The Anatomy of a Medical Device Rally

The recent dramatic surge in the market valuation of Microbot Medical Inc. (NASDAQ: MBOT) is not a singular event but rather the convergence of several meticulously executed strategic milestones. A thorough analysis reveals that this market revaluation has been fueled by a combination of factors, including the successful receipt of U.S. Food and Drug Administration (FDA) 510(k) clearance for its flagship LIBERTY® Endovascular Robotic System [1], the validation of its technologically disruptive innovation [2], the strengthening of a foundational intellectual property (IP) portfolio [3], and a crucial, non-dilutive financing strategy that provides a significant operational runway [4, 5]. This report delves into each of these pillars, alongside an analysis of macro-level trends and inherent risks, to provide a holistic view of the company’s current position and future prospects.

Key Takeaways from the Analysis

The core takeaways from this analysis are multifaceted. First, the FDA clearance represents a profound clinical and regulatory validation of the company’s core technology, confirming its safety and efficacy [1]. Second, the LIBERTY® System’s business model, which is centered on a single-use, low-capital-cost solution, presents a disruptive force that directly challenges the entrenched, high-capital-expenditure models of market leaders [2]. Third, a recent, multi-tranche funding round has provided the necessary capital for the transition from a pre-commercial entity to a commercially focused company, a critical step that demonstrates financial fortification [4]. Finally, the company’s demonstrated ability to maintain its operational timeline and commercial readiness despite ongoing geopolitical tensions in its R&D base in Israel highlights a notable degree of strategic and operational resilience [6].

The Road to a Revaluation

The sharp upward trajectory of Microbot Medical’s stock is not merely a reaction to a single FDA approval. Instead, it is the market’s response to the culmination of a deliberate, multi-year strategy designed to systematically derisk the company and its technology. The market has been keenly observing and is now pricing in the successful execution of multiple pre-commercial milestones. This includes the announcement of positive clinical trial data [1, 7], the granting of significant new patents [3], and the strategic build-out of its commercial team [8]. The initial volatility and low valuations that characterized the stock’s performance were a reflection of the inherent risks associated with a pre-commercial medical device company [9]. The turning point in mid-2024, when human trials began and progressed faster than anticipated, was a significant step in mitigating the clinical pathway risk [10]. The FDA clearance on September 8, 2025, served as the primary, highly anticipated catalyst [1], but its impact was magnified by the fact that management was already preparing the commercial team and infrastructure in parallel [7, 8]. This sequence of events culminated in the announcement of a major capital raise [4], which, by its strategic timing following regulatory clearance, serves to validate the commercialization strategy and provides the necessary financial runway to execute it, a clear and deliberate move to maximize valuation and secure long-term viability.

Introduction: Microbot Medical at a Crossroads

Microbot Medical Inc. (NASDAQ: MBOT), a company with a dual presence in Hingham, Massachusetts, and Nesher, Israel, is a pre-commercial medical technology company dedicated to revolutionizing endovascular procedures [10, 11]. The company’s core mission is to redefine the field of robotics by improving the quality of care for millions of patients and providers globally. Its flagship product, the LIBERTY® Endovascular Robotic System, is positioned as a breakthrough innovation aimed at eliminating the traditional barriers to the adoption of advanced robotic systems in the endovascular space [2, 11].

The company operates within the broader surgical robotics market, which is a multi-billion dollar industry with a global market size projected to grow from a valuation of $16.0 billion in 2024 to $33.8 billion by 2029 [12]. This market is dominated by established players such as Intuitive Surgical, with its leading da Vinci platform, as well as other large-scale medical device companies like Medtronic, Stryker, and Johnson & Johnson [13]. Despite the presence of these industry giants, the endovascular market remains a frontier with significant untapped potential. Existing robotic systems have achieved only a minimal penetration rate, with less than 1% of endovascular procedures currently performed robotically [2]. This low adoption rate is primarily due to the significant barriers imposed by first-generation robotic platforms.

In recent months, Microbot Medical’s stock has undergone a significant transformation in investor sentiment. Following a prolonged period of volatility and low valuations, the company’s share price has experienced a notable rally, surging from a 52-week low of $0.85 to a high of $4.67 [14, 15]. This article serves as an in-depth investigation into the underlying catalysts and strategic maneuvers that have driven this dramatic shift, moving beyond superficial observations to provide a comprehensive analysis of the company’s value proposition.

