Nasdaq’s Geopolitical Tailwind

Today’s market session witnessed a robust rally across major U.S. indices, with the technology-heavy Nasdaq Composite leading the charge. This significant uplift directly correlates with a perceived de-escalation in the volatile Middle East conflict, specifically the announced ceasefire between Israel and Iran. President Trump’s declaration of a “complete and total ceasefire” between Israel and Iran, ending the “12-day war,” immediately spurred a “risk-on” sentiment. This pivotal shift followed a period of heightened investor anxiety stemming from U.S. strikes on Iranian nuclear sites and subsequent Iranian retaliation.1 The Nasdaq’s outperformance underscores technology’s inherent resilience to geopolitical shocks, particularly those impacting energy markets. As oil prices tumbled on de-escalation hopes, the tech sector, with its minimal oil exposure, became a prime beneficiary.5 While geopolitical calm currently prevails, upcoming Federal Reserve commentary on monetary policy and key corporate earnings reports from Carnival, FedEx, and BlackBerry will shape the market’s near-term trajectory.6

The Ceasefire Catalyst: A Market-Moving Announcement

U.S. President Donald Trump announced a “Complete and Total CEASEFIRE” between Israel and Iran on Truth Social, effective around 12 a.m. ET, congratulating both nations for ending the “12-day war”. This declaration acted as the primary catalyst for today’s market surge.

Asian markets opened significantly higher following Trump’s announcement. Japan’s Nikkei 225 gained 1.59%, with the Topix index rising 1.32%. South Korea’s Kospi surged 2.09%, while the Kosdaq was up 1.71%. Australia’s S&P/ASX 200 also edged higher, trading up by 0.69%. In Hong Kong, the Hang Seng index pointed to a stronger open at 23,721. Gift Nifty traded around 25,175, indicating a gap-up start for Indian stock market indices.10

Wall Street futures reacted positively, indicating a strong start. Dow Jones futures rose over 200 points, S&P 500 futures gained around 23 points, and Nasdaq futures saw gains of approximately 140 points.10 U.S. markets ended Monday on a firm note as Middle East tensions showed signs of de-escalation. The Dow Jones Industrial Average rose 374.96 points, or 0.89%, to close at 42,581.78. The S&P 500 advanced 0.96% to end at 6,025.17, while the tech-heavy Nasdaq Composite added 0.94%, finishing the day at 19,630.97.10

Despite Trump’s definitive announcement, the situation remained unclear, with attacks reportedly continuing and Israel not immediately confirming any ceasefire.11 This highlights the market’s sensitivity to perceived de-escalation, even when official confirmation or complete cessation of hostilities is pending. The market’s strong positive reaction, despite the lack of immediate, full confirmation from Israel and reports of continued attacks, demonstrates that perceived de-escalation, especially from a high-profile figure like the U.S. President, can be a more immediate and powerful market driver than verified ground realities. Investors rapidly priced in the hope or expectation of de-escalation rather than waiting for absolute certainty. This indicates that in highly volatile geopolitical situations, market sentiment can pivot sharply on significant announcements, even if the underlying facts are still developing or contested. This rapid re-pricing, sometimes described as “buying the de-escalation headline,” represents a crucial aspect of how markets process geopolitical events. It underscores the psychological component of market movements, where the removal of a major tail risk, even if temporary, can trigger a rapid “risk-on” shift.

The table below summarizes the immediate performance of major U.S. indices following the ceasefire announcement:

| Index Name | Futures Gain (Points) | Monday’s Closing Value | Monday’s Percentage Gain |

| Dow Jones Industrial | >200 | 42,581.78 | 0.89% |

| S&P 500 | ~23 | 6,025.17 | 0.96% |

| Nasdaq Composite | ~140 | 19,630.97 | 0.94% |

From Escalation to De-escalation: The Middle East Narrative

The market had been on edge following the U.S. attack on Iranian nuclear sites over the weekend.12 This U.S. intervention involved striking three Iranian nuclear sites, including Fordow, Natanz, and Esfahan, with B-2 stealth bombers dropping 30,000-pound bunker-buster bombs, marking a direct U.S. involvement in Israel’s war aimed at destroying Iran’s nuclear program.1 This operation, dubbed “Operation Midnight Hammer,” was designed as a “knockout blow” to Iran’s nuclear program, utilizing deceptive tactics and decoys to maintain secrecy.2

