Rocket Lab (NASDAQ: RKLB) is no longer just a “small-sat” story. The company capped 2025 with 21 successful Electron launches. Its shares surged nearly 175% year-to-date. 2026 represents a fundamental shift in valuation and strategic utility.

Geostrategy: The New Defense Prime

Rocket Lab has pivoted from a launch provider to a critical national security asset. The company recently secured a massive $816 million contract from the Space Development Agency (SDA). It will build 18 satellites for the Tranche 3 Tracking Layer. This mission targets hypersonic missile threats.

The U.S. government now views Rocket Lab as a primary defense contractor. Its vertical integration reduces reliance on fragile global supply chains. This “in-house” capability ensures mission readiness during geopolitical friction. By 2026, defense contracts will likely dominate the company’s revenue mix.

Technology: The Neutron Inflection Point

The Neutron rocket is the company’s most significant technological leap. Designed for medium-lift missions, it carries up to 13,000 kilograms to Low Earth orbit. Neutron targets the lucrative mega-constellation market. Its first test flight is slated for mid-2026.

Neutron features a unique “Hungry Hippo” fairing design. This innovation simplifies satellite deployment and booster recovery. The rocket uses the 3D-printed Archimedes engine. This technology reduces manufacturing complexity and costs. If successful, Neutron will directly challenge SpaceX’s Falcon 9 dominance.

Economics: EPS Growth and Peer Benchmarking

Analysts expect Rocket Lab to significantly outpace traditional aerospace giants in growth. While established firms show modest gains, Rocket Lab’s EPS growth forecast hits 52.2%. This trajectory highlights its transition from high-burn development to operational scaling.

| Company | Projected EPS Growth (2026) |

| Rocket Lab (RKLB) | ~52.2% |

| Blacksky Technology | ~48.7% |

| Airbus Group | ~20.9% |

| Lockheed Martin | ~0.6% |

| Northrop Grumman | ~-7.6% |

The company’s 2026 EPS is expected to reach ($0.27). This is a marked improvement from the 2025 losses. Revenue momentum from the Space Systems segment drives this narrowing gap. Investors are paying a premium for this rapid expansion compared to stagnant incumbents.

Macroeconomics: The SpaceX Valuation Anchor

A potential SpaceX IPO in mid-2026 could trigger a sector-wide revaluation. Analysts expect SpaceX to debut with a $1.5 trillion valuation. This event will force investors to reassess the entire aerospace sector.

Rocket Lab remains the only public, vertically integrated alternative to SpaceX. As the “valuation anchor” shifts, RKLB could see a significant price correction. Investors often look for “pure-play” space stocks during major industry liquidity events.

High-Tech Moat: Patent and Cyber Analysis

Rocket Lab maintains a formidable intellectual property moat. The company holds over 550 patents globally. These filings cover rocket injectors, electric turbopumps, and composite guide rails. This patent density prevents competitors from easily replicating their efficient launch platforms.

The company also leads in cyber-resilient space architecture. Their SDA Transport Layer satellites utilize encrypted communication networks. These systems protect vital military data from state-sponsored cyberattacks. Rocket Lab builds its hardware and software in-house to ensure end-to-end security.

Future Outlook

Rocket Lab enters 2026 with historic momentum and clear catalysts. Wall Street analysts have already raised price targets to as high as $90. The company is successfully bridging the gap between a startup and a global aerospace titan. Its evolution into a defense prime and the debut of Neutron are game-changers.

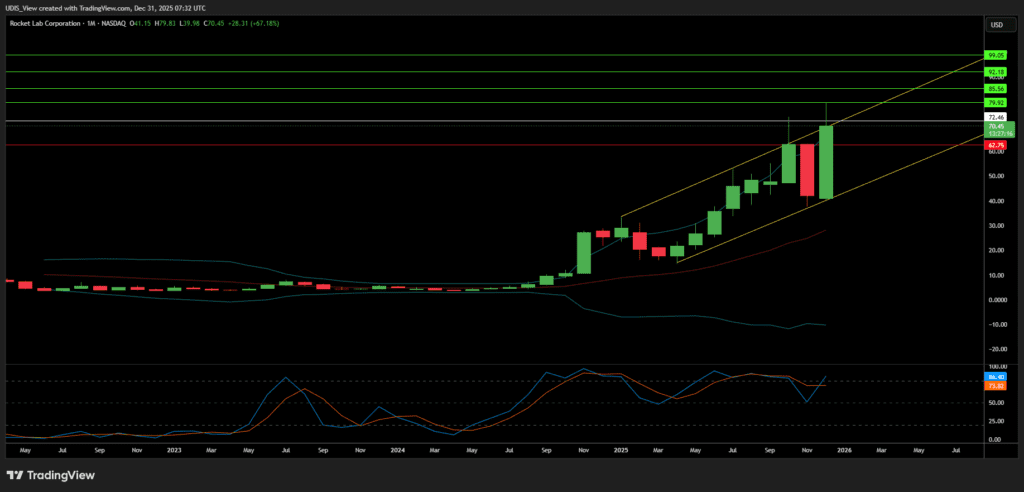

Rocket Lab Long (Buy)

Enter At: 72.46

T.P_1: 79.92

T.P_2: 85.56

T.P_3: 92.18

T.P_4: 99.05

S.L: 62.75