The Argentine Peso (ARS) enters 2026 at a defining historical inflection point. President Javier Milei’s administration has fundamentally re-engineered the nation’s macroeconomic architecture. The strategy prioritizes strict fiscal anchors over traditional monetary intervention.

This report analyzes the Peso’s trajectory through a multi-domain lens. We examine the interplay of geopolitical realignment, energy export surges, and technological disruption. Financial stabilization has been achieved through a historic fiscal surplus. However, this stability comes at the cost of “scienticide” in the public innovation sector.

The Peso is transitioning from a distressed asset to a commodity-backed currency. This shift relies heavily on the Vaca Muerta energy formation and lithium reserves. Simultaneously, the administration is dismantling protectionist barriers for technology imports. This move threatens local assembly industries but promises to modernize the digital economy.

Our analysis reveals a tension between short-term financial success and long-term cognitive atrophy. Investors must weigh the benefits of the US-aligned trade framework against social risks. The new inflation-linked currency bands for 2026 signal a move toward normalization. We provide an exhaustive evaluation of these conflicting forces shaping the Peso’s future.

1. Macroeconomic Architecture: The Anchor of Stability

The Fiscal Surplus Paradigm

The primary driver of Peso stabilization is the unwavering commitment to fiscal surplus. Argentina achieved a primary and financial surplus in 2024 for the first time since 2006. The government recorded a fiscal surplus of 1.8% of GDP in 2024.

This reversal marks a decisive break from decades of chronic deficit spending. The “zero deficit” rule acts as the central anchor for market expectations. It eliminates the treasury’s need to monetize debt through central bank emission. Stopping the “money printer” addresses the root monetary cause of Argentina’s inflation. Market confidence stems directly from this demonstrable fiscal discipline.

Projections for 2025 estimate a primary surplus of 1.6% of GDP. The 2026 outlook targets further consolidation to a 1.7% surplus. This fiscal rigor reduces the sovereign risk premium embedded in the currency. Bond markets have rewarded this austerity with yield compression. The surplus allows the government to service debt without depleting reserves and creates a floor for the Peso by limiting the supply of unbacked currency. Investors view the surplus as the “proof of work” for the administration’s strategy.

Inflation Dynamics and Monetary Emission

Inflation has plummeted from hyperinflationary levels to manageable monthly rates. Annual inflation exceeded 211% in 2023, threatening total currency collapse. By late 2025, monthly inflation rates stabilized around 2%.

This disinflation restores the Peso’s function as a transactional store of value. However, the “crawling peg” devaluation strategy created friction in 2024. The peg moved at 2% monthly, often lagging behind domestic inflation. This caused a real appreciation of the Peso in effective terms. Argentina became expensive in dollar terms, squeezing export competitiveness. The “Blue Dollar” gap narrowed, but capital controls (“cepo”) remained a distortion.

The Central Bank (BCRA) has shifted focus to remonetizing the economy. Money demand is rising as inflation expectations become anchored. The BCRA plans to expand the monetary base from 4.2% to 4.8% of GDP by end-2026. This expansion is backed by hard asset accumulation, not fiscal dominance. The strategy relies on the private sector voluntarily holding more Pesos.

The New Monetary Regime: January 2026

A pivotal policy shift occurs on January 1, 2026. The BCRA will implement inflation-linked currency trading bands. This mechanism replaces the rigid crawling peg of previous years. The new system adjusts the exchange rate floor and ceiling based on inflation. Specifically, bands adjust based on the inflation rate from two months prior.

This prevents further real appreciation of the exchange rate. It aims to maintain export competitiveness without triggering discrete devaluation shocks. Importers gain predictability regarding future replacement costs. Exporters receive a signal that the currency will not lag indefinitely behind costs. The policy aligns with IMF recommendations to unwind foreign exchange restrictions. It represents a transition from a rigid nominal anchor to a real-variable managed float. This flexibility is crucial for absorbing external shocks without depleting reserves.

Reserve Accumulation Strategy

The Achilles’ heel of the Peso remains the Central Bank’s net reserve position. Milei inherited negative net reserves exceeding $11.5 billion in late 2023. Rebuilding this liquidity buffer is essential for lifting capital controls. The 2026 plan involves purchasing up to $10 billion to $17 billion in reserves.

