Genasys Inc. (NASDAQ: GNSS) commands a pivotal position within the protective communications sector, delivering essential emergency warning and mass notification solutions worldwide. The company’s innovative portfolio, comprising its sophisticated Genasys Protect software platform and proprietary Long Range Acoustic Device (LRAD) systems, directly addresses the escalating complexities of global security. Despite navigating recent financial fluctuations, Genasys demonstrates robust strategic alignment with increasing defense expenditures, significant critical infrastructure investments, and a formidable patented technology base. This analysis examines the multifaceted factors driving Genasys’s market expansion and its promising future trajectory.

The Protective Communications Landscape: A Growing Market

The global demand for effective protective communications continues its sharp ascent. This rising need stems from diverse threats, ranging from natural disasters to geopolitical instability and sophisticated cyberattacks. Genasys Inc. has solidified its leadership role in this critical domain, providing solutions that ensure timely, intelligible communication in high-stakes environments. Its integrated hardware and software platforms offer distinct capabilities for enhancing public safety and maintaining operational continuity.

Genasys has a four-decade history of protecting people and saving lives, reaching over 155 million individuals across more than 100 countries.1 Its offerings are fundamental for public safety, encompassing emergency warnings and highly customizable mass notifications.1 The Genasys Protect platform, a unified and cloud-first system, facilitates targeted communication, data-driven decision-making, and secure inter-agency collaboration.2 It integrates numerous data streams using an API-first approach, providing emergency managers a unified operational view.2 This platform supports public safety, enterprise business continuity, and campus safety applications.2

Complementing its software, Genasys offers LRAD (Long Range Acoustic Device) systems. LRAD stands as the global standard in Acoustic Hailing Devices (AHDs), broadcasting exceptionally clear voice messages over significant distances, even amidst loud background noise.3 These systems deliver messages 20 to 30 decibels louder and with superior intelligibility compared to traditional bullhorns and vehicle-based public address systems.3 Models like the LRAD 950NXT integrate communication with surveillance and security features, enabling remote threat identification and warning.3

Genasys has achieved extensive market penetration, serving federal governments, military forces, state and local governments, and critical enterprise organizations.1 Law enforcement agencies in over 500 U.S. cities utilize LRAD systems for diverse applications, including SWAT operations, crowd control, and de-escalation scenarios.4 The Genasys Protect platform’s emphasis on secure inter-agency collaboration and a unified operating picture proves crucial for effective emergency response.2 Disparate systems often impede coordination; Genasys’s focus on open standards and API-first integration makes its platform highly adaptable and appealing to various agencies. This design directly addresses a major pain point for public safety organizations, enhancing the platform’s utility and long-term adoption.

Geopolitical Shifts Fueling Demand

The global security environment continues to deteriorate, prompting a substantial increase in defense spending and a renewed emphasis on non-kinetic de-escalation tools. This evolving geopolitical landscape directly translates into heightened demand for Genasys’s advanced protective communication solutions, particularly its LRAD systems.

Global defense spending reached USD 2.46 trillion in 2024, according to the International Institute for Strategic Studies (IISS).5 The Stockholm International Peace Research Institute (SIPRI) reported an even higher figure of USD 2.718 trillion for 2024, marking a 9.4% increase, the steepest year-on-year rise since at least 1988.6 This surge in expenditure directly results from intensifying security challenges, notably the ongoing Russia-Ukraine war in Europe and conflicts in the Middle East.5 Many nations have also pledged further increases in military spending, ensuring continued growth in this sector.6

LRAD systems play a strategically important role in de-escalation and crowd control. They provide a safe, scalable, and non-kinetic means of force escalation for law enforcement, homeland security, and defense operations.3 These systems are indispensable for managing large crowds and events, supporting SWAT operations, and de-escalating high-risk situations.4 The capacity to deliver clear warnings and commands from safe distances represents a transformative capability for public safety agencies.4

