Financial Velocity: Analyzing the Valuation Reset

2.1 The 1,000% Market Re-Rating

Kraken’s stock performance is an outlier. Gaining 1,000% in two years attracts attention.5 Wall Street is waking up. The catalyst was a shift in execution reliability. Historically, small defense contractors suffer from lumpy revenue. Kraken broke this pattern. They delivered consistent, high-growth quarters. They proved the scalability of their model.

Investors are rewarding this consistency. The market capitalization now exceeds $1.3 billion.6 This is a crucial threshold. It opens the door to institutional capital. Pension funds and large asset managers can now invest. The liquidity risks associated with “penny stocks” have vanished. The recent $115 million bought deal financing confirmed this.7 Major institutions bought in. They validated the company’s long-term strategy.

The valuation multiple has expanded. This is rational. High-growth defense tech commands a premium. Kraken is growing faster than its peers. It is profitable, unlike many high-tech disruptors. The “Rule of 40” (Growth + Margin) is a key metric here. Kraken exceeds it comfortably.

2.2 Revenue Growth Vectors

The top-line numbers are robust. Q3 2025 revenue hit $31.3 million.7 This represents a 60% year-over-year increase.7 This is not a one-off spike. It is part of a sustained trend. Management guidance for fiscal 2025 forecasts up to $135 million in revenue.7 This would be a 40% annual growth rate.

Three engines drive this growth. The first is product sales. NATO navies are buying KATFISH systems. They are buying SeaPower batteries. These are large, capital-intensive contracts. The second engine is services. This is the “Robotics-as-a-Service” (RaaS) model. Customers pay for data, not hardware. This revenue is recurring and sticky. The third engine is acquisitions. The purchase of 3D at Depth added immediate cash flow.8

2.3 Margin Expansion and Profitability

Growth is worthless without profit. Kraken understands this. The company is aggressively expanding margins. Gross profit margin reached 59% in Q3 2025.7 This is an elite figure for a hardware-involved business. It indicates pricing power. It shows that customers value the unique data Kraken provides. They are willing to pay a premium for it.

Adjusted EBITDA is following suit. It grew 92% year-over-year to $8.0 million in the recent quarter.7 The EBITDA margin is now 25.5%.7 This creates a flywheel effect. Profits generate cash. Cash funds R&D. R&D creates better products. Better products command higher margins. Kraken has entered this virtuous cycle.

2.4 Balance Sheet Fortress

Financial stability is a strategic weapon. Kraken holds $126.6 million in cash.7 Working capital sits at $193.9 million.7 This war chest is significant. It allows Kraken to bid on massive contracts. Large defense primes need to know their suppliers are stable. Kraken’s balance sheet provides that assurance.

The company is debt-light. Total debt is a fraction of cash reserves. This is prudent in a high-interest-rate environment. It minimizes interest expense. It maximizes net income. The company has the capital to weather storms. It also has the dry powder to acquire competitors.

2.5 Analyst Consensus and Targets

The financial community is bullish. Six analysts cover the stock.9 All have positive ratings. The consensus is a “Buy”.9 The average price target is C$6.29. This implies significant upside from current levels. Some targets go as high as C$7.50.9

These analysts cite several factors. They like the defense tailwinds. They appreciate the recurring service revenue. They see the NASDAQ uplisting as a catalyst. An uplisting would increase visibility. It would likely drive further multiple expansion.

Table 1: Key Financial Metrics Q3 2025 vs Q3 2024

| Metric | Q3 2025 | Q3 2024 | Change |

| Revenue | $31.3M | $19.6M | +60% |

| Gross Profit | $18.6M | $10.3M | +81% |

| Gross Margin | 59% | 52% | +700 bps |

| Adj. EBITDA | $8.0M | $4.1M | +92% |

| Net Income | $3.3M | $1.6M | +106% |

| Cash | $126.6M | $14.9M | +750% |

Data Source: Kraken Robotics Q3 2025 Financial Results 7

3. Geostrategic Analysis: The Battle for the Seabed

3.1 The New Iron Curtain

A new Iron Curtain has descended. It lies on the ocean floor. The conflict between NATO and Russia has moved subsea. The sabotage of the Nord Stream pipeline was the turning point. It proved that energy infrastructure is a target. It showed that the seabed is a grey zone warfare domain.

Russia has invested heavily in seabed warfare. They possess specialized submarines. They operate the GUGI directorate for deep-sea research. This unit is tasked with tampering with cables. They map Western infrastructure. They prepare the battlefield for future conflict. NATO was caught unprepared. The alliance lacked persistent subsea surveillance.

