The convergence of geopolitical necessity, macroeconomic shifts, and technological maturity has positioned D-Wave Quantum Inc. (QBTS) for a potential valuation breakout in 2026. For years, the quantum computing sector operated on the fringes of speculative finance, driven by theoretical promises rather than tangible utility.

That paradigm has shifted. As 2025 closes, D-Wave stands distinct among its peers, possessing not only a scientifically validated roadmap but a commercial engine generating revenue growth of over 200%. The company has transitioned from a research-focused entity to a critical component of the U.S. defense industrial base and enterprise logistics infrastructure.

This report provides an exhaustive analysis of the factors driving D-Wave’s ascent. We examine the company through multiple lenses: the intensifying U.S.-China technology war, the strategic imperative of the “Huntsville Defense Corridor,” the macroeconomic rotation anticipated with 2026 interest rate cuts, and the granular technical superiority of quantum annealing in solving combinatorial optimization problems.

The thesis for a 2026 breakout rests on three foundational pillars supported by the data:

- Geostrategic Integration: D-Wave is no longer just a vendor; it is a strategic partner. The deployment of the Advantage2 system at Davidson Technologies in Huntsville, Alabama, integrates D-Wave directly into the U.S. missile defense and logistics architecture. In an era where the U.S.-China Economic and Security Review Commission warns of “Q-Day” threats, D-Wave’s technology provides immediate “bridge” capabilities for national security.

- Financial Fortification: The company’s balance sheet has undergone a radical transformation. With a cash balance exceeding $836 million and gross margins expanding to nearly 78%, D-Wave has eliminated the near-term liquidity risks that plague the deep-tech sector. This financial runway allows for aggressive R&D while competitors struggle for capital.

- Technological Supremacy in Optimization: While the broader industry chases universal gate-model computing, a goal potentially decades away from fault tolerance, D-Wave’s annealing technology is delivering commercial value today. Scientific benchmarking demonstrates that D-Wave’s systems outperform classical supercomputers and gate-based rivals in specific optimization tasks by orders of magnitude.

Investors have taken notice. The accumulation of shares by institutional heavyweights, including Citadel Advisors, signals a migration of ownership from retail speculation to high-conviction institutional holding. As the market rotates away from the “AI exuberance” of 2025 toward technologies that optimize energy and resource consumption, D-Wave’s ability to solve the “energy problem” of AI training positions it at the forefront of the next computational supercycle.

1. Geopolitics: The Quantum Arms Race

The valuation of deep technology companies can no longer be decoupled from the geopolitical landscape. The friction between the United States and the People’s Republic of China (PRC) has escalated into a structural conflict over “foundational” technologies. Quantum computing sits at the apex of this competition, recognized by both nations as the key to future military and economic dominance.

1.1 The “China Shock 2.0” and Economic Warfare

Global markets in 2025 face what economists term “China Shock 2.0,” Beijing’s attempt to export its way out of domestic stagnation through state-directed manufacturing surpluses. This flood of subsidized goods has forced Western nations to reconsider their industrial strategies, moving from efficiency-based global supply chains to resilience-based domestic production.

In this environment, optimization capability becomes a weapon. The ability to streamline logistics, optimize port loading, and manage complex supply chains is not merely a cost-saving measure; it is a requirement for economic survival against a competitor that controls critical mineral inputs and legacy semiconductor markets. D-Wave’s annealing technology addresses exactly this need. Unlike generative AI, which creates content, quantum annealing optimizes processes. It is the digital infrastructure required to counter the logistical weight of China’s manufacturing base.

The U.S. response involves the re-industrialization of the American homeland, a process heavily subsidized by federal spending. The U.S.-China Economic and Security Review Commission explicitly recommends the creation of a unified Economic Statecraft Agency and bold action to decouple supply chains. D-Wave’s suite of optimization tools fits squarely into this industrial policy, offering U.S. firms the computational edge needed to compete with China’s subsidized labor and state-owned enterprises.

