Executive Thesis: Asymmetry in the Abyss

Nauticus Robotics (NASDAQ: KITT) represents a high-variance option on the future of ocean infrastructure. The company is currently executing a precarious pivot. It is moving from a speculative research entity toward a strategic industrial asset. This transition occurs against a backdrop of intensifying geopolitical friction.

The United States and China are locked in a race for critical minerals. The deep seabed has emerged as the new front in this “Blue Cold War.” Nauticus Robotics positions itself as the primary technological enabler for U.S. interests in this domain.

The investment thesis for Nauticus has evolved fundamentally since its SPAC merger. It is no longer simply an energy services play. The company has become a derivative bet on national security and resource independence. Macroeconomic forces act as a tailwind for its autonomous model. Inflation in the offshore energy sector drives demand for labor-saving robotics. Tight capital markets force operators to seek operational expenditure (OpEx) savings over capital expenditure (CapEx) investments.

However, the financial risks remain acute. The company’s balance sheet has required significant restructuring. Reliance on complex equity lines of credit introduces dilution risk. Compliance with NASDAQ listing standards has been a persistent struggle. Yet, the technology portfolio offers a unique defensive moat. The proprietary Aquanaut vehicle and Olympic Arm manipulator solve distinct physical problems. They bridge the gap between efficiency and capability in the underwater domain.

This report analyzes the convergence of these factors. We examine the geopolitical drivers pushing the U.S. toward seabed mining. We dissect the technical specifications that differentiate Nauticus from legacy dredging competitors. We scrutinize the financial engineering underpinning its survival. Finally, we assess the cyber-hardening required for these systems to operate in contested waters. The analysis reveals a company balancing on a knife-edge of execution risk and immense strategic potential.

Section I: The Geopolitical Imperative

The Strategic Vacuum in the Pacific

The primary external driver for Nauticus Robotics is not commercial market demand. It is the urgent requirement for supply chain security in the United States’ defense industrial base. The global economy relies heavily on seventeen rare earth elements. These minerals power everything from electric vehicle batteries to advanced missile guidance systems.

China currently exercises a near-monopoly over this supply chain. Estimates suggest Beijing controls over 80% of global rare earth mine production. Their dominance in processing capacity is even higher, nearing 90%. This dependency poses an existential threat to U.S. national security. A disruption in supply would cripple the production of high-tech weaponry. It would also stall the green energy transition.

The United States has recognized this vulnerability. The response has been a shift toward “resource nationalism.” This policy shift explicitly targets the deep seabed as an alternative source of these critical materials.

The Clarion-Clipperton Zone Competition

The geographic focal point of this competition is the Clarion-Clipperton Zone (CCZ). This vast fracture zone stretches across the Pacific Ocean between Hawaii and Mexico. It contains billions of tons of polymetallic nodules. These potato-sized rocks sit on the abyssal plain. They are rich in manganese, nickel, cobalt, and copper. The concentration of these metals in nodules often exceeds terrestrial ore grades.

China has moved aggressively to secure rights in this region. State-backed entities like the China Minmetals Corporation hold multiple exploration contracts with the International Seabed Authority (ISA). They have mapped thousands of square kilometers. Their deep-sea mining vehicles have already conducted retrieval tests. The United States holds no such contracts. The U.S. Senate has not ratified the United Nations Convention on the Law of the Sea (UNCLOS). This prevents American companies from sponsoring claims through the ISA mechanism.

The 2025 Executive Order

The geopolitical landscape shifted dramatically in April 2025. President Donald Trump signed the Executive Order titled “Unleashing America’s Offshore Critical Minerals and Resources“. This directive fundamentally alters the regulatory environment for Nauticus Robotics. The order declares seabed minerals a “core national security interest.” It commands federal agencies to expedite permitting for exploration.

The Executive Order directs the Department of Commerce to bypass the ISA where necessary. It invokes the Deep Seabed Hard Mineral Resources Act of 1980 to issue domestic licenses. This creates a parallel legal framework. It allows U.S. companies to operate in international waters under U.S. protection. This policy move de-risks the regulatory hurdles for American firms. It signals that the government will back private sector exploration efforts.

Nauticus as the Technological Enabler

Nauticus Robotics aligns its corporate strategy directly with this policy shift. In October 2025, the company announced a strategic initiative to enter the deep-sea mineral market. The logic is asymmetric. Traditional mining requires massive surface vessels and dredging equipment. These assets are expensive and vulnerable. They are also environmentally destructive, drawing ire from the international community.

