I. The Convergence of Performance and Policy

Amprius Technologies (NYSE: AMPX) is demonstrating accelerated market action driven by the commercial validation of its proprietary silicon nanowire anode platform and profound structural tailwinds stemming from global geopolitical realignments. The company’s value proposition rests on its ability to produce the highest-energy-density lithium-ion batteries available on the market today, a technological advantage that translates directly into extended endurance and range for mission-critical applications.

The financial outlook for Amprius is currently defined by robust projections that include hyper-growth at high triple-digit revenue rates over the next two years, with forecasts suggesting profitability could be achieved within three years.1 This aggressive optimism has driven a volatile but upward trajectory in the stock, with shares leaping dramatically over the past year.2 Analysts, who unanimously rate AMPX as a Buy or Strong Buy, anticipate further positive revision cycles in estimates, placing the average price target above $11.67, with a high estimate of $18.00.1

Crucially, the company has begun transitioning from a purely research and development entity to a scalable manufacturer, achieving a landmark positive gross margin of 9% in a recent quarter, signaling viable unit economics at initial production volumes.5 However, the core challenge remains the high capital expenditure required to transition its advanced manufacturing processes to the gigawatt-hour (GWh) scale. The valuation is currently anchored in future performance and strategic positioning rather than current free cash flow, scoring low on traditional undervaluation metrics.2 The company’s trajectory hinges entirely on the timely and cost-effective execution of its GWh domestic manufacturing facility in Colorado.

II. The Macroeconomic and Geopolitical Imperative

A. Global Market Dynamics: The Electrification Tipping Point

The global advanced battery market is witnessing vigorous expansion, underpinned by intensifying demand across multiple domains. Macroeconomic factors driving this growth include the increasing adoption of electric vehicles (EVs) and the improving economics of battery storage systems.6 Furthermore, the expansion of data centers and telecommunication infrastructure globally requires increasingly reliable and high-capacity backup power solutions.7

A major structural driver is the global emphasis on clean energy practices and the urgent need to reduce carbon emissions. The growing concerns about atmospheric CO2 concentration resulting from industrial activities and fossil fuel combustion accelerate the demand for advanced batteries that offer features like grid flexibility and enhanced competence.6 This bifurcates the battery market: while mass-market applications (e.g., entry-level EVs) prioritize cost reduction (favoring chemistries like LFP), high-performance sectors require the specific energy density and superior power metrics that only advanced materials, such as Amprius’s silicon nanowire anode, can deliver.8

B. Geopolitical Risk Mitigation and the US Supply Chain Mandate

Amprius is fundamentally intertwined with the strategic geopolitical shift toward securing critical domestic technology supply chains. Globally, the supply chain for lithium-ion batteries is heavily reliant on Asian dominance, particularly China, which holds a 35% market share via companies like CATL.9 The U.S. government views domestic battery manufacturing capability as essential for economic security and defense readiness.

1. The Strategic Need for Domestic Anode Production

The core of Amprius’s geopolitical value proposition is its technology’s ability to replace traditional graphite anodes with a 100% silicon alternative that is developed and scaled domestically.10 The company’s commitment to establishing a large-scale factory in the U.S. aligns directly with the Department of Energy’s (DOE) mission to catalyze investments in America’s energy future and enhance national security through strengthening domestic critical materials processing and manufacturing.11

2. Q7: Government and Strategic Funding Sources

Amprius receives substantial governmental and strategic support, confirming its designation as a key domestic strategic asset:

- U.S. Department of Energy (DOE): Amprius was among the first companies to receive funding under President Biden’s Bipartisan Infrastructure Law, securing a significant $50 million cost-sharing grant from the DOE’s Office of Manufacturing and Energy Supply Chains.12 This funding is dedicated to accelerating large-scale, domestic production of its silicon nanowire anode lithium-ion batteries for electric vehicles and the electrical grid.12 Additionally, the company received a $1 million grant from the DOE’s Advanced Manufacturing Office (AMO) to further mature its nanowire anode manufacturing process 14