Iran retaliated by targeting Al Udeid Air Base in Qatar, a major U.S. military hub.3 Crucially, President Trump described Iran’s response as “very weak,” noting “NO Americans were harmed, and hardly any damage was done”.4 Qatar confirmed its air defenses successfully intercepted most missiles, with no casualties reported at the base.3 Iran’s state media announced the military response, “Operation Fatah’s Blessing,” claiming it matched the number of bombs dropped by the U.S. and targeted the base because it was outside of populated areas.4

The consensus quickly emerged that Iran’s attack conveyed a desire to de-escalate rather than escalate the conflict.4 The fact that Iran’s retaliation caused no casualties or significant damage was a pivotal factor in raising hopes for de-escalation.12 Iran’s measured retaliation, specifically its lack of significant damage or casualties, was not merely “weak” but a calculated strategic move to signal de-escalation without appearing to capitulate. This allowed both sides a face-saving exit from immediate escalation. Given the severity of the U.S. “knockout blow” on Iranian nuclear sites, traditional geopolitical dynamics might have predicted a strong, reciprocal response from Iran to save face and deter future attacks. However, Iran’s actions – targeting a military base, causing minimal damage, and avoiding casualties – and its rhetoric, claiming a proportional response and targeting unpopulated areas, suggest a deliberate strategy to respond without escalating further. Iran needed to demonstrate a response for domestic and regional credibility, but carefully avoided actions that would trigger a more severe U.S. counter-retaliation. This “weak” response was strategically powerful for de-escalation, allowing markets to interpret the event as a sign of reduced conflict risk, leading to the “risk-on” rally and the sharp drop in oil prices. It demonstrates how adversaries can use the nature of their retaliation to signal intent and manage conflict trajectories, which markets then rapidly price in.

Fears of a prolonged, escalating conflict, particularly an Iranian blockade of the Strait of Hormuz – a vital waterway for oil shipping – had previously injected a $5–$15 per barrel geopolitical premium into oil prices, with Brent crude hitting $79.60.5 However, as de-escalation hopes solidified, oil prices tumbled sharply. U.S. benchmark crude fell 7.2% initially and dropped further early Tuesday, giving up 2.7% to $66.67 per barrel. Brent crude, the international standard, shed 2.5% early Tuesday to $69.68.11 This swift reversal in oil prices served as a clear indicator of receding geopolitical risk. The dramatic swing in oil prices, from a significant “geopolitical premium” to a sharp decline, serves as the most direct and liquid real-time indicator of shifting geopolitical risk perception in the Middle East. The direct and inverse correlation between perceived geopolitical risk, especially regarding the Strait of Hormuz, and oil prices is evident: when risk rises, oil rises; when risk recedes, oil falls. For financial analysts, oil price movements are not just about supply/demand fundamentals but are also a critical, almost instantaneous, reflection of geopolitical temperature, particularly in the Middle East. Its rapid decline confirmed the market’s belief in de-escalation more broadly than just equity index movements, establishing oil as a key geopolitical barometer for investors.

Nasdaq’s Distinct Advantage: Tech’s Resilience to Geopolitical Shocks

The tech-heavy Nasdaq Composite’s advance of 0.94% on Monday, matching or slightly exceeding the S&P 500 and Dow, highlights its unique positioning in a de-escalating geopolitical environment.10 The Nasdaq Composite’s resilience, up 8% year-to-date despite the oil spike, hinted at investor confidence in the sector’s low oil-price sensitivity.5

Technology benefits from several factors in such an environment. First, technology firms derive value primarily from software, data, and innovation, not physical commodities. Even hardware giants like Nvidia and Microsoft are more tied to cloud adoption and technological advancements than direct energy costs.5 This makes them less vulnerable to oil price volatility. Second, Federal Reserve rate expectations play a significant role. A sustained geopolitical premium on oil could pressure the Federal Reserve to pause rate hikes, as inflation eases.5 Conversely, if the geopolitical premium fades, as it did today, the Fed could hold rates steady or even cut them, easing pressure on equities.5 A stable or easing Fed policy environment strongly favors high-growth tech stocks, which are often more sensitive to interest rate changes due to their future earnings potential being discounted at higher rates. Markets currently price in a 70% chance of a July pause.5