1.2 The “Q-Day” Threat Vector

The geopolitical stakes extend beyond economics to existential security threats. “Q-Day,” the hypothetical date when a quantum computer can break current RSA and ECC encryption standards, drives national security policy. The Commission’s 2025 report states bluntly: “Whoever leads in quantum (and AI) will control the encryption of the digital economy… and gain persistent advantage in intelligence and targeting.”

China continues to outspend the U.S. in state-directed quantum research, with an estimated $15 billion allocated to national initiatives compared to the U.S. fragmented approach. China leads the world in Quantum Key Distribution (QKD) and has built a 2,000-kilometer quantum communication network. This asymmetry pressures the U.S. government to accelerate the adoption of “dual-use” technologies systems with both commercial and military applications.

D-Wave benefits from this urgency. While the “Q-Day” threat focuses on gate-model computers (which D-Wave is developing in parallel), the immediate need is for logistics supremacy. Modern warfare, as evidenced by conflicts in Eastern Europe and the Pacific, is a logistical exercise. Moving interceptors, fuel, and personnel efficiently across contested domains requires solving combinatorial optimization problems that overwhelm classical supercomputers. D-Wave’s immediate ability to solve these problems makes it a critical asset in the 2026 geopolitical theater.

1.3 Federal Funding and Policy Tailwinds

The U.S. government has mobilized capital to close the gap. The Department of Energy’s Quantum Leadership Act of 2025 proposes $2.5 billion in funding for the 2026–2030 period. This legislation specifically targets technologies that demonstrate “near-term utility,” a designation that favors D-Wave’s annealing approach over more theoretical modalities.

Furthermore, the defense establishment is moving from research grants to procurement contracts. The recommendation by the U.S.-China Commission to establish a “Quantum First” national goal by 2030 underscores the shift. D-Wave’s strategic pivot to establish a U.S. Government Business Unit and its compliance with national security protocols position it to capture a significant share of this allocated capital.

2. Geostrategy: The Huntsville Defense Corridor

Geostrategy examines how geography and strategic assets intersect. For D-Wave, the center of gravity has shifted from its Canadian roots to Huntsville, Alabama, a city known as “Rocket City” and the beating heart of the U.S. missile defense industry.

2.1 The Davidson Technologies Alliance

The partnership with Davidson Technologies represents the most significant geostrategic development for D-Wave in 2025. Davidson is not merely a reseller; it is a prime integrator for the Department of Defense (DoD), specializing in missile defense, aerospace, and intelligence. The installation of a D-Wave Advantage2 quantum computer at Davidson’s new global headquarters is a watershed moment. This is not a cloud access agreement; it is the physical deployment of hardware into a secure facility designed to run classified operations.

Table 1: Strategic Implications of Huntsville Deployment

| Strategic Asset | Description | Geostrategic Value |

| Physical Sovereignty | Hardware located on U.S. soil in a secure facility. | Enables processing of Top Secret/SCI data that cannot leave the secure perimeter. |

| Missile Defense | Co-development of “Interceptor Assignment” applications. | Rapid allocation of defensive assets against hypersonic threats. |

| Radar Scheduling | Optimization of phased-array radar resources. | Maximizes detection capabilities of existing hardware assets through superior software scheduling. |

| Supply Chain | Integrated logistics for contested environments. | Ensures resilience of military supply lines in the event of a Pacific conflict. |

2.2 Operational Stickiness in Defense

Defense contracting is characterized by high barriers to entry and extreme “stickiness.” Once a technology is integrated into a Program of Record (PoR), it becomes embedded in the operational doctrine of the military. By co-developing applications for interceptor assignment and radar scheduling, D-Wave and Davidson are embedding quantum annealing into the “Kill Chain”, the sequence of processes involved in detecting and neutralizing a threat. In a conflict scenario involving saturation attacks (e.g., swarms of drones or missiles), classical computers struggle to optimize defense allocation in real-time. D-Wave’s annealers excel at these specific combinatorial problems.

