Core Assessment: Strategic Certainty Drives A&D Valuations

The recent extraordinary performance of Aerospace and Defense (A&D) Exchange Traded Funds (ETFs) signals a decisive market repricing of strategic risk. This acceleration followed President Donald Trump’s October 2025 directive to resume U.S. nuclear weapons testing.1 ETFs like the SPDR S&P Aerospace & Defense ETF (XAR) already reflected this bullish trend with a 49.11% year-to-date return in 2025.2

This directive transcended mere policy adjustment. It formally recognized the escalation of Great Power Competition into a quantifiable, technology-intensive arms race.3 Investors now view A&D spending as mandatory, ensuring immense, sustained governmental capital flow. This influx focuses on long-term modernization, technological development, and necessary industrial capacity expansion. The sector’s valuation now captures this geopolitical certainty.

Geopolitics & Geostrategy: The New Deterrence Calculus

The decision to end the 33-year nuclear testing moratorium represents a monumental strategic pivot.4 This move guarantees a costly, protracted confrontation between major powers. Consequently, the A&D sector gains a permanent “instability premium” on its equity valuations.

The End of the Moratorium and Strategic Signaling

The U.S. testing order directly responded to recent strategic weapons demonstrations by rivals. Russia successfully tested its Poseidon nuclear-powered super torpedo and the Burevestnik nuclear cruise missile just weeks prior in October 2025.1 President Trump framed the testing resumption as necessary to counter escalating programs in competitor nations 1

This policy action establishes a significantly higher baseline for global strategic stability and deterrence.3 It signals a willingness to discard decades of arms control treaties to match perceived adversary capabilities.4 This shift demonstrates that the administration prioritizes capability demonstration over adherence to the existing Science-Based Stockpile Stewardship (SSP) program.5 The National Nuclear Security Administration (NNSA) has stated “no technical reasons” currently exist to mandate explosive tests.6 The testing decision is thus purely political and geostrategic. Its primary purpose is to signal resolve, forcing rivals into a costly response cycle that guarantees long-term technology spending.

Global Conflict and Instability Premiums

Deteriorating global security environments are directly responsible for increased defense budgets worldwide.8 Global military expenditure soared to an unprecedented $2.443 trillion in 2023.9 Major defense contractors benefit from this surging global demand. Geopolitical conflicts, specifically the wars in Ukraine and Gaza, alongside the renewed focus on strategic competition with China, fuel this trend 10

This escalating instability creates a durable premium for A&D stocks. Furthermore, NATO members globally are increasing their defense budgets.8 This boosts U.S. firms through massive foreign military sales. Foreign-funded arms sales to European allies alone surpassed $170 billion in 2023 and 2024.10 The clear focus on Russia and China solidifies the U.S. role as the essential security provider for allies globally. This dynamic guarantees persistent, high-volume foreign sales, extending revenue visibility beyond the U.S. Congressional budgetary cycles. Record backlogs at prime contractors are thus supported equally by Pentagon contracts and surging international demand.11

Macroeconomics & Economics: The Fiscal Windfall

The appreciation of A&D ETFs is fundamentally supported by the immense scale and reliability of contracted revenue and federal investment. Recent corporate earnings releases and unprecedented backlogs validate this macroeconomic certainty for investors.

Record Budgetary Commitments

The commitment to nuclear modernization guarantees a massive, multi-year funding stream. The Congressional Budget Office estimated U.S. programs to operate and modernize nuclear forces would cost $946 billion over the next 10 years.13 The FY2026 defense budget request included approximately $60 billion across the nuclear enterprise to fund the recapitalization of all three legs of the nuclear triad.13

Total nuclear costs reached $87 billion in FY2026 under the White House plan.14 This figure represents a 26% increase over the previous administration’s budget request.14 Key modernization programs receiving massive funding include the B-21 stealth bomber ($10.3 billion), the Sentinel ICBM ($4.1 billion in R&D), and Columbia-class submarines ($11.2 billion in R&D/procurement).14 This spending stream secures the financial stability of primary contractors such as Northrop Grumman (NOC) and Lockheed Martin (LMT).15

