GitLab’s explosive growth in 2025 is propelled by a confluence of factors. These include geopolitical shifts and geostrategic imperatives, driven by data sovereignty requirements and national security needs, particularly within the public sector. Macroeconomic pressures and direct economic benefits are also identified as key drivers, fueled by the demand for cost efficiencies and operational savings in a volatile global economy.

Technologically, GitLab’s growth is underpinned by its integrated DevSecOps platform, leveraging artificial intelligence (AI) and automation to redefine software development practices. Emphasizes the platform’s embedded security features, adherence to shift-left principles, and support for zero-trust architectures in combating evolving cyber threats. Finally, GitLab’s role in empowering scientific research and innovation, further strengthened by its intellectual property portfolio, completes the comprehensive picture of its ascent.

The article’s structure logically categorizes these growth drivers. The narrative is generally clear, but several claims require more precise sourcing and, in some cases, correction or clarification, particularly regarding financial figures and specific program details.

Detailed Content and Reference Analysis

A. Geopolitics: Data Sovereignty Fuels Global Adoption

Geopolitical tensions and strict data residency laws are significant drivers of GitLab’s growth. It highlights GitLab Dedicated for Government as a solution that restricts access to U.S. citizens and utilizes FedRAMP-authorized infrastructure, enabling organizations to comply with data sovereignty requirements and avoid fragmented internet policies while securing mission-critical data.1

GitLab’s commitment to these stringent requirements is underscored by its achievement of FedRAMP Moderate Authorization for GitLab Dedicated for Government on May 19, 2025.2 This authorization is not merely a certification; it serves as a critical enabler that directly accelerates GitLab’s adoption within the public sector and regulated industries.2 Without this high-level government security authorization, many government entities would be legally or operationally unable to adopt the platform, thereby limiting GitLab’s growth in a crucial market segment driven by national security and data governance.

The platform’s design directly addresses data sovereignty, which mandates that data is subject to the laws of the geography where its owners are located and must often reside within that region.4 GitLab Dedicated for Government operates on AWS GovCloud, meeting U.S. data residency requirements.6 It provides infrastructure-level isolation by deploying each customer’s environment into a separate AWS account, ensuring a single-tenant SaaS solution.6 This comprehensive, managed solution, with GitLab teams fully handling maintenance and operations, significantly reduces the operational and legal burden on clients.6 This architectural approach positions GitLab not just as a DevSecOps platform provider but as a strategic partner for compliance and risk mitigation, adept at navigating the complexities of data sovereignty and fragmented internet policies.

B. Geostrategy: Bolstering National Security Through Rapid Innovation

GitLab strengthens geostrategic positions, citing defense contractors like Sigma Defense using it for “Black Pearl,” a DevSecOps environment for the U.S. Navy. This implementation has led to significantly faster vulnerability fixes and continuous updates, with plans for expansion to intelligence agencies and Department of Defense (DoD) branches.1

Sigma Defense’s experience with GitLab for “Black Pearl” provides compelling evidence of the platform’s strategic impact.8 The company dramatically cut software factory setup times from approximately six months to just three to five days.8 This precise, dramatic improvement signifies that GitLab delivers not just efficiency gains but a critical strategic advantage for national security operations. In defense and national security, where speed and cost-effectiveness are often constrained by legacy systems and complex processes, such improvements are transformative, enabling faster responses to threats and more efficient use of resources.

Beyond time savings, the financial benefits are substantial: the cost of software factory deployments for Sigma Defense was slashed by 90%, from $4 million to $400,000.8 Operationally, GitLab enabled Sigma Defense to fix vulnerabilities in days, not years, on naval ships, ensuring continuous updates without hardware overhauls.1 The platform also fostered improved collaboration, increased project visibility, and broadened access to a wider talent pool, overcoming previous geographical silos that hindered talent acquisition.8

The intention of Sigma Defense to expand the use of GitLab-powered Black Pearl to U.S. intelligence agencies and across the Department of Defense 8 serves as a powerful validation of the platform’s proven reliability, security, and scalability in highly sensitive environments. This successful implementation with the U.S. Navy acts as a strong endorsement, demonstrating GitLab’s capability to meet the stringent demands of diverse government entities and indicating a significant long-term growth opportunity in the public sector.