3. Macroeconomics: The 2026 Supercycle

The macroeconomic environment of 2026 is poised to serve as a powerful accelerant for deep technology stocks. After years of monetary tightening to combat inflation, global central banks are signaling a shift toward accommodation, reducing the cost of capital and fueling a rotation into high-growth assets.

3.1 Interest Rate Sensitivity and Valuation

Deep tech companies like D-Wave are “long-duration assets.” Their value is derived from cash flows expected far in the future. In a high-interest-rate environment (2023-2024), these future cash flows are heavily discounted, compressing valuations.

Forecasts for 2026 indicate a favorable shift. Deloitte’s global outlook projects inflation stabilizing and borrowing costs falling. State Street Global Advisors projects 75 basis points of Fed cuts in 2025, with growth improving in 2026 as supportive policies take hold. As the “risk-free rate” (yield on Treasury bonds) declines, the discount rate applied to D-Wave’s future earnings drops, mathematically increasing the stock’s intrinsic value.

Furthermore, Vanguard’s outlook suggests that while the “AI exuberance” may face headwinds due to valuation concerns, the broader tech innovation cycle remains intact. Capital is expected to rotate from over-crowded trades (like established AI giants) into emerging “picks and shovels” plays that enable the next phase of efficiency. D-Wave, offering energy-efficient optimization, fits this thesis perfectly.

3.2 The Energy Crisis of AI

A critical macroeconomic driver for 2026 is the energy constraint on Artificial Intelligence. The explosion of Generative AI has placed unprecedented demands on global power grids. Data centers are hitting capacity limits, and the cost of electricity is becoming a primary bottleneck for AI scaling. D-Wave positions itself as the solution to this “energy problem.”

- Energy Efficiency: Quantum annealing uses a fraction of the power required by classical GPU clusters to solve the same optimization problems.

- Green Computing: As regulatory frameworks in the EU and U.S. begin to mandate carbon efficiency for data centers, D-Wave’s technology offers a path to compliance without sacrificing performance.

4. Financial Analysis: The Breakout Metrics

The most compelling argument for D-Wave’s 2026 breakout is found in its financial statements. The company has successfully navigated the “Valley of Death” that claims many hardware startups, emerging in late 2025 with a fortified balance sheet and accelerating revenue.

4.1 Revenue Acceleration and Quality

D-Wave’s Q3 2025 results shattered expectations. The company reported $3.7 million in quarterly revenue, a 100% year-over-year increase. Year-to-date revenue reached $21.8 million, up 235% from the prior year. This is not linear growth; it is exponential adoption.

The quality of this revenue is high. The transition to the Leap™ cloud service model generates recurring subscription revenue with software-like gross margins.

- Gross Margin Expansion: GAAP gross margin expanded to 71.4% in Q3 2025, up from 55.8% the previous year. Non-GAAP gross margin hit 77.7%. These margins are characteristic of mature SaaS (Software as a Service) companies, not hardware manufacturers, indicating that D-Wave has successfully monetized its cloud delivery model.

4.2 The Capital Injection

Perhaps the most shocking metric in the 2025 financial data is the cash balance. D-Wave reported a record cash balance of over $836 million, a 2,700% increase year-over-year. This massive capital injection, likely stemming from equity offerings and strategic investments, fundamentally changes the company’s risk profile.

- Bankruptcy Risk Eliminated: The primary bear case for D-Wave was that it would run out of cash before achieving commercial scale. With $836 million, the company has a multi-year runway to execute its roadmap without further dilution.

- R&D Aggression: This capital allows D-Wave to accelerate the development of its “Fluxonium” gate-model program while simultaneously scaling sales and marketing for the Advantage2 annealing system.