Financial Performance and Backlog Assurance

Major defense primes reported exceptional financial performance in Q3 2025. Northrop Grumman beat earnings estimates by 18.2%, and RTX Corporation exceeded estimates by 19.7%.16 Lockheed Martin (LMT) reported Q3 2025 net sales of $18.61 billion, an 8.8% year-over-year increase, and consequently raised its 2025 sales outlook.16

LMT established a record order backlog of $179 billion as of September 28, 2025.11 This backlog functions as a long-duration treasury bond for investors, ensuring revenue streams for over two and a half years.12 The certainty derived from this backlog reduces earnings volatility and justifies the high P/E ratios seen across A&D ETFs 12

Macroeconomic Impact

The highly anticipated One Big Beautiful Bill Act is expected to front-load defense appropriations.18 This provision drives defense spending above $1 trillion in fiscal year 2026.18 Analysts project this front-loading will boost real U.S. GDP growth by 0.2 percentage points in 2026.18 This direct economic stimulus, combined with the sector’s insulation from short-term fiscal shocks, stabilizes and bolsters defense stock valuations. Despite the massive spending boost, capacity constraints and labor shortages will likely spread the economic impact over several years.18 This challenge compels defense primes to invest heavily in Internal Research and Development (IRAD) and capital improvements to shore up manufacturing capacity. These capital investments, utilizing tools like digital engineering, generate further revenue streams and efficiency gains, reinforcing long-term corporate profitability.19

| Metric | Value / Amount | Strategic Implication |

| XAR ETF YTD Return (2025) | 49.11% | Investor confidence in sustained sector growth is extreme.2 |

| Lockheed Martin (LMT) Backlog | $179.07 Billion | Guarantees multi-year revenue stability, mitigating economic downturn risk.11 |

| Total U.S. Nuclear Modernization (FY2026) | $87 Billion | Demonstrates massive, dedicated capital flow into core strategic programs.14 |

| Global Military Expenditure (2023) | $2.443 Trillion | Reflects worldwide demand surge, boosting U.S. defense exports and revenue.9 |

Technology & High-Tech: The New Arms Race Drivers

Strategic competition now fundamentally hinges on achieving technological superiority. This demand drives immediate, massive investments in advanced technology, notably hypersonics, digital engineering, and resilient command structures.

Hypersonic Weapon Systems

The U.S. is aggressively developing hypersonic weapons systems maneuvering at speeds of at least Mach 5.20 This capability is critical for achieving conventional prompt global strike objectives.20 The advances demonstrated by rivals accelerate this necessity, as both Russia and China have likely already fielded nuclear-capable hypersonic glide vehicles.20

Lockheed Martin stands central to these efforts, leading crucial programs. These include the Air-Launched Rapid Response Weapon (ARRW) and the Conventional Prompt Strike (CPS).21 These programs develop advanced missile and hypersonic vehicle technologies. They enhance end-to-end strike force systems, thereby increasing national defense and deterrence potential.21 A significant driver of cost is complexity: U.S. hypersonic systems are generally designed to be conventionally armed. This requires greater accuracy and makes them significantly more technically challenging and expensive to develop than nuclear-armed rival systems.20

Digital Engineering and Manufacturing Velocity

Meeting record defense order backlogs requires a dramatic transformation in production processes.11 Major contractors are successfully scaling manufacturing through advanced digital techniques.19 Programs like the Precision Strike Missile (PrSM) rely heavily on model-based design, digital twin technology, and net-centric, data-driven production environments.19

These tools enable rapid production surges without sacrificing reliability.19 LMT secured a $4.94 billion contract to rapidly transition PrSM to large-scale manufacturing, targeting 400 units annually.19 The ability to rapidly upgrade and integrate hardware (like PrSM) using digital engineering and software patches provides a sustained competitive advantage. This approach transforms defense contracting into a hybrid hardware/software service model, generating higher margin revenue long after the physical weapon system is delivered.

