Silver Super-Cycle: Why iShares Silver Trust (SLV) Is The Critical Play of 2026

The investment thesis for the iShares Silver Trust (SLV) has fundamentally shifted. Silver is no longer merely a monetary hedge. It has transitioned into a strategic industrial imperative. This report analyzes the iShares Silver Trust through a multi-domain lens. We examine geopolitics, macroeconomics, and breakthrough technologies. The convergence of these factors creates a unique “super-cycle” for silver.

The year 2025 marks a definitive turning point. The United States Geological Survey (USGS) has designated silver a “Critical Mineral“5. This regulatory shift validates what market dynamics have indicated for a decade. Silver is essential for national security. It is vital for the energy transition. It is the backbone of digital infrastructure.

We observe a market driven by three distinct vectors. The first is geostrategic. Supply chains are becoming weaponized. Production is heavily concentrated in Latin America and China. The second is macroeconomic. Sovereign debt crises drive monetary demand. Real interest rates remain negative. The third is technological. Innovations in solid-state batteries and AI data centers rely on silver1313. Industrial demand has become inelastic. Manufacturers cannot substitute silver without sacrificing performance. This report dissects these drivers. We utilize patent analysis and supply chain forensics. We project the trajectory of the iShares Silver Trust. The analysis confirms a fracture in historical correlations. Silver is forging a new price discovery mechanism. This mechanism is based on industrial scarcity and strategic necessity.

1. Regulatory Paradigm: The Critical Mineral Designation

1.1 The USGS 2025 Critical Minerals List

On November 7, 2025, the USGS finalized its 2025 Critical Minerals List. This document fundamentally alters silver’s status. The inclusion of silver signals federal recognition of supply chain vulnerability. This is a historic shift in US policy. The Energy Act of 2020 defines a “critical mineral.” It must be essential to economic or national security. It must have a vulnerable supply chain. It must be essential for manufacturing. Silver meets all these criteria. Silver is irreplaceable in photovoltaics. It is vital for electronics. It is crucial for defense systems. The list now includes 60 minerals. New additions include copper, silicon, and silver. This expansion highlights a strategic pivot. The government is reacting to supply chain fragility. Dependence on foreign sources is now a national security risk. The Trump administration has focused on reducing this dependence. The target is specifically reliance on China.

1.2 Policy Implications for Investment

This designation activates federal support. The Department of Energy (DOE) announced significant funding opportunities38. Nearly $1 billion is allocated for production and recovery. This creates a floor for the domestic silver market. Mining and refining projects now qualify for tax credits. These credits equal 10% of production costs. This includes extraction, processing, and purification42. This incentivizes domestic output. However, new mines take years to develop. The immediate impact is on above-ground stockpiles. The iShares Silver Trust holds verified bullion44. As the US government diversifies supply chains, these stockpiles become strategic assets. The “critical” label may eventually lead to export restrictions46. It could also lead to strategic stockpiling orders 47. This would directly impact the availability of physical bars for SLV creation.

1.3 The Strategic Stockpile Mandate

Executive Order 14154, “Unleashing American Energy,” was signed in January 2025. It directs a review of the National Defense Stockpile. The goal is to ensure a robust supply in the event of shortfalls. The addition of silver to the list makes it eligible for this stockpile52. The government could become a net buyer. This would compete directly with industrial users and investors. The iShares Silver Trust competes for the same 1,000-ounce bars. Increased government demand would tighten the wholesale market. This supports the bullish case for SLV.

2. Geostrategy: The Weaponization of Supply

2.1 The Inelasticity of Mine Supply

Silver supply is structurally inelastic. This is a critical market flaw. Approximately 75-80% of the global supply is a byproduct. It comes from lead, zinc, copper, and gold mines. Primary silver miners produce less than 28% of global output. Rising silver prices do not trigger immediate production increases. If copper demand falls, copper mines slow down. This reduces silver output, even if silver prices are high. This is the “supply trap.” Market signals cannot efficiently stimulate new output.

2.2 Latin American Concentration Risks

Silver production is dangerously concentrated. Mexico and Peru account for 40% of global output. Mexico produces 185.7 million ounces annually. Peru produces 108 million ounces. These regions face significant volatility. Mexican operations suffer from labor disputes. Security concerns disrupt transport. Peru faces similar challenges. Strikes and blockades are common. Political instability threatens mining licenses. Operational challenges are mounting. Ore grades are declining. Environmental regulations are tightening. Costs are rising. High-altitude mining in Peru faces unique logistical hurdles. Any disruption in these two countries impacts global supply immediately. The market lacks a buffer.

