1. The Return of Naval Power

1.1 The Strategic Imperative

The world has returned to the sea. Great power competition is no longer a theoretical exercise. It is a reality of steel and radar. The United States Navy faces its greatest challenge in generations. It must secure the oceans against rising rivals. It must protect global trade from asymmetric threats. This mission requires ships. It requires advanced sensors. It requires autonomous systems. Huntington Ingalls Industries (HII) stands alone at this intersection.

1.2 Redefining the Defense Prime

HII is not merely a legacy shipbuilder. It is a technology integrator of the highest order. The market has misunderstood this evolution. Investors see a slow-moving industrial giant. The reality is a nimble, tech-forward defense prime. HII has secured the most critical franchises in naval warfare. It owns the destroyer market. It has captured the future frigate program. It is pioneering the unmanned frontier.

1.3 Operational Excellence and Value

The company executes while others delay. The delivery of USS Ted Stevens proves this competence. The pivot to the Legend-class frigate validates their design philosophy. The expansion into distributed shipbuilding solves the labor crisis. HII is building the “Golden Fleet” demanded by the national strategy. The stock trades at a discount to its potential. This report outlines the case for HII as the premier defense asset of the decade.

2. The Destroyer Backbone: Dominating the High-End Fight

The Arleigh Burke-class destroyer is the workhorse of the fleet. It is the most successful surface combatant in history. HII’s Ingalls Shipbuilding division is the master of this platform. The program has entered a new, critical phase. This is the Flight III era.

2.1 The Strategic Significance of Flight III

The Flight III is not just an upgrade. It is a transformation. The hull looks familiar, but the capabilities are revolutionary. The driving force is the AN/SPY-6(V)1 radar. This system changes the calculus of naval warfare. The Navy needs a shield against ballistic missiles. The Flight III provides it.

Ingalls Shipbuilding delivered the USS Ted Stevens (DDG 128) in late 2025. This was the second Flight III ship to join the fleet. Brian Blanchette, Ingalls president, noted the strong momentum. The yard is not struggling with the transition. It is accelerating. Four more Flight III ships are under fabrication. Seven others are in pre-planning. This backlog is a fortress of revenue.

2.2 The Physics of SPY-6 Superiority

The AN/SPY-6(V)1 Air and Missile Defense Radar is a technological marvel. It replaces the legacy SPY-1D. The difference is stark.

- Sensitivity: The SPY-6 is 30 times more sensitive than its predecessor.

- Material Science: It uses Gallium Nitride (GaN) modules.

- Efficiency: These modules operate at 30% higher voltage.

- Reliability: The system offers 15% more uptime under continuous use.

These numbers translate to survival. A 30x increase in sensitivity allows earlier detection. The ship can see stealthier targets. It can track hypersonic missiles further out. This buys time. In missile defense, time is the only currency that matters.

Table 1: Radar Evolution – SPY-1 vs. SPY-6

| Feature | AN/SPY-1D (Legacy) | AN/SPY-6(V)1 (Flight III) | Operational Impact |

| Technology | Passive Phased Array | Active Electronically Scanned Array | Instantaneous beam steering. |

| Semiconductor | Gallium Arsenide | Gallium Nitride (GaN) | Higher power density and range. |

| Tracking Capacity | High | Massive (+100 targets) | Defeats saturation attacks. |

| Threat Set | Cruise/Ballistic | Hypersonic/Ballistic/Drone | Future-proofs the fleet. |

Raytheon President Wes Kremer called it the most advanced naval radar in existence. No other system matches its maritime capabilities. It turns the destroyer into a true missile hunter. The USS Jack H. Lucas proved this in trials. The USS Ted Stevens will now deploy this power globally.

2.3 Economic Impact of Sensor Dominance

The strategic value has an economic dimension. A 2025 report credits SPY-6 ships with protecting trade. The report cites a 45% reduction in successful attacks by hostile groups. This protects $1.2 trillion in annual trade flows. The radar handles asymmetric threats effectively. It tracks drones and missiles simultaneously. This capability justifies the cost of the ship. Congress understands this return on investment.

2.4 Engineering the Hull for Power

Integrating SPY-6 was a massive engineering challenge. The radar demands immense power. It generates significant heat. HII had to redesign the ship’s interior. They upgraded the electrical grid. They installed new cooling plants. HII achieved this while maintaining the hull form consistency. This evolutionary approach minimized risk. A new hull design would have caused delays. HII chose stability. They modified the existing Arleigh Burke plans. The length increased slightly to 509.5 feet. The displacement grew to 9,700 tons. HII engineers successfully managed these changes. The seamless delivery of DDG 128 proves their skill. 15151515

3. The Frigate Pivot: Validating the HII Model

The U.S. Navy made a stunning pivot in late 2025. It canceled the Constellation-class frigate. It selected a design based on HII’s Legend-class cutter. This decision is a vindication of HII’s performance. It is a massive win for the Pascagoula shipyard. 16161616

3.1 The Failure of Complexity

The Constellation-class was meant to be a quick win. It failed. The design became too complex. Delays mounted. Costs rose. The Navy needed ships in the water. They could not wait for a paper design to mature. Navy Secretary John Phelan announced the change. He directed the acquisition of a new class. He specifically cited HII’s Legend-class National Security Cutter (NSC), calling it a “proven American-built ship”. This phrase is key. The Navy values execution over theoretical perfection.