Space-Based Architecture Integration

Modern strategic deterrence demands resilient space-based capabilities for detection and communication. Lockheed Martin is actively constructing the Space Development Agency’s (SDA) Proliferated Warfighter Space Architecture (PWSA) transport layer satellites.22 This high-tech satellite network is essential for missile tracking, warning, and command communication. Investing in these space assets directly supports the credibility of the terrestrial nuclear deterrent, guaranteeing long-term R&D investment in high-value space contracts.

Science & Stockpile Stewardship: Policy vs. Technical Necessity

The directive to resume nuclear testing introduces profound long-term scientific and financial implications, challenging the established U.S. maintenance program.

The Stockpile Stewardship Contradiction

The U.S. has reliably maintained its nuclear arsenal since 1992 using the Science-Based Stockpile Stewardship (SSP) program.5 The SSP employs advanced computer simulations combined with vast historical test data to assess reliability.7 Critically, the NNSA Administrator and laboratory directors have annually certified for 27 years that “there is no technical reason to conduct nuclear explosive testing”.6

The decision to test is explicitly political, aimed at strategic signaling against perceived Russian and Chinese testing activity.3 If testing resumes, the law mandates certification that the objectives cannot be achieved through simulation and that they are vital enough to warrant ending the moratorium.7

Future Costs and Complexity

The resumption of testing significantly complicates the nuclear enterprise’s long-term cost profile. It demands immediate, substantial investment in specialized infrastructure remediation. This includes upgrading instrumentation and diagnostic capabilities at test sites, such as the Nevada National Security Site (NNSS).6 This specialized infrastructure work represents a unique, high-cost contracting opportunity for support service companies. Furthermore, analysts express concern that the NNSA’s development of new warhead designs, necessary for modernization programs like Sentinel and Columbia, will eventually generate technical demands for explosive testing.6 The October 2025 political order anticipates this technical necessity, creating a self-fulfilling prophecy that guarantees future research and eventual large-scale testing expenditures.

| Program Focus | FY2026 Budget Request | Key Contractor(s) | Strategic Rationale |

| B-21 Stealth Bomber (Procurement/R&D) | $10.3 Billion | Northrop Grumman (NOC) | Modernization of the Air Leg of the Nuclear Triad. 14 |

| Sentinel ICBM (R&D) | $4.1 Billion | Northrop Grumman (NOC) | Replacement for Minuteman III, ground-based deterrent continuity.[14, 23] |

| Columbia-Class Submarine (R&D/Procurement) | $11.2 Billion | General Dynamics, NOC | Sea-based deterrence capability (SLBMs), highest survivability.14 |

| Sea-Launched Cruise Missile (SLCM-N) (R&D) | $1.9 Billion | RTX Corporation (RTX) | Low-yield, flexible deterrent option capability.14 |

Cyber & Command Modernization: The Deterrent Shield

The reliability and credibility of the modernized nuclear triad depend critically on the survivability of its command systems. This necessity ensures extensive capital allocation to cybersecurity and advanced C3I solutions.

Modernizing Nuclear Command, Control, and Communications (NC3)

The modernization of the Nuclear Command, Control, and Communications (NC3) system is a foundational requirement for strategic deterrence.15 This colossal effort requires integrating robust cybersecurity, data analytics tools, automation, machine learning (ML), and artificial intelligence (AI).15 These technologies aid operators in faster decision-making and ensure system assurance under attack.24

Major defense contractors, including Northrop Grumman, are essential providers. They deliver generational advances in resilient networking, microelectronics, and electronic warfare systems necessary for sophisticated C3I.25

