A Perfect Storm of Converging Headwinds

Snowflake Inc. (NYSE: SNOW) currently stands at a perilous strategic inflection point. The company, once the undisputed darling of the cloud data warehousing era, faces a harsh winter.

Fiscal Q3 2026 results technically exceeded analyst estimates, yet the market reacted with skepticism. 1 The stock’s sharp decline following ostensibly positive results signals a structural realignment in investor sentiment. This is no longer a hyper-growth anomaly immune to gravity. Snowflake is a maturing enterprise software company fighting a multi-front asymmetric war.

The thesis of this report is definitive. Converging forces across macroeconomics, geopolitics, and technology are eroding Snowflake’s dominance. Aggressive competitors like Databricks have successfully capitalized on the generative AI boom. 2 Macroeconomic pressure is forcing a global consolidation of IT budgets. 3 Most critically, the technological shift toward open table formats like Apache Iceberg threatens to cannibalize high-margin revenue. 4 This report offers an exhaustive analysis of the “Data Cloud’s” potential decline.

1. Macroeconomic Analysis: The End of Free Money

The macroeconomic landscape of late 2025 has fundamentally altered the valuation models for SaaS companies. The era of near-zero interest rates is over. That prior era buoyed Snowflake’s initial public offering and early trading multiples.

Capital is no longer free. Investors now demand profitability alongside growth. 5 Snowflake’s valuation has compressed significantly as the market adjusts to a persistent high-rate regime. 6

The Valuation Compression Cycle

The Federal Reserve’s monetary policy through 2024 and 2025 created a hostile environment for high-duration assets. As yields on risk-free assets rose, the present value of Snowflake’s future cash flows diminished. Revenue multiples exceeding 50x are a relic of the past. Snowflake once commanded a premium for its 100% year-over-year growth. It now faces scrutiny as growth decelerates to the 20-30% range. 1

Investors are aggressively applying the “Rule of 40” metric. This combines revenue growth and profit margin. Snowflake shows improvement in free cash flow. However, its GAAP profitability remains elusive due to heavy stock-based compensation. 5 The market no longer rewards revenue growth that comes with massive equity dilution.

Interest Rate Forecasts and Discount Rates

The cost of capital remains elevated compared to the pre-2022 era. Forecasts for the December 2025 Federal Reserve meeting anticipate rates stabilizing between 3.50% and 3.75%. 7 This creates a high hurdle rate for equity investments. Growth stocks must offer exceptional returns to justify the risk over risk-free Treasuries. Snowflake’s terminal value in Discounted Cash Flow (DCF) models shrinks as the discount rate rises. This mathematical reality forces a downward re-rating of the stock price independent of operational execution.

A “higher-for-longer” rate environment specifically punishes companies with back-loaded cash flows. Snowflake’s profit generation is projected far into the future, making it highly sensitive to these rate dynamics.

The Global IT Spending “Uncertainty Pause”

A critical economic headwind is the “uncertainty pause” currently gripping global IT spending. CIOs are not necessarily slashing budgets. They are freezing net-new allocations to assess the ROI of Generative AI. 3

Enterprises spent the years 2021 through 2023 migrating aggressively to the cloud. In 2025, the focus has shifted entirely to optimization. Snowflake’s consumption-based model was once a key strength. It now exposes the company to immediate revenue hits when customers optimize queries.

Customers are reducing data retention periods to save costs. 8 They are archiving data to cold storage rather than keeping it in Snowflake’s active, billable tier. Funds are shifting from traditional data warehousing toward AI-specific infrastructure. Budgets are diverting to GPUs and LLM training clusters. Snowflake is perceived primarily as a “data warehouse first” company. Competitors are successfully capturing the “AI infrastructure” spend. 9

Table 1: Macroeconomic Headwinds Impact Assessment

| Economic Indicator | Snowflake Impact | Trend Analysis |

| Federal Funds Rate | Negative | Rates of 3.50%-3.75% maintain high discount rates, hurting long-duration equity valuations. 7 |

| IT Budget Cycles | Neutral/Negative | Shift from “migration” to “optimization” limits consumption growth and encourages data archiving. 3 |

| SaaS Multiples | Contracting | Market creates a valuation ceiling based on slower growth rates and GAAP losses. 6 |

| AI CapEx Shift | Threat | Enterprise budgets divert from storage/SQL to compute/GPUs, favoring Databricks and Nvidia. 9 |

2. Financial Anatomy: Deceleration and Dilution

The Guidance Disconnect

Snowflake’s Q3 Fiscal 2026 earnings report illustrates a classic “beat and drop” scenario. The company reported $1.21 billion in revenue, up 29% year-over-year. 1 This result beat analyst estimates. However, the stock fell sharply. This reaction is rational when analyzing the rate of change (second derivative).