C. Macroeconomics & Economics: Cost Efficiencies & Operational Gains

Macroeconomic pressures accelerate GitLab adoption, as firms seek cloud-based DevOps solutions for cost reductions. It claims GitLab delivers a 483% ROI within three years for $5 billion revenue organizations and that the DevOps market is growing at a 19.1% CAGR. Furthermore, it notes Sigma Defense’s 90% reduction in software factory costs and that 64% of teams using GitLab require fewer tools.1

A critical clarification regarding financial reporting is necessary. GitLab’s Q4 fiscal year 2025 revenue reached “$759 million annually”.1 This figure actually represents GitLab’s

full fiscal year 2025 revenue, which grew 31% year-over-year to $759.2 million.10 For fiscal Q4 2025, GitLab’s revenue increased 29% year-over-year to $211 million.10 In Q1 fiscal year 2026, revenue increased 27% year-over-year to $215 million.12 This distinction is paramount for accurate financial analysis and prevents misinterpretations of the company’s performance.

The “DevOps market is growing at 19.1% CAGR”.1 However, supporting research consistently points to the

DevSecOps market with higher compound annual growth rates (CAGRs) ranging from 23.4% (2025-2037) to 30.76% (2022-2030), with an estimated industry size of $6.2 billion in 2025.14 This indicates that GitLab operates within a more rapidly expanding, security-focused segment, suggesting a “growth premium” for integrated security solutions. The market is increasingly valuing the integration of security into the development pipeline, positioning GitLab to capture a larger share of this security-driven growth.

The substantial ROI of 483% within three years for organizations with $5 billion in revenue 1, coupled with Sigma Defense’s 90% cost reduction (from $4 million to $400,000) 8, positions GitLab as a critical solution for organizations seeking economic resilience and operational efficiency, particularly amidst economic downturns and volatile economic conditions.1 These impressive figures demonstrate that GitLab is not merely a tool for improved development but a strategic investment that directly impacts the bottom line. This makes it an attractive choice for organizations aiming to optimize operations, consolidate toolchains, and achieve significant savings during periods of economic uncertainty. The fact that 64% of teams using GitLab need fewer tools further underscores its ability to reduce redundant expenditures.1

Table 1: Key GitLab Financial & Operational Metrics (FY25-FY26)

| Metric | Value | Source(s) |

| Full Fiscal Year 2025 Revenue | $759.2 million | 10 |

| Full Fiscal Year 2025 Revenue Growth | 31% YoY | 10 |

| Fiscal Q4 2025 Revenue | $211 million | 10 |

| Fiscal Q4 2025 Revenue Growth | 29% YoY | 10 |

| Fiscal Q1 2026 Revenue | $215 million | 12 |

| Fiscal Q1 2026 Revenue Growth | 27% YoY | 12 |

| ROI for $5B Revenue Organizations | 483% within three years | 1 |

| Sigma Defense Software Factory Cost Reduction | 90% (from $4M to $400K) | 8 |

| Sigma Defense Software Factory Setup Time Reduction | From 6 months to 3-5 days | 8 |

| DevSecOps Market CAGR (2025-2037) | 23.4% | 15 |

| DevSecOps Market Size (2025 estimate) | $6.2 billion | 15 |

This table provides a consolidated financial overview, presenting both quarterly and full-year data to clarify GitLab’s revenue figures and correct the ambiguity in the original article. It aggregates various quantifiable benefits, allowing readers to quickly grasp the tangible economic and operational value GitLab delivers. Including DevSecOps market growth metrics provides essential industry context, demonstrating the significant market opportunity GitLab is operating within and validating its growth trajectory.