The JADC2 Imperative

The Department of Defense (DoD) is actively executing the Joint All-Domain Command and Control (JADC2) strategy.24 JADC2 aims to achieve real-time situational awareness and rapid decision support across all warfighting domains.24 This strategy demands massive investment in new concepts and sustained Science and Technology (S&T) development over many years.24

The success of strategic programs, such as the Sentinel ICBM and the B-21 bomber, depends entirely on their seamless integration into a resilient JADC2 architecture.15 Cyber warfare increasingly provides an outlet for low-level competition and information gathering.26 This recognition necessitates continuous investment in advanced defensive and offensive cyber capabilities. Operations targeting a state’s retaliatory nuclear capability are viewed as potential trigger events for escalation.27 This perception elevates cybersecurity from a simple IT requirement to a core strategic weapon system prerequisite. Defense contractors offering cyber-hardening and C3I solutions are therefore positioned for guaranteed, high-margin, long-term services contracts.28

Patent Analysis & Intellectual Property Valuation

The character of defense competition is rapidly evolving, moving toward proprietary intellectual property (IP), software, and dual-use technologies. Patent portfolios represent critical valuation metrics for investors in the A&D sector.

The Rising Value of Defense IP

Successful defense contractors achieve technological leadership, generate distinct revenue streams post-contract execution, and simplify international partnerships through aggressive patent protection.29 Defense patent valuation is complex, requiring analysis across military, legal, economic, and technical factors.30

The industrial shift toward software-based innovations, especially in Artificial Intelligence (AI) and autonomy, lowers the traditional entry barrier for agile newcomers.29 Despite this, established prime contractors are leveraging patents protecting complex systems integration (C3I/NC3), manufacturing processes, and advanced materials.29 This patent thicket protects the established competitive moat. Even if a newcomer wins a component contract, the prime controls the high-margin integration and long-term maintenance IP.

Dual-Use Technology and Competitive Intelligence

Dual-use technologies are those valuable for both defense and commercial markets.29 Investment in dual-use technology increased by 25% during a recent period.29 This growth is largely fueled by contractor Internal Research and Development (IRAD) funds.29 The use of model-based design and automation in programs like PrSM demonstrates the application of proprietary IP in manufacturing efficiency.19

Patent filings also serve as vital competitive intelligence. For example, Chinese military research institutions continue to cite Nvidia A100 chips in AI-related patent filings despite U.S. sanctions. This information reveals key technological reliance and potential supply chain vulnerabilities. The focus on IRAD-funded dual-use technology further diversifies the A&D IP portfolio, moving beyond reliance exclusively on government-funded contracts.

Investment Outlook and Conclusion

The investment thesis supporting A&D ETFs is structurally robust. The October 2025 strategic pivot has fundamentally altered the sector’s financial outlook. The directive to resume nuclear testing provides definitive validation for long-term revenue projections across the entire sector.

The U.S. response to Russian and Chinese advanced weapons demonstrations has effectively created a condition of permanent strategic competition.1 This environment eliminates uncertainty regarding future defense appropriations. The legally mandated, high-cost, multi-decade nuclear modernization programs Sentinel, B-21, and Columbia are structurally immune to typical discretionary budget cuts.14

Defense contractors demonstrate superior financial health, reporting solid earnings beats and unprecedented, record-setting backlogs.12 Maintaining technological superiority requires continuous, high-margin investment. These investments span hypersonics, AI-driven JADC2 modernization, and proprietary digital manufacturing processes.15 The convergence of geopolitical escalation, macroeconomic certainty, and rapid technological innovation cements the A&D sector as an essential, high-growth component of institutional portfolios. We maintain an assertive long-term bullish outlook for this sector.

