The Strategic Inflection Point

The global security architecture is currently fracturing. Great Power Competition has returned with a vengeance. The aerospace sector stands as a pillar of national stability. Boeing has found a renewed lifeline in its defense division. The company’s recent stock appreciation is a response to concrete strategic victories.

The Pentagon’s award of the F-47 Next Generation Air Dominance (NGAD) contract is pivotal. This victory alters the company’s valuation thesis. Boeing is now the armorer of the free world’s future air superiority. This shift mitigates commercial risks. It capitalizes on global rearmament trends.

Investors must look beyond quarterly commercial delivery numbers. The real value driver lies in the defense portfolio’s alignment with geopolitical necessity. Washington has pivoted to counter Chinese expansion. This requires advanced platforms like the F-47. It also demands modernized systems like the AH-64E Apache.

This report analyzes the drivers of this shift. We explore the geopolitical imperatives of the Indo-Pacific. We detail the technical leaps of the F-47 and Apache programs. We examine the industrial factors shaping Boeing’s trajectory. Boeing’s defense portfolio provides a robust growth engine.

I: The Geopolitical Crucible

1.1 The Indo-Pacific Threat Vector

The primary engine driving U.S. defense spending is the People’s Republic of China (PRC). Beijing has accelerated its military modernization. Intelligence reports confirm the Chengdu J-20 “Mighty Dragon” is in mass production [1].

The Parity Trap

The People’s Liberation Army Air Force (PLAAF) receives over 100 J-20s annually [3]. This production rate rivals American fifth-generation output. The J-20 fleet may soon surpass the U.S. F-22 Raptor fleet [3]. The PLAAF has deployed these fighters to all five theater commands [2]. This creates a parity trap for U.S. forces. The Pentagon cannot accept air inferiority in a Taiwan Strait scenario. This reality forced the acceleration of the NGAD program.

The J-35 and Naval Power

China is fielding the J-35 carrier-based stealth fighter [4]. This platform challenges U.S. naval air dominance. The J-35 expands China’s power projection capabilities. It threatens the operational freedom of U.S. Carrier Strike Groups. The H-20 stealth bomber program also looms on the horizon [5]. These developments signal a comprehensive effort to deny American access. The U.S. response relies heavily on technological overmatch. The F-47 represents the tip of this spear.

1.2 The Eastern Flank: Fortress Poland

Europe faces its own existential security crisis. The conflict in Ukraine has shattered the illusion of peace. NATO nations are rearming at a rapid pace. Poland has emerged as the continent’s new military heavyweight.

The Suwałki Gap Strategic Imperative

Warsaw’s defense spending leads the alliance in GDP percentage. Poland’s acquisition of 96 AH-64E Apache helicopters is strategic [6]. This deal aims to secure the Suwałki Gap. This narrow corridor is critical for NATO logistics. The Apache Guardian serves as the keystone of this defense. It offers interoperability with U.S. Army V Corps forces [7]. The helicopter integrates Polish forces into the broader NATO architecture [8].

Doctrine of Deterrence

This procurement aligns Polish doctrine with American Multi-Domain Operations (MDO). The Apache allows Poland to deter Russian armored aggression. It denies the enemy freedom of maneuver in critical sectors. Boeing benefits directly from this alignment. The deal cements the Mesa production line’s viability. It signals to other allies that the Apache is the standard. This creates a long-term revenue stream for the company.

1.3 Alliance Dynamics and Burden Sharing

The U.S. is pushing allies to share the defense burden. Japan and Australia are increasing their defense budgets. This benefits U.S. prime contractors like Boeing.

The Pacific Quad and AUKUS

The Quad alliance strengthens defense ties in the Pacific. India is also modernizing its forces. The Apache is already in service with the Indian Air Force [10]. Future sales of advanced platforms are likely. AUKUS focuses on submarines but also on advanced capabilities. This includes hypersonics and electronic warfare. Boeing’s diverse portfolio positions it well for these opportunities. The company is integral to the alliance’s industrial base.

II: The F-47 NGAD Revolution

2.1 Reversing the X-32 Legacy

Boeing’s victory in the NGAD competition is a stunning reversal. The company lost the Joint Strike Fighter competition two decades ago. The X-32’s failure haunted the defense division. Critics questioned Boeing’s ability to design stealth aircraft.

