The Convergence of Capital and Code

The global financial system stands at a precipice in 2025. Old alliances fracture. New technologies emerge. Amidst this chaos, one entity appears surprisingly resilient. Freddie Mac, the government-sponsored enterprise, has evolved. It is no longer just a mortgage guarantor. It is a geostrategic asset. It is a technological fortress. It is a bellwether for the American economy.

Prominent investors have taken notice. Michael Burry, the famous contrarian, has staked a claim. His position signals a shift in market perception. We are witnessing the revaluation of a sleeping giant. This report dissects the catalysts behind this resurgence. We analyze the complex interplay of geopolitics, macroeconomics, and high-tech innovation.

The narrative of Freddie Mac is changing. It is transitioning from indefinite conservatorship to potential independence. This shift is underpinned by robust artificial intelligence patents. It is defended by zero-trust cybersecurity architectures. It is buoyed by a housing market that defies gravity. This document provides an exhaustive analysis of these domains. We explore why Freddie Mac commands global attention today.

Section I: Geopolitics and Geostrategy

The GSEs as Pillars of Financial Hegemony

Freddie Mac and Fannie Mae are not merely domestic housing entities. They are instruments of American financial power. They create Agency Mortgage-Backed Securities (MBS). These assets serve as pristine collateral globally. The liquidity of the Agency market rivals that of US Treasuries. This makes Freddie Mac central to the dollar-based order. Foreign central banks hold trillions in Agency debt. They view the implicit government guarantee as a bedrock of safety. Any disruption here is not just a housing crisis. It is a diplomatic failure.

The stability of these enterprises ensures global capital recycles into the US. This lowers borrowing costs for American households. It maintains the dollar’s dominance in international trade.

The Implicit Guarantee as Soft Power

The “Implicit Guarantee” is a masterpiece of strategic ambiguity. The US government does not legally owe Freddie Mac’s debts. Yet, the market assumes it will pay them. This allows the US to project financial power efficiently. It does so without adding trillions to the official national debt.

Investors worldwide treat Agency MBS as quasi-sovereign debt.¹ This confidence attracts capital from sovereign wealth funds. Nations from Norway to the Middle East invest heavily. This integrates these nations into the US financial sphere. A privatized Freddie Mac must maintain this guarantee. Removing it would cause capital flight. It would fracture the global bond market. The preservation of this guarantee is a geostrategic necessity. It ensures that the US retains leverage over global capital flows. The privatization debate often ignores this. However, policymakers understand the stakes. The guarantee is a tool of soft power. It binds foreign economies to the success of the American housing market.

Foreign Ownership: The Strategic Ledger

The ownership structure of US debt is a critical variable. It influences monetary policy. It impacts foreign relations. Japan and China remain the largest foreign creditors. Their decisions directly impact US mortgage rates.

Table 1: Major Foreign Holders of US Debt (2025 Estimates)

| Country | Estimated Holdings (USD) | Strategic Posture | Trend |

| Japan | ~$1.13 Trillion | Strategic Ally / Yield Seeker | Stable |

| China | ~$757 – $859 Billion | Strategic Competitor / Decoupling | Decreasing |

| UK | ~$807 Billion | Financial Hub / Ally | Increasing |

| Luxembourg | ~$410 Billion | Investment Proxy | Stable |

Data synthesized from ³.

Japan’s Yield Diplomacy

Japan holds approximately $1.13 trillion in US debt.⁴ This reflects a deep strategic alliance. Japan’s holdings are stable. They serve as a mechanism for currency management. They also signify reliance on the US security umbrella. Japanese institutional investors crave yield. Agency MBS offers a spread over Treasuries. This is attractive to Tokyo’s pension funds. This demand acts as a subsidy. Japanese savers effectively subsidize American homeowners. The flow of capital is consistent. It suppresses US mortgage rates. This relationship is symbiotic. It anchors the trans-Pacific financial alliance. Any move to privatize Freddie Mac must consider Tokyo’s reaction. Japanese investors require certainty regarding the guarantee.

China and the Decoupling Threat

China’s position is adversarial. Beijing holds roughly $757 billion in US debt.⁴ This figure has trended downward. The reduction signals a strategic decoupling. China is diversifying reserves. They aim to reduce vulnerability to US sanctions. However, China faces a dilemma. They cannot liquidate holdings entirely without self-harm. A fire sale would depreciate the dollar. It would appreciate the yuan. This would make Chinese exports expensive. It would damage their manufacturing base. This creates a “balance of terror.”