The Core Innovation: A Paradigm Shift in Endovascular Care

The Scientific and Clinical Imperative

The field of endovascular intervention, which involves navigating the body’s vascular system to treat conditions in the arteries and veins, has long been challenged by a series of critical unmet needs. Traditional manual techniques expose physicians to high levels of radiation from X-ray imaging, a significant health risk [1, 2]. Furthermore, the prolonged, intricate movements required for manual navigation can cause severe physical strain on healthcare providers, leading to fatigue and potentially inconsistent outcomes [1]. The dexterity and precision required to manually advance and retract catheters and guidewires through tortuous anatomical pathways can be a demanding and difficult process [16].

Compounding these challenges are the substantial barriers that have prevented the widespread adoption of robotics in this market. First-generation robotic systems are characterized by high capital costs, with many platforms requiring multi-million-dollar purchases [2]. They often have a large physical footprint, necessitating dedicated operating rooms and specialized infrastructure [2]. The setup process is time-consuming, and the learning curve for proficiency can be long, further limiting their appeal and utility [2]. These barriers have created a market with massive potential that remains largely unaddressed by robotics.

The LIBERTY® System’s Technological Edge

The LIBERTY® Endovascular Robotic System has been engineered to directly address and overcome these fundamental challenges. The system’s core innovation lies in its unique set of features that differentiate it from existing robotic platforms [2]. The system’s working method involves the remote delivery and manipulation of guidewires and catheters, allowing physicians to navigate anatomical targets from a handheld remote control while operating away from the radiation source [2].

Some of the key differentiating features include:

- Single-Use/Disposable: The system is fully disposable, which eliminates the need for hospitals to make a large upfront capital investment [2]. This model contrasts sharply with the high-cost capital equipment model of many competitors [17].

- Remote Operation: By allowing physicians to steer devices from a distance, the system provides a significant safety advantage. A pivotal study demonstrated a 92% relative reduction in radiation exposure for physicians, while also reducing the physical strain associated with manual procedures [1, 2].

- Small Footprint: The LIBERTY® System is designed to be mobile and compact, with a small physical footprint that integrates seamlessly into existing procedural workflows without requiring a dedicated room or additional infrastructure [2].

- Universal Compatibility: The system is designed for universal compatibility, allowing it to be used with off-the-shelf instruments and devices, which reduces friction and costs for hospitals by enabling them to utilize their preferred inventory [2].

Clinical Validation and FDA Clearance

The clinical efficacy and safety of the LIBERTY® System have been rigorously validated. Results from the pivotal study showed a 100% success rate in robotic navigation to the target anatomical location and reported zero device-related adverse events [1]. This clinical evidence provided the foundation for the company’s regulatory success. On September 8, 2025, Microbot Medical announced that it had received FDA 510(k) clearance for the LIBERTY® System [1]. This clearance is a landmark achievement, as the LIBERTY® System is the first FDA-cleared single-use, remotely operated robotic solution specifically designed for peripheral endovascular procedures [1]. This regulatory milestone provides the company with a significant first-mover advantage in this niche yet rapidly growing market segment.

The LIBERTY® System’s business model can be seen as a direct challenge to the revenue stream of established players. The business model of a market leader like Intuitive Surgical is based on selling expensive hardware systems and then generating high-margin, recurring revenue from the sale of proprietary instruments and maintenance service fees [17]. By contrast, Microbot’s model, with its disposable system that is compatible with off-the-shelf instruments, shifts the financial burden away from capital expenditure toward a more manageable per-procedure cost [2]. This strategic pivot to a single-use model is a classic example of disruptive innovation. By eliminating the multi-million-dollar upfront capital barrier, Microbot opens up a new, highly fragmented market segment that includes smaller hospitals, ambulatory surgery centers, and clinics that were previously unable to afford robotic technology [2]. The system’s universal compatibility further reduces the friction of adoption, as healthcare facilities do not need to overhaul their existing instrument inventory [2]. This strategy is poised to accelerate adoption and capture a significant portion of the currently non-robotic market.