Revenue growth has slowed from triple digits post-IPO to under 30%. The guidance for Q4 FY26 suggests product revenue of approximately $1.195 billion. 1 This implies a further deceleration to roughly 27% year-over-year growth. For a stock priced at a premium, 27% growth is insufficient. The market anticipates that as the law of large numbers takes hold, Snowflake will struggle to re-accelerate. 1 The days of hyper-growth appear to be mathematically over.

Net Revenue Retention (NRR) Erosion

A key pillar of the bull case was historically Snowflake’s Net Revenue Retention. NRR has declined from historic highs exceeding 150% to 125% in the most recent quarter. 10 While 125% is healthy for a mature SaaS company, the downward trend is undeniable. Existing customers are finding it harder to expand their spend at the same explosive rate.

Customer segmentation data reveals concerning trends. Growth in the “Forbes Global 2000” customer cohort is slowing significantly. This cohort grew only 4% year-over-year. 10 This suggests market saturation among the world’s largest enterprises. Snowflake must now rely almost exclusively on expanding usage within existing accounts. It can no longer rely on landing massive new logos to drive top-line numbers.

Profitability vs. Stock-Based Compensation (SBC)

Snowflake reports positive non-GAAP income and free cash flow. However, GAAP net losses persist, with a $329.5 million operating loss in Q3. 11 Stock-based compensation remains a massive expense line item. This dilution harms shareholders and complicates the path to true GAAP profitability. 12

SBC expenses often exceed 40% of revenue. This is an outlier even among high-growth SaaS peers. Investors in 2025 are less forgiving of companies that rely on heavy dilution to pay talent. This is especially true when the stock price declines, reducing the retention value of that equity. This creates a negative feedback loop. The company must issue more shares to retain talent as the stock falls, further diluting investors.

Table 2: Fiscal Q3 2026 Financial Metrics Summary

| Metric | Value | YoY Growth | Implication |

| Total Revenue | $1.21 Billion | +29% | Deceleration from historical +50% levels. 1 |

| Product Revenue | $1.16 Billion | +29% | Core business is slowing in line with total revenue. 1 |

| Net Revenue Retention | 125% | – | Down from >150% peaks; expansion is getting harder. 10 |

| Operating Loss (GAAP) | ($329.5M) | +9.9% (Worse) | Path to GAAP profitability remains unclear. 13 |

| Free Cash Flow | $113.6 Million | +9% | Cash generation is positive but margins are thin. 10 |

3. Technology Analysis: The Architecture War

The Rise of the “Lakehouse” Paradigm

Snowflake built its empire on the “Data Cloud.” This was a proprietary, closed-source data warehouse that separated compute and storage. This architecture was revolutionary in 2012. In 2025, the paradigm has shifted to the “Lakehouse,” championed by Databricks. 2

The Lakehouse allows companies to store data in open formats. Users keep data in Parquet or Delta Lake formats while performing warehouse-style queries. This challenges Snowflake’s model directly. Snowflake historically required ingesting data into its proprietary micro-partitions. 14 Data Engineers increasingly prefer the flexibility of the Lakehouse. It handles unstructured data and ML workloads more natively than a strict warehouse. Snowflake is playing catch-up here. It is frantically adding support for unstructured data after Databricks established dominance in that category. 15

The Apache Iceberg Cannibalization Threat

The most significant technological threat to Snowflake’s business model is Apache Iceberg. Iceberg is an open table format. It allows multiple engines to query the same data stored in cheap object storage like S3.

Snowflake has been forced to support Iceberg to avoid “vendor lock-in” criticisms. 4 However, this support comes at a steep strategic cost. Historically, Snowflake charged customers to store data. This storage revenue was high-margin and created high switching costs. With Iceberg, customers store data in their own cheap storage buckets. Snowflake becomes just a compute engine among many.