3.2 NATO’s Critical Response

NATO is now playing catch-up. The alliance has launched the Critical Undersea Infrastructure (CUI) Network.10 This initiative aims to coordinate defense. It brings together military and civilian stakeholders. The goal is 360-degree security.

Specific missions are underway. The “Baltic Sentry” mission monitors the Baltic Sea.11 This is a chokepoint for Russian naval forces. It is also dense with pipelines and cables. NATO needs technology to enforce this sentry. They need to scan the seabed daily. They need to detect new objects instantly.

3.3 The Threat to Data Cables

The internet is physical. It relies on fiber optic cables on the seafloor. These cables carry financial data. They carry military communications. Severing them would cause chaos. It could cripple economies. It could blind military command centers.

Kraken provides the solution. Their SAS technology can inspect cables at speed. It can detect listening devices. It can spot where a cable has been moved. This capability is vital for “Intelligence, Surveillance, and Reconnaissance” (ISR).12 Governments are paying for this assurance. They are hardening the global information grid.

3.4 Mine Countermeasures (MCM) Transformation

Naval mines are the poor man’s strategic weapon. They are cheap and effective. They can deny access to entire sea lanes. Clearing them is dangerous work. Traditionally, it required expensive minehunting ships. It put sailors in the minefield.

This approach is obsolete. Navies are shifting to unmanned systems. They want to keep sailors out of the danger zone. They use Unmanned Underwater Vehicles (AUVs). These robots scan the seabed. They identify mines autonomously. Kraken is a leader in this transition. Their systems are integrated into the standard NATO MCM toolset.13

3.5 Interoperability and Alliances

Defense is a team sport. Interoperability is key. A system must work with allies. Kraken has proven this capability. They participate in the REPMUS exercises annually.14 This is NATO’s premier unmanned systems wargame.

In 2025, Kraken SAS was used by seven naval teams and integrated into four different AUV types. This massive endorsement demonstrates that Kraken is platform-agnostic; by functioning seamlessly with both American and European robots, the system has established itself as the universal standard for high-quality imaging.

4. Technological Deep Dive: The SAS Advantage

4.1 The Physics of Resolution

To understand Kraken, you must understand sound. Conventional sonar is limited by diffraction. The resolution depends on the array length. A short array produces a wide beam. A wide beam creates a blurry image at range. To see clearly far away, you need a huge antenna. This is impossible on a small robot. An AUV cannot carry a 100-meter antenna. This physical limit constrained subsea imaging for decades. Side-scan sonar offers a trade-off. You can have high resolution, or long range. You cannot have both.

4.2 Synthetic Aperture Explained

Synthetic Aperture Sonar (SAS) cheats physics. It uses motion to create a virtual antenna. The sonar pings rapidly as the vehicle moves. The system records the return echoes. It then combines them mathematically. It synthesizes an array that stretches along the vehicle’s path.4

The result is revolutionary. The resolution becomes independent of range.15 A SAS image is just as sharp at 200 meters as it is at 20 meters. Kraken achieves 3 cm x 3 cm resolution constantly.16 This is 15 times better than traditional side-scan sonar.17

4.3 Interferometry and 3D Bathymetry

Kraken goes a step further. They use Interferometric SAS (InSAS). This adds a vertical dimension. It uses multiple receive arrays. By measuring the phase difference of the echo, it calculates depth. This produces 3D bathymetry.

The precision is stunning. The system resolves depth to 25 cm.16 It does this while capturing the high-res image. It is a “co-registered” dataset. You see the picture of the pipeline. You also see the 3D terrain around it. This eliminates the need for separate survey passes. It doubles operational efficiency.

4.4 The KATFISH Engineering Marvel

The KATFISH is the delivery vehicle. It is a towed SAS system. Towing a sonar is difficult. The ocean is turbulent. If the sensor moves unpredictably, the SAS image breaks. The “synthetic” array requires a stable path.

Kraken engineered active stabilization. The KATFISH has four intelligent fins.18 They adjust hundreds of times per second. They counteract heave, pitch, and roll. The vehicle flies straight and true. This allows it to operate in rough seas. It can tow at 10 knots.16 This speed is a game-changer for area coverage rates.