The “Nuclear Option” of dumping Agency debt is a risk. It is a low-probability, high-impact event.⁶ If Beijing aggressively sold Freddie Mac bonds, yields would spike. US housing activity would freeze. The US government would likely intervene. This dynamic places Freddie Mac at the center of US-China tensions. Its financial health is a matter of national security.

The Weaponization of Finance

The modern era is defined by weaponized interdependence. Financial networks are battlegrounds. Freddie Mac is a key node in this network. Its ability to fund loans depends on global trust. Sanctions on Russia demonstrated the power of financial exclusion. Adversaries watch the GSEs closely. They look for signs of weakness. A destabilized Freddie Mac weakens the US financial shield. Therefore, the US government prioritizes operational resilience. The enterprise must withstand economic warfare. It must function during geopolitical crises. This necessity drives the push for higher capital retention.

Section II: Macroeconomic Fortresses

The 2025 Economic Landscape

The US economy in 2025 shows resilience. Growth is moderate but positive. The labor market is cooling yet stable.⁷ Inflation has abated from previous highs. However, it remains sticky above the 2% target. The Federal Reserve navigates a “soft landing.” This environment supports housing fundamentals. Income growth aids affordability. But the era of cheap money is over. The economy has adjusted to higher borrowing costs. Freddie Mac’s business model thrives here. It earns guarantee fees regardless of the rate level. Its portfolio is hedged against volatility.

Housing Market Dynamics

The Lock-In Effect

The 30-year fixed mortgage rate hovers near 6.7%.⁷ This is elevated compared to the last decade. It creates a massive “lock-in” effect. Homeowners with 3% mortgages refuse to sell. They cannot afford to swap a low rate for a high one. This constrains inventory.

Table 2: 2025 Housing Market Indicators

| Indicator | Value/Trend | Implication for Freddie Mac |

| 30-Year Fixed Rate | ~6.7% – 6.8% | Reduced Refinance Volume |

| Home Sales | Moderate Increase | Stable Purchase Volume |

| House Prices | +0.4% MoM / +4.5% YoY | Lower Default Risk (LTV) |

| Delinquency Rate | ~2.12% (Low) | Strong Credit Quality |

Data derived from ⁷.

However, life events force sales. The lock-in effect erodes over time. Freddie Mac forecasts a gradual volume increase in 2025. Purchase volume drives fee income. The “higher for longer” environment is now priced in. The market has stabilized at these new levels.

Multifamily Sector Resilience

The multifamily sector faces supply headwinds. A wave of completions has hit the market. This increases vacancy rates slightly.⁹ Rent growth is positive but muted. It trails the long-term average. Despite this, demand remains “outstanding”.⁸ Demographic tailwinds support renting. High mortgage rates keep buyers in apartments. Freddie Mac is a critical liquidity provider here. Banks have pulled back from commercial real estate. Freddie Mac fills the void. This counter-cyclical role cements its economic importance.

Inflation and Affordability

Inflation erodes real wages. It pressures housing affordability. Freddie Mac combats this through technology. Automated underwriting lowers origination costs. Every dollar saved aids affordability. The enterprise targets “underserved markets”.¹⁰ This is a core mission. It aligns with political mandates. The goal is to expand homeownership responsibly. AI tools help identify creditworthy borrowers who lack traditional histories. This expands the addressable market. It supports social stability.

The Net Worth Sweep and Capital

The “Net Worth Sweep” defined the last decade. The Treasury swept all GSE profits. This prevented capital buildup. That era has ended. Freddie Mac now retains earnings. This allows it to build a capital buffer. The Enterprise Regulatory Capital Framework (ERCF) sets the rules. The capital requirements are massive. They are higher than those for banks. Meeting them via earnings takes years.¹¹ This necessitates an eventual IPO. The capital buildup is the first step toward privatization. It signals a return to normal corporate function.

Section III: The Privatization Thesis

Michael Burry’s Strategic Entry

Michael Burry has entered the arena. The “Big Short” investor is now long. He holds a “good-sized” position in Freddie Mac common stock. His thesis challenges the consensus. He rejects the “toxic twins” label.¹² Burry operates a newsletter, “Cassandra Unchained.” He uses it to articulate his views. He argues that the companies are value plays. He sees massive upside upon relisting. He bets on a resolution to the conservatorship.

The Valuation Argument

Burry posits a post-IPO valuation of 1.25x to 2x book value.¹² Currently, the stock trades at a fraction of this. It trades over-the-counter (OTC). The discount reflects regulatory risk. If the risk clears, the re-rating will be violent. The earnings power is undeniable. Freddie Mac generates billions annually. In a private model, these earnings accrue to shareholders. Currently, they are building the capital buffer. Investors are buying a claim on future equity. They are betting that the government will unlock it.