- Department of Defense (DOD): Amprius is engaged with the U.S. Army through successful development programs, including one for safe conformal wearable batteries, which is part of a larger $1.25 billion opportunity through 2030.15 It has also secured contracts, such as one with the U.S. Army to develop 100% silicon anode cells.17

- State Incentives: The company’s selection of Brighton, Colorado, for its GWh factory was supported by the state, which recognized the role of the factory in creating over 300 new, good-paying jobs and bringing federal investment through the Bipartisan Infrastructure Law 13

The financial contribution of the DOE grant serves as more than just capital; it functions as a crucial political validation and a strategic de-risking mechanism for the technology. By committing to US-based manufacturing with federal backing, Amprius gains privileged access to defense and infrastructure markets where non-domestic competitors face significant regulatory and logistical barriers. This alignment with national security objectives introduces a “geostrategic premium” into Amprius’s valuation, distinguishing it from purely commercial battery developers.

III. The Nanoengineered Competitive Moat

Amprius’s market differentiation stems from its unique and patent-protected material science solution to the inherent limitations of silicon anodes. This technological moat is rigorously protected by a deep intellectual property portfolio covering composition and manufacturing processes.

A. Q3: The Advantage of the Silicon Nanowire Working Method

The advantage of Amprius’s method lies in overcoming the core scientific flaw that has historically prevented silicon from widespread use in lithium-ion batteries. While silicon offers up to 10x the capacity of traditional carbon anodes, the material swells dramatically (up to 300%) as lithium ions are absorbed during charging.18 This expansion causes cracking, pulverization, and rapid degradation (low cycle life).

Amprius’s proprietary solution is the SiMaxx™/SiCore® silicon nanowire anode platform.

1. The Mechanics of the Rooted Nanowire Structure

The system utilizes a 100% pure silicon material structured as nanowires that are directly growth-rooted to the conductive substrate.18 This unique architecture enables the anode to expand and contract

internally through engineered micro- and nano-porosity within and between the nanowires.18 This structural robustness allows the cell to withstand hundreds of charge/discharge cycles while retaining over 80% of its initial capacity, a key requirement for commercial viability.20

2. Superior Rate Capability

The nanowire structure also facilitates high-power and fast-charging capabilities. The straight path of the nanowires creates low tortuosity, improving electric and ionic conductivity compared to conventional materials.19 This design allows Amprius cells to achieve high power discharge alongside high energy storage, making them suitable for demanding applications like drones and high-performance electric mobility.8

B. Q5: Technological Advantage and Performance Benchmarks

The result of the nanowire structure is the delivery of the industry’s highest known energy density cells commercially available.

1. Quantifying the Lead: Density Metrics

Amprius’s commercially available batteries deliver up to 450 Wh/kg and 1,150 Wh/L.22 The company is actively working toward performance levels exceeding

500 Wh/kg and 1,300 Wh/L.23 To illustrate the technological lead, state-of-the-art lithium-ion cells with graphite anodes typically achieve specific energies up to

250 Wh/kg.20 Amprius’s technology provides performance approaching 2x that of current commercially available graphite cells 22, enabling applications like drones to achieve greater than 4-hour missions, more than doubling current endurance.19

2. Key Technology Differentiation

The following table summarizes Amprius’s material advantage relative to the industry standard:

Table 1: Amprius Technologies Core Technology Differentiation

| Metric | Amprius SiMaxx/SiCore (Silicon Nanowire) | State-of-the-Art Graphite Li-ion | Significance for Customer |

| Energy Density (Wh/kg) | Up to 500 Wh/kg (Projected/Best Case) | ∼200−260 Wh/kg | Up to 2x Longer Range/Mission Endurance |

| Volumetric Density (Wh/L) | Up to 1,300 Wh/L (Projected/Best Case) | ∼600−700 Wh/L (Estimate) | 40-50% Weight/Size Reduction Potential |

| Anode Material | 100% Pure Silicon Nanowire | Graphite (Carbon) | Addresses US supply chain critical mineral vulnerability |

| Expansion Mitigation | Rooted Nanowires and Engineered Porosity | Additives/Architecture (Limited Success) | Enables high cycle life despite high silicon content |

| Market Readiness | Commercially Available (Defense/Aerospace Focused) | Mass Market Standard | Proven technology, not a future promise |

C. Q2, Q5: Intellectual Property and the Competitive Barrier (Patent Analysis)

The proprietary nature of the silicon nanowire structure and its production methods is protected by a substantial and mature intellectual property (IP) portfolio. Without these patents, the foundational value of the company – its unique technology – would be unprotected from immediate replication by competitors.

1. Protecting the Innovation: Key Patent Families

Amprius relies heavily on granted patents covering both the fundamental nanostructure and the manufacturing processes required to create them at scale:

- Anode Architecture Patents: These grants cover the critical design element, such as electrodes including silicon nanowires used for lithium-ion insertion that are growth-rooted to the conductive substrate.24 This protects the mechanism that mitigates volumetric expansion.

- Manufacturing Process Patents: Patents detail methods for structurally controlled deposition of silicon onto nanowires.24 This includes inventive systems for growing silicon nanowires on carbon-based substrates at large-scale quantities using chemical vapor deposition (CVD).26 These patents also specify complex deposition techniques, such as the use of a non-conformal, porous layer followed by a conformal, denser layer of silicon, ensuring the structure is optimized for performance and longevity 24

2. IP Geographic Scope: Defense Against Global Giants

The IP portfolio has a broad geographic scope, which is essential given Amprius’s “capital-light” strategy of using international contract manufacturers and competing in global markets. The portfolio includes patent families across key manufacturing and market territories: Japan (16 patents), South Korea (15 patents), China (14 patents), Taiwan (13 patents), and the European Patent Office (EPO, 13 patents), in addition to the United States (12 patents).28 This rigorous international protection is a necessary defense mechanism designed to prevent foreign manufacturing entities, including contract partners, from circumventing the IP and producing equivalent technology without authorization.

The comprehensive nature of the patents, which include specific technical blueprints that match the latest investor presentations, suggests the core technology is legally well-defended. The patented technology is fundamentally designed to be a “drop-in replacement” for graphite anodes.10 This characteristic significantly lowers the barrier to adoption for established battery manufacturers by minimizing the required changes to the rest of the cell chemistry and assembly lines, facilitating quicker market entry through partnerships.

D. Q6: Are there other better technologies and techniques on the market?

While Amprius currently offers the highest energy density cells commercially available, the market for next-generation batteries is highly competitive, focusing heavily on silicon anodes and solid-state concepts.

- Silicon Anode Competitors: Amprius faces intense competition from peers such as Sila Nanotechnologies and Enovix Corporation. Sila Nanotechnologies focuses on silicon-carbon composite materials and has secured substantial private funding ($1.4 billion) to scale its technology for EV (Mercedes-Benz) and consumer electronics applications.29 Enovix also uses a 100% silicon anode but employs a distinct 3D cell architecture, focusing on consumer electronics initially.29 Other key players include Group14 Technologies, NanoGraf, and Nexeon.31 While these companies compete in the silicon space, Amprius maintains a lead in energy density primarily because of its unique 100% silicon nanowire structure.

- Solid-State Batteries (SSBs): SSBs, represented by companies like Sakuu, represent a revolutionary shift, promising high density and enhanced safety by replacing the flammable liquid electrolyte.33 However, SSBs still face significant technical hurdles in achieving commercial stability, cycle life, and manufacturability at scale. Amprius’s silicon nanowire technology, operating within the established lithium-ion framework (using liquid electrolyte), is currently market-ready and scalable, positioning it several years ahead of true solid-state commercialization for high-demand applications.19

The current technological landscape positions Amprius at the pinnacle of advanced lithium-ion chemistries, offering a validated path to performance far exceeding traditional graphite and slightly ahead of its closest silicon anode peers in raw energy density metrics.

