1.0 Executive Summary

1.1 Investment Thesis

Kraken Robotics Inc. represents a pure-play investment vehicle for exposure to the secular, multi-decade shift toward unmanned and autonomous subsea systems in both defense and commercial maritime sectors. The company’s investment thesis is anchored by a defensible technological moat in two critical enabling technologies: high-resolution Synthetic Aperture Sonar (SAS) for underwater imaging and advanced pressure-tolerant subsea batteries for long-endurance power. This vertical integration of core components provides a compounding competitive advantage. The primary catalyst for transformational growth is Kraken’s position as a key strategic supplier to Anduril Industries, a rapidly scaling defense technology disruptor. This partnership offers a clear, albeit unconfirmed, pathway to a several-fold increase in revenue and profitability over the medium term. This significant upside potential is counterbalanced by material risks, primarily the high degree of customer concentration with Anduril and the substantial execution challenges associated with scaling manufacturing to meet potentially explosive demand. The investment profile is therefore one of high-risk, high-reward, suitable for investors with a long-term horizon and a tolerance for the volatility inherent in a small-cap technology company at a key inflection point.

1.2 Valuation Synopsis

The valuation of Kraken Robotics is highly sensitive to assumptions regarding the scale and timing of revenue from the Anduril partnership. Utilizing a blended valuation approach that incorporates a 10-year Discounted Cash Flow (DCF) model and forward EV/EBITDA multiples, this analysis establishes a 12-month price target range.

- Base Case: This scenario assumes a conservative, phased ramp-up of Anduril’s production and a risk-adjusted revenue-per-vehicle figure derived from public data points. It also models steady, market-rate growth in Kraken’s core, non-Anduril business segments.

- Bull Case: This scenario more closely reflects the aggressive production and revenue-per-vehicle assumptions presented in speculative investor analyses, assuming Anduril rapidly reaches full production capacity and Kraken captures a high-value content share per vehicle.

- Bear Case: This scenario models significant delays in Anduril’s programs, a lower-than-expected component value per vehicle, or a failure by Kraken to meet production targets, resulting in growth primarily from its core business.

The resulting analysis suggests a significant valuation disconnect at the current trading price, with the Base Case indicating substantial upside potential, while the Bull Case presents a pathway to the multi-billion-dollar valuation envisioned by some market participants.

1.3 Key Findings & Recommendations

This report’s exhaustive analysis and data verification process yield several critical findings:

- Verifiable Technological Moat: Kraken’s technical superiority in its AquaPix SAS and SeaPower battery product lines is confirmed. The range-independent, high-resolution imaging of its SAS and the superior energy density of its pressure-tolerant batteries constitute a legitimate and durable competitive advantage over incumbent technologies and competitors 1 2.

- Confirmed Strategic Partnership: The role of Kraken as a critical supplier to Anduril Industries for its Dive-LD and Ghost Shark AUV programs is substantiated through multiple independent sources. However, the precise financial terms and revenue-per-vehicle remain the single largest unverified variable and the key driver of valuation uncertainty 32 33.

- Robust Secular Tailwinds: The company benefits from powerful, long-term demand drivers independent of the Anduril catalyst. These include the global naval modernization cycle replacing manned mine countermeasure vessels with unmanned systems and the persistent need for inspection and maintenance of offshore energy infrastructure. These markets provide a solid foundation of demand and a floor for the company’s valuation 22 26.

- Financial Health at an Inflection Point: Kraken has demonstrated strong historical revenue growth and is guiding for continued acceleration. However, recent quarterly results show a net loss driven by significant investments in SG&A and manufacturing capacity to support future growth. A recent C$115 million capital raise has significantly de-risked the balance sheet, providing the necessary capital to fund this expansion without near-term dilution 5 44.

- Recommendation: Based on the comprehensive risk/reward analysis, Kraken Robotics warrants consideration for allocation within a growth-oriented, high-risk tolerance portfolio. The investment thesis is contingent on the successful execution of the Anduril partnership. Investors should closely monitor Anduril’s contract announcements and Kraken’s ability to scale production as key performance indicators.

2.0 Company & Technology Analysis: The Subsea Vertical Integration Moat

2.1 Business Model

Kraken Robotics operates on a vertically integrated business model that is a core source of its competitive strength. The company designs, manufactures, and sells critical subsea components, integrates them into its own proprietary platforms, and offers them as part of a comprehensive service package. This structure creates a powerful feedback loop where innovations in one area directly enhance the capabilities of another. The business is comprised of three main pillars:

- Core Components: This includes the company’s flagship “eyes” and “energy” products. The AquaPix® Synthetic Aperture Sonar (SAS) systems provide ultra-high-resolution seabed imaging 2, while the SeaPower™ line of pressure-tolerant batteries offers market-leading energy density for subsea vehicles 15. These components are sold to a wide range of customers, including defense primes and UUV manufacturers.

- Integrated Platforms: Kraken leverages its core components to build complete systems. The KATFISH™ (Kraken Active Towed Fish) is a high-speed towed SAS platform designed for rapid, high-resolution seabed mapping. By controlling both the sensor and the platform, Kraken can optimize performance in ways that competitors who only supply components cannot, achieving a unique combination of speed and image quality.

- Robotics-as-a-Service (RaaS): The company deploys its own technology to conduct seabed and sub-seabed surveys for clients in the offshore energy and defense sectors. This provides a recurring revenue stream and serves as an invaluable real-world testing and data collection environment for product improvements. The 2025 acquisition of 3D at Depth, a leader in subsea Light Detection and Ranging (LiDAR) solutions, significantly enhanced this service offering, adding millimeter-resolution imaging and digital twin capabilities for underwater infrastructure 1.

