BigBear.ai (NYSE: BBAI) is solidifying its position as a significant force in the artificial intelligence sector, strategically situated at the confluence of national security demands and commercial innovation. The company’s recent trajectory demonstrates a robust growth strategy, powered by crucial U.S. Department of Defense (DoD) contracts, substantial investment in research and development, and strategic acquisitions such as Pangiam. This acquisition notably expands BigBear.ai’s market presence into high-growth commercial domains including Vision AI and biometrics. While exhibiting strong stock performance and a growing backlog, BigBear.ai operates within a complex financial landscape, including a recent financial restatement. This report provides a comprehensive analysis of the core drivers behind BigBear.ai’s rise, examining its technological foundation, strategic partnerships, and financial outlook, offering a detailed perspective for discerning finance professionals.

The Strategic Imperative: BigBear.ai in a Geopolitical Landscape

The Expanding Role of AI in National Security and Defense

The global geopolitical environment increasingly necessitates sophisticated artificial intelligence capabilities for intelligence gathering, decision support, and modern warfare. Nations worldwide prioritize technological superiority to effectively analyze emerging threats, optimize military operations, and maintain a strategic advantage. BigBear.ai directly addresses this critical requirement by developing and deploying advanced AI solutions tailored for these demanding applications.

BigBear.ai’s technology functions as a pivotal force multiplier in the geopolitical arena. The company’s Virtual Anticipation Network (VANE) platform, for instance, assists the Pentagon’s Chief Digital and AI Office (CDAO) in monitoring and assessing adversarial media. This capability supports U.S. national security missions by providing rapid predictions based on high-tech analysis, informing senior leader decisions.1 Furthermore, BigBear.ai focuses on contemporary methods of warfare, including guiding unmanned vehicles and missions.2 This deep integration into national defense and intelligence capabilities indicates that BigBear.ai’s technology transcends a mere commercial tool; it represents a strategic asset directly impacting national security. The persistent demand for such advanced technology is inherently linked to ongoing global instability and the continuous race for technological supremacy in defense. This dynamic ensures that BigBear.ai’s market is not solely influenced by typical economic cycles but also by enduring geopolitical tensions and consistent defense spending, providing a stable and high-value demand base that makes it a compelling investment within the defense technology sector.

BigBear.ai’s Core Focus and Market Niche

BigBear.ai specializes in AI-powered decision intelligence solutions, offering predictive analytics, autonomous systems, real-time decision-making, and AI-powered data visualization.3 This specialized focus positions the company as a provider of essential tools for complex, data-intensive operational environments. Historically, its primary market has centered on defense and national security.5 The company aims to deliver “modern, AI-powered solutions that enable data-driven decision-making at the highest levels of defense leadership”.5

BigBear.ai’s core value proposition lies in its ability to transform raw information into decisive action. In an era characterized by an overwhelming influx of data, particularly within defense and intelligence sectors, the capacity to synthesize vast datasets into actionable insights is paramount. BigBear.ai’s solutions address this challenge by enabling organizations to derive strategic advantage from complex information. This fundamental capability makes their technology highly transferable and scalable across various intricate domains beyond initial defense applications, significantly broadening their long-term market potential. The company effectively provides tools that substantially enhance human decision-making, a critical need across diverse industries.

Forging Alliances: Contracts, Collaborations, and Acquisitions

Deepening Ties with the U.S. Department of Defense

BigBear.ai has secured significant contracts, underscoring its integral role within the U.S. national security apparatus. The Chief Digital and AI Office (CDAO) is prototyping BigBear.ai’s Virtual Anticipation Network (VANE) to monitor and assess adversarial media and associated data. This initiative supports U.S. national security missions and provides swift predictions based on high-tech analysis.1 This $1.3 million Other Transaction Agreement (OTA) signifies a successful transition from a research prototype to an operational prototype, delivering critical insights to decision-makers.1 In April 2024, the VANE tool achieved “awardable” status on the CDAO Tradewinds Solutions Marketplace, which allows any federal government entity to view, contact, and negotiate procurement with BigBear.ai.1