Genasys demonstrates direct market penetration in regions experiencing heightened security concerns. The company recently secured $1.0 million in LRAD orders for the Middle East and Africa.1 This expansion highlights how global events directly translate into business opportunities for Genasys. The rising global tensions and increased defense spending do not exclusively drive demand for kinetic weaponry. The growing emphasis on non-kinetic escalation of force and de-escalation for crowd control and law enforcement signals a strategic shift. Governments increasingly seek effective methods to manage threats and civil unrest without resorting to lethal force. LRAD systems offer a preferred solution in this context. This positions Genasys to benefit from a broader societal and strategic imperative to resolve conflicts with minimal harm, extending its market reach beyond traditional military applications.

Macroeconomic Tailwinds: Critical Infrastructure Investment

The global critical infrastructure protection (CIP) market is experiencing robust growth, driven by the increasing digitization of essential services and the escalating threat of cyber-physical attacks. Governments worldwide are prioritizing investments in resilience, creating a significant and sustained market opportunity for Genasys’s integrated solutions.

The U.S. critical infrastructure protection market alone reached USD 36.28 billion in 2024, with projections indicating a rise to USD 55.56 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 4.85%.8 Globally, the CIP market was valued at USD 148.64 billion in 2024 and is forecast to reach USD 213.94 billion by 2032, growing at a CAGR of 4.73%.9 This substantial growth is primarily fueled by increasing cyberattacks, stringent regulatory mandates, and the widespread digitization of core infrastructure sectors.9

Table 2: Global Critical Infrastructure Protection Market Projections

| Attribute | 2024 Market Size (USD Billion) | Projected Market Size (USD Billion) | CAGR (2025-2032/33) | Key Drivers |

| U.S. CIP Market | 36.28 8 | 55.56 (by 2033) 8 | 4.85% 8 | Digital monitoring, proactive threat mitigation, smart utility networks, supply chain security, state-sponsored cyber intrusions 8 |

| Global CIP Market | 148.64 9 | 213.94 (by 2032) 9 | 4.73% 9 | Rising cyberattacks, regulatory mandates, widespread digitization 9 |

Governmental funding and initiatives significantly bolster national resilience. The U.S. Department of Energy (DOE) has, for example, allocated nearly $23 million in funding for projects aimed at enhancing the resilience and security of the nation’s energy systems.8 Furthermore, the U.S. government committed $2 billion in October 2024 to 32 projects across 42 states specifically for protecting power transmission lines.9 Regulations such as the Cyber Incident Reporting for Critical Infrastructure Act also mandate rapid threat disclosure, further shaping market behavior.8

The energy sector remains a primary focus for enhanced resilience against both physical and cyber threats.8 Increased spending on smart utility networks also acts as a significant market driver.8 Genasys’s solutions, including physical security system upgrades for electrical substations, directly align with this critical trend.7 The growth of the critical infrastructure market is increasingly driven by the prioritization of cyber-physical system integration.8 Genasys’s offerings, which combine physical acoustic devices like LRAD with the Genasys Protect software platform, are uniquely positioned to address this convergence. The platform integrates numerous discrete data streams through API-first data integration.2 This allows Genasys to function as a holistic solution provider for complex, integrated threats, offering a distinct advantage over single-solution providers.

Technological Superiority: High-Tech and Cyber Innovation

Genasys’s market standing is significantly strengthened by its advanced technological capabilities, particularly its cloud-first platform and patented acoustic innovations. The company actively integrates high-tech solutions, including AI and IoT, to counter the evolving landscape of cyber-physical threats, ensuring its offerings remain at the forefront of protective communications.