4.3 Institutional Validation: The Citadel Signal

In Q3 2025, Citadel Advisors, led by billionaire Ken Griffin, increased its stake in D-Wave by over 200%, acquiring 122,600 additional shares. While Citadel’s position is a small fraction of its total portfolio, the signal is significant. Citadel is known for rigorous quantitative and fundamental analysis. Their entry suggests that D-Wave’s valuation has become attractive relative to its growth potential and that the “smart money” is positioning for a re-rating of the stock.

4.4 Comparative Valuation

Comparing D-Wave to its primary pure-play competitors, IonQ and Rigetti Computing, reveals distinct value propositions.

Table 2: Comparative Financial Metrics (2025 Estimates)

| Metric | D-Wave Quantum (QBTS) | IonQ (IONQ) | Rigetti Computing (RGTI) |

| Technology Focus | Annealing (Primary) + Gate (R&D) | Trapped Ion Gate-Model | Superconducting Gate-Model |

| YTD Revenue Growth | +235% | +222% | Flat/Declining |

| Gross Margin | ~78% (Non-GAAP) | ~8.9% | ~21% |

| Cash Balance | ~$836M | ~$3.5B (Pro Forma) | ~$600M |

| Analyst Sentiment | Buy/Outperform (14 Analysts) | Mixed/Hold | Moderate Buy |

Analysis: D-Wave trades at a discount to IonQ despite having significantly higher gross margins (78% vs 9%). The market has historically placed a premium on IonQ’s “general purpose” gate-model promise. However, as D-Wave demonstrates commercial utility now, this valuation gap is likely to close.

5. Technology: The Annealing Advantage

To understand the bullish case for D-Wave, one must understand the physics of Quantum Annealing. While the media focuses on “Gate-Based” systems (the approach taken by IBM, Google, and IonQ), annealing is the only quantum technology currently capable of solving industrial-scale optimization problems.

5.1 The Physics of Optimization

Quantum annealing works by mimicking nature’s tendency to find low-energy states. Imagine a landscape of peaks and valleys, where the deepest valley represents the optimal solution to a complex problem (e.g., the most efficient delivery route for a global fleet).

- Classical Computers: Must “climb” over every peak to find the next valley, a process that takes exponential time as the problem grows.

- Quantum Annealing: Uses quantum tunneling to pass through the hills, locating the global minimum almost instantly.

This capability is not theoretical. It is purpose-built for Combinatorial Optimization, a class of problems that underpins logistics, finance, and drug discovery.

5.2 The Zephyr Topology and Advantage2

The 2026 breakout is technically underpinned by the rollout of the Advantage2 system. This hardware features a new processor architecture called Zephyr.

- Connectivity: Zephyr increases qubit connectivity from 15-way to 20-way. Higher connectivity allows more complex problems to be mapped onto the chip with fewer overheads, effectively increasing the system’s computational power.

- Coherence: The new chips boast a 2x increase in coherence time and a 75% reduction in noise. Lower noise means a higher probability of finding the exact optimal solution rather than just a good one.

- Scale: With 4,400+ qubits, Advantage2 operates at a scale that gate-model computers (struggling to pass 100 logical qubits) cannot touch for at least another decade.

5.3 Scientific Supremacy

In 2025, a landmark research paper validated D-Wave’s superiority. The study compared D-Wave’s annealers against the Quantum Approximate Optimization Algorithm (QAOA) running on IBM’s gate-model processors.

- The Result: D-Wave “vastly outperformed” the gate-based approach in both speed and solution quality.

- Simulation Power: In simulations of “spin glasses” (complex magnetic materials), D-Wave’s system performed calculations in minutes that would take the Frontier Supercomputer (the world’s fastest classical machine) millions of years to simulate.

This data point is critical. It proves that for specific, commercially valuable problem sets, D-Wave is not just better than other quantum computers; it is better than the best classical supercomputers in existence.

