The Invisible Hand of AI

The artificial intelligence revolution is loud. It dominates headlines with generative models and chat interfaces. Yet, the infrastructure powering this revolution is quiet. It is built on silicon, copper, and code.

At the center of this infrastructure stands Broadcom Inc. (AVGO). This report analyzes Broadcom’s ascent to a trillion-dollar valuation. We dissect the strategic maneuvers that positioned it as the “arms dealer” of the AI age. Broadcom is not merely a chip company. It is a vertically integrated infrastructure sovereign.

Its strategy relies on three pillars: custom silicon dominance, private cloud monopoly, and aggressive financial engineering. The company creates a symbiotic relationship with hyperscale’s like Google. It simultaneously locks down the enterprise market with VMware. This dual approach creates a diversified revenue stream resilient to market cycles.

Our analysis spans multiple domains. We examine the geopolitical friction of the Taiwan Strait. We analyze the thermodynamics of the Ironwood TPU. We deconstruct the subscription economics of the VMware Cloud Foundation. We explore the legal warfare of its patent portfolio. This is not just a financial success story. It is a lesson in ruthless efficiency and strategic foresight.

Broadcom has built a moat that is wide, deep, and filled with intellectual property. The market has rewarded this execution. Broadcom’s stock has surged, driven by AI momentum.[1] But the story is deeper than the stock price. It is about the fundamental rewiring of the global economy. Broadcom is the architect of this rewiring. This report provides the definitive analysis of how they did it and where they are going.

1: Geopolitics and Geostrategy

1.1 The Taiwan Dependency Paradox

The global semiconductor supply chain is fragile. It relies on a single island: Taiwan. Broadcom designs its chips in California. However, the physical manifestation of these designs happens in Hsinchu.

TSMC is the sole foundry capable of manufacturing the Ironwood TPU at scale.[2] This creates a critical geopolitical vulnerability. A blockade of the Taiwan Strait would halt Broadcom’s AI revenue instantly. This is the “Silicon Shield” paradox. Taiwan’s indispensability protects it but also makes it a target.

Broadcom is acutely aware of this risk. The company is securing capacity at TSMC’s Arizona facilities.[3] Yet, the most advanced nodes remain in Taiwan. The 3nm and 2nm processes required for future TPUs are not yet available on US soil. Broadcom’s geostrategy involves balancing this risk. They maintain deep ties with TSMC while lobbying for US domestic capacity.

The risk is not theoretical. Earthquakes in Taiwan have disrupted supply chains before.[4] Geopolitical tensions are rising. Broadcom’s supply chain managers are effectively diplomats. They must navigate cross-strait relations to ensure the flow of wafers. This requires a nuanced understanding of international relations. Broadcom’s success depends on the status quo in the Pacific. Any disruption is an existential threat to the AI ecosystem they support.

1.2 The US-China Tech War

The US government uses export controls as a weapon. The “Entity List” restricts the sale of advanced AI chips to China. Broadcom is caught in the crossfire. The company has seen orders from Chinese clients collapse.[5] Firms like Sophgo have been cut off from TSMC due to potential links to Huawei.[5] This restricts Broadcom’s total addressable market.

However, sanctions also create opportunities. As Chinese firms are squeezed, global demand shifts to compliant vendors. Broadcom benefits from this consolidation. The company ensures its custom designs for remaining Chinese clients meet US performance thresholds. This is a delicate dance. Broadcom must comply with Washington without abandoning Beijing entirely.

The retaliation risk is real. China could target Broadcom’s non-AI business. The company’s software division provides a buffer. Software is harder to intercept than physical hardware. Broadcom’s diversification into VMware and Symantec is a geostrategic hedge. It reduces reliance on physical goods crossing contentious borders. This foresight protects the company’s revenue from trade war volatility.

1.3 Supply Chain Sovereignty and Resilience

Broadcom does not own fabs. It is a fabless designer. This model is capital efficient but operationally risky. To mitigate this, Broadcom controls the rest of the chain.

They own the IP for the SerDes (serializer/deserializer) blocks.[6] They control the packaging specs. They manage the test and assembly ecosystem. This control allows Broadcom to switch suppliers for non-critical components. But for the logic die, there is no alternative to TSMC.

Intel Foundry Services is a potential future partner.[3] However, Intel’s 18A node is not yet proven for high-volume AI ASICs. Broadcom is betting that the US government will ensure TSMC’s survival. The company’s strategic importance to Google and OpenAI makes it a national security asset. This political capital is a hidden asset on Broadcom’s balance sheet.