Nauticus proposes a different approach. They utilize swarms of autonomous, electric robots. The Aquanaut platform can perform high-resolution surveys of nodule fields. It can identify high-yield clusters with precision. Future iterations could potentially harvest nodules with minimal sediment disturbance. This “surgical” extraction method offers political cover. It allows the U.S. to exploit these resources while claiming environmental stewardship.

The Cook Islands Proxy War

The competition is already active in the waters surrounding the Cook Islands. This Pacific nation controls a massive Exclusive Economic Zone (EEZ) rich in minerals. It has issued exploration licenses to multiple parties. China has signed cooperation agreements with the Cook Islands government. They are actively mapping the seabed. The United States has responded with “technical assistance.” A U.S. research vessel was deployed in late 2025 to map the same waters.

Nauticus Robotics views this as a prime market. Their technology allows for lower-cost mapping than traditional research vessels. Deploying Aquanaut units from shore or smaller boats reduces the logistical footprint. This capability allows the U.S. to project soft power by aiding Pacific nations in resource assessment.

Reducing Reliance on Chinese Processing

The strategic value of deep-sea nodules extends to processing. Terrestrial ores often contain high levels of radioactive contaminants like thorium. Removing these requires complex, toxic chemical processes. China dominates this dirty processing industry due to lax environmental standards. Deep-sea nodules are relatively clean. They require less energy-intensive refining. This offers a path to break China’s chokehold on the midstream supply chain. The U.S. Department of War is actively seeking such alternatives. Nauticus Robotics’ pivot is a bet on this supply chain reconfiguration. They anticipate that the federal government will subsidize the higher initial costs of deep-sea mining to ensure security of supply.

Section II: Macroeconomic Winds

The End of Cheap Capital

The macroeconomic environment of 2024 and 2025 reshaped the robotics industry. The era of zero interest rates ended. Capital became expensive. This punished “growth at all costs” business models. Companies like Nauticus Robotics faced a reckoning. They could no longer rely on endless equity raises to fund research and development. Investors demanded a path to profitability. The market punished companies with high cash burn rates. Nauticus stock suffered significantly during this correction. The company was forced to restructure its operations. They moved away from pure R&D contracts. The focus shifted to commercial revenue generation. This transition was painful but necessary for survival in a high-rate regime.

The Capex to Opex Shift

A distinct trend in the offshore energy sector favors the Nauticus business model. Oil majors and wind farm developers are under pressure to return cash to shareholders. They are slashing capital expenditures (Capex). They are reluctant to buy expensive new assets. They do not want to own fleets of ROVs. Instead, these giants prefer operational expenditure (Opex) models. They want to pay for a service. They pay for the data, not the robot. This aligns perfectly with the “Robotics as a Service” (RaaS) model. Nauticus owns and operates the fleet. The customer pays a day rate. This shifts the capital risk to Nauticus. It makes the service attractive to cash-conscious energy executives.

Inflation in the Offshore Sector

Inflation has hit the offshore industry hard. The cost of labor has skyrocketed. The “Great Crew Change” has left a demographic void. Experienced ROV pilots are retiring. Young talent is scarce. Wages for offshore personnel have hit record highs. Vessel costs have also surged. A fully crewed support vessel can cost over $100,000 per day. Fuel costs are volatile. These inflationary pressures squeeze the margins of energy companies. They are desperate for deflationary technology.

The Automation Arbitrage

Nauticus Robotics offers a solution to this inflation. The Aquanaut system is untethered. It does not require a massive support ship. It creates an arbitrage opportunity. The company replaces expensive human labor and diesel fuel with relatively cheap electricity and software. Nauticus estimates its system can reduce operational costs by 30% to 40%. It also reduces carbon emissions by eliminating the support vessel. This “green premium” is a secondary selling point. But the primary driver is economic. In a world of expensive labor and capital, automation is the only deflationary force available.

Interest Rates and Small Caps

The valuation of Nauticus is highly sensitive to Federal Reserve policy. As a small-cap growth stock, its future cash flows are discounted heavily when rates are high. The high-rate environment of 2024 suppressed its stock price. This made equity financing more dilutive. However, the rate outlook for 2026 appears more stable. Any stabilization in rates benefits long-duration assets like Nauticus. It lowers their cost of capital. It increases the present value of their future contracts. Investors must watch the yield curve closely. A steepening curve could signal better financing conditions for speculative tech firms.