6. The Gate-Model Pivot: The “Clarity” Roadmap

Critics often argue that annealing is a niche technology and that the future belongs to universal gate-model computers. D-Wave has addressed this criticism by launching its own gate-model program, ensuring it remains relevant regardless of which architecture ultimately wins.

6.1 Fluxonium Qubits

Unlike IBM and Google, which use “Transmon” qubits, D-Wave is building its gate-model computer using Fluxonium qubits.

- Why Fluxonium? These qubits offer significantly longer coherence times and higher “anharmonicity,” which makes them less prone to errors.

- Validation: D-Wave has demonstrated fluxonium qubits with relaxation times exceeding 100 microseconds, comparable to the best academic results globally.

6.2 The NASA JPL Partnership

D-Wave is not building this alone. The company has entered a strategic development initiative with NASA’s Jet Propulsion Laboratory (JPL). The goal is to master “cryogenic packaging” and superconducting interconnects. Scaling a quantum computer requires wiring thousands of qubits together in a frozen vacuum. NASA JPL’s expertise in deep-space electronics is being leveraged to solve these physical engineering hurdles.

7. Commercial Utility: Beyond the Lab

The defining characteristic of D-Wave in 2026 is the transition from “science project” to “production infrastructure.” The company’s presence at CES 2026 as a sponsor of the “CES Foundry” underscores this shift toward mainstream commercial adoption.

7.1 Logistics and Manufacturing

This sector represents the immediate “killer app” for quantum annealing.

- Pattison Food Group: Used D-Wave to optimize driver scheduling, reducing manual effort by 80%.

- BASF: Optimized a liquid filling facility, reducing production scheduling time from hours to seconds.

- Ford Otosan: Accelerated vehicle production scheduling by 83%.

These are not abstract experiments. They are operational improvements that directly impact the P&L of Fortune 500 companies.

7.2 Life Sciences and Quantum AI

The intersection of Quantum and AI is a major theme for 2026.

- Japan Tobacco is using D-Wave’s hybrid solvers to accelerate the training of Generative AI models for drug discovery. The system helps identify “first-in-class” small molecules faster than classical AI alone.

- The “Hybrid” Advantage: D-Wave’s hybrid solvers allow customers to tackle problems with up to 2 million variables. This allows pharma companies to model complex molecular interactions that were previously computationally intractable.

7.3 Financial Services

The financial sector is adopting D-Wave for portfolio optimization and risk analysis.

- Mastercard & Yapi Kredi: Are exploring quantum applications for fraud detection and customer targeting.

- Risk Scoring: In volatile markets, the ability to re-calculate risk exposure across a global portfolio in near real-time (sub-second) offers a distinct competitive advantage to algorithmic traders and risk managers.

8. Cyber & Blockchain: The “Proof of Quantum Work.”

An emerging and under-appreciated catalyst for 2026 is D-Wave’s entry into the blockchain and cybersecurity domain. As digital assets become institutionalized, the energy cost and security vulnerabilities of classical blockchain consensus mechanisms are coming under scrutiny.

8.1 The “Proof of Quantum Work” Mechanism

D-Wave has published research and demonstrated a new consensus mechanism called “Proof of Quantum Work”. The system uses quantum annealing to generate and validate blockchain hashes.

- Benefit 1 (Energy): It requires a fraction of the electricity used by classical Proof of Work (Bitcoin), solving the ESG concerns preventing large-scale institutional adoption of crypto assets.

- Benefit 2 (Security): By offloading the hashing to a quantum processor, it creates a layer of security that is resistant to classical brute-force attacks.

8.2 Distributed Quantum Networks

In a groundbreaking demonstration, D-Wave deployed this blockchain architecture across four distributed quantum computers located in Canada and the U.S. This proved that quantum computers can be networked to validate transactions, laying the groundwork for a future “Quantum Internet.” This capability positions D-Wave as a potential infrastructure provider for Central Bank Digital Currencies (CBDCs) or secure inter-bank clearing networks.

