Howmet Aerospace – Navigating Geopolitical Currents to Soar

Howmet Aerospace (HWM) stands as a prominent performer within the aerospace sector. It consistently defies broader market headwinds through robust earnings growth and strategic capital allocation. Despite trading at a premium valuation, the company’s strong fundamentals, driven by commercial aerospace demand, margin expansions, and disciplined shareholder returns, present a compelling investment opportunity. The trajectory of Howmet Aerospace is deeply intertwined with global geopolitical and geostrategic shifts. These macro-level dynamics significantly influence the company’s stock performance and its strategic fit within the evolving global landscape. The aerospace and defence industry is undergoing a profound transformation, with mounting geopolitical tensions serving as a primary catalyst for this change.1

Howmet’s success extends beyond internal operational efficiency. Its ability to align with and benefit from global shifts is fundamental. The company’s premium valuation reflects this deep macro-alignment. This strategic positioning within a geopolitically volatile world is a core driver of its sustained growth and market perception, rather than simply a contextual factor.

Howmet Aerospace: A Resilient Performer in a Dynamic Market

Robust Earnings Growth and Financial Health

Howmet Aerospace has demonstrated exceptional financial performance. The company reported a record-setting first quarter in 2025. Revenue reached $1.94 billion, marking a 6% year-over-year increase. The commercial aerospace segment notably surged by 9%. This growth underscores strong market demand for Howmet’s specialized products.

Profitability metrics also showed significant improvement. Earnings per share (EPS) jumped 42% to $0.84. Adjusted EPS rose 51% to $0.86, reflecting substantial operational efficiency gains. The adjusted operating margin expanded by 500 basis points to 25.3%. This expansion is a testament to the company’s stringent cost discipline and leveraging of scale advantages.

Howmet’s financial outlook remains optimistic for 2025. Full-year revenue is projected to grow to $7.88–8.18 billion. Adjusted EBITDA is expected to reach $2.225–2.275 billion. The company’s adjusted EBITDA margin has steadily expanded, from 25.7% in Q2 2024 to 28.8% in Q1 2025. This consistent improvement stems from pricing strength and productivity gains.2 Furthermore, Howmet’s cost of goods sold remained flat year-over-year in Q1 2025. Selling, General, and Administrative (SG&A) expenses also decreased slightly. These factors collectively contributed to improved profit margins, even amidst challenging conditions in the commercial transportation market.2 Howmet’s operational execution and cost management actions are evident.

Table 1: Howmet Aerospace Key Financial Performance & Outlook (Q1 2025 & Full Year 2025 Guidance)

| Metric | Q1 2025 Performance | Full-Year 2025 Guidance |

| Revenue | $1.94 Billion | $7.88–8.18 Billion |

| Commercial Aerospace Rev. Growth | 9% | N/A |

| Adjusted EPS | $0.86 | $3.36–$3.44 |

| Adjusted Operating Margin | 25.3% | N/A |

| Adjusted EBITDA | N/A | $2.225–2.275 Billion |

| Free Cash Flow | $253 Million | $1.15 Billion |

| Current P/E Ratio (TTM) | 55.59x | N/A |

| Current EV/EBITDA | 32.91x | N/A |

Favorable Industry Dynamics: Twin Tailwinds

The aerospace sector benefits from two significant tailwinds. Surging demand for commercial aircraft and rising defence spending both contribute to industry growth.3 Howmet’s diversified portfolio, encompassing engine components, fasteners, and forged wheels, strategically positions it to capitalize on both trends.3

In commercial aerospace, airlines are actively upgrading their fleets. They favor fuel-efficient aircraft such as the Boeing 787 and Airbus A320neo. This modernization drives substantial demand for Howmet’s lightweight, high-performance parts.3 Passenger air traffic continues its upward trajectory. Demand for new airplanes is expected to outstrip supply for several years.4