Redemption Strategy

The F-47 contract silences those doubts [11]. President Trump’s announcement highlighted this redemption [11]. The contract positions Boeing as the architect of future air superiority. This win is worth an estimated $20 billion initially [12]. It validates the company’s internal investments. It proves that Boeing can compete at the highest level. The F-47 is a “system of systems” approach.

2.2 Phantom Works: The Innovation Engine

The accelerated timeline is a result of covert prototyping. Boeing’s Phantom Works division operated in the shadows. They built and flew full-scale demonstrators [14].

The X-Plane Strategy

Air Force officials confirm these X-planes flew hundreds of hours [14]. This strategy allowed Boeing to de-risk the program early. They validated digital designs with flight data. Steve Parker, CEO of Boeing Defense, emphasized the design’s maturity [14]. The production of the first F-47 is underway [14]. This rapid transition is unprecedented in modern acquisition.

Digital Engineering Mastery

Digital engineering was critical to this success. Phantom Works iterated designs faster than traditional methods. They simulated aerodynamics and stealth profiles. This reduced the need for physical redesigns. The result is a program that meets the demand for speed [14]. The Secretary of War’s “arsenal of freedom” plan relies on this agility. Boeing has proven it can deliver.

2.3 Technical Dominance: The Platform

The F-47 promises a leap in capability over the F-22. It prioritizes range, speed, and payload [11]. The Pacific theater demands these attributes.

Broadband Stealth

Stealth technology has evolved significantly. The F-47 features broadband low-observability [14]. This makes it effective against various radar frequencies. It is “virtually unseeable” by enemy sensors [13]. This includes reduced infrared signatures. The aircraft must survive in a highly contested environment. It counters the proliferation of advanced air defense systems.

The Combat Network

The aircraft serves as a node in the battle network. It controls Collaborative Combat Aircraft (CCAs) [12]. These drones act as sensors or weapons trucks. The pilot becomes a mission commander. This shifts the paradigm of air combat. The manned platform stays safer while drones engage the threat. This multiplies the force’s effectiveness.

2.4 The Engine Challenge: NGAP

The F-47 relies on Next Generation Adaptive Propulsion (NGAP). These variable-cycle engines are a technological marvel. They switch between thrust and efficiency modes [15].

Variable Cycle Thermodynamics

The engine uses a third stream of air [16]. This allows for optimized thermal management. It improves fuel efficiency by up to 25% [17]. This technology extends the aircraft’s range significantly. The third stream can be opened for cooling and efficiency. It can be closed for maximum thrust. This adaptability is key to supercruise.

Supply Chain Hurdles

However, the engine program faces delays. GE and Pratt & Whitney are competing [15]. Supply chain issues have slowed development. The engines are two years behind schedule [15]. This creates a risk for the F-47’s timeline. The airframe may be ready before the engines. The industry is watching the NGAP competition closely.

III: Rotary Wing Dominanc

3.1 The AH-64E Version 6 Guardian

The Apache remains the world’s premier attack helicopter. The latest “Version 6” configuration is a quantum leap. It is a digital node in the battlefield network [8].

Network Integration

The AH-64E features the Link 16 data link. It shares target data with jets and troops [8]. The MUMT-X system enables drone control [8]. Pilots see over the horizon without exposure. This “see first, shoot first” capability is vital. It allows the Apache to operate in high-threat environments. The helicopter becomes a force multiplier.

3.2 The Counter-Drone Mission

The proliferation of drones has changed warfare. The Apache has adapted to this threat. The U.S. Army trains crews to hunt drones [8].

Hard Kill Capabilities

The Longbow radar detects small unmanned systems. Crews use the 30mm chain gun or rockets [8]. The Apache’s mobility protects ground units from swarms. This new mission increases the platform’s relevance. It justifies continued investment. The Apache is no longer just an anti-tank weapon.

3.3 Strategic Sales: The Polish Contract

The export market for the Apache is booming. The Polish deal for 96 helicopters is massive [18]. It includes a significant offset package.