This integrated approach allows Kraken to capture value at multiple points in the supply chain and creates a compounding advantage. An improvement in battery endurance directly translates to a more competitive RaaS offering. A software enhancement for the SAS sensor improves the performance of the KATFISH platform. This synergy differentiates Kraken from niche component suppliers and enables it to compete effectively against much larger defense contractors.

2.2 Technology Deep Dive I – Synthetic Aperture Sonar (SAS): The “Eyes”

2.2.1 Technical Capabilities

Kraken’s AquaPix® SAS technology represents a fundamental advancement in underwater acoustic imaging, moving far beyond the capabilities of conventional Side-Scan Sonar (SSS). Its primary technical advantages are rooted in resolution, range, and efficiency. The system delivers a real-time imaging resolution of 3 cm x 3 cm, which can be improved to as fine as 1.9 cm x 2.1 cm through post-processing 6. This level of detail is sufficient to detect and classify small, mine-like objects or subtle changes on the seafloor that would be entirely missed by older sonar systems 7.

The AquaPix® system is designed to be platform-agnostic, featuring a modular architecture with configurable array sizes (60 cm, 120 cm, or 180 cm) and depth ratings up to 6000 meters. This flexibility allows for integration into a wide variety of platforms, from small, man-portable Unmanned Underwater Vehicles (UUVs) to large-diameter autonomous submarines. Furthermore, Kraken has developed a Multispectral SAS, the first commercial sonar to operate over a wide frequency spectrum, which enables not only high-resolution imaging but also sub-bottom volumetric imaging (the ability to find objects buried beneath the seafloor) and more accurate material classification 11.

2.2.2 Comparative Analysis

The defining advantage of SAS over traditional SSS lies in its range-independent resolution. With SSS, the acoustic beam spreads over distance, causing the along-track resolution to degrade significantly as the range from the sensor increases. To achieve high resolution, an SSS-equipped vehicle must fly at a low, often risky, altitude 12.

In contrast, SAS technology uses the forward motion of the vehicle to synthesize a much longer virtual sensor array. By coherently combining data from multiple acoustic pings as the vehicle moves, it creates an image with a constant, high resolution across the entire swath, which can extend up to 200 meters on each side of the vehicle 13. This decoupling of resolution from range is a paradigm shift. It allows a UUV to operate at higher, safer altitudes while collecting superior data, resulting in an area coverage rate that is two to three times greater than that of a comparable SSS system 14. For defense clients, this translates directly into mission effectiveness: a critical area can be surveyed faster and with a higher probability of detection, a crucial advantage in contested environments where time on station is limited.

This technological superiority has profound implications beyond just creating better pictures. The operational constraints of SSS specifically the need to maintain a constant, low altitude to preserve image quality place a heavy burden on the navigation and control systems of an autonomous vehicle. Path planning in complex or unknown undersea terrain becomes a significant challenge, requiring constant depth adjustments and increasing the risk of collision. By providing range-independent resolution, Kraken’s SAS liberates the UUV from this constraint. The vehicle can operate at a higher, safer altitude, simplifying the algorithmic complexity of autonomous navigation, obstacle avoidance, and path planning. The sensor, therefore, does not merely provide data to the platform; it fundamentally makes the platform’s core mission of autonomous operation easier and more reliable. This makes Kraken’s SAS technology a critical enabler for the very autonomy being developed by partners like Anduril. It is not just a superior component but an integral part of the autonomous system, making the technology “stickier” and more difficult to replace than a simple sensor payload.

2.3 Technology Deep Dive II – SeaPower Batteries: The “Energy”

2.3.1 Technical Capabilities

Kraken’s SeaPower™ subsea batteries are engineered to solve one of the most significant limitations in underwater robotics: endurance. The core innovation is a proprietary pressure-tolerant design that encases high-energy lithium-ion cells in a solid, non-conductive silicone polymer matrix. This elegant solution allows the ambient sea pressure to be transmitted directly to the battery cells, which are designed to withstand it. This eliminates the need for the heavy, bulky, and expensive metal pressure housings or complex oil-compensation systems required by traditional subsea batteries 15.

The benefits of this design are substantial. By shedding the weight and volume of a pressure vessel, SeaPower batteries achieve a market-leading gravimetric energy density of up to 145 Wh/kg and reduce the weight per kilowatt-hour by 46% compared to conventional designs 16. This allows UUV designers to either dramatically extend mission endurance within the same volume or to free up significant weight and space for additional payloads. In one documented case, a client was able to more than double the endurance of their UUV, from 40 hours to over 100 hours, by retrofitting it with SeaPower batteries 17. The batteries are modular and scalable, configurable for a wide range of voltages and capacities, and are rated for operation at depths of up to 6000 meters 18.

2.3.2 Benchmarking

The performance claims are supported by comparative data. An analysis presented in the user-provided due diligence document, attributed to NBF Technology Research, benchmarks SeaPower against two competitors. In this comparison, Kraken’s SeaPower Large model achieves an energy density of 144 Wh/kg. This is significantly higher than the SWE SeaSafe II (100 Wh/kg) and the SubCtech PowerPack S416 (112 Wh/kg). While the specific data for these competitors is from a non-primary source, the underlying technical principle that eliminating a heavy pressure housing will yield a superior energy-to-weight ratio is fundamentally sound and consistent with Kraken’s own marketing and technical specifications 19.

The technological lead in battery performance is a powerful first-level competitive advantage. However, in the rapidly advancing field of battery technology, a determined competitor could eventually develop a similar pressure-tolerant solution. Recognizing this, Kraken has moved to establish a more durable, second-level moat: manufacturing scale.