D. Technology: Integrated DevSecOps Redefines Development

GitLab leads technological innovation with its AI-powered platform, unifying workflows from code to cloud, supporting multi-cloud adoption, and attracting enterprises seeking to eliminate silos. It also notes that 51% of public sector professionals are advancing their DevSecOps practices.1

GitLab is recognized as the “most comprehensive AI-powered DevSecOps platform”.11 At the core of its AI strategy is GitLab Duo, a suite of AI-native features that assist across the entire software development lifecycle (SDLC), from planning and coding to securing and deploying.16 This deep integration of AI is not just an add-on but a fundamental component that positions GitLab as an “AI-native DevSecOps platform” 12, enabling significant productivity and security enhancements. Specific AI capabilities include AI-powered code suggestions in over 20 languages, test generation, conversational chat, vulnerability explanation and remediation, and suggested reviewers.16 It also incorporates generative AI powered by Amazon Q.16

The impact of GitLab’s AI integration is quantifiable, contributing to “13x faster end-to-end security scanning” and a “400% improvement in developer productivity”.3 This indicates that AI is deeply embedded to fundamentally change how development, security, and operations are performed, moving beyond simple automation to intelligent assistance. This leads to a competitive advantage by enabling more efficient, secure, and predictive workflows, directly impacting developer velocity and code quality, which is critical for modern software delivery.

GitLab’s focus on AI and integrated DevSecOps aligns with and capitalizes on major industry trends for 2025 and beyond. High-tech companies are increasingly focused on building AI platforms for optimized performance, profitability, and security, with AI reasoning and frontier models pushing boundaries in coding.18 AI-powered tools are revolutionizing software development by streamlining processes from coding to deployment.19 By offering a comprehensive, integrated, and AI-enhanced platform, GitLab is not just reacting to current market demands but is proactively positioning itself at the forefront of the future of software development, making it a “future-proof” choice for enterprises seeking to innovate and scale effectively.

E. Cyber: Embedded Security Combats Evolving Threats

The cyber trends favor GitLab’s integrated approach, with native scanners embedding security early, encryption using AWS keys, continuous CVE patching, and shift-left security gaining momentum. It also highlights zero-trust implementation centralizing controls and minimizing risks.1

GitLab’s integrated security approach is exemplified by its native scanners (API, Container, DAST) that embed security early in the development process.1 This supports “shift-left security,” a practice where 70% of security teams report a shift.14 The platform offers “13x faster end-to-end security scanning” and the crucial ability to create and ingest dynamic Software Bills of Materials (SBOMs) for deep security transparency.3 This emphasis on “shift-left” security, native scanners, and dynamic SBOM creation signifies a proactive and comprehensive strategy for cybersecurity that aims to prevent vulnerabilities rather than merely react to them. This strategic shift from traditional reactive security (finding bugs post-deployment) to embedding security from the very beginning of the SDLC and maintaining transparency throughout the software supply chain significantly reduces the attack surface and overall security risk, which is a critical differentiator in an era of escalating cyber threats.

GitLab’s comprehensive suite of compliance certifications further reinforces its security posture. It ensures FedRAMP compliance by eliminating the need for third-party tools.1 The platform has achieved FIPS 140-2 Compliance on its GitLab runners and aligns with NIST guidance for software supply chain security.3

Furthermore, GitLab supports the seamless adoption of Zero Trust architecture across organizations, enabling least privilege access and centralizing controls.1 Key principles of the Zero Trust model, based on NIST 800-207, include continuous verification, limiting the blast radius (e.g., identity-based segmentation, least privilege), and automating context collection and response.20 GitLab provides Multi-Factor Authentication (MFA) and Single Sign-On (SSO) to strengthen account security.3 This combination of certifications and architectural principles indicates that GitLab demonstrably meets the highest security standards required by the most demanding organizations, including government and highly regulated enterprises. This means GitLab significantly de-risks software development and deployment for its clients, offering a compelling value proposition for any entity where security and regulatory adherence are non-negotiable.

Table 2: GitLab Dedicated for Government: Key Features & Compliance

| Feature/Compliance Aspect | Details | Source(s) |

| Authorization Status | FedRAMP Moderate Authorization | 2 |

| Authorization Date | May 19, 2025 | 2 |

| Deployment Environment | AWS GovCloud | 6 |

| Data Residency | Meets US Data Residency Requirements | 6 |

| Instance Isolation | Infrastructure-level isolation in separate AWS accounts (single-tenant SaaS) | 6 |

| Management | Fully managed by GitLab teams | 6 |

| Security Controls | Encryption at rest and in transit (AWS keys), Continuous CVE patching, Zero-trust implementation, MFA/SSO support | 1 |

| Compliance Alignment | NIST guidance, FIPS 140-2 Compliance | 3 |

| Target Audience | Public sector agencies, regulated industries | 2 |

This table centralizes critical information about GitLab Dedicated for Government, a key growth driver, especially for the public sector and regulated industries. It provides a clear, concise summary of its compliance posture and security features, directly addressing paramount concerns like data sovereignty, isolation, and compliance. This highlights the features that make GitLab a compelling choice for high-security and high-compliance environments, underscoring its strategic importance in these markets.