Defence spending presents another robust growth area. The U.S. defence budget is projected to exceed $840 billion in 2025. This substantial allocation supports critical programs like the F-35 fighter jet, where Howmet supplies essential components.3 Global military expenditure reached an unprecedented $2.718 trillion in 2024. This marked a 9.4% increase from 2023, representing the steepest year-on-year rise since the Cold War.7 This surge occurred across all world regions, with particularly rapid growth in Europe and the Middle East.7

Howmet’s strong operational execution and cost management serve as a significant buffer. They allow the company to thrive even when external geopolitical and economic conditions are uncertain. Its ability to maintain margins despite challenging conditions in the commercial transportation market further underscores this resilience.2 The company’s focus on lightweight, high-performance components serves a dual strategic purpose. It meets immediate economic needs for fuel efficiency. It also aligns with long-term sustainability trends in aerospace, driven by growing regulatory and consumer demand for greener aviation solutions.8

Shareholder Returns and Valuation Justification

Howmet remains committed to returning cash to shareholders, even with its premium valuation. The company’s P/E ratio stands at 55.59, and its EV/EBITDA at 32.91, both exceeding industry averages. In Q1 2025 alone, Howmet repurchased $125 million of stock, with an additional $100 million in April. It also increased its dividend by 100% to $0.10 per share. Strong free cash flow, totaling $253 million in Q1, robustly supports these returns.

Howmet’s valuation is elevated. Its forward P/E of 44.9x surpasses the sector average of 26x. However, the company’s fundamentals justify this optimism. Operating margins have surged 520 basis points year-over-year, a trend likely to persist as scale benefits materialize. Fitch’s recent BBB+ rating upgrade and low debt levels ($2.9 billion in cash versus $1.3 billion in debt) bolster its creditworthiness. Furthermore, Howmet’s capital allocation prioritizes high-return projects, such as advanced engine components for hybrid-electric aircraft. This strategic focus positions the company for future technologies.

The Geopolitical Imperative: Reshaping Global Aerospace & Defense

Evolving Global Geopolitical Landscape (2025)

The year 2025 promises significant geopolitical developments, profoundly impacting global business. The world is increasingly multipolar, characterized by fragmented influence among global powers.10 Globalization itself may become more fractious and uncertain. The United States is pursuing a potentially more protectionist economic approach. Proposed tariffs of 60% on China and up to 20% on all trading partners could disrupt global trade patterns, especially with potential retaliation from trading partners.10

The declining cooperation between the U.S. and China is deepening global divisions. This raises concerns about the stability of international partnerships and the global economy.11 The rivalry intensifies over technological dominance, particularly in artificial intelligence, fueling uncertainty over supply chains and long-term business planning.11 This drive for geopolitical derisking is compelling aerospace companies to reconfigure their supply chains. It favors suppliers with robust, geographically diversified, or domestically anchored production capabilities. Howmet is well-positioned to leverage this trend.

The European Union also faces considerable pressure. High energy prices and competitive pressures from China and the U.S. challenge European industry. The U.S. trade agenda could exacerbate these challenges through potential tariffs on Europe.10 A revised American approach to the Ukraine conflict will also impact European security dynamics.10

Surge in Global Defense Spending

Global military expenditure reached an unprecedented $2.718 trillion in 2024. This represents a 9.4% increase from 2023, marking the steepest year-on-year rise since the end of the Cold War.7 Military spending increased across all world regions. Europe and the Middle East experienced particularly rapid growth.7

Growing geopolitical tensions have created an urgent need to strengthen Europe’s defense capabilities.12 The ongoing Russian threat and concerns about possible U.S. disengagement within NATO primarily drove rapid spending increases among European NATO members.7 NATO’s defense spending target, as a share of national GDP, is set to rise beyond 2% in the coming years. A new target level of 3%-3.5%, and possibly even 5% longer-term, has been suggested. Decisions are expected at the NATO summit in late June 2025.12

The U.S. maintains its dominance in defense spending. Its military expenditure rose 5.7% to $997 billion in 2024. This accounted for 66% of total NATO spending and 37% of world military spending.7 The U.S. defense budget is projected to exceed $840 billion in 2025. Military spending now accounts for approximately 60% of the overall aerospace and defense market. Investments in advanced fighter jets, unmanned aerial vehicles (UAVs), and missile systems are consistently rising.13

For the aerospace and defense sector, especially companies like Howmet, escalating geopolitical instability translates into a direct and substantial market opportunity. This creates a counter-cyclical demand driver.