Further solidifying its defense footprint, BigBear.ai secured a 3.5-year, $13.2 million sole-source contract in March 2025. This contract mandates the modernization of the DoD Joint Staff J-35’s ORION Decision Support Platform (DSP), which provides automated force management capabilities and data analytics to the DoD’s Joint Planning and Execution Community (JPEC).5 This agreement, also awarded through the Tradewinds Marketplace, highlights BigBear.ai’s expertise in enhancing force readiness and integrating global operations at the highest levels of defense leadership.5

The consistent mention of the “Tradewinds Solutions Marketplace” and the utilization of “Other Transaction Agreements (OTAs)” signal a deliberate evolution in government procurement. This shift aims to accelerate the adoption of commercial AI technologies, streamlining the integration of cutting-edge solutions into operational use by bypassing traditional, often protracted, procurement cycles. This represents a strategic initiative by the DoD to rapidly deploy AI capabilities and maintain a technological edge. BigBear.ai benefits considerably from this evolving procurement landscape, gaining a competitive advantage through quicker contract awards and operational deployments. This translates into more predictable revenue streams and robust market validation for its defense-focused AI solutions.

Strategic Expansion through Acquisition: The Pangiam Integration

In November 2023, BigBear.ai strategically acquired Pangiam Intermediate Holdings, LLC, a recognized leader in Vision AI for the global travel and digital identity industries.6 This acquisition aimed to establish a comprehensive Vision AI portfolio by combining Pangiam’s facial recognition and advanced biometrics platform with BigBear.ai’s existing computer vision capabilities.6

This acquisition expands BigBear.ai’s customer base to include leading airlines, airports, and identity verification companies.6 The facial recognition device market is projected for substantial growth, estimated to reach $16.5 billion by 2032 from $4.5 billion in 2023, reflecting a Compound Annual Growth Rate (CAGR) of 15.7%.6 This trajectory underscores the significant commercial opportunity and market relevance of this strategic move.

The Pangiam acquisition represents a deliberate and astute move to diversify revenue streams into a rapidly expanding commercial market, specifically facial recognition, travel, and digital identity. While BigBear.ai maintains robust ties with the U.S. defense sector, relying solely on government contracts carries inherent risks, such as budget cycles, political shifts, and evolving defense priorities. This strategic pivot leverages BigBear.ai’s core AI competencies in new, high-growth verticals, effectively reducing concentration risk. This diversification strategy not only unlocks new revenue opportunities but also mitigates over-reliance on a single client segment, positioning BigBear.ai as a more resilient and attractive investment proposition by balancing the stability of government contracts with the high-growth potential of commercial markets. The acquisition also creates synergistic intellectual property and enhances market leadership. The explicit combination of “Pangiam’s facial recognition and advanced biometrics platform” with “BigBear.ai’s computer vision capabilities” 6 signifies more than just market expansion; it aims to create a more robust and comprehensive AI offering. The synergy of these technologies could lead to accelerated new product development and a stronger competitive positioning in both defense (ee.g., enhanced identity verification for secure facilities) and commercial sectors (e.g., seamless travel experiences). The combined entity thus possesses a broader technological base and potentially a more dominant market position in specific Vision AI applications, enhancing its long-term growth prospects and intellectual capital, and creating a more formidable competitor.

Global Market Penetration: The UAE Partnership and Future Horizons

In June 2025, BigBear.ai announced a strategic partnership in the United Arab Emirates (UAE) with Easy Lease and Vigilix Technology Investment.3 This collaboration seeks to accelerate AI adoption across key UAE industries, including mobility, logistics, industrial services, and smart city infrastructure.3

A crucial aspect of this partnership involves BigBear.ai leading the development and localization of AI tools specifically tailored to the UAE’s unique requirements, encompassing local languages, regulations, business environments, and sectoral challenges.3 This includes platforms for predictive analytics, autonomous systems, real-time decision-making, and AI-powered data visualization.3 This commitment to localization serves as a powerful global expansion catalyst. Simply exporting existing solutions globally often proves insufficient for sustained success. BigBear.ai’s proactive adaptation for local languages, regulations, and business environments demonstrates a sophisticated understanding of successful international market entry. This approach signifies a deeper, more sustainable method for global expansion than merely importing technology, fostering stronger local integration and relevance. This localization strategy significantly enhances BigBear.ai’s competitive edge in international markets, cultivating stronger client relationships and potentially opening doors to other regions with similar needs for tailored AI solutions. It positions the company as a global AI partner, not merely a vendor, facilitating broader market acceptance and sustained international growth.

