The Geostrategic Pivot

Cisco Systems has engaged in a radical transformation. The fiscal year 2025 marks the definitive end of Cisco as a legacy hardware vendor and its rebirth as the central architect of the secure, interconnected, AI-driven world.[1] This report analyzes the structural, geopolitical, and technological metamorphosis of the San Jose giant.

The analysis reveals a corporation that has successfully weaponized its intellectual property, realigned its global supply chain against the Sino-American fracture, and positioned itself as the gatekeeper of the “Quantum Internet”.[2]

Revenue for Fiscal Year 2025 reached $56.7 billion, a 5% year-over-year increase driven largely by a 30% surge in operating cash flow and explosive demand for AI infrastructure.[1] Yet, the balance sheet tells only a fraction of the story.

The real narrative lies in the strategic maneuvers executed in the shadows of the trade war: the quiet migration of critical manufacturing to India [4], the deployment of “sovereign” clouds to appease European regulators [5], and the audacious partnership with IBM to network quantum computers by 2030.[2]

We are witnessing the convergence of three distinct timelines. First, the immediate “AI timeline,” where Cisco’s Hypershield and Splunk integration are fighting a war against algorithmic cyber threats.[6] Second, the “Geopolitical timeline,” where the company navigates tariffs as high as 145% on Chinese components by creating a new export corridor in the Global South.[7] Third, the “Quantum timeline,” a long-term bet that aims to build the fiber-optic connective tissue for the post-silicon age.[3]

This report dissects these converging vectors. We provide an exhaustive analysis of Cisco’s patent portfolio, its aggressive defense of intellectual property, and its role in the “Endless Frontier” of American innovation.[9] We examine the company’s expansion into the orbital economy through partnerships with SpaceX and NASA.[10] This is no longer just about routing packets; it is about securing the infrastructure of Western democracy in an age of digital fragmentation.

I: The Geopolitical Supply Chain

The “China Plus One” Realignment

The escalating technology war between the United States and China has dismantled the globalization consensus of the last three decades. Cisco has responded not with retreat, but with a calculated geostrategic pivot.

The company has identified India not merely as a market, but as its new global export hub, a “China Plus One” strategy executed with military precision.[4]

This shift is driven by a chaotic trade environment. New U.S. tariffs on telecommunications equipment manufactured in China have escalated dramatically, reaching up to 145% for high-end data center gear.[7] These tariffs are not temporary policy levers; they represent a structural decoupling of the world’s two largest economies.

For Cisco, heavily reliant on a complex global supply chain, this presented an existential risk. Continued reliance on Chinese manufacturing would have eroded gross margins and exposed the company to abrupt export control shocks.[12]

CEO Chuck Robbins’ declaration that India is a “viable” export hub serves as a signal to global markets.[8] The inauguration of the manufacturing facility near Chennai is the physical manifestation of this strategy.[8] This facility produces advanced routing and switching hardware, including the 8000 series routers, which are critical for AI and hyperscaler networks.[13] By validating India’s manufacturing capability for these high-complexity devices, Cisco insulates itself from the volatility of the “tech war.”

The Economics of the India Pivot

The move to India is underpinned by robust economic fundamentals. While labor arbitrage remains a factor, the primary driver is the maturation of India’s engineering ecosystem. The country has evolved from a back-office support center to a hub of deep technical innovation.[14]

Table 1: Comparative Analysis of Manufacturing Hubs

| Factor | China (Legacy Hub) | India (New Strategic Hub) | Cisco Strategic Implication |

| Tariff Exposure | High (25% – 145%) [7] | Low / Preferential Trade | Margin preservation; pricing power protection. |

| Geopolitical Risk | Critical (Export Bans) | Moderate (Aligns with US) | Security of supply; compliance with US “Clean Network” initiatives. |

| Talent Pool | High Cost / Aging | Deep / Growing Engineering | R&D synergy; faster product iteration cycles.[14] |

| Infrastructure | Mature | Rapidly Improving | Long-term capital investment required but high ROI potential. |

The strategic “wait-and-watch” approach regarding further investment, articulated by Robbins, is a negotiation lever.[4] It pressures the Indian government to maintain favorable trade policies and infrastructure investments while acknowledging that the Chinese manufacturing corridor is becoming untenable.[8] This is geoeconomic statecraft practiced by a corporation.

