I. The Cracking Foundation of Vertical Integration

CVS Health faces converging crises that undermine its vast vertically integrated model. The company built its foundation on market dominance in pharmacy benefit management (PBM).1 That structure now struggles against intensifying regulatory scrutiny and technology-driven disruption.1 Investors must recognize systemic weaknesses masked by adjusted financial reporting. CVS’s core operational reliability now faces substantial long-term threats.

The conflict with Eli Lilly & Co. provides a critical strategic inflection point. Lilly pulled its employees from CVS Health Corp.’s PBM plan in a highly visible protest. This followed CVS Caremark’s exclusion of Lilly’s weight-loss drug, Zepbound. Lilly’s decision to shift benefits to Rightway Healthcare validates concerns about CVS’s client retention.3 This single conflict exposes deep fissures across CVS’s economic, scientific, and technological domains.

The Lilly exit is more than a simple loss of a large PBM client. It sends a profound reputational signal to the market. CVS champions its PBM for delivering value through aggressive cost control.5 However, Lilly, a sophisticated pharmaceutical client, chose to fire CVS and absorb the disruption to protest the formulary decision. This demonstrates the perceived future value of Zepbound’s science outweighed Caremark’s projected savings. This action sets a dangerous precedent for other major employers who currently evaluate their opaque PBM contracts.

II. The GLP-1 Formulary Flashpoint: A Strategic Miscalculation

PBM’s Cost Mandate Versus Clinical Outcomes

CVS Caremark dropped Zepbound (tirzepatide) from its standard formulary starting July 1.6 The PBM prioritized Novo Nordisk’s rival product, Wegovy (semaglutide), citing “more favorable pricing”. This choice exemplifies the PBM’s central mandate for pure cost containment. GLP-1 medications account for approximately 15% of the total drug costs for PBM clients.6 CVS employed an aggressive negotiation strategy, leveraging the two blockbuster products against each other.

The decision to exclude Zepbound critically failed to balance economics with scientific merit. Head-to-head clinical trials demonstrated that tirzepatide generally promoted greater weight loss compared to semaglutide.7 This observed scientific superiority complicates CVS’s purely economic rationale. CVS aims to reduce costs for plan sponsors, but the exclusion risks continuity of care for patients and invites potential litigation over clinical appropriateness 9

Science Driving Structural Economic Pressure

The Zepbound conflict proves the PBM model is structurally challenged by rapidly evolving, high-cost scientific innovation. GLP-1 drugs represent significant scientific breakthroughs, achieving rapid, necessary market penetration.8 The high cost of these medications immediately stresses the PBM’s ability to maintain margins and manage overall plan expenditures.6 By prioritizing cost (Wegovy) over the potential superior clinical benefit (Zepbound), CVS signals a reactive, price-focused PBM function.

Eli Lilly’s strategic retort represents a calculated attempt to reclaim leverage. By shifting its own employee benefits away from CVS Caremark to a rival PBM, Lilly publicly protests the PBM’s negotiating power. While initial reports suggested the impact on Zepbound’s subsequent sales growth was “limited” 10, the client loss signals deep corporate distrust in Caremark’s ability to balance market access and cost management. Lilly’s action elevates commercial friction to an issue of strategic corporate alignment.

III. Macroeconomic and Core Economic Vulnerabilities

The M&A Integration Burden: Goodwill Impairment

CVS’s long-term strategy depends entirely on successful vertical integration, particularly of its Health Services segment. Management’s acquisition of Oak Street Health was central to this strategy.11 However, the company recently reported a massive $5.7 billion goodwill impairment charge in the third quarter of 2025.13 This immense write-down explicitly links to decelerated growth and integration issues within Oak Street Health.13

The impairment signals that CVS management acknowledges the overvaluation of these primary care assets.13 This economic failure undermines the core thesis of the integrated model: that combining insurance (Aetna), PBM (Caremark), and delivery assets (Oak Street) creates substantial synergistic value.12 The impairment demonstrates that the anticipated value of future cash flows from these integrated assets failed to materialize, contradicting the dominant vertical integration trend in healthcare.

