Is the German auto giant committing “industrial suicide”? We analyze the deep Volkswagen crisis, from the Nexperia chip ban to the loss of tech sovereignty to China.

The Structural Dismantling of a Titan

The European automotive industry is witnessing a historical inflection point. Germany, the industrial engine of the continent, is losing control of its most prized asset. Volkswagen Group, a symbol of post-war European recovery and engineering dominance, is currently undergoing a structural dismantling.

This is not merely a cyclical downturn or a temporary correction. It is a fundamental transfer of power, technology, and sovereignty from Wolfsburg to Hefei, Shenzhen, and Shanghai. We are observing the end of the German industrial model. For decades, this model relied on superior engineering, high-value exports, and a stable geopolitical order. All three pillars have collapsed simultaneously.

The technology leadership has been lost to Chinese competitors who move faster and innovate more aggressively. The export model is shattered by uncompetitive cost structures and geopolitical fragmentation. The stable order has been replaced by a weaponized supply chain where critical components are held hostage by Beijing.

This report provides an exhaustive forensic analysis of this decline. We analyze the geopolitical strangulation of European supply chains, exemplified by the Nexperia crisis. Furthermore, subsequent sections dissect the macroeconomic realities that make German labor prohibitively expensive compared to its Chinese counterparts. Additionally, the article exposes the catastrophic failure of Volkswagen’s internal software division, CARIAD, which ultimately forced the company to outsource its “brain” to American and Chinese startups.

The data is unequivocal. Volkswagen is cutting 35,000 jobs in Germany while expanding in China [1]. It is closing domestic factories for the first time in 87 years while building new hubs in Anhui [2]. It is buying platforms from XPeng because its own engineers cannot deliver [4]. These are the actions of a company that has lost its independence.

Germany is no longer the technological hub of the auto world. It has become a legacy assembly base, increasingly dependent on imported Chinese innovation. The “Industrial Suicide” warned of by labor leaders is not a future risk; it is a current process [5]. Europe is losing control. The German car industry is moving into Chinese hands.

Geopolitics: The Weaponization of the Supply Chain

The vulnerability of the European automotive sector to geopolitical coercion is absolute. The illusion of European industrial sovereignty was shattered in late 2024. The crisis involving Nexperia, a Dutch semiconductor manufacturer, exposed the fragility of the entire German automotive ecosystem. It demonstrated that ownership of intellectual property means nothing without control over physical production.

The Nexperia Crisis: Anatomy of a Chokehold

Nexperia represents the complex reality of modern globalization. Headquartered in Nijmegen, Netherlands, it is owned by Wingtech Technology, a Chinese conglomerate [6]. Nexperia produces standard logic chips, diodes, and MOSFETs. These are not cutting-edge AI chips. They are the “commodities” of the electronics world. Yet, they are indispensable. A modern Volkswagen cannot function without hundreds of them managing power windows, braking systems, and battery regulation.

In September 2025, the Dutch government made a fateful decision. Citing national security concerns and “governance shortcomings,” the Dutch Minister of Economic Affairs intervened [7]. They invoked the Goods Availability Act of 1952. This is a Cold War-era statute designed for national emergencies [8]. It had lain dormant for decades.

The Dutch government seized control of Nexperia’s local management. They aimed to prevent the transfer of critical technology and capital to the Chinese parent company, Wingtech [9]. The fear was that Wingtech was stripping the European entity of its assets to bolster China’s domestic semiconductor capabilities. The move was intended to secure European strategic autonomy. It achieved the exact opposite.

Beijing’s Escalation Dominance

China’s response was swift, calculated, and devastating. Beijing did not fight the legal battle in Dutch courts. Instead, it weaponized the supply chain. Nexperia’s global production model is circular. Wafers are fabricated in Hamburg (Germany) and Manchester (UK). However, the “backend” process assembly, packaging, and testing takes place largely in Dongguan, China [9]. The Dongguan facility handles approximately 70% of Nexperia’s global output [6].

On October 4, 2025, Chinese authorities imposed strict export controls on the Dongguan plant [10]. They froze shipments of finished chips destined for Europe. The justification was defensive. China’s Ministry of Commerce accused the Netherlands of “overstretching the concept of national security” and interfering in corporate governance [6].

The impact was immediate paralysis. Volkswagen’s production lines began to starve. The wafers made in Germany were useless without the packaging performed in China. The supply loop was severed at the point of Chinese control.