IV. Market Strategy and Customer Validation

Amprius’s go-to-market strategy is characterized by a deliberate focus on high-margin, mission-critical applications that demand its unique performance advantages, providing immediate revenue and crucial real-world validation.

A. Q1: Profile of the High-Value Customer Base

Amprius’s customer base is concentrated in sectors where weight and space savings translate directly into a tactical or operational advantage, justifying a higher unit cost.

1. Concentration in Defense and Aerospace

This is Amprius’s primary revenue driver. Customers include leading Unmanned Aerial Systems (UAS) manufacturers, exemplified by a single, unnamed customer who placed repeat purchase orders totaling over $50 million in 2025 alone ($15 million order followed by a $35 million order).34 These SiCore cells are specifically engineered for the rigorous demands of UAS missions, extending flight times and mission ranges significantly beyond conventional limits.34 Other notable partners include Teledyne FLIR (unmanned solutions for military/public safety) and BAE Systems (stratospheric flight).8 The U.S. Army is a confirmed customer, working with Amprius on developing safe, conformal wearable batteries 15

2. Expansion into Light Electric Vehicles (LEV) and Custom Cells

Amprius has secured contracts totaling over $20 million for Light Electric Vehicle (LEV) applications.35 Furthermore, the company signed a development contract with a Fortune 500 company in late 2024 to create a custom high-energy SiMaxx™ pouch cell, expected to reduce the battery’s weight and size by approximately 50% compared to the customer’s current battery solution.38 The success of this single project is projected to require over one million cells per year, illustrating the potential for rapid scale adoption once product validation is complete 38

The performance advantage- enabling a 40-50% reduction in weight or size while maintaining performance is the core reason these high-value customers choose Amprius. They prioritize the competitive edge provided by superior energy density over optimizing cycle life or cost for long-term fleet depreciation. This “Performance First” strategy allows Amprius to establish strong relationships and generate revenue while delaying a direct price war with high-volume EV battery giants.

B. Q8, Q12: Current Projects and Strategic Timeline

Amprius’s strategic plan is focused on transitioning from pilot manufacturing to GWh-scale domestic production while fulfilling immediate customer demand through a capital-light model.

1. Current Projects and Short-Term Execution (H2 2025 – 2026)

In the short term, the company is focused on the successful commercial rollout of its SiCore cells, including fulfilling the substantial UAS and LEV purchase orders.8 This production is largely supported by its established contract manufacturing network, which provides over 1.8 GWh of capacity.39 The critical immediate execution milestone is the operational launch of the domestic GWh facility in Brighton, Colorado, targeted for the

first half of 2025.41

2. Long-Term Goals (2027+)

The long-term objective is to leverage the capacity generated by the Brighton facility (up to 5 GWh potential) to aggressively reduce the cost per kilowatt-hour (kWh).13 This reduction is necessary to make the technology viable for the mainstream EV market.18 The company will aim to penetrate the performance and luxury EV sectors, where the range advantage offered by 500

Wh/kg cells justify a higher premium.43 Continuous research and development will focus on optimizing cycle life and energy density to meet the durability demands of large-scale automotive manufacturers.18

The decision to focus initially on defense and aerospace, despite the lower volume compared to the EV market, provided critical operational de-risking. The mission profiles for UAS and military applications are highly sensitive to weight and endurance, making the immediate implementation of high-density cells imperative. While analysts note that conventional, highly managed lithium-ion batteries may offer up to 10x higher longevity in low-stress EV applications 27, the hundreds of cycles achieved by Amprius are sufficient for the typical lifespan and use patterns of high-end drones and military equipment.20 This strategic sequencing guarantees early revenue and product validation in the most challenging environments before tackling the immense capital and durability requirements of the automotive sector.