4.5 Data Processing and AI

The hardware is useless without software. SAS generates massive data. Processing this in real-time is a feat. Kraken has developed proprietary algorithms. They process the raw signal onboard. They generate the image instantly.16

This enables real-time decision-making. The operator sees the mine on the screen immediately. Kraken also integrates AI. Automatic Target Recognition (ATR) algorithms scan the feed. They flag potential threats. This reduces operator fatigue. It ensures nothing is missed in the vastness of the data.

Table 2: SAS vs. Side-Scan Sonar Performance

| Feature | Synthetic Aperture Sonar (SAS) | Side-Scan Sonar (SSS) |

| Resolution | Constant (Range Independent) | Degrades with Range |

| Pixel Size | 3 cm x 3 cm | Variable (often >50cm) |

| Area Coverage | Up to 3.5 km²/hr | < 1.0 km²/hr |

| Speed | High (up to 10 knots) | Low (typically 3-4 knots) |

| 3D Data | Co-registered Bathymetry | None (requires separate sensor) |

| Stability | Active Stabilization (Required) | Passive Stability |

Data Source: Kraken KATFISH Specifications 16

5. The Battery Revolution: Powering the Deep

5.1 The Energy Bottleneck

Robots need power. In the ocean, you cannot plug in. AUVs run on batteries. Endurance is the primary constraint. Traditional batteries are heavy. They need thick pressure housings to survive depth. This adds weight. It reduces the payload capacity. This limit hindered the industry. AUVs could only run for a few hours. They had to surface often to recharge. This limited their range. It made them unsuitable for long covert missions. Kraken saw this as a strategic gap.

5.2 SeaPower™ Technology

Kraken developed SeaPower to solve this. These are pressure-tolerant batteries.1 They do not fight the ocean pressure. They accept it. The battery cells are encapsulated in a specialized polymer. The entire module is oil-filled. It is pressure-balanced.

This eliminates the heavy housing. It improves the energy-to-weight ratio significantly. A SeaPower battery packs more kilowatt-hours into a smaller space. It is rated to 6,000 meters depth.3 It is truly full-ocean depth capable.

5.3 Manufacturing Scale-Up

The market wants these batteries. AUV manufacturers are switching to SeaPower. Kraken has secured over $13 million in recent orders.19 They are equipping large AUVs for major defense primes. To meet demand, Kraken is building factories. They are expanding a facility in Nova Scotia.20 This plant will increase throughput. It will lower unit costs. The battery division is becoming a major revenue pillar. It is no longer just an accessory. It is a core business line.

6. Strategic M&A: The 3D at Depth Acquisition

6.1 The Logic of Light

In April 2025, Kraken acquired 3D at Depth.8 This deal cost $17 million. It was a bargain. 3D at Depth is the leader in subsea LiDAR. This technology uses pulsed lasers to map underwater objects.

Why buy a laser company? Because sonar has limits. Sonar is great for finding things. LiDAR is great for measuring things. Sonar gets you to the target. LiDAR tells you exactly what it is. It offers sub-millimeter precision.21 This is required for complex engineering tasks.

6.2 The “Detect to Engage” Workflow

The combination creates a complete workflow. Imagine a pipeline inspection. Kraken’s SAS scans the pipe at 10 knots. It finds a dent. The vehicle slows down. It switches to LiDAR. It scans the dent with laser precision. The engineer gets a perfect 3D model of the damage.

This capability is unique. No other company offers both high-end SAS and LiDAR. It creates a “best-of-breed” toolbox.21 It allows Kraken to bid on the most complex survey projects. It differentiates them from pure-play sonar companies.

6.3 Geographic Expansion

3D at Depth is American. It has offices in Texas and Colorado.8 This is strategic. It gives Kraken a foothold in the U.S. market. Texas is the heart of the global offshore energy industry. Colorado is a hub for geospatial tech. This presence helps with U.S. government contracts. It simplifies compliance with American procurement rules. It also provides a base for servicing Gulf of Mexico clients. The acquisition accelerates Kraken’s international growth.

7. Macroeconomic Drivers: The Blue Economy Boom

7.1 The Offshore Wind Supercycle

The world is transitioning to green energy. Offshore wind is a pillar of this transition. Governments have set massive targets. Global capacity is set to rise from 35 GW in 2020 to 250 GW by 2030.2 This is a construction boom of historic proportions.

Building in the ocean is hard. You cannot build on a mystery. Developers need perfect seabed maps. They need to know where the rocks are. They need to know the soil stability. Kraken provides this data. Their high-speed SAS reduces survey time. It accelerates project timelines.