2.3 The China Export Dynamic

China plays a complex role. It is a major producer but a massive consumer. Peru’s exports reveal a startling trend. In early 2025, Peruvian silver exports rose 97.5%. Crucially, 98% of this went to China. China is cornering the market on raw materials. They are securing direct supply lines from Latin America. This bypasses Western markets. It leaves less metal available for London and New York vaults. The iShares Silver Trust relies on these vaults. This is a resource war. There are two “supereconomies”. They are decoupling. China is securing physical assets. The West is relying on financialized contracts. This divergence creates systemic risk for SLV’s authorized participants. Sourcing metal may become difficult.

2.4 Trade Wars and Tariffs

Global trade tensions are intensifying. The US-China trade war impacts mining economics. Tariffs disrupt the flow of technology and machinery. They also affect the pricing of exported metals. Trade policy is a weapon. Sanctions can target specific producers. Export bans can lock up supply. Indonesia banned nickel exports to force domestic processing. A similar move by Mexico or Peru for silver is possible. This would be catastrophic for global supply. It would send SLV prices vertical.

3. Macroeconomics: The Sovereign Debt Crisis

3.1 Sovereign Debt and Monetary Demand

The global economy faces a sovereign debt crisis. Debt levels are unsustainable. This drives investors toward tangible assets. Gold and silver are the primary beneficiaries. Confidence in fiat currency is eroding. Investors fear currency debasement. They seek assets that cannot be printed. Silver has a dual role. It is a monetary metal and an industrial input. This makes it unique. Analysts predict silver could reach $200 per ounce. This prediction assumes a loss of faith in sovereign bonds. It also accounts for industrial shortages. The “sovereign debt” narrative is a powerful psychological driver. It pushes retail and institutional capital into SLV.

3.2 Real Interest Rates

The correlation between silver and rates is key. Historically, high rates hurt precious metals. This relationship has broken. Gold and silver now rally despite rate uncertainty. The driver is the “real” interest rate. This is the nominal rate minus inflation. Inflation remains persistent. Real rates are often negative. This makes holding cash a losing proposition. Silver becomes an attractive alternative. It preserves purchasing power. Bolliger notes that gold prices have decoupled from rates. Institutional buying drives this divergence. Silver follows gold but with higher volatility. It acts as a “high beta” version of the gold trade.

3.3 The Gold-Silver Ratio

The gold-silver ratio is a valuation metric. It measures how many ounces of silver buy one ounce of gold. Historically, this ratio was 1:15. Today, it is much higher. This suggests silver is undervalued. During the 1970s stagflation, the ratio narrowed significantly. We may be entering a similar period. If the ratio normalizes, silver will outperform gold. SLV investors stand to gain from this mean reversion.

3.4 Central Bank Accumulation

Central banks are buying gold at record rates. This is a strategic shift. They are diversifying away from the US dollar. This is known as “de-dollarization”. While they primarily buy gold, the effect spills over. It legitimizes precious metals as reserve assets. It removes supply from the market. China is also accumulating silver inventories. This state-level hoarding reduces commercial availability. It tightens the physical market for industrial users.

4. Technological Revolution I: Solid-State Batteries

4.1 The Solid-State Paradigm Shift

The battery industry is undergoing a revolution. Solid-state batteries (SSBs) are the future. They replace liquid electrolytes with solid ones. This improves safety and energy density. The market is projected to grow rapidly. It will reach $1.77 billion by 2031. The CAGR is 37.5% from 2025 to 2031. This growth is driven by electric vehicles (EVs).

4.2 The Ag-C Anode Solution

A critical challenge in SSBs is “dendrites.” These are lithium crystals that form on the anode. They cause short circuits and fires. Samsung SDI has found a solution. They use a silver-carbon (Ag-C) composite layer. This layer is ultrathin. It measures just 5 micrometers. Despite its size, it is vital. It effectively blocks dendrite growth. It enables the use of lithium metal anodes. This innovation is transformative. It allows for energy densities of 900 Wh/L. It enables an 800 km range for EVs. It doubles the lifespan of the battery.

4.3 Quantifying the Silver Demand

The material requirements are massive. Each cell uses about 5 grams of silver. A 100 kWh EV battery pack would require 1 kilogram of silver. Let us contextualize this. Global silver production is ~25,660 metric tons. 16 million EVs are produced annually. If 20% use this tech, demand increases by 16,000 tons. That is 62% of the global supply. This single application could consume the market. It leaves no silver for other industries. It forces a repricing. The automotive industry has high pricing power. They will pay premiums to secure the supply. SLV holds the metal they need.