Shares of the world’s largest technology companies finished mostly higher on Monday.12 Tesla (TSLA) jumped over 8% after launching its driverless robotaxi service in Austin, Texas.12 Microsoft (MSFT) and Meta Platforms (META) each tacked on approximately 2%.12 Nvidia (NVDA), Apple (AAPL), and Broadcom (AVGO) also gained ground.12 Alphabet (GOOG) shares dropped 1%, while Amazon (AMZN) fell 0.6%.12 This suggests some divergence within the tech sector, but the overall trend remained positive.

Contrarian investors are advised to hold tech as a “steady counterweight” in times of Middle East turmoil, focusing on firms with strong free cash flow and low debt like Apple or Amazon.5 Defensive tech bets include cybersecurity plays such as CrowdStrike and Palo Alto Networks, which benefit from heightened geopolitical surveillance, and enterprise software leaders like Adobe and Salesforce.5

The table below illustrates the performance of selected Nasdaq tech stocks on Monday:

| Company (Ticker) | Performance (% Change) | Key Driver (if applicable) |

| Tesla (TSLA) | +8% | Driverless robotaxi service launch |

| Microsoft (MSFT) | +2% | Cloud adoption, innovation |

| Meta Platforms (META) | +2% | Cloud adoption, innovation |

| Nvidia (NVDA) | Gained ground | Cloud adoption, innovation |

| Apple (AAPL) | Gained ground | Strong free cash flow |

| Broadcom (AVGO) | Gained ground | |

| Alphabet (GOOG) | -1% | |

| Amazon (AMZN) | -0.6% | Strong free cash flow |

While de-escalation is generally a “risk-on” scenario, the tech sector’s minimal oil exposure and sensitivity to Fed rate policy make it a defensive play against geopolitical energy shocks. When those shocks subside, tech benefits disproportionately from the re-pricing of future growth. Geopolitical tension typically leads to a “risk-off” sentiment, where investors move out of riskier assets into safe havens. Yet, the Nasdaq Composite showed resilience even during the oil spike, indicating it held up better than expected. When de-escalation occurred and oil prices fell, tech stocks surged. This creates a paradoxical resilience: tech stocks are less vulnerable to the direct impact of energy-driven geopolitical shocks. When these shocks recede, the indirect benefit of potential Fed easing, due to lower inflation pressure from oil, disproportionately boosts tech’s future valuations. Thus, tech acts as a “defensive edge” against energy-related geopolitical risk, allowing it to outperform both during and after such events, provided the conflict remains localized and does not trigger broader economic disruption. This represents a “risk-off” characteristic within a “risk-on” rally.

Beyond Geopolitics: Monetary Policy and Corporate Earnings on the Horizon

While geopolitical de-escalation provided an immediate boost, the market’s attention will quickly pivot to the Federal Reserve. Federal Reserve Chair Jerome Powell will testify before the House Financial Services Committee on Tuesday, delivering prepared remarks on monetary policy and holding question-and-answer sessions with lawmakers.6

The Federal Open Market Committee (FOMC) remains firmly committed to promoting maximum employment, stable prices, and moderate long-term interest rates, with a longer-run goal of 2% inflation.13 The Fed recently kept interest rates unchanged, with expectations of two rate cuts in 2025. Inflation is expected to stabilize at 3% this year and decline to 2.4% next year, with the core PCE price index standing at 2.5% year-on-year for May.6 The Fed’s next move hinges on whether oil’s spike translates into sustained inflation.5 If the geopolitical premium fades, the Fed could hold rates steady, easing pressure on equities. Conversely, a prolonged premium could force the Fed to tighten further, dampening growth narratives.5 The market currently prices in a 70% chance of a July pause.5 The de-escalation in the Middle East directly impacts the Fed’s calculus. Reduced oil price pressure lessens inflationary concerns, potentially giving the Fed more flexibility to maintain or even cut rates. This creates a positive feedback loop for growth-oriented sectors like tech. Geopolitical tensions previously injected a geopolitical premium into oil prices, and higher oil and gasoline prices would push inflation higher. Since the Fed aims for 2% inflation, a rise in oil-driven inflation could force the Fed to tighten or maintain higher rates. With de-escalation leading to tumbling oil prices, the Fed gains flexibility to hold rates steady, easing pressure on equities. The “risk-on” sentiment from geopolitical de-escalation is thus amplified by the expectation of a more dovish Fed, particularly beneficial for the Nasdaq, as tech stocks are sensitive to borrowing costs and the discount rate applied to their future earnings. The market’s pricing of a 70% chance of a July pause reflects this anticipated flexibility, creating a dual tailwind for equities.