Operational Margin Erosion

The goodwill impairment resulted in a significant GAAP loss for Q3 2025.14 While management raised its full-year adjusted EPS guidance, this common corporate tactic obscures the economic failure of the M&A strategy 16 Categorizing the impairment as a non-recurring charge detracts attention from the profound underlying economic strain in the Health Services segment.14

Operational profitability faces dual macroeconomic pressures. First, CVS recorded $833 million in litigation charges in Q2 2025 related to past business practices, directly decreasing operating income.18 Second, the rapid rise of high-cost branded GLP-1 drugs has reduced the generic dispensing rate (GDR) within the Pharmacy and Consumer Wellness segment.19 PBM profits rely heavily on high generic volume. This decline in a key metric signals structural margin erosion for Caremark.

The following data summarizes the most critical financial shocks undermining CVS Health’s balance sheet in 2025:

Table 1: CVS Health Recent Financial Shocks and Drivers (2025)

| Financial Metric | Q3 2025 Value | Primary Driver | Risk Domain |

|---|---|---|---|

| Goodwill Impairment Charge | $5.7 Billion Loss | Decelerated growth/integration issues at Oak Street Health | Economics/High-Tech 13 |

| Q2 2025 Litigation Charges | $833 Million | Court decisions related to past business practices | Economics/Cyber 18 |

| Q3 2025 GAAP Diluted Loss per Share | $(3.13) | Goodwill impairment charge | Economics 14 |

| P&CW Generic Dispensing Rate | Declined (Y/Y) | Increased utilization of high-cost brand-name GLP-1 claims | Economics/Science 19 |

IV. The Regulatory and Political Squeeze on PBMs

Regulatory Assault on PBM Transparency

The PBM industry faces intense regulatory and political scrutiny, fueled by public anger over escalating drug costs. CVS Caremark, alongside Express Scripts and OptumRx, controls nearly 80% of the U.S. market, forming an oligopoly that draws direct legal and antitrust attention.1 Legislative proposals, such as the PBM Prescription Pricing for the People Act, require the Federal Trade Commission (FTC) to scrutinize PBM business practices, including formulary design.21

The core revenue mechanics of the PBM, specifically rebates and spread pricing, face direct legal threat. 22 Lawmakers aim to mandate transparency or eliminate these mechanisms.1 The high client retention rate CVS often cites becomes irrelevant when macro-level regulation forces structural change in the business model.5 This legal and political environment places Caremark’s long-term market dominance at significant risk.

Medicare Advantage and Cost Pressures

Federal policy concerning GLP-1 coverage indirectly caps PBM pricing flexibility. The immense financial commitment required for broad GLP-1 coverage directly threatens the viability of Aetna’s Medicare Advantage (MA) margins.23 Recent Centers for Medicare & Medicaid Services (CMS) rule changes now permit coverage of GLP-1s for expanded cardiovascular indications, guaranteeing astronomical future costs.24

If Medicare covers GLP-1s for millions of eligible seniors, net spending is projected to increase by billions over a decade.23 This cost inflation compels CVS to manage drug expenditures tightly within its Aetna segment or risk eroding MA margins and facing potentially lowered Star Ratings. Furthermore, federal intervention in pricing, possibly through referencing international prices, limits CVS’s ability to negotiate high rebates, reducing the primary profit lever for the Caremark segment.25

V. Deep Dive: Multipolar Risks to CVS’s Enterprise

A. Geopolitics and Geostrategy: The API Supply Chain Crisis

CVS’s reliance on foreign sources for Active Pharmaceutical Ingredients (APIs) constitutes a critical geostrategic vulnerability. The U.S. pharmaceutical sector depends heavily on sourcing concentrated in regions like China and India.26 This geographic concentration creates inherent supply chain risks, exposing CVS to tariffs, trade disputes, or foreign regulatory disruption.27

The U.S. government prioritizes reducing foreign reliance through policy, including the Strategic API Reserve and executive orders aimed at streamlining domestic manufacturing.28 However, vertical integration and domestic API on-shoring are disruptively expensive.28 Domestic production costs sharply exceed those of Chinese or Indian sources.27 This geopolitical mandate translates directly into unavoidable cost inflation for CVS, undermining Caremark’s commitment to cost containment.