2: The Silicon Science of AI

2.1 The Ironwood TPU v7 Architecture

The Google Ironwood TPU is a marvel of engineering. It is the seventh generation of Google’s custom silicon.[7] It is designed specifically for inference. Inference is the process of running a trained model. It requires different math than training.

Ironwood optimizes for low latency and high throughput. The chip delivers 4.6 PetaFLOPS of dense FP8 performance.[8] FP8 is an 8-bit floating-point format. It reduces memory usage without sacrificing accuracy. This performance is critical for models like Gemini 3. The chip also features a “SparseCore”.[7] This is a specialized accelerator for embeddings. Embeddings are crucial for search and recommendation systems.

Broadcom’s contribution is the physical implementation. They take Google’s logic and turn it into a manufacturable chip. This involves complex physics. The signals must travel across the chip at light speed without interference. Broadcom’s SerDes IP ensures this signal integrity. The result is a chip that runs faster and cooler than competitors.

2.2 Thermodynamics and Liquid Cooling

Heat is the enemy of compute. As transistors shrink, power density increases. Ironwood consumes approximately 1kW of power per chip.[2] Air cooling is insufficient for this density. Ironwood is designed for liquid cooling. This allows for higher sustained performance.

Liquid cooling changes the data center design. Pipes replace fans. Coolant circulates directly to the chip. These captures heat more efficiently. Ironwood delivers 2x the performance per watt of the previous generation.[7] This efficiency is vital. Data centers are power-constrained. More efficient chips mean more compute within the same power envelope.

The move to liquid cooling is a paradigm shift. Broadcom is at the forefront of this shift. Their reference designs include the plumbing for cooling. This holistic approach ensures the chip performs in the real world. It is not just about the silicon; it is about the system.

2.3 Memory Physics: HBM3e

AI models are memory hungry. The bottleneck is often memory bandwidth, not compute. Ironwood addresses this with HBM3e. Each chip carries 192GB of High Bandwidth Memory.[7] This is six times the capacity of the previous Trillium chip.[2]

HBM3e involves stacking memory dies vertically. They connect via Through-Silicon Vias (TSVs). This creates a massive data highway. The bandwidth is 7.37 TB/s per chip.[8] This allows the TPU to feed data to the compute cores instantly. Models with trillions of parameters can fit entirely in memory.

This memory architecture enables new workloads. “Agentic” workflows require keeping large context windows active. The agent needs to “remember” previous steps. Massive HBM capacity makes this possible. Broadcom’s expertise in packaging these memory stacks is a key differentiator. It ensures high yield and reliability.

2.4 The Interconnect Fabric

Chips do not work alone. They work in pods. An Ironwood superpod contains 9,216 chips.[9] Connecting these chips requires a high-speed fabric. Broadcom provides the optical interconnects. The Inter-Chip Interconnect (ICI) runs at 9.6 Tb/s.[8]

This network is flat. Every chip can talk to every other chip. This creates a single “AI Hypercomputer”.[7] The latency is minimal. To the software, the pod looks like one giant chip. This scalability is unique to the TPU architecture. Nvidia uses InfiniBand for this. Google uses Broadcom’s custom optical links.

The physics of this interconnect is daunting. Signals degrade over distance. Broadcom’s optical DSPs (Digital Signal Processors) correct these errors. They allow data to travel across the data center without loss. This connectivity is the secret sauce of Google’s AI infrastructure.

3: The Google Nexus

3.1 A Decade of Partnership

Broadcom and Google have collaborated since 2016.[1] This partnership is built on trust and execution. Google defines the logic; Broadcom builds the chip. This model works. It has produced seven generations of successful silicon.

The partnership is exclusive. Broadcom is the sole partner for the TPU.[1] This gives Broadcom visibility into Google’s roadmap. They know what Google needs years in advance. This allows for long-term R&D planning. The revenue is substantial. Analysts project $10 billion in revenue from this program in 2025.[10]

This relationship is a moat. Competitors cannot easily displace Broadcom. The integration is too deep. The IP is too intertwined. Google relies on Broadcom’s SerDes and packaging. Replacing Broadcom would require redesigning the entire physical layer of the TPU.

3.2 Gemini 3 and Nano Banana Pro

Hardware exists to run software. Google’s Gemini 3 model drives the demand for TPUs.[11] Gemini 3 is multimodal. It understands text, images, and video. This requires massive computing.