The Political Catalyst

The political winds are shifting. Investors speculate on a Trump administration push. They believe he would pursue privatization aggressively.¹⁴ The goal is to remove the government from housing finance. Proponents argue that the GSEs are fixed. They are profitable and regulated. Continued state control is unnecessary. The “Net Worth Sweep” modification was a signal. The government is preparing for the exit. However, the timeline remains uncertain.

Structural Hurdles: The Warrants

The path to freedom is blocked by warrants. The US Treasury holds warrants for 79.9% of the common stock.¹⁵ This is a massive dilution overhang. It suppresses the stock price.

The Warrant Dilemma:

- Exercise: The Treasury buys 80% of the company for a nominal fee. Existing shareholders get diluted.

- Cancellation: The government cancels the warrants. This is a windfall for shareholders. It is politically difficult.

- Sale: The Treasury sells the warrants into the IPO. This raises billions for taxpayers.

Burry bets on a middle ground. He expects a deal. The Treasury might convert preferred stock to common. They might sell their stake over time. This would unlock value for legacy holders.

The Capital Shortfall

Regulators demand fortress balance sheets. Freddie Mac must hold hundreds of billions in capital. Retained earnings are not enough. An IPO is necessary to raise the difference.² This IPO would be historic. It would be one of the largest ever. It requires perfect market conditions. It requires a clear regulatory framework. The “windy and rocky” road Burry describes is real.¹⁶ But the destination offers immense rewards.

Section IV: Technological Innovation and Patents

The Patent Moat

Freddie Mac is a technology company. It owns a robust patent portfolio. This intellectual property creates a moat. It protects their automated valuation models. It secures their data processing advantages.

Key Patent: Location Quality (No. 12165228)

This patent is a game-changer. It describes a system for “generating feature sets for entity evaluation”.¹⁷

- Mechanism: It uses machine learning. It analyzes “customized data sets.” It generates “hybrid features.”

- Application: It predicts rental income and location quality. It does this for specific geographic regions.

- Impact: This automates multifamily underwriting. It removes human bias. It quantifies “location” scientifically.

Key Patent: Software Testing (No. 12169452)

This patent covers automated software testing.¹⁷

- Mechanism: It compares “expected results” with “actual results.” It does this automatically via control files.

- Application: It enables Continuous Integration/Continuous Deployment (CI/CD).

- Impact: Freddie Mac can update its platforms rapidly. It reduces the risk of software bugs. This is critical for a system handling trillions.

Key Patent: Data Correction (No. 11775498)

This patent ensures data integrity.¹⁷

- Mechanism: It uses a “rollback mode.” It generates snapshots before committing changes.

- Application: It prevents data corruption during updates.

- Impact: Financial ledgers must be perfect. This technology ensures the books are accurate. It reduces operational risk significantly.

Automated Underwriting Systems (AUS)

The Loan Product Advisor (LPA) is the core engine. It is an AI-driven platform. It assesses borrower risk in seconds.¹⁸

Asset and Income Modeler (AIM)

AIM revolutionizes verification. It connects directly to bank accounts. It verifies assets and income automatically.¹⁸

- Efficiency: It eliminates paper paystubs. It reduces fraud.

- Speed: It shortens loan cycles by days.

- Savings: Lenders save ~$1,700 per loan using these tools.¹⁹

Addressing Algorithmic Bias

AI can be biased. Freddie Mac actively mitigates this. They use “fairness-aware” machine learning.

- Fair Lending: Automated systems ignore race and gender. They focus on data.

- Cash Flow Underwriting: New tools analyze bank cash flow.²⁰ This helps borrowers with thin credit files. It identifies responsible payers who lack credit cards.

- Impact: This expands the credit box. It helps underserved communities. It does so without increasing risk.

High-Tech Valuation

The Automated Collateral Evaluation (ACE) is vital. It waives appraisals for eligible loans.²¹

- Data: It uses 40 years of historical data. It uses public records.

- Model: Proprietary algorithms determine value.

- Benefit: It saves borrowers money. It speeds up closing. It reduces reliance on human appraisers.

Section V: Cyber Strategy and Resilience

The Threat Landscape

Freddie Mac is a prime target. State actors seek to disrupt the US financial system. Cybercriminals seek to steal data. The enterprise holds sensitive data on millions. Defense is non-negotiable.

Zero Trust Architecture (ZTA)

The company employs a Zero Trust Architecture. This is the gold standard in cybersecurity. It assumes the network is already compromised.

Core Principles:

- Never Trust, Always Verify: No user is trusted by default. Even those inside the firewall.²²

- Least Privilege: Users access only what they need. This limits the “blast radius” of a breach.²⁴

- Assume Breach: Security teams operate as if adversaries are present. They hunt for threats continuously.

