I. General Dynamics Commands Dual-Engine Growth

General Dynamics (GD) reported robust Q3 2025 results, confirming its strategic position. The company successfully navigates persistent geopolitical demand and robust luxury markets. Revenue reached $12.9 billion, marking a significant 10.6% increase year-over-year.1 Diluted Earnings Per Share (EPS) soared to $3.88, demonstrating powerful 15.8% growth from the year-ago quarter.2

This financial strength validates the dual-engine growth thesis currently propelling GD. The defense segment capitalizes on mandatory global rearmament expenditures.3 Meanwhile, the Gulfstream Aerospace segment leverages resilient demand from the high-net-worth market.4

The Aerospace segment provided immediate margin uplift and revenue acceleration. Aerospace revenue grew by 30.3% in the quarter.2 Operating margin expanded by 100 basis points (bps) year-over-year.2 This commercial success stabilizes overall corporate performance during ongoing challenges in the defense industrial sector.

Decades of revenue visibility are secured by strategic defense programs. These include the essential Columbia-class ballistic missile submarine (SSBN).6 They also encompass multi-billion-dollar European land system contracts.7 GD’s differentiation relies on superior, often proprietary, technology. This technology spans nuclear propulsion systems and advanced IT modernization platforms.8

II. Economics and Financial Efficacy: FCF Aristocrat Profile

General Dynamics exhibits structural financial efficacy driven by high cash generation. The overall corporate operating margin expanded to 10.3% in Q3 2025.2 This represents a 20-bps improvement year-over-year.2 Margin strength stems from improved operational efficiency and a favorable mix of high-margin products, particularly in the Aerospace segment.

The company maintains superior cash conversion rates. Net cash provided by operating activities totaled $2.1 billion during the third quarter.2 This extraordinary performance represents 199% of net earnings.2 Such high cash generation provides substantial financial resilience against project risks or economic downturns.

This reliable cash flow underpins GD’s disciplined capital deployment strategy. The company paid $403 million in dividends during the quarter.2 Its consistent, predictable dividend policy appeals significantly to conservative institutional investors. GD demonstrates characteristics aligning with the S&P 500 Quality Free Cash Flow (FCF) Aristocrats Index 10

Inclusion in the FCF Aristocrats Index requires ten consecutive years of positive FCF.10 This criterion confirms GD’s deep structural stability across various economic cycles. The sustained cash strength is critical for self-funding large, capital-intensive projects like the Columbia SSBN program. It minimizes reliance on external financing during these crucial construction phases.

Table 1: General Dynamics Q3 2025 Financial Highlights

| Metric | Q3 2025 Result | Year-Over-Year Change | Strategic Implication |

| Revenue | $12.9 Billion | 10.6% Increase | Exceeding analyst estimates 1 |

| Diluted EPS | $3.88 | 15.8% Increase | Margin improvement achieved 2 |

| Operating Margin | 10.3% | 20 BPS Expansion | Enhanced operational efficiency 2 |

| Cash from Operations | $2.1 Billion | 199% of Net Earnings | Superior FCF generation profile 2 |

III. Geopolitics and Geostrategy: European Rearmament Catalyst

Escalating geopolitical tensions drive mandatory increases in global defense spending.3 This urgent requirement for military modernization directly benefits GD’s Land Systems division. European military expenditure has surged significantly since Russia’s 2014 aggression in Crimea 11

This upward trend accelerated sharply in recent years. European Union defense spending reached €343 billion ($402 billion) in 2024.11 This set a new record, representing a 19% increase over the previous year.11 The European Defense Agency (EDA) anticipates continued spending growth.11 Spending is projected to reach €381 billion ($446 billion) in 2025.11

European nations prioritize “defense investments,” particularly new equipment purchases and research and development (R&D). 11 Equipment purchases saw a 39% jump year-over-year in 2024.11 This spending shift directly creates opportunities for high-value platform providers like GD.

General Dynamics European Land Systems (GDELS) is capitalizing heavily on this European urgency. GDELS secured a critical €3 billion contract from the German government.7 This deal supplies the next-generation reconnaissance vehicle (LUCHS 2) to the German Army (Bundeswehr).7 The vehicle replaces the FENNEK 4×4 platform.7

Germany chose the PIRANHA 6×6 amphibious variant for the LUCHS 2 program.7 This selection follows the previous choice of the PIRANHA 8×8 for the German TaWAN project.12 This strategic move creates platform commonality within the Bundeswehr’s fleet. Standardized platforms maximize logistical support, simplifying training and securing long-term service and maintenance revenue for GDELS.