Table 1: Key Government Contracts & Strategic Partnerships

| Contract/Partnership Name | Partner/Client | Date/Timeline | Value (if applicable) | Key Focus/Technology | Strategic Impact |

| VANE Prototype | CDAO (Pentagon) | Sep 2024 (OTA), Feb 2025 (Operational Prototype) | >$1.3M 1 | Adversarial media analysis, predictions | Operational prototype, critical insights for national security |

| ORION Decision Support Platform (DSP) | DoD Joint Staff J-35 | Mar 2025 | $13.2M 5 | Automated force management, data analytics | Modernization of critical defense platform, enhances force readiness |

| Pangiam Acquisition | Pangiam Intermediate Holdings | Nov 2023 6 | N/A | Vision AI, facial recognition, biometrics | Market diversification, commercial expansion, enhanced technological portfolio |

| UAE Partnership | Easy Lease, Vigilix (UAE) | Jun 2025 3 | N/A | Localized AI for mobility, logistics, smart cities | Global expansion, regional market penetration, R&D collaboration |

Technological Prowess and Intellectual Property Foundation

Advanced AI and Machine Learning Capabilities

BigBear.ai employs advanced artificial intelligence and machine learning models to guide unmanned vehicles and missions.2 Its technology stack encompasses platforms for predictive analytics, autonomous systems, real-time decision-making, and AI-powered data visualization.3 The company’s core strength lies in its ability to transform complex information into actionable intelligence for senior leaders, a capability consistently demonstrated through its work with the CDAO and the DoD Joint Staff.1

BigBear.ai’s AI serves as a new operational backbone. The consistent emphasis on “decision intelligence,” “real-time decision-making,” and “guiding unmanned vehicles and missions altogether” 1 indicates that BigBear.ai’s AI is not merely an analytical tool but is deeply embedded in operational control and strategic execution. This suggests a fundamental shift from AI as a supportive technology to AI as a core, indispensable component of modern operations, particularly in defense and complex commercial environments. This positioning as a provider of mission-critical infrastructure, rather than just software, leads to highly sticky customer relationships and long-term contracts, which are inherently attractive to investors.

Unpacking BigBear.ai’s Patent Portfolio and R&D Investment

The patent landscape surrounding BigBear.ai requires careful clarification. Some sources, such as AltIndex, suggest that BigBear.ai “does not hold a significant number of patents” and “underperforms its industry peers when it comes to Patents, ranking dead last”.7 However, a more specific and recent source indicates that BigBear.ai possesses “17 active AI and machine learning patents”.8 This distinction is crucial, as it points to a focused, relevant portfolio directly tied to their current core business, rather than a broad, generic one. Patents listed for “Big Bear Networks, Inc.” from the early 2000s, such as those related to high-frequency oscillations and optical transmission 9, appear unrelated to BigBear.ai’s current core AI/ML business. It is highly probable these patents originate from a distinct, older entity or a very old, unrelated predecessor company, and do not reflect BigBear.ai’s contemporary AI intellectual property.

BigBear.ai also protects its intellectual property through proprietary information and invention assignment agreements with employees, consultants, and contractors, and through provisions in its agreements with customers.10 This approach highlights a strategic reliance on trade secrets and contractual IP protection, a common and often effective method for software and AI companies where rapid innovation can outpace traditional patenting cycles.

The nuance of AI intellectual property strategy and value creation for companies like BigBear.ai extends beyond a simple patent count. The apparent contradiction regarding the number of patents and the presence of old, seemingly unrelated patents necessitates a deeper analytical approach. The most relevant data point for current valuation is the “17 active AI and machine learning patents”.8 When combined with the emphasis on contractual IP protection in SEC filings 10, this suggests BigBear.ai’s intellectual property strategy prioritizes strategically protecting core, high-value AI algorithms and models through a combination of patents and trade secrets. For cutting-edge AI, where algorithms and datasets evolve rapidly, traditional patenting alone may not capture the full scope of innovation. Investors should therefore not solely evaluate BigBear.ai’s intellectual property based on a high patent count compared to older, more diversified technology giants. Instead, the focus should be on the strategic relevance and quality of its active AI/ML patents, its robust trade secret protection mechanisms, and its aggressive research and development investment. This multi-faceted intellectual property strategy is characteristic of agile, cutting-edge AI firms and contributes significantly to the company’s intangible asset base, a key driver of its valuation.2

BigBear.ai demonstrates a strong commitment to continuous innovation and maintaining a technological edge through significant research and development (R&D) investment. The company shows a “fourfold increase in R&D budgets” 2 and reported a substantial $18.2 million in R&D investment in 2023.8 This increasing investment is critical for sustaining its competitive position in a rapidly evolving field.