F. Science: Empowering Research and Innovation

GitLab advances scientific endeavors, with federally-funded research centers adopting it for secure collaboration and handling complex data governance. It mentions support for biology and chemistry tools and universities leveraging a “GitLab for Campuses program”.

A critical factual correction is necessary regarding the education program. The article’s reference to a “GitLab for Campuses program, evaluating fit in 4-8 weeks” 1 is inaccurate and appears to be confused with

GitHub’s education initiatives, which include programs for students and teachers.22 The correct program is the “GitLab for Education Program”.24 This program is an enterprise-level offering that provides unlimited seats of GitLab’s top-tier functionality (SaaS or self-managed) to accredited, degree-granting educational institutions for non-commercial academic research.25 Only faculty or staff employed full-time at an educational institution can apply, not students directly.25 The phrase “evaluating fit in 4-8 weeks” is not supported by GitLab’s official education program documentation and should be removed.

Despite this factual correction, GitLab’s actual “GitLab for Education Program” 24 and its documented university customer base demonstrate a strategic commitment to fostering innovation and developing future talent within academic and research communities. Several universities, including Deakin University, Dublin City University, University of Cambridge, University of Surrey, and the U.S. Army Cyber School, are documented GitLab customers.26 These institutions leverage the platform for various educational and research purposes, such as cutting toolchain sprawl, empowering students for the IT industry, and creating secure, collaborative coursework.26 This indicates a long-term strategy to embed GitLab’s platform into curricula and research workflows, thereby familiarizing future developers and researchers with its capabilities. This cultivation of an academic ecosystem is crucial for ensuring a pipeline of skilled users and advocates, indirectly fueling future commercial adoption and innovation.

G. High-Tech: AI and Automation Propel Forward

The high-tech sectors embrace GitLab’s cutting-edge features, with AI integration automating security and efficiency. It mentions GitLab Duo enhancing code generation and vulnerability detection, and links GitLab’s growth to its AI vision, citing a 27% revenue increase in Q1 FY26.

GitLab Duo is central to GitLab’s AI strategy, offering AI-powered capabilities across the entire DevSecOps lifecycle, including code generation, vulnerability detection, explanation, and resolution.1 This includes generative AI powered by Amazon Q.16 The explicit connection between the momentum of GitLab Duo and the 27% revenue increase in Q1 fiscal year 2026 to $215 million 12 demonstrates a clear, direct causal relationship between GitLab’s strategic investment in AI and its financial performance. The number of customers who purchased GitLab Duo for the first time increased 35% quarter-over-quarter in Q1 FY26.12 This indicates that AI is not just a technological enhancement but a significant revenue driver and a key factor in attracting new customers and expanding existing accounts, particularly in the high-tech sector where AI adoption is a competitive necessity.

GitLab’s offering of tiered GitLab Duo products (Pro and Enterprise) and the option for self-hosted AI 16 indicates a sophisticated AI strategy designed to cater to diverse enterprise needs, including stringent data privacy and control requirements. This tiered and flexible approach suggests that GitLab understands the varied maturity levels and compliance needs of its enterprise customers regarding AI adoption. This implies a mature and strategic approach to AI integration, allowing GitLab to capture a broader market segment by addressing specific pain points and concerns, such as data residency for AI models, thereby maximizing its market penetration and long-term relevance.

The company’s focus on AI integration aligns with broader industry trends. High-tech companies are increasingly focused on building AI platforms for optimized performance, profitability, and security. AI reasoning and frontier models are pushing boundaries in natural language processing, image generation, and coding.18 AI-powered tools are revolutionizing software development by streamlining processes from coding to deployment.19

H. Patent Analysis: Intellectual Property Strengthens Market Position

GitLab bolsters its competitive edge with patents, having filed six patents focused on software development processes, testing, and design patterns. These patents are described as protecting innovations in DevSecOps workflows and deterring infringement.