IV. Geostrategy and Science: The Naval Innovation Moat

The Columbia-class SSBN program represents the cornerstone of U.S. strategic deterrence.13 It is the U.S. Navy’s unequivocally stated top acquisition priority.6 This immense program involves building 12 submarines, securing decades of workload for GD Electric Boat.14 The program’s total projected cost is approximately $130 billion.15

The Columbia class is not merely a replacement; it incorporates significant technological leaps. Key innovations include the turbo-electric drive propulsion system and the S1B nuclear reactor.14 These non-commercial, high-tech features establish a durable competitive moat for GD in strategic naval construction.

The S1B reactor core is engineered to last the vessel’s entire 42-year service life.8 This design eliminates the requirement for a costly, lengthy mid-life nuclear refueling overhaul.16 Avoiding this major disruption significantly reduces the vessel’s life-cycle operating costs. It also guarantees uninterrupted deterrence patrols, maintaining constant operational availability for the U.S. Navy.

The propulsion architecture also advances naval science. The turbo-electric drive combined with pump-jet propulsion significantly enhances acoustic stealth.14 Superior stealth is paramount for ballistic missile submarines executing their nuclear deterrence mission.13

Construction progress continues despite industrial challenges. The lead boat, USS District of Columbia (SSBN-826), reached approximately 60% completion.17 Company officials anticipate having all major modules at the Groton facility for final assembly by the end of 2025.17

V. Macroeconomics: Gulfstream’s Luxury Market Dominance

Macroeconomic factors continue to support persistent demand for premium, large-cabin business jets. Global economic stability, even amid uncertainty, provides a solid foundation for business aviation.19 Analyst forecasts indicate continued demand and price stability, specifically for heavy jet models.4 New jet purchase plans are stabilizing at high levels, exceeding pre-pandemic figures significantly.5

GD’s Aerospace segment, dominated by Gulfstream, successfully converted this demand into record performance. Aerospace segment revenue rose 30.3% in Q3 2025.2. This execution resulted in a 41% surge in operating profit year-on-year.20

Operational execution achieved record levels due to supply chain normalization. Gulfstream delivered 39 business jets in Q3, representing a 39% increase over 2024.20 Management confirmed that supply chain improvements allowed delivery cadence to return to pre-pandemic on-time levels.20 This operational elasticity allowed Gulfstream to disproportionately boost corporate margins.

Success centers on flagship models in the heavy jet category. Gulfstream delivered 13 G700s and three G800s during the quarter.20 The G800, which received certification in April, saw its first customer delivery in Q3.20. These models represent Gulfstream’s longest-range, most expensive offerings.20 Heavy jets like the G700 remain in high demand across the market.21

VI. Technology and Cyber: Modernizing the Digital Battlefield

The Technology division, primarily General Dynamics Information Technology (GDIT) and Mission Systems, is critical for digital transformation. This division focuses on Command, Control, Communications, Computers, Cyber, and Intelligence, Surveillance, and Reconnaissance (C5ISR) systems.22 GDIT’s recent contract wins demonstrate its role as an essential digital system integrator.

GDIT secured a $1.5 billion contract to modernize enterprise IT systems for U.S. Strategic Command (USSTRATCOM).23 Concurrently, GDIT won a $1.25 billion task order for the U.S. Army Europe and Africa (USAREUR-AF).9 These deals secure GD’s position as the backbone for critical military communications infrastructure worldwide.

The contracts mandate leveraging cutting-edge, high-tech capabilities. GDIT must deploy artificial intelligence (AI), machine learning (ML), cloud computing, and data analytics.24 Implementing these tools enhances operational readiness and supports rapid, informed decision-making across the battlefield.24

Proactive cybersecurity measures form a crucial element of the mandate. GDIT deploys automation and real-time threat detection capabilities.25 These advanced cyber systems protect critical government data and services.25

Beyond IT infrastructure, GD Mission Systems provides highly specialized Electronic Warfare (EW) technology.26 These systems detect, locate, and identify signals across the electromagnetic spectrum.26 Furthermore, GD Mission Systems received a contract supporting the AUKUS partnership.27 They are developing the Common Weapon Launcher and Multi-Tube Weapon Simulator for submarines utilized by the US, UK, and Australia 27

VII. Science, High-Tech, and Patent Analysis: Sustaining the IP Moat

General Dynamics sustains its competitive advantage through a deep investment in intellectual property (IP). The company holds a total of 3,340 patents globally.28 Importantly, over 45% of this extensive patent portfolio remains active.28 This confirms a continuous commitment to proprietary scientific development.