The Failure of European “De-Risking”

This episode exposed the hollowness of the European Union’s “de-risking” strategy. European politicians have argued that they can reduce dependency on China without fully decoupling. The Nexperia crisis proves this is a fantasy. The supply chain is too integrated to be “de-risked” piecemeal.

Volkswagen found itself collateral damage in a diplomatic dispute it could not influence. The company had to warn of production stoppages within weeks of the ban [11]. This revealed a critical strategic weakness: Escalation Dominance. China demonstrated that it controls the choke points. It can turn off the tap of essential components at will.

The Dutch government was forced to retreat. On November 19, 2025, the Dutch Minister suspended the order under the Goods Availability Act [12]. This suspension was a capitulation. It was a tacit admission that Europe cannot afford to anger Beijing. The flow of chips resumed, but the message was clear: German industrial output continues only as long as China allows it.

Structural Vulnerability of the “In China, For China” Strategy

Volkswagen’s response to this geopolitical volatility has been to deepen its commitment to China. The company calls this strategy “In China, for China” [13]. The logic is that by localizing supply chains within China, VW can insulate its Chinese operations from global trade wars. However, this creates a dangerous bifurcation.

- Technological Divergence: VW is building a separate technological ecosystem for China. The “China Electronic Architecture” (CEA) is distinct from global platforms [14].

- IP Transfer: To execute this, VW is transferring massive R&D capabilities to Hefei [3]. This involves 3,000 engineers working in the “Volkswagen Group China Technology Company” (VCTC).

- Loss of Control: This localized entity becomes hostage to local regulations. The Chinese Communist Party (CCP) has mandated strict data control and national security laws.

By moving the “brain” of development to China, VW places its intellectual property under the jurisdiction of a systemic rival [15]. This is not risk mitigation. It is risk concentration. Volkswagen is betting its future on the benevolence of the Chinese state.

Macroeconomics: The Collapse of Competitiveness

The geopolitical fragility of Volkswagen is compounded by a catastrophic macroeconomic environment in Germany. The country is no longer a competitive location for heavy industry. The “Standort Deutschland” (business location Germany) is plagued by high costs, rigid bureaucracy, and stagnant productivity.

The Labor Cost Disadvantage

The most glaring issue is the cost of labor. Germany has the highest automotive manufacturing costs in the world. This was sustainable when German cars commanded a premium for superior quality. Today, that quality gap has closed, but the cost gap remains.

Data from 2024 and 2025 highlights the disparity. The labor cost contribution to a single vehicle produced in Germany is approximately $3,307 [16]. This covers high wages, generous pensions, and substantial social security contributions. Compare this to China. The labor cost per vehicle in China is roughly $597 [16].

This is a difference of over $2,700 per car. In the mass market segment, margins are razor thin. A $2,700 cost disadvantage is insurmountable. It wipes out the profit margin for vehicles like the Volkswagen Golf or the ID.3. It means that before a single car leaves the factory, the German-built unit is already financially uncompetitive against a BYD Atto 3 or an MG4.

Table 1: Comparative Automotive Labor Costs Per Vehicle (2025 Estimates) [16]

| Manufacturing Location | Avg. Labor Cost Per Vehicle (USD) | Cost Disadvantage vs. China |

| Germany | $3,307 | +454% |

| United Kingdom | $2,333 | +291% |

| France | $1,569 | +163% |

| United States | $1,341 | +125% |

| Slovakia | $830 | +39% |

| China | $597 | Baseline |

| Mexico | $305 | -49% |

| Morocco | $106 | -82% |

These arithmetic drives Volkswagen’s decision to move production. The iconic Golf model will see its production shifted to Puebla, Mexico [2]. This is not a strategic choice; it is a survival necessity. Germany is too expensive for volume manufacturing.

The Energy Cost Crisis

German industry was built on a foundation of cheap Russian natural gas. That era ended in 2022. While prices have stabilized from their crisis peaks, they remain structurally higher than in competitor nations. During 2024, the average industrial electricity price in Germany was approximately $0.18 per kWh [19]. In China, industrial users pay between $0.08 and $0.10 per kWh [20]. The United States, the price is roughly $0.08 per kWh [19].

This disparity is lethal for the electric vehicle supply chain. Battery cell manufacturing is highly energy intensive. Producing battery cells in Germany costs significantly more than producing them in China. This embeds a permanent cost penalty into every German-made EV.