4.4 Commercialization and Patents

This is not science fiction. Samsung SDI plans mass production by 2027. Pilot lines are operational. Toyota targets 2027-2028. Patent analysis confirms this trend. Samsung holds key patents for the Ag-C layer. Toyota leads in total patent count. QuantumScape is also aggressive. The IP landscape is dense. This indicates heavy R&D investment. The commitment is real. Automakers are locking in designs. These designs require silver. Demand is becoming structural. It is “baked in” to future production lines.

5. Technological Revolution II: AI and High-Tech

5.1 The Physical Layer of AI

Artificial Intelligence lives in data centers. These centers require massive hardware. Silver is the best electrical conductor. It is the best thermal conductor. AI infrastructure demands reliability. Uptime must be 99.999%. Connectors must not fail. Heat must be dissipated efficiently. Silver is the material of choice. It is used in connectors, motherboards, and switches.

5.2 Power Density and Thermal Management

Data centers are getting hotter. IT power capacity has grown 53-fold since 2000. It reached nearly 50 GW in 2025. Higher power density requires better conductors. Resistance generates heat. Silver minimizes resistance. It is crucial for energy efficiency. Governments are prioritizing data center efficiency. This mandates the use of premium materials like silver.

5.3 5G and 6G Networks

Connectivity drives silver demand. 5G networks are rolling out. They require more base stations. Each station uses silver-plated components. This ensures low latency. 6G is on the horizon. It will use higher frequencies. It aims for sub-millisecond latency. The physics of high-frequency transmission favors silver. Skin effect losses are lower. Device proliferation is also a factor. The Internet of Things (IoT) connects billions of devices. Each contains traces of silver151. This silver is hard to recycle. It is consumed and lost. This creates a permanent drain on supply.

6. Technological Revolution III: Photovoltaics

6.1 The Solar Efficiency Race

Solar power is the largest industrial consumer of silver. The industry is evolving. Old technology is being replaced. New cells are more efficient. The shift is from PERC to TOPCon and HJT cells. TOPCon sales surpassed PERC in 2024. These new cells use 50% more silver. The pastes are essential for conductivity.

6.2 The Scale of Demand

Solar installations are surging. Global capacity reached 139 GW in 2023. Demand is projected to exceed 150 million ounces by 2026. This is nearly 18% of mine supply. Thrifting is hitting a wall. Engineers try to use less silver. But physics intervenes. Copper is a poor substitute. It oxidizes. It reduces panel life. For guaranteed performance, silver is non-negotiable. Governments mandate renewable energy. The EU and the US have aggressive targets. This guarantees demand. The solar sector acts as a massive, subsidized buyer of silver. This supports the SLV price floor.

7. Cyber Domain: The Hardware of Trust

7.1 Hardware Security Modules (HSMs)

Cybersecurity relies on hardware. Hardware Security Modules (HSMs) protect digital keys. They are the “root of trust”. Banks and governments use them. HSMs must be tamper-resistant. They use physical security mechanisms. Silver plays a unique role here. It is used in tamper-responsive envelopes.

7.2 The Mechanism of Tamper Response

These envelopes surround the internal chips. They consist of fine silver traces. These traces are serpentine. They are embedded in resin. If an attacker drills into the module, they break the trace. The circuit opens. The device detects this instantly. It erases its memory. The keys are destroyed. The data is safe.

7.3 Regulatory Standards

Standards drive this market. FIPS 140-2 Level 3 is the benchmark. It requires physical tamper detection. Silver is ideal for these traces. It is ductile. It is highly conductive. It is distinct from copper. This application is low volume but high value. It is price inelastic. Security vendors will pay any price for silver. The cost of a breach is far higher.

8. Patent Analysis: The IP Battlefield

8.1 Asian Dominance

Patents reveal the future. We analyzed filings in solid-state batteries. Asian firms dominate. Toyota, Samsung, and LG are the leaders. Japan holds 68% of international patents. The US holds 16%. Korea holds 12%. This concentration matters. It shows where the R&D money is going. It is going into silver-intensive tech.

8.2 Emerging Players

China is rising fast. Companies like CATL are filing more patents. Newcomers are entering the field. Startups like QuantumScape are innovating. QuantumScape holds patents on lithium-metal anodes. Samsung holds patents on Ag-C layers. These are competing approaches. However, Samsung’s approach is safer. It is gaining traction.