Google recently launched “Nano Banana Pro”.[12] This is an AI image generation tool. It connects to Google Search for real-time data.[13] Generating images from real-time data is compute intensive. It requires fast memory and high parallel throughput. Ironwood is optimized for this.

The “Nano Banana Pro” tool exemplifies the workload shift. It is not just about static models. It is about dynamic, real-time generation. This increases the utilization of the TPU clusters. Broadcom benefits from this utilization. More usage means more chips needed.

3.3 The Era of Agentic AI

The future is agentic. Google launched “Antigravity,” an agentic development platform.[14] Agents are autonomous programs. They plan, execute, and iterate. They do not just answer questions; they solve problems.

An agent might spend hours coding a software patch. This creates long-running inference tasks. It changes the demand profile for compute. Bursty queries are replaced by sustained workloads. Ironwood’s efficiency is critical here. Sustained loads generate heat. Liquid cooling manages this heat.

Broadcom’s silicon is the engine for these agents. The large memory capacity allows agents to maintain context. The high bandwidth allows for fast reasoning. “Antigravity” democratizes agent creation.[15] This will lead to an explosion of agents. Each agent consumes compute. This is a bullish signal for Broadcom’s volume growth.

3.4 The Economics of the TPU

Why does Google build its own chips? Economics. Nvidia GPUs are expensive. They carry a high margin for Nvidia. By building TPUs, Google captures that margin. They pay Broadcom for the design and manufacturing services, but they own the final asset.

This lowers the Total Cost of Ownership (TCO). Ironwood is 30x more efficient than early TPUs.[7] This saves millions in electricity bills. It allows Google to offer AI services at a lower cost than competitors. Broadcom enables this economic model. They provide the expertise of a chip company without the markup of a finished product vendor.

4: The Custom Silicon Market

4.1 The ASIC vs. GPU Debate

The industry is bifurcating. Nvidia represents the General Purpose GPU (GPGPU). Broadcom represents the Application Specific Integrated Circuit (ASIC). GPUs are flexible. They can run any workload. ASICs are specialized. They run one workload extremely well.

For training, flexibility is good. Algorithms change fast. For inference, efficiency is king. Once a model is stable, you want to run it as cheaply as possible. ASICs are superior for this. They strip out unnecessary logic. They focus purely on the matrix math required for the model.

Broadcom bets on this shift. They believe the market will move toward ASICs for inference. The data support this. Broadcom has a 75% market share in custom AI accelerators.[10] As AI matures, the volume of inference will dwarf training. This favors the ASIC model.

4.2 The OpenAI Deal

Broadcom’s strategy was validated by OpenAI. The AI leader signed a deal with Broadcom to build custom inference chips.[16] This is a massive endorsement. OpenAI wants to reduce reliance on Nvidia. They chose Broadcom as their partner.

The deal is valued at potentially $10 billion in bookings.[17] It involves co-designing the chip. OpenAI provides the model knowledge. Broadcom provides the physical design and manufacturing access. This allows OpenAI to optimize its hardware for its specific models.

This deal changes the landscape. It shows that even software companies can become chip designers with Broadcom’s help. It lowers the barrier to entry for custom silicon. Broadcom is the enabler of this trend. They are democratizing high-end chip design for the hyperscalers.

4.3 The “XPU” Program

Broadcom calls its custom chips “XPUs”.[18] The XPU program is a platform. Broadcom offers a library of IP blocks. Customers can pick and choose. Do they need a PCIe controller? Broadcom has it. They need a memory interface. Broadcom has it.

This speeds up development. Customers focus on their secret sauce: the AI logic. Broadcom handles the plumbing. This reduces risk. Broadcom’s IP is proven in silicon. It works. This “LEGO block” approach is attractive to companies without deep hardware teams.

The program also includes patent protection. Broadcom indemnifies its customers.[18] This is crucial. The chip industry is litigious. Broadcom’s patent portfolio shields its partners. This is a hidden value proposition of the XPU program.

4.4 Competitors: Marvell and Intel

Broadcom is not alone. Marvell Technology competes in this space. They also offer custom ASIC design. Intel is trying to enter with foundry business. However, Broadcom has a lead.

Broadcom’s lead is in SerDes technology. SerDes moves data in and out of the chip. Broadcom’s SerDes is the industry standard. It is faster and has lower power. This is a critical bottleneck for AI chips. Until competitors catch up on SerDes, Broadcom has a technical advantage.

Intel faces execution challenges. Their manufacturing nodes have been delayed. Broadcom uses TSMC. This gives Broadcom access to the best manufacturing immediately. Broadcom’s fabless model allows it to choose the winner in manufacturing. Currently, that is TSMC.