The “Debt Brake” and Investment Starvation

While China pours state capital into “new productive forces” subsidizing battery plants, raw material processing, and grid upgrades, Germany is constrained by fiscal austerity. The constitutional “debt brake” limits government borrowing. Public investment in Germany is a meager 2.8% of GDP [21]. This lags behind European peers like Sweden (5.2%) and Poland (5.1%).

Infrastructure is crumbling. Bridges are closed to heavy trucks. Digital infrastructure is patchy. This lack of investment creates a hostile environment for industry. Companies like Volkswagen are asked to lead a green transition without the necessary public infrastructure support. They face high taxes, high energy costs, and crumbling logistics. It is a recipe for de-industrialization.

Labor & Social: The Breaking of the Contract

Volkswagen is not just a company; it is a social institution. For decades, it has operated under a “social contract” with its workforce, guaranteeing job security in exchange for moderation. That contract has now been torn up.

The 35,000 Job Cuts

In a move described by labor leaders as a “declaration of war,” Volkswagen plans to cut approximately 35,000 jobs in Germany by 2030 [1]. This represents nearly 30% of its domestic workforce. The scale of the reduction is unprecedented.

- Capacity Reduction: VW aims to cut European production capacity by 734,000 vehicles [1]. This is equivalent to closing two major factories.

- Plant Closures: For the first time in its 87-year history, management has threatened to close German plants entirely [2]. The transparent factory in Dresden is set to cease production by the end of 2025 [2]. The Osnabrück plant faces closure by 2027 [2].

- Wolfsburg Downsizing: The main plant in Wolfsburg, the heart of the empire, will reduce its assembly lines from four to two [1].

“Industrial Suicide”

Unions and experts have labeled this strategy “industrial suicide” [7]. They argue that by cutting capacity and skilled labor, Volkswagen is destroying its long-term ability to innovate. The cuts are not merely efficiency measures. They are a retreat. Volkswagen is ceding market share to Chinese competitors rather than fighting for it.

By shrinking its European footprint, it accelerates the shift of the center of gravity to China. The psychological impact on the German workforce is devastating. Volkswagen was seen as “too big to fail” and “too German to leave.” The shattering of this illusion creates deep social unrest. Strikes have already begun, with 100,000 workers mobilizing in December 2024 [22].

Economics: The Profit Collapse

The financial engine of the Volkswagen Group is stalling. For years, the group relied on two sources of profit: the Chinese market and the luxury brands (Porsche, Audi). Both pillars are crumbling simultaneously.

The Porsche Crash

Porsche has long been the profit driver of the group, subsidizing the lower-margin VW mass-market brand. In the third quarter of 2024, Porsche’s financial performance collapsed. Operating profit plummeted by 99% to a mere €40 million [23]. This compares to over €4 billion in the same period the previous year. The causes are structural:

- China Slump: Porsche sales in China dropped significantly [23]. Chinese consumers are turning away from Western luxury brands in favor of domestic high-tech luxury EVs like the Yangwang U8 (BYD) or HiPhi.

- Model Transitions: The electric Macan was delayed due to software failures, leaving Porsche with an aging lineup [25].

- One-off Costs: The revaluation of inventory and high costs of the failed software projects hit the bottom line hard [23].

Without Porsche’s massive profits, the Volkswagen Group’s financial model is broken. There is no surplus cash to cover the losses of the VW passenger car brand or the massive R&D investments needed for the EV transition.

The China Market Share Erosion

Volkswagen’s dominance in China is evaporating. The company’s market share has fallen from over 17% in 2019 to under 13% in 2024 [26]. In the electric vehicle segment, VW is a minor player. Its EV market share in China is roughly 4% [26]. This is catastrophic for a market that is rapidly transitioning too electric. VW is losing the new generation of Chinese consumers who view German cars as “old technology,” mechanically sound but digitally illiterate.

Technology: The Great Surrender

The root cause of Volkswagen’s decline is a failure of technology. The transition to the “Software-Defined Vehicle” (SDV) exposed the company’s inability to adapt. Hardware engineering, VW’s traditional strength, is no longer the differentiator. Software is. And in software, Volkswagen has failed.

CARIAD: The Billion-Euro Disaster

Volkswagen created CARIAD (Car.Software Org) in 2020 to develop a unified software operating system (VW.OS) for all group brands. It was meant to be the “Windows” of the automotive world. Instead, it became a money pit that consumed €12 billion with little to show for it.