The FDA’s enforcement actions further intensify formulary pressure. The agency recently cracked down on non-compliant foreign APIs often used by compounding pharmacies to produce cheap GLP-1 alternatives.31 By successfully limiting these low-cost sources, the FDA forces PBMs further into negotiations with the high-priced, patent-protected manufacturers (Lilly and Novo Nordisk). This action heightens the exact formulary pressure witnessed in the Zepbound conflict.

B. Technology and Cyber Risk: The Failure of Digital Trust

CVS’s vast integrated structure makes it an immense target and a critical component of the healthcare infrastructure. The catastrophic Change Healthcare cyberattack demonstrated the devastating impact of a Single Point of Failure (SPoF) in centralized claims processing.33 As a highly integrated conglomerate, CVS represents a complex, lucrative SPoF risk for sophisticated attackers.

Management recognized the need for modernization and announced a $20 billion technology investment over ten years to improve health tech interoperability.35 While essential for integrated care, linking all components, Aetna, Caremark, and Oak Street into a single, highly connected system dramatically amplifies the potential damage of a single successful cyber intrusion. A widespread attack on one linked segment could compromise the entire vertically integrated empire, justifying greater client skepticism following the Change Healthcare fallout.34

The Caremark PBM model relies on complex rebate opacity, but newer high-tech competitors emphasize transparency. Rightway Healthcare, the provider Lilly selected, leverages “smart technology” and “expert-led guidance” to offer simplified, transparent care navigation and support.4 These AI-enabled, transparent models pose an existential threat to Caremark’s traditional, opaque pricing structure, accelerating client migration.2 Furthermore, Caremark has a documented history of security lapses, including previous FTC settlements related to failing to protect sensitive data, eroding client confidence.38

C. Patent Analysis and Scientific Leverage

Manufacturers possess exceptional leverage in PBM negotiations because of robust, long-term patent protection surrounding GLP-1 drugs. Patent analysis shows Zepbound (tirzepatide) compound patents extend as late as 2039.41 Wegovy (semaglutide) patents are projected to remain active until 2041.42 This intellectual property strength ensures no meaningful generic competition exists for nearly two decades, locking PBMs into high-cost contracts.43

This strong patent wall transforms formulary decisions from routine annual negotiations into systemic, long-term cost traps for the PBM. PBMs typically mitigate costs significantly when drugs lose patent protection.44 Since this relief is 15 to 20 years away for GLP-1s, CVS cannot use the threat of generic entry as leverage. This forces the PBM into either exclusion (risking client loss, as with Lilly) or acceptance (risking severe margin erosion).

Continuous scientific innovation further drives formulary instability. The GLP-1 class is constantly evolving, with newer scientific breakthroughs, such as triple-agonist drugs like retatrutide, promising even greater efficacy.7 As superior drugs enter the market, PBMs must perpetually decide whether to exclude the most effective options for price or risk recurring client backlash, forcing the company to repeat the Zepbound scenario indefinitely.

The relative patent strength of the GLP-1 market leaders is critical to understanding long-term PBM cost exposure:

Table 2: Comparison of Leading GLP-1 Drugs and Intellectual Property

| Drug (Active Ingredient) | Manufacturer | Clinical Efficacy Profile | Earliest Generic Entry Est. | PBM Impact |

|---|---|---|---|---|

| Wegovy (Semaglutide) | Novo Nordisk | High weight loss, expanded cardiovascular indications | 2041 (Patent Dependent) | Preferred formulary status (Cost-driven negotiation) 42 |

| Zepbound (Tirzepatide) | Eli Lilly | Superior weight loss in head-to-head trials | 2036–2039 (Patent Dependent) | Excluded formulary status (Price-driven conflict) 7 |

VI. Competitive Landscape and Disruption

The Shift to Transparency

The traditional PBM business model relies fundamentally on opacity in rebate sharing and spread pricing.22 CVS faces accelerating pressure from sophisticated employers demanding transparent, pass-through PBM models.2 The highly visible exit of Eli Lilly, a major pharmaceutical company, validates the emerging trend of employers carving out pharmacy benefits or shifting to alternative PBMs.3