This threatens to evaporate Snowflake’s storage revenue stream. 16 It turns a sticky platform into a commoditized utility. The dilemma is severe. If Snowflake did not support Iceberg, they would lose customers to Databricks. By supporting it, they cannibalize their own storage revenue. It is a classic innovator’s dilemma. 17

The Commoditization of SQL Compute

High-performance SQL querying was once Snowflake’s unassailable moat. In 2025, high-performance SQL is becoming commoditized. Competitors like Google BigQuery and Amazon Redshift offer comparable speeds. Databricks has closed the gap with its Photon engine. 2

Benchmarks show Databricks SQL is now competitive with Snowflake for many workloads. This erodes Snowflake’s pricing power. It is harder to charge a premium for SQL when “good enough” SQL is available everywhere. Snowflake is natively built for SQL. Databricks is natively built for AI and Spark. Adapting a SQL engine for Python-heavy AI workloads is technically complex. Snowflake’s “Snowpark” attempts to bridge this gap. However, it is often less efficient than a native AI platform like Databricks. 18

4. Geopolitics and Geostrategy: The Splinternet

Data Sovereignty and Nationalism

The era of the “global internet” is fracturing. We are entering the age of the “Splinternet.” Nations are enacting strict data sovereignty laws. These require data to reside physically within national borders.

This fragmentation forces Snowflake to deploy distinct infrastructure in every jurisdiction. Operating 50 fragmented regions is significantly more expensive than operating 5 massive global hubs. This reduces margin efficiency compared to a unified global cloud. 19 It creates a heavy CapEx burden. Snowflake must invest in infrastructure ahead of revenue in smaller, regulated markets.

Competitors like Oracle are moving faster to deploy “Sovereign Clouds.” These are air-gapped from the US internet to satisfy local regulators. Snowflake’s reliance on the public cloud (AWS/Azure) makes it harder to compete for strictly regulated government workloads in Europe. 20 61% of Western European CIOs indicate geopolitics will increase reliance on local cloud providers. 21

The China Market Void

Snowflake has limited exposure to China due to trade restrictions. The “Great Firewall” and China’s Personal Information Protection Law (PIPL) create massive barriers. Snowflake lacks a direct region in China. This forces customers to use complex workarounds like S3 replication. 22

This effectively locks Snowflake out of the world’s second-largest digital economy. Local competitors have filled the void. Alibaba Cloud (MaxCompute) and Huawei Cloud (GaussDB) dominate the Chinese market. This loss of the Asian growth engine forces Snowflake to rely heavily on saturated Western markets.

Recent regulatory actions in China have intensified. High-profile investigations into data transfers have spooked multinationals. 23 Companies are repatriating data to local Chinese clouds. This reduces the global data volume available for Snowflake to process.

Federal Sector Risks

Snowflake has achieved FedRAMP High authorization on Azure Government. 24 This is a strategic win. It allows Snowflake to serve the US Department of Defense and intelligence agencies. However, government contracts are a double-edged sword.

They are lucrative but slow-moving. They are subject to political budget impasses. The potential for US government shutdowns poses a risk to revenue stability. Budget uncertainty in late 2025 delayed federal contract awards. 7

Snowflake’s reliance on hyperscalers introduces supply chain risk. If US-China tensions escalate, the GPU supply chain could shatter. Snowflake needs GPUs for its new AI features. A conflict over Taiwan would stall capacity expansion globally.

5. Cyber Analysis: The Trust Deficit

The 2024 Identity Breach Fallout

In mid-2024, a massive campaign targeted Snowflake customer accounts. Snowflake maintained its platform was not breached. The attacks were credential stuffing on accounts without Multi-Factor Authentication (MFA). 25 However, the perception damage was severe. The narrative that “Snowflake data is vulnerable” permeated the C-suite.

High-profile victims like Ticketmaster and Santander drew regulatory scrutiny. 25 The incident exposed a lack of default security protocols. Snowflake was forced to push mandatory MFA in late 2024 and 2025. 26 This adds friction to the user experience. Ease of use was historically Snowflake’s key selling point. The “secure by design” reputation was tarnished. Rebuilding trust takes longer than losing it.