References

- Pentagon to ‘immediately’ start testing US nuclear weapons, Trump orders ahead of meeting with Xi – The Economic Times

- PPA vs. XAR: Head-To-Head ETF Comparison – ETF Database

- Trump directs Pentagon to test nuclear weapons for the first time since 1992

- Why Nuclear Testing Stopped and What Trump’s Order to Resume Could Mean

- Stockpile stewardship – Wikipedia

- US Nuclear Weapons Tests | Congress.gov

- Requiring Technical Necessity for Explosive Nuclear Testing

- Defense Budgets in an Uncertain Security Environment – CSIS

- Global Defence Industry at a Critical Juncture: Strengthening Governance and Managing Risks Amidst Soaring Military Spending

- Profits of War: Top Beneficiaries of Pentagon Spending, 2020 – 2024 – Quincy Institute

- Lockheed Martin Increases 2025 Outlook on Strong Defense Demand and Record Backlog

- Lockheed Martin Reports Third Quarter 2025 Financial Results

- Defense Primer: Strategic Nuclear Forces | Congress.gov

- Trump Administration Increases Nuclear Weapons Budget – Arms Control Association

- War Department Continues Nuclear Modernization > U.S. Strategic …

- Aerospace & Defense ETFs in Focus This Earnings Season – October 23, 2025 – Zacks.com

- Lockheed Martin Boosts Outlook As Backlog Hits Record $179 Billion – Benzinga

- The Economic & Fiscal Impacts of U.S. Defense Spending in 2026 and Beyond

- Scaling Precision: How Lockheed Martin is Building the Arsenal for the Army’s Next-Generation Strike Missile

- Hypersonic Weapons: Background and Issues for Congress

- Hypersonics | Lockheed Martin

- Space-Based Missile Warning, Tracking & Defense – Lockheed Martin

- DOD C3 Modernization Strategy

- Modernizing Defense Technology | Northrop Grumman

- The Role of Cyber Conflict in Nuclear Deterrence | Article | The United States Army

- THE CYBER-NUCLEAR NEXUS: – UNIDIR

- Serving the U.S. Navy & Marine Corps | Amentum

- Protecting Defense Technology Innovations | Sterne Kessler

- Construction of National Defense Patent Value Evaluation Index System – Atlantis Press

- China’s next-generation weapons: AI, autonomy, and the race to outpace the U.S. | Ctech

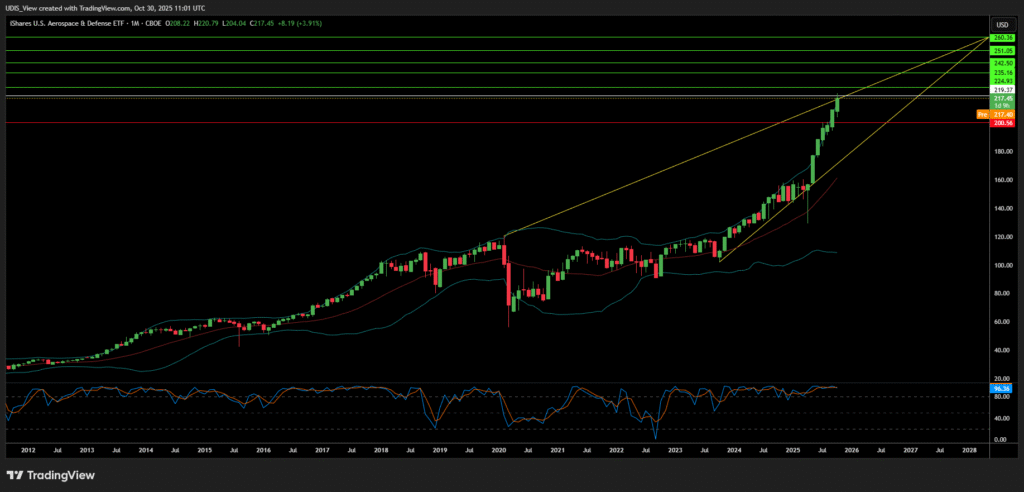

Aerospace & Defense ETF ITA Long (Buy)

Enter At: 219.37

T.P_1: 224.93

T.P_2: 235.16

T.P_3: 242.50

T.P_4: 251.05

T.P_5: 260.36

S.L: 200.56