Table 2: Global Military Expenditure & NATO Defense Spending Targets (2024-2025)

| Metric | Value (2024) | Outlook (2025) |

| World Military Expenditure | $2.718 Trillion | Continued Growth |

| Year-over-Year Increase | 9.4% | N/A |

| U.S. Military Expenditure | $997 Billion | >$840 Billion |

| U.S. % of Total NATO Spending | 66% | N/A |

| NATO Defense Spending Target (% of GDP) | >2% | 3%-3.5% (suggested) |

Geopolitical Impact on Commercial Aviation & Supply Chains

Geopolitical tensions significantly affect commercial aviation and global supply chains. Ongoing conflicts lead to sudden airspace restrictions. This forces airlines to make rapid operational adjustments. These adjustments result in longer flight times, increased fuel consumption, and higher operational costs.14 For instance, Western countries banned Russian airlines from their airspace, leading to extensive rerouting of long-haul flights between Europe and Asia.15

Economic sanctions, a direct consequence of geopolitical strife, indirectly impact general aviation. They can disrupt the supply of critical materials like titanium, essential for aircraft parts.14 Maintenance shops frequently face longer lead times or higher prices for globally sourced components due to these ripple effects.14

Broader geopolitical risks, including trade wars and conflicts, destabilize entire supply chains. This leads to production delays, increased costs, or even complete breakdowns in critical operations.16 Operational costs increase through trade route disruptions, tariffs, sanctions, and the necessity for inventory stockpiling as a countermeasure to potential shortages.16 The aerospace and defense industry faces ongoing challenges such as supply chain issues, longer lead times, and talent shortages, even as demand increases.17 Personnel shortages, affecting 65% of companies, and a lack of production capacity, cited by 34% of respondents, remain key challenges in the aerospace supply chain in 2025.18 Financing is also emerging as a growing concern for the industry.18 Geopolitical tensions create a complex web of increased costs and delays across the aerospace supply chain. This impacts not just direct tariff exposure but also broader inflationary pressures on materials and operations. Howmet’s demonstrated resilience is particularly noteworthy amidst these pervasive challenges.

Howmet’s Strategic Nexus: Powering Geopolitical Priorities

Critical Components for Major Programs

Howmet Aerospace’s contributions are vital to major aerospace and defense programs. Its innovation is instrumental in the F-35 Joint Strike Fighter’s performance.5 Howmet supplies single-piece forged aluminum bulkheads for the F-35, saving 300 to 400 pounds per jet and reducing costs by up to 20%.6 It also provides titanium bulkheads and titanium material for airframe structures across all three F-35 variants.6

For engine propulsion, Howmet delivers single-crystal, nickel-based superalloy blades and vanes for the F-35 engine. These components operate in environments hotter than the metal’s melting point.6 Seamless rolled rings encase these engine parts, ensuring structural integrity.6 Howmet also supplies turbine blades for CFM International’s LEAP engine, directly supporting Boeing 737 MAX and Airbus A320neo production targets.19 Additionally, it provides advanced blades for the GTF engine, a joint venture between Pratt & Whitney and Safran.19

Howmet manufactures vibration-resistant fasteners, engineered to endure extreme G-forces and performance requirements. These are crucial for the F-35’s complex design.6 The company has seen fastener margins surge by 400 basis points.19 For commercial aviation, Howmet supplies lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo.3 Howmet’s components are not merely parts; they are innovations enabling unprecedented stealth, speed, and agility. They help meet aggressive weight, range, and fuel efficiency targets. Howmet is not simply a supplier but a critical technological partner driving the future of aviation.