Section III: Financial Engineering and Health

The Liquidity Crisis and Resolution

Nauticus Robotics faced a severe liquidity crisis in early 2025. Cash reserves dwindled. The company struggled to fund its operations. The burn rate was unsustainable. Net losses for 2024 totaled $134.9 million. Much of this was non-cash warrant accounting, but the operational cash outflow was real. The management team executed a series of maneuvers to survive. They utilized At-The-Market (ATM) offerings to raise cash. They aggressively converted debt into equity. In October 2025, they converted $3.7 million of debt. This diluted the shareholders but kept the company solvent. It also cleaned up the balance sheet, making the company more investable.

The $250 Million Equity Facility

The centerpiece of the company’s financial strategy is the $250 million Equity Line of Credit (ELOC). This facility was secured in October 2025. It acts as a financial backstop. It gives Nauticus the right to sell stock to an institutional investor over 24 months. The terms of this facility are strict. Issuances are capped at 19.99% of total outstanding shares unless shareholder approval is obtained. The investor cannot own more than 9.99% of the company at any time. This prevents a hostile takeover. It also limits the speed at which Nauticus can draw down funds.

Analysis of the ELOC Strategy

This facility is expensive in capital. The shares are typically sold at a discount to the market price. This creates constant selling pressure. However, it provides certainty of execution. Nauticus knows it has access to capital if needed. This “dry powder” is intended for strategic acquisitions. The company explicitly stated the funds would support the pivot to deep-sea mining. It allows them to acquire distressed assets or complementary technologies. In a fragmented market, this liquidity is a strategic weapon.

Revenue Trajectory and Volatility

Revenue growth has been volatile. In Q3 2025, revenue was $2.0 million. This was a massive increase from the $0.4 million in the prior year. However, it was a slight decline from the previous quarter. Management attributed this to strategic deferrals. The company is transitioning from “lumpy” R&D revenue to recurring commercial revenue. This transition creates noise in the quarterly numbers. Investors should focus on the contract backlog rather than quarter-to-quarter variance. The partnership with SeaTrepid provides a baseline of service revenue that stabilizes the cash flow.

NASDAQ Compliance Saga

Nauticus fought a prolonged battle to remain listed on the NASDAQ exchange. The stock price lingered below the $1.00 minimum bid requirement for months. The market capitalization also fell below the required threshold. Delisting would have been catastrophic. It would have cut off access to institutional capital. On December 19, 2025, Nauticus received formal notice of compliance. They satisfied the equity requirement of Listing Rule 5550(b)(1). This was a major victory. It removed the immediate threat of moving to the OTC markets. However, the company remains under a “Panel Monitor” through December 2026. Any future violation triggers immediate delisting. The company is on probation.

Section IV: Technological Moat

The Physics of the Aquanaut

The Aquanaut is the flagship technology. It solves a fundamental problem in hydrodynamics. Traditional AUVs are torpedo-shaped. They are efficient at cruising but cannot hover. Traditional ROVs are boxy. They can hover but create massive drag. They require a tether to the surface for power and control. Aquanaut is a transformer. It travels to the site in a streamlined AUV configuration. Upon arrival, the hull separates. The top half lifts to expose the control surfaces and manipulators. This changes the center of buoyancy. It allows the vehicle to hover with high stability.

Sensor Fusion and Perception

The vehicle operates autonomously using a suite of advanced sensors. It employs a Voyis Discovery 3D stereo camera. This provides high-resolution visual data. It also uses a structured light system. This projects a pattern onto the seabed to measure 3D distortions. The navigation package includes an iXblue Phins 6000 inertial navigation system. This provides military-grade positioning accuracy. A Nortek Doppler Velocity Log (DVL) measures speed over ground. These sensors feed into the ToolKITT software. The system builds a real-time voxel map of the environment. It can identify pipelines, valves, and obstacles without human input.