Competitive Differentiation in AI-Powered Decision Intelligence

BigBear.ai differentiates itself by focusing “more on the new methods of modern warfare” compared to peers such as Palantir.2 Its stated objective is to “land clients as soon as possible, regardless of terms and pricing” 2, indicating an aggressive market penetration strategy centered on rapid adoption and operational impact. Its proprietary products now require “less customization,” and customers desire to “more rapidly integrate our capabilities into their current operating environments”.11 This indicates product maturation, ease of adoption, and a strategic shift towards scalable, repeatable solutions.

BigBear.ai leverages agility and focused specialization as key competitive levers. The explicit comparison to Palantir 2, a significantly larger and more established company, highlights BigBear.ai’s distinct competitive approach. Its smaller size and stated objective allow for greater agility and a sharper focus on rapid client acquisition within specific niches. This potentially enables the company to offer more tailored or quicker-to-deploy solutions for critical defense and emerging commercial AI markets. The reduction in customization further supports this, indicating a strategic move towards scalable, productized offerings that can be deployed efficiently. BigBear.ai is not attempting to be a generalist AI platform; it aims to dominate specific, high-value niches by being faster, more adaptable, and highly specialized. This focused strategy can yield significant market share and investor returns in its targeted segments, positioning it as a compelling, albeit specialized, investment.

Table 2: BigBear.ai’s Core AI Capabilities & Applications

| Category | Details |

| Core AI Capabilities | Predictive Analytics, Autonomous Systems, Real-time Decision-Making, AI-powered Data Visualization, Computer Vision, Facial Recognition, Biometrics 3 |

| Key Technologies/Platforms | Virtual Anticipation Network (VANE), ORION Decision Support Platform (DSP), Pangiam’s Vision AI platform 1 |

| Primary Applications | Adversarial Media Analysis, Force Management, Guiding Unmanned Vehicles and Missions, Global Travel & Digital Identity, Mobility & Logistics, Industrial Services, Smart City Infrastructure 1 |

| Strategic Value | Enhanced national security, optimized operational efficiency, improved data-driven decision-making, significant market diversification |

Financial Trajectory and Valuation Insights

Growth Metrics: Revenue, Backlog, and Market Performance

BigBear.ai has experienced a significant surge in its stock performance, with an “incredible 287% rally” over the past 12 months, substantially outperforming the broader S&P 500 index.2 The stock has also demonstrated strong quarterly performance, with gains reaching up to 92.3%.2 This upward trend is further supported by a substantial 30% rise in backlog orders 2, indicating robust future revenue visibility and sustained demand for its services.

In the first quarter of 2025, BigBear.ai reported revenue of $34.8 million, representing a 4.9% increase year-over-year.3 While this figure slightly missed market expectations, the company maintained its full-year 2025 guidance, projecting a revenue growth range of 1.1% to 13.7%.3 Market capitalization figures for BigBear.ai vary across different sources, with approximately $1.1 billion cited in one instance 3 and $2 billion in another.12 This discrepancy likely reflects market volatility and different reporting dates, which are common characteristics of high-growth, actively traded stocks.

The observed growth momentum amidst inherent volatility is a key characteristic of BigBear.ai’s financial profile. The robust stock performance and rising backlog clearly signal strong investor confidence and future revenue potential. However, the missed quarterly revenue and EPS expectations indicate that growth is not always linear and can be subject to short-term fluctuations. The observed discrepancy in market capitalization further underscores this inherent volatility, which is typical for high-growth technology stocks operating in dynamic markets. Investors evaluating BigBear.ai should therefore consider it a high-growth, high-volatility stock. While the long-term trajectory appears positive due to strategic contract wins, acquisitions, and a growing backlog, short-term quarterly results may fluctuate. This necessitates a long-term investment horizon and a clear understanding of the risks associated with rapid expansion.