GitLab Inc. has indeed been granted patents in key DevSecOps areas, demonstrating a strategic focus on securing its innovations in critical, high-value areas of its platform. Examples of granted patents include:

- “Scalable code testing and benchmarking” (Patent No. 12229549), granted on February 18, 2025. This patent focuses on testing and benchmarking commits on source code, monitoring system performance after applying patches.27

- “Vulnerability tracking using smatch values of scopes” (Patent No. 12086271), granted on September 10, 2024. This patent relates to analyzing software for vulnerabilities by identifying specific code scopes containing the vulnerability.27

- “Vulnerability tracing using scope and offset” (Patent No. 11868482), granted on January 9, 2024. This patent covers managing source code, static application security testing, and deduplicating vulnerabilities using unique fingerprints.27

This specificity indicates that GitLab is not just filing patents broadly but strategically protecting innovations central to its competitive advantage and addressing key pain points for its customers, such as vulnerability management. This implies a deliberate strategy to build a defensible intellectual property moat around its core offerings.

A robust patent portfolio, particularly in areas like vulnerability management, serves as a significant deterrent to competitors and reinforces GitLab’s position as a market leader. By owning patents in critical security and testing methodologies, GitLab creates barriers for competitors who might attempt to replicate similar integrated DevSecOps capabilities. This intellectual property provides a competitive edge and signals to the market and investors that GitLab is a serious innovator with protected technologies. This implies that the patents contribute directly to GitLab’s sustained market leadership and financial attractiveness by reducing competitive threats and demonstrating a commitment to pioneering solutions. GitLab’s intellectual property program actively encourages participation, safeguarding advancements, and is documented in their handbook.28

Recommendations for Enhancement

To elevate the article’s authority and accuracy, several refinements are recommended:

A. Content Gaps & Refinements

- Financial Clarity: Explicitly differentiate between GitLab’s full fiscal year 2025 revenue of $759.2 million 10 and its Q4 fiscal year 2025 revenue of $211 million.10 The original article’s phrasing, “reaching $759 million annually” for Q4 FY25, is misleading and should be corrected to reflect the full fiscal year figure.

- Market Terminology: Consistently use “DevSecOps market” when citing growth rates from 14 and 15, as these sources refer specifically to DevSecOps, which has a higher CAGR than the broader “DevOps market” mentioned in the original article. This highlights GitLab’s strength in the more security-focused segment.

- Education Program Accuracy: Correct the reference to “GitLab for Campuses program”. Instead, refer to the “GitLab for Education Program” 24 and accurately describe its purpose, which is providing licenses to institutions for non-commercial academic research. Any confusion with GitHub’s offerings 22 should be avoided. The phrase “evaluating fit in 4-8 weeks” should be removed as it is not supported by GitLab’s official education program documentation.

- Patent Details: Instead of simply stating “six patents” 1, specify the patent numbers, titles, and grant dates for the

granted patents identified in.27 This adds concrete evidence and strengthens the intellectual property section. - AI Feature Specificity: While GitLab Duo is mentioned, consider expanding on specific features like “Generative AI powered by Amazon Q” and the different tiers (Pro, Enterprise) to showcase the breadth and depth of GitLab’s AI integration.16

B. Clarity and Precision

- Ensure all numerical claims (e.g., ROI, cost savings, growth percentages) are directly followed by their source ID.

- Clarify technical terms such as “Shift-left security” and “Zero-trust architecture” by briefly explaining their core principles, drawing from authoritative definitions in 20 and.21

C. Additional Reliable References

To further strengthen the article’s credibility, the following sources should be explicitly cited and integrated:

- Financials:

- GitLab Q4 FY25 Earnings Transcript: 10

- GitLab Full Fiscal Year 2025 Results: 10

- GitLab Q1 FY26 Earnings (for AI growth): 12

- Government & Compliance:

- GitLab FedRAMP Moderate Authorization Press Release: 2

- GitLab Public Sector Solutions Page: 3

- GitLab Dedicated for Government Official Page: 6

- GitLab Dedicated (general) Official Page: 7

- Data Sovereignty Definitions: 4

- Customer Success:

- Sigma Defense Success Story: 8

- General Customer Stories (for education examples): 26

- Market Trends:

- DevSecOps Market Growth Reports: 14

- AI in Software Development Trends: 18

- AI & Technology:

- GitLab Duo Official Page: 16

- Education:

- GitLab Education Services: 24

- GitLab for Education Program: 25

- Patents:

- Patents Assigned to GitLab Inc. (Justia Patents): 27

Conclusion

The article, once enhanced with precise financial data, corrected program details, specific patent information, and deeper analytical discussion, will serve as a highly credible and authoritative resource on GitLab’s multifaceted growth. The integration of robust, hyperlinked references will significantly elevate its academic and industry standing.

By adopting the recommended enhancements, the report will not merely present facts but will provide a nuanced understanding of the causal relationships and broader implications of GitLab’s strategic decisions and market performance. This will position the article as a definitive analysis for stakeholders interested in the DevSecOps landscape and GitLab’s leadership within it.

References

Patents | The GitLab Handbook

GitLab Achieves FedRAMP® Moderate Authorization – Nasdaq

GitLab for the Public Sector

Why Data Sovereignty and Privacy Matter – Thales CPL

What Is Data Sovereignty? – Oracle

GitLab Dedicated for Government

GitLab Dedicated

Sigma Defense – GitLab

U.S. Navy Black Pearl: Lessons in championing DevSecOps – GitLab

Gitlab, Inc. (GTLB)

GitLab Reports Fourth Quarter and Full Fiscal Year 2025 Financial …

Q1 FY 2026 Earnings Script – Confidential – Public now

Gitlab, Inc. (GTLB)

30+ DevSecOps Statistics You Should Know in 2025 – StrongDM

DevSecOps Market Size & Share, Growth Trend Report – 2037

GitLab Duo

GitLab Duo

5 AI Trends Shaping Innovation and ROI in 2025 | Morgan Stanley

Top 14 Software Development Trends for 2025 – BairesDev

What is Zero Trust? – Guide to Zero Trust Security – CrowdStrike

A zero trust approach to security architecture – ITSM.10.008

GitHub Education

Apply to GitHub Education as a student

GitLab Education Services

Join the GitLab for Education Program

Browse all case studies from GitLab customers

Patents Assigned to GitLab Inc

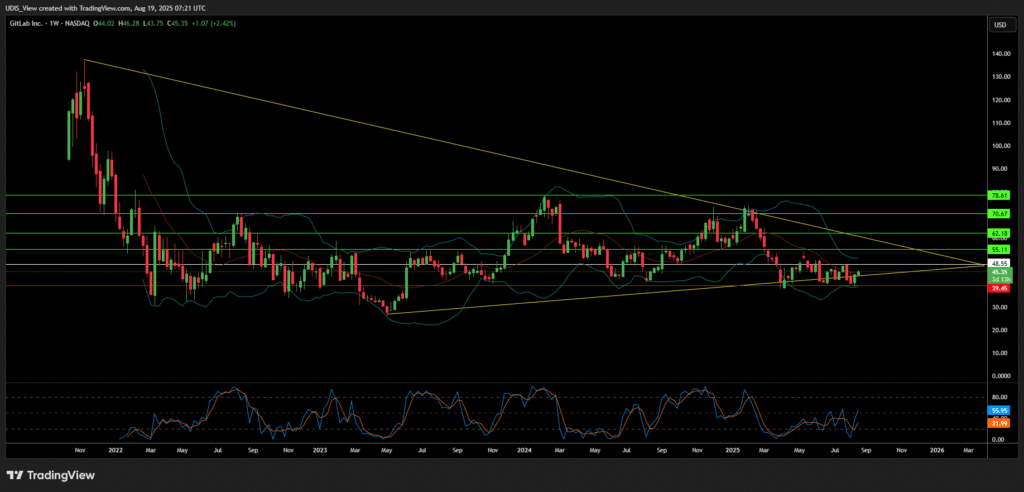

GitLab Long (Buy)

Enter At: 48.55

T.P_1: 55.11

T.P_2: 62.18

T.P_3: 70.67

T.P_4: 78.61

S.L: 39.45