The failure was total:

- Delays: The software architecture (E3 1.2) was delayed by years. This forced Porsche to delay the electric Macan and Audi to delay the Q6 e-tron [27].

- Dysfunction: The organization bloated to 6,000 employees too quickly. “We hired anyone who could carry a laptop,” one insider admitted [28].

- Internal Warfare: The brands (Audi, Porsche, VW) refused to cede control to CARIAD. They fought over specifications, creating a paralyzed decision-making structure. Porsche eventually broke away to develop its own systems because it lost faith in CARIAD [28].

The failure of CARIAD is the reason Volkswagen is now dependent on external partners. It could not build the “brain” of the car itself.

The Rivian Bailout: Buying Competence

In a desperate bid to save its future models, Volkswagen announced a $5.8 billion investment in the American startup Rivian [29]. This is a joint venture designed to access Rivian’s “zonal architecture” and software stack. VW is effectively paying billions to a loss-making startup because its own internal efforts failed.

- Deal Structure: VW invests $1 billion immediately via a convertible note, with further billions contingent on milestones [31].

- Goal: To use Rivian’s technology in VW models by 2027 [30].

This deal signals that VW has given up on developing its own core software architecture. It is outsourcing the most critical component of the modern vehicle to a Silicon Valley company.

The XPeng Deal: Junior Partner in China

In China, the capitulation is even more stark. Volkswagen invested $700 million to acquire a 4.99% stake in XPeng, a Chinese EV startup [4]. The goal is to use XPeng’s “Edward” platform and its G9 vehicle architecture to build Volkswagen-branded cars for the Chinese market [4].

Implication: Volkswagen, the giant of Wolfsburg, is admitting that a Chinese startup founded in 2014 has superior technology. VW is not just buying parts; it is buying the platform. The chassis, the electronic architecture, and the ADAS software will be XPeng’s. VW is providing the “top hat” (the body) and the badge. This is a reversal of the last 40 years. Previously, VW provided the technology, and Chinese partners provided the labor. Now, the roles are reversed. VW provides the brand and capital; China provides the technology.

Cyber & Data Security: The Surveillance Machine

As vehicles become computers on wheels, cybersecurity becomes a national security issue. Here, Volkswagen has displayed shocking negligence.

The 800,000 User Data Leak

In late 2024, the “Chaos Computer Club” (CCC) exposed a massive data breach at Volkswagen. A misconfigured cloud storage bucket (managed by CARIAD) left the data of 800,000 customers exposed to the public internet [32].

The exposed data was highly sensitive:

- Geolocation Logs: The data contained GPS coordinates of vehicles, accurate to within centimeters [32].

- Tracking: It included logs of when engines were started and stopped.

- Profiles: This allowed for the creation of detailed movement profiles of drivers.

This breach affected Audi, Seat, and Skoda owners as well. It exposed police officers, politicians, and military personnel to potential tracking by hostile actors [32]. It shattered the reputation of German data privacy.

The “Surveillance on Wheels” Threat

The integration of Chinese technology (XPeng software, Chinese chips) into VW vehicles raises profound security questions. Modern cars collect terabytes of data: voice recordings, camera feeds, and location history. If the software running the car is developed in China, or if the data is processed on Chinese-controlled servers (as required by Chinese law for local operations), the risk of espionage is high.

The “In China, For China” strategy effectively builds a walled garden where VW data is accessible to the CCP. Furthermore, Chinese hackers have already targeted VW directly. Reports indicate that over a period of years, hackers stole thousands of files related to VW’s gasoline engine and transmission development [33]. This IP theft helped Chinese manufacturers close the gap in internal combustion technology before they pivoted to EVs.

Patent Analysis: The Innovation Gap

Patent data provides an objective measure of who owns the future. A comparison between Volkswagen and BYD reveals a disturbing trend for Europe.

BYD’s Patent Explosion

BYD has aggressively built a “patent moat” around its technology. The company holds over 51,000 patents [35].

- Battery Dominance: BYD is the world leader in battery technology patents. Its “Blade Battery” (LFP chemistry) is a proprietary advantage that VW cannot match [36].

- Growth Rate: BYD’s patent filings have surged exponentially since 2018. In the “Battery Unit” technology cluster, BYD moved from rank 5 to rank 1 in a single year [36].

VW’s “Zombie” Portfolio

Volkswagen also holds a massive number of patents. However, a qualitative analysis reveals a weakness.