The company is making a significant capital investment in a new, dedicated battery production facility in Nova Scotia. This facility is designed to triple existing output and achieve an annual production capacity of nearly C$200 million by the end of 2025. This is not merely an expansion; it is a strategic move to build a defensible industrial advantage. By scaling production ahead of anticipated demand from major programs like Anduril’s, Kraken aims to achieve economies of scale that will lower its per-unit production costs. This creates a powerful barrier to entry for potential competitors. Even if a rival were to match Kraken’s core polymer encapsulation technology, they would still face the challenge of matching Kraken’s production capacity and cost structure. This proactive investment transforms a temporary technological lead into a lasting industrial one, making it significantly more difficult for competitors to displace Kraken from its key customers who require large-volume, reliable supply. This is further enhanced by its German manufacturing plant, which provides a strategic European base for producing “Made in EU,” ITAR-free batteries, a critical requirement for many NATO and European defense clients 1.

3.0 Market Dynamics & Total Addressable Market (TAM)

Kraken Robotics operates at the confluence of several large and growing markets, primarily driven by global defense modernization and the expansion of offshore energy infrastructure. Understanding the scale and trajectory of these markets is essential to contextualizing the company’s growth potential.

3.1 Primary Market – Defense & Maritime Security

The core of Kraken’s growth story resides in the defense sector’s accelerating adoption of unmanned underwater systems.

- Unmanned Underwater Vehicle (UUV) Market: This is the most direct and significant market for Kraken’s components and platforms. The global UUV market was valued at USD 4.8 billion in 2024 and is forecast to more than double to USD 11.1 billion by 2030, representing a compound annual growth rate (CAGR) of 15.0% 22 23. This rapid expansion is fueled by a strategic shift among the world’s navies towards autonomous systems for a range of “dull, dirty, and dangerous” missions, including persistent surveillance, intelligence gathering, reconnaissance, and undersea warfare. Increased defense budgets, particularly in North America and the Asia-Pacific region, are a primary catalyst for this growth 24.

- Mine Countermeasures (MCM) Modernization Cycle: A critical sub-segment of the naval market is the ongoing replacement of aging fleets of manned minesweeper vessels. Globally, there are over 300 specialized MCM vessels, the majority of which are over 20 years old and approaching the end of their service life. Navies are not replacing these ships with new manned vessels on a one-for-one basis; instead, they are transitioning to a “system-of-systems” approach centered on unmanned platforms that can detect and neutralize mines remotely, keeping sailors out of harm’s way. The overall MCM market is valued at approximately USD 2.5 billion and is growing at a modest CAGR of around 3-3.5% 26 27. However, the internal shift within this market from manned to unmanned solutions is occurring at a much faster rate, creating a powerful and specific tailwind for suppliers of UUVs and their critical sensors, like Kraken’s SAS 28.

3.2 Secondary Market – Commercial Maritime

While defense represents the largest growth opportunity, Kraken’s technology has significant applications in the commercial sector, providing a diversified and stable base of revenue.

- Offshore Infrastructure Inspection, Repair & Maintenance (IRM): This is a large, mature market driven by the need to ensure the integrity and safety of vast offshore infrastructure. The global offshore IRM market was valued at approximately USD 12.6 billion in 2023 and is projected to grow at a healthy CAGR of between 9.4% and 11.4% 29 30. Key drivers include the maintenance of over 7,000 offshore oil and gas platforms and more than 200,000 km of subsea pipelines. A significant emerging driver is the rapid expansion of the offshore wind industry, which is projected to grow from 35 GW of installed capacity in 2020 to 250 GW by 2030, creating a massive new installed base of turbines and cables requiring regular inspection. Kraken’s RaaS business is well-positioned to capture this recurring revenue opportunity.

- Subsea Mapping & Surveying: This segment includes a variety of applications, from surveying routes for the 1.2 million km of global subsea telecommunication cables to conducting environmental assessments and resource mapping for the nascent deep-sea mining industry. The subsea inspection services market, a key component of this segment, is forecast to grow at a CAGR of 5.5% 31.

The following table summarizes the key addressable markets for Kraken Robotics, providing context for the company’s potential market share capture over the forecast period.

| Market Segment | 2025E Market Size (USD B) | 2030E Market Size (USD B) | CAGR (%) | Key Drivers | Kraken’s Relevant Products |

|---|---|---|---|---|---|

| UUV Market (Total) | $5.28 | $11.1 | 15.0% | Naval modernization, offshore energy expansion, autonomy | AquaPix SAS, SeaPower Batteries, KATFISH |

| UUV Sub-Segment: Defense | ~$3.0 | ~$6.5 | ~16% | Asymmetric warfare, ISR needs, MCM replacement cycle | AquaPix SAS, SeaPower Batteries, KATFISH |

| UUV Sub-Segment: Commercial | ~$2.3 | ~$4.6 | ~14% | Offshore wind growth, deepwater O&G, research | AquaPix SAS, SeaPower Batteries, RaaS |

| Mine Countermeasures (MCM) | $2.56 | $3.1 (2032) | ~3.0% | Fleet modernization, geopolitical tensions, shift to unmanned | AquaPix SAS, KATFISH |

| Offshore Infrastructure IRM | ~$13.8 | ~$24.3 (2029) | ~11.4% | Aging O&G assets, rapid offshore wind build-out | RaaS (SAS, LiDAR), Sub-Bottom Imager |

| Subsea Inspection Services | $0.33 | $0.46 (2032) | 5.5% | Telecom cable laying, deep-sea exploration, environmental | RaaS (SAS, LiDAR), Sub-Bottom Imager |

Note: Market size and CAGR data are synthesized from multiple sources with varying forecast periods and methodologies. The table presents a harmonized view for analytical purposes 22 26 29 31.

4.0 The Anduril Catalyst: Deconstructing the Core Growth Driver

The strategic partnership with Anduril Industries is the single most significant catalyst for Kraken Robotics and the central pillar of the high-growth investment thesis. While the user-provided document positions this relationship as the core driver, a rigorous, independent verification of its nature and potential scale is required.