7.2 Reducing Levelized Cost of Energy (LCOE)

The wind industry is cost-sensitive. Inflation has hurt project economics. Developers are desperate to cut costs. Survey vessels are expensive. They can cost $100,000 per day. Kraken’s technology saves money. KATFISH surveys faster. It covers more ground per day. This reduces the vessel charter time. It lowers the total cost of the survey. This directly improves the LCOE for the developer. Kraken is an efficiency enabler for the green revolution.

7.3 The Deep Sea Mining Potential

The seabed is rich in minerals. Polymetallic nodules cover the abyss. They contain nickel, cobalt, and copper.22 These metals are essential for electric vehicles. The resource value is estimated at $177 trillion.22

This industry is controversial but inevitable. The International Seabed Authority (ISA) is finalizing regulations.23 Mining companies are preparing. They need detailed resource maps. They need to monitor environmental impact.24 Kraken’s sensors are the standard for this work. Even before mining starts, exploration generates revenue.

7.4 Oil and Gas Life Extension

We still use oil. The infrastructure is getting old. Pipelines are corroding. Platforms are fatiguing. Accidents are unacceptable. The regulatory burden is increasing. Operators must inspect their assets more frequently. Kraken serves this market. Their RaaS model is popular here. Oil companies do not want to buy sonars. They want the report. Kraken deploys its team. They scan the asset. They deliver the data. This provides steady, recurring cash flow to balance the cyclical projects.25

8. Intellectual Property: The Patent Moat

8.1 Building a Fortress

Kraken is an IP-first company. They do not just assemble parts. They invent technology. The company holds 19 patent families.26 There are 31 granted patents in total. This portfolio protects their core innovations. Key patents cover the SAS processing chain. They cover the interferometric depth measurement. They cover the autonomous launch and recovery mechanisms. This makes it hard for copycats. A competitor cannot just reverse-engineer the hardware. They would need the patented algorithms.

8.2 Strategic Licensing

Kraken is smart about R&D. They do not invent everything from scratch. They license key tech when it makes sense. The deal with Fraunhofer IOSB is a prime example.27 Fraunhofer is a top German research institute. They spent millions developing the DEDAVE AUV. Kraken licensed this tech. They used it to jump-start their ThunderFish program. This saved years of development time. It saved millions in R&D spend. It demonstrates a pragmatic approach to innovation. Buy what exists; invent what is missing.

8.3 Defensibility

The subsea market is competitive. Giants like Thales and Kongsberg are present. Kraken’s IP is its shield. It forces the giants to partner rather than crush. Teledyne Marine buys Kraken batteries.28 They integrate Kraken SAS. The IP has made Kraken a necessary component of the ecosystem.

9. Cyber and Data Sovereignty: The Invisible Shield

9.1 Data is the Asset

In modern warfare, data is ammo. Subsea maps are classified. Bathymetry data reveals submarine routes. Kraken treats data with extreme care. Their systems are built for secure environments. The company uses AES-256 encryption.29 This protects data at rest on the vehicle. If a drone is lost, the adversary cannot read the drive. Data in transit is protected by TLS 1.3. This prevents interception during upload.

9.2 SOC 2 Compliance

Kraken is SOC 2 Type 2 compliant.29 This is a rigorous auditing standard. It verifies that security controls are effective. It covers availability, processing integrity, and confidentiality. Defense clients demand this. They need to know their supply chain is secure. They need to know Kraken’s servers are hardened. This compliance is a barrier to entry. A startup cannot easily achieve SOC 2 certification. It takes time and money. Kraken has made that investment.

9.3 Counter-Sabotage Tech

Kraken’s tech detects sabotage. Russia operates “parasitic” submarines. They can tap into cables. They can place listening devices. These devices are small. They are hard to see. Kraken’s SAS/LiDAR combo finds them. The SAS scans the cable route. It detects the anomaly. The LiDAR confirms the device. This capability is marketed as “Cable Route Security.” It is a new product line. It addresses a specific, high-priority threat.30

10. Risks and Mitigation Strategies

10.1 Execution Risk

Kraken is growing fast. Doubling revenue stresses operations. Supply chains can break. Hiring skilled engineers is hard. Manufacturing defects can occur.

Mitigation: The company is expanding facilities methodically. They are pre-purchasing inventory. They have a seasoned management team. The balance sheet allows them to over-invest in capacity to ensure delivery reliability.2

10.2 Defense Budget Volatility

Government spending is fickle. Elections change priorities. A change in administration could delay contracts. Defense procurement cycles are long.

