The Convergence of Scarcity and Strategy

The global economy stands at a pivotal juncture. Currently, a new era of resource nationalism has begun, while geostrategic fragmentation creates deep fissures in global trade. Simultaneously, decarbonization accelerates despite economic headwinds.

In this volatile landscape, platinum emerges as a critical asset. It is no longer merely a cyclical industrial metal; rather, it has become a strategic imperative. The convergence of supply destruction and demand shock is undeniable.

Current market pricing reflects an outdated paradigm because investors view platinum through the lens of internal combustion. However, this view is dangerously myopic. It fails to account for the fragility of the supply chain, ignores the weaponization of trade by the BRICS+ alliance, and overlooks the exponential demand from the hydrogen economy.

The deficit projected for 2025 is not an anomaly. On the contrary, it marks the start of a chronic structural shortfall. [10]

This report provides an exhaustive analysis of the platinum market. We dissect the geopolitical maneuverings of Russia and China, examine microscopic breakthroughs in single-atom catalysis, and reveal the vulnerability of mining infrastructure to cyber warfare.

The evidence is overwhelming. Platinum is undervalued. Furthermore, it is strategically critical and poised for a violent repricing. The “Platinum Supercycle” has arrived.

Geopolitics: The BRICS+ Resource Lock

The Weaponization of Critical Minerals

The era of free trade in raw materials is over. A shift toward resource nationalism defines the new global order, and the BRICS+ alliance anchors this shift. Brazil, Russia, India, China, and South Africa lead the bloc, while new members like Saudi Arabia and the UAE strengthen it. Consequently, this coalition controls a staggering share of global resources. [1]

Crucially, they dominate the supply of platinum group metals (PGMs). South Africa and Russia control the vast majority of primary production. Conversely, the West relies on these adversaries for its green transition, presenting a severe strategic risk.

The BRICS+ nations recognize this leverage and are moving to consolidate control. China has already weaponized supply chains; for example, recent export controls on gallium and germanium serve as warnings. Restrictions on antimony further highlight the trend. [2] These measures disrupt Western defense and tech industries.

The Threat of Export Restrictions

Platinum is a logical next target because it is essential for hydrogen fuel cells and critical for electrolysis. Therefore, a restriction on PGM exports would be catastrophic since the West has no immediate alternative. Building new mines takes over a decade, and processing facilities are concentrated in the East.

Ultimately, the strategic leverage lies entirely with BRICS+. The alliance is forming a “commodities cartel” seeking to dictate global pricing. This strategy applies to energy and metals alike. [4]

De-Dollarization and the Hard Asset Pivot

Financial warfare accompanies trade restrictions. BRICS nations are diversifying reserves and moving away from the US dollar. As part of this strategy, they are accumulating physical gold at record rates. [3] This “hard money” pivot is accelerating, reflecting a loss of trust in Western financial systems.

Canadian financier Frank Giustra calls this the era of “hard money,” arguing that paper assets are losing relevance. Physical ownership is paramount. Consequently, BRICS nations are building a parallel financial infrastructure that bypasses the US dollar and facilitates direct commodity-for-commodity trade.

Arbitrage Opportunities

Platinum benefits directly from this trend. Although it historically trades at a premium to gold, it currently trades at a deep discount. This creates a massive arbitrage opportunity. Furthermore, central banks may diversify beyond gold because platinum offers both industrial utility and monetary value.

Russia and China have already settled trade in local currencies, removing liquidity from Western markets. This creates a “shadow market” for commodities where strategic stockpiling is likely occurring off-market. As a result, physical availability for Western consumers tightens. The West’s financial sanctions have backfired; they have accelerated the very trend they sought to prevent.

Macroeconomics: The Inevitability of Deficits

The Structural Supply Deficit

The platinum market faces a severe imbalance where consumption exceeds production. The deficit is structural, not cyclical. Specifically, the World Platinum Investment Council projects a large shortfall, estimated at 850,000 ounces for 2025. [10]

This follows consecutive deficits in 2023 and 2024. The cumulative effect is draining stocks, and above-ground inventories are falling rapidly. Once these stocks are gone, prices must rise. Price discovery will be brutal.

Table 1: Projected Global Platinum Market Balance [10]

| Year | Supply Outlook | Market Balance | Status |

| 2023 | Constrained | -400,000 oz | Deficit |

| 2024 | Falling Output | -600,000 oz | Deepening Deficit |

| 2025 | Critical Failure | -850,000 oz | Structural Crisis |

Collapse of Primary Production

South African mine output is collapsing, with forecasts predicting a 2-5% decline in 2025. [10] This is driven by economic factors: basket prices for PGMs have fallen while costs have risen. Consequently, miners cannot operate profitably.

In response, they are cutting capital expenditure (CapEx) and deferring maintenance. Additionally, they are closing marginal shafts. This guarantees lower production in the future. The industry is eating its own capital, effectively sacrificing the future to survive today.

The Recycling Cliff

Secondary supply is also failing. Recycling rates have dropped significantly because high interest rates hurt new car sales. As a result, consumers keep old cars longer, meaning fewer cars are being scrapped. [12] This reduces the feed for recyclers.