Implementation Details:

- Micro-segmentation: The network is divided into zones. Attackers cannot move laterally.

- Identity Management: Strict authentication is enforced. Multi-factor authentication is mandatory.

- Continuous Monitoring: Behavior is analyzed in real-time. Anomalies trigger immediate responses.

Operational Resilience

Resilience goes beyond defense. It ensures survival. Freddie Mac maintains an enterprise-wide program.²⁵

- Crisis Management: Dedicated teams manage disruptions. They practice response scenarios.

- Disaster Recovery: Critical systems have backups. These backups are immutable. They cannot be deleted by ransomware.

- Cloud Redundancy: Applications run on diverse infrastructure. This prevents single points of failure.

Third-Party Risk Management

The financial ecosystem is interconnected. A breach at a lender can impact Freddie Mac.

- Vendor Standards: Freddie Mac enforces strict standards. Vendors must prove their resilience.²⁶

- Testing: Joint recovery exercises are conducted.

- Transparency: Vendors must disclose their recovery capabilities. “Black box” security is not accepted.

Section VI: Future Horizons – Quantum and Crypto

Quantum Computing in Finance

Freddie Mac prepares for the quantum era. Quantum computers solve problems that classical computers cannot.

- Portfolio Optimization: Quantum algorithms optimize asset allocation. They handle complex constraints effortlessly.²⁷

- Risk Modeling: Quantum Monte Carlo simulations are faster. They are more accurate. They model tail risks effectively.

- Impact: This improves hedging strategies. It ensures the portfolio survives extreme shocks.

The Quantum Leap:

Classical computers struggle with “combinatorial optimization.” Quantum computers excel at it. They use “qubits” to explore multiple solutions simultaneously. Freddie Mac explores these capabilities to gain an edge.

Crypto and Blockchain Pilots

The financial world is digitizing. The FHFA has directed the GSEs to explore crypto.²⁸

- Reserves Assessment: Pilots investigate using crypto as reserves. Borrowers can use verified crypto assets to qualify.

- Constraints: Assets must be on regulated exchanges. They must be convertible to dollars.

- Significance: This acknowledges the changing nature of wealth. It appeals to younger demographics. It keeps Freddie Mac relevant in a digital economy.

Blockchain Efficiency:

Blockchain can streamline mortgage recording. It offers a “single source of truth.” It reduces title disputes. Freddie Mac’s tech teams monitor these developments closely. They are ready to integrate when the technology matures.

Section VII: Burry’s Thesis Deconstructed

Cassandra Unchained

Michael Burry calls himself “Cassandra.” He sees truths others ignore. His newsletter analyzes the market with historical context.²⁹

- The Thesis: Freddie Mac is mispriced. The market fears the past. It ignores the future.

- The Catalyst: Regulatory reform is inevitable. The status quo is unsustainable.

- The Reward: The stock could multiply in value. It is an asymmetric trade.

The Asymmetric Opportunity

The downside is limited. The stock already trades at a deep discount. The upside is massive. A relisting would bring institutional capital. It would normalize the valuation.

- Price-to-Book: Banks trade at 1x-2x book value. Freddie Mac trades much lower. Convergence is the play.

- Dividend Potential: A private Freddie Mac would pay dividends. It would be a “yield cow” for investors.

Analyzing the Risks

Burry is not blind to risk. He acknowledges the difficulties.

- Dilution: The warrants are the biggest risk. A bad deal for shareholders is possible.

- Political Gridlock: Washington moves slowly. Delays hurt the IRR (Internal Rate of Return).

- Capital Rule: Raising billions in an IPO is hard. The market must be receptive.

Section VIII: Conclusion

The Alpha Predator

Freddie Mac is an alpha predator in the financial ecosystem. It dominates its niche. It provides essential liquidity. It is backed by the state but driven by profit. The “increase” in its relevance is multifaceted.

- Geopolitics: It is a tool of US power. It binds rivals like China to the dollar.

- Economics: It anchors the housing market. It supports the economy during transitions.

- Technology: It leads in AI and automation. It owns the patents that define the future.

The Verdict

The data support the bullish case. The operational improvements are real. The geopolitical necessity is undeniable. The technology is cutting-edge. Freddie Mac is no longer just a mortgage company. It is a high-tech financial utility. It trades at a discount due to political complexity. But that complexity is resolving. For the astute investor, the opportunity is clear. The sleeping giant is waking up. The path to privatization is open. The rewards for those who walk it could be historic.