The Genasys Protect platform operates on a cloud-first architecture, enabling the ingestion of diverse data streams through API-first integration.2 This architecture facilitates data-driven decision-making and predictive simulation, allowing for rapid response to emergencies.2 It provides a unified operating picture, offering real-time, zone-by-zone visibility for emergency management personnel.2

The broader critical infrastructure protection market is witnessing a surge in the adoption of AI-enabled surveillance, IoT-based monitoring solutions, and analytical/predictive technologies to enhance security.9 Genasys’s strategic partnership with FloodMapp exemplifies this trend; FloodMapp utilizes real-time flood intelligence and dynamic data for operational flood forecasting.10 The Genasys Protect platform further demonstrates this integration by connecting facility sensors to trigger automatic alerts when dangerous readings are detected.2 This represents a shift from purely reactive emergency response to proactive threat mitigation. Genasys’s platform capabilities, particularly predictive simulation 2 and its collaboration with FloodMapp for operational flood forecasting 10, enable clients to anticipate and prepare for events rather than merely respond. This forward-looking approach enhances the value proposition for clients, allowing for earlier, more effective evacuations and resource deployment, ultimately improving life-saving outcomes and reducing potential damage.

The market’s growth is also propelled by the increased frequency of state-sponsored cyber intrusions targeting strategic sectors.8 Genasys’s integrated solutions contribute directly to domestic resilience initiatives.8 These offerings support the critical prioritization of cyber-physical system integration, addressing the complex interplay between digital and physical threats that characterizes modern critical infrastructure vulnerabilities.8

Patent Portfolio: A Strategic Moat

Genasys possesses a robust intellectual property portfolio that underpins its technological leadership and provides a significant competitive advantage. These patents, particularly those related to its advanced acoustic hailing devices, establish a strategic barrier to entry in the specialized protective communications market.

Genasys, formerly known as LRAD Corporation, holds foundational patents in acoustic hailing devices. Patent US9693148B1, for example, details an acoustic hailing device featuring a pair of compression drivers, each incorporating two diaphragms oriented facewise, integrated with specialized waveguide housings.12 This innovative dual-diaphragm technology allows for double the power input and a substantial increase in sound pressure level (SPL) compared to conventional single-diaphragm drivers.12 The sound waves generated by these dual diaphragms are precisely directed through individual sound ducts, which are then redirected to exit the driver together in a common direction. Crucially, the lengths of these sound ducts are meticulously designed to be identical, ensuring that audio produced by both diaphragms arrives in phase, maximizing SPL.12

These patents directly underpin the technological differentiation and market leadership of Genasys. The patented technology ensures exceptional clarity over long distances and significantly greater intelligibility than legacy systems.3 LRAD’s proprietary audio technology focuses sound into a precise 30° beam, substantially reducing sound levels behind the device and in surrounding areas.4 Genasys reports holding 17 registered patents, which collectively reinforce its technological edge and create a defensible market position.15 This detailed patent protection means LRAD’s superior performance is not easily replicated. This intellectual property creates a significant barrier to entry for potential competitors, safeguarding Genasys’s market share and enabling premium pricing for its specialized hardware.

The company demonstrates a strong commitment to research and development for sustained innovation. Genasys invests $4.2 million annually in R&D.15 This ongoing investment ensures the company continues to develop and refine its protective communication solutions, maintaining its competitive advantage in a rapidly evolving market. This continuous innovation allows Genasys to adapt its offerings to emerging threats and technological advancements, securing its long-term relevance and growth.

Financial Performance and Future Trajectory

Genasys Inc. operates within a dynamic financial landscape, characterized by significant revenue growth driven by key projects, alongside ongoing profitability challenges. A thorough understanding of its financial reporting, particularly the accounting impact of large-scale hardware deployments, becomes essential for assessing its future trajectory.