Comparative Valuation: Benchmarking Against Industry Peers

BigBear.ai’s stock currently trades at only 56% of its 52-week high, suggesting considerable room for it to retest or even exceed those highs.2 A closer examination of its valuation reveals that BigBear.ai trades at 7.0x its underlying asset base, which is “mostly comprised of intangible assets (likely the IP running its artificial intelligence models)”.2 This valuation contrasts sharply with other companies operating in similar technology domains, which consistently trade at an average asset multiple of approximately 18.0x. This disparity implies a potential upside of over 100% for BigBear.ai.2

The company is often compared to Palantir Technologies (PLTR), a significantly larger entity with a market capitalization of approximately $300 billion, compared to BigBear.ai’s $2 billion.2 BigBear.ai’s distinct strategy to “land clients as soon as possible, regardless of terms and pricing” 2 suggests a focus on rapid market penetration rather than maximizing initial contract value. This valuation disparity presents BigBear.ai as a strategic investment opportunity. The significant discount in BigBear.ai’s asset multiple compared to its industry peers is a strong indicator of potential undervaluation. For a finance audience, this point is critical as it highlights a potential arbitrage opportunity. The fact that its asset base is “mostly comprised of intangible assets (likely the IP running its artificial intelligence models)” further emphasizes that the company’s true value resides in its proprietary technology and future growth potential, not merely in physical assets. The comparison to Palantir, a market leader, positions BigBear.ai as a potential “catch-up” play, offering substantial upside if it can narrow this valuation gap. This valuation discrepancy therefore presents a compelling investment thesis for investors seeking growth in the AI sector, suggesting substantial upside if BigBear.ai can close the gap with its peers through continued strong execution, successful market penetration, and increasing investor recognition of its intangible asset value.

Hedge funds have notably spotlighted BigBear.ai as one of the best AI stocks to consider. Significant institutional investor activity was observed in Q1 2025, with major additions to portfolios by firms such as BNP Paribas, Goldman Sachs, and Renaissance Technologies.3

Financial Considerations and Risk Factors

BigBear.ai underwent a restatement of prior periodic reports. This action became necessary because its convertible notes issued in December 2021 (the “2026 Notes”) were deemed ineligible for a scope exception from bifurcation requirements under ASC 815-15. Consequently, these notes required re-measurement at fair value as a derivative instrument.10

In response to this, the company proactively entered into privately negotiated exchange agreements in December 2024 for these 2026 Notes. This transaction involved exchanging approximately $182.3 million principal amount of the 2026 Notes for new 2029 Notes.14 The exchange also included crucial amendments to the indenture governing the 2026 Notes, specifically eliminating certain restrictive covenants and limitations.14 The new 2029 Notes are structured as senior, secured obligations.14

The restatement, while initially a point of concern for any finance professional due to past accounting complexities, was followed by proactive debt management and enhanced financial flexibility. The subsequent actions to address the convertible notes by exchanging them for new notes, and crucially, eliminating restrictive covenants, demonstrate astute financial management. This move simplifies their debt structure, potentially reduces future accounting complexities, and provides greater operational and financial flexibility for the company. While the restatement signals past issues that required correction, the proactive resolution mitigates the long-term financial risk associated with those issues. Investors should monitor future financial reporting closely for consistency and transparency, but the debt restructuring indicates a positive move towards healthier financial governance and an improved capital structure.

Table 3: BigBear.ai Financial & Valuation Snapshot (vs. Peers)