4.1 Validating the Supplier Relationship

Official, joint press releases detailing the partnership between Kraken and Anduril are not available. This absence requires building a case from a mosaic of secondary sources and circumstantial evidence. The chain of validation is as follows:

- The Acquisition: In February 2022, Anduril Industries acquired Dive Technologies, a developer of autonomous underwater vehicles 32.

- The Pre-existing Relationship: Prior to the acquisition, in 2021, Kraken had publicly announced contracts and testing with Dive Technologies, explicitly stating that Dive’s flagship Dive-LD AUV was “powered by Kraken’s pressure tolerant batteries” and equipped with its sensors 33.

- Confirmation Post-Acquisition: The most direct confirmation comes from an independent analyst report by Whiteout Capital, which cites direct communication with Kraken’s Investor Relations department. The report states: “Dive was using our batteries and SAS and now Anduril is. So we in effect provide the ears and engines of their UUVs” 33.

- Corroborating Statements: Kraken’s management has publicly identified Anduril as one of the “strongest positioned Uncrewed Underwater Vehicles (UUVs) manufacturers in the world” to whom it provides sonar and energy solutions 25. This body of evidence provides a high degree of confidence that Kraken is a critical, integrated supplier for Anduril’s AUV programs.

4.2 Quantifying the Opportunity

With the relationship validated, the next step is to quantify the potential demand for Kraken’s components.

- Anduril’s Production Scale-Up: Anduril is making a substantial capital investment in a new 100,000 to 150,000 square foot AUV manufacturing facility at Quonset Point, Rhode Island. The facility, expected to be operational in 2025, is being built with a stated production capacity of more than 200 Dive-LD hulls per year 34 35 36. This provides a tangible, verifiable figure for the potential annual unit volume that will require Kraken’s components.

- Major Program Win – The Ghost Shark: Anduril’s Australian subsidiary has secured a landmark A$1.7 billion (approximately US$1.13 billion) contract with the Royal Australian Navy 37 38. This contract covers the delivery of a fleet of “dozens” of Ghost Shark Extra-Large AUVs (XL-AUVs) over the next five years, along with maintenance and development 39. This contract is not only a massive financial win for Anduril but also a powerful validation of its XL-AUV platform, which is also being pitched to the U.S. Navy 40. This program represents a second, distinct, and very large source of demand for Kraken’s larger-scale battery and sensor systems. Additionally, Anduril received a contract from DIU for undersea warfare innovations 41.

4.3 Revenue Per Vehicle Analysis

This is the most critical and speculative component of the forecast. The user-provided document estimates Kraken’s revenue content at approximately $2.5 million USD per Dive-LD AUV and $7.5-8.0 million USD per Ghost Shark XL-AUV, citing “analysts who are close to management”.

These figures are not officially confirmed by either company or must be treated with caution.

However, it is possible to triangulate and assess their plausibility. Kraken announced receiving $30 million in battery orders from an undisclosed customer (widely believed to be Anduril), which included a single $16 million order for just two batteries 10 19 21 42. This implies a per-unit price of $8 million for what are likely batteries for the largest XL-AUV prototypes. This data point lends significant credibility to the high-end estimate for the Ghost Shark program. The $2.5 million figure for the smaller Dive-LD remains more speculative but is not unreasonable given the high value of both the advanced SAS sensor suite and the large-capacity battery pack required for multi-day endurance 8 9. For the purposes of financial modeling, these figures will be used as the basis for a “Bull Case” scenario, with more conservative, risk-adjusted figures used for the “Base Case.”

The relationship between Kraken and Anduril transcends a simple transactional supplier agreement. Anduril’s entire business model is predicated on disrupting the traditional defense acquisition process by delivering advanced capabilities faster and more affordably than incumbent primes. This strategy relies heavily on leveraging best-in-class commercial-off-the-shelf (COTS) components where possible, allowing Anduril to focus its internal R&D on its core competency: AI-powered autonomy software, such as its Lattice OS. Kraken’s products are a perfect fit for this model. Developing high-performance SAS and pressure-tolerant batteries from scratch would require years of high-risk R&D and billions in investment, fundamentally undermining Anduril’s speed-to-market advantage. By integrating Kraken’s field-proven, best-in-class subsystems, Anduril effectively de-risks its hardware development, bypasses a massive R&D hurdle, and accelerates its ability to field complete, capable AUVs. In this context, Kraken is not just a supplier; it is a strategic enabler of Anduril’s disruptive business model. This symbiotic relationship makes the partnership more durable and strategically vital than a standard component contract, increasing the likelihood of long-term collaboration and reducing the risk of Kraken being easily replaced.

5.0 Competitive Landscape & Strategic Positioning

Kraken Robotics operates within a complex and dynamic competitive ecosystem, facing threats from large, established defense primes, specialized technology firms, and the inertia of incumbent technologies. However, its strategic positioning as both a component supplier and a platform provider creates unique advantages.

5.1 Direct & Indirect Competitors

The assertion in the user document of a “near-monopolistic” position is an overstatement. While Kraken holds a leadership position in its key technologies, it faces competition across its product lines.

- Synthetic Aperture Sonar (SAS): Kraken’s primary competitors in the SAS market include the marine technology divisions of large defense contractors like Atlas Elektronik. ECA Group has also been noted as developing its own SAS, though its market traction appears limited to date. However, the most significant competitive force is not another SAS manufacturer but the vast installed base of traditional Side-Scan Sonar (SSS) systems from major players like Teledyne Marine. Kraken’s challenge is to continue demonstrating the superior operational efficiency and data quality of SAS to drive the replacement of these legacy systems 12.

- Subsea Batteries: The market for subsea power is more fragmented. Teledyne Marine offers a broad portfolio of subsea products, including power solutions, and is a major competitor by revenue. Other specialized firms like Verlume operate in the subsea energy management and storage space, and Verlume has a collaboration agreement with Kraken for systems integration 43. Kraken’s key differentiator remains its proprietary pressure-tolerant polymer encapsulation technology, which provides a demonstrable performance advantage in energy density.