European Sovereignty and the Digital Iron Curtain

While the Asian strategy focuses on hardware supply chains, the European strategy addresses the fragmentation of the internet itself. Europe’s aggressive pursuit of “Digital Sovereignty,” codified in the GDPR and the new EU Cybersecurity Certification (EUCC), has created a regulatory firewall against US tech giants.[5]

Cisco’s response in late 2025 was the launch of its Sovereign Critical Infrastructure portfolio.[5] This is a radical departure from the cloud-first, centralized management models of the past decade. The new portfolio allows European governments and regulated industries to operate in “air-gapped” environments.[5]

The Architecture of Trust

The core innovation here is political as much as it is technical. In an air-gapped deployment, Cisco surrenders the ability to remotely access, update, or disable the infrastructure.[15] This addresses the deep-seated European fear of US extraterritorial overreach, the “kill switch” anxiety.

Key components of the Sovereign Portfolio:

- Customer-Managed Encryption: The client holds the keys. Cisco has zero visibility into the data payload or the metadata.[5]

- Local Operations: The infrastructure is operated entirely by the customer or a local sovereign partner, such as NTT DATA.[5]

- Compliance Alignment: The hardware and software stack maps directly to the requirements of the EUCC and local national security standards.[15]

This strategy allows Cisco to operate behind the emerging “Digital Iron Curtain.” By selling the tools of sovereignty, Cisco monetizes the fragmentation of the global network. It ensures that even as nations build digital borders, the underlying infrastructure remains Cisco-branded.

The “Clean Network” and US Policy Alignment

Cisco’s moves are deeply aligned with US foreign policy objectives. The “Endless Frontier” narrative, championed by the White House, calls for American preeminence in critical technologies like quantum, AI, and 6G.[9] Cisco’s investments mirror this national agenda.

The “Clean Network” initiative, aimed at purging untrusted (read: Chinese) vendors from critical telecom infrastructure, creates a vacuum that Cisco is eager to fill.[16] The shift to India and the focus on sovereign clouds positions Cisco as the “trusted vendor” for the Western alliance. When the US government speaks of “secure supply chains,” they are effectively describing Cisco’s new operational model.

II: The Quantum Internet Horizon

The IBM-Cisco Alliance: Building the Future

In November 2025, a partnership was announced that may define the next half-century of computing. IBM and Cisco formalized an alliance to build the world’s first large-scale, fault-tolerant quantum network by the early 2030s.[2] This collaboration is the industrial realization of theoretical physics.

Quantum computers today are isolated islands of computation. They are powerful but limited by the number of qubits that can be maintained in a single cryostat. To scale beyond these physical limits, one must network multiple quantum processors (QPUs) together to function as a single, massive machine.[2] This is the “distributed quantum computing” paradigm.

The Division of Labor

The partnership leverages the respective monopolies of two tech titans. IBM, the leader in superconducting quantum processors, will build the Quantum Processing Units (QPUs).[3] Cisco, the master of networking, will build the “connective tissue” of the Quantum Networking Units (QNUs) and the optical interconnects required to transport quantum information.[3]

The Technical Challenge: Entanglement Swapping

The fundamental challenge is that quantum information cannot be copied (the No-Cloning Theorem). It must be teleported. This requires distributing quantum entanglement between distant processors.[18]

- The QNU Interface: IBM’s QNU will convert stationary qubits (microwave photons inside the fridge) into “flying qubits” (optical photons) that can travel through fiber optic cables.[3]

- The Optical Switch: Cisco is developing the high-speed, low-loss optical switches necessary to route these flying qubits without destroying their fragile quantum state.[2]

This is a bet on the physics of the future. If successful, it allows for a “Quantum Internet” where a user can access a cluster of 100,000 qubits distributed across multiple data centers to solve problems in materials science, cryptography, and logistics that are impossible for classical supercomputers.[3]

Quantum Security: The Defensive Moat

While the IBM partnership plays offense, Cisco’s internal research plays defense. The looming threat of quantum computers breaking RSA encryption, the “Q-Day” scenario, drives intense R&D into Post-Quantum Cryptography (PQC).

Cisco’s “Quantum Alert” prototype is an operational example of this defense.[19] The system uses the principles of quantum mechanics to detect eavesdropping. Because measuring a quantum state disturbs it, any attempt to intercept data on a quantum-secured link immediately creates a detectable error rate.[19]

Quantum Alert Mechanism:

- Entanglement Source: Generates pairs of entangled photons sent to receiver nodes.

- Coincidence Detection: Detectors operating at sub-Kelvin temperatures monitor the arrival times of these photons.[19]

- Intrusion Alarm: If the coincidence rate drops below a specific threshold, the system knows an eavesdropper is present and shuts down the link.[19]

This technology is critical for the finance and defense sectors. Snippets indicate intense interest from the US Department of Defense (DoD) in these capabilities.[20] As the DoDIN APL (Approved Products List) sunsets its current testing regime in late 2025, new standards for quantum-resistant equipment are emerging.[21] Cisco is positioning its hardware to be the first to meet these post-quantum requirements.