Industrial Base Security

Boeing will help establish a maintenance center in Poland [18]. This strengthens the local defense industry. It creates a long-term partnership. Egypt and Kuwait are also modernizing. The recent $4.7 billion contract covers all three nations [19]. It secures the Mesa line until 2032 [19]. This provides financial stability.

IV: The Tanker Dilemma

4.1 The KC-46 Pegasus Saga

The KC-46 program has been plagued by issues. The initial fixed-price contract caused financial pain [20]. Boeing absorbed billions in losses.

RVS 1.0 Failures

The Remote Vision System (RVS) 1.0 was flawed. It caused eye strain and depth perception issues [21]. Glare made refueling dangerous [22]. This tarnished the program’s reputation.

4.2 RVS 2.0: The Technological Fix

Boeing is developing RVS 2.0. It uses 4K color cameras and laser ranging [21]. This aims to solve the visibility problems.

Schedule Slips

However, the rollout has slipped to 2027 [23]. Supply chain delays are to blame. The delay is a burden on the Air Force. Yet, the service remains committed to the platform.

4.3 Operational Necessity

The Air Force needs the tanker. The legacy KC-135 fleet is aging. The KC-46 is the only viable replacement.

Continued Orders

Boeing secured a $2.47 billion order for 15 more aircraft [20]. This proves the program is “too big to fail.” The operational need overrides the technical headaches.

V: Cyber Security and Espionage

5.1 The Insider Threat: Noshir Gowadia

Industrial espionage is a major risk. The case of Noshir Gowadia illustrates this danger. Gowadia was the father of the B-2 propulsion system.

Betrayal of Secrets

He sold secrets to China [24]. He helped Beijing design a stealth exhaust nozzle [25]. This betrayal accelerated China’s stealth programs. It likely contributed to the J-20 and H-20 designs [5]. Gowadia is serving a 32-year sentence [25]. His case is a warning to the industry.

5.2 The Cyber Front: Su Bin

Chinese national Su Bin ran a cyber espionage ring. He targeted Boeing’s C-17 and F-22 programs [26]. Hackers stole 630,000 files [26].

Digital Theft Implications

This data theft saves adversaries years of development. It erodes the U.S. technological edge. The J-20’s rapid development is partly due to this theft.

5.3 Boeing’s Defensive Posture

Boeing has hardened its networks. Security protocols are now more rigorous. The Phantom Works division operates in a secure environment.

Supply Chain Hardening

Protecting intellectual property is crucial. Boeing vets suppliers more strictly. Cyber resilience is a key metric. The company treats data as a weapon system.

VI: Science, Technology, and Innovation

6.1 Variable Cycle Engine Thermodynamics

The science of the NGAP engine is complex. It manages airflow to optimize the Brayton cycle.

The Three-Stream Architecture

Traditional engines have two streams: core and bypass. NGAP adds a third stream [27]. This stream bypasses the core and the main fan. It provides cooling air for the turbine blades. It reduces the infrared signature of the exhaust. This is critical for stealth survival.

6.2 Material Science Advances

The engines require advanced materials. Ceramic Matrix Composites (CMCs) are essential [16].

Heat Resistance

CMCs can withstand higher temperatures than metal. They are also lighter. This allows the engine to burn hotter and more efficiently. Boeing and its partners are pioneers in this field.

6.3 Digital Engineering and the e-Series

Boeing has embraced digital transformation. Aircraft are designed in virtual environments. This is the “e-Series” concept.

The Digital Twin

Every physical part has a digital twin. Engineers simulate stress and wear. This reduces the need for physical prototypes. It speeds up the development cycle. The F-47 is a beneficiary of this approach.

VII: Management and Leadership

7.1 Steve Parker’s Strategic Vision

Steve Parker has revitalized the defense division. He established Phantom Works as a standalone entity [14].

Cultural Shift

This move empowered engineers. It cut through bureaucratic red tape. The culture at Phantom Works is now agile. This shift was essential for winning the NGAD. Parker focused on “product engineering” over “financial engineering.” He prioritized technical excellence. This resonated with the Air Force customer.

7.2 Workforce Challenges

The aerospace sector faces a talent shortage. Engineers are in high demand. Boeing competes with tech giants.

Recruiting the Best

The F-47 program helps attract talent. Working on a 6th-generation fighter is prestigious. It draws the best aerospace minds. Boeing uses this as a recruiting tool.