V. Execution: Scalability, Capacity, and Competition

The central remaining determinant of Amprius’s long-term financial success is its ability to successfully scale its technically complex manufacturing process domestically and cost-effectively.

A. Q9: The Hybrid Manufacturing Model and Capacity Roadmap

Amprius employs a phased, hybrid manufacturing strategy to manage capital risk while rapidly securing volume capacity.

1. The Capital-Light Strategy

Amprius utilized its pilot facility in Fremont, California, for R&D and MWh-scale output.23 To meet immediate, rising global demand for its high-performance SiCore cells, the company secured manufacturing partnerships with international contract partners, notably in South Korea.40 This approach provides over

1.8 GWh of contracted capacity available today 39, allowing Amprius to serve customers at volume without the immediate full CapEx burden of building every factory itself. This strategy strengthens supply chain resilience and accelerates global market penetration.40

2. The Domestic Hub: Brighton, CO, GWh Factory

The cornerstone of Amprius’s strategic plan is the establishment of its domestic gigawatt-hour (GWh) scale factory in Brighton, Colorado (Amprius Fab). The company plans to invest $190 million, including the $50 million DOE grant, to develop a facility with an initial potential capacity of up to 5 GWh within the existing footprint, with the ability to expand to 10 GWh total.13 The site selection and rezoning approvals mark significant milestones toward the goal of beginning operations in the

First half of 2025.41 The facility will create over 300 net new jobs.13

Table 2: Amprius Technologies Manufacturing and Capacity Roadmap

| Facility/Partnership | Geographic Location | Status/Timeline | Capacity (MWh/GWh) | Strategic Goal |

| Fremont Facility | Fremont, California, US | Operational (Pilot/R&D) | MWh Scale | Core R&D and High-End Small Volume Production |

| Contract Manufacturing Network | Global (e.g., South Korea) | Operational | >1.8 GWh Contracted | Capital-light scaling, immediate volume fulfillment, supply chain resilience |

| Brighton Facility (Amprius Fab) | Brighton, Colorado, US | Development Phase (Target H1 2025 Operational) | Initial 500 MWh; Potential up to 5 GWh | Domestic gigawatt scale; secures US government/defense contracts; EV market entry platform |

| Estimated CapEx for 1 GWh | N/A | Projected | $120M – $150M | High cost indicates inherent complexity of advanced technology |

The cost of achieving GWh scale remains significant. The estimated capital equipment expenditure for just 1.0 GWh per year of capacity ranges between $120 million and $150 million.45 This high CapEx requirement, partially offset by the DOE grant, highlights the technical complexity and financial challenge of industrializing this high-performance nanowire technology.

B. Q10, Q11, Q6: Competitive Landscape and Market Share Ambition

1. Comparison with Mass-Market Leaders

In the overall lithium-ion market, Amprius competes against massive, established entities. Contemporary Amperex Technology Co., Limited (CATL) dominates with a 35% global market share.9 Other formidable competitors include LG Energy Solution, Panasonic, and Samsung SDI.46 These companies focus overwhelmingly on GWh volume production using cost-optimized graphite or LFP chemistries. Amprius’s share in these overall markets is currently negligible, as its technology is too expensive for most mass-market applications.

2. Strategy to “Bite” into Market Share

Amprius is executing a strategy of market segmentation:

- Initial Domination: It is establishing clear dominance in the ultra-high-performance niche (defense, UAS, stratospheric flight) where its energy density lead is critical and justifies the premium cost.34

- EV Penetration: It intends to “bite” into the broader electric mobility market by targeting performance-oriented sectors (Light Electric Vehicles, premium EVs) where range and weight characteristics provide a valuable differentiator.37 The company aims to compete on performance rather than cost initially, hoping its unique density enables new product designs and enhanced customer experience.38

This approach acknowledges the technological constraint: the current complex manufacturing process (CVD for nanowires) is inherently costlier than the slurry coating methods used for graphite.27 Therefore, Amprius must focus its efforts on increasing the throughput and capital efficiency of its proprietary deposition process to bring the cost structure down to competitive levels necessary for large-volume EV contracts.