The Patent Battlefield: 6G and Quantum

Cisco’s patent filings in 2024 and 2025 reveal an aggressive staking of territory in the quantum domain. While IBM leads in qubit fabrication patents, Cisco is cornering the market on networking those qubits.[22]

Key Patent Areas:

- Quantum Repeaters: Methods for extending the range of entanglement distribution.[23]

- Hybrid Networks: Architectures that allow classical data and quantum keys to share the same fiber optic infrastructure.[23]

- Quantum Error Correction: Algorithms to manage the noise inherent in distributed quantum systems.[23]

This intellectual property acts as a future royalty stream. Just as Cisco extracted value from the protocols of the classical internet (TCP/IP routing), it intends to own the protocols of the quantum internet.

III: The Orbital Edge and Space Economy

Starlink and the End of Geography

The distinction between terrestrial and non-terrestrial networks (NTN) has evaporated. In 2025, Cisco formalized the integration of SpaceX’s Starlink into its SD-WAN (Software-Defined Wide Area Network) portfolio.[10] This is a transformative development for the enterprise edge.

For decades, remote connectivity meant expensive, slow VSAT links or unreliable microwave hops. Starlink’s Low Earth Orbit (LEO) constellation offers gigabit-speed, low-latency connectivity globally. Cisco’s value add is the management layer.

The SD-WAN Integration:

- Cisco 8000 series routers can now recognize a Starlink terminal as a standard WAN interface.[13] The software dynamically steers traffic.

- Critical voice and video packets are routed via Starlink’s low-latency path, while bulk data might travel over a slower terrestrial link.[10]

- Plug-and-Play: The integration uses DHCP to automatically configure the satellite link, removing the need for specialized satellite engineers at remote sites.[10]

- Forward Error Correction (FEC): Cisco’s software compensates for the packet loss inherent in satellite links, smoothing out the connection for sensitive applications like VoIP.[10]

Case Study: Reliance Jio and Rural India

The partnership with Reliance Jio in India serves as the proving ground for this technology. Jio is deploying massive satellite broadband capabilities to cover rural and mountainous India.[13] Cisco provides the “Crosswork” automation tools that give Jio visibility into this hybrid network.[26]

Jio Brain and Hyperscale:

Jio is building “Jio Brain,” a hyperscale AI infrastructure.[27] Cisco’s hardware connects the ground stations to the data centers where AI training occurs. This integration ensures that data collected from remote villages via satellite can be fed directly into AI models for analysis, a true “sensor-to-cloud” pipeline.[27]

Project Callisto: The Interplanetary Internet

Cisco’s ambitions extend beyond Earth orbit. The “Callisto” payload, flown on NASA’s Artemis I mission, was a technology demonstration of immense symbolic and technical weight.[11]

The Mission Profile:

Developed in partnership with Lockheed Martin and Amazon, Callisto tested consumer-grade collaboration tools in deep space. A customized version of Webex ran on a tablet inside the Orion capsule, communicating with Mission Control in Houston via NASA’s Deep Space Network (DSN).[28]

Technical Hurdles:

- Latency: The Moon is ~1.3 light-seconds away. Round-trip communications have significant delays. Webex software had to be modified to buffer and synchronize audio and video streams to make conversation intelligible.[28]

- No Internet: There is no TCP/IP on the Moon. Alexa had to be re-engineered to process voice commands locally on the spacecraft, accessing a local database rather than the cloud.[30]

Strategic Value:

Why put Webex on the Moon? It serves as the ultimate stress test. If Cisco’s collaboration software can function reliably over the Deep Space Network, it can certainly handle a flaky connection in a branch office in rural Montana. It positions Cisco as a key contractor for the future Artemis missions and the inevitable “Lunar Gateway” station.[28]

IV: AI-Native Security and Hypershield

The 25,000th Patent: Defining a New Era

In 2025, Cisco was granted its 25,000th U.S. patent.[6] The technology protected by this milestone patent is “Hypershield,” a distributed, AI-native security architecture that represents the company’s most aggressive move against competitors like Palo Alto Networks.[6]

Hypershield is designed for the AI era. Traditional firewalls act as chokepoints; they inspect traffic at the perimeter. In modern data centers, where “East-West” traffic (server-to-server) dominates, this model fails. Hypershield moves the enforcement point down to the kernel of the workload itself.[31]

The eBPF Revolution

The technical core of Hypershield is eBPF (Extended Berkeley Packet Filter). This technology allows Cisco to run sandboxed programs inside the operating system kernel without changing the source code.[31]