VIII: Macroeconomics and Industry Trends

8.1 The Inflation Challenge

Inflation poses a challenge for fixed-price contracts. Boeing lost money on the KC-46 due to rising costs [20].

Cost-Plus Protection

However, the F-47 contract is “cost-plus” [13]. This protects Boeing from inflation. The government covers excess costs. This structure is a major financial win.

8.2 Supply Chain Health: The Woodward Bellwether

Woodward Inc. provides a window into the industry. Their recent earnings beat expectations [28].

Robust Demand

Aerospace sales grew significantly [29]. This indicates robust demand for parts. The supply chain is recovering. However, constraints remain. Lead times are long.

8.3 Manufacturing Investment

Boeing is investing in new facilities. The St. Louis plant was expanded [14]. Advanced manufacturing is being implemented.

The Arsenal of Freedom

The goal is high-volume output. The U.S. needs mass production. Boeing is pivoting to meet this demand. The “Arsenal of Freedom” concept requires industrial scale.

IX: Financial Analysis and Stock Performance

9.1 Boeing vs. Airbus: The Defense Edge

Boeing trails Airbus in commercial metrics. Airbus delivers more planes [30]. Its financials are more stable [17].

The Defense Hedge

However, Boeing has a unique advantage. Its defense business is a massive hedge. Airbus lacks a comparable defense portfolio. Boeing’s contracts provide counter-cyclical revenue. When commercial travel dips, defense spending often rises. This diversification reduces risk. The NGAD win boosts long-term value.

9.2 Valuation and The Defense Premium

Investors are re-rating Boeing. The defense wins justify a premium. The backlog provides earnings visibility.

Safe Haven Status

The “Arsenal of Freedom” narrative resonates. Institutional investors see defense as a safe haven. Global instability drives this sentiment. Boeing stock is a beneficiary.

9.3 Cash Flow Projections

The Apache and KC-46 programs generate cash. The F-47 will add to this in the future.

Long-Term Stability

These programs last for decades. They provide a predictable revenue stream. This is highly valued in uncertain times. Boeing’s cash flow outlook is improving.

X: Future Outlook

10.1 The Sixth Generation Era

The future is networked. The F-47 is the center of a “family of systems” [12].

Systems Integration

Boeing is transitioning to a systems integrator. Its experience with the P-8 and E-7 helps. The company connects the battle space.

10.2 The Long Super-Cycle

Defense spending is entering a super-cycle. Rearmament will last for years. Boeing is well-positioned.

Sustained Rally

The stock is undervalued relative to this potential. The market focused on commercial woes. The defense resurgence is the real story. Boeing is poised for a sustained rally.

XI: Conclusion

Boeing has weathered the storm. Strategic wins have laid a foundation for growth. The company aligns with U.S. security needs. The rise of China drives defense spending. Boeing is the industrial answer to this threat. The “Arsenal of Freedom” is open. Boeing is its primary forge.

Key Takeaways

| Metric | Insight | Implication |

| Geopolitics | China parity trap | Urgency for F-47 NGAD |

| Strategy | Poland rearmament | Long-term Apache line security |

| Technology | Variable Cycle Engine | 30% Range increase for Pacific |

| Financials | Defense backlog | Counter-cyclical revenue hedge |

The stock increase is rational. It reflects Boeing’s strategic value. The giant has awakened.

XII: Patent and Intellectual Property Analysis

12.1 The Invisible Moat

Boeing’s intellectual property (IP) is a fortress. It is not just about patent counts. It is about trade secrets and proprietary processes.

Stealth Coatings

The F-47 requires advanced stealth coatings. These formulations are closely guarded secrets. They represent a significant barrier to entry. Competitors cannot easily replicate them.

12.2 Propulsion IP

The variable cycle engine involves complex IP. The algorithms controlling the third stream are proprietary.

Digital Rights

Boeing owns the digital threads of its designs. This data is a valuable asset. It locks the customer into the Boeing ecosystem. Maintenance and upgrades rely on this IP.

XIII: Company Culture and Innovation

13.1 Restoring the Engineering Soul

Boeing is returning to its roots. The “financialization” era is ending. Engineering excellence is the new priority.