Cyber Sovereignty and Localization

European and Asian clients are increasingly wary of US-based data platforms. The US CLOUD Act allows US law enforcement to access data stored abroad. This drives clients toward local solutions or “Sovereign Cloud” configurations.

Snowflake is seen as a US-centric platform. This creates headwinds for expansion in EMEA and APAC. The 2024 breach reinforced these fears. It highlighted the risks of centralized data aggregation. Local competitors are capitalizing on this. They market their solutions as “sovereign” and “immune to US jurisdiction.” Snowflake must invest heavily in local compliance to counter this narrative. This further depresses margins.

6. High-Tech and Patent Analysis: The AI Gap`

R&D Efficiency and Direction

Snowflake invests heavily in R&D, spending $490 million in Q3 alone. 27 However, questions remain about the yield of this investment. Snowflake holds approximately 2,500 patents. 28 The portfolio is strong in concurrency control and data sharing. It includes patents for secure micro-partition storage and zero-copy cloning. 29

Critically, these are “Data Warehouse” patents. They solve problems of the 2015-2020 era. They address migration to the cloud and SQL concurrency. The market in 2025 values different IP. Investors want IP related to vector indexing and automated reasoning. They value federated learning and generative AI technologies. Databricks has a stronger IP position in the generative layer. Its acquisition of MosaicML gave it a platform for training models. 18

Snowflake is responding with “Arctic” and “Cortex.” However, the perception remains that their IP core is relational, not generative.

The AI Agent Engineering Challenge

Snowflake Intelligence (AI agents) is their newest strategic bet. 1 Building effective enterprise AI agents is an immense engineering challenge. It requires massive context windows and unstructured data processing. Snowflake’s architecture was optimized for structured rows and columns. Retrofitting this for vector search involves significant engineering overhead.

Native vector databases often offer lower latency for these workloads. 15 Snowflake is trying to pivot a massive ship. Databricks is building on a native Spark foundation that was always friendlier to unstructured data. The technical debt of the micro-partition architecture may be slowing Snowflake’s AI pivot.

Table 3: Patent Portfolio Focus Area Comparison

| Focus Area | Snowflake Patents | Market Relevance 2025 | Gap Analysis |

| Concurrency | High | Medium | Solved problem; commodity feature. |

| Data Sharing | High | High | Strong moat; unique differentiator. |

| Vector Search | Low/Emerging | Very High | Critical for RAG/AI; playing catch-up. |

| GenAI Training | Low | Very High | Databricks leads with MosaicML IP. |

7. Competitive Landscape: The Valuation Flip

Databricks Ascendant

In a stunning reversal, Databricks has arguably eclipsed Snowflake. Databricks is a private company, but its valuation metrics are telling. It raised funds at a valuation exceeding $100 billion in late 2025. 30

This effectively flips the narrative. Databricks is now the more valuable asset compared to Snowflake’s ~$88 billion market cap. 31 Growth rates tell a similar story of divergence. Databricks is growing revenue at over 50% year-over-year. 32 Snowflake is growing at roughly 29%. 1 This growth delta is significant. It suggests new workloads are flowing disproportionately to Databricks. The market believes Databricks is capturing the AI windfall. Snowflake is seen as capturing the “optimization” headwinds.

Feature Parity and Convergence

Both companies are racing toward convergence. Snowflake is adding AI and Python capabilities via Snowpark. Databricks is adding SQL Warehousing capabilities. It is generally easier for a Data/AI platform to add SQL than vice versa. A SQL warehouse has rigid architectural constraints. An AI platform like Databricks is inherently more flexible.

Databricks’ acquisition of Tabular was a strategic checkmate. 33 Tabular was founded by the creators of Apache Iceberg. Buying them gives Databricks influence over the open standard that threatens Snowflake. It allows Databricks to optimize Iceberg better than anyone else.

8. Institutional and Insider Sentiment

The Insider Exodus

Insider trading activity reveals a concerning lack of confidence. High-profile executives have executed significant stock sales. Former CEO Frank Slootman and CFO Michael Scarpelli have sold shares. 34

While often part of 10b5-1 plans, the volume is notable. There has been a distinct lack of open market buying. In bear markets, confident management teams often buy shares to signal value. The absence of such buying at Snowflake is deafening. 35 The stock is trading more than 50% below all-time highs. If insiders believed it was undervalued, they would likely be buying.