The IP strategy aligns with core business segments, covering shipbuilding, C4ISR, and combat vehicles 29 Patent analysis confirms GD is advancing in critical areas like signals intelligence (SIGINT) and autonomous systems.

Recent patent applications detail high-tech, proprietary solutions. One application focuses on utilizing neural networks for signal processing.31 This technology trains AI to maximize scale-invariant ratio comparisons, significantly improving SIGINT capabilities.31 This demonstrates a scientific commitment to applying AI to complex defense requirements.

Another high-tech patent application addresses drone communication networks.31 The invention facilitates high-bandwidth communication using direct line-of-sight between autonomous and semi-autonomous drones.31 This capability supports the military’s strategic shift toward integrated autonomous battlefield systems.

GD Electric Boat maintains critical IP related to marine propulsion systems.32 Specific patents cover electric motor drive use and submersible power units.32 This intellectual history validates the technology underpinning the Columbia-class’s advanced turbo-electric drive, reinforcing the program’s strategic monopoly.

VIII. Navigating Operational Headwinds: Submarine Industrial Stress

Despite robust financial performance, the Naval segment faces systemic operational challenges. The highly specialized defense industrial base remains fragile.34 The Columbia-class SSBN program now faces significant schedule pressure. The first submarine delivery is estimated to be delayed by 12 to 16 months.15 Delivery is now anticipated between late 2028 and early 2029.15

Supply chain fragility is the primary driver of these delays and cost increases 34 Late delivery of major components, including large turbines and bow sections, forces complex, out-of-sequence construction work.17 Management acknowledges that the industrial base is struggling to improve quickly enough.34

The specialized workforce shortage exacerbates production issues.35 Systemic difficulties include shortages of skilled labor, such as nuclear-certified welders and specialized engineers.35 These critical skill gaps limit overall industrial capacity and drive up program costs.35

This skilled labor constraint is a sector-wide issue for aerospace and defense. The industry faces persistent talent gaps in engineering and trades.36 Attrition rates remain high, reported at nearly double the average for other U.S. industries 36 Addressing this structural talent gap is essential for margin and schedule recovery in the Naval segment.

Both the Navy and GD are intensely focused on enhancing the submarine industrial supply chain.17 Company executives emphasize that the upcoming year will be pivotal for driving productivity improvements and margin growth in the Naval division.17

Table 2: Key Strategic Programs and Multi-Domain Drivers

| Program/Segment | Domain Driver | Technological Edge | Financial Impact |

| Columbia-Class SSBN | Geostrategy 6 | S1B Life-of-Ship Reactor, Electric Drive 8 | $130 Billion total program value 15 |

| Gulfstream G700/G800 | Macroeconomics 5 | Ultra-Long Range, Cabin Size 20 | 30.3% Aerospace Revenue Growth 20 |

| GDELS Reconnaissance | Geopolitics 11 | Low Signature, Networked Sensors 38 | €3 Billion German Contract 7 |

| GDIT IT Services | Cyber/High-Tech 24 | AI/ML, Cloud Transformation 24 | $2.75 Billion in recent contracts 9 |

IX. Conclusion: Assertion of Sustained Strategic Alpha

General Dynamics maintains a uniquely balanced, high-quality portfolio. The company effectively leverages high-margin, operationally resilient luxury aviation (Gulfstream) against stable, strategic defense programs (Naval and Land Systems).29 This segmentation shields the company from extreme volatility inherent in any single sector.

The defense segments capitalize on non-discretionary global rearmament and strategic deterrence mandates.6 These programs are essential and largely immune to routine budget cycles. GD maintains an indispensable role in nuclear shipbuilding and next-generation C4ISR integration.26 This technological moat, substantiated by a broad patent portfolio, secures competitive advantages and pricing power.

GD’s robust cash flow profile provides critical financial stability. High cash conversion (199% of net earnings) mitigates the execution risks associated with massive programs like the Columbia SSBN.2

Near-term investment focus must prioritize stabilizing the submarine industrial base.34 Success in mitigating the systemic supply chain and skilled labor constraints determines the long-term margin trajectory of the crucial Naval segment.17 General Dynamics’ strategic depth, powerful cash generation, and technological dominance position the company for sustained alpha generation in a volatile global environment.