Intellectual Property and Strategic Moat

Patent Portfolio Analysis

Microbot Medical has placed a strong emphasis on building a robust intellectual property portfolio to protect its foundational technology and provide a sustainable competitive advantage. The company’s IP portfolio for the LIBERTY® System now includes 12 patents granted globally and a significant pipeline of 57 patent applications that are currently pending [3]. A particularly significant event was the granting of a new U.S. patent on August 20, 2025 [3]. This patent covers a modular robotic surgical system that includes a base and multiple tool-receiver units arranged as separate components that can be independently and interchangeably attached to the base [3].

Expansion of Total Addressable Market (TAM)

The granting of this modularity patent is a strategic game-changer. It provides the company with the flexibility and protection to continue building additional capabilities and features for the LIBERTY® System, enabling it to be adapted for a wider range of endovascular procedures in the future [3, 18]. This modularity is a critical component of the company’s long-term growth strategy, as it expands the total addressable market (TAM) that the company is aiming to penetrate [3]. According to Microbot’s leadership, this patent has the potential to expand the company’s reach from its initial target of approximately 2.5 million peripheral endovascular procedures to over 6 million total endovascular procedures performed annually in the U.S. alone [3, 18].

Strategic Acquisitions

The company’s IP strategy extends beyond organic innovation to include strategic acquisitions that support its ecosystem-based approach. The acquisition of privately-held Nitiloop Ltd. [19] is a prime example of this strategy. The acquisition includes the FDA-cleared NovaCross™ family of microcatheters, which are medical devices intended to facilitate the placement of guidewires and catheters beyond stenotic lesions [19]. Once integrated with the LIBERTY® System, these devices will create “procedure-related kits” that align with Microbot’s goal of becoming a complete procedure-based company [19]. This allows Microbot to be competitive not only in the robotic system market but also in the instruments market for endovascular procedures.

The intellectual property strategy is not merely a defensive measure; it is a clear roadmap for future-proofing the business model and signaling long-term growth potential. The modularity patent [3] demonstrates a clear and tangible plan for expanding into new, high-value indications beyond the peripheral market. This includes areas such as coronary or neurovascular procedures, which are currently monopolized by manual techniques or other robotic systems that do not have the same unique characteristics [2, 16]. By pursuing a “procedure-based company” strategy through strategic acquisitions like Nitiloop [19], Microbot is aiming to create a full solution, not just a single-use device. This could lead to a ‘razor-and-blade’ model, where the recurring revenue is not from an expensive capital system but from the disposable device and accompanying kits. The strategic alignment of IP, acquisitions, and a disruptive business model provides a compelling narrative for investors about the company’s sustainable long-term value.

Macroeconomic and Commercialization Landscape

Global Market Trends and Corporate Catalysts

The surgical robotics market is experiencing significant macroeconomic tailwinds. The global medical robots market, which was valued at $16.0 billion in 2024, is projected to reach $33.8 billion by 2029, representing a robust compound annual growth rate (CAGR) of 16.1% [12]. Key drivers of this growth include technological advancements, an aging population with a rising prevalence of chronic diseases, and a broader push for automation and efficiency in healthcare [12, 20]. While North America currently dominates the surgical robots market with over 50% of the revenue share in 2024, emerging markets present lucrative prospects due to rising healthcare spending and less stringent regulatory environments [12, 20].

In preparation for its commercial launch, Microbot Medical has been actively strengthening its internal corporate infrastructure. The company has made key hires, including a new Vice President of Sales [7] and a head of Sales Operations & Analytics [8], to build a robust commercial readiness team. The company’s target for a U.S. commercial launch is Q4 2025 [1]. In a separate but related development that could increase visibility among institutional investors, Microbot Medical was also added to the Russell Microcap® Index on June 30, 2025 [7].

Financial Fortification and Capital Strategy

A critical component of Microbot Medical’s recent momentum is its strategic capital-raising efforts. On September 15, 2025, the company announced that it had entered into definitive agreements for the exercise of outstanding preferred investment options that could generate up to $92.2 million in gross proceeds [4, 5]. This financing is structured in multiple tranches, demonstrating a sophisticated approach to securing capital [5].

Understanding the Financing Mechanics

The transaction involves a first closing of approximately $25.2 million from the exercise of preferred investment options with exercise prices ranging from $1.50 to $2.13 per share [4]. A second closing of approximately $4.0 million is expected from options with an exercise price of $2.10 per share [4]. Crucially, in consideration for these exercises, Microbot is issuing new, short-term series J preferred investment options that have an exercise price of $4.50 per share [5]. If these new options are fully exercised, they could generate an additional $63 million in gross proceeds for the company [4].