Strategic Importance of Lightweight Materials and Advanced Manufacturing

Lightweighting is a central focus for aerospace research and development. It significantly improves fuel efficiency and reduces emissions.9 Reducing one kilogram of material from an airplane saves 106 kilograms of jet fuel annually, leading to dramatic impacts at scale.9 This is crucial for meeting stringent sustainability goals and environmental regulations within the aerospace industry.8

In defense applications, lightweight materials are critical. They allow components to be lighter without sacrificing strength, enhancing maneuverability and overall performance of military equipment.20 Howmet’s deep material science and manufacturing expertise make it an indispensable partner in the development and production of next-generation aircraft, both commercial and military. This ensures its long-term relevance and growth.

Howmet has also made significant strides in advanced manufacturing. The company doubled production since 2019 while halving its workforce in key facilities. This remarkable achievement stems from extensive automation and process optimization.19 This efficiency directly translates to increased profitability.19 Howmet’s substantial investment in automation and process optimization not only drives profitability but also enhances its supply chain resilience. This mitigates labor-related risks and strengthens its competitive position in a volatile geopolitical environment.

Table 3: Howmet Aerospace’s Strategic Product Contributions to Key Aerospace Programs

| Program | Howmet Components | Strategic Impact |

| F-35 Joint Strike Fighter | Forged Aluminum Bulkheads, Titanium Bulkheads, Superalloy Blades & Vanes, Seamless Rolled Rings, Vibration-Resistant Fasteners | Weight reduction (300-400 lbs/jet), 20% cost savings, Enhanced stealth, speed, agility, Extreme temperature operation, Structural integrity, Fuel efficiency |

| Boeing 737 MAX, Airbus A320neo | Turbine Blades (LEAP engine), Lightweight, High-Performance Parts | Supports production targets, Improves fuel efficiency, Reduces emissions |

| Next-Gen Propulsion Systems (GTF engine) | Advanced Blades | Future-proofing technology, High-value component leadership |

| Boeing 787, Airbus A320neo | Lightweight, High-Performance Parts | Drives demand for fuel-efficient aircraft, Supports fleet upgrades |

Diversified Portfolio Capitalizing on Tailwinds

Howmet’s diversified portfolio is a key strength. Its segments, including engine components, fasteners, and forged wheels, enable it to capitalize on both surging commercial aircraft demand and rising defense spending.3 While the Forged Wheels segment faced a 13% revenue decline due to weaker commercial transportation demand, this drag was offset by strong performance in Engine Products and Fastening Systems.3 These latter two segments are leveraging margin improvements, a trend that can sustain profitability even amidst market volatility.

Mitigating Risks: Supply Chain Resilience and Tariff Navigation

Aerospace Supply Chain Challenges and Resilience Measures

The aerospace supply chain continues to face significant challenges. Almost two-thirds of aerospace companies, 64%, still report supply chain disruptions. The primary reasons cited are increased lead times and limited availability of raw materials and semi-finished goods.18 However, the industry appears to be turning a corner. The supply chain crisis shows signs of stabilization. Resilience is increasing, and the severity of disruptions is decreasing.18 Measures implemented to improve resilience are beginning to yield positive results.18

Howmet’s robust operational efficiency, strong demand outlook, and proactive supply-chain management efforts position it to maintain margin strength.2 The company’s new plant in Japan, dedicated to industrial gas turbine (IGT) components, serves as a strategic hedge against potential supply chain disruptions.19 This proactive approach helps Howmet navigate the inherent volatility of global supply networks.

Navigating Tariff Impacts

The threat of tariffs presents a notable risk to global trade. For instance, former President Donald Trump’s threat of tariffs against U.S. imports of copper pushed prices up on COMEX.21 Trump announced tariffs ranging from 10% to 50%.21 He also threatened additional tariffs on China, potentially 50% effective April 9, 2025, if China did not withdraw a 34% increase by April 8, 2025.22

Howmet has adopted a proactive and assertive strategy to mitigate these tariff impacts. The company declared a “force majeure” event. This legal term allows contracting parties to be excused from obligations when faced with unavoidable or unpredictable external circumstances, such as government-imposed tariffs.21 This declaration signals Howmet’s intent to be excused from providing products or services impacted by such executive orders.21

Howmet’s use of force majeure clauses demonstrates a sophisticated legal strategy to manage geopolitical trade risks. It effectively turns a potential liability into a managed cost and strengthens its contractual position. By leveraging these clauses and renegotiating trade agreements, Howmet has successfully slashed tariff-related costs. These costs are now below initial estimates of €15 million annually.19 This proactive stance highlights the company’s agility in a complex global trade environment.