The Olympic Arm: Electric Innovation

The Olympic Arm is a critical differentiator. Most subsea manipulators are hydraulic. They use pressurized oil to move. They are powerful but inefficient. The pumps must run constantly, draining batteries. They are also prone to leaks, posing environmental risks. The Olympic Arm is fully electric. It uses linear actuators. These devices convert electrical energy directly into motion. They are oil-filled to withstand the crushing pressure of the deep ocean. However, the force generation is electromagnetic.

Advantages of Electric Actuation

This design offers several advantages. First, efficiency. The arm consumes power only when moving. This significantly extends the mission life of battery-powered robots. Second, precision. Electric motors provide exact force feedback. The software knows exactly how much torque is applied. This allows for delicate manipulation tasks that hydraulic arms cannot perform. Third, maintenance. Electric systems have fewer moving parts. They do not have hydraulic hoses that can burst. This reduces the mean time between failures. It lowers the total cost of ownership. The partnership with Forum Energy Technologies (FET) validates this technology. FET will manufacture the arm for the global market.

Acoustic Communications: Wavelink

Operating without a tether requires wireless communication. Radio waves are absorbed by water. Acoustic signals are the only viable option for long-range transmission. However, the bandwidth is extremely low. It is like trying to browse the internet over a 1990s dial-up connection. Nauticus developed Wavelink. This is a proprietary acoustic communication protocol. It utilizes delay-tolerant networking (DTN). The signal packets are robust against interference. In late 2025, Nauticus tested this system at 2,300 meters depth. The link held. This proves the system can operate in the deep ocean, covering 90% of global oil fields.

Edge Computing and AI

Because bandwidth is low, the robot cannot stream video to the surface for processing. It must “think” locally. The Aquanaut carries powerful edge computing hardware. It runs the AI algorithms onboard. The AI analyzes the sensor data in real-time. It decides what a hazard is and what a target is. It only sends high-level updates to the surface. It tells the operator “Valve turned” rather than streaming the entire video of the turn. This reduces the reliance on the acoustic link. It makes the system robust against communication dropouts.

Section V: Software as a Strategy

ToolKITT: The Operating System

ToolKITT is the software backbone. It is not just for the Aquanaut. It is a platform-agnostic operating system for subsea robotics. It uses behavior trees to manage autonomy. This architecture allows for complex, hierarchical decision-making. The software includes modules for every aspect of the mission. Commander handles mission planning. Helmsman executes the pathing and control. Wayfinder builds the environmental model. This modularity allows Nauticus to update individual components without rewriting the entire code base.

The Licensing Business Model

Nauticus has begun licensing ToolKITT to third parties. This is a high-margin business model. It decouples revenue from capital expenditure. Nauticus does not need to build the robot to make money. They just need to sell the software license. In 2025, ToolKITT was integrated into a SeaTrepid ROV. It successfully controlled the vehicle in a commercial operation. This proves the software works on legacy hardware. There are thousands of “dumb” ROVs in the world. Nauticus can upgrade them all. This retrofit market represents a massive, immediate revenue opportunity.

The Integration with SeaTrepid

The acquisition of SeaTrepid provided a testbed. Nauticus now has a fleet of vehicles to refine its software. They can iterate faster than competitors who rely on simulations. The feedback loop from offshore operators is immediate. This vertical integration also provides credibility. SeaTrepid is a respected operator. Their endorsement of ToolKITT carries weight in the industry. It proves the software is “field-ready,” not just a lab experiment.

Section VI: Cyber Warfare and Defense

The Underwater Cyber Front

The underwater domain is increasingly contested. Adversaries are actively mapping undersea cables. They are developing capabilities to disrupt subsea infrastructure. Security is no longer optional. It is a requirement. Acoustic networks are vulnerable. An adversary can jam the frequency. They can flood the water with noise, severing the link between the robot and the operator. More sophisticated attacks involve “spoofing.” An enemy could record a valid command signal and replay it later to confuse the robot.

Securing the Acoustic Link

Nauticus must harden its systems against these threats. Wavelink employs robust encryption. It uses rolling codes to prevent replay attacks. The system also verifies the timestamp of every command. If a signal is delayed or repeated, the robot ignores it. The company is also developing autonomous fail-safes. If the link is severed, the robot knows to return to a pre-set rendezvous point. It does not simply drift away. These “return to base” protocols are critical for defense applications.