| Metric | BigBear.ai Value | Peer Average Value | Peer Example (Palantir) |

| Market Cap | ~$1.1B 3 to $2B 12 | N/A | ~$300B 2 |

| 12-Month Stock Performance | 287% rally 2 | N/A | N/A |

| Quarterly Revenue (Q1 2025) | $34.8M 3 | N/A | N/A |

| YoY Revenue Growth | 4.9% 3 | N/A | N/A |

| Q1 2025 EPS | -$0.25 3 | N/A | N/A |

| Full-Year 2025 Revenue Guidance | 1.1%-13.7% growth 3 | N/A | N/A |

| Price/Asset Ratio | 7.0x 2 | 18.0x 2 | N/A |

| R&D Investment (2023) | $18.2M 8 | N/A | N/A |

| Backlog Increase | 30% 2 | N/A | N/A |

| P/E Ratio | -8.76 2 | N/A | 592.70 2 |

Navigating the Future: Risks and Opportunities

Key Challenges and Competitive Pressures

The artificial intelligence and defense technology markets are characterized by intense competition, with both established players and agile startups vying for market share. BigBear.ai faces significant competitive pressures from larger, more entrenched companies like Palantir 2, as well as numerous other specialized AI firms. Successfully integrating acquired businesses, such as Pangiam, and achieving the anticipated synergies and benefits remains a significant operational challenge.11 The recent financial restatement could impact investor confidence and necessitates sustained transparent financial reporting and rigorous adherence to accounting standards. Furthermore, a degree of dependency on government contracts, while providing a stable revenue base, renders the company susceptible to political shifts, budget constraints, and evolving procurement priorities, factors largely outside of BigBear.ai’s direct control.

Sustaining Growth in a Dynamic Market

BigBear.ai’s aggressive strategy of rapid client acquisition and its specialized focus on modern warfare applications 2 strategically position it for continued growth within the lucrative defense sector. Strategic diversification into high-growth commercial sectors like Vision AI, biometrics, and international markets through the UAE partnership provides new avenues for revenue generation and reduces over-reliance on a single sector.3 Continued substantial R&D investment 2 is critical for maintaining its technological edge and competitive differentiation in the fast-evolving AI landscape. The ability to productize its solutions for “less customization” and “rapid integration” 11 will be key to efficiently scaling its commercial offerings and expanding its customer base.

Execution stands as the ultimate differentiator for BigBear.ai. The company has articulated a clear and compelling growth strategy, encompassing diversification, rapid client acquisition, and significant R&D investment. The identified risks—intense competition, integration challenges, and financial scrutiny—are inherent to high-growth companies operating in dynamic, cutting-edge sectors. Therefore, the primary determinant of BigBear.ai’s future success will be its ability to consistently and effectively execute on these strategies, particularly in integrating Pangiam’s capabilities and scaling its localized AI solutions in new international markets. Investors should closely monitor BigBear.ai’s operational efficiency, the successful integration of its acquisitions, and its ability to consistently convert its growing backlog into realized revenue. Strong execution will serve as the ultimate validation of its investment thesis and enable the company to fully capitalize on its significant market opportunities.

Conclusion: BigBear.ai’s Investment Thesis

BigBear.ai stands at a compelling juncture, effectively capitalizing on the surging demand for advanced artificial intelligence in both critical national security applications and burgeoning commercial sectors. Its strategic partnerships with the U.S. Department of Defense, coupled with the transformative acquisition of Pangiam and ambitious global expansion initiatives like the UAE partnership, underscore a robust growth trajectory. While the company has navigated past financial complexities, its aggressive research and development investment, growing backlog, and a current valuation discount relative to peers suggest significant upside potential. For investors seeking exposure to the evolving AI frontier, particularly where geopolitical imperatives intersect with technological innovation, BigBear.ai presents a unique and assertive investment thesis, contingent on disciplined execution and continued market penetration.

References

- Pentagon prototypes AI platform to better analyze adversaries’ news media – DefenseScoop, accessed July 1, 2025, https://defensescoop.com/2025/02/06/pentagon-bigbear-ai-vane-prototype-platform-analyze-media/

- Why BigBear.ai Could Rally 100% and Catch Palantir Soon – MarketBeat, accessed July 1, 2025, https://www.marketbeat.com/originals/why-bigbearai-could-rally-100-and-catch-palantir-soon/

- BigBear.ai stock soars over 11% on UAE tech deal, partners with Easy Lease and Vigilix in big be – The Economic Times, accessed July 1, 2025, https://m.economictimes.com/news/international/us/bigbear-ai-stock-soars-over-11-on-uae-tech-deal-partners-with-easy-lease-and-vigilix-in-big-be/articleshow/122163063.cms

- BigBear.ai, Easy Lease, and Vigilix Announce Strategic Partnership in the UAE, accessed July 1, 2025, https://ir.bigbear.ai/news-events/press-releases/detail/111/bigbear-ai-easy-lease-and-vigilix-announce-strategic