References

- General Dynamics Books Double-Digit Sales Growth in Q3 2025

- General Dynamics Reports Third-Quarter 2025 Financial Results …

- The Military Balance 2025: Defence Spending and Procurement Trends

- Business Jets: Market Dynamics Support Continued Growth | RBCCM

- Honeywell Forecast Shows Increased Demand for New Business Jets, Stable Growth for Next Decade

- Columbia-Class Nuclear Submarine Case Study – Keel

- Germany signs €3B deal with GDELS for new reconnaissance vehicle – Defensehere

- COLUMBIA CLASS SUBMARINE Immature Technologies Present Risks to Achieving Cost, Schedule, and Performance Goals

- GDIT Secures $1.2B IT Contract Supporting US Army Europe, Africa – GovCon Wire

- S&P 500 Quality FCF Aristocrats Index | S&P Dow Jones Indices – S&P Global

- EU sets military spending record, expects more growth in 2025

- GDELS receives contract for the next-generation reconnaissance vehicle of the Bundeswehr

- Navy Columbia (SSBN-826) Class Ballistic Missile Submarine Program: Background and Issues for Congress

- Columbia-class submarine – Wikipedia

- Columbia Class Submarine: Overcoming Persistent Challenges Requires Yet Undemonstrated Performance and Better-Informed Supplier Investments | U.S. GAO – Government Accountability Office

- United States Naval Nuclear Propulsion Program – Department of Energy

- First Columbia-class Sub 60% Complete, Next Year ‘Pivotal,’ Says …

- General Dynamics reported a 60% progress in the construction of the first of the U.S. Navy’s new Columbia-class nuclear submarines – Zona Militar

- Q2 2025 Market Brief – Global Jet Capital

- Gulfstream Reports Record Deliveries in First Nine Months of 2025 – ePlaneAI

- Demand for Heavy Jets in 2025: Charter and Purchase Trends | Safefly Aviation

- General Dynamics – Wikipedia

- GDIT Awarded $1.5 Billion Enterprise IT Modernization Contract to Strengthen U.S. Strategic Command’s Operational Readiness | GD – General Dynamics

- General Dynamics unit wins $1.25B Army contract – Virginia Business

- State and Local Government – GDIT

- Electronic Warfare – General Dynamics Mission Systems

- General Dynamics Mission Systems

- General Dynamics Patents Key Insights & Stats

- General Dynamics | Home

- Aerospace and Defense – Colby Nipper

- Patents Assigned to General Dynamics

- US8152577B1 – Electric boat – Google Patents

- US5479871A – Emergency power system for submarines – Google Patents

- Supply chain issues are slowing down General Dynamics’ sub construction, CEO says

- Pentagon Awards $5B to Strengthen Submarine Supply Chain – Trax Technologies

- AIA and McKinsey Release New Study on Tackling Talent Gaps in Aerospace and Defense Industry

- 2025 Hiring Trends in Aerospace & Defense – Blue Signal Search

- GDELS Secures Contract for Next Generation Reconnaissance Vehicle for Bundeswehr

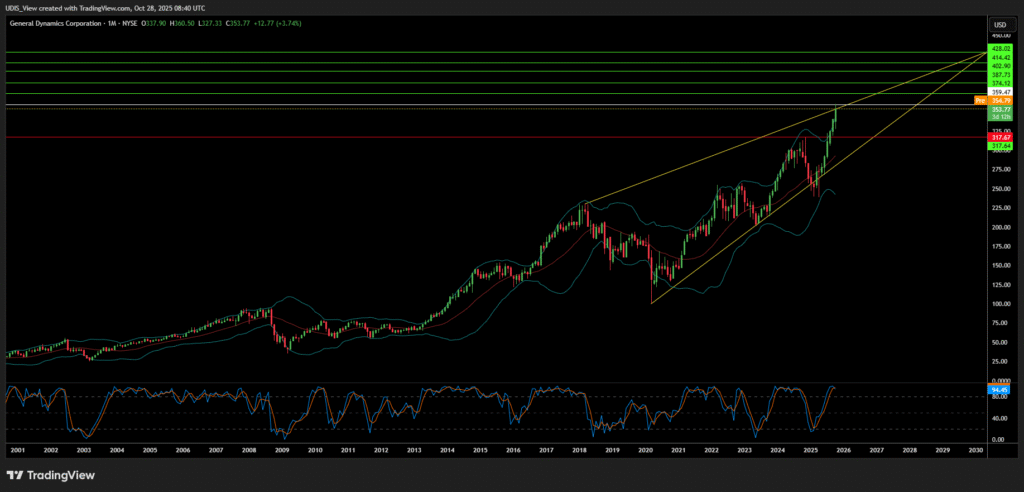

General Dynamics Long (Buy)

Enter At: 359.47

T.P_1: 374.12

T.P_2: 387.73

T.P_3: 402.90

T.P_4: 414.42

T.P_5: 428.02

S.L: 317.67