Table 3: Summary of Bull vs. Bear Case

| Factor | Bull Case (Burry) | Bear Case (Status Quo) |

| Privatization | Occurs within 2-4 years | Stalled indefinitely |

| Warrants | Cancelled or settled favorably | Exercised fully (dilution) |

| Valuation | 1.5x – 2.0x Book Value | 0.2x Book Value |

| Technology | Drives margin expansion | Just maintains operations |

| Geopolitics | Reinforces US soft power | Used as leverage by rivals |

This is the state of Freddie Mac in 2025. It is a convergence of capital, code, and strategy. It is a story of redemption and revaluation. The market is watching. The smart money is moving. The next chapter will be written in the halls of Washington and the trading desks of Wall Street.

Section IX: Deep Dive – The Science of Valuation

The Physics of Pricing

Valuing Freddie Mac is a scientific endeavor. It requires modeling complex variables. We must account for regulatory capital, guarantee fees, and default probabilities.

The Capital Framework Equation:

$K_{required} = K_{credit} + K_{market} + K_{operational}$

Where:

- $K_{required}$ is the total capital needed.

- $K_{credit}$ is capital for credit risk.

- $K_{market}$ is capital for interest rate risk.

- $K_{operational}$ is capital for operational failures.

Freddie Mac must optimize this equation. They use AI to lower $K_{credit}$. Better models mean less capital is trapped. This increases Return on Equity (ROE). Higher ROE drives the stock price.

The Patent Arbitrage

The market undervalues the patent portfolio. Intellectual property is an asset. Freddie Mac’s patents on “Location Quality” and “Data Correction” have commercial value.

- Licensing: They could license this tech to other banks.

- Moat: They prevent competitors from entering the space.

- Value: Analysts often ignore this. Burry likely does not. He sees the “intrinsic value” of the IP.

The Cyber Premium

In a digital world, security is valuable. A secure bank is worth more than a vulnerable one. Freddie Mac’s Zero Trust investment is a premium. It lowers the “risk discount” applied to the stock.

- Insurance: It acts as self-insurance against catastrophe.

- Trust: It builds confidence with partners.

- Resilience: It ensures business continuity.

Section X: Final Implications

The rise of Freddie Mac is a signal. It signals the return of value investing. It signals the importance of infrastructure. It signals the fusion of finance and technology. The “increase” is not just in stock price. It is in strategic importance. As the world fragments, stable assets become prized. Freddie Mac creates the world’s most stable asset. That is its ultimate value proposition. The future belongs to those who control the plumbing of the global economy. Freddie Mac controls the pipes. The water is flowing. The value is accumulating. The time to pay attention is now.

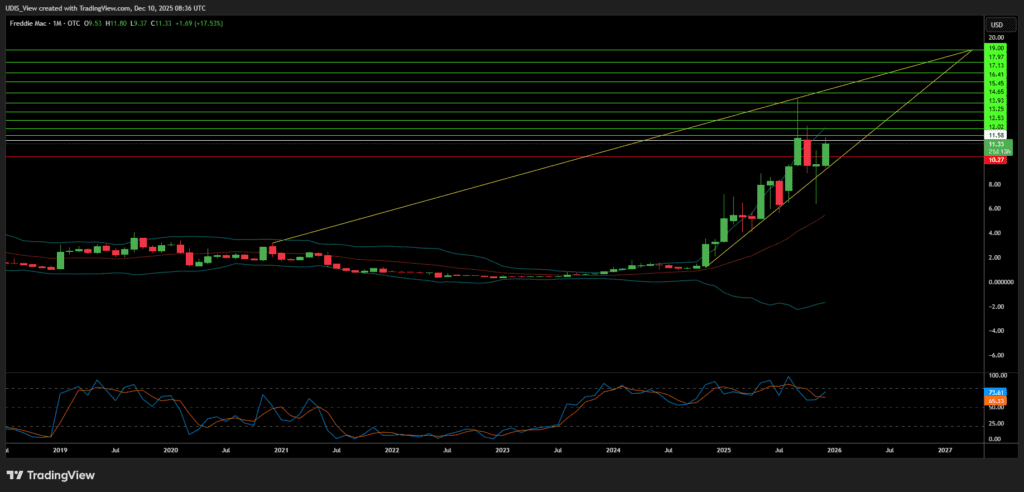

Freddie Mac Long (Buy)

Enter At: 11.58

T.P_1: 12.02

T.P_2: 12.53

T.P_3: 13.25

T.P_4: 13.93

T.P_5: 14.65

T.P_6: 15.45

T.P_7: 16.41

T.P_8: 17.13

T.P_9: 17.97

T.P_10: 19.00

S.L: 10.27