3.2 The Legend-Class Solution

The Legend-class NSC is a known quantity. Ingalls Shipbuilding has delivered 10 of them to the Coast Guard. The production line is warm. The workers know the build sequence. The supply chain is established.

Table 2: Legend-Class Base Specifications

| Metric | Specification | Strategic Relevance |

| Length | 418 feet | Ocean-going capability. |

| Beam | 54 feet | Stability in rough seas. |

| Displacement | 4,500 – 4,700 long tons | Sufficient payload capacity. |

| Speed | 28+ knots | Keeps pace with task forces. |

| Range | 12,000 nautical miles | Global reach without tankers. |

| Endurance | 60-90 days | Sustained independent patrols. |

HII CEO Chris Kastner emphasized the value of speed. He noted that the NSC design is “stable and producible”. This predictability is what the Pentagon craves. The Navy needs to reach 355 ships. They cannot do it with delays. The NSC hull provides a fast track to fleet growth.

3.3 The “Golden Fleet” Concept

This new frigate fits into the “Golden Fleet” strategy. This concept calls for distributed lethality. The Navy needs more sensor nodes. It needs more missile shooters. It cannot risk a $3 billion destroyer for every mission. The NSC-based frigate fills the gap. It is a “Small Surface Combatant” (SSC). It can handle convoy escort. It can patrol the Red Sea. It can hunt submarines in the Atlantic. This frees up the Arleigh Burkes for the high-end fight. The NSC hull is large enough for upgrades. It already has a large flight deck. It has automated weapons systems.

3.4 Industrial Synergy

The award leverages Ingalls’ existing infrastructure. HII is currently building three classes of ships at Pascagoula. These are the DDG 51, the LHA, and the LPD. Adding the NSC-based frigate is seamless. The yard has the capacity. HII has invested $1 billion in facility upgrades. They have laser scanning tools. They have covered production halls. The NSC line will sit alongside the destroyer line. This density reduces overhead. It allows for flexible labor allocation. If one program slows, workers can shift to another. This stabilizes the workforce.

4. The Unmanned Revolution: Coding the Future

HII is not waiting for the manned ship market to peak. They are aggressively entering the unmanned sector. This is the fastest-growing segment of naval defense. HII is positioning itself as the leader in autonomous maritime systems.

4.1 The Exploding Market for Drones

The market numbers are compelling. The Unmanned Surface Vehicle (USV) market will grow rapidly.

- 2025 Value: $0.82 billion.

- 2030 Forecast: $1.59 billion to $2.18 billion.

- CAGR: Approximately 14.1%.

- Volume: Units will double from 2,036 to 4,010.

The Navy’s “Project 33” drives this demand. The goal is to field robotic platforms quickly. These vessels must be cost-effective. They must reduce risk to sailors. The Navy wants “non-exquisite” vessels built to commercial standards. 32323232

4.2 Enter the Romulus

HII’s answer is the Romulus family of USVs. The company unveiled this line in September 2025. The flagship is the Romulus 190. It is designed precisely for the Navy’s needs.

Table 3: Romulus 190 USV Capabilities

| Capability | Specification | Mission Application |

| Length | 190 feet | Open ocean stability. |

| Speed | 25+ knots | Transit and intercept. |

| Range | 2,500+ nautical miles | Long-duration surveillance. |

| Payload | 4 x 40ft ISO Containers | Modular mission packages. |

| Autonomy | Odyssey ACS | COLREGS-compliant navigation. |

The use of standard ISO containers is brilliant. It allows for rapid reconfiguration. The Navy can swap modules in port. One mission might be mine hunting. The next might be electronic warfare. The hull remains the same. The payload changes. This reduces logistical drag.

4.3 The Remus Deep Connection

HII dominates the underwater domain with Remus. The Remus 620 is a medium-class UUV. It is the industry standard. HII has sold over 700 Remus vehicles to 30 countries. This user base is a massive competitive advantage.

The synergy is powerful. The Romulus USV can launch the Remus UUV. This creates a “dual-domain” force. The surface ship acts as a mothership. It carries the robots to the danger zone. It deploys them. It relays their data. The human operator stays safe over the horizon.