Investment Outlook: Howmet’s Enduring Value in a Geopolitically Charged Era

Investment Thesis: Growth, Profitability, and Shareholder-Friendly Policies

Howmet Aerospace represents a compelling investment opportunity. It offers a unique blend of growth, profitability, and shareholder-friendly policies within a sector often overshadowed by macroeconomic risks. The company’s consistent execution excellence and the prevailing secular tailwinds in aerospace justify a bullish stance, despite its current premium valuation. Howmet is well-positioned to sustain its strong margin performance and deliver continued growth in the foreseeable future.2

Contrarian Opportunity from Russell Index Rebalance

Howmet’s removal from the Russell 3000 Value Index on June 30, 2025, sparked considerable debate among investors. Typically, such exclusions might trigger short-term selling pressure. However, Howmet’s stock surged 40% in the preceding quarter, defying this conventional wisdom. This divergence suggests that astute investors have already factored in the company’s robust fundamentals, prioritizing them over mechanical index rules.

This situation presents a potential buying signal. Howmet’s Q1 2025 results were stellar, with sales rising 15% year-over-year and net income doubling. The company also reaffirmed its $1.2 billion buyback program. The stock is currently trading near analyst targets, indicating a slight discount to its intrinsic value.

The exclusion from the Value Index likely reflects Howmet’s transition from a traditional “value” stock to a growth-oriented one. Metrics such as a rising price-to-book ratio, now 5.2x compared to 2.8x three years ago, signal stronger earnings momentum. This makes it a more suitable fit for growth indices. Yet, its forward P/E of 22x remains lower than peers like Spirit AeroSystems (SPR) at 28x. This misalignment between mechanical reclassification and economic reality creates a potential buying opportunity. Howmet’s reclassification from a value to a growth stock by index providers presents a unique contrarian investment opportunity. Its underlying fundamentals and strategic direction may be undervalued by passive investment flows.

Several catalysts lie ahead for Howmet. The company’s business is closely tied to the global aerospace recovery, with surging demand for commercial aircraft engines and defense systems. Long-term contracts with industry giants like Boeing (BA) and Lockheed Martin (LMT) provide significant stability. Furthermore, Howmet’s lightweight aerospace components are critical for fuel efficiency, offering a “green premium” in an increasingly carbon-conscious era.

Key Risks and Monitoring Points

While Howmet Aerospace demonstrates strong resilience, certain risks warrant monitoring. Broader macroeconomic risks, including geopolitical tensions and interest rate trends, could impact valuation multiples and global manufacturing demand. A general deterioration in global economic and financial market conditions also poses a risk.23

Specific industry risks include potential tariff escalation or a slowdown in defense spending. The company also faces potential cyberattacks and information technology or data security breaches.23 While the Russell index exclusion could attract short-term volatility as passive funds liquidate positions, Howmet’s diversified revenue streams and robust liquidity buffer help mitigate these concerns. In a world of heightened geopolitical risk, Howmet’s strategic alignment with rising defense budgets and its demonstrated ability to proactively manage trade-related challenges positions it as a higher-quality investment within the aerospace sector.

Conclusion: A Geopolitically Aligned Investment Opportunity

Howmet Aerospace’s robust financial performance, strategic discipline, and pivotal industry positioning establish it as a leading player in the aerospace sector. The company has demonstrated exceptional earnings momentum and operational efficiency, even amidst global economic uncertainty. Its deep integration into critical commercial and defense programs, driven by demand for lightweight, high-performance components, underpins its sustained growth.