CMMC Compliance

The U.S. Department of Defense requires strict cybersecurity standards. Contractors must achieve Cybersecurity Maturity Model Certification (CMMC). Level 2 or 3 certification is required for handling Controlled Unclassified Information (CUI). Nauticus is actively working toward these certifications. Compliance is a binary gate. Without it, the company cannot bid on major defense contracts. The Aquanaut systems must be auditable. The software supply chain must be secure. Keysight Technologies and other partners aid in this compliance process.

The AEMRV Program

The Defense Innovation Unit (DIU) has contracted Nauticus for the Autonomous Explosive Ordnance Disposal Maritime Response Vehicle (AEMRV). This robot is designed for mine countermeasures. It hunts for underwater mines. The AEMRV must be amphibious. It operates in the surf zone. It can crawl onto the beach to neutralize threats in the landing zone. This capability is unique. It supports the U.S. Marine Corps’ shift toward distributed littoral operations. The success of this program validates the dual-use nature of Nauticus technology.

Section VII: Patent Analysis and IP Moats

The Defensive Patent Portfolio

Nauticus Holdings Inc. holds a robust patent portfolio. These patents act as a defensive moat. They prevent competitors from easily copying the technology. The key patent is US 11,559,905. This covers the subsea manipulator with linear electric actuators. This patent protects the core mechanic of the Olympic Arm. It covers the specific arrangement of the electric motor and the oil-filled housing. Competitors cannot simply buy off-the-shelf actuators and build a copy. They would infringe on the Nauticus design.

Whole Body Control

Another critical area of IP is “whole body control.” Traditional ROVs treat the arm and the vehicle as separate systems. The pilot flies the vehicle, then stops to use the arm. Aquanaut integrates them. The thrusters compensate for the movement of the arm in real-time. Patents covering this control logic are vital. They prevent competitors from replicating the Aquanaut’s stability. US Patent 10,293,481 protects the sensor systems used to detect deflection and force. This ensures that Nauticus retains the lead in autonomous manipulation.

Inventor Pedigree

The patents list Nicolaus Radford as a primary inventor. Radford is a former NASA roboticist. He led the development of the Valkyrie humanoid robot. His pedigree lends technical credibility to the IP. It suggests the technology is derived from rigorous, space-grade engineering principles.

Section VIII: Scientific Context

Geology of the Abyss

The target of the new strategy is polymetallic nodules. These form over millions of years. Metals precipitate from seawater around a core, like a shark tooth or a shell fragment. They grow at a rate of millimeters per million years. The nodules in the CCZ are particularly rich. They contain high concentrations of nickel and cobalt. These metals are essential for lithium-ion batteries. The geology of the abyssal plain is flat and sediment-covered. This makes it ideal for robotic harvesting.

Environmental Controversies

Deep-sea mining is controversial. The abyssal plain is a unique ecosystem. It hosts slow-growing, long-lived species. Disturbing the sediment creates plumes. These plumes can smother marine life. Scientists warn that mining could cause irreversible damage. Biodiversity loss is a major concern. The Aquanaut platform offers a potential mitigation. Its precision allows for selective harvesting. It can theoretically pick up nodules without dredging the entire seafloor. Nauticus argues this is the “responsible” way to mine.

Comparative Impact

Nauticus positions its technology against terrestrial mining. Rainforests in Indonesia are being razed for nickel mines. Child labor is used in cobalt mines in the DRC. Deep-sea mining has zero human impact. It does not displace communities. It does not require deforestation. The company argues that the environmental cost of seabed mining is lower than land-based alternatives. This is a scientific and ethical debate. However, the strategic necessity of the minerals often overrides these concerns in Washington.

Section IX: Competitive Landscape

Traditional Dredging Giants

The incumbents in seabed mining are dredging companies. Allseas and Jan De Nul operate massive surface vessels. They use riser pipes to suck nodules to the surface. These systems are efficient at scale but environmentally destructive. Nauticus competes on precision. Their method is slower but cleaner. It may be the only method permitted in sensitive areas. The dredging companies have capital, but they lack the robotics expertise.

Subsea Robotics Competitors

In the robotics space, Oceaneering is the giant. They operate a massive fleet of ROVs. However, most are hydraulic and tethered. They are optimized for oil and gas support, not autonomous mining. Saab Seaeye is a strong competitor in electric robotics. Their Sabertooth AUV is a capable vehicle. However, Nauticus holds specific IP on the transformation mechanism. This gives Aquanaut a unique operational profile. It is a true hybrid, whereas competitors are often compromises.