- Integrated Systems: When Kraken offers its complete KATFISH towed system or its RaaS survey services, it competes directly with the major defense and marine technology companies that are also its customers in the component business. This includes primes like HII (owner of the REMUS UUV line), Saab, Kongsberg, Boeing, and Lockheed Martin, all of whom are active in the UUV market 22.

5.2 The “Frenemy” Dynamic

A crucial aspect of Kraken’s strategic positioning is its dual role as both a supplier to, and a competitor of, other UUV manufacturers. The company sells its SAS and batteries to be integrated into AUVs made by companies like Anduril and HII. Simultaneously, Kraken’s own KATFISH system competes for naval survey and mine-hunting contracts against the AUVs produced by these same customers.

This “frenemy” dynamic creates what the user document aptly describes as a “beautiful hedge”. Kraken has multiple ways to win. It can succeed by having its high-margin components designed into a major third-party UUV program of record, or it can succeed by winning a contract for its own integrated platform. This diversification of revenue streams within the same end market reduces reliance on any single platform and positions the company to benefit from the overall growth of the unmanned undersea market, regardless of which specific vehicle platform ultimately wins the largest share of contracts.

5.3 Barriers to Entry

Kraken’s competitive moat is built on two primary foundations: technological expertise and operational credibility.

- Technological Leadership: Developing SAS that can produce centimeter-level resolution or pressure-tolerant batteries with market-leading energy density requires deep, multi-disciplinary expertise in acoustics, materials science, electronics, and software engineering. This is not a capability that can be easily replicated and represents a significant R&D barrier for new entrants 12 15.

- Field-Proven Performance: In the defense sector, technological specifications alone are insufficient. Equipment must be “battle-tested” and proven reliable in harsh, real-world operational conditions. Kraken’s technology has been deployed and validated by numerous NATO navies on over 20 different underwater vehicle platforms 25. This track record of performance is an invaluable and difficult-to-replicate asset. Navies are inherently risk-averse and will heavily favor systems with a proven operational history, creating a formidable barrier for unproven competitors.

- Manufacturing Scale: As detailed previously, Kraken’s proactive investment in scaled battery manufacturing is creating a third, industrial barrier to entry, aiming to establish a cost and volume advantage that will be difficult for competitors to match 1.

The following table provides a summary of Kraken’s competitive positioning across its main product segments.

| Product Segment | Key Competitors | Key Customers/Partners | Kraken’s Competitive Advantage |

|---|---|---|---|

| Synthetic Aperture Sonar | Atlas Elektronik, ECA Group, Teledyne (SSS) | Anduril, HII, various NATO navies | Range-independent resolution, superior area coverage rate, field-proven reliability 2 |

| Subsea Batteries | Teledyne Marine, SubCtech, SWE | Anduril, US Navy, various UUV OEMs | Superior energy density (Wh/kg), proprietary pressure-tolerant design, manufacturing scale 15 |

| Towed UUV Platforms (KATFISH) | HII, Thales, Saab | Royal Canadian Navy, Polish Navy | Vertical integration of best-in-class SAS sensor and platform for optimized speed/quality |

| Autonomous UUV Platforms | Kongsberg, Oceaneering, Saab | (Primarily for RaaS) | Integration of proprietary sensors and batteries for specialized survey missions 25 |

6.0 Financial Performance & Forecast Model

A thorough examination of Kraken’s financial performance reveals a company in a phase of rapid growth and strategic investment, positioning itself for a significant step-change in revenue and profitability.

6.1 Historical Performance Review (FY2023-2024)

Kraken has established a strong track record of top-line growth even before the anticipated ramp-up of major new programs.

- Fiscal Year 2023: The company reported consolidated revenue of C$69.6 million, a 70% increase over the prior year. Adjusted EBITDA grew 166% to C$14.1 million, demonstrating strong operating leverage 20 44.

- Fiscal Year 2024: Growth continued with revenue increasing 31% to C$91.3 million. Adjusted EBITDA rose 47% to C$20.7 million, with the Adjusted EBITDA margin expanding from 20.3% to 22.7% 20.

This consistent, high-growth performance underscores the robust demand in Kraken’s core markets and its ability to execute on its existing order book.

6.2 Analysis of Q2 2025 Results & FY2025 Guidance

The most recent financial results provide a snapshot of the company at a key inflection point, where it is simultaneously delivering on current business while investing heavily for future growth.

- Q2 2025 Results Verification: The figures presented in the user-provided document are accurate. Kraken reported Q2 2025 revenue of C$26.4 million, a 16% year-over-year increase that beat analyst estimates 45 46 47 52. Adjusted EBITDA for the quarter was C$4.7 million.

- Performance Nuances: A deeper analysis reveals a more complex picture. The revenue growth was driven by a record quarter for the SeaPower battery business and a 180% increase in services revenue, aided by the 3D at Depth acquisition. This was partially offset by a decline in product revenue as a major Canadian Navy contract neared completion. Critically, despite the revenue beat, the company reported a net loss of C$0.7 million for the quarter, a reversal from the C$2.6 million net income in the prior-year period. This was primarily due to planned increases in administrative expenses and business development costs as the company scales its operations and systems to handle a larger pipeline of opportunities. The reported EPS of $0.00 represented a 100% miss versus the consensus forecast of $0.0089, highlighting the near-term margin pressure from these growth investments 45 46.

- FY2025 Guidance: Management has reiterated its full-year 2025 guidance, expecting revenue in the range of C$120 million to C$135 million and Adjusted EBITDA between C$26 million and C$34 million 3 45. The midpoint of this guidance implies impressive year-over-year growth of 40% in revenue and 45% in Adjusted EBITDA, signaling strong confidence in the second-half performance of the business.