This accumulation is tied directly to the remonetization strategy. As the economy demands more Pesos, the BCRA sells Pesos and buys Dollars. This allows reserve growth without inflationary emission, provided demand is genuine. The IMF has supported this approach with a waiver on previous targets. Success depends on sustained trade surpluses from energy and agriculture. Any external shock to commodity prices could derail this delicate mechanism. The “credibility trap” remains a risk if reserve targets are missed. Markets continuously test the BCRA’s ability to defend the new bands. Accumulating reserves is the only path to eventually floating the currency.

Macroeconomic Indicators Forecast (2025-2026)

| Indicator | 2024 Value | 2025 Forecast | 2026 Forecast | Source |

| Fiscal Balance (% GDP) | +1.8% (Surplus) | +1.6% | +1.7% | Link |

| GDP Growth | -1.7% | +3.5% | +3.5% | Link |

| Annual Inflation | >200% | Decelerating | <20% | Link |

| Monetary Base (% GDP) | 4.2% | 4.5% | 4.8% | Link |

| Reserve Accumulation | Recovery Phase | Positive Flow | +$10B Target | Link |

2. Sovereign Debt and Financial Re-Entry

Returning to International Markets

Argentina prepares to re-enter global debt markets in early 2026. The government targets a bond issuance of approximately $4.1 billion. This capital is required to service maturities of $4.5 billion due in January 2026.

Accessing voluntary credit markets is a key validator of the normalization strategy. It marks the end of the default/restructuring cycle that plagued the country post-2020. Yield compression is the prerequisite for this strategic move. Spreads must fall below 1,000 basis points to make borrowing sustainable. Investors demand high yields but acknowledge the structural fiscal changes. A yield below 10% is cited as the “magic number” for market re-entry. Successful issuance would provide a “bridge” to roll over debts, preventing the depletion of scarce reserves for debt service.

IMF Relations and the EFF

The relationship with the IMF has shifted from contentious to cooperative. The Fund approved a $20 billion Extended Fund Facility (EFF) in April 2025. This program supports the stabilization plan and structural reforms. Key pillars include the fiscal anchor, FX flexibility, and anti-corruption measures. Disbursements of $12 billion were immediate, stabilizing the balance of payments.

However, the IMF continues to press for the dismantling of the “cepo”. The Fund warns that controls distort investment decisions and hinder long-term growth. Negotiations for 2026 focus on the pace of this liberalization. US support within the IMF board has been crucial for securing waivers. The IMF views the inflation-linked bands as a positive step toward normalization. Continued compliance with fiscal targets is non-negotiable for the program.

3. Geopolitics and Geostrategy: The Western Alignment

The Milei-Trump Axis

The geopolitical stance of Argentina has swung decisively toward the United States. President Milei’s ideological alignment with the Trump administration is a strategic asset. This alliance unlocked financial support and shielded Argentina from aggressive IMF pressure.

A “Framework for a United States-Argentina Agreement on Reciprocal Trade” was signed in Nov 2025. This framework reduces tariffs and non-tariff barriers for US products and aligns Argentina’s economic security policies with US interests. Specific commitments include cooperation on critical minerals and supply chains. This serves as a counterweight to Chinese influence in the Southern Cone. The alignment reduces the political risk premium embedded in Argentine assets. Investors view US backing as an implicit guarantee of institutional stability. The agreement includes provisions to combat “non-market policies,” a veiled reference to China. Argentina accepts US FDA certifications, streamlining medical imports.

The China Dilemma

The pivot to the US creates friction with China, a major trade partner. Milei campaigned on “getting China out,” but economic reality forces pragmatism. The US Treasury has signaled it wants to help Argentina reduce its reliance on Beijing. Yet, China renewed a vital $5 billion currency swap in mid-2025. This swap acts as a critical lifeline for reserves and trade settlement.