The Chinese Threat

The real competition is China. Chinese state-owned enterprises (SOEs) are well-funded. They are developing their own deep-sea mining robots. They do not face the same funding constraints as Nauticus. However, U.S. policy favors domestic companies. The Trump administration’s “America First” approach to resources excludes Chinese firms. This protectionism shields Nauticus from direct Chinese competition in U.S. waters.

Section X: Strategic Outlook and Risks

Execution Risk in Mining

The pivot to mining is high-risk. The regulatory framework is still evolving. Environmental lawsuits could halt operations. The technology has not been proven at a commercial mining scale. Surveying is one thing; extraction is another. Nauticus must demonstrate it can scale the Aquanaut fleet. Building hundreds of robots requires manufacturing prowess. The partnership with FET helps, but integration risks remain.

Dilution and Shareholder Value

The financial structure is fragile. The reliance on the ELOC guarantees dilution. Long-term shareholders may see their ownership percentage shrink significantly. The company must grow its valuation faster than its share count to generate returns.

The Path to 2026

The year 2026 will be decisive. The NASDAQ compliance issue is resolved for now. The focus must shift to execution. The company needs to convert the SeaTrepid backlog into cash. It needs to secure the first government contracts for mineral exploration. Success depends on the convergence of policy and technology. If the Trump administration pushes ahead with seabed mining, Nauticus is perfectly positioned. If the policy stalls, the company falls back on its commercial services business.

Conclusion

Nauticus Robotics is a company transformed by necessity. It has shed its identity as a speculative SPAC. It has emerged as a strategic instrument of U.S. industrial policy. The pivot to autonomous deep-sea mining is a bold response to the geopolitical reality of the 2020s. The company leverages a unique technological stack. The Aquanaut vehicle, Olympic Arm, and ToolKITT software form a cohesive ecosystem. This ecosystem addresses the specific economic and physical constraints of the ocean domain. It offers a way to break the Chinese monopoly on critical minerals. Financial risks are abundant. Dilution is a certainty. However, the strategic upside is asymmetric. Nauticus offers investors a rare pure-play exposure to the intersection of robotics, defense, and resource nationalism. In the unfolding Blue Cold War, Nauticus Robotics provides the essential hardware for the front lines.

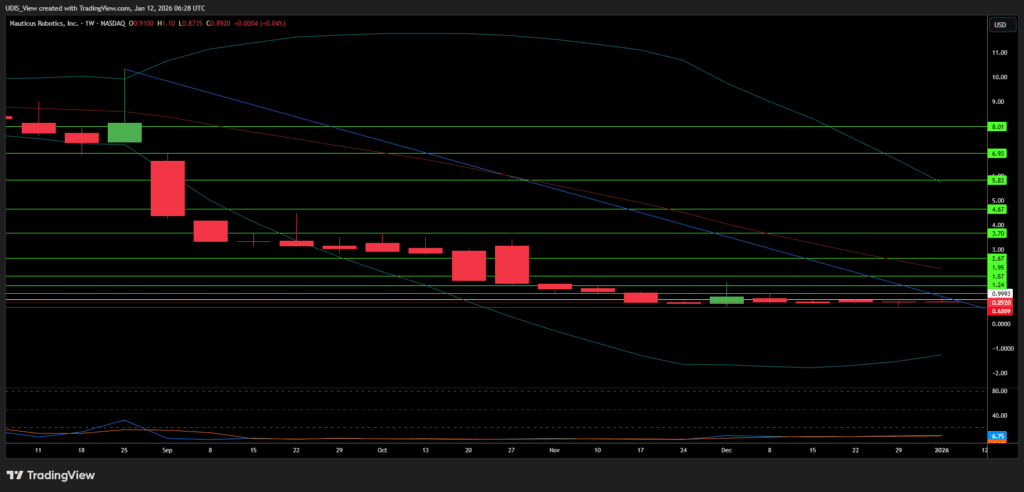

Nauticus Robotics Long (Buy)

Enter At: 0.9993

T.P_1: 1.2400

T.P_2: 1.5700

T.P_3: 1.9500

T.P_4: 2.6700

T.P_5: 3.7000

T.P_6: 4.6700

T.P_7: 5.8300

T.P_8: 6.9300

T.P_9: 8.0100

S.L: 0.6889