C. Q4: Can Amprius Be a Major Player?

Amprius Technologies can be a major player in the production of advanced, ultra-high-energy-density lithium-ion batteries. Its current technological lead and strategic adoption by the defense and aerospace sectors confirm this status within the performance segment.

However, to become a major player in the overall, macro-scale battery market (dominated by automotive applications), the company must successfully navigate the “scalability contradiction.” The current technological superiority is derived from manufacturing complexity; translating that advantage to cost-competitive GWh scale is the greatest remaining obstacle. The Brighton factory’s operational launch in H1 2025 will serve as the crucial indicator of whether Amprius can overcome this hurdle and successfully transition from a high-tech niche supplier to a foundational supplier for the entire electric mobility ecosystem.

VI. Financial Dynamics and Conclusion

A. Q13: Analyzing the Drivers of Current Growth

The current rapid growth in Amprius Technologies is driven by a powerful synergy across three distinct domains:

| Domain | Driving Factor | Amprius Action/Impact |

| Technology/Science | Breakthrough Energy Density | SiMaxx/SiCore Nanowire Anode (500 Wh/kg target) enables mission profiles previously impossible. |

| Patent Analysis/High-Tech | Robust IP Moat | Exclusive patent rights covering nanowire structure and deposition methods secure technology lead globally. |

| Geopolitics/Geostrategy | US Supply Chain Localization | Receipt of $50M DOE grant and commitment to domestic GWh factory establishes Amprius as a strategic national asset. |

| Economics/Finance | Revenue Inflection Point | Achievement of positive 9% Gross Margin and record H1 2025 revenue validates unit economics and fuels analyst hyper-growth forecasts. |

| Customer Validation | Critical Mission Adoption | Repeat purchase orders ($35M+ from UAS manufacturers) proves real-world reliability in the most demanding segments. |

B. Financial Performance Metrics

The financial trajectory reflects a pivotal moment for the company. Revenue for the first half of 2025, which totaled $26.4 million, already surpassed the total revenue generated in all of fiscal year 2024 ($5.681 million).5 This accelerated annual growth culminated in the crucial landmark achievement of a 9% positive gross margin, signaling the early feasibility of profitable production.5

Despite these positive operational indicators, the company incurred a GAAP net loss of $6.4 million in the second quarter of 2025, reflecting continued investment in R&D and scaling infrastructure.48 However, the market’s focus remains firmly on future potential. Analysts expect quarterly revenue growth to continue at high triple-digit rates, predicting AMPX will likely exceed consensus estimates and provide favorable guidance.1 Projected quarterly revenue for Q4 2026 is estimated at $60 million.49

C. Investment Outlook and Risk Factors

Wall Street analysts maintain a strong consensus rating of “Strong Buy,” suggesting significant confidence in the company’s ability to execute its long-term plan.3 The high price targets are predicated on the assumption that Amprius successfully navigates the complex transition to cost-effective GWh scale.

However, the investment carries inherent volatility and risk. The stock’s massive rally (over 1,100% gain over the past year) 2 indicates that expectations may have outpaced near-term financial reality, as demonstrated by the low score on standard undervaluation criteria.2

A notable caution flag exists in the form of significant insider selling over the past year. Insiders, including the CEO and Director Kang Sun, have divested shares, with one recent sale representing 20% of the CEO’s holding.50 While insider sales can occur for personal financial planning, consistent selling, especially after a massive stock surge, suggests that key internal stakeholders may perceive the current market valuation as fully reflecting immediate prospects, potentially contradicting the unanimous external analyst optimism.50 Investors must weigh the strong analyst confidence against this perceived lack of sustained, long-term insider accumulation.