- Legacy Bias: A huge portion of VW’s portfolio protects internal combustion engine technologies (pistons, exhaust systems, turbochargers) [37]. These patents are losing value rapidly as the world shifts to EVs. They are “stranded assets” in IP form.

- Software Lag: In the critical areas of autonomous driving and smart cabin software, VW lags behind tech-native companies like BYD, Tesla, and Xiaomi. The patent data confirms that VW is defending a dying technology (ICE) while BYD is patenting the future (EV/Battery).

Geostrategy: The Forced Labor Dilemma

Volkswagen’s presence in Xinjiang has become a geopolitical liability. For years, the company operated a plant in Urumqi, despite mounting evidence of state-sponsored forced labor and human rights abuses against the Uyghur population in the region.

The Ethical and Legal Trap

Investigations have linked the automotive supply chain in Xinjiang to forced labor transfer programs [38]. This is not just a moral issue; it is a legal one.

- UFLPA: The US Uyghur Forced Labor Prevention Act bans the import of goods made with forced labor. This puts VW’s global supply chain at risk. If a component in a VW ID.4 sold in the US contains aluminum or polysilicon from a tainted supplier, the cars can be seized at the border [39].

- The Exit: Under immense pressure, VW announced plans to sell its Xinjiang plant in late 2024 [40]. However, the reputational damage is done. The delay in exiting has alienated ethical investors and consumers.

Conclusion: The Loss of Control is Permanent

The evidence presented in this report leads to a singular, stark conclusion: Europe is losing control of its automotive industry. The decline of Volkswagen is structural, multifaceted, and likely irreversible.

The company is squeezed by a “perfect storm” of negative forces:

- Geopolitical: It is a hostage to Chinese supply chain weaponization (Nexperia).

- Macroeconomic: It cannot manufacture profitably in Germany due to extreme labor and energy costs ($3,300 labor cost per car vs $600).

- Technological: It has failed to build its own software (CARIAD) and must buy it from rivals (Rivian/XPeng).

- Strategic: Its pivot to China (“In China, For China”) is transferring its remaining know-how to a systemic rival.

The result is a hollowing out of the European industrial base. Volkswagen is becoming a brand management company. The “hard work” the engineering, battery chemistry, software coding, and manufacturing is increasingly done by Chinese hands, or on Chinese soil.

Germany’s control of the auto industry is slipping away. The “crown jewel” of the European economy is being dismantled, piece by piece, and reassembled in the East. This is not just a corporate crisis; it is a continental defeat.

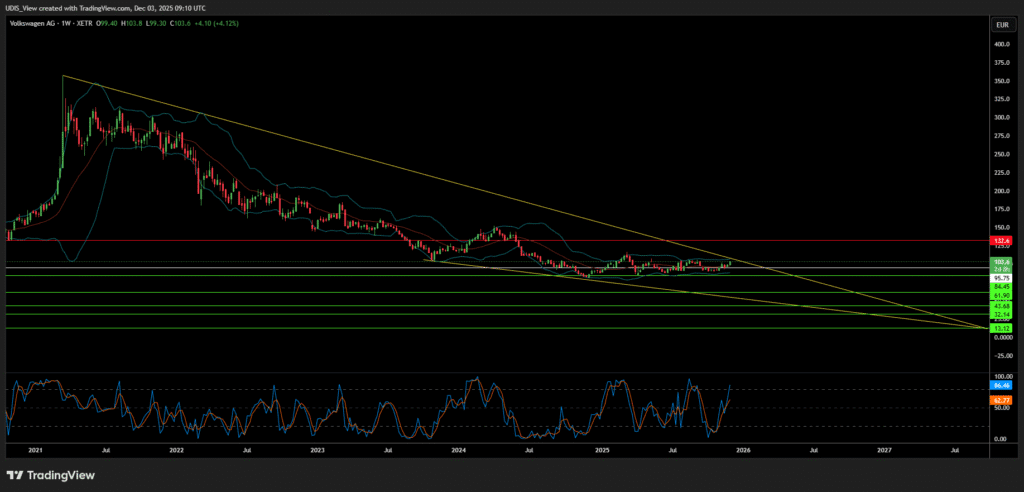

Volkswagen Short (Sell)

Enter At: 95.75

T.P_1: 84.45

T.P_2: 61.9

T.P_3: 43.68

T.P_4: 32.14

T.P_5: 13.12

S.L: 132.6