9. Patent Analysis: The IP Moat

Behind the commercial success lies a formidable intellectual property fortress. D-Wave holds one of the top three quantum patent portfolios globally.

Table 3: Intellectual Property Overview

| Asset Class | Count | Strategic Relevance |

| Granted U.S. Patents | 240+ | Protects core annealing architecture and hybrid solver methods. |

| Pending Patents | 100+ | Covers emerging gate-model designs and fluxonium control systems. |

| Scientific Papers | 240+ | Validates technology through peer review; establishes academic dominance. |

| Human Capital | 43 PhDs | A density of talent that is difficult for competitors to replicate in a labor-constrained market. |

This patent portfolio does two things:

- Freedom to Operate: It ensures D-Wave can innovate without fear of litigation.

- M&A Appeal: In the event of industry consolidation, D-Wave’s IP library makes it an attractive acquisition target for hyperscalers (Amazon, Google, Microsoft) looking to secure their quantum future.

Conclusion: The Asymmetric Opportunity

As 2026 dawns, D-Wave Quantum Inc. represents a rare asymmetry in the public markets. It is a deep-tech company priced for skepticism but delivering results that demand conviction.

The “Quantum Winter” that suppressed valuations in 2023-2024 has thawed. The catalyst was not a single breakthrough, but a convergence:

- Geopolitically, the U.S. government needs D-Wave to secure its supply chains and missile defenses against a rising China.

- Financially, the company has secured a cash fortress of ~$836 million, removing the existential risk that keeps institutional investors away.

- Technologically, annealing has proven itself superior to classical systems for the optimization problems that run the global economy today.

For the investor, D-Wave in 2026 offers exposure to the three most critical themes of the decade: Defense, AI Efficiency, and Industrial Re-shoring. It is no longer a question of if quantum computing will arrive. It is here, humming in a secure facility in Huntsville, Alabama, optimizing the systems that keep the world moving. The market is just beginning to realize it.

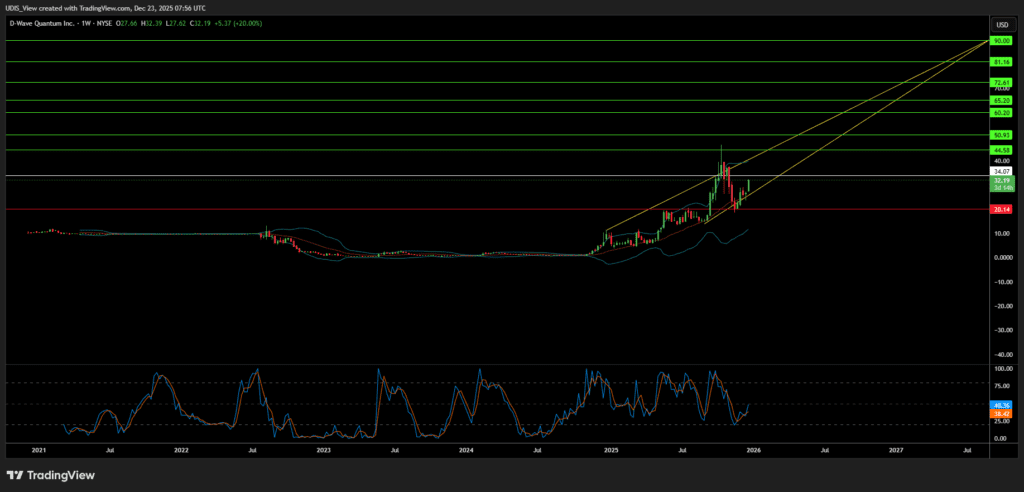

D-Wave Long (Buy)

Enter At: 34.07

T.P_`1: 44.58

T.P_2: 50.93

T.P_3: 60.20

T.P_4: 65.20

T.P_5: 72.61

T.P_6: 81.16

T.P_7: 90.00

S.L: 20.14