Moreover, recyclers are hoarding inventory. They refuse to process catalysts at current prices and are waiting for a rebound. [13] This creates a “price floor” and tightens immediate availability. The “thrifting” of past years plays a role as well; newer scraps contain less metal. We are approaching a “recycling cliff.”

Supply Chain Crisis: The South African Breakdown

The Eskom Power Collapse

South Africa hosts 70% of global reserves, yet its infrastructure is crumbling. The state utility, Eskom, is broken and cannot generate enough power. “Load shedding” is a daily reality involving scheduled power cuts.

Deep-level mines require continuous power for ventilation to clear gases and cooling to manage heat. When power fails, operations stop. [11] Shifts are cancelled, and workers are evacuated.

The impact is cumulative. Repeated stops and starts damage equipment and reduce overall efficiency. Smelters are also affected because they need constant, high-load energy. Power cuts force smelters to throttle down, creating a backlog of unrefined concentrate.

Labor Instability and Crime

The social environment is volatile. Unemployment is high, and inequality is extreme. This fuels labor militancy. For instance, the AMCU union is aggressive, meaning wage negotiations in 2025 will be tough. [11]

Strikes are a constant threat; a major strike would devastate supply. Furthermore, the “construction mafia” adds risk. Criminal syndicates extort projects by demanding contracts or halting work. This lawlessness deters investment.

The Hydrogen Economy: A Demand Tsunami

PEM Electrolyzers: The Green Engine

The hydrogen economy drives long-term demand. Proton Exchange Membrane (PEM) electrolyzers are key because they produce green hydrogen from renewables. Furthermore, they handle intermittent power well. Platinum is the catalyst that makes them work. [14]

The market is exploding. Growth is projected at a CAGR of 32% through 2030. [14] Capacity will scale from megawatts to gigawatts. By 2030, capacity could reach 212 GW. [15] This is a massive increase.

Platinum demand from this sector will soar, rising from 4 koz in 2023 to 229 koz by 2030. [15] This is entirely new demand. It stacks on top of existing uses and is structurally supportive of prices.

Fuel Cell Electric Vehicles (FCEVs)

While batteries win in passenger cars, hydrogen wins in heavy trucks. Batteries are too heavy for long-haul routes; they reduce cargo capacity and take too long to charge. In contrast, fuel cells offer diesel-like performance.

China is leading the way by rolling out hydrogen trucks aggressively. [18] They recognize the logistics benefit. Additionally, Toyota and Hyundai are committed. Heavy-duty FCEVs use significant platinum; a truck uses 5-10 times the metal of a car. As trucking decarbonizes, demand shifts from exhaust pipes to fuel cells. Platinum demand decouples from ICE decline and finds a new, growing home.

Strategic Projects and Policy

Governments are backing hydrogen. For example, the US Inflation Reduction Act offers subsidies, providing a $3/kg tax credit for green hydrogen. Similarly, the EU has the Hydrogen Bank, and China has national targets. Projects are moving to Final Investment Decision (FID). Plug Power is building in Europe [14], while Siemens Energy is scaling up manufacturing. [19] These are real commitments involving billions of dollars, ensuring the demand is real.

Table 2: Key PEM Electrolyzer Market Forecasts [15]

| Metric | 2025 Estimate | 2030 Forecast | Growth Driver |

| Market Value | $6.1 Billion | $26.1 Billion | Green Hydrogen Demand |

| CAGR | N/A | 15.7% | Policy & Subsidies |

| Pt Demand | Low | ~229 koz | Capacity Expansion |

| Dominant Size | <2 MW | >500 MW | Industrial Scale-up |

Patent Analysis: The Innovation War

China’s Strategic Ascendance

A quiet revolution is underway. China now leads in hydrogen patents, having recently overtaken Japan. [18] This is a strategic signal indicating future dominance. The “Third Wave” of filings began in 2016. [21] Chinese state-owned enterprises drive this, filing across the value chain. They cover production, storage, and transport, effectively building a patent fortress.

The Deployment Gap

Japan was the early mover, with Toyota holding massive legacy patents. [22] However, Japan focuses on cars, whereas China focuses on industry. Crucially, China focuses on the supply chain. This distinction is vital.

China invents to scale, using patents to drive down costs. As a result, Chinese electrolyzers are cheaper, [23] costing a fraction of European models. This positions China to dominate manufacturing.

Automotive Resilience: The Substitution Reality

Platinum for Palladium Substitution

Palladium was expensive, while platinum was cheap. Consequently, automakers switched, substituting platinum into gasoline catalysts. This trend is now embedded. [5] Substitution reached 700,000 ounces in 2024. [5] This is a massive shift, and reverse substitution is slow.

The Hybrid Bridge

Pure EVs are stalling due to consumer range anxiety. In contrast, hybrids are booming. Hybrids use combustion engines and therefore need catalytic converters. Moreover, they often use more metal. [24] Hybrids run colder because the engine stops and starts. Palladium struggles in cold conditions, but platinum excels.