Agricultural exports (soy, beef) remain heavily dependent on Chinese demand. The administration walks a tightrope: political distance but commercial engagement. Retaliatory risks from China could target soy purchases, hurting the trade surplus. Brazil’s deepening ties with China contrast sharply with Argentina’s stance. This divergence complicates regional integration but clarifies Argentina’s specific value proposition. Argentina positions itself as the reliable Western partner in a “pink tide” region.

Regional Tensions and Mercosur

Argentina’s unilateral trade opening strains the Mercosur bloc. The government reduced tariffs on technology and capital goods without a bloc consensus. Brazil and Uruguay have pursued their own distinct trade agendas. Tensions rise over the influx of cheap imports affecting regional industries.

However, the EU-Mercosur deal, finalized in late 2024, offers a potential anchor. Ratification faces hurdles from European farmers and environmental clauses. Argentina’s dismissal of the “2030 Agenda” conflicts with EU environmental requirements. Yet, the strategic necessity of the deal for EU supply chains keeps it alive. Mercosur is evolving from a customs union into a looser de facto free-trade area. Brazil has responded by expanding its own list of tariff exceptions. The bloc is fractured, but trade flows remain essential for all members.

4. Sector Analysis: Energy as the New Sovereign

Vaca Muerta and the RIGI

Energy is the structural game-changer for the Argentine Peso. The Vaca Muerta shale formation is driving a massive reversal in the energy trade balance. Oil and gas exports are projected to turn Argentina into a net creditor of dollars. The “Large Investment Incentive Regime” (RIGI) is the legal catalyst. RIGI offers 30-year fiscal stability, tax cuts, and FX access for projects >$200M. This specifically targets LNG terminals, pipelines, and mining infrastructure.

Investments under RIGI for LNG alone total $6.8 billion in the first phase. Oil production is forecast to grow 13% in 2025 to 805,000 barrels per day. Gas production aims for 143 million cubic meters per day. These exports provide the hard currency needed to stabilize the Peso structurally. The energy surplus reduces the economy’s vulnerability to agricultural droughts and fundamentally alters the balance of payments equation for the next decade.

LNG: The Export Horizon

A landmark project by YPF and Petronas/Eni aims to liquefy and export gas. Exports are expected to reach $300 billion cumulatively between 2031 and 2050. This changes Argentina’s macroeconomic constraint from “dollar scarcity” to abundance. Infrastructure build-out (pipelines) is the immediate bottleneck. US diplomatic support facilitates the financing of this critical infrastructure. Energy security for Europe and Asia positions Argentina as a strategic global supplier. The project entails an $85 billion total investment through 2050.

5. Sector Analysis: Mining and Critical Minerals

The Lithium Triangle

Argentina sits atop the world’s most promising lithium reserves. Mining exports are projected to reach $5.5 billion in 2025. Lithium contributes 14% of this total, with massive growth potential. Copper projects like Los Azules are attracting billions in RIGI-protected investment. Total mining investment could reach $51.9 billion by 2035.

These minerals are essential for the global energy transition and EV batteries. The US-Argentina trade framework explicitly prioritizes critical mineral cooperation. This sector insulates the Peso against agricultural drought cycles and diversifies the export basket, reducing volatility in foreign exchange inflows. Gold currently contributes 69% of mining exports, but lithium is the growth engine.

6. Technology and Innovation: The “Scienticide” Crisis

Defunding CONICET

While financial sectors thrive, the scientific apparatus faces an existential crisis. The administration views public science as a source of fiscal waste. CONICET, the premier research council, suffered a ~40% real budget cut. Administrative staff were laid off, and research grants (PICT) were frozen or canceled.

Nobel laureates and global bodies have condemned this “scienticide”. The ideological stance frames science as a private market activity, not a public good. Laboratories lack funds for basic reagents and equipment maintenance. This erodes the “knowledge economy” foundation that supports high-value exports. Specific projects, such as cancer research and agricultural genetics, are paralyzed. The dismissal of 1,000 staff members represents 9% of the CONICET workforce.