Mitigation: Kraken diversifies its operations to ensure it is not 100% dependent on defense. The company serves a broad client base including oil, gas, and wind farm sectors, while the 3D at Depth acquisition has further balanced the portfolio. This diversity extends geographically as well, with sales reaching NATO, Australia, and commercial entities globally.

10.3 The Competitive Landscape

Kongsberg and Thales are massive. Have deep pockets. They could subsidize a price war. They could bundle sonar with other naval systems.

Mitigation: Kraken focuses on performance. Their SAS is simply better. It offers higher resolution. It is cheaper to operate. Kraken partners with the primes. They become a supplier to the giants. This turns competitors into customers.28

11. Conclusion: The Compounder of the Deep

Kraken Robotics is a rare asset. It is a technology compounder in a critical sector. The world is turning its attention to the ocean floor. The reasons are existential. National security depends on secure cables. Energy transition depends on offshore wind. Future resources depend on seabed mining.

Kraken is the “picks and shovels” play for this blue economy. Beyond possessing the best technology in Synthetic Aperture Sonar, the company offers the premier solution for subsea power and holds a monopoly on subsea LiDAR. Its financial health is pristine. Cash is high; debt is low. Margins are expanding.

The 1,000% stock rise is justified. It reflects a business that has successfully scaled. It reflects a management team that executes. The path to $200 million in revenue is clear. The uplisting to a major exchange is imminent. For the astute investor, Kraken Robotics offers a window into the future of the oceans. It is a future that is transparent, intelligent, and profitable.

12. Outlook for 2026 and Beyond

12.1 The Upside Case

The bull case for Kraken is compelling. If offshore wind accelerates, demand for RaaS will outstrip supply. Kraken could raise prices. If the Ukraine conflict drags on, NATO spending on MCM will increase. Kraken will win more battery orders.

The uplisting to NASDAQ is a major catalyst.31 It will bring US retail investors. It will force index funds to buy. This structural demand could drive the stock price significantly higher. Analyst targets of C$7.50 may prove conservative.9

12.2 The Trillion-Dollar Vision

Ultimately, Kraken plays for the long term. The ocean economy is valued at $3 trillion today. It is heading to $20 trillion.32 Kraken aims to be the standard for subsea data. Every time a pipe is laid, a mine is hunted, or a nodule is found, Kraken wants to be the one seeing it. This is a platform play. Kraken is building the digital infrastructure of the ocean. It is a bold vision. But the execution so far suggests it is achievable. Kraken Robotics has surfaced as a titan of the deep. The market is only just beginning to fathom its depth.

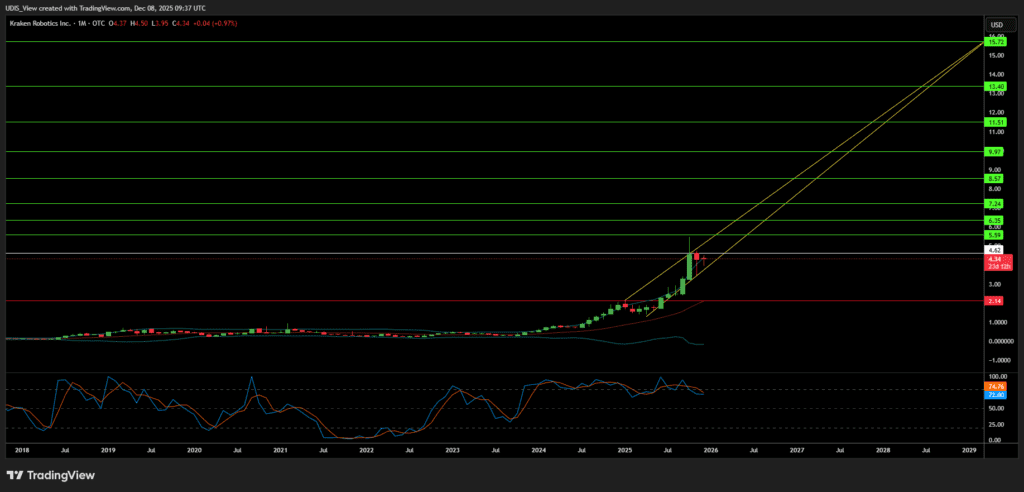

Kraken Robotics Long (Buy)

Enter At: 4.62

T.P_1: 5.59

T.P_2: 6.35

T.P_3: 7.24

T.P_4: 8.57

T.P_5: 9.97

T.P_6: 11.51

T.P_7: 13.40

T.P_8: 15.72

S.L: 2.14