8.3 Strategic Implications

Patents are a moat. They protect investment. Companies with these patents will defend them. They will push for commercialization. This ensures the technology will hit the market. The surge in filings in 2025 confirms the trend. R&D is accelerating. The industry is preparing for mass adoption. This validates the projected demand for silver187.

9. iShares Silver Trust: Instrument Analysis

9.1 Trust Structure and Objective

The iShares Silver Trust (SLV) is a passive vehicle. It seeks to reflect the price of silver. It holds physical bullion. It issues shares backed by this metal. It is not an investment company. It is a grantor trust. It does not speculate. It does not trade futures. It exists to provide exposure to the spot price.

9.2 Custodian and Location

JPMorgan Chase Bank N.A. is the custodian. The silver is held in London vaults. This centralization is efficient. However, it introduces risk. London is a key hub. But supply is tightening. LME stocks are at historic lows. If physical metal runs out in London, the trust faces challenges.

9.3 Allocated vs. Unallocated Accounts

The trust uses allocated accounts. The silver is identified. It belongs to the trust. However, unallocated accounts are used for transfers. Unallocated silver is a credit claim. It is not physical ownership. The prospectus allows this for short periods. Critics argue this is a risk. In a default, unallocated holders are unsecured creditors. However, the trust minimizes this. It allocates metal quickly. The real risk is sourcing. Can Authorized Participants find 1,000-ounce bars? If not, share creation halts. This leads to premiums.

9.4 The Creation/Redemption Mechanism

Authorized Participants (APs) create shares. They deposit silver. They receive baskets of 50,000 shares. They can also redeem shares for silver. This mechanism keeps the price near NAV. But it relies on liquid physical markets. If the physical market dries up, the mechanism breaks. We saw this in 2020. Premiums spiked. This could happen again.

10. Conclusion

The iShares Silver Trust is at the center of a perfect storm. The drivers are structural. They are not merely cyclical.

- Regulatory Floor: The US government has acted. Silver is a Critical Mineral. This necessitates stockpiles. It invites federal support.

- Supply Cliff: Production is inelastic. It is concentrated in volatile regions. Deficits are chronic. Inventory is depleted.

- Demand Explosion: Three “super-cycles” are converging. Solar, AI, and Batteries. The demand is massive. It exceeds mine supply.

- Technological Lock-in: Patents are filed. Factories are built. Samsung and Toyota are committed. They need silver.

SLV is the vehicle of choice. It offers liquidity. It offers direct exposure. As industrial users scramble for metal, prices must rise. The market must ration demand. Silver is moving from a discretionary asset to a strategic necessity. SLV investors are positioned to benefit from this historic repricing.

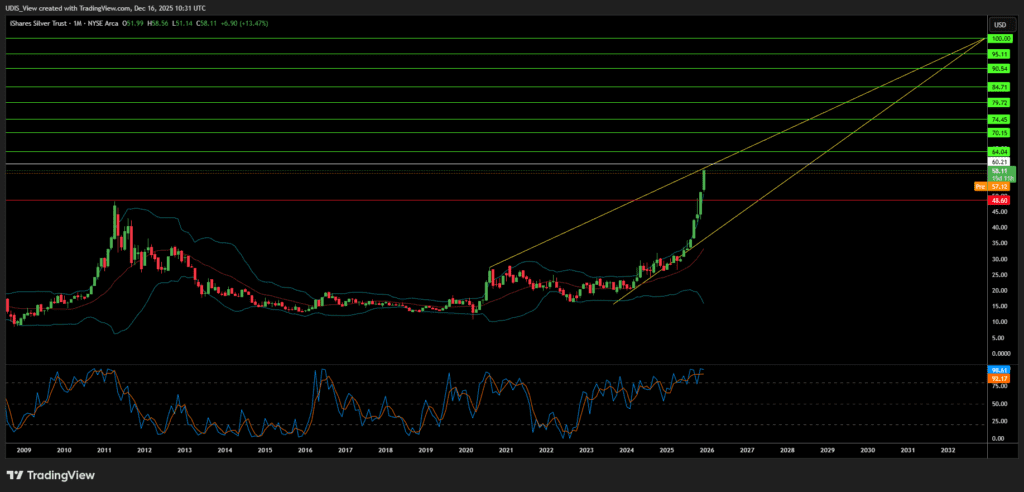

SLV Long (Buy)

Enter At: 60.21

T.P_1: 64.04

T.P_2: 70.15

T.P_3: 74.45

T.P_4: 79.72

T.P_5: 84.71

T.P_6: 90.54

T.P_7: 95.11

T.P_8: 100

S.L: 48.60