4.4 The Odyssey Brain

The secret sauce is software. HII developed the Odyssey Autonomous Control System. This software runs the ships.

- Experience: 6,000+ operational hours.

- Versatility: Integrated on 23 different vessel types.

- Open Architecture: Supports UMAA, ROS, and DDS.

Open architecture is crucial. The Navy hates vendor lock-in. They want to plug in third-party sensors. Odyssey allows this. It is “plug-and-play” for autonomy. HII sells the platform and the operating system. This is a sticky revenue model.

4.5 Strategic Partnerships in Tech

HII does not work alone. They partner with the best.

- Thales: HII integrated the SAMDIS 600 sonar into the Remus 620. This sonar takes three images per pass. It uses AI to classify mines.

- Incat Crowther: This Australian firm designs the Romulus hulls. They are experts in commercial ferries. This ensures the hull is efficient and cheap to build.

- Breaux Brothers: This Louisiana shipyard builds the Romulus. They are commercial builders. This keeps costs down.

These partnerships allow HII to move fast. They do not need to invent a new sonar. They use Thales. They do not need to design a new hull form. They use Incat. HII acts as the prime integrator. They bring the pieces together.

5. Distributed Shipbuilding: Solving the Labor Crisis

The U.S. industrial base faces a labor shortage. Shipyards struggle to hire welders and fitters. HII has attacked this problem head-on. They pioneered “distributed shipbuilding.”

5.1 The Outsourcing Strategy

HII realized they could not build everything in Pascagoula. They decided to outsource structural work. They partner with smaller yards. These partners build ship modules. The modules are barged to HII for assembly.

- Bollinger Shipyards: They build the Mine Countermeasures USV.

- Austal USA: They provide steel fabrication capacity.

- Network: HII has 23 manufacturing partners.

HII doubled its outsourced hours in 2025. They plan to quadruple them in two years. This expands the industrial base. It taps into labor pools in other states. It reduces bottlenecks at the main yard.

5.2 The HHI Partnership

HII is also looking abroad for ideas. They hosted executives from HD Hyundai Heavy Industries (HHI). HHI is the world’s largest shipbuilder. They are masters of efficiency. The goal is technology transfer. HII wants to learn Korean production methods. They want to use robotics. They want to digitize the yard. This partnership is unique. It shows HII’s willingness to adapt. They are not too proud to learn.

5.3 The Workforce Battle

Retention is the other half of the equation. Attrition for first-year shipbuilders was 50-60%. The work is hard. The pay must be competitive. HII raised wages in mid-2025. The results were immediate. Retention of skilled trades improved. CEO Chris Kastner said they are “paying for experience”. They stopped hiring just anyone off the street. They focus on graduates from the Apprentice School and community colleges. These workers have a career mindset. They stay longer.

6. Spectrum Dominance: The Invisible War

Modern ships are data centers. They fight in the electromagnetic spectrum (EMS). HII designs its ships for this reality.

6.1 The EMS Imperative

The 2025 National Security Strategy highlights EMS superiority. Friendly forces must communicate. They must jam the enemy. This is “spectrum superiority”. HII ships host the most advanced EW suites. The Legend-class frigate carries the AN/SLQ-32 system. This system detects radar lock-ons. It triggers decoys. It creates electronic noise to hide the ship.

6.2 Miniaturization and Swarms

The future is small EW payloads. Thales unveiled a mini-payload for small drones. Leonardo launched BriteStorm.

- BriteStorm: A stand-in jammer. It weighs only 5.5 lbs.

- Function: It creates “ghost” fleets on enemy radar.

HII’s Romulus USV can carry these. Imagine a swarm of USVs. Each carries a BriteStorm jammer. They rush the enemy fleet. The enemy radar sees hundreds of targets. They cannot find the real destroyers. The USVs act as a screen. This is a game-changer. HII provides the delivery vehicle for this chaos.

7. Financial Fortress: The Value Case

The market undervalues HII. The company has strong fundamentals. It has a massive backlog. It has a secure dividend.

7.1 Valuation Disconnect

Defense stocks typically trade at high multiples. HII trades at a discount.

- Industry Average P/E: 37.6x.

- HII P/E: ~24.2x.

- General Dynamics P/E: 21.8x.

- Northrop Grumman P/E: 20.5x.

HII is cheaper than the industry average. Yet, its estimated growth is higher.

Investors are missing the growth story. The Flight III ramp-up drives revenue. The new frigate award adds a second growth engine. The unmanned business adds a third.