Institutional ownership remains high but is churning. Growth funds are exiting the stock. They are being replaced by “GARP” (Growth at a Reasonable Price) investors. These new investors demand stricter financial discipline and are less tolerant of high PE ratios. 13

The CEO Transition Risk

The replacement of Frank Slootman with Sridhar Ramaswamy marked a pivot. Slootman was a legendary sales executor. Ramaswamy is a technologist (ex-Google). The market is waiting to see if Ramaswamy can drive sales ferocity.

The “guidance disconnect” in Q3 suggests a potential lapse in execution. 1 The sales machinery may be losing the extreme predictability it was famous for under Slootman. Ramaswamy’s focus on AI is strategically correct. However, investors worry about the execution risk during this transition. Transforming a sales-led culture into a product-led AI culture is difficult. It creates internal friction and potential turnover among top sales talent.

9. Strategic Conclusion: The Great Thaw

Snowflake is not “dying.” It remains a vital piece of the global enterprise stack. Its “Data Sharing” network effect is powerful and unique. However, the company is undergoing a painful maturation process. The decline in its stock price reflects a rational repricing of risk and growth expectations.

The company is sandwiched between two massive forces. On one side is the commoditization of its core product (Data Warehousing). On the other is the dominance of a competitor in its aspirational market (AI).

Summary of Decline Factors:

- Deceleration: Growth slowing to sub-30% removes the “hyper-growth” valuation premium.

- Competition: Databricks is winning the “hearts and minds” of the AI community.

- Architecture: Apache Iceberg threatens to erode high-margin storage revenue.

- Macroeconomics: High interest rates punish high-PE stocks and IT budgets are paused.

- Sentiment: Insiders are selling, and the 2024 cyber incidents created a trust deficit.

The outlook remains cautious. Snowflake must execute a flawless pivot. It must embrace open formats without losing revenue. It must integrate AI without breaking its ease-of-use promise. Unless it can successfully reinvent itself as the primary platform for Generative AI beating Databricks at its own game the stock is unlikely to reclaim its 2021 highs. The market has moved from valuing “Data Storage” to valuing “Data Intelligence,” and Snowflake is currently playing catch-up.

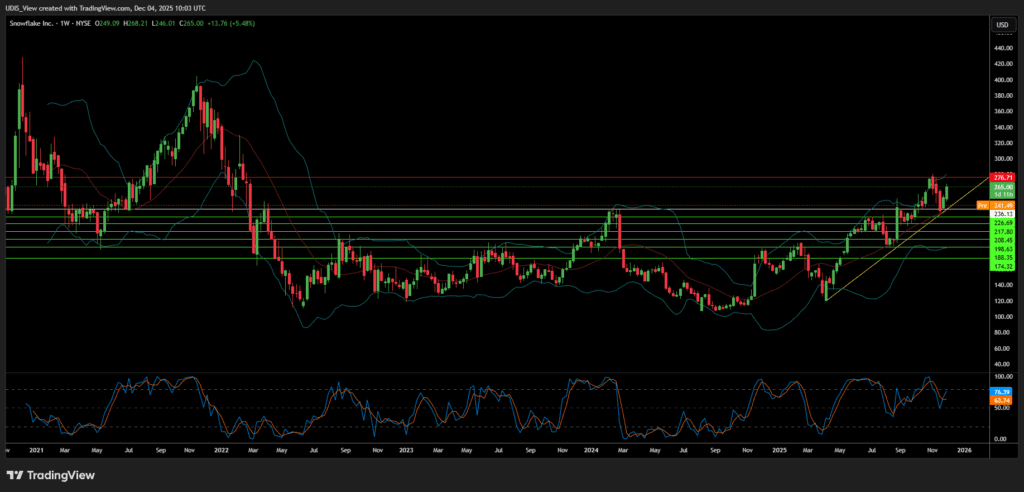

Snowflake Short (Sell)

Enter At: 236.13

T.P_1: 226.69

T.P_2: 217.80

T.P_3: 208.45

T.P_4: 198.63

T.P_5: 188.35

T.P_6: 174.32

S.L: 276.71