5: The VMware Transformation

5.1 The Private Cloud Imperative

The cloud narrative is changing. Public cloud is no longer the default. It is expensive and complex. Data sovereignty laws are tightening. Enterprises want control. They want the “private cloud.”

Broadcom acquired VMware to capture this trend. VMware is the OS of the data center. Broadcom’s strategy is to modernize it. They launched VMware Cloud Foundation (VCF) 9.0.[19] This is a complete stack. It includes compute, storage, and networking.

VCF 9.0 brings the cloud experience on-premises. It supports Kubernetes natively.[19] Developers get the agility they need. IT gets the control they demand. Hock Tan calls this the “private AI” future.[20] Data stays local. Models run locally. This appeals to banks, governments, and regulated industries.

5.2 Subscription Economics

Broadcom changed the business model. They killed perpetual licenses. Everything is now a subscription.[21] This caused friction. Customers complained about price hikes. But they stayed.

The product is sticky. Migrating off VMware is hard. It requires rewriting applications. It risks downtime. Broadcom knows this. They raised prices because they have pricing power. The subscription model creates recurring revenue. It increases the lifetime value of the customer.

Broadcom focuses on the top 10,000 customers.[22] They ignore the long tail. This reduces sales costs. It improves margins. The strategy is ruthless but effective. VCF bookings are strong. The transition is working financially.

5.3 Divesting the Distractions

Broadcom cleans house. They bought VMware but didn’t keep everything. They sold the End-User Computing (EUC) unit to KKR for $4 billion.[23] EUC was desktop virtualization. It was a lower-margin business.

This divestiture is classic Hock Tan. Keep the core. Sell the rest. The core is infrastructure. EUC was software for users. It didn’t fit. The sale raised cash. It allowed Broadcom to pay down debt. It focused the management team on the VCF mission. The remaining portfolio is pure infrastructure. It is a high margin. It is mission-critical. This focus is Broadcom’s strength. They do not dabble. They dominate specific niches.

5.4 Integration Execution

Integration is where acquisitions fail. Broadcom excels here. They integrate immediately. They consolidated VMware’s divisions. They streamlined R&D. They cut marketing spend.

The goal is operational efficiency. Broadcom targets an EBITDA margin of 60% or higher for acquired assets. They achieve this by removing duplication. They put engineers in charge. They remove middle management layers. This culture shock is painful for employees. But it works for shareholders. VMware is now a leaner, more profitable machine. It contributes significant cash flow to the parent company. These funds are the dividend and the AI R&D.

6: Cyber Science and Security Moats

6.1 The Carbon Black Reversal

Broadcom planned to sell Carbon Black. It is an endpoint security company. The offers were too low. Broadcom wanted $1 billion; the market offered less.[24] So, Broadcom kept it.

This was a pivot. They merged Carbon Black with Symantec.[25] This created a unified security division. It aligns with the VCF strategy. Private clouds need security. Carbon Black protects the workloads running on VCF. The decision shows flexibility. Broadcom is not dogmatic. If the price is wrong, they change the plan. Now, Carbon Black is a strategic asset. It provides telemetry from the endpoint. This data is valuable.

6.2 Cyber Science: AI in Defense

Security is a data problem. There are too many threats to track manually. You need AI. This is “Cyber Science.” It uses math to find anomalies.

Symantec uses Gemini models to analyze threats.[26] They feed the models with data from Carbon Black. The “Data Forwarder” pumps telemetry to the cloud.[27] The AI looks for patterns. It predicts attacks before they happen.

This integration is powerful. Broadcom owns the network (Symantec) and the endpoint (Carbon Black). They see the whole picture. This “defense in depth” is attractive to CSOs. It simplifies their vendor list. They buy one solution from Broadcom.

6.3 The Enterprise Focus

Broadcom’s security strategy is elitist. They focus on the Global 2000.[28] They cut support for smaller customers. This is controversial. But it is profitable. Large enterprises pay more. They have complex needs.

Broadcom tailors its product for these giants. They offer bespoke support. They integrate with legacy systems. This high-touch model works for banks and governments. It does not work for SMBs. Broadcom ceded the SMB market to CrowdStrike and Microsoft. This focus improves margins. Support costs go down. Revenue per customer goes up. It aligns with the overall Broadcom strategy: fewer customers, higher value.