- BigBear.ai Awarded Contract to Modernize Critical Department of Defense Force Management Platform, accessed July 1, 2025, https://bigbear.ai/newsroom/bigbear-ai-awarded-contract-to-modernize-critical-department-of-defense-force-management-platform/

- Face Recognition Device Market to Observe Strong Development by 2032 – EIN Presswire, accessed July 1, 2025, https://www.einpresswire.com/article/825504579/face-recognition-device-market-to-observe-strong-development-by-2032

- BigBear.ai (BBAI) Patents Statistics 2025 – AltIndex, accessed July 1, 2025, https://altindex.com/ticker/bbai/patents

- BigBear.ai Holdings, Inc. (BBAI) BCG Matrix Analysis, accessed July 1, 2025, https://dcfmodeling.com/products/bbai-bcg-matrix

- Patents Assigned to Big Bear Networks, Inc., accessed July 1, 2025, https://patents.justia.com/assignee/big-bear-networks-inc

- BigBear.ai Holdings, Inc., accessed July 1, 2025, https://ir.bigbear.ai/sec-filings/all-sec-filings/content/0001628280-25-014752/0001628280-25-014752.pdf

- bbai-20221231 – Investor Relations – BigBear.ai, accessed July 1, 2025, https://ir.bigbear.ai/sec-filings/all-sec-filings/content/0001628280-23-010166/bbai-20221231.htm

- Why BigBear.ai Stock Is Skyrocketing Today | The Motley Fool, accessed July 1, 2025, https://www.fool.com/investing/2025/06/30/why-bigbearai-stock-is-skyrocketing-today/

- BigBear.ai Holdings, Inc. (BBAI) Opinions on Recent Stock Surge, accessed July 1, 2025, https://www.quiverquant.com/news/BigBear.ai+Holdings%2C+Inc.+%28BBAI%29+Opinions+on+Recent+Stock+Surge

- BigBear.ai Holdings, Inc., accessed July 1, 2025, https://ir.bigbear.ai/sec-filings/all-sec-filings/content/0001193125-24-286239/0001193125-24-286239.pdf

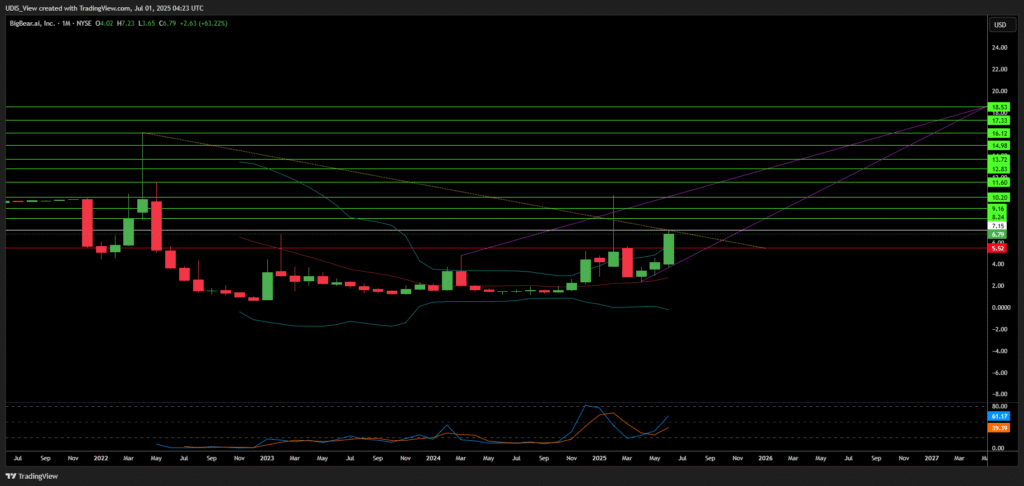

BigBear.ai Long (Buy)

Enter At: 7.15

T.P_1: 8.24

T.P_2: 9.16

T.P_3: 10.20

T.P_4: 11.60

T.P_5: 12.83

T.P_6: 13.72

T.P_7: 14.98

T.P_8: 16.12

T.P_9: 17.33

T.P_10: 18.53

S.L: 5.52