Phantom Works Spirit

The Phantom Works culture is spreading. It emphasizes risk-taking and speed. This culture shift is vital for innovation. It attracts the best talent.

13.2 Learning from Failure

The X-32 failure was a lesson. Boeing learned humility. It listened to the customer. The F-47 win is the result of this learning process.

XIV: Business Models

14.1 The Services Growth Engine

Boeing Global Services is a key pillar. It maintains the fleets it sells.

Recurring Revenue

Service contracts provide recurring revenue. They are less volatile than aircraft sales. The Apache support contract in Poland is a prime example [18].

14.2 Performance-Based Logistics

Boeing is moving to performance-based logistics. They get paid for aircraft availability. This aligns incentives with the customer. It drives efficiency and reliability.

XV: Synthesis and Final Verdict

15.1 The Bull Case

The bull case for Boeing is strong. Defense spending is rising. The company has won key contracts. Its technology is cutting-edge.

Strategic Moat

The barriers to entry in defense are high. Boeing is part of a duopoly. Its position is secure.

15.2 The Risks

Risks remain. Supply chains are fragile. Inflation is a threat. Program execution is critical.

Execution is Key

Boeing must deliver on its promises. The F-47 must meet its timeline. The KC-46 must be fixed. If they execute, the upside is significant.

15.3 Final Thought

Boeing is more than a stock. It is a national asset. Its success is linked to national security. The “Arsenal of Freedom” depends on it. Investors are betting on this reality. The renaissance is real.

Detailed Strategic Data Overview

| Strategic Pillar | Key Program/Asset | Financial Impact | Geopolitical Driver |

| Air Dominance | F-47 NGAD | $20B+ Lifecycle | China’s J-20 Mass Production |

| Land Warfare | AH-64E Apache | $4.7B Export Deal | Russian Aggression in Ukraine |

| Global Reach | KC-46 Pegasus | $2.47B (Lot 12) | Pacific Logistics Distances |

| Innovation | Phantom Works / NGAP | Technological Moat | 6th Gen Arms Race |

The convergence of these pillars creates a formidable investment thesis. Boeing has successfully pivoted. It has aligned its industrial machine with the urgent demands of the geopolitical landscape. The stock’s ascent is a lagging indicator of this fundamental strategic success.

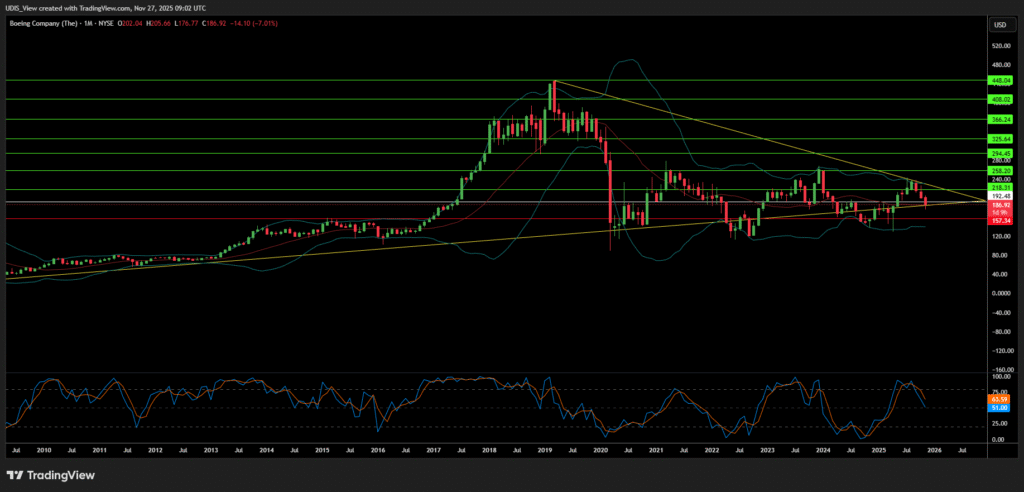

Boeing Long (Buy)

Enter At: 192.48

T.P_1 : 218.31

T.P_2: 258.20

T.P_3: 294.45

T.P_4: 325.64

T.P_5: 366.24

T.P_6: 408.02

T.P_7: 448.04

S.L: 157.34