D. Final Strategic Synthesis

Amprius Technologies has successfully translated groundbreaking scientific research into a technologically superior, commercially validated product. The company’s strategic alignment with critical US defense and energy initiatives, backed by federal funding, provides a substantial competitive advantage and a protected path to large-scale adoption in high-performance sectors. The successful execution of the hybrid manufacturing strategy (leveraging existing contract capacity while building the domestic GWh facility) is critical for managing capital expenditure and meeting escalating demand.

The central thesis for Amprius’s long-term financial success is that its patented silicon nanowire architecture provides a performance leap so significant (approaching 500 Wh/kg) that it fundamentally redefines mission capabilities for aerospace and specialized mobility. If Amprius can achieve its H1 2025 operational milestones in Colorado and demonstrate progress toward reducing the cost complexity associated with nanowire deposition, the company is poised to move beyond its niche and become a formidable, strategically crucial player in the next generation of advanced battery technology.

Refferences

- Amprius Technologies: Anatomy of a Textbook, Raging Bull Market – Nasdaq

- Is It Too Late to Consider Amprius Technologies After Shares Surge Over 1100% in 2025?

- AMPX Stock Forecast: Analyst Ratings, Predictions & Price Target 2025 – Public Investing

- Amprius Technologies (AMPX) Stock Forecast & Analyst Ratings – Moomoo

- Amprius Technologies’ Blowout Quarter Fuels Record-Setting Growth – Nasdaq

- Advanced Battery Market Size to Hit Around USD 208.28 Bn by 2034

- Battery Market Size, Share & Growth | Industry Report, 2030 – Grand View Research

- Amprius Announces Breakthrough SiCore™ Cell Chemistry to Boost Battery Performance for Electric Mobility Applications – Business Wire

- Which companies control the lithium-ion battery supply chain? – Benchmark Source

- DOE AMO awards Amprius $1M to advance manufacturing process of nano-wire silicon anodes – Green Car Congress

- DOE Issues Notice of Intent for Funding in Strengthening Domestic Critical Materials Processing and Manufacturing to Enhance National Security | Department of Energy

- Amprius Technologies Among First Funding Recipients from Biden Administration’s Bipartisan Infrastructure Law

- Polis Administration Announces Amprius Technologies Inc. Chooses Brighton, Colorado for New Gigawatt-Scale Lithium-Ion Factory

- Amprius Technologies Awarded Department of Energy Funding Grant for Advanced Battery Manufacturing

- Amprius Successfully Completes Safe Cell Development Program for the U.S. Army

- Amprius Successfully Completes First Volume Shipment of Safe Cells for the U.S. Army

- Amprius Technologies Awarded U.S. Army Contract to Develop 100% Silicon Anode Li-Ion Batteries using Si-Nanowire

- Amprius Technologies, Inc.

- High Energy Density and Specific Energy Silicon Anode-Base Batteries for Aerospace Applications – NASA

- High Energy Density and Specific Energy Silicon Anode-Based Batteries – Power Sources Conference

- The Future of Battery Technology | Amprius

- Amprius Technologies Selects Colorado for Gigawatt-Hour Scale Factory Site

- Understanding High Energy Density Batteries for Nanotech – Amprius Technologies

- Patents Assigned to Amprius, Inc.

- Patents Assigned to AMPRIUS TECHNOLOGIES, INC.