Howmet’s trajectory is inextricably linked to the evolving geopolitical landscape. The surge in global defense spending, fueled by international rivalries and security concerns, directly translates into a significant market opportunity for the company. Simultaneously, its contributions to fuel-efficient commercial aircraft align with the industry’s sustainability imperatives. Howmet’s proactive approach to supply chain resilience and tariff mitigation further strengthens its competitive advantage in a volatile global environment.

The company is actively steering the aerospace recovery. Its leadership in high-value components positions it as a prime beneficiary of both production ramp-ups and aftermarket demand. For investors, Howmet Aerospace offers a rare combination of near-term catalysts and long-term strategic moats.

Considering these factors, adding Howmet Aerospace (HWM) to a diversified portfolio warrants consideration. This is particularly true for investors who anticipate a sustained recovery in commercial aviation and the enduring strength of global defense budgets. However, prudent investors should continue to monitor geopolitical tensions and interest rate trends, as these factors could influence both valuation multiples and global manufacturing demand. Howmet Aerospace’s unique blend of operational excellence and strategic alignment with global geopolitical priorities positions it for continued success.

References

- 2025 Report on Top Risks in the Aerospace and Defense Industry …, accessed July 7, 2025, https://www.protiviti.com/us-en/survey/top-risks-aerospace-defense-industry-2025

- Howmet Aerospace’s Margins Continue to Expand: Can the Momentum Sustain? | Nasdaq, accessed July 7, 2025, https://www.nasdaq.com/articles/howmet-aerospaces-margins-continue-expand-can-momentum-sustain

- Howmet Aerospace: Soaring to New Heights Amid Premium Valuations – AInvest, accessed July 7, 2025, https://www.ainvest.com/news/howmet-aerospace-soaring-heights-premium-valuations-2507/

- Commercial Market Outlook | 2025-2044 – The Boeing Company, accessed July 7, 2025, https://www.boeing.com/content/dam/boeing/boeingdotcom/market/assets/downloads/2025-commercial-market-outlook.pdf

- Defense & Space – Howmet Aerospace, accessed July 7, 2025, https://www.howmet.com/defense/

- F-35 Lightning II Fighter Jet Engine | Howmet Aerospace, accessed July 7, 2025, https://www.howmet.com/f35-speed-stealth-agility/

- Unprecedented rise in global military expenditure as European and …, accessed July 7, 2025, https://www.sipri.org/media/press-release/2025/unprecedented-rise-global-military-expenditure-european-and-middle-east-spending-surges

- 2024 Global Sustainability in Aerospace and Defense report – KPMG agentic corporate services, accessed July 7, 2025, https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2024/07/sustainability-in-a-and-d-main-report.pdf

- How Lightweight Aerospace Components Affect Efficiency & Reduce Emissions, accessed July 7, 2025, https://www.nmgaerospace.com/the-role-of-lightweight-components-in-fuel-efficiency-and-emissions-reduction-in-aerospace-manufacturing/

- Top Geopolitical Trends in 2025 | Lazard, accessed July 7, 2025, https://www.lazard.com/research-insights/top-geopolitical-trends-in-2025/

- Top 5 Geopolitical Threats to Businesses in 2025 – SHRM, accessed July 7, 2025, https://www.shrm.org/enterprise-solutions/insights/top-5-geopolitical-threats-to-businesses-2025

- How would higher defence spending affect Finland’s economic growth?, accessed July 7, 2025, https://www.bofbulletin.fi/en/2025/4/how-would-an-expansion-of-defence-spending-affect-finland-s-economic-growth/

- Aerospace & Defense Sector Market Size & Analysis 2025-2033 – Global Growth Insights, accessed July 7, 2025, https://www.globalgrowthinsights.com/market-reports/aerospace-defense-sector-market-106513

- Navigating Geopolitical & Economic Uncertainty: General Aviation …, accessed July 7, 2025, https://www.pilotmall.com/pt/blogs/news/navigating-geopolitical-and-economic-uncertainty-what-every-pilot-should-watch-in-2025

