I. The Disconnect Between Index and Reality

A. Establishing the Paradox

Germany’s benchmark DAX 40 index has shown remarkable recent resilience. The DAX delivered a strong 30.0% return over the last year.1 This index buoyancy creates a deceptive impression of underlying economic health. However, a deeper analysis reveals significant structural decay within the German foundational economy.

The DAX represents globally diversified multinational corporations. Their revenues originate largely outside of the struggling domestic market. This reliance on global profit streams makes the index a poor barometer for German structural stability. This resilience may provide false assurance to policymakers and investors.

B. Fundamental Economic Decline

The domestic economy faces fundamental and sustained deterioration. Price-adjusted Gross Domestic Product (GDP) fell by 0.3% in the second quarter of 2025.2 This decline was 0.2 percentage points greater than initial estimates.2 Economists anticipate negligible annual growth, forecasting a slight 0.2% increase for 2025.3 This negligible forecast suggests the economy is merely “treading water” rather than recovering its competitive edge.3

Weakness centers heavily on the crucial manufacturing sector. Industrial output declined sharply in June 2025, reaching its lowest level since May 2020.4 Total production fell by 4.8% compared to the previous year.4 Energy-intensive industries suffered even steeper contraction, declining by 7.5%.4 This sustained pressure confirms that high input costs have become a structural, long-term threat.

II. Geopolitical and Geostrategic Vulnerabilities

A. The Cost of Strategic De-Risking

Germany executed a rapid and necessary pivot away from Russian energy imports. Russia’s share of Germany’s energy imports dropped from over 30% in 2017 to just 1% in 2023.5 This strategic transition, however, imposed severe costs on the domestic industry.6 The ensuing energy price surge stalled industrial output. Consequently, a rising number of companies are considering relocating production abroad due to uncompetitive energy prices.6

Germany is simultaneously reducing its trade dependence on China. Unlike the United States, Germany’s trade reduction resulted primarily from a decrease in German exports to China.5 This export decline directly threatens major industries. Key German manufacturers rely heavily on the Chinese market for profitability. The market contributes 30% to 45% of their pre-tax profits.7 This dependence on a market experiencing economic slowdown amplifies systemic risk.

B. Critical Supply Chain Exposure

The supply chain model substitutes energy risk for material risk. The automotive sector exemplifies this vulnerability.8 German manufacturers require consistent rare earth supplies, such as neodymium and dysprosium, for electric vehicle motors.8 Germany possesses no domestic capacity to process these materials from ore to industrial-grade components.8 This gap establishes critical chokepoints susceptible to geopolitical tension.

The economic implications of a disruption are quantifiable and severe. A major supply interruption lasting six to twelve months could trigger economic losses between €45 billion and €75 billion.8 This level of disruption jeopardizes over 1.2 million jobs.8 To mitigate competitive disadvantage, the government recently amended the supply chain law (LkSG).9 This removed the mandatory external review of corporate due diligence compliance reports.9 The rollback reveals internal acknowledgment that regulation acts as a significant competitive friction point.

III. Technology and High-Tech Failure: The Automotive Collapse

A. Loss of Mobility Leadership

German original equipment manufacturers (OEMs) struggle significantly in the transition to electric vehicles (EVs).10 They failed to anticipate the necessary speed and fundamental technological shift required. This strategic miscalculation results in shrinking profits across the sector.11 German premium brands now face a fierce new competitive environment, particularly from China’s rapidly growing EV industry.11

Market share erosion in China is accelerating this decline. European carmakers’ collective share in China plummeted from 24% in 2020 to just 15% in 2024.12 Chinese consumers are shifting decisively towards domestic brands, lured by features and lower prices.12 This rapid decline pressures profit forecasts for key companies like BMW and Mercedes-Benz.12

German OEMs demonstrate global leadership in R&D spending.13 Total global R&D investment by German OEMs rose to €58.4 billion in 2023.13 This massive financial commitment, however, is not yielding commensurate results in digital and software dominance. The structural contradiction suggests R&D focus remains anchored in legacy engineering strengths, failing to drive disruptive innovation necessary for the digital age.