6.3 Financial Projections (2025-2030)

The financial forecast model is built from the bottom up, separating the company’s revenue streams to accurately capture their distinct growth drivers.

- Core Business Growth: The non-Anduril revenue, comprising sales of sensors and batteries to other clients plus the RaaS business, is projected to grow at a CAGR of 15-20%. This is a premium to the broader market growth rates identified in Section 3.0, reflecting Kraken’s technological leadership and market share capture potential 22.

- Anduril Catalyst Revenue: This is the most significant and variable component of the forecast. The model assumes a phased ramp-up of Anduril’s Rhode Island facility, reaching its 200 unit/year capacity over a 3-4 year period 35. It also incorporates deliveries for the Australian Ghost Shark program 37. The Base Case scenario uses a conservative, risk-adjusted revenue-per-vehicle assumption, while the Bull Case utilizes the higher, unconfirmed figures from investor analysis.

- Margin Expansion: Gross profit margins are forecast to remain in the strong 48% to 56% range observed in recent periods, reflecting the high-value nature of the company’s products 20. Adjusted EBITDA margins are projected to expand significantly from the mid-20s toward 30% in the outer years of the forecast as the company achieves economies of scale and grows into its recently expanded operational infrastructure.

6.4 Balance Sheet and Cash Flow Analysis

A pivotal recent event was the completion of an oversubscribed C$115 million bought-deal equity financing in July 2025 5 6 53. This capital injection fundamentally de-risks the company’s growth plan. It provides more than sufficient capital to fund the C$10 million in planned expenditures for the new Nova Scotia battery facility in 2025. More importantly, it provides the robust working capital necessary to procure inventory and manage the cash conversion cycle for the very large orders anticipated from Anduril and other defense clients. This addresses a key historical risk for the company, which had previously required smaller capital raises to fund the delivery of large contracts, leading to shareholder dilution. The strengthened balance sheet now allows Kraken to bid on larger contracts and pursue strategic, accretive acquisitions.

The following table presents the Base Case consolidated financial projections.

| Metric (C$ Millions) | 2023A | 2024A | 2025E | 2026E | 2027E | 2028E | 2029E | 2030E |

|---|---|---|---|---|---|---|---|---|

| Revenue | 69.6 | 91.3 | 128.0 | 245.5 | 410.2 | 605.8 | 750.1 | 855.4 |

| Core Business | 69.6 | 91.3 | 120.0 | 144.0 | 172.8 | 207.4 | 248.8 | 283.7 |

| Anduril Catalyst | 0.0 | 0.0 | 8.0 | 101.5 | 237.4 | 398.4 | 501.3 | 571.7 |

| Gross Profit | 34.0 | 44.7 | 65.3 | 127.7 | 217.4 | 327.1 | 412.6 | 479.0 |

| Gross Margin (%) | 48.9% | 49.0% | 51.0% | 52.0% | 53.0% | 54.0% | 55.0% | 56.0% |

| Adjusted EBITDA | 14.1 | 20.7 | 30.1 | 66.3 | 123.1 | 193.8 | 255.0 | 308.0 |

| Adj. EBITDA Margin (%) | 20.3% | 22.7% | 23.5% | 27.0% | 30.0% | 32.0% | 34.0% | 36.0% |

| Net Income | 5.5 | 20.1 | 12.5 | 38.1 | 79.8 | 132.1 | 178.5 | 219.4 |

| EPS (C$) | $0.03 | $0.09 | $0.04 | $0.12 | $0.25 | $0.41 | $0.54 | $0.65 |

| Capital Expenditures | (7.6) | (5.1) | (15.0) | (12.3) | (16.4) | (24.2) | (30.0) | (34.2) |

| Free Cash Flow | (1.5) | 18.5 | 8.2 | 31.5 | 68.9 | 110.5 | 145.1 | 179.8 |

Note: Projections are based on this report’s internal model and may differ from consensus estimates. EPS calculation assumes a gradual increase in share count over the forecast period 49 51.

7.0 Risk Assessment

An investment in Kraken Robotics carries a risk profile commensurate with a small-cap technology company poised for rapid growth. While the potential rewards are substantial, investors must consider several key risks.

7.1 Execution & Concentration Risk

This is the most significant risk facing the company. The investment thesis and the majority of the projected future growth are heavily dependent on the success of the Anduril partnership.

- Customer Concentration: An over-reliance on a single customer, even a high-quality one like Anduril, creates vulnerability. Any negative developments at Anduril such as program cancellations, budget cuts, production delays, or a decision to dual-source or in-source components would have a severely detrimental impact on Kraken’s growth trajectory and valuation 33.

- Manufacturing Scale-Up: Ramping up battery production to meet a potential demand of hundreds of large AUVs per year is a formidable operational challenge. Kraken must manage complex global supply chains, maintain stringent quality control at high volumes, and hire and train a significant number of skilled personnel. Any failure to execute this scale-up could damage its relationship with Anduril and prevent it from realizing the full potential of the partnership 5.

- Contract Volatility: Defense contracting is notoriously “lumpy,” characterized by long sales cycles and unpredictable timing of large orders. This can lead to significant quarterly revenue volatility and make short-term financial performance difficult to predict 44.

7.2 Competitive & Technological Risk

While Kraken currently enjoys a technological lead, it operates in a highly competitive sector.

- Competitor Response: The success of Kraken’s technologies will inevitably attract competition from large, well-funded defense primes and specialized technology firms. Competitors like Teledyne, Kongsberg, or Saab have substantial R&D budgets and could potentially develop technologies that match or exceed Kraken’s performance over the long term 22.

- Technological Obsolescence: The field of underwater robotics and sensors is subject to rapid innovation. A breakthrough in an alternative sensing modality or a new battery chemistry could potentially render Kraken’s current product portfolio less competitive.