The Rationale Behind the Financing Strategy

This financing is a masterclass in financial engineering, signaling management’s confidence in the company’s future value and aligning the interests of investors. The issuance of new options at a premium exercise price of $4.50, which is significantly higher than the stock’s current trading levels, incentivizes existing investors to support the company’s growth [5]. This structured approach provides a critical operational runway without immediately diluting shares at a lower price, a common occurrence for pre-commercial companies [5]. The company’s financial statements highlight the necessity of this capital injection, with a trailing 12-month net income of -$12.7 million [15]. By tapping into a pre-committed pool of capital and offering new options at a premium, management is communicating a strong belief that the stock will be worth more in the near future. This creates a powerful shared incentive for long-term growth and stability.

Comparative Market Valuation

To put Microbot Medical’s valuation into perspective, a comparative analysis with key competitors reveals that the market is not valuing the company on current fundamentals, but on future potential. The following table provides a snapshot of key metrics for Microbot and its competitors, highlighting this dynamic.

| Company | Market Cap (M) | Share Price | 52 wk Range | EPS (TTM) | P/E Ratio | P/S Ratio | Analysts’ Consensus Price Target | Beta |

| Microbot Medical (MBOT) | $166M [15] | $3.42 [15] | $0.85 – $4.67 [15] | -$0.58 [15] | N/A [21] | N/A [21] | $12.24 [22] | 1.216 [21] |

| Intuitive Surgical (ISRG) | $155.8B [21] | $434.50 [21] | $0.85 – $4.67 [15] | N/A [21] | 60.60x [21] | 17.29x [21] | N/A | 1.124 [21] |

| Boston Scientific (BSX) | $146.7B [21] | $98.98 [21] | $0.85 – $4.67 [15] | $0.00 [21] | 58.92x [21] | 7.98x [21] | $124.53 [21] | 0.655 [21] |

| Stryker (SYK) | $144B [21] | $376.62 [21] | $0.85 – $4.67 [15] | $0.84 [21] | 49.88x [21] | 6.11x [21] | N/A | 1.003 [21] |

This table starkly illustrates that Microbot Medical, with its current lack of revenue and negative earnings, is valued not on traditional financial metrics like P/E or P/S, but rather on its future potential. The analyst consensus price target of $12.24 [22] suggests a significant upside, highlighting the market’s belief in the company’s disruptive technology and ability to capture market share.

Navigating a Complex Global Environment

Geopolitical Resilience and Operational Strategy

While the primary catalysts for Microbot Medical’s revaluation are internal, the company’s ability to navigate external, macro-level risks is a critical factor for long-term viability. Microbot Medical’s operational footprint includes a U.S. headquarters in Massachusetts and a significant research and development base in Israel [6, 10]. The ongoing conflict in the region since October 7, 2023, has raised concerns about potential operational disruptions.

However, the company has actively addressed these concerns. On April 15, 2024, Microbot Medical issued a public statement reassuring the market that despite “unprecedented events” and the ongoing situation in Israel, all regulatory, clinical, operational, and pre-commercial activities have continued without disruption and are “on track” to meet their timelines [6]. This explicit reassurance is a significant de-risking event. While the broader medtech industry faces geopolitical risks like supply chain disruptions from conflicts in the Red Sea and Ukraine [23, 24], for a company with a critical R&D base in a conflict zone, the primary risk is operational failure. The fact that the company has actively and successfully mitigated this specific, high-impact risk suggests a robust geostrategy and a mature contingency plan, which builds significant confidence among institutional investors.

Cybersecurity and New Age Risks

The increasing digitization of healthcare and the reliance on connected medical devices introduce new and complex risks, with cybersecurity being paramount for a remotely operated system. While robotic surgery offers significant advantages, it also presents numerous points of vulnerability that can be exploited by cyber attackers, including interconnected networks, control consoles, and data transmission channels [25, 26].

For a system like LIBERTY®, which is operated remotely [2], these risks are particularly salient. A study from the University of Waterloo demonstrated that even when commands are encrypted, hackers can analyze network traffic patterns to infer private details about robot actions with high accuracy [27]. The stakes are highest in surgical robotics, where system manipulation or the remote exploitation of network vulnerabilities could lead to catastrophic physical harm to patients [26]. Attackers could potentially hijack control commands, alter surgical outcomes, or inject false sensor data, leading to unintended movements or surgical errors [26, 28]. For Microbot Medical to achieve its full potential, it must not only prove clinical efficacy but also demonstrate an impregnable cybersecurity posture. This unstated but critical risk factor is a key consideration for sophisticated investors, as a single cyber incident could have profound consequences for patient safety and the company’s commercial viability.