B. The Autonomous Driving Gap

The German automotive industry remains critically behind in autonomous driving development. Most German manufacturers are confined to Level 2+ autonomy.14 These systems offer incremental improvements like adaptive cruise control and lane keep assist.14 This contrasts with competitors like Tesla, which aggressively pursue complex, vision-only, full-stack self-driving solutions.14

Regulatory structures actively impede scaling advanced technology. The deployment of Level 4 autonomy, requiring no human intervention in specific zones, faces severe headwinds.15 Development is hampered by Germany’s stringent safety standards, complex liability laws, and multi-layered federal approval processes.15 This bureaucracy prioritizes caution over speed, ceding critical data collection advantages to international rivals.

Furthermore, German firms encounter technological barriers in crucial overseas markets. In China, restrictive cross-border data rules undermine R&D efforts and customer support.12 These rules are essential for developing and validating advanced driving systems.12 This regulatory friction limits the global competitive reach of German automotive high-tech.

IV. The Innovation Ceiling: Patents, Quantum, and Cyber Risk

A. Patent Strength vs. Future Dominance

Germany maintains a robust, high-quality patent profile globally. The nation ranks 4th worldwide in patent families and 5th in total PCT international applications.16 However, the growth trajectory shows signs of strain. PCT applications declined by 3% in 2023, signaling a potential slowdown in global filing activity 17

German patents concentrate on traditional high-tech fields. Key filings focus on quantum measurement technology and quantum electronics.16 While this demonstrates technical quality, it suggests insufficient breadth in high-growth, general-purpose technologies like Artificial Intelligence (AI).

The nation lags key rivals in scaling emerging technologies. Germany ranks 4th in scientific publications but trails the US, China, and the UK in coordinated output.16 Significant investments target quantum computing (QC) and AI.18 Despite this focus, Germany currently falls below the EU average in overall digital deployment and infrastructure.18 This gap between research strength and scaled application indicates a commercialization failure.

Table 1. Global Innovation Standing: Germany vs. Rivals

| Innovation Metric | Germany Global Rank | Recent Trend |

| PCT International Applications (2023) | 5th | Down 3% |

| Patent Families | 4th | Trails China, US, Japan |

| Scientific Publications | 4th | High quality, scale challenge |

| Digital Performance | Below EU Average | Infrastructure and deployment lag |

B. Digital Sovereignty and Cyber Strategy

The government has prioritized a strategy of “digital sovereignty”.18 This initiative aims to reduce technological dependence on the US and China. Key goals include enhancing digitalization and boosting investments in AI and QC.18 This focus necessitates creating a stand-alone digital ministry for state modernization 18

The drive for digital sovereignty introduces complexity for foreign technology partners. It may result in local content requirements and compliance friction for US and other non-EU tech companies.18 While strengthening national security, this protectionism risks isolating German industry from global best practices and cutting-edge cyber solutions. The strategy could inadvertently widen the existing technology gap with leading nations.

The emphasis on sovereignty must be matched by deployment success. The persistent finding that Germany is below the EU average in overall digital metrics 18 confirms that infrastructure deficits remain. Simplifying public procurement procedures is essential to ensure the timely and efficient implementation of public investment projects.19

V. The Euro Anchor: Unilateral Fiscal Burden

A. Carrying the European Continent

Germany serves as the undisputed fiscal anchor of the European Union. It consistently ranks as the largest net contributor to the EU budget.20 In 2021, Germany contributed €25.6 billion more than it received.20 This contribution far surpasses that of any other member state.

This financial commitment places a substantial burden on the German state budget. In 2024, Germany’s net contribution approximated 0.4% of its Gross National Income, totaling €18 billion.21 This disproportionate burden limits the government’s fiscal space for large-scale domestic structural reform and infrastructure investment.19

Germany’s leadership role during successive Euro crises is politically taxing. The high visibility of its decisions provokes controversy and debate across Europe.22 Berlin often attempts to condition financial support on austerity measures and macroeconomic rules for troubled partners.23 This approach often incurs resentment, complicating European unity.

