Mobileye Global Inc. (MBLY) recently secured a monumental agreement with a top-10 US automaker. This deal involves 9 million EyeQ6H chips for next-generation ADAS. Combined with a previous Volkswagen order, Mobileye now commands a 19-million-unit pipeline. Despite a 50% stock decline in 2025, this surge signals a strategic pivot. Investors now weigh this massive win against persistent geopolitical and macroeconomic headwinds.

Economic Transformation: From Chips to Platforms

The financial core of this deal rests on a shifting revenue model. Traditionally, Mobileye earned $40–$50 per basic safety chip. The new “Surround ADAS” platform moves this revenue per vehicle to $150–$200. This tripling of unit value provides a robust long-term cash flow. It creates a “network effect” as more vehicles join the fleet. This scale allows Mobileye to fund R&D without external capital raises. Analysts view this as a transition from a component supplier to a software-centric platform provider.

Technical Prowess: The Power of EyeQ6H

Mobileye’s EyeQ6H chip represents a significant leap in high-tech automotive science. The 7nm processor handles data from 11 sensors, including cameras and radars. Crucially, Mobileye opted to exclude expensive LiDAR sensors from this platform. This choice reduces costs for mass-market vehicles while maintaining high safety standards. The system supports hands-free highway driving up to 130 km/h. By consolidating functions into a single ECU, automakers simplify vehicle architecture and lower production expenses.

Geopolitical Resilience and Global Strategy

Mobileye faces unique geostrategy challenges due to its Israeli headquarters. With 3,000 of its 4,300 employees in Israel, the regional conflict impacts investor sentiment. CEO Amnon Shashua recently noted that security uncertainty affects company valuation. Simultaneously, the “China challenge” looms. Chinese rivals like Huawei and Xpeng are developing in-house solutions. Mobileye is responding by streamlining its workforce, recently laying off 200 employees. This 5% cut focuses resources on the most competitive technologies for 2026.

The IP Moat: Patents and Data Security

Mobileye’s competitive advantage lies in its Road Experience Management (REM™) technology. This system uses crowdsourced data from millions of vehicles to create high-definition maps. Patent analysis reveals a focus on vision-only fusion and “Responsibility Sensitive Safety” (RSS). These patents protect the company from competitors like Tesla and Nvidia. Furthermore, the software-defined architecture allows for over-the-air (OTA) updates. This keeps the vehicle’s cyber defenses and safety features current throughout its lifecycle.

The Verdict: A High-Stakes Turnaround

Mobileye is successfully democratizing advanced safety technology. The 19-million-unit commitment validates its “Surround ADAS” strategy. While 2025 was a “transition year” filled with inventory hurdles, the outlook for 2026 is brightening. The company offers a scalable, cost-effective alternative to full autonomy. This balance appeals to legacy automakers navigating the electric vehicle transition. If Mobileye executes its product launches on time, it may reclaim its position as the undisputed leader in automotive intelligence.

Mobileye’s EyeQ6H chip explained

This video provides a deep dive into the architecture and capabilities of the EyeQ6H chip, which is the central technology discussed in the article.

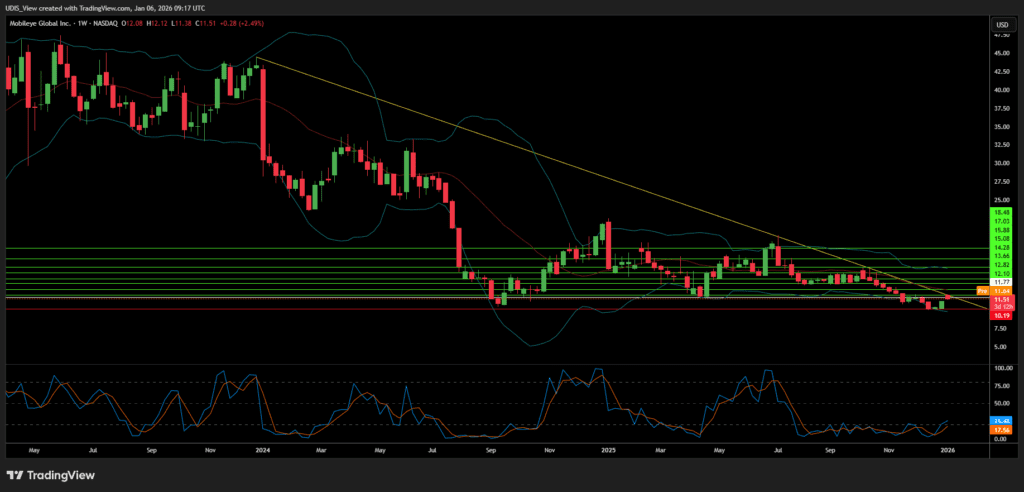

Mobileye Long (Buy)

Enter At:

T.P_1: 12.10

T.P_2: 12.82

T.P_3:13.66

T.P_4: 14.28

T.P_5: 15.08

T.P_6: 15.88

T.P_7: 17.03

T.P_8: 18.48

S.L: 10.19