Genasys reported fiscal third quarter 2025 revenue of $9.9 million, marking a 38% increase year-over-year from $7.2 million in Q3 2024.16 Hardware revenue experienced a substantial 50% increase year-over-year, while software revenue grew by 7%.16 Annual Recurring Revenue (ARR) for software reached $8.7 million in Q3 2025, an 8% increase year-over-year.16 For the full fiscal year 2024, revenue was $24.0 million, a decrease from $46.7 million in fiscal year 2023. This decline primarily resulted from a $26.2 million (61.1%) decrease in hardware revenue due to the completion of a major U.S. Army program.17

Table 1: Genasys Inc. Key Financial Metrics (FY2024-FY2025 Q3)

| Metric | FY2024 (Full Year) 17 | Q3 2024 (Unaudited) 16 | Q3 2025 (Unaudited) 16 |

| Revenue | $24.0 million | $7.2 million | $9.9 million |

| Net Loss | ($31.7) million | ($6.7) million | ($6.5) million |

| Gross Profit Margin | 42.4% | 52.8% | 26.3% |

| Hardware Revenue Growth (YoY) | N/A | N/A | 50% |

| Software Revenue Growth (YoY) | N/A | N/A | 7% |

| Annual Recurring Revenue (ARR) | N/A | N/A | $8.7 million |

| Hardware Backlog (excl. Puerto Rico) | N/A | N/A | Over $16 million 16 |

| Puerto Rico Project Value/Expected Revenue (FY2025) | N/A | N/A | $15-$20 million expected in FY2025 15 |

Significant projects notably impact gross margins and backlog. The Puerto Rico Early Warning System (EWS) project represents a major revenue driver, with $4.3 million in project-related revenue recognized in Q3 2025.16 To date, Genasys has recognized $5.6 million in revenue from this project.16 The company anticipates realizing between $15 million and $20 million in Puerto Rico-related revenue during fiscal 2025.7

Gross profit margin stood at 26.3% in Q3 2025, a decrease from 52.8% in Q3 2024.16 This depressed margin primarily results from the “percentage-of-completion accounting” methodology applied to the Puerto Rico project, where hardware shipments are initially recognized at cost.15 As installations near completion, revenue and profit recognition will accelerate, with labor-based profits recognized at a 100% gross margin.15 This structural shift is expected to drive margin expansion in fiscal 2026.15 The hardware backlog, excluding the Puerto Rico project, exceeds $16 million.16 The Puerto Rico project itself represents a substantial $40 million backlog item.15 Genasys’s current net losses and cash burn reflect significant investment in large, long-term projects like Puerto Rico.16 While these projects initially depress gross margins due to accounting methods, they are crucial for future revenue and margin expansion. This indicates a strategic decision to prioritize market penetration and long-term growth over immediate GAAP profitability. Investors should view current losses as an investment in future, higher-margin revenue streams.

Genasys demonstrates a commitment to operational efficiency and improved profitability. The GAAP net loss was ($6.5) million in Q3 2025, a slight improvement from ($6.7) million in Q3 2024.16 Adjusted EBITDA was ($4.8) million, compared to ($4.3) million in the prior fiscal year period.16 Operating expenses decreased 6.8% year-over-year in Q3 2025, reflecting operational and cost discipline.16 The company has implemented cost reduction actions projected to deliver approximately $2.5 million in annualized savings starting in Q1 2026.16 Cash and cash equivalents totaled $5.5 million as of June 30, 2025, down from $13.1 million as of September 30, 2024.16 The company secured a $4 million bridge loan to support the Puerto Rico project 15, demonstrating proactive liquidity management.

Conclusion: Positioning for Sustained Growth

Genasys Inc. is uniquely positioned to capitalize on powerful global trends. Its innovative protective communication solutions, underpinned by proprietary technology and a strategic patent portfolio, address critical needs in an increasingly volatile world. While navigating the financial complexities inherent in large-scale deployments, the company’s strategic vision and operational discipline point toward a trajectory of sustained growth.

Genasys offers a comprehensive suite of protective communications, from advanced acoustic hailing devices to a cloud-first, data-driven software platform. Its solutions directly align with escalating geopolitical tensions, increased defense spending, and the urgent need for critical infrastructure protection against evolving cyber-physical threats. The company’s significant project backlog, particularly the Puerto Rico Early Warning System, provides clear revenue visibility for the coming periods. Its strategic partnerships and ongoing research and development investments ensure continued innovation and market relevance. The global shift toward non-lethal de-escalation tactics and proactive security measures further enhances Genasys’s market opportunity.