B. Strategic Advantage and Self-Defeating Policy

Despite the net fiscal contribution, Eurozone membership provides immense economic advantages to Germany. The common currency provides stability and access to a large, diverse internal market.23 These benefits substantially outweigh the direct fiscal costs.

However, a pervasive internal political perception exists that Germany sacrifices its economic interests. Many politicians and citizens feel the country bails out “the malingering economies”.23 This opposition fuels resistance to necessary domestic structural reforms. This self-defeating policy approach, emphasizing external austerity over internal investment, hinders Germany’s long-term resilience. The Euro crisis revealed rising socio-economic divergence among EU members.22 Germany’s new role involves managing this heterogeneity, a task that demands continued, politically fraught, fiscal leadership.

VI. Domestic Friction: Federalism, Demographics, and Bureaucracy

A. The Paralysis of Federal Fragmentation

Germany’s constitutional structure consists of 16 sub-states (Bundesländer). This robust federalism causes deeply fragmented governance and policy execution.24 When solutions are identified, the lack of agreement among the 16 states often leads to paralysis.24

Digitalization projects provide a clear example of this inertia. Approval requirements for fiber optic and 5G network expansion vary significantly across federal states and municipalities.25 This non-harmonized approach creates severe, complex administrative burdens for broadband providers.25 Lengthy and inconsistent approval procedures actively undermine profitability and substantially delay crucial infrastructure rollout.25 The government recently designated network expansion as an “overriding public interest” in 2025 to mitigate this friction.25

B. Demographic Pressures and Migration Fragility

Germany faces demographic headwinds from a low birth rate.26 Recent large immigration waves have become essential for structural economic stability.27 Immigration, particularly since 2012, stabilized the country’s median age and slowed the decline of the working-age cohort.27 This inflow provided necessary labor to sustain economic performance and low unemployment 27

The integration of migrants into the labor market has shown success. Employment rates among people with a migration background reached 70% in Germany, one of the highest in the EU.28 The number of employed migrants more than doubled between 2005 and 2023.28

However, the benefit derived from immigration is structurally fragile. Highly educated, economically successful, and linguistically integrated migrants are disproportionately more likely to consider leaving Germany.28 While specific reasons are complex, this intention to depart points to systemic barriers that erode long-term talent retention.28 A failure to retain this high-skilled cohort risks turning a crucial demographic solution into a net brain drain.

VII. Conclusion: Reforming the Structural Rigidities

The German economy is suffering from a systemic misalignment: robust global corporate performance on the DAX masks a deteriorating domestic industrial base. External shocks, particularly the energy pivot, exposed deep-seated internal structural rigidities that now impede competitiveness across all sectors.

Decisive policy action is non-negotiable for sustained economic revival.19 Berlin must ruthlessly streamline federal and municipal approval processes for digital infrastructure.25 The federal governance structure must cease functioning as a drag on national competitiveness.

German manufacturers must accept that the legacy competitive model is obsolete.10 Automotive R&D must radically pivot to software and autonomous capability, moving past incremental engineering to embrace disruptive technologies.14 Concurrently, strategic vulnerabilities related to rare earth dependency must be mitigated through diversification and proactive supply chain de-risking.8

Finally, policy must shift toward talent retention. While attracting migrants solved an immediate labor supply issue, systemic bureaucracy and administrative friction deter the most valuable, high-skilled cohorts.28 Germany’s future hinges not only on maintaining its fiscal anchor role in Europe but also on its capacity to enact a fundamental domestic structural overhaul. Without this assertion of governmental efficiency and future-focused investment, the DAX disconnect will widen, signaling a chronic decline in the foundational economy.