Table 4: Valuation Metrics Comparison

| Metric | HII | Peer Average | Implication |

| P/E Ratio | 24.2x | 37.6x | Significant upside potential. |

| Growth Est. | 11.19% | ~8% | Outpacing major competitors. |

| Market Cap | ~$13.6B | $90B+ (GD/NOC) | Agile mid-cap with room to run. |

7.2 Revenue Visibility

Shipbuilding is a long-cycle business. Contracts last for decades. Ingalls Shipbuilding has a backlog that stretches into the 2030s. The destroyer line is booked solid. The amphibious ship line is stable. The new frigate line will run for 20 years. This visibility allows for capital planning. HII can return cash to shareholders. They can invest in R&D. They do not worry about next quarter’s sales. The sales are already signed.

7.3 The Maintenance Annuity

HII does not just build ships. They fix them. Every ship needs maintenance. This is the “razor and blade” model. The Navy cannot go elsewhere. HII owns the technical data. The Arleigh Burke fleet is aging. They need upgrades. HII wins these contracts. The Legend-class cutters need refits. HII wins these, too. This service revenue is high-margin. It balances the lower margins of new construction.

8. Geopolitical Drivers: The Demand Signal

HII does not operate in a vacuum. Global events drive its order book. The world is becoming more dangerous. This is good for business.

8.1 The China Challenge

China is building a massive navy. They launch more tonnage than the U.S. every year. The U.S. Navy must respond. They need more vertical launch cells. They need better radar. The Arleigh Burke Flight III is the direct response. It is the only ship that can track Chinese hypersonic missiles. The Navy cannot stop buying them. The strategic risk is too high. HII is the sole source for the solution.

8.2 The Red Sea Lesson

The Houthi attacks in the Red Sea changed naval thinking. Cheap drones can threaten billion-dollar ships. The Navy needs depth. They need numbers. The NSC-based frigate is the answer. It provides presence. It can shoot down drones. It frees up the destroyers. The Romulus USV is the other answer. It provides a picket line. It takes the first hit. HII builds both solutions.

8.3 Protecting the Arteries of Commerce

The global economy relies on shipping. 90% of trade moves by sea. The U.S. Navy guarantees this flow. The SPY-6 radar protects $1.2 trillion in trade. This is not just defense. It is economic insurance. Wall Street understands this. The stability of the global market depends on HII products.

9. Conclusion: The Indispensable Titan

Huntington Ingalls Industries is the most critical company in the naval sector. It has successfully navigated the transition to a new era. It has embraced technology. It has reformed its labor model. It has secured the most important contracts in the Pentagon budget. The Flight III destroyer ensures cash flow for a decade. The new frigate opens a new chapter of growth. The unmanned division positions the company for the 2040s. The valuation remains attractive. The risks are known. Budgets fluctuate. Labor is tight. Supply chains are fragile. But HII has built a fortress against these threats. They have diversified their portfolio. They have distributed their production. They have deepened their moat. For the investor, the signal is clear. HII is not a relic of the past. It is the architect of the future fleet. The Golden Fleet is rising. HII is building it. The anchor is weighed. The course is set. The opportunity is now.

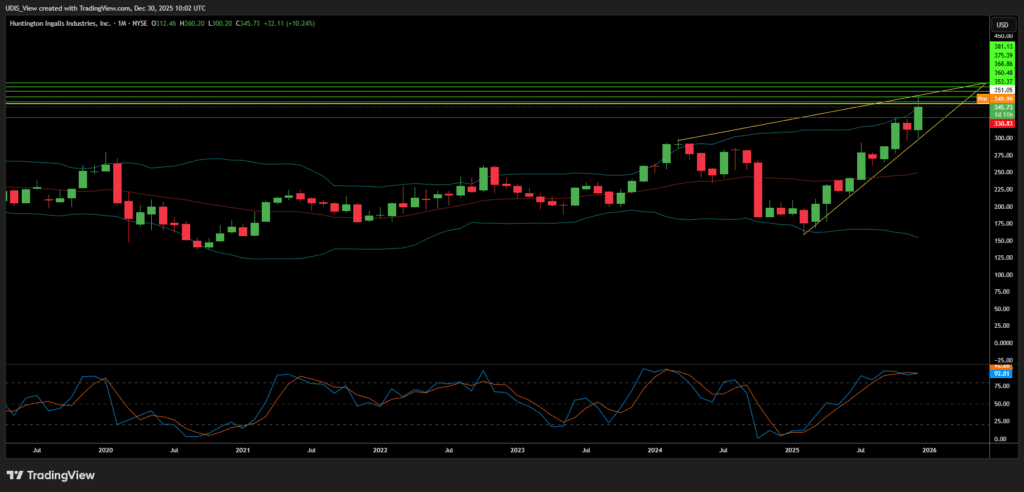

Huntington Ingalls Industries Long (Buy)

Enter At: 351.05

T.P_1: 353.37

T.P_2: 360.48

T.P_3: 368.86

T.P_4: 375.39

T.P_5: 381.13

S.L: 330.83