- Autonomous Segmentation: Hypershield observes the behavior of applications and automatically writes segmentation rules. If a web server suddenly tries to connect to a payroll database, a behavior it has never shown before, Hypershield blocks it instantly.[31]

- Distributed Exploit Protection: It protects against vulnerabilities (CVEs) before a patch is even applied. By knowing the “signature” of an exploit, Hypershield can block the specific memory call used by the attacker, effectively “patching” the system virtually.[31]

Splunk: The Nervous System

The acquisition of Splunk has now been fully integrated into the Cisco ecosystem. The launch of “Splunk Federated Search for Snowflake” in late 2025 resolves the data gravity problem.[32]

Security teams previously had to move massive amounts of data into a SIEM (Security Information and Event Management) tool to analyze it. This was slow and expensive. Federated Search allows Splunk to query data where it lives in Snowflake, in Amazon S3, or on Cisco edge devices.[32]

Unified TDIR (Threat Detection, Investigation, and Response):

Cisco has integrated its XDR (Extended Detection and Response) platform with Splunk Enterprise Security. Alerts from Cisco Duo (identity) and Cisco Secure Network Analytics (traffic) now feed directly into Splunk dashboards.[33] This creates a closed loop: Cisco hardware sees the threat, Splunk analyzes it, and Hypershield blocks it.

AI Security and the “Jailbreak” Threat

The “State of AI Security 2025” report highlights a new class of threats: adversarial attacks on AI models themselves.[34] Attackers are using “prompt injection” and “data poisoning” to manipulate Large Language Models (LLMs).

Cisco’s response is “AI Defense.” This solution sits in front of the AI model, inspecting inputs for malicious prompts and filtering outputs to prevent data leakage.[35] In the partnership with NVIDIA, this security layer is embedded directly into the “AI Factory” architecture, ensuring that the massive GPU clusters training these models are secure from the silicon up.[35]

V: Financial Performance and Market Analysis

Fiscal Year 2025: By the Numbers

Cisco’s financial performance in FY 2025 demonstrates the success of its pivot to software and subscriptions. The company generated $56.7 billion in revenue, a 5% increase over the previous year.[1]

Table 2: Fiscal Year 2025 Financial Performance Summary [1]

| Financial Metric | Q4 FY 2025 | FY 2025 Total | YoY Growth | Analyst Context |

| Total Revenue | $14.7 Billion | $56.7 Billion | +5% | Beats estimates; driven by AI infra. |

| Product Revenue | $10.9 Billion | $41.6 Billion | +10% (Q4) | Strong rebound in networking hardware. |

| Service Revenue | $3.8 Billion | $15.0 Billion | Flat | Shift to recurring software model. |

| GAAP EPS | $0.71 | $2.61 | +3% | Solid profitability despite R&D spend. |

| Operating Cash Flow | — | $14.2 Billion | +30% | Massive efficiency gains.[1] |

The AI “Windfall”

The most striking metric is the explosion in AI infrastructure orders. In Q1 FY2026 alone, orders from “hyperscaler” customers (e.g., Microsoft, Amazon, Google) totaled $1.3 billion.[37] For the full FY 2025, these orders exceeded $2 billion, doubling the company’s internal targets.[36]

This validates the thesis that while general IT spending is soft due to high interest rates, the “AI Arms Race” is price-inelastic. Hyperscalers must build massive GPU clusters to compete, and they need Cisco’s 800-gigabit and 1.6-terabit switches to connect them.