Genasys presents a compelling investment case for those seeking exposure to the growth of defense, public safety, and critical infrastructure markets. Its strong technological foundation and strategic market positioning suggest significant long-term potential. Investors should consider the company’s substantial backlog and the anticipated margin expansion from completed projects as key indicators of future financial health and profitability, outweighing current profitability challenges.

References:

- About Us – Emergency Warnings & Mass Notifications | Genasys

- Genasys Protect – Emergency Communications Platform

- LRAD Products | Genasys

- Law Enforcement | Genasys LRAD

- Global defence spending soars to new high – The International Institute for Strategic Studies,

- Trends in World Military Expenditure, 2024 – SIPRI

- Genasys Inc. (GNSS) Q2 2025 Earnings Call Transcript | Seeking Alpha

- U.S. Critical Infrastructure Protection Market Size & Share 2033

- Critical Infrastructure Protection Market Size to Surpass USD 213.94 Billion by 2032, Owing to Increasing Cybersecurity Threats and Regulatory Push | Research by SNS Insider – GlobeNewswire

- Genasys and FloodMapp partner for advanced flood response – Investing.com India,

- Genasys Protect Partners,

- U.S. Patent for Acoustic hailing device Patent

- US9693148B1 – Acoustic hailing device – Google Patents

- Patents Assigned to LRAD Corporation – Justia Patents Search

- Genasys Inc (GNSS): A High-Conviction Long-Term Buy Amid Operational Turnaround and Strong Backlog Growth – AInvest,

- Genasys Inc. Reports Fiscal Third Quarter 2025 Financial Results

- Genasys Inc. Reports Fiscal Fourth Quarter and Fiscal Year 2024 Financial Results

- Earnings call transcript: Genasys Inc Q3 2025 sees revenue beat amid EPS miss

- EX-99.1 – SEC.gov

- Financial Results – Genasys – Investor Relations

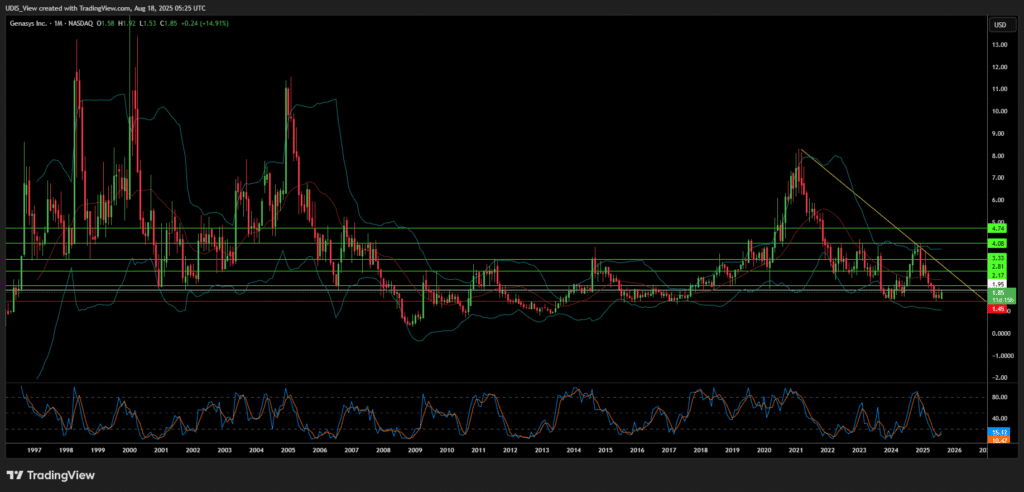

Genasys long (Buy)

Enter At: 1,95

T.P_1: 2.17

T.P_2: 2.81

T.P_3: 3.33

T.P_4: 4.08

T.P_5: 4.74

S.L: 1.45