Euro 7 Regulations

Europe has new emissions rules. Euro 7 tightens limits, focusing on heavy-duty vehicles. For instance, NOx limits were cut by 50%. [25] This requires better catalysts. Trucks and buses must comply and use platinum-rich systems.

Table 3: Euro 7 Emission Limits for Heavy-Duty Vehicles [25]

| Pollutant | Euro VI Limit | Euro 7 Limit | Reduction | Impact on Catalyst |

| NOx | 460 mg/kWh | 200 mg/kWh | -56% | Higher PGM Loading |

| PM | 10 mg/kWh | 8 mg/kWh | -20% | Improved Filtration |

| CO | 4000 mg/kWh | 1500 mg/kWh | -62% | Enhanced Oxidation |

| NMOG | 160 mg/kWh | 80 mg/kWh | -50% | Advanced Washcoat |

Cyber Warfare: The Invisible Risk

The Vulnerability of Digital Mines

Modern mines are digital, utilizing SCADA systems connected to the internet. However, this creates an attack surface. Hackers target mining firms. [27] Ransomware is a major threat; groups like LockBit target the sector, [28] encrypting control systems and demanding millions in ransom. Attacks have tripled recently. [29]

Specific Incidents

Attacks are real. For example, Alamos Gold was hit by BlackBasta. [29] Additionally, Northern Minerals was targeted by BianLian, a group that is likely Russian. [29] Nucor Steel suffered a breach that halted production. [30] This shows the impact on heavy industry. A similar attack on a platinum major would be devastating.

Geopolitical Cyber Sabotage

State actors are involved. Russia has attacked infrastructure before, [31] targeting Ukraine’s grid. They could similarly target Western mineral supplies. This is asymmetric warfare: it is low-cost but has a high impact.

Science and Technology: The Atomic Frontier

Single-Atom Catalysis

Science is improving efficiency. Researchers are developing Single-Atom Catalysts (SACs) [32] which anchor individual platinum atoms. This maximizes surface area so that every atom contributes, reducing waste.

However, scaling is hard. Stability is a challenge because atoms can migrate or clump together, reducing effectiveness. [33] Therefore, commercialization will take time and is not an immediate threat to demand.

Graphene and Durability

UCLA researchers made a breakthrough by encasing platinum in graphene. [34] This protects the metal and prevents degradation. Lifespans exceeded 200,000 hours, which is a game-changer. It makes fuel cells viable for trucks because it matches diesel durability.

Magnetic Alloys

New alloys are emerging. Researchers added magnetic materials, mixing iron and cobalt with platinum. [35] This boosted activity by aligning electron spins and improving the reaction rate. This shows platinum’s potential; it is not stagnant material, but rather it is evolving.

Conclusion: The Strategic Imperative

The platinum market is mispriced. Currently, it ignores fundamental realities and prices in a surplus that does not exist. Moreover, it ignores geopolitical risks that are flashing red.

The window to acquire this asset is closing. The convergence of forces is unique. The Platinum is the apex trade of the decade.

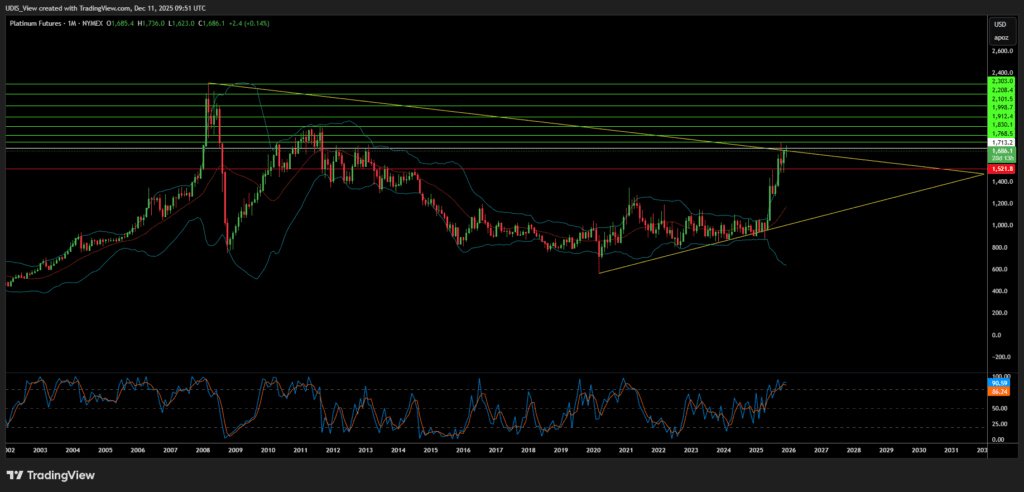

Platinum Long (Buy)

Enter At: 1713.2

T.P_1: 1768.5

T.P_2: 1830.1

T.P_3: 1912.4

T.P_4: 1998.7

T.P_5: 2101.5

T.P_6: 2208.4

T.P_7: 2303.0

S.L: 1521.8