Competitive Landscape and Disruption Potential

Analysis of Major Competitors

The surgical robotics market is characterized by a high degree of innovation and intense competition [20].

- Intuitive Surgical (ISRG): The dominant global leader, with its da Vinci platform. Its business model relies on high-cost capital equipment and recurring revenue from proprietary instruments and services [13, 17]. The da Vinci system has a large installed base and a strong ecosystem, but its high capital cost remains a barrier for many healthcare facilities [17].

- Medtronic (MDT): Has a significant presence with its Hugo™ RAS, a modular, mobile-cart system designed as a lower-cost alternative to fixed-tower platforms [17].

- Other Competitors: The market also includes major players like Stryker (SYK) and Johnson & Johnson (JNJ) in orthopedics and other minimally invasive surgery segments [13, 29], as well as emerging companies like CMR Surgical and Asensus Surgical, each with its own differentiated approach [17, 30].

The Case for Disruption

Microbot Medical’s value proposition is its ability to disrupt this established landscape by addressing the primary barriers to robotic adoption that existing systems have failed to overcome [2]. The company’s unique business model, centered on a low capital cost, single-use device, sets it apart. The company is not positioned to compete directly with Intuitive Surgical for the same high-end customers that can afford a multi-million-dollar system. Instead, Microbot is creating a new market by “democratizing” endovascular procedures [18].

The following table provides a comparative analysis that highlights how Microbot’s unique model is genuinely disruptive, positioning it to capture a market segment currently underserved by existing technologies.

| Company | System | Primary Target Market | Business Model | Footprint | Key Differentiator | Regulatory Status |

| Microbot Medical | LIBERTY® [2] | Peripheral Endovascular [1] | Single-Use/Disposable [2] | Small, mobile [2] | First single-use, remotely operated system [1] | FDA 510(k) Cleared [1] |

| Hansen Medical (acquired) | Magellan [31] | Coronary/Peripheral [16] | Capital Equipment [31] | Large, dedicated room [31] | Remote control of guidewires/catheters [31] | FDA 510(k) Cleared (2012) [16] |

| Intuitive Surgical | da Vinci [13] | General, Urology, GYN [17] | Capital Equipment/Proprietary Instruments [17] | Large, dedicated room [13] | Multi-port, high-precision, large installed base [17] | FDA Cleared (2000) [13] |

| Medtronic | Hugo™ RAS [17] | Urology, Gynecology [17] | Modular, Capital Equipment [17] | Modular, mobile carts [17] | Scalable investment, mobile arms [17] | CE Mark, International Clearances [17] |

Microbot’s unique combination of a single-use device, remote operation, and low capital footprint is a powerful value proposition. It is designed to be mobile and compatible with existing infrastructure, which makes it an attractive option for the vast majority of hospitals and ambulatory surgery centers that have been unable to justify the cost and complexity of existing robotic systems. The company’s strategy is not to win a share of the small robotic market but to expand the market itself by making robotics accessible to the masses.

Conclusion: The Road Ahead

Microbot Medical stands at a pivotal moment. The recent stock rally is a direct result of a sequence of carefully executed de-risking events. The clinical validation from its pivotal study [1], the securing of critical intellectual property that expands its long-term potential [3], and the successful financial security from its recent capital raise [4] have all built a solid foundation for the company’s future. With FDA clearance now in hand, the narrative shifts from one of speculation to one of commercial execution, with the U.S. launch of the LIBERTY® System targeted for Q4 2025 [1].

The company’s primary challenge now transitions from technological and regulatory hurdles to commercialization. Microbot must successfully penetrate the market and demonstrate strong adoption rates, which will be the key metric for future valuation [1, 8]. While the recent funding provides a significant operational runway, the company’s need for future capital is likely, and the exercise of the new $4.50 preferred options will serve as a key indicator of continued investor confidence and market enthusiasm [5]. The FDA clearance is a beginning, not an end, and the company must navigate post-market surveillance and the potential for new product launches from competitors. The speed of market adoption, particularly in ambulatory surgery centers and smaller hospitals, will be a critical metric to watch, as this will validate the company’s disruptive business model.