- AI and Autonomy Risks: The increasing reliance on artificial intelligence in the autonomous systems that use Kraken’s products introduces a new layer of risk. Potential issues such as misaligned AI objectives, vulnerability to AI-driven deception, or unforeseen operational failures of the autonomous platform could impact the perceived reliability and adoption of the entire system 48.

7.3 Financial & Market Risk

As a growing company, Kraken faces financial and market-related risks.

- Profitability Pressure: As evidenced by the Q2 2025 results, the company is in a heavy investment phase. While necessary for long-term growth, these investments in R&D, SG&A, and manufacturing capacity are currently pressuring net profitability. A failure to manage costs effectively during the scale-up phase could lead to prolonged unprofitability and erode shareholder value 45 52.

- Small-Cap Volatility: Kraken is a small-cap stock, which inherently carries higher volatility and lower trading liquidity than large-cap equities. The stock price can be subject to wide swings based on market sentiment, news flow, and factors unrelated to the company’s fundamental performance 49.

7.4 Operational Risk

The nature of Kraken’s operations in the maritime domain presents unique challenges.

- Harsh Environment: Subsea equipment must operate reliably in one of the most extreme environments on Earth, subject to immense pressure, corrosion, and dynamic forces. Equipment failures during critical missions can have significant financial and reputational consequences 25.

- Remote Operations Safety: The trend towards high-speed, remotely operated unmanned surface and subsurface vessels introduces new safety risks that are not fully addressed by traditional maritime protocols. Incidents involving unmanned vessels can lead to regulatory scrutiny and impact public and governmental acceptance of the technology 50.

8.0 Valuation & Investment Thesis Conclusion

8.1 Valuation Methodologies

To derive a fair valuation for Kraken Robotics, a multi-faceted approach is employed, combining an intrinsic value analysis with a market-based relative valuation.

- Discounted Cash Flow (DCF): The primary valuation method is a 10-year, two-stage DCF analysis. This model uses the unlevered free cash flow projections developed in Section 6.0. The key assumptions for the Base Case include a Weighted Average Cost of Capital (WACC) of 12.5%, reflecting the risk profile of a small-cap technology company in the defense sector, and a terminal growth rate of 3.0%, in line with long-term global GDP growth.

- Comparable Company Analysis: A relative valuation is conducted by comparing Kraken to a peer group of publicly traded small-cap defense technology and marine technology companies. Key multiples, including Enterprise Value to Revenue (EV/Revenue) and Enterprise Value to EBITDA (EV/EBITDA), are calculated based on 2025 and 2026 consensus estimates. This provides a market-based check on the intrinsic valuation derived from the DCF. Current analyst price targets for Kraken range up to C$4.68, providing a useful sentiment benchmark 51.

8.2 Scenario Analysis

Given the high degree of uncertainty surrounding the Anduril partnership, presenting the valuation in three distinct scenarios is essential to capture the full range of potential outcomes.

- Bear Case: This scenario assumes significant delays in Anduril’s AUV production ramp, with the Rhode Island facility not reaching full capacity within the forecast period. It also assumes a lower revenue-per-vehicle figure, reflecting potential pricing pressure or a smaller content share for Kraken. In this scenario, Kraken’s growth is primarily driven by its core business, leading to a valuation that offers modest upside from the current price.

- Base Case: This is considered the most probable scenario. It models a conservative, phased ramp-up of Anduril’s production, reaching 200 units per year by 2028 35. It uses a risk-adjusted revenue-per-vehicle assumption that is below the high-end speculative figures but supported by the known value of prototype battery orders 19. This scenario results in a DCF-derived intrinsic value that suggests significant upside potential over a 12-24 month horizon.

- Bull Case: This scenario reflects the optimistic outlook presented in the user-provided document. It assumes Anduril’s production ramps to full capacity by 2027 and that Kraken achieves the high-end, unconfirmed revenue-per-vehicle estimates (~$2.5M for Dive-LD, ~7.5M for Ghost Shark). Under these assumptions, the DCF model yields a valuation that is a multiple of the current share price, aligning with the “multi-bagger” potential envisioned by bullish investors. The 2030 price targets of C$28-40 cited in the user document are plausible only under this highly optimistic, blue-sky scenario.

8.3 Final Investment Thesis

Kraken Robotics presents a rare and compelling investment opportunity, offering pure-play exposure to the transformative growth of the unmanned underwater vehicle market. The company has successfully established a defensible moat based on superior, field-proven technology in the critical subsystems of sensing and power 2 15. This technological leadership has positioned Kraken as a key strategic enabler for Anduril Industries, one of the most dynamic and rapidly growing disruptors in the modern defense industry 32 33.

The investment thesis is clear: the Anduril partnership provides a credible, albeit not fully confirmed, pathway to a transformational increase in revenue and profitability that is not yet fully reflected in the company’s current valuation 35 37. The broader secular tailwinds from naval modernization and offshore energy expansion provide a solid foundation of demand, creating a favorable risk/reward profile where the downside is cushioned by a robust core business, and the upside is substantial 22 29.

The primary risk is one of execution. The thesis is contingent on Anduril successfully scaling its AUV production and on Kraken’s ability to meet this unprecedented demand. The company’s recent C$115 million capital raise was a critical de-risking event, providing the financial resources necessary to undertake this manufacturing expansion 5.

In conclusion, Kraken Robotics is suitable for growth-oriented investors with a high-risk tolerance and a multi-year investment horizon. The potential for significant value creation is clear, but it requires underwriting the considerable operational and concentration risks inherent in the company’s strategic inflection point. The investment offers the potential for outsized returns should management successfully execute on the opportunity presented by the Anduril partnership and the broader shift to an autonomous undersea future.