Beyond macro factors, company-specific performance from major corporations will introduce volatility and investment opportunities. Carnival Corporation (CCL), FedEx (FDX), and BlackBerry (BB) are all due to report earnings.

Carnival Corporation (CCL) is set to report Q2 2025 earnings on June 24.7 Analysts project an adjusted EPS of $0.25, up from $0.11 in the same period last year, and revenue of $6.21 billion, a 7.4% increase year-over-year.7 Carnival has a strong track record of beating estimates, with 10 straight bottom-line beats and an average surprise of 458% over the past four quarters.7 Key metrics to watch include yield improvements, cost management (fuel, dry dock, labor inflation), booking momentum (80% of 2025 capacity already booked at higher prices), and debt reduction efforts (a $25 billion debt load, but recent $5.5 billion refinancing at lower rates).7 The stock trades at a forward P/E of 14.2x, which is below peers like Royal Caribbean and Norwegian Cruise Line.7

FedEx (FDX) is scheduled to post its fiscal fourth-quarter results for 2025 after the market closes on Tuesday.8 Analysts are largely bullish on the shipping giant’s stock, with 12 “buy” ratings out of 14 and an average price target of $281, implying roughly 24% upside from Friday’s close.8 Revenue is expected to decline just over 1% from a year ago to $21.82 billion, but adjusted earnings per share are projected to rise over 8% to $5.88 as FedEx continues its cost-cutting efforts.8 Concerns include potential tariff impacts on demand and a “noisy miss” for Q4 due to inflationary pressures, one fewer operating day, tariff-related volume headwinds, and business-to-business weakness.8 Traders expect a sizable move of close to 7%, or nearly $16, in either direction for FedEx stock after the report.15

BlackBerry (BB) reports its first-quarter fiscal 2026 earnings on June 24.9 Analysts estimate a breakeven EPS ($0.00).9 Revenue growth has faced challenges, with a decline of approximately -6.01% in the prior three months, and the company lags competitors in revenue growth, gross profit, and Return on Equity.9 However, BlackBerry has an impressive earnings surprise history, outpacing the Zacks Consensus Estimate in each of the trailing four quarters with an average beat of 93.75%.16 Strengths include its QNX segment, particularly solid demand for automotive solutions, healthy royalties, and successful cost-cutting, having achieved its initial target of cutting roughly $150 million from its run rate.16 Geopolitical uncertainties and tariff changes on automotive goods pose indirect risks.16 The stock has outperformed its industry, gaining 14% in the past six months.16

The table below provides a preview of these upcoming key earnings reports:

| Company (Ticker) | Report Date | Expected EPS (YoY Change) | Expected Revenue (YoY Change) | Key Drivers/Challenges | Analyst Consensus/Outlook |

| Carnival (CCL) | June 24, 2025 | $0.25 (up from $0.11) | $6.21B (up 7.4%) | Strong bookings, yield growth vs. rising fuel, labor costs, debt management | Strong beat history, “Hold” to “Buy” for Q2 beat |

| FedEx (FDX) | June 24, 2025 | $5.88 (up >8%) | $21.82B (down >1%) | Cost-cutting efforts vs. tariff impacts, B2B weakness, inflationary pressures | Mostly “Buy” (12/14), average price target $281 |

| BlackBerry (BB) | June 24, 2025 | $0.00 (breakeven) | $107-$115M (down ~6%) | QNX strength, cost cuts vs. revenue challenges, geopolitical/tariff risks | Breakeven EPS, impressive beat history, “Hold” strategy |