Brain Drain and Human Capital

The immediate consequence is a massive brain drain. Salaries for researchers fell by ~30% in real terms, pushing many into poverty. Ten percent of CONICET researchers have already left the system. Young scientists are emigrating to Europe, the US, and Brazil. Resignations rose 33% in 2024 compared to the previous year. This loss of human capital is a lagging indicator for economic decline. Researchers are taking jobs as Uber drivers or electricians to survive. The economic value of this lost talent exceeds the fiscal savings from budget cuts.

Innovation Indicators Comparison

| Indicator | Metric | Trend | Source |

| CONICET Budget | -25.5% Real Terms | Severe Cut | Link |

| Researcher Salaries | -29.7% Real Terms | Collapse | Link |

| Staff Losses | “~1,000 Employees” | Exodus | Link |

| GII Input Rank | 92nd Globally | Stagnant | Link |

| Patent Filings | ~400/year | Multi-decade Low | Link |

7. Patent Analysis: Stagnation and Decline

The Innovation Paradox

Argentina exhibits a stark “innovation paradox.” It possesses high human capital (historically) but low innovation inputs. The 2025 Global Innovation Index (GII) highlights this discrepancy. Argentina ranks 64th in outputs but a dismal 92nd in innovation inputs. This suggests the system is efficient at using limited resources but is being starved. The decline in patent filings is a symptom of structural decay. Residents filed only 406 patents in 2021, a multi-decade low. This compares to a global average of over 20,000 applications. The refusal to join the PCT (Patent Cooperation Treaty) isolates Argentine inventors. Without the PCT, local inventors face prohibitive costs to patent abroad.

Sectoral Shifts in IP

Pharmaceutical patents are the most contentious area. Strict patentability guidelines (2012) reject many incremental innovations. This protects the local generic industry but angers US/EU innovators. The new US trade framework specifically targets these “patentability criteria”. We expect a liberalization of IP rules in 2026 to align with US demands. This could lead to a surge in foreign patent filings in Argentina.

In agriculture, biotech patents remain robust due to the sector’s profitability. GMO approvals have accelerated under the new administration, approving 13 events. Trademark filings surged 19.7% in 2024, indicating branding activity over invention. This divergence confirms a shift toward commercialization rather than R&D.

8. Cybersecurity and the Digital Economy

Market Drivers and Trends

The cybersecurity market is a rare bright spot in the tech landscape. The market is valued at $1.5 billion (2024) and projected to double by 2033. Growth is driven by a 30% surge in cyberattacks and banking digitization. Fintech and digital wallets require a robust security infrastructure. However, the talent shortage is acute due to the brain drain and wage gaps. Senior cybersecurity professionals earn in dollars working remotely abroad. This “wage arbitrage” makes it hard for local firms to retain top talent. The market is projected to grow at a CAGR of 7.64% through 2035.

Import Liberalization for Tech Hardware

To modernize the economy, the government slashed import tariffs on tech hardware. Tariffs on cell phones, computers, and components drop to 0% by 2026. This reverses decades of protectionism for the Tierra del Fuego assembly hub. The goal is to lower costs for businesses and consumers to upgrade technology. Tariffs on 27 types of industrial machinery were cut to 12.6%. This policy aligns with the “supply side” reforms to boost competitiveness. Prices for electronics are expected to fall by at least 30%. This deflationary pressure on durables aids the overall disinflation effort.

9. Technology Trade and Industry Impact

The Tierra del Fuego Question

The zero-tariff regime for tech imports existentially threatens Tierra del Fuego. This southern province relies on a tax-advantaged assembly of electronics. The Union of Metalworkers (UOM) launched strikes, fearing 6,000 job losses. The government views these jobs as “subsidized inefficiency.” Eliminating this subsidy is a key part of the fiscal surplus strategy. It transfers wealth from protected industrial workers to consumers and digital businesses. The regime’s expiration in 2038 may be effectively accelerated by these tariff cuts.

Software and Knowledge Economy

The software industry faces a complex landscape. Exports are projected to reach significant levels, but currency controls hinder growth. The “cepo” forces exporters to liquidate earnings at the official rate. The “Knowledge Economy Law” provides tax incentives, but stability is key. Deloitte projects total exports to grow to $116.7 billion by 2030. Services and energy are the twin pillars of this growth projection.