- Manufacturing apparatus and method for making silicon nanowires on carbon-based powders for use in batteries – Google Patents

- Amprius: silicon anode technology review? – Thunder Said Energy

- Amprius Technologies Patents – Insights & Stats (Updated 2024)

- The State of the Silicon: – Paths to Commercializing Ultra-High Energy Density Batteries

- Silicon anode battery companies get a major boost – NanoGraf Corporation

- Silicon Battery Companies – Amprius Technologies, Inc. (US) and Enovix Corporation (US) are the Key Players – MarketsandMarkets

- Silicone Anodes Market Size, Growth Outlook 2025 – 2034

- Cells – Soteria Battery Innovation Group

- Amprius Secures Repeat $35 Million Purchase Order from Leading UAS Manufacturer

- Amprius Secures $15M Purchase Order for SiCoreTM Cells from Leading UAS Manufacturer

- KULR Partner Spotlight: Amprius Technologies and Their Lucrative Possibilities – Reddit

- Amprius Secures Over $20 Million in Contracts for Light Electric Vehicle Applications

- Amprius Signs Development Contract for a High-Energy Custom Cell with a Fortune 500 Company

- Amprius Announces Strategic Manufacturing Partnership in South Korea to Support Global Demand

- Amprius Announces Strategic Manufacturing Partnership in South Korea to Support Global Demand

- Amprius’ State-of-the-Art Gigawatt-Hour Scale Factory in Colorado Passes Major Milestone

- Amprius’ State-of-the-Art Gigawatt-Hour scale factory in Colorado passes Major milestone

- Amprius cell vs QS cell: compare and contrast: r/QUANTUMSCAPE_Stock – Reddit

- Amprius Ships High-Performance SiCore Cells to Multiple Drone Customers from U.S. Pilot Line

- 10-K – Amprius Technologies

- Top 12 Lithium-Ion Battery Companies: EV Market Growth

- August 7, 2025 – 10-Q: Quarterly report [Sections 13 or 15(d)] | Amprius Technologies, Inc. (AMPX)

- Amprius Technologies

- AMPX / Amprius Technologies, Inc. (NYSE) – Forecast, Price Target, Estimates, Predictions

- Have Insiders Sold Amprius Technologies Shares Recently? – Webull

- Amprius Technologies (NYSE:AMPX) – Stock Analysis – Simply Wall St

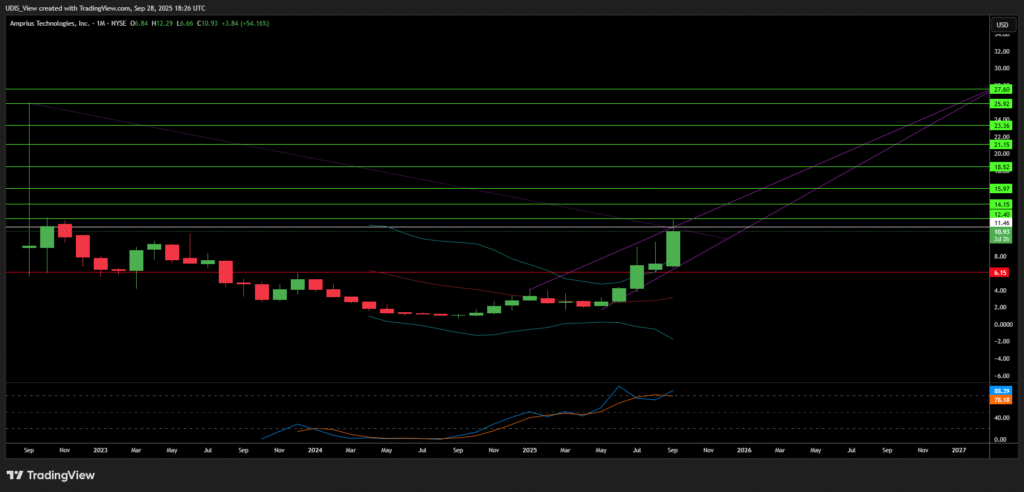

Amprius Technologies Long (Buy)

Enter At: 11.46

T.P_1: 12.40

T.P_2: 14.15

T.P_3: 15.97

T.P_4: 18.52

T.P_5: 21.15

T.P_6: 23.36

T.P_7: 25.92

T.P_8: 27.60

S.L: 6.18