While macro events like geopolitical de-escalation drive broad market sentiment, upcoming earnings reports will provide a granular look at underlying corporate health, potentially challenging or reinforcing the current optimistic narrative. Strong earnings beats could reinforce the broader “risk-on” narrative and signal underlying economic resilience. However, misses or weak guidance, particularly from bellwethers like FedEx, could introduce company-specific or sector-specific headwinds, reminding investors that not all companies benefit equally from macro tailwinds, or that underlying economic challenges persist regardless of geopolitical calm. This highlights the transition from a broad, sentiment-driven rally to a more fundamental, company-specific evaluation.

Investment Implications: Navigating a Shifting Landscape

The immediate market response to the Israel-Iran ceasefire signals a strong preference for de-escalation and a return to “risk-on” assets. The Nasdaq’s outperformance underscores the market’s confidence in the technology sector’s structural advantages and its sensitivity to favorable monetary policy expectations.

While the ceasefire announcement provided significant relief, the situation’s inherent “unclarity” and the history of rapid escalation in the Middle East necessitate continued vigilance.11 Investors must distinguish between short-term volatility and enduring structural trends.5

Federal Reserve policy remains a paramount driver. Powell’s testimony will offer crucial insights into the Fed’s stance on inflation and interest rates. A sustained period of lower oil prices, combined with contained inflation, could pave the way for rate cuts, further bolstering growth stocks.

From a sector-specific perspective, technology continues to offer a “defensive edge” and benefits from potential Fed easing.5 Investors should focus on firms with strong free cash flow and low debt, such as Apple and Amazon, and cybersecurity plays like CrowdStrike and Palo Alto Networks.5 For energy, the recent dip in oil prices might present a “buying opportunity for energy stocks” if the market assumes the risk of a Strait of Hormuz closure remains a “tail event”.5 Overweighting energy ETFs like XLE on dips could prove strategic.5 For the broader market, upcoming earnings reports will test individual company fundamentals against the backdrop of macro optimism. Investors should monitor these closely for signs of resilience or weakness.

A balanced approach, potentially including a hedge with gold and utilities, can provide ballast against unforeseen escalations, while tactical plays in energy and resilient tech capitalize on the current market dynamics.5 The key is disciplined investing, recognizing that while geopolitics dominates headlines, the Fed’s hand on rates and oil’s structural trends ultimately decide market direction.5

References

- US inserts itself into Israel’s war with Iran, striking 3 Iranian nuclear sites, accessed June 24, 2025, https://apnews.com/article/israel-iran-war-nuclear-talks-geneva-news-06-21-2025-a7b0cdaba28b5817467ccf712d214579

- How U.S. stealth bombers struck Iran’s nuclear sites without detection | PBS News, accessed June 24, 2025, https://www.pbs.org/newshour/world/how-u-s-stealth-bombers-struck-irans-nuclear-sites-without-detection

- A look at Al Udeid Air Base, the US military site that Iran attacked, accessed June 24, 2025, https://apnews.com/article/al-udeid-air-base-military-qatar-iran-501e9e64e80480ef3aa4ee43c1243235

- Iran strikes US base in Qatar; Trump says Israel-Iran ceasefire coming | LiveNOW from FOX, accessed June 24, 2025, https://www.livenowfox.com/news/iran-attacks-al-udeid-air-base-qatar

- US Stock Market Rebound Amid Middle East Tensions: Opportunities in Energy and Tech Amid Volatility – AInvest, accessed June 24, 2025, https://www.ainvest.com/news/stock-market-rebound-middle-east-tensions-opportunities-energy-tech-volatility-2506/

- US Federal Reserve Chairman Jerome Powell testimony June 2025: Economic Spotlight 23-30/06/2025 – CFI Trading, accessed June 24, 2025, https://cfi.trade/en/uae/blog/economic/us-federal-reserve-chairman-jerome-powell-testimony-june-2025-economic-spotlight-23-30062025

- Carnival Corporation’s Q2 2025 Earnings: Navigating Costs and Demand for a Post-Pandemic Turnaround – AInvest, accessed June 24, 2025, https://www.ainvest.com/news/carnival-corporation-q2-2025-earnings-navigating-costs-demand-post-pandemic-turnaround-2506/