7: Patent Warfare and Analysis

7.1 The Netflix Litigation

Broadcom weaponizes its IP. They sued Netflix in Germany.[29] The issue was video compression. Broadcom owns patents on HEVC (High Efficiency Video Coding). Netflix uses this to stream 4K video.

The court ruled for Broadcom. They issued an injunction. This forces Netflix to pay. It is a “patent tax.” Broadcom argues that its R&D created the standards. Companies that use the standards must pay. This strategy is aggressive. It targets major tech firms. It turns the legal department into a profit center. The revenue from licensing is high-margin. It flows directly to the bottom line.

7.2 The Defensive Shield

Patents are also a shield. Broadcom has thousands of them.[30] This protects its customers. When OpenAI builds a chip with Broadcom, they are safe. Broadcom’s portfolio covers the basics of chip design.

This indemnification is valuable. The chip industry is a minefield. Patent trolls are everywhere. Broadcom’s size scares them off. Partners gain this protection. It is part of the “XPU” value proposition. This defensive moat is hard to replicate. It took decades to build. It covers networking, storage, and virtualization. Competitors like Nvidia have patents, but Broadcom’s breadth is unique. It covers both hardware and software.

7.3 Standard Essential Patents (SEPs)

Many of Broadcom’s patents are SEPs. They are essential to industry standards. Wi-Fi, Ethernet, Bluetooth. You cannot build a device without them. This gives Broadcom leverage.

They are required to license SEPs on FRAND terms (Fair, Reasonable, and Non-Discriminatory). But disputes arise over what is “fair.” Broadcom is willing to litigate to establish the price. This ensures a baseline of revenue. Even if a competitor wins a socket, they might still pay Broadcom for the IP. It is a hedged position. Broadcom wins either way.

8: Management and Leadership

8.1 The Hock Tan Playbook

Hock Tan is the architect of Broadcom. He is a financial engineer and an operational manager. His playbook is simple. Buy dominant franchises. Cut costs. Raise prices. Focus on the core.

He is not a visionary in the Steve Jobs sense. He is a pragmatist. He buys companies that are already winning. Then he makes them more profitable. He cuts speculative R&D. He doubles down on what works. This style is polarizing. Employees fear the cuts. Shareholders love the returns. Tan has delivered massive shareholder value. He is one of the highest-paid CEOs for a reason. He delivers.

8.2 Operational Efficiency

Broadcom is lean. There is no bloat. Divisions run like independent companies. General Managers have autonomy. But they have strict targets. If they miss, they are out.

This culture is Darwinian. It attracts a certain type of talent. Engineers who want to build and ship. Not those who want to do pure research. The focus is on productization. Getting the chip out of the door. This efficiency is a competitive advantage. Broadcom moves fast. They don’t have committees. They have decision-makers. This speed allows them to keep up with Google’s demands.

8.3 Capital Allocation

Tan is disciplined with capital. He pays a strong dividend. He buys back stock. He pays down debt. He does not hoard cash. He returns it to shareholders.

The VMware acquisition added debt. Broadcom is paying it down aggressively. They use the cash flow from the legacy businesses. This deleveraging improves the credit rating. It lowers interest expenses. This financial discipline is rare in tech. Many companies overspend. Broadcom counts every penny. This protects the downside. Even in a downturn, Broadcom remains profitable.

9: Macroeconomics and Financials

9.1 Interest Rates and CapEx

The Federal Reserve cut rates to roughly 3.9%.[31] This is bullish. AI infrastructure is capital-intensive. Hyperscalers borrow to build. Cheaper money means more building.

Broadcom sits upstream of this CapEx. When Google builds a data center, it buys Broadcom chips. Lower rates stimulate this spending. We expect a surge in orders in 2026 as financing becomes easier. However, inflation is a risk. Costs are rising. Electricity, construction, labor. This could squeeze margins. Broadcom has pricing power. They pass these costs on. But there is a limit.

9.2 The Debt Profile

Broadcom carries significant debt. Over $70 billion.[32] This is from the VMware deal. In a high-rate environment, this is a burden. Interest payments are high.

Broadcom is managing this. They prioritize debt repayment. The divestitures help. The strong free cash flow helps. They are effectively using the acquired assets to pay for themselves. The risk is a rate spike. If inflation returns, rates could go up. This would increase the cost of debt. Broadcom is racing to deleverage before that happens.

9.3 Valuation and Stock Performance

The market values Broadcom as an AI growth stock. The PE ratio has expanded. The market cap is over $1.7 trillion.[11] This reflects the AI premium.