- Geopolitical Impacts on Aviation: How Airspace Restrictions and Tensions Shape Flight Routes – Hub Selection, accessed July 7, 2025, https://hub-selection.com/geopolitical-impacts-on-aviation-how-airspace-restrictions-and-tensions-shape-flight-routes/

- The Impact of Geopolitical Risks on Global Supply Chains in 2025, accessed July 7, 2025, https://www.cin7.com/blog/geopolitical-risks-in-supply-chains/

- 2024 aerospace and defense industry outlook | Deloitte Insights, accessed July 7, 2025, https://www.deloitte.com/us/en/insights/industry/aerospace-defense/aerospace-and-defense-industry-outlook-2024.html

- Aerospace supply chain report 2025: Is the crisis over? | Roland …, accessed July 7, 2025, https://www.rolandberger.com/en/Insights/Publications/Aerospace-supply-chain-report-2025-Is-the-crisis-over.html

- Howmet Aerospace: A Turbocharged Play on Jet Engine Recovery – AInvest, accessed July 7, 2025, https://www.ainvest.com/news/howmet-aerospace-turbocharged-play-jet-engine-recovery-2505/

- (PDF) A review on lightweight materials for defence applications: Present and future developments – ResearchGate, accessed July 7, 2025, https://www.researchgate.net/publication/369174297_A_review_on_lightweight_materials_for_defence_applications_A_present_and_future_developments

- Howmet, an aircraft supplier, may stop orders if Trump tariffs are imposed. – Energy News, accessed July 7, 2025, https://energynews.oedigital.com/mining/2025/04/04/howmet-an-aircraft-supplier-may-stop-orders-if-trump-tariffs-are-imposed

- Pittsburgh aerospace company considers pausing orders as tariff threats rise – TribLIVE.com, accessed July 7, 2025, https://triblive.com/business/pittsburgh-aerospace-company-considers-pausing-orders-as-tariff-threats-rise/

- Q4 2024 Earnings Presentation – Howmet Aerospace, accessed July 7, 2025, https://www.howmet.com/wp-content/uploads/sites/3/2025/02/Howmet-Aerospace-2024-Q4-Earnings-Presentation.pdf

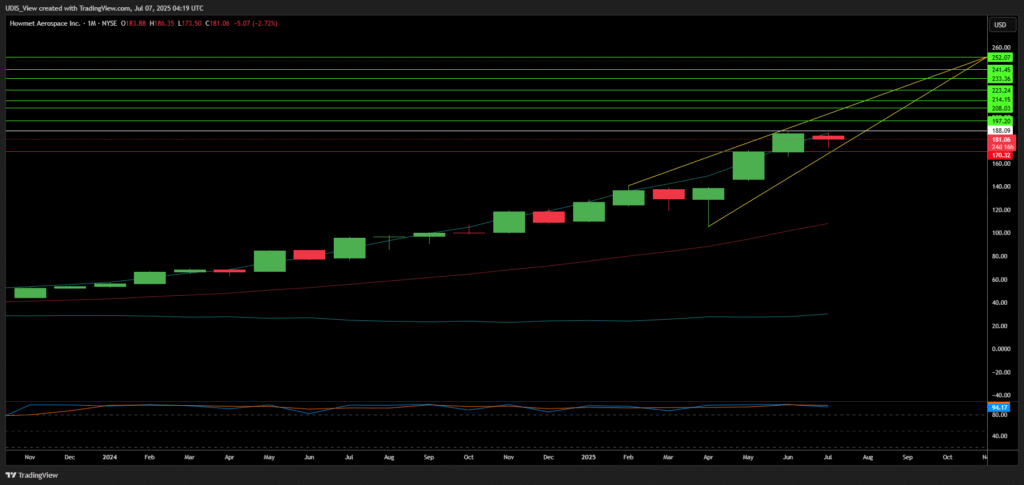

Howmet Aerospace Long (Buy)

Enter At: 188.09

T.P_1: 197.20

T.P_2: 208.03

T.P_3: 214.15

T.P_4: 223.24

T.P_5: 233.36

T.P_6: 241.45

T.P_7: 252.07

S.L: 170.32