- What Analysts Think of FedEx Stock Ahead of Earnings – Investopedia, accessed June 24, 2025, https://www.investopedia.com/what-analysts-think-of-fedex-stock-ahead-of-earnings-q4-fy-2025-11756249

- Exploring BlackBerry’s Earnings Expectations – Nasdaq, accessed June 24, 2025, https://www.nasdaq.com/articles/exploring-blackberrys-earnings-expectations

- Asia & Wall St Futures Surge After Trump Announces Iran-Israel Ceasefire; D-St To Open In The Green? – YouTube, accessed June 24, 2025, https://www.youtube.com/watch?v=IcKgcmBEIak

- Asian shares rally after Trump announces Israeli-Iran ceasefire – Midland Daily News, accessed June 24, 2025, https://www.ourmidland.com/news/world/article/asian-shares-rally-after-trump-announces-20390766.php

- Markets News, June 23, 2025: Stocks Jump, Oil Prices Plunge as Hopes Rise That Middle East Conflict Could Subside; Tesla Surges on Robotaxi Launch – Investopedia, accessed June 24, 2025, https://www.investopedia.com/stock-market-today-11759095

- Monetary Policy Report June 2025 – Federal Reserve Board, accessed June 24, 2025, https://www.federalreserve.gov/monetarypolicy/files/20250620_mprfullreport.pdf

- 3 Reasons to Buy Carnival Before Tuesday, and 1 Reason to Sell | The Motley Fool, accessed June 24, 2025, https://www.fool.com/investing/2025/06/23/3-reasons-to-buy-carnival-before-tuesday-1-reason/

- Here’s How Much Traders Expect FedEx Stock to Move After Tuesday’s Earnings, accessed June 24, 2025, https://www.investopedia.com/here-is-how-much-traders-expect-fedex-stock-to-move-after-earnings-11758188

- Should You Hold or Sell BlackBerry Stock Before Q1 Earnings Release? – June 20, 2025, accessed June 24, 2025, https://www.zacks.com/stock/news/2520006/should-you-hold-or-sell-blackberry-stock-before-q1-earnings-release

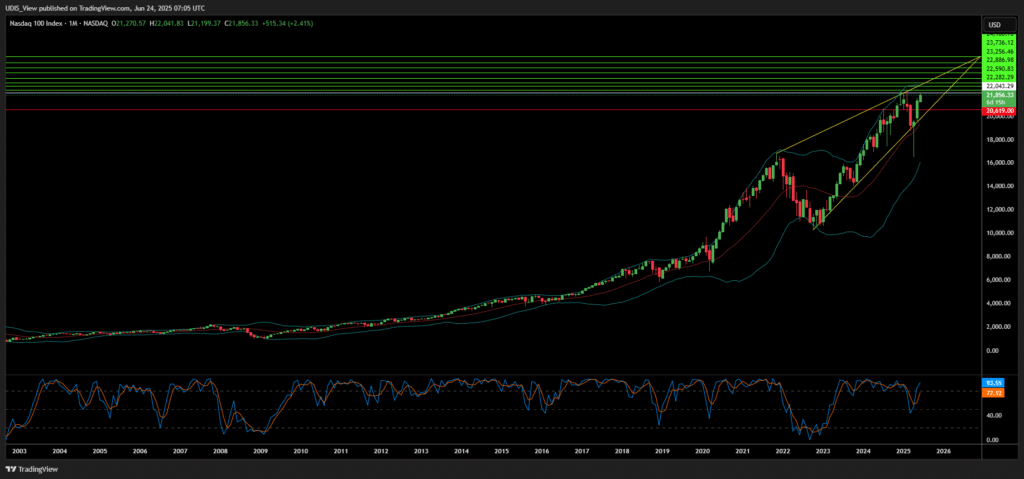

Nasdaq 100 Long (Buy)

Enter At: 22043.29

T.P_1: 22282.29

T.P_2: 22590.83

T.P_3: 22886.98

T.P_4: 23256.46

T.P_5: 23736.12

T.P_6: 24160.70

T.P_7: 24620.65

T.P_8: 25115.99

S.L:20619.00