In a market dominated by high-cost, high-complexity systems, Microbot Medical’s unique, single-use, and low-capital model has the potential to redefine the endovascular space. Its success will depend entirely on its ability to leverage this disruptive strategy to capture a significant share of a market that, for the first time, is truly accessible to robotic innovation. The company’s recent rally suggests that the market believes in its ability to execute this vision.

References:

- Microbot Medical® Receives FDA 510(k) Clearance for Its LIBERTY® Endovascular Robotic System

- LIBERTY® Endovascular Robotic System

- Microbot Medical® Granted U.S. Patent that Significantly Expands Potential Market Applications

- Microbot Medical Announces Exercise of Outstanding Preferred Investment Options for Up to $92.2 Million in Gross Proceeds

- Microbot Medical Announces Exercise of Outstanding Preferred Investment Options for Up to $92.2 Million in Gross Proceeds

- Microbot Medical Shares Status Following Recent Geopolitical Events

- Press Release – Microbot Medical

- Launch of its LIBERTY® Endovascular Robotic System

- Microbot Medical (MBOT) Earnings Dates & Reports

- Microbot Medical share price jumps after FDA approva

- Investor Relations

- Medical Robots Market

- Top 8 Robotic Surgery Companies in the United States

- Stock Quote & Chart

- Microbot Medical Overview

- Novel Endovascular Interventional Surgical Robotic System Based on Biomimetic Manipulation

- Top 8 surgical robotics companies in 2025

- Microbot Medical earns new surgical robot patent

- Microbot Medical Strengthens LIBERTY® Robotic System Portfolio with Acquisition of Novel FDA-Cleared Devices

- Surgical Robots Market (2025 – 2033)

- MBOT Quote, Financials, Valuation and Earnings

- Price Target

- Worldwide worries: How geopolitical issues impact the MedTech industry

- Geopolitical Issues: Impacts on the Medtech Industry

- Protecting procedural care – cybersecurity considerations for robotic surgery

- Cybersecurity Risks in Robotic Surgical Systems

- New Study Finds Collaborative Robots Pose Hidden Cybersecurity Risks

- Cybersecurity Challenges in Robotic Systems for Healthcare: Safeguarding Patient Data and Devices

- Navigating the Next Wave of Surgical Robotics

- Next Generation Robotic Surgery

- Magellan Robotic System

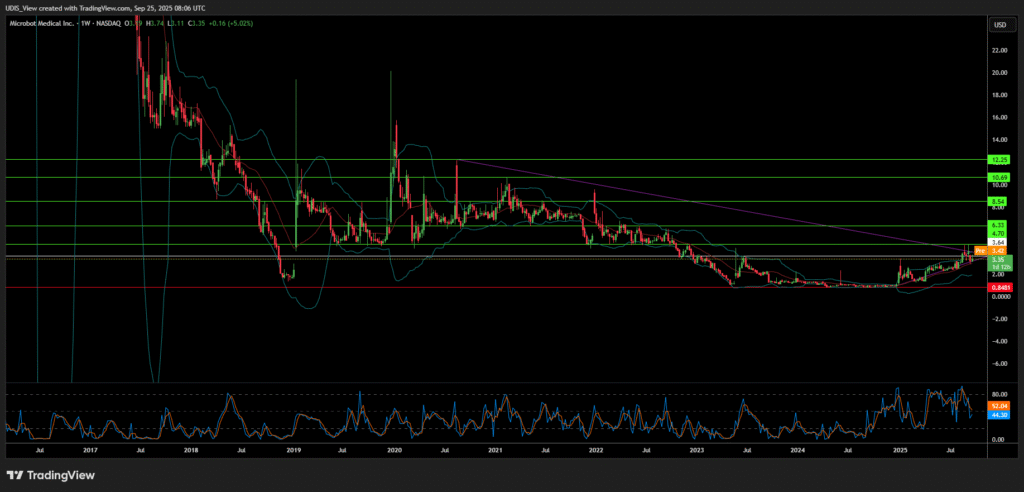

Microbot Medical Long (Buy)

Enter At: 3.64

T.P_1: 4.70

T.P_2: 6.33

T.P_3: 8.54

T.P_4: 10.69

T.P_5: 12.25

S.L: 0.8481