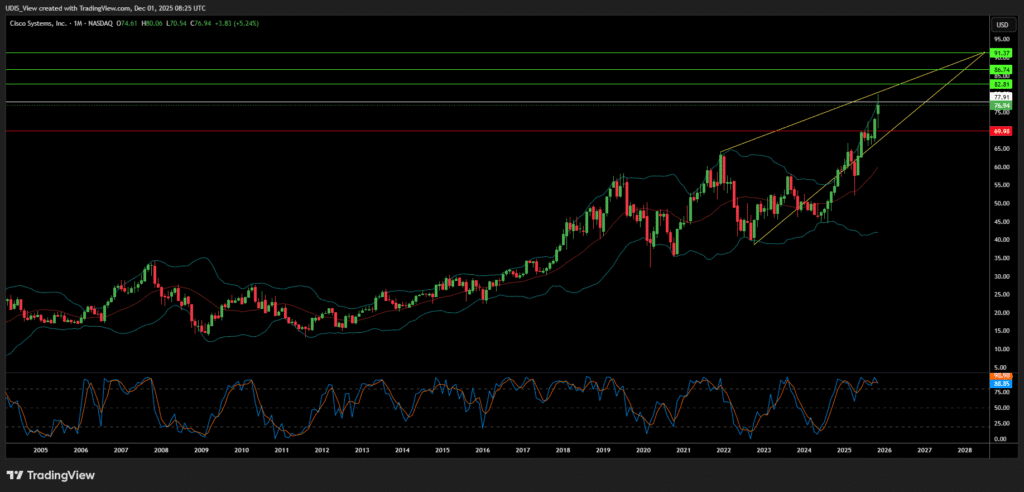

Stock Performance and Analyst Sentiment

Cisco’s stock (CSCO) experienced a 25% rally in 2025, outperforming the Nasdaq index.[38] This re-rating is driven by the market’s realization that Cisco is a beneficiary, not a victim, of the AI boom.

Analyst Perspectives:

- Bull Case: Analysts cite the strong Free Cash Flow (FCF) and the raising of price targets to the $76-$78 range.[39] The integration of Splunk is seen as a margin-accretive move that locks in customers.

- Bear Case: Concerns linger about the “rest of world” growth and the potential for a slowdown in legacy campus switching.[38] The 145% tariffs on certain components also present a gross margin risk if supply chain migration to India encounters delays.[7]

RPO: The Hidden Value

A critical metric for financial analysts is “Remaining Performance Obligations” (RPO). This represents future revenue under contract that has not yet been recognized. Cisco’s RPO grew 7% to $42.9 billion.[37]

- Product RPO: Up 10%.

- Long-term RPO: Up 13%.[37]

This double-digit growth in long-term contracts indicates that enterprise customers are signing multi-year agreements for Cisco’s platforms. They are not just buying boxes; they are subscribing to the architecture.

VI: The “Endless Frontier” and Cultural Impact

The Viral “Time and Space” Controversy

In April 2025, the cultural impact of Cisco’s industry was highlighted by a bizarre viral moment. At the “Endless Frontiers” retreat in Austin, Texas, a gathering of tech leaders and policymakers, White House Science Director Michael Kratsios declared, “Our technologies permit us to manipulate time and space”.[9]

Social media erupted. Conspiracy theories about time travel and exotic physics trended globally.[40] However, in the context of the conference, Kratsios was referring to the compression of latency and the acceleration of discovery enabled by quantum computing and AI.[9]

Why This Matters:

This incident underscores the public anxiety and awe surrounding “Deep Tech.” As companies like Cisco deploy quantum networks and orbital internet, they are effectively altering the human experience of distance and time. The “Endless Frontier” narrative serves as the ideological engine for the US tech sector. It frames the technological competition with China not just as a trade dispute, but as a civilizational struggle for the future.[9]

Cisco’s participation in this retreat, and its alignment with the “Endless Frontier” goals, signals its role as a “National Champion.” It is the infrastructure partner for the American project in the 21st century.

Conclusion: The Grand Strategy Realized

Cisco Systems in late 2025 is a formidable entity. It has successfully executed a complex “Grand Strategy” that harmonizes its commercial goals with the geopolitical realities of its home country.

- Geostrategic Resilience: By pivoting manufacturing to India and deploying sovereign clouds in Europe, Cisco has inoculated itself against the worst effects of the US-China trade war and the fragmentation of the internet.

- Technological Supremacy: The partnership with IBM to build the Quantum Internet and the launch of AI-native Hypershield ensure that Cisco will remain the gatekeeper of high-value infrastructure for the next decade.

- Financial Robustness: A 30% increase in operating cash flow and a successful transition to recurring revenue have created a financial fortress capable of funding these massive R&D bets.

As the world fractures into rival technological blocs, the value of the company that builds the bridges, whether they are fiber optic cables, quantum entanglement links, or satellite beams, only increases. Cisco is no longer just selling routers; it is selling the sovereignty, security, and connectivity of the future.

Recommendations for Investors and Stakeholders

- Watch the India Margin: Monitor the gross margins in upcoming quarters to verify that the shift to India manufacturing is delivering the expected cost savings and tariff avoidance.

- Quantum Milestones: Track the specific technical milestones of the IBM partnership. The first successful “entanglement swapping” demo will be a major catalyst for the stock.

- Regulatory Headwinds: Keep a close eye on the implementation of the EUCC in Europe. If Cisco’s Sovereign Cloud gains rapid accreditation, it will be a significant competitive advantage over its US peers.

Cisco Long (Buy)

Enter At: 77.91

T.P_1: 82.81

T.P_2: 86.74

T.P_3: 91.37

S.L: 69.98