Is it overvalued? Not compared to Nvidia. Broadcom trades at a discount to Nvidia. Yet, it has a stronger moat in networking and software. It is a “value” AI play. The dividend yield is also attractive. It provides income while waiting for growth. This dual appeal attracts a wide base of investors. Growth funds and income funds both own AVGO.

10: Industry Trends

10.1 The Convergence of Compute and Network

The network is becoming the computer. In AI, you cannot separate them. The Ironwood pod acts as one machine. The network determines the speed.

Broadcom dominates this convergence. They own the switch (Tomahawk). They own the NIC (Thor). They own the TPU physical layer. They optimize the whole path. Competitors like Nvidia are trying to do this with InfiniBand. Broadcom bets on Ethernet. They believe Ethernet is the future of AI networking. The “Ultra Ethernet Consortium” supports this. Broadcom is a leader there.

10.2 Moore’s Law is Dead, Long Live Packaging

Transistors are not getting much cheaper. The gains from shrinking are slowing. The new frontier is packaging. Stacking chips. CoWoS. Broadcom is a packaging expert. They work closely with TSMC. They design for yield. This is a hidden skill.

It allows them to build massive chips like Ironwood economically. The industry is moving to “chiplets.” Breaking big chips into small ones. Broadcom’s SerDes IP connects these chiplets. They are the glue of the chiplet era.

11: Future Outlook

11.1 The 2026-2030 Roadmap

The future is bright. The AI buildout is just beginning. Google has a roadmap for TPUs through 2030.[33] Broadcom is designing them now.

The OpenAI deal will ramp up. Other hyperscalers may follow. Meta, Amazon, Microsoft. They all look at custom silicon. Broadcom is the partner of choice. VMware will complete its transition. The subscription revenue will stabilize. Margins will peak. It will be a cash cow.

11.2 Risks to Watch

The biggest risk is Taiwan. A conflict there stops everything. Broadcom has no Plan B for high-end manufacturing. Investors must watch the geopolitical news.

Another risk is competition. Nvidia could open up its ecosystem. Intel could fix its foundry. Marvell could win a major socket. Broadcom must stay paranoid. Regulatory risk is also present. Anti-trust regulators are watching. Broadcom is big. Future acquisitions will be hard. They must grow organically.

11.3 Final Conclusion

Broadcom is the silent titan. It runs the infrastructure of the world. From the cloud to the edge. From the chip to the software.

They have executed a perfect strategy. They pivoted to AI. They consolidated software. They maintained financial discipline. For the investor, Broadcom offers a unique mix. Growth from AI. Stability from software. Income from dividends. It is a fortress in a volatile world. The silent titan will continue to reign.

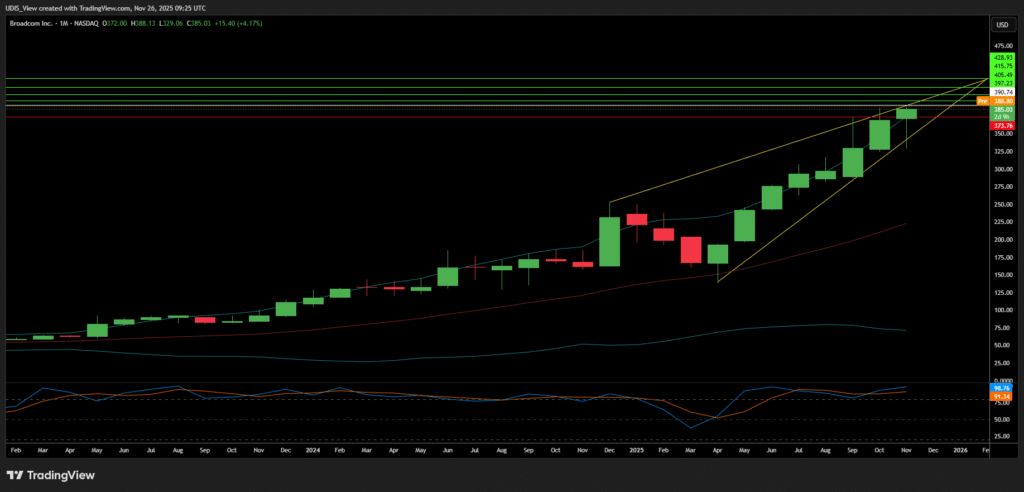

Broadcom Long (Buy)

Enter At: 390.74

T.P_1 :397.23

T.P_2: 405.49

T.P_3: 415.75

T.P_4: 428.93

S.L: 373.76