10. Agricultural Biotechnology

Precision Agriculture and GMOs

Agriculture remains the backbone of Argentina’s export economy. Adoption of precision agriculture technologies is expected to exceed 60% by 2025. This includes satellite monitoring, soil sensors, and AI-driven advisory tools. The government approved 13 new GMO events in late 2024/2025. These approvals cover corn, soy, and cotton, enhancing yield resilience. The sector is integrating blockchain for traceability to meet EU standards. Despite the “scienticide” in public labs, private ag-tech remains dynamic. Farmonaut and other platforms are gaining traction for crop management.

11. Strategic Scenarios: 2026 and Beyond

- Scenario A: The Virtuous Cycle (High Probability)The fiscal anchor holds, and inflation converges to international levels. The new monetary regime (Jan 2026) successfully manages expectations. Argentina re-enters bond markets, rolling over debt and lowering country risk. RIGI investments in energy and mining begin to flow, boosting reserves. The Peso stabilizes in real terms.

- Scenario B: The Social/Political Rupture (Medium Probability)The “scienticide” and social spending cuts trigger massive unrest. The brain drain hollows out the capacity to innovate. Commodity prices crash, exposing the lack of reserve buffers. The IMF demands faster devaluation than the government can politically afford.

- Scenario C: The Geopolitical Shock (Low Probability)China retaliates against the US alignment by cutting soy purchases. Brazil imposes strict non-tariff barriers. The US trade deal stalls. Argentina finds itself isolated.

12. Conclusion: The Peso as a Commodity Asset

The Argentine Peso in 2026 is a currency backed by fiscal rigor and geological wealth. It is no longer backed by scientific prowess or industrial protectionism. The decline in value is being arrested by a surplus-first approach. Future appreciation relies on the successful execution of energy exports. The geopolitical bet on the US provides the necessary bridge financing. Investors should view the Peso as a proxy for Milei’s structural reforms. The currency is pivoting from a tool of soft-budget populism to a hard asset of a commodity superpower. The risks are social and scientific, not financial or fiscal.

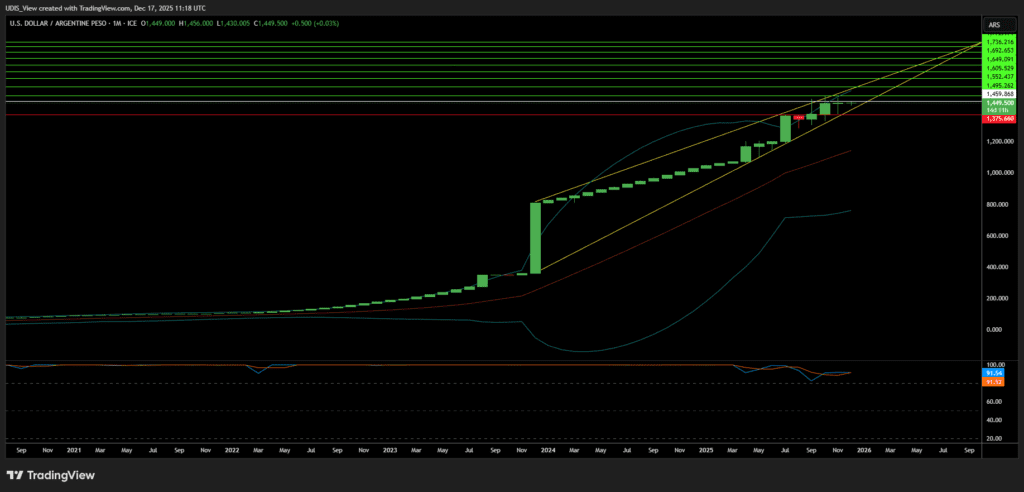

USD/ARS Long (Buy)

Enter At: 1,459.868

T.P_1: 1,495.262

T.P_2: 1,552.437

T.P_3: 1,605.529

T.P_4: 1,649.091

T.P_5: 1,692.653

T.P_6: 1,736.216

T.P_7: 1,772.971

T.P_8: 1,811.088

T.P_9: 1,837.811

S.L: 1,375.660