References

- DAX vs S&P 500: historical performance from 1992 to 2025 – Curvo

- Gross domestic product: detailed economic performance results for the 2nd quarter of 2025 – German Federal Statistical Office – Statistisches Bundesamt

- ifo Economic Forecast

- The German Economy in the second half of 2025 | Roland Berger

- Geopolitics and the geometry of global trade: 2025 update – McKinsey

- Germany 2025 – NET

- German automobile industry: 2024 analysis and outlook [Research] – Intotheminds

- Germany’s Critical Rare Earth Supply Chain Dependencies in 2025 – Discovery Alert

- Supply chains: Germany eases reporting but risks persist | Risk Management Partners

- (PDF) A Comparative Analysis of the Global Competitiveness of China’s Electric Vehicle Industry and Germany’s Traditional Automotive Industry – ResearchGate

- Germany’s Auto Industry Is Facing Decline. Here’s Why – Autoblog

- Green competitiveness: Why Europe should rethink targets to outpace China | ECFR

- The Automotive Industry in Germany

- Where is the innovation from non-Tesla companies (Mercedes, BMW, GM)? : r/SelfDrivingCars – Reddit

- Germany’s Auto Giants Face Hurdles in Autonomous Driving Push – WebProNews

- Germany Quantum Computing – International Trade Administration

- Intellectual property statistics – Germany – WIPO

- Germany – Digital Economy – International Trade Administration

- Germany Economic Snapshot – OECD

- Chart: Which Countries are EU Contributors and Beneficiaries? – Statista

- Monthly Report on the 2024 EU budget: Germany remains a net contributor, but is not a frontrunner | Deutsche Bundesbank

- Germany’s new role in Europe – deutschland.de

- The Euro Payoff: Germany’s Economic Advantages from a Large and Diverse Euro Area

- Federalism in the Digital Age: How Federal Structures in Germany and Canada Impact Digitalization Policy

- Germany accelerates digital expansion (as of 12 September 2025 …

- Consequences of Enduring Low Fertility – A German Case Study. Demographic Projections and Implications for Different Policy Fields

- How Has Germany’s Economy Been Affected by the Recent Surge in Immigration?

- Germany overview August 2025 – Migration and Home Affairs

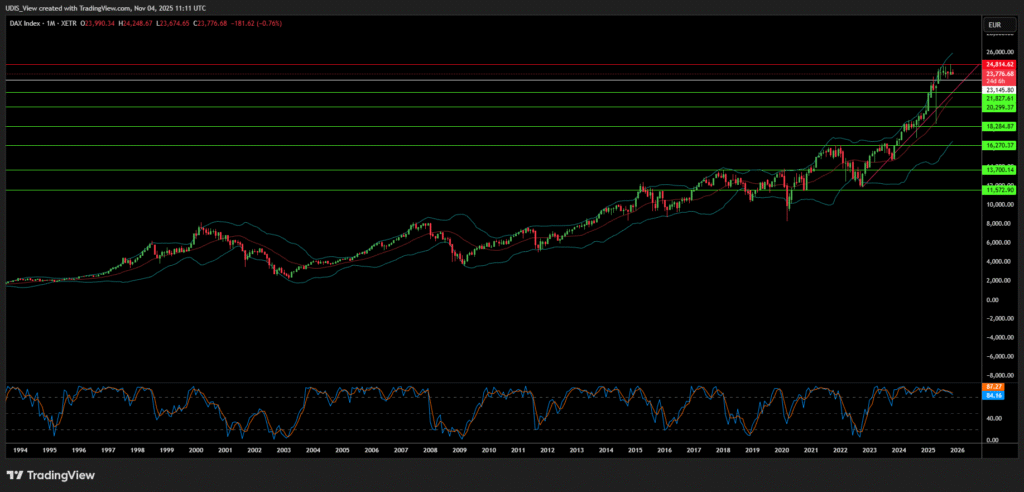

Dax 40 Short (Sell)

Enter At: 23145.80

T.P_1: 21827.61

T.P_2: 20299.37

T.P_3: 18284.87

T.P_4: 16270.37

T.P_5: 13700.14

T.P_6: 11572.90

S.L: 24814.62