Executive Strategic Overview: The Convergence of Necessity

The global financial architecture is undergoing a fundamental phase shift. For fifty years, gold functioned primarily as a portfolio hedge and a passive insurance policy against inflation; that era is over. We are witnessing the weaponization of the monetary system alongside the physical industrialization of the gold market. The convergence of these forces drives a repricing event of historical magnitude.

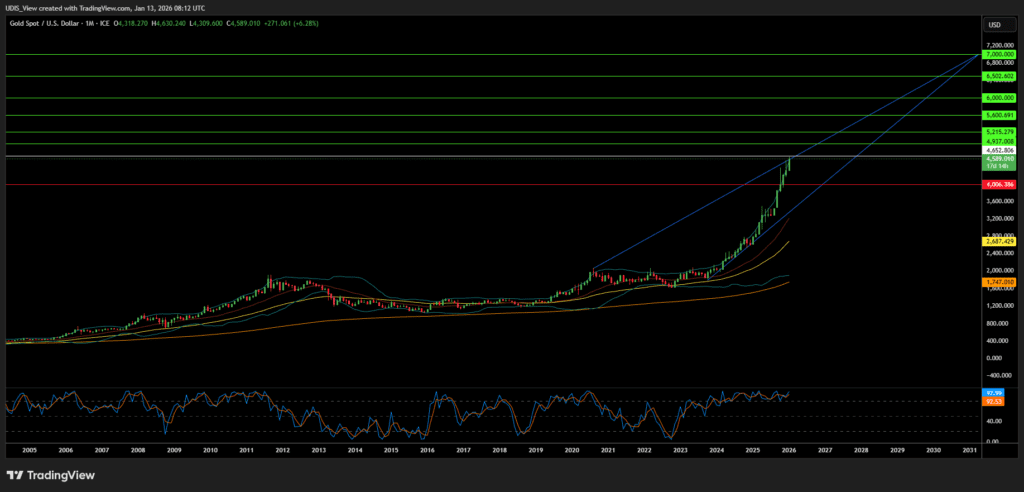

Our analysis projects a structural price target of $7,000 per ounce. This target is a derivative of three unstoppable vectors: the mathematical inevitability of sovereign debt debasement, the return of kinetic geopolitical conflict, and the critical dependency of AI and quantum technology on gold’s atomic properties. Gold is moving from a “nice-to-have” asset to a “must-have” strategic material.

Part I: The Macro-Fiscal Precipice

The Mathematics of Insolvency

The United States fiscal position has deteriorated beyond the point of no return, with the national debt breaching $38 trillion. The debt-to-GDP ratio currently exceeds 124%, a level where historical data confirms economic growth typically stalls. The deficit for fiscal year 2026 reached $439 billion in just the first two months.

Interest expense has become the critical failure point, costing $201 billion annually as of late 2025. This represents 17% of total federal spending and creates a “debt spiral” where the Treasury must borrow more simply to pay interest.

Global Debt Saturation

The problem is global. Global debt stockpiles surged by $26 trillion in the first three quarters of 2025, bringing the total load near $346 trillion. Mature markets like France and the UK, as well as emerging markets like Brazil and Russia, are seeing rapid increases in leverage. In a world of massive liabilities, zero-liability assets like gold command a premium.

Part II: Geopolitics and Kinetic Risk

The Return of Kinetic Conflict

The geopolitical landscape has shifted toward kinetic action. The capture of Venezuelan President Nicolas Maduro by US forces in January 2026 was a watershed event, causing gold prices to jump 4% as investors reacted to the uncertainty of regime change.

The Greenland Strategic Flashpoint

Tensions in the Arctic are escalating due to renewed US interest in purchasing Greenland for its vast rare-earth mineral deposits and its position on the GIUK gap naval choke point. These fractures in the Western alliance are causing defense stocks and gold to rally in tandem.

The BRICS Counter-Hegemony

The BRICS alliance is launching a new unit of account, the “Unit,” which is a basket currency 40% backed by gold. The Unit pilot launched in October 2025, forcing member nations to accumulate physical gold and remove supplies from Western markets.

Part III: The Monetary Reset & Central Banks

Central banks are buying gold at a record pace, with net purchases reaching 220 tonnes in the third quarter of 2025. Poland, for example, aims to hold 30% of its reserves in gold for national security. Brazil has also resumed buying, signaling a broad-based shift away from fiat currencies.

Basel III Catalyst

Under Basel III standards, allocated physical gold is now a Tier 1 asset, meaning it is treated as a High-Quality Liquid Asset (HQLA) and can be valued at 100% of market price. This incentivizes banks to swap paper assets for physical metal, draining LBMA and COMEX inventories.

Part IV: The Industrial Singularity – AI & Chips

Gold’s role as a critical industrial metal is expanding. Gold-tin (AuSn) solder is the industry standard for high-performance chips because it withstands the extreme heat cycles of AI processing. The NVIDIA B200 GPU and other advanced hardware rely on gold wire bonding for perfect conductivity and corrosion resistance.

Furthermore, High-Bandwidth Memory (HBM) is essential for AI uses gold in its bonding layers. As Samsung and SK Hynix pivot production lines to meet demand, industrial offtake becomes increasingly price-inelastic. Gold wire bonding markets are projected to reach $4.08 billion by 2035.

Part V: Quantum Frontiers & Nanotech

In quantum computing, gold nanoclusters show promise as scalable qubits. Simultaneously, gold nanoparticles are revolutionizing oncology through photothermal therapy, where they destroy cancer cells by absorbing light. Innovative drug delivery systems also utilize these properties, creating a constant, non-recoverable drain on the global gold supply.

Samsung and IBM lead the patent landscape for these gold-related inventions, signaling massive R&D flow into materials science.

Part VI: The Space Economy & 6G

Gold is the perfect shield for the hostile environment of space. China’s plan to launch over 200,000 satellites for 6G networks will require significant gold infrastructure. Additionally, astronaut visors for the Artemis missions are gold-plated for radiation protection. NASA continues to rely on gold for its unmatched reliability in orbital components. Gold is even the enabler for 6G and autonomous military operations in space.

Part VII: Cyber Warfare & The Analog Hedge

As the world becomes digital, it becomes fragile. The financial sector is increasingly exposed to cyber warfare, and the IMF has warned of systemic risks that could paralyze digital ledgers. Gold is the “analog antidote.” It cannot be hacked, deleted, or frozen during a liquidity crisis.

Part VIII: Crypto Divergence & Market Flows

The “digital gold” narrative for Bitcoin failed in 2025; Bitcoin crashed during geopolitical stress while gold rallied. Institutional money is returning to the proven Safe Haven, with Indian gold ETF holdings jumping 65% year-over-year in 2025.

Part IX: Supply Constraints & The Squeeze

Gold production is plateauing as ore grades decline and miners are forced to decarbonize under tight ESG regulations. Furthermore, strategic resource nationalism is rising; following China’s restrictions on silver exports, many fear a similar shock in the gold market could trigger a catastrophic short squeeze in the paper markets.

Conclusion: The $7,000 Valuation Matrix

The path to $7,000 is not a bubble but a rational repricing of a strategic asset. Gold is reclaiming its throne as the currency of kings, the material of the future, and the shield against global chaos.

Gold Long (Buy)

Enter At: 4652.806

T.P_1: 4937.008

T.P_2: 5215.279

T.P_3: 5600.691

T.P_4: 6000.000

T.P_5: 6502.602

T.P_6: 7000.000

S.L: 4006.386