The Rightway Healthcare Challenge

Rightway Healthcare, the transparent provider Lilly selected, champions “expert-led execution” and “smart technology”.4 This competitor provides comprehensive, simplified benefits support, directly targeting the operational friction and lack of pricing clarity that characterize the services of the “Big Three” PBMs.2 This strategic victory for an alternative PBM signals the fragmentation of the market, confirming that technological transparency can successfully compete against an oligopolistic market scale.

VII. Investment Outlook: Valuation and Path Forward

CVS Health’s integrated structure currently serves to compound risk across disparate domains rather than generating stable synergy. The Zepbound conflict proves that pricing power has significantly shifted back to the drug manufacturer, strongly enabled by resilient patent law. Regulatory pressure now favors transparency and structural reform, fundamentally undermining Caremark’s historic profit mechanics.1

Management recognizes the necessity of change, committing to a 10-year, $20 billion technology investment plan aimed at improving health tech interoperability.35 This massive outlay, however, fails to address immediate geopolitical supply chain risks or the intensifying regulatory threats facing Caremark. These expensive modernization efforts occur while core M&A assets, like Oak Street Health, simultaneously require multi-billion-dollar write-downs.13

Investors must ignore narratives focused exclusively on adjusted earnings. A sober assessment requires focusing on critical indicators that reflect systemic risk. Investors should closely track annual PBM client retention rates, particularly among Fortune 500 employers, as further large departures would accelerate systemic decline.5 Monitoring the operational stabilization and profitability timeline for the Health Care Delivery segment remains essential to validate the core vertical integration thesis.11 Finally, regulatory movements by the FTC and Congress represent the largest non-market threat to Caremark’s financial model, requiring constant vigilance.1

CVS Health must adapt its PBM model to sustainable transparency and demonstrate successful M&A integration without further impairments. Until these structural vulnerabilities across economics, technology, and geopolitics are decisively addressed, the investment profile remains challenged.

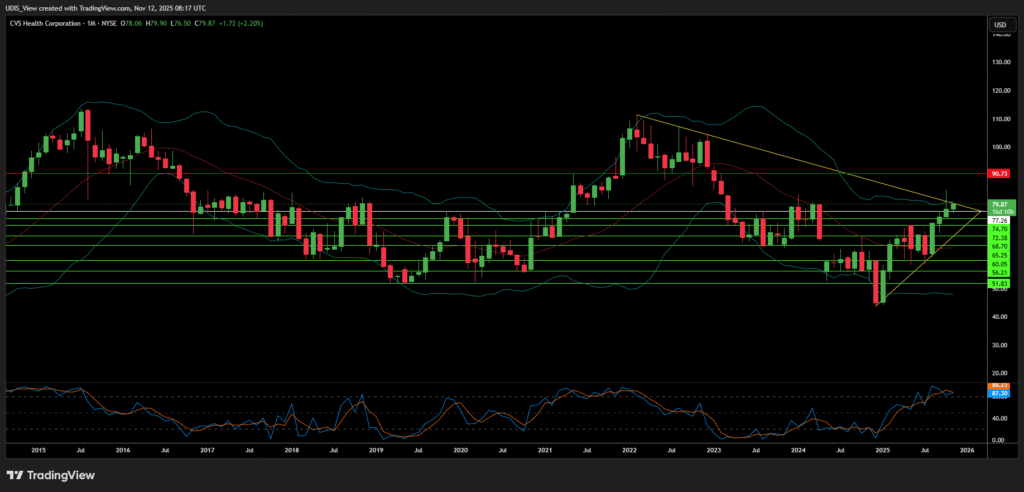

CVS Health Short (Sell)

Enter At: 77.26

T.P_1: 74.70

T.P_2: 72.38

T.P_3: 68.70

T.P_4: 65.25

T.P_5: 60.05

T.P_6: 56.21

T.P_7: 51.83

S.L: 90.73