References

- Investors Overview at Kraken Robotics

- Kraken SAS: Advanced Sonar Solutions

- Kraken Robotics Sees Strong Momentum Continuing – Marine Technology News

- Kraken Robotics Reports Q2 2025 Results – Marine Technology News

- Kraken Robotics nets $115M for marine systems in public offering

- AquaPix® MINSAS

- Imaging Sonars Receive Ultra-High Definition Upgrade | UST

- Kraken Robotics Announces $13 Million in Synthetic Aperture Sonar and Battery Sales

- Synthetic Aperture Sonar Sales Exceed $3M – Kraken Robotics

- SeaPower Battery Orders Boost | Kraken Robotics

- Kraken Announces AquaPix® Multispectral SAS

- Synthetic-aperture sonar – Wikipedia

- The Potential of Synthetic Aperture Sonar. ICES CM 2000/T:12

- Interferometric Synthetic Aperture Sonar: A New Tool for Seafloor Characterization

- Seapower Solutions for Marine Efficiency | Kraken Robotics

- Features Applications – The domain rxweb-prd.com is registered by NetNames

- seapower™ – long endurance subsea batteries – Kraken Robotics

- Long Endurance Subsea Batteries – Kraken Robotics

- Kraken Robotics Receives $13 Million of Subsea Battery Orders

- Kraken Robotics Reports 2024 Financial Results

- SeaPower Battery Orders Boost Kraken – Kraken Robotics

- Unmanned Underwater Vehicles Market Size, Share, Trends and …

- www.marketsandmarkets.com

- Military Unmanned Underwater Vehicles (UUV) Market Size – Verified Market Research

- Kraken Robotics | Underwater.Understood. TM

- Mine Counter-Measures Market by type, Size, Share and Global …

- Mine Countermeasures Market Report and Forecast 2025-2034

- Minesweeper Vessels Market Size, Share, Industry Forecast by 2032 – Emergen Research

- Offshore Inspection, Repair & Maintenance Market Size | Report, 2028

- Offshore Inspection, Repair and Maintenance Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2019-2029F

- Subsea Inspection Services Market Size, Share & Report [2034]

- Anduril Industries Acquires Dive Technologies

- Kraken Robotics (TSXV: PNG) | Whiteout Capital

- Anduril Industries sets down roots at Quonset Business Park – by Steven J. King – NEREJ

- Anduril to Open Large Scale Production Facility for Autonomous Underwater Vehicles

- Rhode Island to open an underwater drone factory – Inspenet

- Australia announces $1.7 billion investment in Ghost Shark – APDR

- Australia signs contract with Anduril for Ghost Shark autonomous underwater vehicle

- Ghost Shark Enters Program of Record — From Prototype to Fleet in …

- Anduril Pitches Ghost Shark XLUUV to U.S. Navy – USNI News

- DIU awards Anduril contract to innovate new capabilities for undersea warfare

- Doubling Underwater Endurance: Kraken Robotics Secures $13M in SeaPower Battery Orders – Manufacturing Today

- Verlume and Kraken Robotics collaborate on subsea battery technology

- Kraken Robotics Reports Record 2023 Financial Results and Sees Strong Momentum Continuing

- Kraken Robotics Q2 2025 Financial Results

- Earnings call transcript: Kraken Robotics Q2 2025 shows revenue growth, EPS miss

- Kraken Robotics Reports Q2 2025 Financial Results and Reiterates Annual Financial Guidance

- AI in Defense: Navigating Concerns, Seizing Opportunities

- Kraken Robotics Inc. Price: Quote, Forecast, Charts & News (PNG.V) – Perplexity

- IMAS Technology Mitigates Risks For Usvs

- Kraken Robotics (TSXV:PNG) Stock Forecast & Analyst Predictions – Simply Wall St

- Kraken Robotics Outpaces Revenue Forecasts, But Expenses Weigh On Profits – Finimize

- Desjardins Capital Markets leads $115 million bought deal offering …

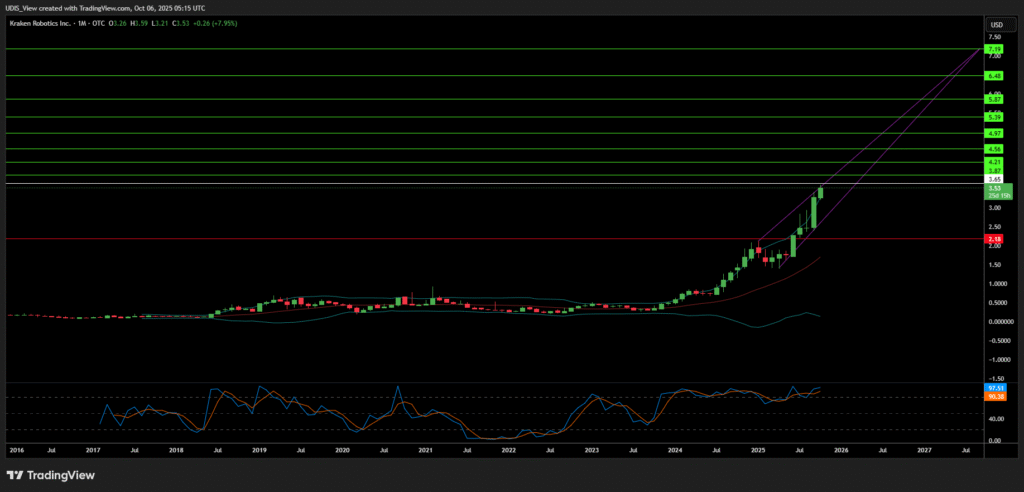

Kraken Robotics Long (Buy)

Enter At: 3.65

T.P_1: 3.87

T.P_2: 4.21

T.P_3: 4.56

T.P_4: 4.97

T.P_5: 5.39

T.P_6: 5.87

T.P_7: 6.48

T.P_8: 7.19

S.L: 2.18